Advance Auto Parts Bundle

Who Really Owns Advance Auto Parts?

Understanding the intricate Advance Auto Parts SWOT Analysis can be pivotal for investors. The ownership structure of a company like Advance Auto Parts is a critical factor influencing its strategic decisions and market performance. Knowing who controls the reins of this major automotive retailer is essential for anyone looking to understand its future trajectory.

Advance Auto Parts, a publicly traded company since its 2001 IPO, presents a dynamic ownership landscape. From its humble beginnings in 1932, founded by Arthur Taubman, to its current status as a Fortune 500 company, the evolution of its ownership has been a key factor in shaping its growth. This exploration will provide insights into the key players and the shifts in the Advance Auto Parts ownership structure, offering a comprehensive view of this leading automotive parts retailer.

Who Founded Advance Auto Parts?

The story of Advance Auto Parts began in April 1932. Arthur Taubman laid the foundation by acquiring three stores from Pep Boys. This marked the inception of what would become a major player in the automotive parts industry, establishing the roots of Advance Auto Parts ownership.

Taubman's initial investment involved selling his car for $2,500 and borrowing an additional $22,500. While specific details on equity splits during the company's early stages are not publicly available, Taubman's sole purchase of the stores indicates his complete initial ownership and control. This early structure set the stage for the company's growth and evolution.

The company started as Advance Stores, selling both automotive parts and home goods. They differentiated themselves by offering services like oil changes. By the early 1940s, the company had expanded to 21 locations, showing early signs of growth. This early expansion showcases the company's ambition.

Arthur Taubman's business approach focused on providing value, maintaining a strong reputation, ensuring customer satisfaction, and treating employees well. These principles guided early decision-making within the privately held company.

In 1969, Nicholas Taubman, Arthur Taubman's son, took over as chairman. This transition signified a shift in leadership within the family-owned business. The company continued to grow under the new leadership.

By 1985, Advance Auto Parts had expanded to 100 stores. This expansion demonstrated the company's growing presence in the automotive parts market. The company's growth trajectory was well underway.

In 1998, the company was sold to Freeman Spogli & Co. This sale marked a significant transition from family ownership to a new ownership structure. This change signaled a new chapter for the company.

Initially, the company offered both automotive parts and home goods. This diversified approach aimed to attract a broader customer base. The company adjusted its offerings over time.

The company provided services like oil changes to differentiate itself. These services helped build customer loyalty and set the company apart. This strategy helped build a loyal customer base.

The early history of the Advance Auto Parts company is marked by entrepreneurial spirit and a focus on customer value. From its humble beginnings, the company grew to become a major player in the automotive industry. For an in-depth look at the company's business model, you can read about the Revenue Streams & Business Model of Advance Auto Parts.

- Arthur Taubman founded the company in 1932.

- The company initially sold automotive parts and home goods.

- Early growth included expansion to 21 locations by the 1940s.

- Nicholas Taubman took over as chairman in 1969.

- The company was sold to Freeman Spogli & Co. in 1998.

