ADM Bundle

How Does ADM Thrive in the Global Market?

Archer Daniels Midland (ADM) is a titan in the agricultural and nutrition industries, boasting a staggering $93.9 billion in revenue in 2023. But how does this agricultural powerhouse, also known as ADM company, actually work? This deep dive explores the inner workings of ADM, revealing the strategies and operations that fuel its success.

Understanding the ADM SWOT Analysis is crucial for grasping its market position. This exploration of the ADM business model will uncover how ADM sources its products, manages its complex supply chain, and maintains its global presence. We'll examine ADM's diverse revenue streams, from agricultural products to food processing, providing insights into its financial performance and strategic direction, making it a must-read for anyone interested in how ADM works.

What Are the Key Operations Driving ADM’s Success?

The ADM company creates and delivers value by transforming agricultural raw materials into a wide range of value-added products and solutions. It serves diverse customer segments within the food, beverage, industrial, and animal feed industries. Its core offerings include ingredients for human and animal nutrition, starches, sweeteners, bio-products, and comprehensive agricultural services.

The company's core operations involve a highly integrated global network. This network encompasses origination, processing, and transportation assets. ADM sources crops directly from farmers worldwide. It uses its extensive network of grain elevators and port facilities for efficient collection and storage. This integrated approach allows for optimization across the entire value chain, reducing costs, and enhancing efficiency.

The company's operational strength lies in its ability to manage complex supply chains, from farm to fork. This includes advanced processing capabilities that convert raw agricultural products into refined ingredients, and a sophisticated logistics network that ensures timely delivery to customers globally. ADM’s supply chain is further enhanced by strategic partnerships and robust distribution networks, allowing it to serve a diverse customer base, from large multinational food manufacturers to local feed producers.

ADM offers a wide array of products and services. These range from ingredients for food and beverages to animal feed and industrial products. The company also provides agricultural services like merchandising, storage, and transportation.

ADM's operations are built on a global network. This network includes sourcing crops, processing them, and transporting products worldwide. The company focuses on efficiency and cost reduction through its integrated approach.

The company manages complex supply chains. This includes advanced processing and a sophisticated logistics network. This ensures timely delivery to customers globally.

Customers benefit from consistent quality, reliable supply, and tailored ingredient solutions. This differentiation helps ADM succeed in a competitive market.

ADM's business model is centered on transforming agricultural products into valuable offerings. The company's success is tied to its efficient operations and integrated supply chain. ADM's global presence and diverse product portfolio are key to its market position.

- Global Network: Operates a vast network of facilities worldwide.

- Integrated Operations: Combines sourcing, processing, and distribution.

- Customer Focus: Provides tailored solutions to meet diverse customer needs.

- Financial Performance: The company's financial performance is influenced by agricultural commodity prices and global demand. For example, in fiscal year 2024, ADM reported revenues of approximately $94.4 billion.

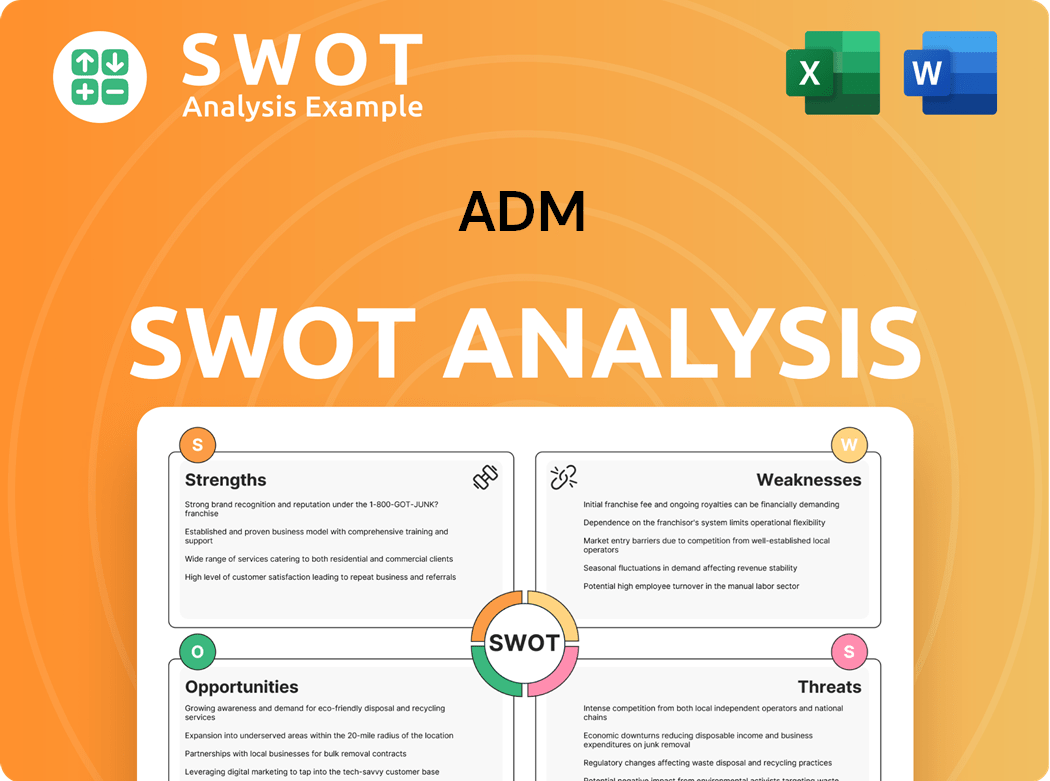

ADM SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does ADM Make Money?

