ADM Bundle

Can ADM Continue to Thrive in a Changing World?

Founded in 1902, Archer Daniels Midland (ADM) has transformed from a traditional agricultural processor into a global powerhouse. Today, ADM plays a crucial role in connecting agricultural production with market demands, offering a wide range of products for food, beverage, and industrial applications. This evolution underscores the importance of strategic growth within the dynamic agricultural and food processing industry.

ADM's strategic focus on portfolio optimization and operational efficiency is key to navigating market challenges. The company's proactive approach, including workforce reductions and manufacturing cost improvements, aims to strengthen its position. To gain deeper insights into ADM's strategic moves, consider exploring the ADM SWOT Analysis for a comprehensive understanding of its strengths, weaknesses, opportunities, and threats within the Agricultural commodities sector.

How Is ADM Expanding Its Reach?

The Target Market of ADM is actively pursuing various expansion initiatives to drive future growth. These initiatives focus on increasing geographical reach and enhancing its product portfolio. The company is strategically positioning itself to meet evolving consumer demands and capitalize on emerging market opportunities within the agricultural commodities and food processing industry.

A key area of expansion for ADM is in regenerative agriculture. This approach aims to enhance sustainability within its value chains and reduce its carbon footprint. The company is partnering with growers to implement regenerative practices across various crops and regions, offering financial incentives and technical support.

In early 2024, ADM acquired Revela Foods and FDL. These acquisitions have strengthened ADM's presence in the dairy flavoring and functional ingredients markets, respectively. These moves align with ADM's commitment to becoming a leader in the ingredients space, reflecting its focus on meeting evolving consumer demand.

ADM is significantly increasing its acreage goals for regenerative agriculture. The company exceeded its 2023 goal, reaching over 2.8 million acres. ADM has set targets of 3.5 million acres in 2024 and 5 million acres globally by 2025. This expansion is crucial for enhancing sustainability and reducing the company's carbon footprint.

ADM is expanding its capabilities through strategic acquisitions and partnerships, particularly in the flavors and ingredients sector. Recent acquisitions, such as Revela Foods and FDL, have strengthened ADM's presence in key markets. The company is also exploring supply chain collaborations, such as the memorandum of understanding with Mitsubishi, which could lead to future expansion opportunities in areas like biofuels.

ADM is committed to becoming a leader in the ingredients space, focusing on meeting evolving consumer demand for better-for-you attributes and bold flavors. The acquisitions of Revela Foods and FDL are prime examples of this strategy. This focus allows ADM to capitalize on the growing market for specialized ingredients and flavors.

ADM is also focusing on organic investments in areas with strong growth potential and differentiation. This includes research and development, as well as investments in new technologies and processes. These investments are designed to drive long-term growth and enhance the company's competitive position in the market.

ADM's expansion strategy involves a multi-pronged approach, including regenerative agriculture, strategic acquisitions, and supply chain collaborations. These initiatives are designed to enhance sustainability, expand market reach, and capitalize on emerging trends in the food and agriculture industries. The company's focus on ingredients and flavors, coupled with organic investments, positions it well for future growth.

- Increasing acreage for regenerative agriculture to 5 million acres globally by 2025.

- Strategic acquisitions to strengthen presence in the flavors and ingredients sector.

- Exploring supply chain collaborations for opportunities in biofuels and other areas.

- Focusing on organic investments in areas with strong growth potential and differentiation.

