Advance Auto Parts Bundle

Can Advance Auto Parts Revitalize Its Growth Trajectory?

Advance Auto Parts (AAP) is undergoing a significant transformation, closing hundreds of stores and distribution centers by mid-2025. This strategic restructuring is a bold move in the competitive auto parts industry. But what does the future hold for this long-standing player in the retail automotive market?

This Advance Auto Parts SWOT Analysis delves into the company's ambitious plans, exploring its growth strategy and future prospects amidst evolving auto parts industry trends. We'll examine how Advance Auto Parts aims to navigate challenges, improve its financial performance, and capitalize on opportunities in the market. The analysis will also consider key aspects like expansion plans, adaptation to electric vehicles, and strategies for boosting revenue, providing insights into the company's long-term growth potential.

How Is Advance Auto Parts Expanding Its Reach?

Following the completion of its store closure program, Advance Auto Parts is embarking on a new phase of growth. The company has outlined ambitious expansion plans to bolster its market presence and enhance operational efficiency. This strategic move is designed to capitalize on opportunities within the evolving auto parts industry.

The expansion strategy focuses on opening new stores and establishing 'market hubs' to improve parts availability and customer service. These initiatives are part of a broader effort to strengthen the company's position in the retail automotive market. The company's focus is on markets where it already holds a strong position based on store density.

This expansion strategy is a key component of the Advance Auto Parts growth strategy, aimed at capturing new customers and increasing market share. The company is also investing in existing stores to improve IT infrastructure, equipment, and inventory, as well as providing additional training to team members to enhance the customer experience.

In 2025, Advance Auto Parts plans to open approximately 30 new locations across the United States. The company aims to add at least 100 more stores through 2027. This expansion is a key part of the company's strategic growth plan, focusing on markets where it already has a strong presence.

The company is establishing 'market hubs' to increase parts availability. These hubs will stock around 75,000 to 85,000 SKUs, significantly more than the typical store. The goal is to have 60 new market hubs by mid-2027. These hubs are designed to facilitate same-day delivery.

Since the beginning of 2025, six new stores have already opened in Florida, New Jersey, Tennessee, and Virginia. Additional store openings are planned for Florida, Illinois, Maryland, Ohio, Virginia, and Wisconsin in the coming months. New market hubs are also planned for the Midwest.

The expansion strategy is focused on strengthening the company's presence in markets where it already holds a No. 1 or No. 2 position based on store density. This approach aims to leverage existing market strengths and improve operational efficiency. This strategy is part of the company's plan to improve its Revenue Streams & Business Model of Advance Auto Parts.

Advance Auto Parts is investing in existing stores to enhance IT infrastructure, equipment, and inventory. They are also providing additional training to team members to improve the customer experience. These investments reflect the company's commitment to improving operational efficiency and customer service.

- Improve IT infrastructure.

- Enhance equipment and inventory.

- Provide additional employee training.

- Focus on customer experience.

