ADM Bundle

Who Really Calls the Shots at Archer Daniels Midland (ADM)?

Understanding the ADM SWOT Analysis is crucial, but have you ever wondered who truly steers the ship at Archer Daniels Midland Company (ADM)? The ownership structure of a company like ADM, a global leader in agricultural processing, is a key indicator of its strategic direction and future prospects. Unraveling the intricacies of ADM ownership reveals a fascinating story of growth, influence, and market dynamics.

From its humble beginnings in 1902, ADM has evolved into a corporate behemoth, and tracing the evolution of its ownership provides invaluable insights. Knowing who owns ADM, from major institutional investors to public shareholders, helps to understand the ADM company's strategic path and its response to market changes. This exploration will delve into the ADM company profile, examining its leadership, financial performance, and the impact of its acquisitions, offering a comprehensive view for anyone interested in ADM stock and its future.

Who Founded ADM?

The story of the ADM company begins in 1902 with John W. Daniels, who established a linseed crushing business in Minneapolis, Minnesota. This marked the start of what would become a global leader in agricultural processing and food ingredients. George A. Archer joined the venture soon after, shaping the company's early trajectory.

By 1905, the company was officially named the Archer-Daniels Linseed Company. George A. Archer held a significant stake, owning 50% of the company and serving as its president. The partnership between Archer and Daniels proved crucial, combining Archer's strategic planning with Daniels' strong trade relationships.

This collaborative approach led to rapid growth. The company's production capacity tripled, and its capitalization increased almost eightfold within its first decade. This early success set the stage for ADM's future expansion and its position in the agricultural sector. This early history is a key part of the Brief History of ADM.

In 1923, the Archer-Daniels Linseed Company acquired Midland Linseed Products Company, officially incorporating as the Archer Daniels Midland Company. The newly formed corporation had assets exceeding $11 million and controlled approximately 35% of the total linseed mill capacity in the United States. While specific early investors are not extensively detailed, the founders' focus on cost-consciousness and strategic expansion laid the groundwork for the company's future.

- The company's focus on linseed oil production was a primary business activity during its early years.

- The incorporation as Archer Daniels Midland Company marked a significant expansion of the company.

- The Andreas brothers, Dwayne and Lowell, became minority shareholders in 1966, changing the ADM ownership landscape.

- ADM's early growth was characterized by strategic acquisitions and expansion of production capacity.

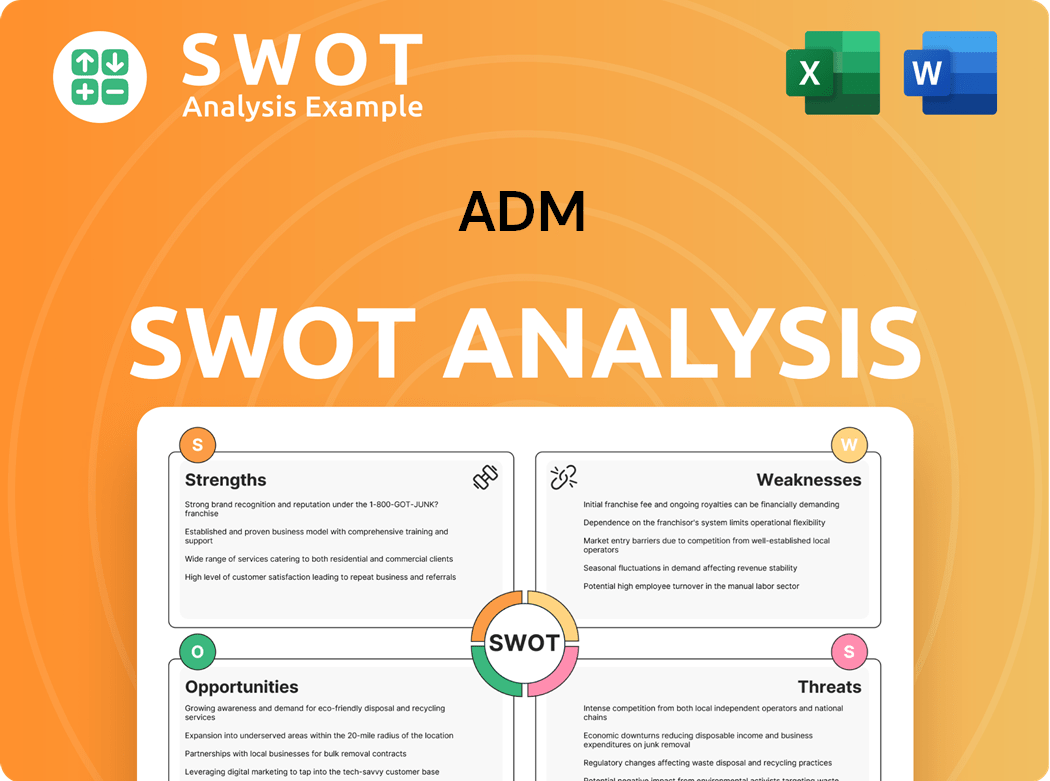

ADM SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has ADM’s Ownership Changed Over Time?