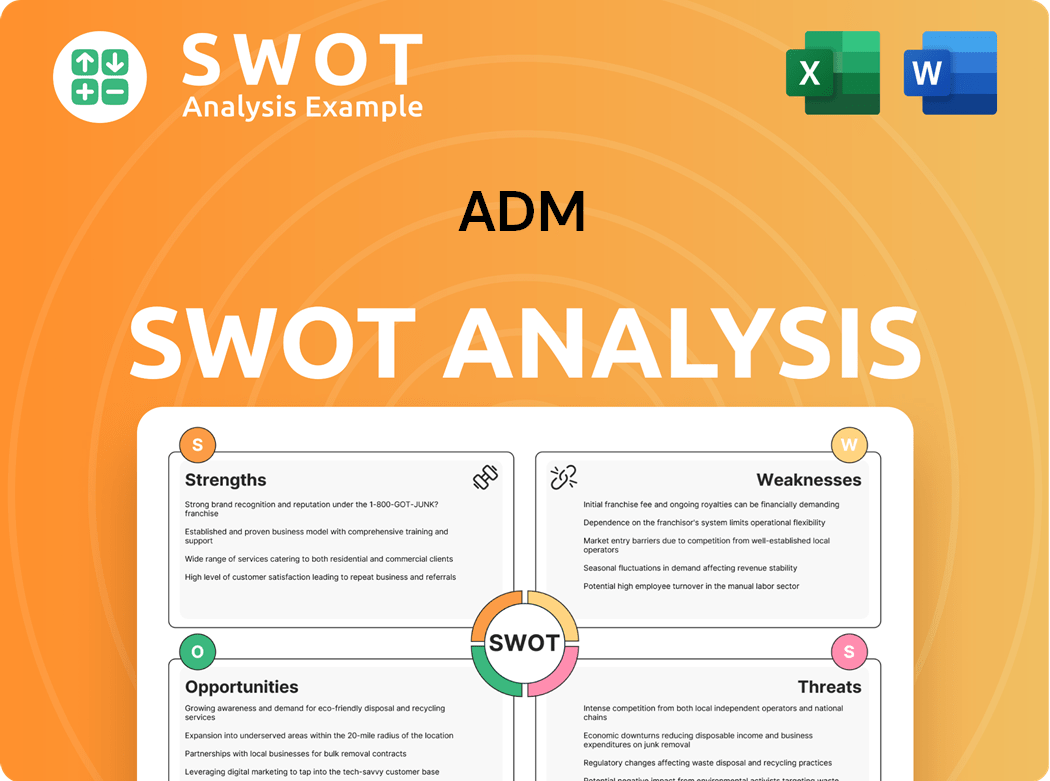

ADM SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does ADM Invest in Innovation?

The company, known as ADM, is actively using innovation and technology to fuel its sustained growth and improve operational efficiency. A key focus area is digital transformation, which involves significant investments in global technology. This strategy is designed to streamline operations and enhance data management across the enterprise.

ADM's approach to innovation includes exploring advanced technologies like artificial intelligence (AI) and automated decision-making (ADM) to enhance business operations and decision-making processes. This forward-thinking approach is expected to improve productivity and efficiency, while also creating new opportunities for skills development within the company. These initiatives are crucial for maintaining a competitive edge in the agricultural commodities and food processing industry.

Furthermore, ADM is committed to sustainability, employing satellite mapping to monitor for deforestation in its supply chains. The goal is to achieve 100% deforestation-free supply chains by 2025, demonstrating a strong commitment to environmental responsibility and sustainable practices. This commitment is an integral part of ADM's long-term growth potential.

ADM is consolidating and standardizing its ERP systems, with a move towards SAP S/4HANA for larger businesses. This initiative is designed to transform how data is managed and utilized across the company.

The company is exploring the use of AI and automated decision-making to improve business operations and decision-making. This includes implementing innovative solutions like generative AI to capture and share knowledge from frontline workers.

ADM has developed an internal, secure generative AI platform called ChatADM. This platform supports various operational improvements and enhances internal communication.

ADM is utilizing satellite mapping to monitor for deforestation in its supply chains. The company aims to achieve 100% deforestation-free supply chains by 2025, reflecting its commitment to sustainability.

These technological advancements contribute to growth objectives by improving productivity and efficiency. They also create new skills development opportunities within the company.

These initiatives are part of ADM's broader strategic initiatives aimed at enhancing its market position and operational capabilities. This is also explored in the Marketing Strategy of ADM article.

ADM's investments in technology are multifaceted, focusing on digital transformation, AI, and supply chain optimization. These investments are expected to yield significant returns by improving operational efficiency and driving growth.

- Consolidation of ERP systems to SAP S/4HANA.