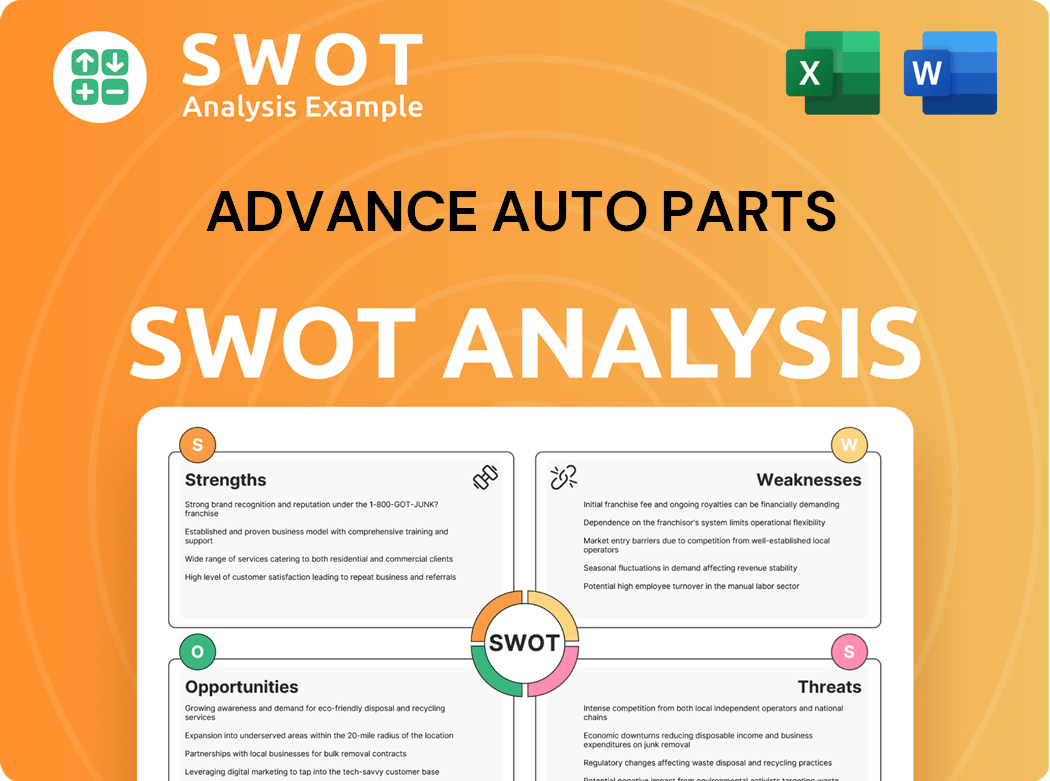

Advance Auto Parts SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Advance Auto Parts’s Ownership Changed Over Time?

The evolution of Advance Auto Parts' ownership is marked by its transition from private to public status. The company went public on November 28, 2001, and began trading on the NYSE under the ticker AAP. This shift from private ownership, previously under Freeman Spogli & Co., to a publicly traded entity, significantly changed its ownership dynamics.

Currently, the majority of Advance Auto Parts ownership resides with institutional investors. As of April 2025, institutional investors hold a large percentage of the company's shares. Key institutional shareholders include BlackRock, Inc., T. Rowe Price Associates, Inc./MD, The Vanguard Group, and State Street Corporation. In April 2025, institutional investors' holding remained unchanged at 123.95%, while mutual funds decreased their holdings from 97.87% to 97.39%. Insiders have shown a slight increase in holdings from 0.91% to 0.91% in April 2025.

| Shareholder Type | April 2025 | Previous |

|---|---|---|

| Institutional Investors | 123.95% | 123.95% |

| Mutual Funds | 97.39% | 97.87% |

| Insiders | 0.91% | 0.91% |

Several key events have reshaped the ownership landscape of the Advance Auto Parts company. The acquisition of General Parts International (GPI) in October 2013, which made it the largest automotive aftermarket parts provider in North America, was a significant move. Furthermore, the involvement of activist investors, such as Starboard Value LP, which disclosed a 3.7% stake in September 2015, and the cooperation agreements reached in March 2024 with Third Point and Saddle Point Management, who collectively owned a five percent stake, leading to the appointment of new directors, highlight the influence of institutional and activist investors on the company's strategy and governance. Understanding the Target Market of Advance Auto Parts is crucial in understanding its business.

Advance Auto Parts ownership is primarily held by institutional investors. The company went public in 2001, marking a significant shift in its ownership structure. Activist investors have also played a role in influencing company strategy.

- Institutional investors hold a substantial portion of shares.

- The company's public listing occurred in November 2001.

- Activist investors have influenced company governance.

- The GPI acquisition expanded its market presence.