The ownership structure of Archer Daniels Midland (ADM) has changed significantly since its initial public offering (IPO) in 1924. Initially, the company's shares were likely held by a mix of individual and early institutional investors. Over time, particularly after the company's listing on the New York Stock Exchange, ADM's ownership evolved, with institutional investors gradually increasing their stake. This shift reflects broader trends in the market, where institutional investors often play a more significant role in publicly traded companies.

The evolution of ADM's ownership also reflects the company's growth and strategic decisions. Acquisitions, expansions, and changes in market dynamics have influenced investor interest and the composition of its shareholder base. Furthermore, ADM's performance and strategic direction have likely attracted different types of investors over the years, leading to shifts in ownership. For a deeper dive into ADM's strategy, consider reading about the Growth Strategy of ADM.

| Ownership Category | Approximate Percentage (June 3, 2025) | Notes |

|---|---|---|

| Institutional Investors | 81.67% | Includes major shareholders like Vanguard Group Inc. and BlackRock, Inc. |

| Individual Insiders | 0.65% - 3.02% | Represents shares held by company executives and board members. |

| Public Companies and Individual Investors | 24.71% - 41.12% | Combined ownership of various public entities and individual shareholders. |

As of June 2025, the dominant ownership of ADM is held by institutional investors, who collectively control over 80% of the outstanding shares. Key institutional shareholders include Vanguard Group Inc., BlackRock, Inc., and State Street Corp. These large investors significantly influence ADM's share price and strategic direction. Individual insiders hold a smaller percentage, while public companies and individual investors make up the remaining portion. This ownership structure is detailed in financial reports, such as the 10-K annual report for the year ending December 31, 2024, and the 10-Q quarterly reports for 2025.

Institutional investors are the primary owners of ADM stock, holding the vast majority of shares.

- Vanguard Group Inc. is a major institutional shareholder, with a significant stake in the company.

- Individual insiders hold a small percentage of ADM's stock.

- The ownership structure influences ADM's share price and strategic decisions.

- ADM's financial reports provide detailed insights into shareholding changes.

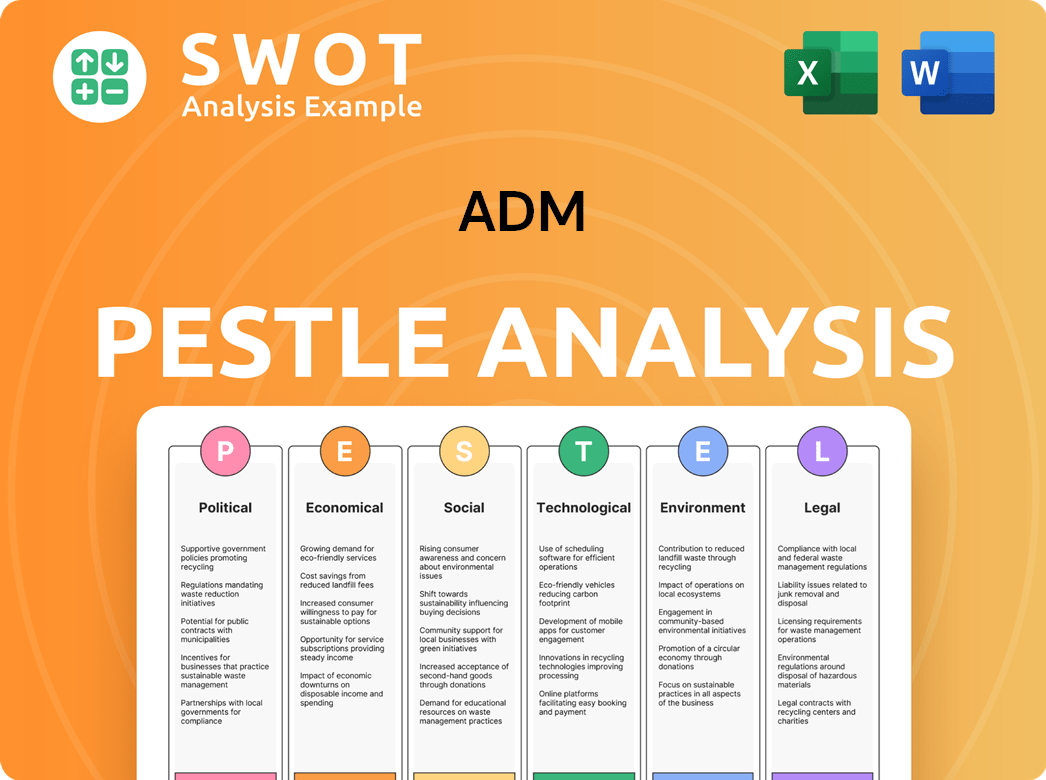

ADM PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on ADM’s Board?

