Advance Auto Parts Bundle

How has Advance Auto Parts Driven the Automotive Aftermarket for Nearly a Century?

Journey back in time to discover the remarkable Advance Auto Parts SWOT Analysis, a company that began during the Great Depression and evolved into a dominant force in the automotive industry. From its humble beginnings, Advance Auto Parts has navigated economic shifts and technological advancements, consistently adapting to meet the ever-changing needs of car owners. Explore the fascinating narrative of this auto parts retailer's growth, strategic acquisitions, and enduring commitment to customer service.

Understanding the Advance Auto Parts history is crucial for investors, analysts, and anyone interested in the automotive industry. This exploration of the Advance Auto Parts company reveals how strategic decisions and a focus on core values have shaped its trajectory. Delving into the brief history of Advance Auto Parts offers valuable insights into its resilience, expansion, and position within the competitive landscape of car parts.

What is the Advance Auto Parts Founding Story?

The story of Advance Auto Parts begins in the depths of the Great Depression. Founded on April 29, 1932, by Arthur Taubman, the company emerged from challenging economic times, seizing an opportunity in the automotive industry.

Taubman, leveraging his retail background, including experience in a chain selling auto parts and household goods, saw potential in the auto parts business. He acquired a struggling three-store chain to kickstart his venture. This acquisition marked the beginning of what would become a major player in the auto parts retailer sector.

Arthur Taubman founded Advance Auto Parts on April 29, 1932. He recognized the need for vehicle maintenance during the Great Depression.

- Taubman purchased a three-store chain in Roanoke and Lynchburg, Virginia, to start the business.

- He sold his car and pawned personal belongings to finance the initial acquisition.

- The original business model included auto parts, household goods, and services like oil changes.

- Taubman's philosophy focused on value, reputation, customer satisfaction, and employee relations.

Taubman's initial investment involved significant personal sacrifice; he sold his car and pawned his and his wife's rings to secure the down payment for the three stores. The early business model of Advance Auto Parts wasn't solely focused on auto parts. It also encompassed a range of household goods and services, such as oil changes, to differentiate itself in the market. Taubman's leadership was guided by a four-point philosophy: value, reputation, customer satisfaction, and treating employees like family. This approach helped shape the company's early culture and its approach to the automotive industry.