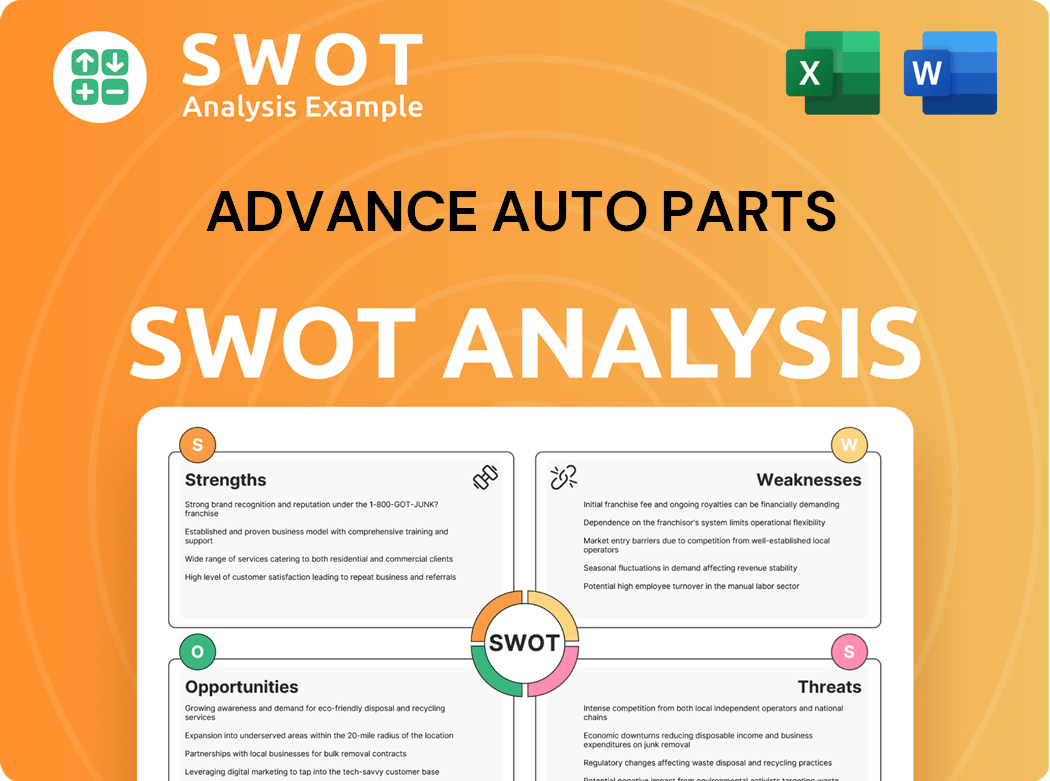

Advance Auto Parts SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Advance Auto Parts Invest in Innovation?

The company is actively leveraging innovation and technology to fuel its growth strategy, focusing on digital transformation, supply chain optimization, and enhancing the overall customer experience. This approach is crucial in navigating the evolving auto parts industry trends and maintaining a competitive edge in the retail automotive market.

Advance Auto Parts is investing significantly in technology to improve its online platform and develop new products and services. This includes an expanded line of electric vehicle (EV) parts and accessories, reflecting its adaptation to the changing demands of the auto industry. These efforts are designed to drive revenue growth and improve the company's financial performance.

In 2024, the company boosted its investment in research and development by 10% to support innovation initiatives. This commitment is coupled with over $50 million invested in technology upgrades and process improvements. These investments aim to enhance operational efficiency and customer service, vital components of the Advance Auto Parts growth strategy.

Advance Auto Parts is focusing on digital transformation to enhance its online platform and customer experience. This includes improvements to its website and mobile app, making it easier for customers to find and purchase auto parts. The company is also leveraging data analytics to personalize the online shopping experience.

The company is optimizing its supply chain to improve efficiency and reduce costs. This involves using data analytics to forecast demand, manage inventory, and streamline logistics. Supplier collaboration is also a key focus to ensure product availability and seamless operations. The company is addressing Advance Auto Parts supply chain challenges.

Advance Auto Parts is dedicated to enhancing the customer experience through various initiatives. This includes offering a true 'click-and-collect' experience, leveraging data-driven personalization, and modernizing fulfillment processes. These efforts are designed to improve customer satisfaction and loyalty. For more insights, consider reading about the Target Market of Advance Auto Parts.

A data-driven approach is being used to revolutionize inventory management. Cutting-edge data analytics tools are employed to optimize supply chain processes and mitigate sales slumps. This involves proactive decision-making based on real-time insights and predictive analytics.

Prioritizing supplier collaboration is key to ensuring seamless operations and improving product availability. This involves working closely with suppliers to streamline processes and ensure timely delivery of parts. This is a crucial part of Advance Auto Parts' strategic partnerships.

The appointment of a new Chief Technology Officer in January 2025, with experience in retail technology, underscores the company's commitment to accelerating its digital plans. This strategic move is pivotal for executing the company's strategic plan and driving innovation.

The investments in technology and process improvements have yielded tangible results, demonstrating the effectiveness of the company's strategic initiatives. These improvements are crucial for assessing Advance Auto Parts' market share analysis.

- A 15% reduction in order processing time.

- A 10% increase in customer satisfaction scores.

- Enhanced inventory forecasting accuracy.

- Streamlined procurement processes.