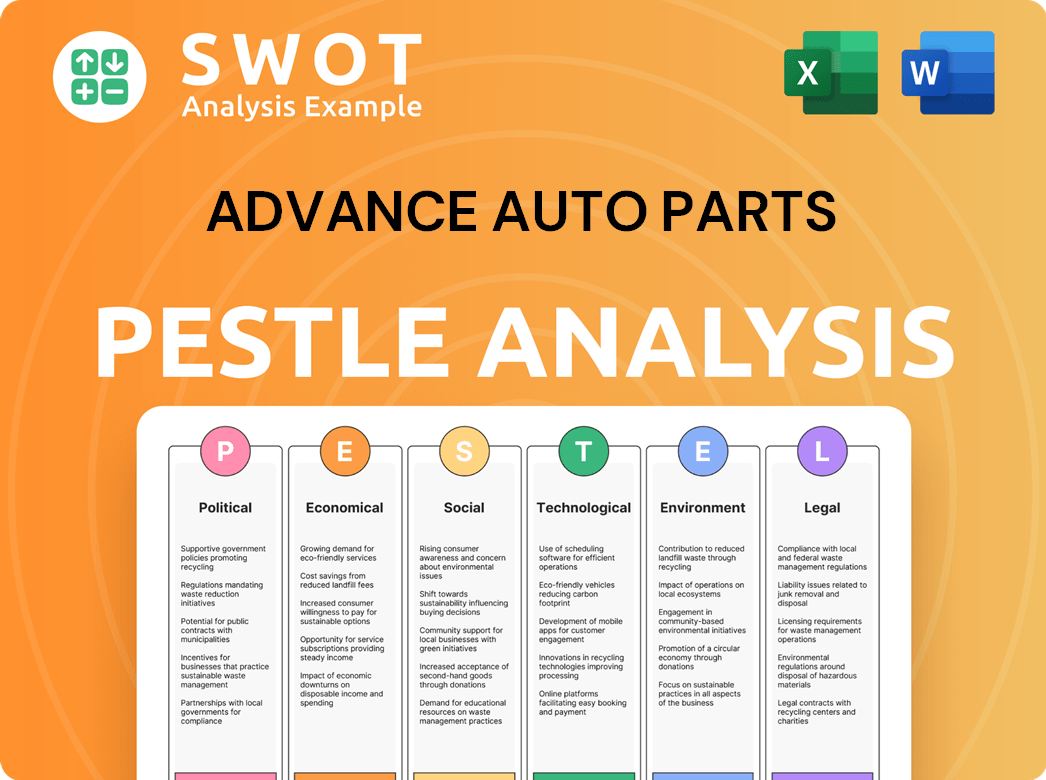

Advance Auto Parts PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Advance Auto Parts’s Board?

As of March 2025, the Board of Directors for Advance Auto Parts includes eleven nominated members. These members are set to be elected at the annual meeting and include Carla J. Bailo, John F. Ferraro, Joan M. Hilson, Jeffrey J. Jones II, Eugene I. Lee, Jr. (Independent Chair of the Board), Shane M. O'Kelly (President and CEO), Douglas A. Pertz, Thomas W. Seboldt, Gregory L. Smith, Sherice R. Torres, and A. Brent Windom. The board's composition reflects a blend of experienced executives and individuals with diverse backgrounds.

The appointments of Thomas W. Seboldt, Gregory L. Smith, and A. Brent Windom in March 2024 are noteworthy. These appointments came about due to cooperation agreements with activist investors Third Point LLC and Saddle Point Management, L.P. These investors held significant stakes in the company, demonstrating how major shareholders can directly influence the board's composition. This highlights the impact of significant shareholdings on corporate governance and strategic direction.

| Board Member | Title | Appointment Date |

|---|---|---|

| Carla J. Bailo | Director | N/A |

| John F. Ferraro | Director | N/A |

| Joan M. Hilson | Director | N/A |

| Jeffrey J. Jones II | Director | N/A |

| Eugene I. Lee, Jr. | Independent Chair of the Board | N/A |

| Shane M. O'Kelly | President and CEO | N/A |

| Douglas A. Pertz | Director | N/A |

| Thomas W. Seboldt | Director | March 2024 |

| Gregory L. Smith | Director | March 2024 |

| Sherice R. Torres | Director | N/A |

| A. Brent Windom | Director | March 2024 |

The voting structure at Advance Auto Parts generally follows a one-share-one-vote system, typical for companies listed on the NYSE. The company's proxy statements, like the Notice of 2025 Annual Meeting of Stockholders, detail the voting procedures, including director elections and other matters. Although there are no specific dual-class shares or special voting rights highlighted in the available information, the influence of activist investors, such as Third Point and Saddle Point Management, underscores that substantial shareholdings can lead to considerable control and influence over decision-making, as seen by their ability to secure board seats. Recent proxy battles or activist investor campaigns have directly shaped the board's composition and strategic direction, emphasizing the power of concentrated ownership in corporate governance.

Understanding the ownership structure of Advance Auto Parts is crucial for investors and stakeholders. Advance Auto Parts is a publicly traded company, making its stock ownership accessible to various investors.

- The Board of Directors comprises experienced members who guide the company's strategic direction.

- Major shareholders can significantly influence the board's composition and corporate governance.

- Voting rights are typically based on a one-share-one-vote system.

- Activist investors play a role in shaping the company's strategic decisions.