The Board of Directors at Archer Daniels Midland (ADM) oversees the company's strategic direction and is accountable to its shareholders. While a comprehensive list of all current board members and their specific affiliations to major shareholders or founders isn't immediately available, the board includes members representing significant interests and independent seats. The Audit Committee, a key board committee, is composed entirely of 'independent' directors, as defined by the New York Stock Exchange listing standards.

The board's composition and actions are subject to scrutiny, especially considering recent events. For instance, a federal judge's 2025 ruling required the company to address allegations of deceptive accounting practices related to its nutrition business. This highlights the board's accountability and the potential for shareholder scrutiny, influencing decision-making and investor relations.

| Board Member | Title | Affiliation |

|---|---|---|

| Juan R. Luciano | Chairman of the Board and Chief Executive Officer | |

| Debra A. Sandler | Lead Director | |

| Ted R. Aronson | Director |

ADM operates under a voting structure where large institutional investors can exert considerable influence. The company's SEC filings, including Schedule 13G forms, report beneficial ownership of more than 5% of a class of equity securities, indicating passive investments by large shareholders. The influence of major institutional holders is significant, given that they collectively own over 50% of the company's stock. This substantial ownership implies that the board likely pays close attention to the preferences of these institutional investors, making the ADM ownership structure a key factor for investors.

The Board of Directors at ADM plays a crucial role in governance, with significant influence from institutional investors. The board includes independent directors, ensuring oversight and accountability, especially concerning financial practices. Understanding ADM stock ownership is important for investors.

- The Audit Committee is composed of independent directors.

- Institutional investors own over 50% of the company's stock.

- Recent legal issues highlight the board's accountability.

- For more insights, explore the Competitors Landscape of ADM.

ADM Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped ADM’s Ownership Landscape?

Over the past few years, Archer Daniels Midland (ADM) has actively managed its capital through significant share repurchase programs. On December 11, 2024, ADM's Board of Directors approved an extension of its share repurchase program, authorizing the purchase of up to an additional 100 million shares through December 31, 2029. This extension brought the total authorized repurchases to 300 million shares. As of December 11, 2024, approximately 114.8 million shares remained available for future repurchases under this extended program, signaling a strong commitment to returning value to shareholders.

In March 2024, ADM announced a $1 billion accelerated share repurchase (ASR) agreement and planned to execute an additional $2 billion in share repurchases throughout 2024. This demonstrates a clear strategy to boost shareholder value. By the end of 2024, the company had returned $3.1 billion in cash through dividends and share repurchases. This active approach to capital allocation has been a key feature of ADM's recent financial strategy, impacting its ADM stock performance and reflecting its confidence in its financial health.

| Metric | June 2024 | Previous Period |

|---|---|---|

| Institutional Ownership | 81.71% | 81.43% |

| Mutual Fund Ownership | 79.90% | 78.42% |

The trend of increasing institutional ownership is evident in ADM. As of June 2024, institutional investors increased their holdings from 81.43% to 81.71%. Mutual funds also increased their holdings from 78.42% to 79.90%. This growing institutional interest influences ADM's strategic direction and its ADM financial performance. The concentration of ownership among large investment firms underscores their significant influence on the company's operations and market behavior, making the ADM ownership structure a key area of interest for investors.

ADM's stock performance is closely watched by investors. Analyzing the stock price today gives insights into the market's perception of the company's value. Understanding ADM's financial performance is crucial for making informed investment decisions.

ADM investors include a mix of institutional and individual shareholders. Knowing who ADM's major shareholders are provides insight into the company's ownership structure. The increasing institutional ownership indicates strong confidence in the company's future.

Understanding the ADM company profile is essential for investors. This includes its business model and the various ADM company subsidiaries. ADM's history and ADM company acquisitions shape its current market position.

The location of ADM headquarters is a key piece of information. Knowing where ADM's main office is located provides context for its global operations. The company's leadership and organizational structure are also important aspects.

ADM Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of ADM Company?

- What is Competitive Landscape of ADM Company?

- What is Growth Strategy and Future Prospects of ADM Company?

- How Does ADM Company Work?

- What is Sales and Marketing Strategy of ADM Company?

- What is Brief History of ADM Company?

- What is Customer Demographics and Target Market of ADM Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.