The ADM company generates revenue through a diversified set of streams, primarily categorized into its Ag Services and Oilseeds, Carbohydrate Solutions, and Nutrition segments. Understanding how ADM works involves examining these core business areas and their respective monetization strategies. This approach allows for a comprehensive view of ADM's business model and its financial performance.

In 2023, ADM showcased its robust revenue generation capabilities across its key segments. The Ag Services and Oilseeds segment, a cornerstone of the company, contributed significantly to the overall revenue. The Carbohydrate Solutions and Nutrition segments also played vital roles, demonstrating the company's diversified business model and its ability to capitalize on various market opportunities.

The Ag Services and Oilseeds segment is a major revenue driver for ADM, encompassing the global origination, merchandising, transportation, and processing of oilseeds. In 2023, this segment reported revenues of $70.4 billion. This revenue stream is heavily influenced by the volume and price of agricultural commodities, alongside the margins derived from processing oilseeds into meal and oil. The segment's success is closely tied to its efficient supply chain and global presence, enabling it to source and deliver products effectively.

The Carbohydrate Solutions segment focuses on converting corn and wheat into sweeteners, starches, and bio-products. This segment generated $11.5 billion in revenue in 2023. The Nutrition segment, offering a wide array of ingredients and solutions for food, beverages, and animal nutrition, brought in $7.4 billion in revenue during the same year. ADM's strategic focus on the Nutrition segment is evident in its efforts to expand and enhance its product offerings.

- The Carbohydrate Solutions segment monetizes its offerings through the sale of high-fructose corn syrup, glucose, ethanol, and other industrial products.

- The Nutrition segment's monetization strategies include product sales of flavors, specialty ingredients, and animal nutrition products, often involving tailored solutions and value-added services.

- ADM also employs hedging strategies to manage commodity price volatility and optimize profitability across its various segments.

- The company continuously evaluates and expands its revenue sources, particularly in the higher-margin Nutrition segment, to drive sustainable growth.

For more details on the company's origins and evolution, you can refer to Brief History of ADM.

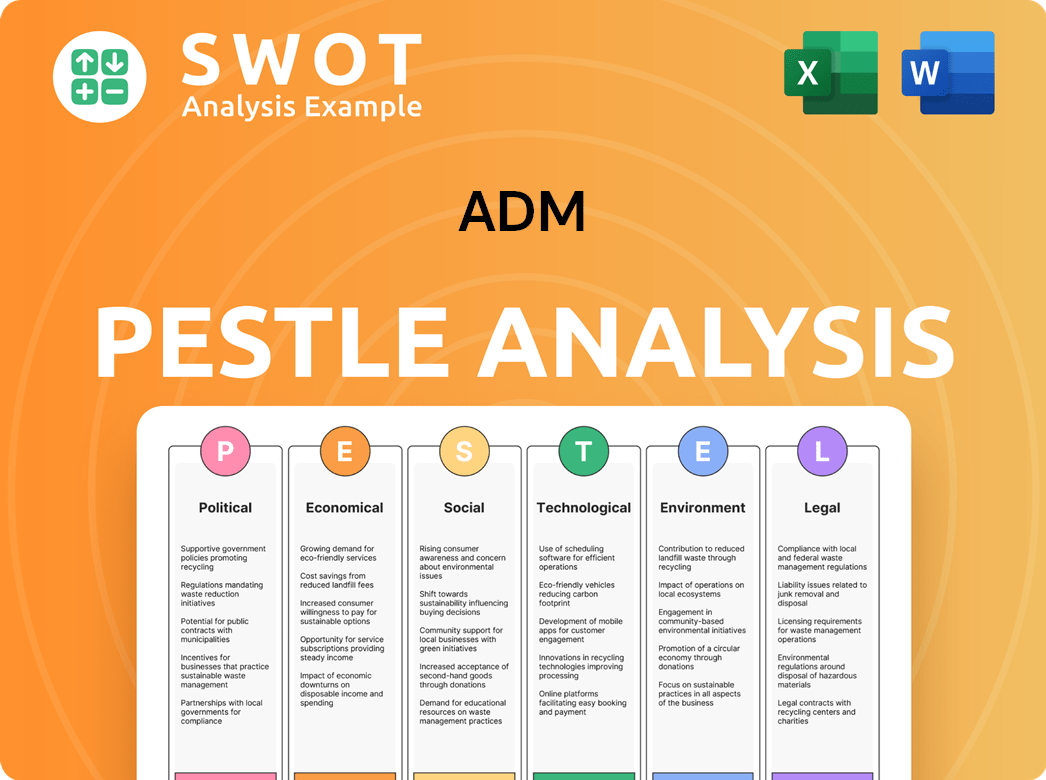

ADM PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped ADM’s Business Model?