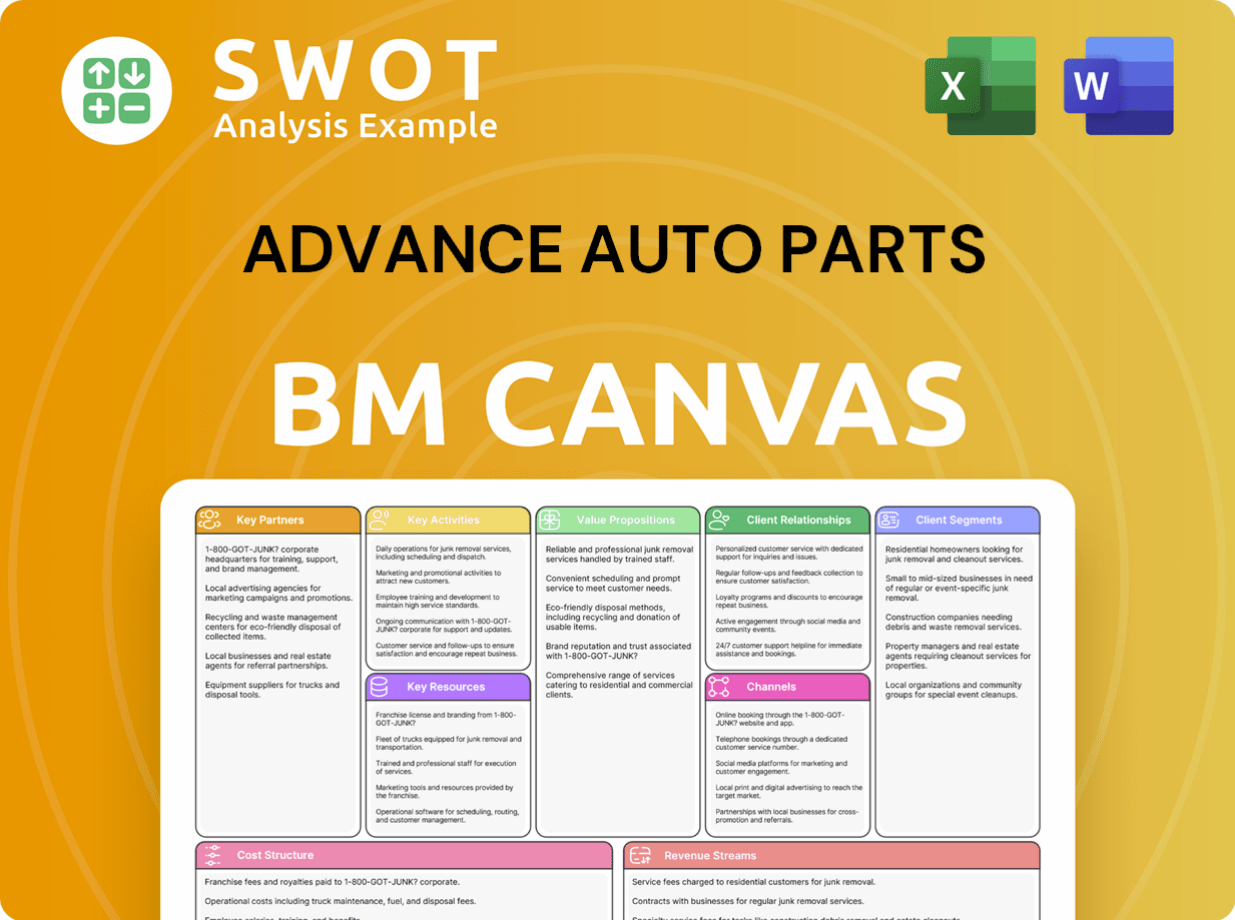

Advance Auto Parts Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Advance Auto Parts’s Ownership Landscape?

In the past few years, Advance Auto Parts has seen shifts in its ownership profile and strategic direction. A key move was the exploration and subsequent sale of Worldpac and its Canadian business, completed in February 2025 for approximately $1.5 billion. This strategic decision aimed to streamline operations, focusing on the 'blended-box' model.

Share buybacks have been part of the company's capital allocation strategy. However, these have decreased recently. For the quarter ending March 31, 2025, share buybacks were $2 million, a decrease of 40.08% from the same period last year. The annual share buybacks for 2024 were $6.501 million, a significant drop from the $14.518 million in 2023 and $1.525 billion in 2022. As of June 2025, the number of shares outstanding is approximately 59.8 million.

| Metric | Q1 2024 | Q1 2025 |

|---|---|---|

| Share Buybacks ($ millions) | $3.34 | $2 |

| Institutional Ownership | 120.0% | 123.95% |

| Shares Outstanding (millions) | 60.1 | 59.8 |

Institutional ownership continues to be a dominant trend in Advance Auto Parts ownership. As of April 2025, institutional investors held 123.95% of the shares. In the first quarter of 2025, there was notable activity among institutional investors, with 172 adding shares and 241 decreasing their positions. Insider buying, including purchases by CEO Shane M. O'Kelly and Director Eugene I. Lee, Jr., also occurred in Q1 2025, which is a signal of insider confidence. The company is currently undergoing a turnaround strategy, including store closures and cost savings, with a target of achieving approximately 7% adjusted operating margin by FY27.