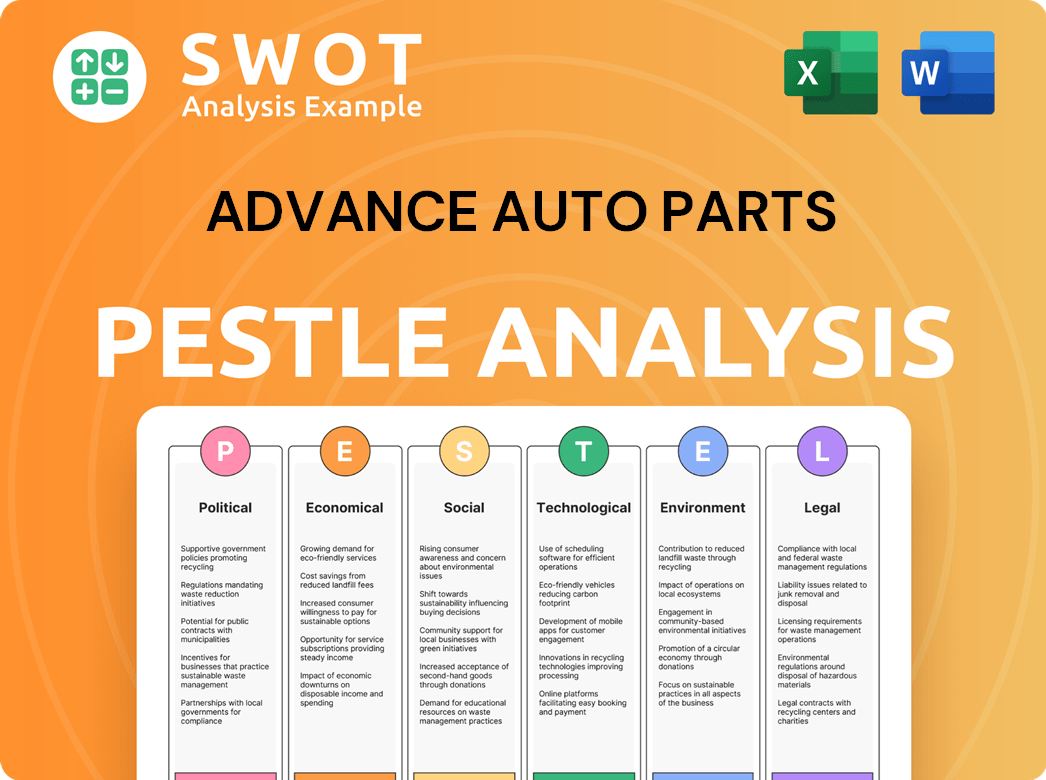

Advance Auto Parts PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Advance Auto Parts’s Growth Forecast?

The financial outlook for Advance Auto Parts reflects a period of transition and strategic recalibration within the auto parts industry. The company is currently navigating headwinds, but it has set forth a plan to stabilize and improve its financial performance. This plan includes cost management, strategic investments, and a focus on improving operational efficiency.

In 2024, the company faced challenges, including a decrease in net sales and a decline in comparable store sales. However, strategic actions such as the sale of its Worldpac business are expected to provide financial flexibility. The company's guidance for 2025 indicates expectations of modest sales growth and improved profitability, suggesting that the company is focusing on sustainable, long-term value creation.

The company's strategic initiatives are designed to position it favorably within the evolving retail automotive market. These initiatives include optimizing store operations, enhancing its online sales strategy, and adapting to changing consumer preferences. The focus is on driving revenue growth, improving profitability, and generating free cash flow to ensure the company's long-term growth potential.

For the full year 2024, net sales were $9.1 billion, a 1.2% decrease compared to 2023. Comparable store sales decreased by 0.7%. The operating loss was $713.3 million, while adjusted operating income was $35.2 million, or 0.4% of net sales. Diluted loss per share was $9.80. Free cash flow was an outflow of $40.3 million.

For fiscal year 2025, net sales are projected to be between $8.4 billion and $8.6 billion. Adjusted earnings per share are expected to range from $1.50 to $2.50. Comparable sales growth is anticipated to be between 0.5% and 1.5%. Capital expenditures are forecast at $300 million, and the company expects negative full-year free cash flow of $25 million to $85 million.

Q1 2025 saw net sales of $2.6 billion, a 7% decrease year-over-year, but exceeding market expectations. The adjusted loss per share was $0.22, which was better than analyst estimates. The company reaffirmed its full-year 2025 guidance in May 2025, indicating confidence in its strategic plan.

Management is targeting an adjusted operating income margin of approximately 7% and a debt leverage ratio of approximately 2.5x by fiscal year 2027. Achieving these targets could potentially lead to earnings per share of around $7.00 by 2027. The sale of Worldpac for $1.5 billion will help reduce debt and fund operational improvements.

The company's financial performance in 2024 reflects the challenges within the auto parts industry, but the strategic initiatives and future prospects are designed to drive long-term value. The focus on cost management, strategic investments, and operational improvements is critical for success. For a deeper dive into the company's structure and ownership, consider reading Owners & Shareholders of Advance Auto Parts.

- 2024 Net Sales: $9.1 billion, down 1.2% year-over-year.

- 2025 Sales Forecast: $8.4 billion to $8.6 billion.

- 2025 Adjusted EPS: $1.50 to $2.50.

- 2027 Targets: Adjusted operating income margin of ~7% and debt leverage ratio of ~2.5x.

