Advance Auto Parts Bundle

Can Advance Auto Parts Revitalize Its Market Position?

Advance Auto Parts, a major player in the Advance Auto Parts SWOT Analysis, navigates a dynamic auto parts industry. With a vast network across North America, the company faces intense competition and evolving market trends. This article provides a deep dive into the competitive landscape, examining key rivals and strategic adaptations.

Understanding the Competitive Landscape of Advance Auto Parts is crucial for investors and industry watchers alike. This Market Analysis will explore the company's position within the Auto Parts Industry, providing insights into its Competitor Analysis and the impact of current Industry Trends. We'll examine how Advance Auto Parts is responding to challenges and aiming for future growth, offering a comprehensive view of its strategic initiatives and financial performance.

Where Does Advance Auto Parts’ Stand in the Current Market?

Advance Auto Parts focuses on the automotive aftermarket, supplying parts and accessories to both professional installers and do-it-yourself (DIY) customers. The company operates across the United States, Canada, and Puerto Rico, offering a wide range of products including replacement parts, accessories, batteries, and maintenance items. The business model historically balanced sales between professional and DIY segments, with a significant portion of revenue coming from professional customers.

The company's value proposition centers on providing a comprehensive selection of auto parts and services, supported by a vast store network and a focus on customer service. Advance Auto Parts aims to be a one-stop shop for automotive needs, offering convenience and expertise to its diverse customer base. Recent strategic moves, such as the sale of the Worldpac business, indicate a focus on streamlining operations and enhancing profitability within the competitive auto parts industry.

As of Q1 2025, Advance Auto Parts held an 18.78% market share within the retail sector, based on total revenue. This position places it behind major competitors like AutoZone (42.40%) and O'Reilly Automotive (38.30%). The company's market share based on the last twelve months ending Q1 2025 was 18.78%, a decrease from 20.37% in the last twelve months ending Q4 2024.

Advance Auto Parts operates over 4,000 stores and branches across the United States, Canada, and Puerto Rico as of February 2025. This extensive network allows for broad market coverage and accessibility for both professional and DIY customers. The company's geographic footprint is a key factor in its ability to compete within the auto parts industry.

Advance Auto Parts caters to a blended customer base, with approximately 50% of sales historically coming from the professional segment. This dual focus allows the company to capture a significant portion of the market. Understanding the customer demographics is crucial for effective marketing and sales strategies.

Recent strategic shifts include the sale of the Worldpac business, aimed at streamlining operations and improving growth potential. This move reflects a focus on core competencies and enhancing profitability. The company is implementing a strategic plan to improve profitability and operational efficiency.

Despite facing financial challenges, including a negative P/E ratio and earnings per share in early 2025, the company is working on strategic plans. The market capitalization was $2.04 billion as of May 2025, indicating investor confidence in the company's future. For more details, you can read a Brief History of Advance Auto Parts.

The competitive landscape in the auto parts industry is intense, with major players like AutoZone and O'Reilly Automotive holding significant market share. Advance Auto Parts must differentiate itself through its service offerings, store network, and customer relationships. Industry trends such as the growth of online retailers also impact the competitive environment.

- AutoZone and O'Reilly Automotive are the primary competitors.

- The company's market share is 18.78% as of Q1 2025.

- Strategic initiatives aim to improve profitability and operational efficiency.

- The company's market capitalization was $2.04 billion as of May 2025.