- Implementation of generative AI for knowledge sharing.

- Development of internal AI platforms like ChatADM.

- Use of satellite mapping for supply chain monitoring.

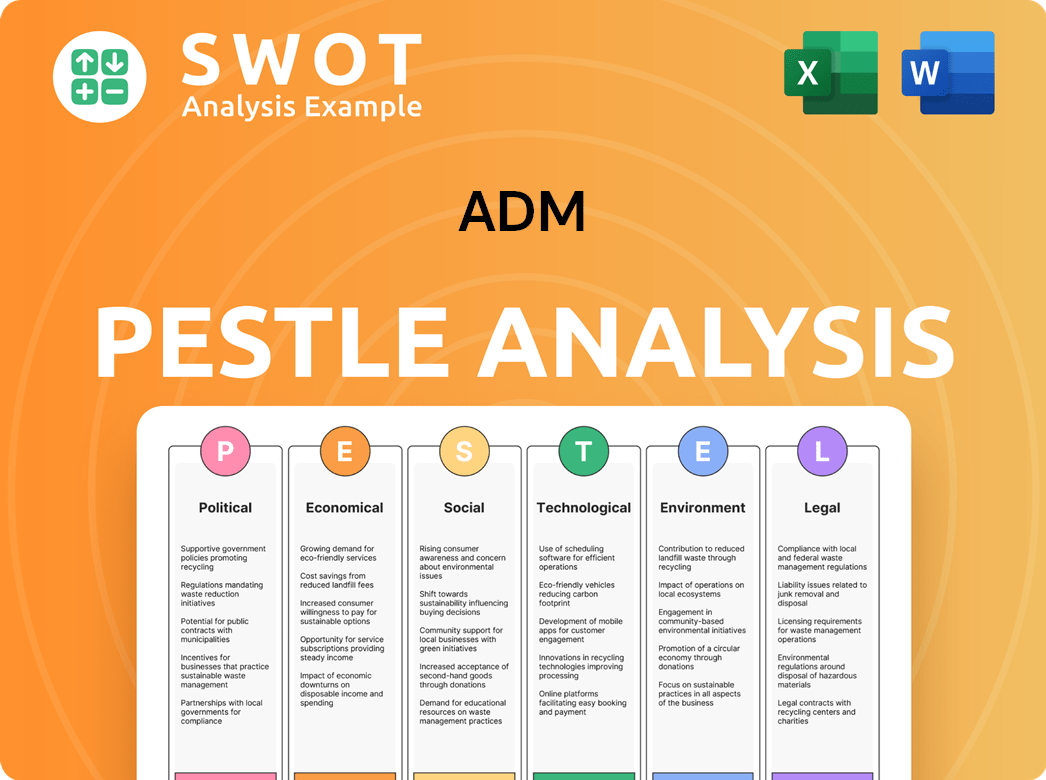

ADM PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is ADM’s Growth Forecast?

The financial outlook for the ADM company in 2025 is shaped by a cautious approach, despite ongoing strategic efforts. The company's performance in 2024 showed a decrease in earnings compared to the prior year, with revenues also declining. This backdrop influences the company's financial guidance for the upcoming year.

For the full year of 2024, ADM reported net earnings of $1.8 billion and adjusted net earnings of $2.3 billion. Adjusted earnings per share were $4.74. Revenues totaled $85.53 billion, reflecting a 9% decrease from the previous year. These figures set the stage for the company's expectations and strategies moving forward.

Looking to 2025, ADM anticipates adjusted earnings per share to be in the range of $4.00 to $4.75. However, the company expects earnings to be at the lower end of this range. This is due to current market conditions, including weaker market dynamics and policy uncertainties. The Ag Services and Oilseeds segment is projected to experience lower operating profit in 2025 compared to 2024.

To address financial challenges, ADM is implementing targeted actions to achieve $500 million to $750 million in cost savings over the next few years. A significant portion of these savings, between $200 million and $300 million, is targeted for 2025. These initiatives are crucial for improving operational efficiency and financial performance.

