ADM Bundle

How did Archer Daniels Midland Rise to Global Dominance?

Ever wondered how a small linseed crushing operation transformed into a global agricultural powerhouse? The ADM SWOT Analysis reveals the strategic decisions that fueled this incredible journey. From its humble beginnings in 1902, ADM's story is one of remarkable growth and adaptation within the ever-changing landscape of commodities trading.

The brief history of ADM's founding is a testament to the vision of its founders, John W. Daniels and George A. Archer, who initially focused on processing flaxseed. Today, ADM corporation's vast network spans the globe, reflecting its significant market position and its role in the history of agriculture. Understanding ADM's early business ventures and its evolution is crucial for grasping its current influence in the food industry and the broader US economy.

What is the ADM Founding Story?

The story of the ADM company, a major player in the agricultural industry, began in 1902. John W. Daniels initiated a linseed crushing business in Minneapolis, Minnesota, setting the stage for what would become a global corporation. This early venture laid the foundation for the company's future growth and influence in the commodities market.

In 1903, George A. Archer joined the operation, and the firm was officially named the Archer-Daniels Linseed Company in 1905. This partnership marked a crucial moment, combining Archer's strategic planning with Daniels's trade expertise. Their collaboration was instrumental in shaping the company's early success and direction.

The initial focus was on the linseed oil marketplace, capitalizing on Minneapolis's resources and infrastructure. The business model centered on year-round production of linseed oil for industrial uses, such as paints and adhesives. This strategic approach allowed the company to establish a strong foothold in the market.

The early days of the ADM company were marked by cost-consciousness and strategic growth. The company's founders, Archer and Daniels, were known for their careful management of resources.

- The company's first year of operation was profitable, achieving a profit of over $30,000 in its first half-year.

- In 1923, the company acquired Midland Linseed Products Company, becoming the Archer Daniels Midland Company.

- This acquisition gave the new corporation control of over a third of the total linseed mill capacity in the United States.

- The acquisition of Midland Linseed Products Company in 1923 was a pivotal moment, solidifying its position in the industry.

The company's early success was driven by a focus on efficiency and strategic acquisitions. The acquisition of Midland Linseed Products Company in 1923 was a pivotal moment, solidifying its position in the industry. This acquisition gave the new corporation control of over a third of the total linseed mill capacity in the United States.

The company's growth continued with strategic acquisitions and expansions. For more details on the current ownership structure and shareholders, you can read the article about Owners & Shareholders of ADM.