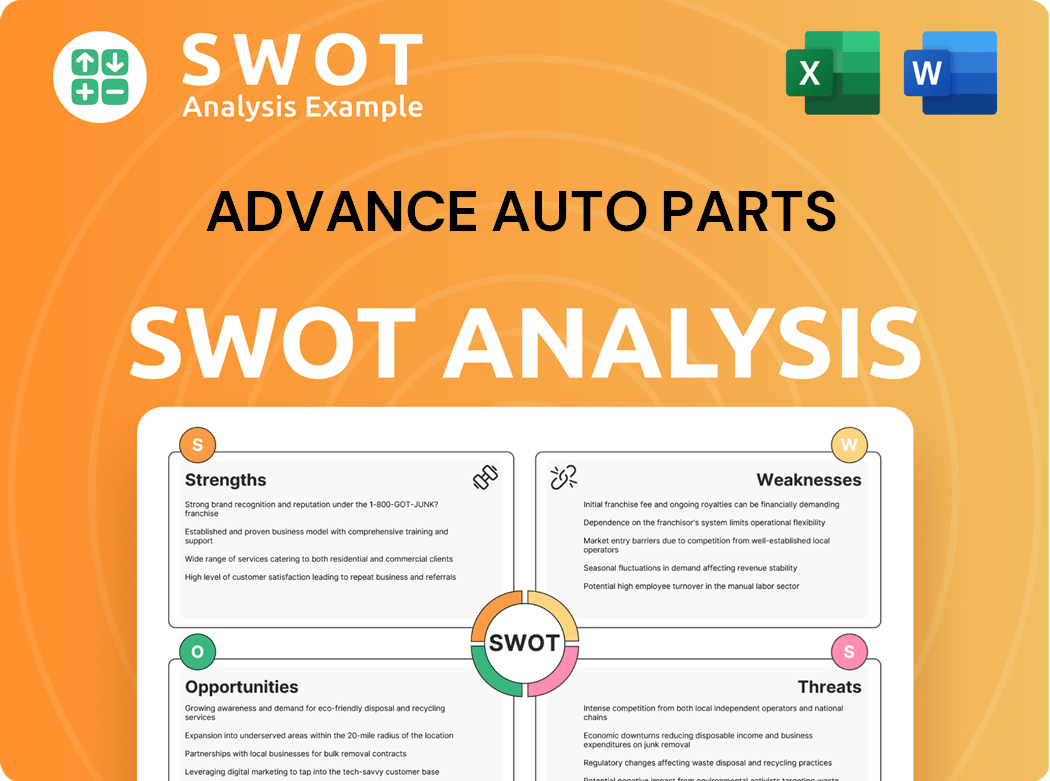

Advance Auto Parts SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Advance Auto Parts?

The early years of the company, known as Advance Stores, saw significant growth under Arthur Taubman. This expansion was fueled by the increasing demand for vehicle maintenance during the Depression era. The company's evolution from its founding to its position as a leading auto parts retailer is a key part of its history. The company's journey reflects the dynamic changes within the automotive industry.

By the early 1940s, Advance Stores had expanded to 21 locations, showcasing its early growth trajectory. Post-World War II, the company broadened its product range, including items like lawn mowers and appliances. This diversification marked an early attempt to cater to a wider consumer base.

In 1978, a pivotal change occurred as the company rebranded from Advance Stores to Advance Auto. This transition signaled a strategic pivot towards specializing in auto parts, discontinuing other consumer products. This focused approach set the stage for the company's future as a major player in the car parts market.

The company was renamed Advance Auto Parts in 1985, coinciding with its expansion to 100 stores. The subsequent years witnessed aggressive growth, with the chain reaching 211 stores by 1991, establishing its presence as the eighth-largest auto parts retailer. This expansion strategy included both new store openings and strategic acquisitions.

A notable acquisition in 1995 involved the purchase of 30 Nationwise Auto Parts stores in Georgia. By mid-1996, Advance Auto Parts operated 660 stores, generating estimated annual revenues of $808 million. This period highlights the company's successful growth through strategic acquisitions and market penetration.

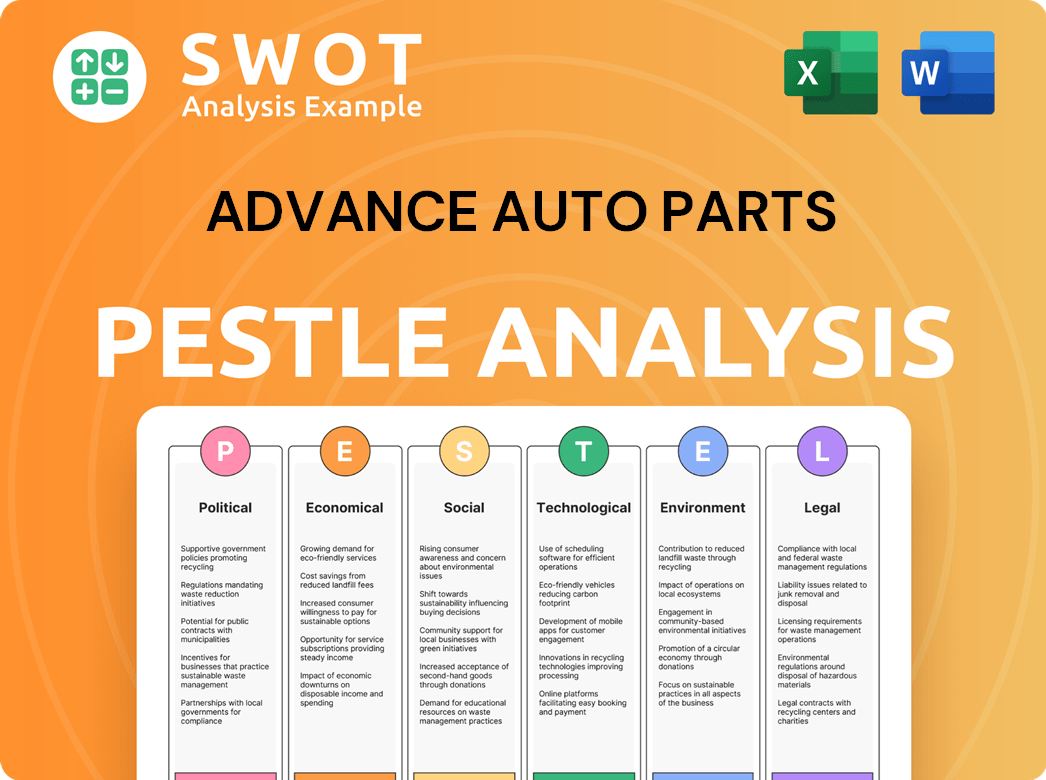

Advance Auto Parts PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Advance Auto Parts history?