ADM is focusing on disciplined capital allocation, including strategic investments and returning cash to shareholders. This strategy involves a balance between growth investments and rewarding shareholders through dividends and share repurchases. This approach aims to enhance shareholder value while supporting long-term growth.

ADM has a strong history of returning value to shareholders, marking its 93rd consecutive year of uninterrupted dividends. The company announced an increase in its quarterly dividend payable in March 2025, demonstrating its commitment to shareholder returns. This consistent dividend policy reflects financial stability and confidence in the company's future.

The company faces several challenges, including weaker market conditions and policy uncertainty, which are impacting its financial outlook. The Ag Services and Oilseeds segment is expected to see lower operating profit in 2025. These challenges highlight the need for strategic adjustments and cost-saving measures.

The Competitors Landscape of ADM reveals the competitive environment in which ADM operates, which influences its financial strategy and market position. ADM's focus on cost savings and disciplined capital allocation is crucial for navigating these challenges and achieving its financial goals.

ADM Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow ADM’s Growth?

The future growth of the ADM company faces several potential risks and obstacles. The ADM growth strategy could be affected by market dynamics, geopolitical tensions, and regulatory changes. These factors, along with internal challenges and competitive pressures, pose significant hurdles for ADM's future prospects.

A key challenge for Archer Daniels Midland is navigating the volatile market environment, including weak market conditions and trade policy uncertainties. Supply chain vulnerabilities, including human rights risks, also demand careful management. The company's stock has faced pressure, declining in the past year due to these headwinds and accounting irregularities.

To mitigate these risks, ADM is focusing on operational improvements, cost savings, and portfolio simplification. Scenario planning is used to prepare for potential global trade disruptions. The company is also leveraging data analytics and aligning its organizational structure to enhance efficiency and adaptability.

Weak market conditions and trade policy uncertainties significantly impact ADM's revenue and operating profits. These factors, including tariffs and geopolitical tensions, create a challenging environment. The company must adapt to these dynamic conditions to maintain its financial performance.

Changes in regulations, particularly around biofuels and tariff policies, pose headwinds for ADM. Compliance and obtaining necessary approvals can be complex. The company must stay updated on evolving regulations to ensure its operations remain compliant.

Managing supply chain risks, including human rights concerns like forced labor, is critical. ADM addresses these by identifying risks and working with suppliers. Continuous monitoring and stringent management are essential to mitigate these vulnerabilities.

Stiff competition for raw materials, transportation, and other supplies impacts ADM. The company must differentiate itself through innovation and operational efficiency. Maintaining a competitive edge is crucial for long-term success.

Internal operational challenges can hinder ADM's growth. The company focuses on operational improvements, cost savings, and portfolio simplification to address these issues. Streamlining processes and enhancing efficiency are key.

Recent financial challenges include declines in revenue and operating profits in certain segments. The stock has faced pressure due to these headwinds and accounting irregularities. ADM is working to improve its financial performance through strategic initiatives.

ADM is focused on enhancing operational efficiency to mitigate risks. This includes streamlining processes, leveraging data analytics for savings, and aligning its organizational structure for better performance. These efforts aim to improve profitability and adaptability in a challenging market. For example, in 2024, ADM announced plans to accelerate cost savings initiatives.

The company is actively engaged in scenario planning to prepare for potential global trade disruptions. Strategic initiatives include portfolio simplification and investments in technology. These proactive measures are designed to strengthen ADM's position in the food processing industry. Read more about Revenue Streams & Business Model of ADM.

ADM is addressing supply chain vulnerabilities, including human rights risks. This involves identifying risks and working with suppliers to resolve issues. The company is also committed to complying with evolving regulations, particularly in biofuels, to ensure sustainable operations. These efforts are crucial for long-term success.

Despite efforts, the company's stock has faced pressure due to headwinds and accounting irregularities that surfaced in 2024. ADM is working to improve its financial performance through strategic initiatives. The company's performance in 2025 will depend on its ability to navigate these challenges and capitalize on opportunities in the agricultural commodities market.

ADM Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.