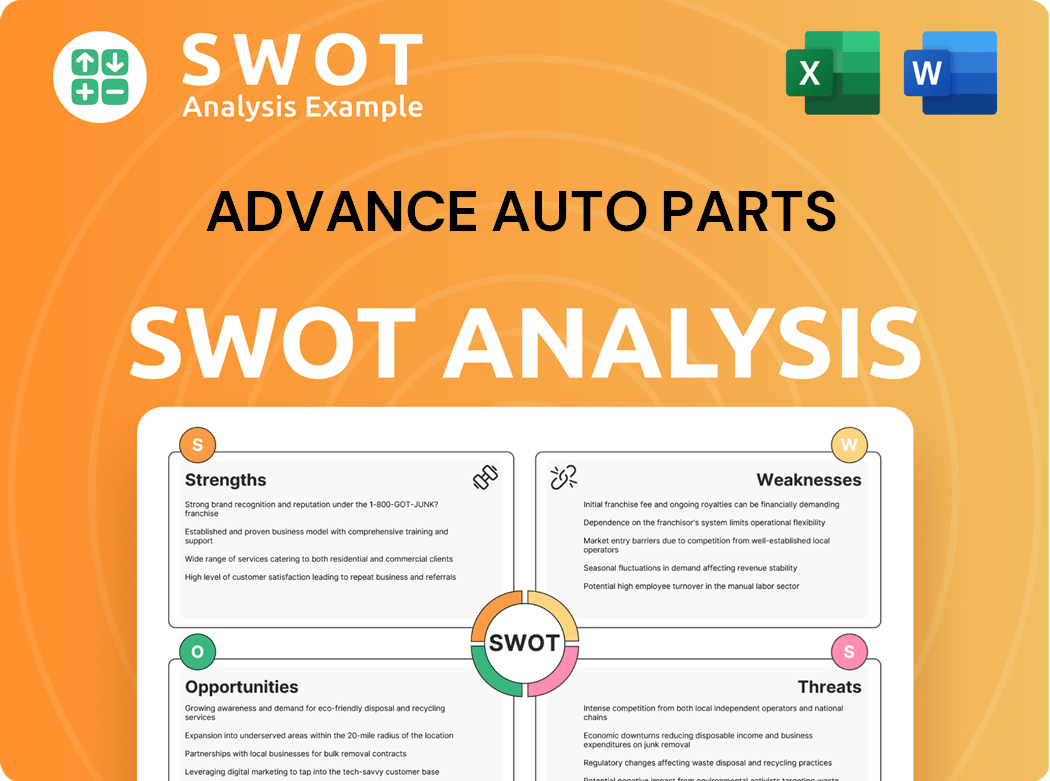

Advance Auto Parts SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Advance Auto Parts?

The Competitive Landscape within the auto parts industry, particularly for Advance Auto Parts, is shaped by a diverse array of competitors. This environment includes national and regional chains, as well as other retail formats. The intensity of competition can lead to price wars and shifts in market share. Understanding these dynamics is crucial for any market analysis.

Advance Auto Parts operates in a sector that is constantly evolving, with new players and strategies emerging. The company faces direct competition from well-established entities and indirect competition from various retail channels. The auto parts industry is influenced by factors such as technological advancements in vehicles and changes in consumer behavior.

The Competitive Landscape for Advance Auto Parts is complex, involving several key players. These competitors range from large national chains to smaller, regional entities and online retailers. The market dynamics are also influenced by mergers and acquisitions, which can reshape the competitive environment. For more insights, consider reading about Owners & Shareholders of Advance Auto Parts.

AutoZone, O'Reilly Automotive, and NAPA Auto Parts are the primary direct competitors. These companies have a significant presence in the market. They compete on factors such as price, product selection, and customer service.

AutoZone is a major rival with a large store network. It has a strong brand recognition and a significant presence in the commercial sales market. As of 2024, AutoZone operates over 6,800 stores, making it a formidable competitor.

O'Reilly Automotive is known for its geographic coverage and loyalty program. It is a key competitor in the auto parts industry. The company focuses on providing a wide range of products and services.

NAPA Auto Parts has a network of independently-owned stores. It has strong ties with professional mechanics, particularly in rural areas. NAPA's focus on professional customers gives it a competitive edge.

Pep Boys, with its service bays, and internet-based retailers also compete. Discount stores, mass merchandisers, wholesalers, jobbers, and independent stores add to the competitive pressure. These competitors offer various products and services.

Online retailers are disrupting the traditional landscape. These new entrants are changing how consumers purchase auto parts. They offer convenience and competitive pricing.

Several factors drive competition in the auto parts industry. These include pricing strategies, product availability, and customer service. Understanding these factors is vital for competitor analysis.

- Price: Competitive pricing is crucial for attracting customers.

- Product Selection: Offering a wide range of parts is essential.

- Customer Service: Providing excellent service builds customer loyalty.

- Geographic Coverage: Having a wide store network is a key advantage.

- Online Presence: A strong online presence is important for reaching customers.