The company is focused on its core business, divesting non-core assets like Worldpac. This strategic shift aims to streamline operations and improve financial performance. This focus is essential for long-term value creation.

Institutional investors remain a significant part of Advance Auto Parts company ownership. There have been shifts in institutional holdings, indicating active portfolio management. Insider buying reflects confidence in the company's future.

Advance Auto Parts is working on a turnaround, which includes store closures and cost savings. The company has reaffirmed its full-year 2025 guidance, projecting net sales between $8.4 billion and $8.6 billion. Adjusted diluted EPS is expected to be between $1.50 and $2.50. For more insights, check out the Marketing Strategy of Advance Auto Parts.

The company plans to open 30 new stores in 2025, with an additional 100 by the end of 2027. This expansion strategy is part of its long-term growth plan. This expansion is a key part of Advance Auto Parts history and future.

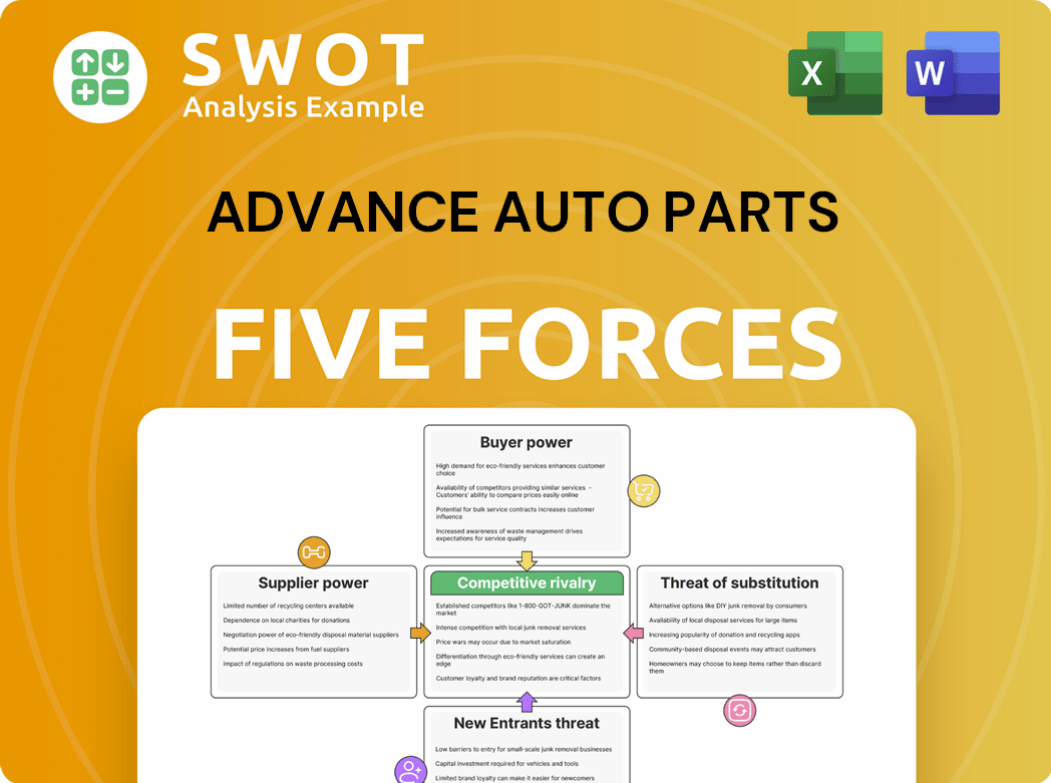

Advance Auto Parts Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Advance Auto Parts Company?

- What is Competitive Landscape of Advance Auto Parts Company?

- What is Growth Strategy and Future Prospects of Advance Auto Parts Company?

- How Does Advance Auto Parts Company Work?

- What is Sales and Marketing Strategy of Advance Auto Parts Company?

- What is Brief History of Advance Auto Parts Company?

- What is Customer Demographics and Target Market of Advance Auto Parts Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.