The ADM company has consistently demonstrated its ability to adapt and thrive, marked by significant milestones and strategic shifts. These actions have shaped its operations and financial results. A key focus has been on expanding its Nutrition segment, which has become a cornerstone of its strategy to mitigate the volatility inherent in commodity markets. This commitment is reflected in its investments and the segment's performance.

A critical aspect of the ADM business model involves navigating operational challenges, such as supply chain disruptions and geopolitical uncertainties. The company leverages its robust global network and diversified sourcing strategies to manage these issues effectively. This approach is crucial for maintaining operational efficiency and ensuring a steady supply of goods, which ultimately impacts its financial stability.

The company's competitive edge is rooted in its extensive global infrastructure, deep expertise in agricultural commodities, and integrated value chain. From origination to processing and distribution, How ADM works provides a significant advantage by optimizing efficiency and reducing costs. Furthermore, its commitment to innovation, particularly in sustainable solutions and advanced nutrition, allows it to adapt to evolving consumer preferences and technological shifts. The company continues to invest in research and development to maintain its leadership position.

Over the years, ADM has achieved several significant milestones, including strategic acquisitions and expansions in key markets. These moves have broadened its product portfolio and strengthened its market position. The company's growth has been driven by both organic initiatives and strategic investments.

Strategic moves include a strong focus on the Nutrition segment, with acquisitions aimed at expanding its portfolio of flavors, specialty ingredients, and health and wellness solutions. These strategic shifts have helped ADM to diversify its revenue streams and improve its profitability. The company continually adapts its strategies to meet market demands.

The company's competitive advantages stem from its immense economies of scale, extensive global infrastructure for sourcing and processing, and deep expertise in agricultural commodities. Its integrated value chain, from origination to processing and distribution, provides a significant competitive edge. This integrated approach allows for greater control and efficiency.

In Q1 2024, the Nutrition segment showed strong performance, highlighting the success of strategic shifts. The company's commitment to innovation, particularly in sustainable solutions and advanced nutrition, allows it to adapt to evolving consumer preferences and technological shifts. ADM continues to invest in research and development to maintain its leadership position.

The company's strengths include its global presence, diversified product portfolio, and strong financial performance. ADM's ability to navigate market challenges and capitalize on growth opportunities is a key factor in its success. The company's focus on innovation and sustainability further enhances its competitive position.

- Extensive global network for sourcing and processing.

- Integrated value chain from origination to distribution.

- Commitment to innovation in sustainable solutions.

- Strong financial performance and strategic investments.

ADM Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is ADM Positioning Itself for Continued Success?

Let's explore the industry position, risks, and future outlook of the ADM company. ADM, or Archer Daniels Midland, holds a prominent position in the global agricultural processing and nutrition sector. Its extensive global reach and integrated business model, which encompasses various ADM operations, provide a strong competitive advantage. The company is a key player in the agricultural landscape.

However, like any major player, ADM faces several challenges. Commodity price volatility, regulatory changes, and the emergence of new competitors are significant factors. The company actively manages these risks through strategic initiatives, including investments in its Nutrition segment and sustainability efforts. This focus is designed to ensure ADM's continued success and profitability.

ADM ranks among the leading companies in the agricultural processing and nutrition industry. Its business model is diversified, allowing it to engage in various activities, including agricultural products, food processing, and trading activities. The company's global presence ensures it can meet the demands of a wide customer base.

ADM faces several risks. Commodity price volatility can significantly impact its Ag Services and Oilseeds and Carbohydrate Solutions segments. Regulatory changes, especially concerning environmental regulations and trade policies, also pose challenges. New competitors and disruptive technologies could challenge ADM’s market position.

The future outlook for ADM is focused on strategic growth and adaptation. The company is investing in its Nutrition segment, which offers higher margins and less commodity price exposure. Sustainability initiatives are also a key focus to meet evolving consumer and regulatory demands.

In fiscal year 2024, ADM reported solid financial results, reflecting its diverse operations. The company generated approximately $94.4 billion in revenue. ADM's ability to generate consistent profits underscores its strong position in the market. For more insights, check out the Competitors Landscape of ADM.

ADM is actively pursuing initiatives to mitigate risks and drive future growth. These include expanding its Nutrition segment, which offers higher margins and less exposure to commodity price volatility. The company is also focusing on sustainability to meet consumer and regulatory demands.

- Investment in Nutrition: Focus on higher-margin products.

- Sustainability Efforts: Meeting evolving environmental standards.

- Operational Excellence: Continuous improvement across all operations.

- Strategic Partnerships: Collaborations to expand market reach.

ADM Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of ADM Company?

- What is Competitive Landscape of ADM Company?

- What is Growth Strategy and Future Prospects of ADM Company?

- What is Sales and Marketing Strategy of ADM Company?

- What is Brief History of ADM Company?

- Who Owns ADM Company?

- What is Customer Demographics and Target Market of ADM Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.