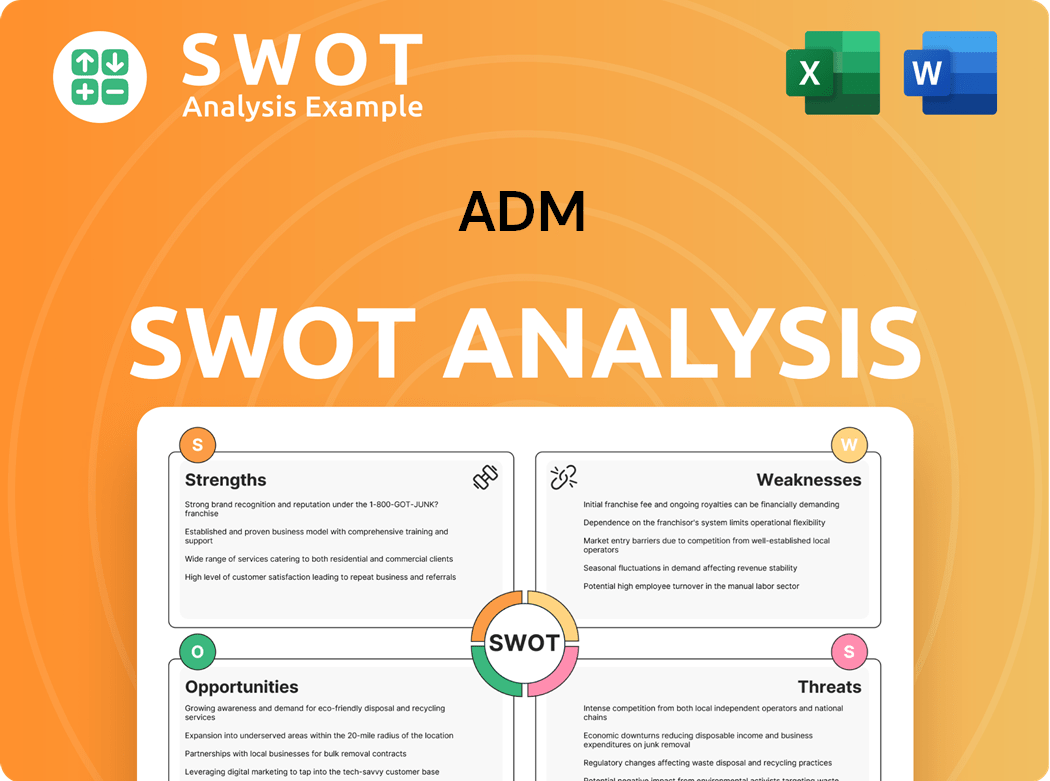

ADM SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of ADM?

The early growth of the ADM company, formerly known as Archer Daniels Midland, was marked by strategic acquisitions and expansion beyond its initial focus on linseed oil processing. This period saw the company evolve from a regional player to a significant force in the agricultural sector. The company's growth was fueled by investments and acquisitions, laying the groundwork for its future as a global agribusiness leader.

In 1924, ADM was listed on the New York Stock Exchange, providing capital for further development. The company expanded its oil processing capabilities and agricultural operations through a series of acquisitions, establishing a grain division in 1927. A notable acquisition was the control of Commander-Larabee Corp., a flour milling company, in 1930.

A key technological advancement came in 1934 with the operation of their first continuous solvent extraction plant in Chicago, enabling the production of soybean oil. The rapid development of similar plants followed. By 1952, ADM's workforce had grown to 5,000 employees, and the company was operating overseas and manufacturing over 700 products.

The company began referring to itself by the initials 'ADM' after acquiring a trademark in 1962. Further expansion included the acquisition of a resin division in 1954 to offer a complete line of resins to the paint industry. ADM established an international presence in 1955, selling products in over 50 countries within two years.

In 1969, the company relocated its headquarters from Minneapolis to Decatur, Illinois, to be closer to its soybean processing operations. By this time, ADM corporation was already considered one of the world's largest agribusiness companies with over 24,000 employees. Under the leadership of Dwayne Andreas, who became CEO in 1970, ADM acquired many smaller agricultural companies and expanded significantly into international markets, with soybean exports increasing dramatically. Early international expansions included acquiring soybean plants in Holland and Brazil in 1974 and establishing international grain operations by purchasing a portion of Toepfer International in Germany in 1982.