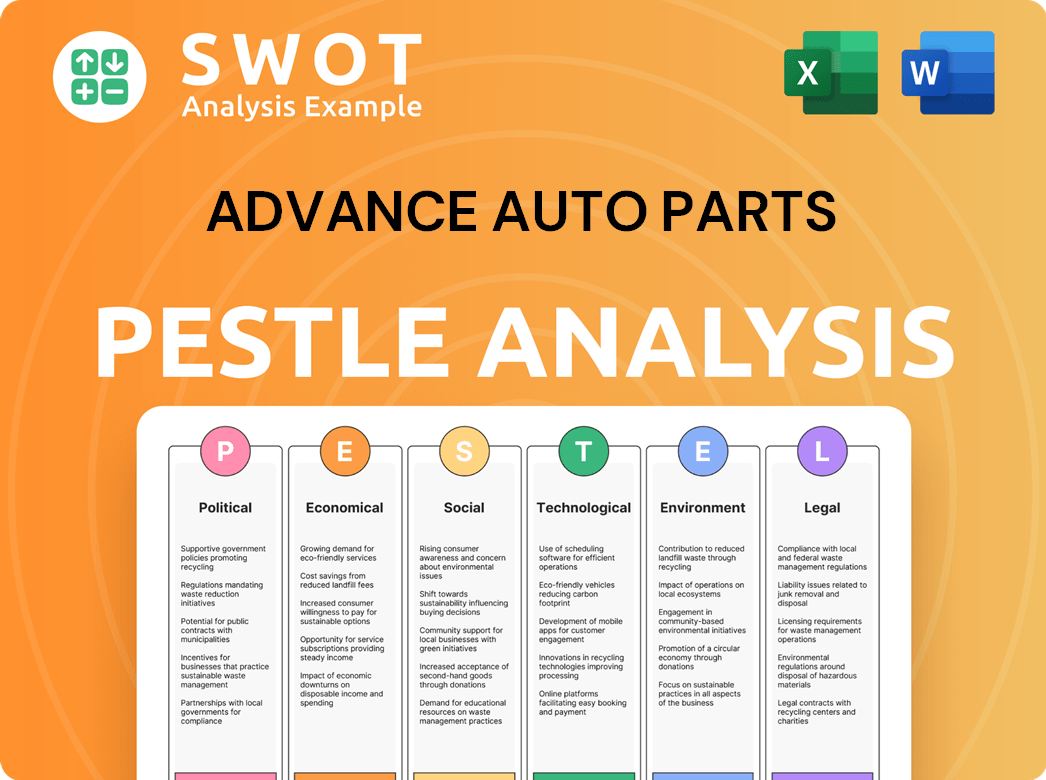

Advance Auto Parts PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Advance Auto Parts a Competitive Edge Over Its Rivals?

The competitive landscape of Advance Auto Parts in the auto parts industry is shaped by several key factors. The company has built a strong brand reputation over many years. It serves both professional and DIY customers, which provides a more stable income stream. The company is actively working to improve its supply chain and distribution model.

Advance Auto Parts is investing in IT infrastructure and employee training to enhance customer experience and operational efficiency. The company's financial health and ability to generate cash flow are strengths, enabling investments in strategic priorities. The company's ongoing efforts to improve its supply chain and operational model are crucial for maintaining a competitive edge against rivals.

Understanding the competitive advantages of Advance Auto Parts is crucial for investors and industry observers. This involves analyzing its strengths, weaknesses, opportunities, and threats within the auto parts industry. This analysis helps in making informed decisions about the company's future prospects and strategies.

Advance Auto Parts benefits from decades of brand recognition, which helps build customer loyalty. This established brand presence is a significant advantage in attracting and retaining customers. Strong brand recognition contributes to a competitive edge in the auto parts industry.

The company serves both professional mechanics and DIY customers. This diversification provides a more stable revenue stream. Serving a broad customer base helps to mitigate risks associated with market fluctuations.

Advance Auto Parts has a wide network of stores and distribution centers. This network is intended to provide wide product availability and service speed. This is a critical factor for both customer segments.

The company is actively working to optimize its supply chain and distribution model. This includes developing larger 'market hubs' to increase parts availability and improve same-day delivery. These improvements are designed to enhance customer service and operational efficiency.

Advance Auto Parts' competitive advantages include a strong brand, a diversified customer base, and an extensive store network. The company's focus on operational improvements, such as supply chain optimization, is crucial for maintaining its edge. These strategies are essential for success in the auto parts industry.

- Brand Strength: Decades of brand building provide a competitive edge.

- Customer Base: Serving both professional and DIY customers provides stability.

- Operational Efficiency: Investments in IT and employee training enhance the customer experience.

- Financial Health: The company's ability to generate cash flow supports strategic investments.