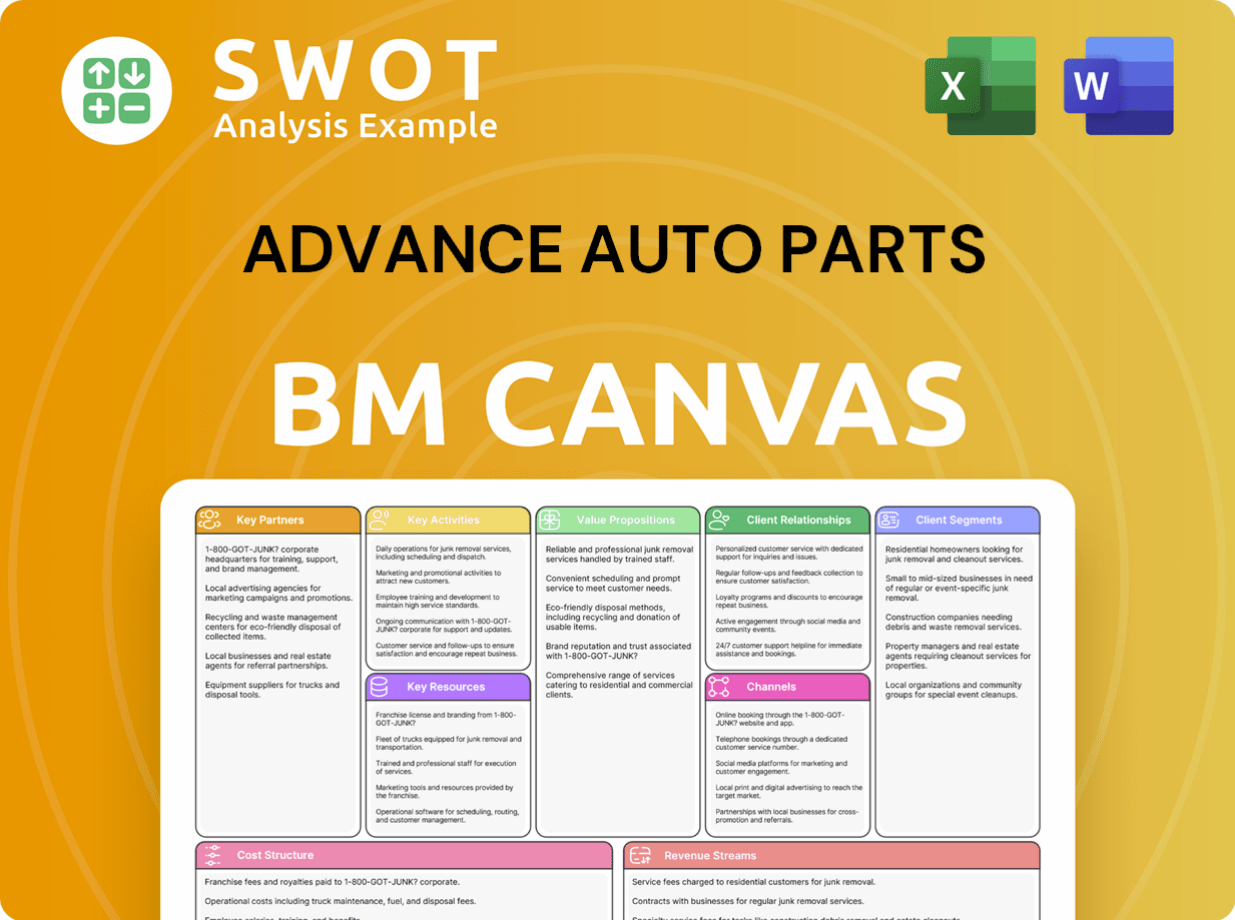

Advance Auto Parts Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Advance Auto Parts’s Growth?

The path forward for Advance Auto Parts, while promising, is fraught with potential obstacles. The company faces a highly competitive landscape in the auto parts industry, requiring constant adaptation and innovation to maintain and grow market share. Successful execution of its strategic initiatives, including significant restructuring and asset optimization, is crucial for realizing its growth ambitions.

Several risks could hinder the company's progress. Economic downturns, geopolitical instability, and supply chain disruptions pose significant challenges. Moreover, the ability to attract and retain a skilled workforce is critical for operational success. These factors, combined with the need to adapt to technological advancements, create a complex environment for Advance Auto Parts.

The company must also navigate the evolving demands of the automotive market. This includes the increasing popularity of electric vehicles and changing consumer behaviors. The company’s financial health, including its debt load, will also influence its capacity to invest in growth and manage potential risks.