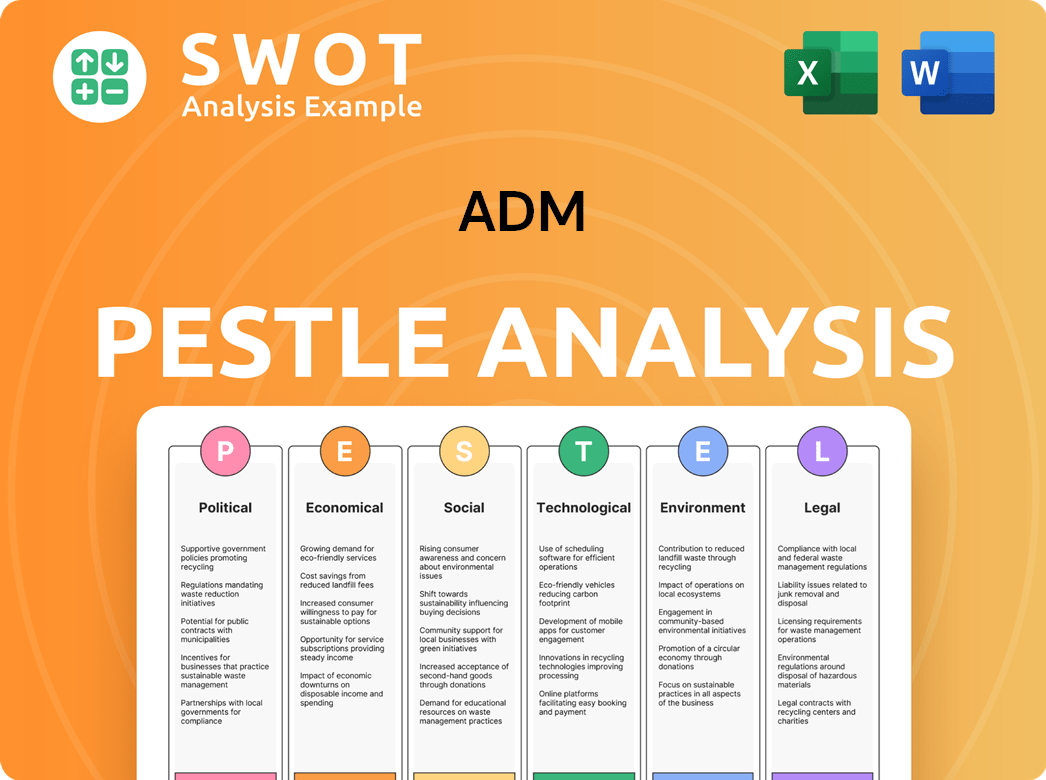

ADM PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in ADM history?

The ADM history is marked by significant milestones that have shaped its trajectory. From its early days as a linseed oil and flaxseed processor to its current status as a global agricultural giant, the ADM company has consistently expanded and adapted. The ADM corporation has navigated various market conditions and strategic shifts to maintain its position in the commodities trading and food industries.

| Year | Milestone |

|---|---|

| 1902 | The company was founded by George A. Archer and John W. Daniels, starting as a grain and seed business. |

| 1923 | The company was incorporated as Archer Daniels Midland Company. |

| 1965 | Registered the original patent for textured vegetable protein (TVP), a key innovation. |

| 2014 | Acquired Wild Flavors to diversify into natural ingredients and flavorings. |

| 2021 | Made several acquisitions in the pet food sector. |

Innovations have been a cornerstone of the ADM company's growth. The registration of the TVP patent in 1965 and subsequent production in 1966 marked a significant advancement in food technology. Furthermore, the company has received recognition for its commitment to sustainability, as evidenced by awards for products like Archer RC and NovaLipid™.

ADM's early innovation in the 1960s with the development and patenting of textured vegetable protein (TVP) significantly impacted the food industry. This product offered a versatile and cost-effective protein source, expanding ADM's product offerings and market reach.

ADM's expansion into citric acid production through acquisitions, like the acquisition of the citric acid business from Tate & Lyle in 2002, broadened its portfolio. This diversification allowed ADM to serve a wider range of industries, including food and pharmaceuticals.

The company's strategic moves into animal feed through acquisitions and internal developments have been crucial. This expansion supports the agricultural value chain, complementing ADM's core competencies in processing and commodities trading.

ADM's commitment to sustainability is highlighted by its recognition with the U.S. Environmental Protection Agency (USEPA) Presidential Green Chemistry Challenge Awards. These awards acknowledge ADM's innovative and environmentally friendly products, such as Archer RC and NovaLipid™.

ADM has increasingly invested in bio-based products. This includes investments in renewable chemicals and materials, reflecting a shift towards sustainable solutions and reducing reliance on fossil fuels. This is part of ADM's broader strategy to meet growing consumer demand for environmentally friendly products.

ADM is entering into partnerships for regenerative agriculture projects, focusing on sustainable farming practices. These initiatives aim to improve soil health, reduce carbon emissions, and enhance biodiversity, demonstrating ADM's commitment to long-term environmental sustainability and responsible sourcing.

The ADM history has also been marked by significant challenges. A price-fixing scandal in the 1990s led to a guilty plea and a substantial fine, impacting the company's reputation. In 2024, the Ag Services and Oilseeds division saw a decline in operating profit due to reduced origination volumes and more balanced supply-demand conditions.

In the 1990s, ADM faced a major challenge due to a price-fixing scandal involving lysine and high-fructose corn syrup. The company pleaded guilty and paid a significant fine, leading to reputational damage and increased regulatory scrutiny.