The Advance Auto Parts company has a rich history marked by significant milestones in the automotive industry. From its early beginnings to its current status as a leading auto parts retailer, the company has consistently expanded its footprint and adapted to the changing market dynamics. The journey of Advance Auto Parts showcases a commitment to growth and strategic acquisitions, shaping its position in the automotive industry.

Empower with Milestones Table| Year | Milestone |

|---|---|

| 1998 | Acquired the remaining operations of Western Auto, expanding its reach. |

| 2001 | Acquired Discount Auto Parts, significantly increasing its store count and becoming a publicly traded company. |

| 2003 | Premiered on the Fortune 500 list, marking a significant achievement. |

| 2013 | Acquired General Parts International, Inc. (GPI), including Carquest and Worldpac brands, becoming the largest automotive aftermarket parts provider in North America at the time. |

| 2019 | Acquired the DieHard battery brand from Sears for $200 million. |

| 2024 | Announced a strategic plan involving closing over 700 locations and four distribution centers to improve business performance. |

| 2024 | Completed the sale of its Worldpac business to Carlyle for $1.5 billion. |

Advance Auto Parts has focused on expanding its market presence through strategic acquisitions and partnerships. These moves have enabled the company to broaden its product offerings and enhance its distribution capabilities, solidifying its position in the competitive car parts market. For more details on how Advance Auto Parts generates revenue, you can read about it in Revenue Streams & Business Model of Advance Auto Parts.

The acquisition of Discount Auto Parts in 2001 and GPI in 2013 were key strategic moves. These acquisitions significantly increased the company's store network and market share, allowing for greater economies of scale and improved distribution capabilities.

The acquisition of the DieHard battery brand in 2019 expanded the company's product offerings. This move enhanced the company's brand portfolio and provided a competitive edge in the automotive aftermarket.

Investing in online platforms and digital tools to improve the customer experience. This includes enhancing the online ordering process and providing customers with more convenient options for purchasing car parts.

Implementing advanced supply chain management systems to improve efficiency and reduce costs. This includes optimizing inventory management and streamlining distribution processes.

Focusing on improving customer service through training and technology. This includes providing better support and assistance to customers, leading to increased customer satisfaction and loyalty.

Using data analytics to understand customer behavior and market trends. This allows for more effective targeting of marketing efforts and better inventory management.

Despite its successes, Advance Auto Parts has faced challenges, especially in recent years. The company has had to navigate market downturns and intense competition. The 2024 strategic plan, which included store closures, reflects the need to adapt to changing market conditions and improve financial performance.

The company has experienced periods of decreased sales due to economic factors. This has led to strategic adjustments, including store closures and restructuring efforts to maintain profitability.

Intense competition from other auto parts retailers has impacted the company's market share. This necessitates continuous innovation and strategic initiatives to stay competitive and retain customers.

The company has incurred significant costs related to restructuring and store closures. These expenses have impacted the company's financial performance, as seen in the 2024 financial results.

The company reported a net sales decrease of 1.2% in 2024. This decline highlights the need for strategic adjustments to improve sales and overall financial health.

In 2024, the company reported a significant operating loss of $713.3 million. This reflects the impact of restructuring costs and declining sales, underscoring the challenges faced by the company.

The sale of the Worldpac business for $1.5 billion in November 2024 was part of a broader strategy. This strategy aims to simplify the company's structure and focus on its core business, improving efficiency and profitability.