The auto parts industry is intensely competitive, with rivals like AutoZone and O'Reilly Automotive vying for market share. Maintaining a competitive edge requires continuous strategic adjustments and operational excellence. This competitive environment directly impacts the company’s ability to achieve its Marketing Strategy of Advance Auto Parts and overall growth targets.

Advance Auto Parts is undertaking a multiyear turnaround, including store closures and supply chain adjustments. Successfully implementing these plans is crucial, but any delays or missteps can disrupt operations and negatively impact financial performance. The closure of over 700 locations and 4 distribution centers by mid-2025 presents significant execution risks.

Economic downturns, inflation, and geopolitical events can all impact the company's performance. Increased tariffs, trade restrictions, and fluctuations in consumer spending can affect sales and profitability. These external factors create uncertainty and require proactive risk management strategies.

Supply chain disruptions and rising costs pose ongoing challenges. The company must effectively manage its inventory, logistics, and distribution networks to ensure product availability and control expenses. Efficient supply chain management is critical to maintaining profitability and meeting customer demand.

Rapid advancements in automotive technology, including the growth of electric vehicles, require the company to adapt quickly. Failure to embrace these changes could lead to a loss of market share. Adapting to new technologies is essential for long-term growth and relevance in the auto parts industry.

The company's debt load and access to favorable financing are factors. Any impairment of assets, including goodwill, could also affect financial results. Maintaining a solid financial position is critical for funding growth initiatives and weathering economic downturns.

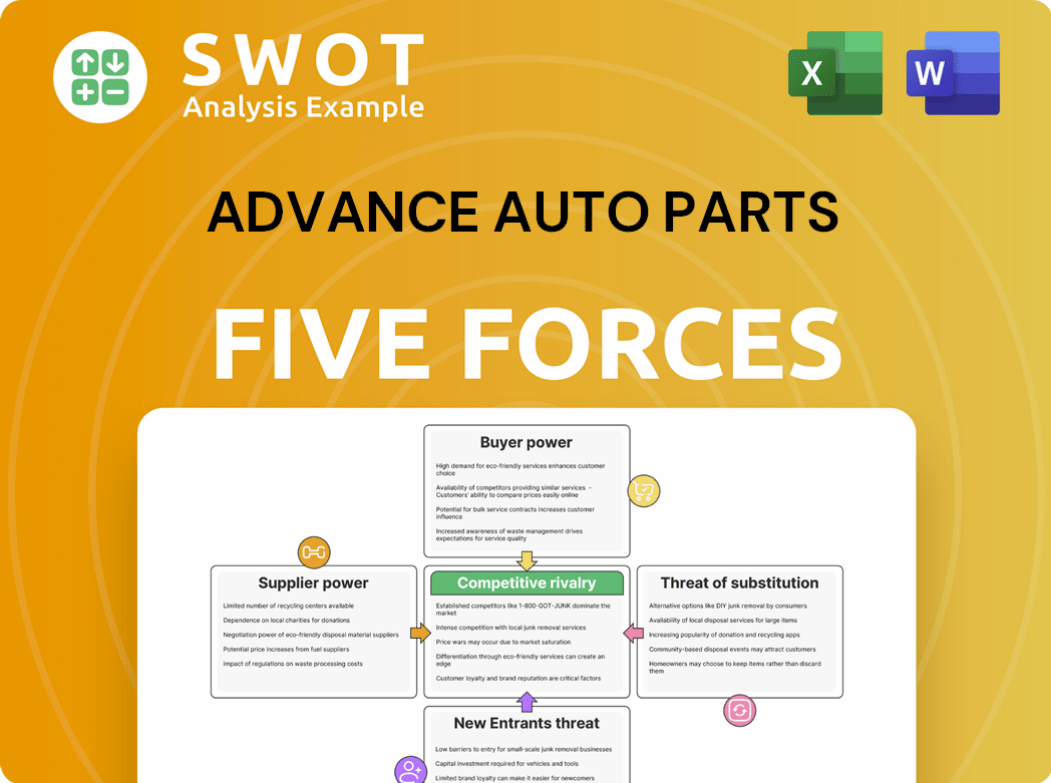

Advance Auto Parts Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Advance Auto Parts Company?

- What is Competitive Landscape of Advance Auto Parts Company?

- How Does Advance Auto Parts Company Work?

- What is Sales and Marketing Strategy of Advance Auto Parts Company?

- What is Brief History of Advance Auto Parts Company?

- Who Owns Advance Auto Parts Company?

- What is Customer Demographics and Target Market of Advance Auto Parts Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.