Market downturns and fluctuations in commodity prices have presented ongoing challenges. For example, in 2024, ADM's Ag Services and Oilseeds division experienced a decline in operating profit due to factors such as reduced South American origination volumes and more balanced supply-demand conditions.

The agricultural sector is highly competitive, with numerous players vying for market share. ADM faces competition from both large multinational corporations and smaller regional businesses. This competitive landscape necessitates continuous innovation and efficiency improvements.

In 2024, the Carbohydrate Solutions unit experienced mixed results, with a decline in the Vantage Corn Processors business. These challenges highlight the volatility and competitive pressures within specific business segments.

Global events and economic factors can lead to supply chain disruptions, impacting ADM's operations. These disruptions can affect the availability and cost of raw materials, as well as the distribution of finished products. ADM must manage these risks to maintain operational efficiency.

Geopolitical instability and trade policies can create uncertainty and challenges for ADM. These factors can affect international trade, commodity prices, and the company's ability to operate in certain regions. ADM must navigate these risks through strategic planning and diversification.

To drive growth and address challenges, ADM has implemented strategic initiatives. These include portfolio simplification and cost management, with a focus on operational efficiency. The company’s strategic pivots also include a focus on sustainability and acquisitions to expand its capabilities, as demonstrated by the acquisition of Wild Flavors in 2014. For more insights into ADM's strategic approach, consider reading Growth Strategy of ADM.

ADM Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for ADM?

The ADM corporation has a rich history, beginning with John W. Daniels' linseed crushing business in 1902. Over the years, it evolved from a small operation to a global leader in agricultural processing and commodities trading. Key milestones include the official naming as Archer-Daniels Linseed Company in 1905, the acquisition of Midland Linseed Products Company in 1923, and its listing on the New York Stock Exchange in 1924. ADM's expansion continued internationally, with significant developments in soybean processing and acquisitions, shaping its current position in the food industry.

| Year | Key Event |

|---|---|

| 1902 | John W. Daniels starts a linseed crushing business in Minneapolis. |

| 1905 | The firm is officially named the Archer-Daniels Linseed Company. |

| 1923 | Archer-Daniels Linseed Company acquires Midland Linseed Products Company and incorporates as Archer Daniels Midland Company. |

| 1924 | ADM is listed on the New York Stock Exchange. |

| 1934 | ADM operates its first continuous solvent extraction plant for soybean oil. |

| 1955 | ADM establishes an international presence. |

| 1962 | The company begins referring to itself as ADM. |

| 1965 | ADM registers the patent for textured vegetable protein. |

| 1969 | Headquarters relocate to Decatur, Illinois. |

| 1970 | Dwayne Andreas becomes CEO. |

| 1982 | ADM establishes international grain operations with the purchase of a portion of Toepfer International. |

| 1996 | ADM pleads guilty to price-fixing charges. |

| 2014 | Headquarters move to Chicago; acquires Wild Flavors. |

| 2021 | Acquires several pet food companies and Sojaprotein. |

| 2024 | Reports full-year financial results with decreased revenue and net income compared to 2023. |

In 2025, ADM is prioritizing strategic simplification and cost management. The company is focusing on operational efficiency to navigate market uncertainties. ADM aims to achieve significant cost savings in the coming years, reflecting a proactive approach to financial performance.

ADM is committed to disciplined capital allocation, including returning cash to shareholders. This includes dividends and share repurchases to enhance shareholder value. The company is also focused on organic investment in key growth areas.

ADM is adapting to changing market dynamics, especially in the food industry. The company is leveraging innovation to capitalize on opportunities. This includes focusing on sustainable and healthy food options.

The future outlook for ADM depends on its ability to adapt and innovate. The company's evolution reflects its commitment to meeting market needs. ADM's growth is tied to its ability to capitalize on emerging trends.

ADM Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of ADM Company?

- What is Growth Strategy and Future Prospects of ADM Company?

- How Does ADM Company Work?

- What is Sales and Marketing Strategy of ADM Company?

- What is Brief History of ADM Company?

- Who Owns ADM Company?

- What is Customer Demographics and Target Market of ADM Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.