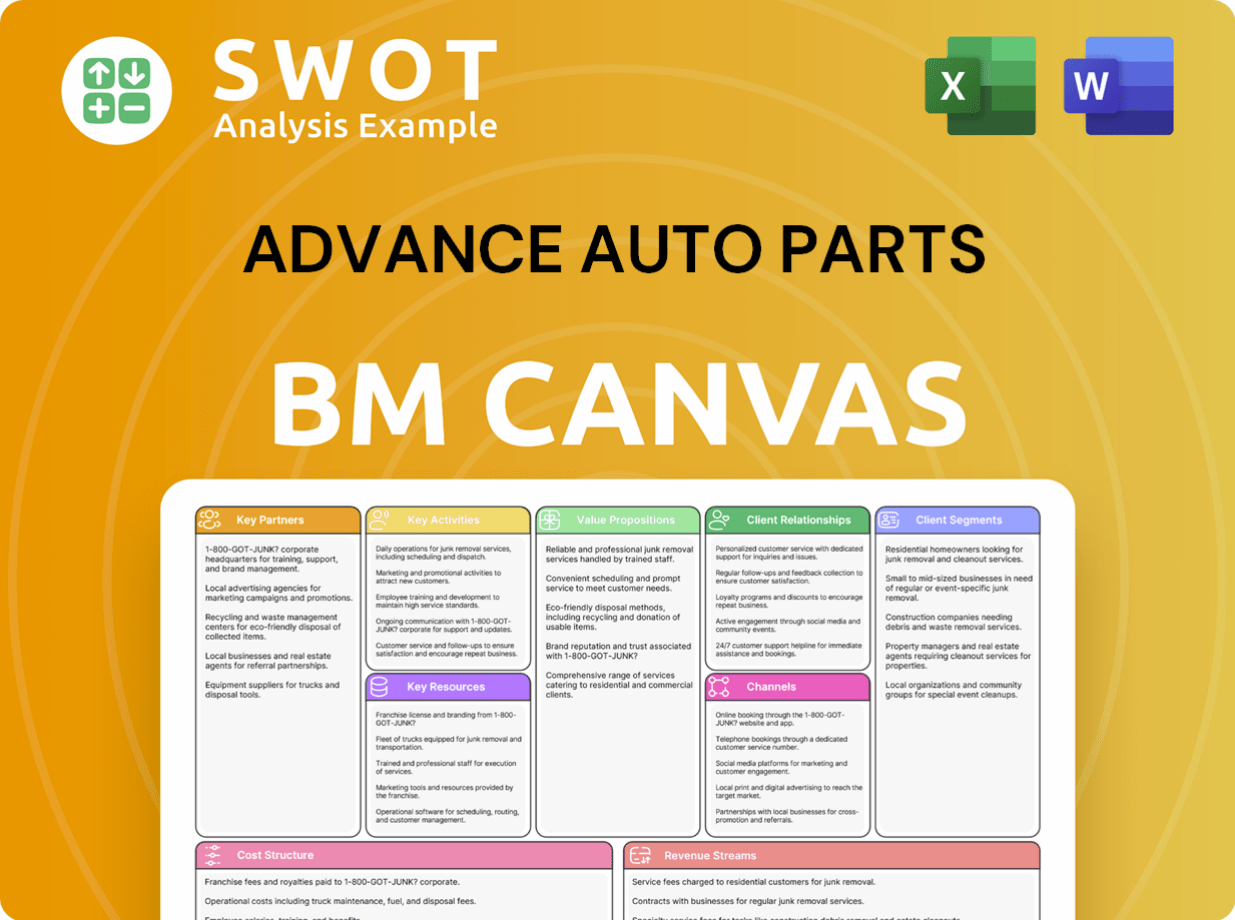

Advance Auto Parts Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Advance Auto Parts?

The Advance Auto Parts history is marked by strategic acquisitions and expansions. Founded in 1932 by Arthur Taubman, the company has evolved from a small group of stores to a major player in the automotive industry. The company has undergone several name changes, acquisitions, and strategic shifts to adapt to the changing market. Recent moves include store closures and a focus on operational efficiency to drive future growth.

| Year | Key Event |

|---|---|

| 1932 | Arthur Taubman founds Advance Stores, acquiring three stores in Virginia. |

| 1978 | The company changes its name to Advance Auto and shifts focus to auto parts. |

| 1985 | The company is renamed Advance Auto Parts. |

| 1998 | Advance Auto Parts acquires the remaining operations of Western Auto. |

| 2001 | Acquires Discount Auto Parts and becomes a publicly traded company on the NYSE. |

| 2003 | Debuts on the Fortune 500 list. |

| 2013 | Acquires General Parts International (Carquest and Worldpac). |

| 2019 | Acquires the DieHard battery brand. |

| November 2024 | Completes the sale of Worldpac and announces the closure of over 700 stores and four distribution centers. |

| March 2025 | Announces plans to open 30 new stores in 2025 and at least 100 more by 2027, including larger market hubs. |

| May 2025 | Reports first quarter 2025 results and reaffirms full year guidance. |

Advance Auto Parts is implementing a three-year financial plan through fiscal year 2027. This plan aims to optimize store operations, improve merchandising, and streamline the supply chain. The goal is to significantly improve the adjusted operating income margin.

The company is consolidating distribution centers, targeting 12 large facilities by the end of 2026. They plan to establish 60 new market hubs by mid-2027. These hubs will stock a wider range of parts, with 75,000-85,000 SKUs, to improve parts availability and enable same-day delivery.

For 2025, Advance Auto Parts projects net sales between $8.4 billion and $8.6 billion. They anticipate an adjusted operating margin of 2.0% to 3.0%. This projection follows a challenging 2024, which saw a net loss of $335.79 million and a comparable store sales decline of 0.7%.

The company is focused on returning to growth, targeting low single-digit comparable store sales growth by 2027. They are aiming for high single-digit margins by 2027. This strategy is a continuation of the founder's vision of providing essential automotive products and services.

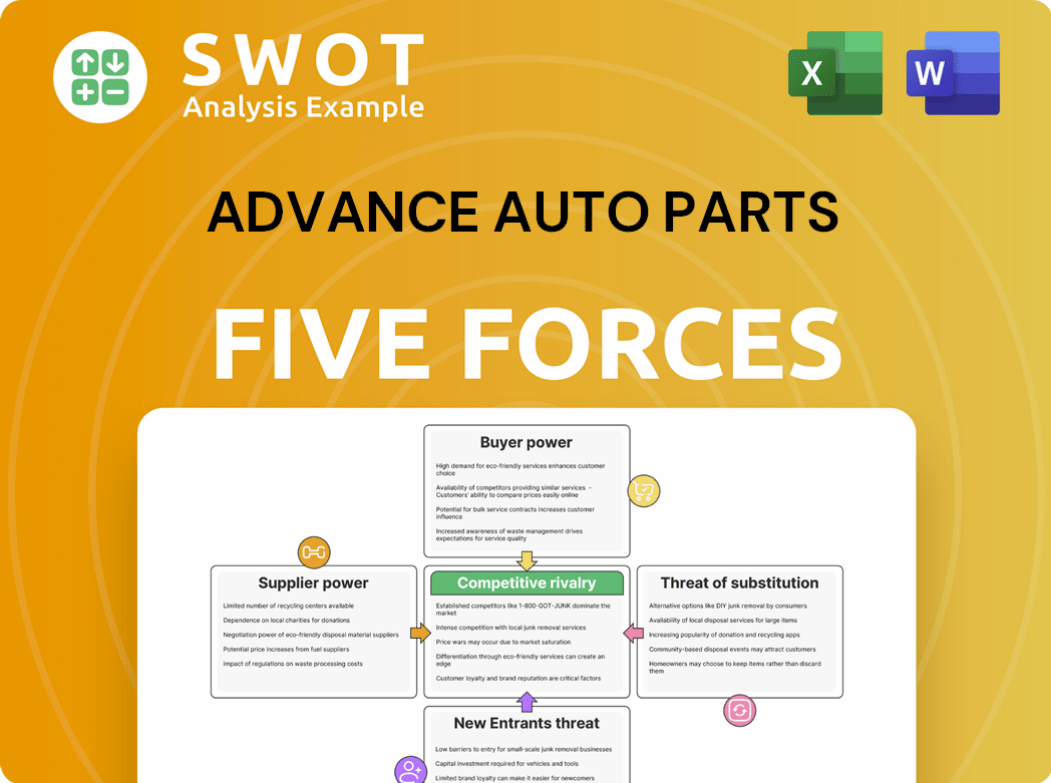

Advance Auto Parts Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Advance Auto Parts Company?

- What is Growth Strategy and Future Prospects of Advance Auto Parts Company?

- How Does Advance Auto Parts Company Work?

- What is Sales and Marketing Strategy of Advance Auto Parts Company?

- What is Brief History of Advance Auto Parts Company?

- Who Owns Advance Auto Parts Company?

- What is Customer Demographics and Target Market of Advance Auto Parts Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.