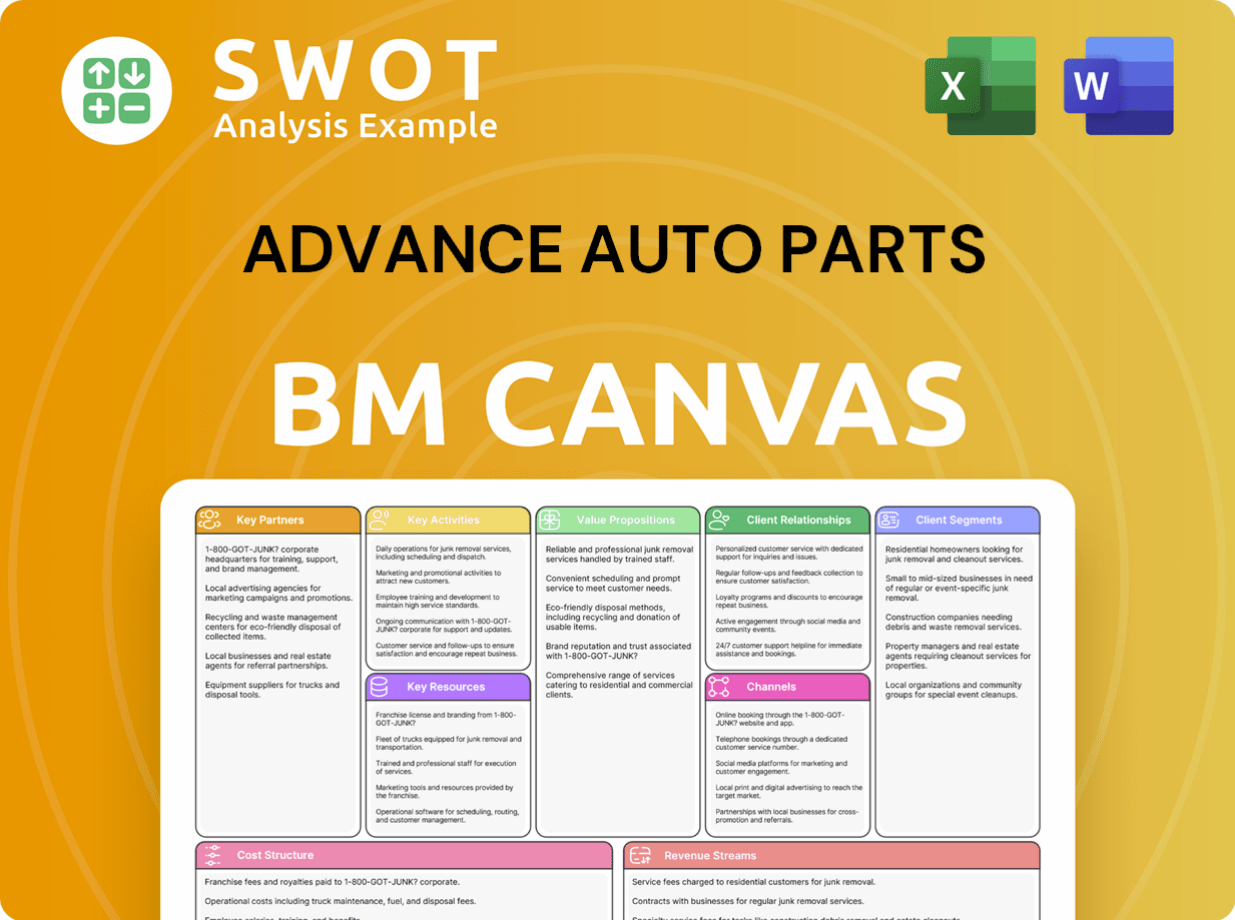

Advance Auto Parts Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Advance Auto Parts’s Competitive Landscape?

The automotive aftermarket industry, where companies like Advance Auto Parts operate, is constantly evolving. Understanding the Competitive Landscape and Industry Trends is crucial for any player in this space. Factors such as technological advancements in vehicles, changing consumer preferences, and economic conditions significantly influence the market dynamics.

Advance Auto Parts faces various challenges, including competition, economic pressures, and the need to adapt to new technologies. However, there are also opportunities for growth, such as the increasing average age of vehicles and the expansion of e-commerce. Navigating these aspects is critical for the company's future success.

The auto parts industry is shaped by several key trends. The growing complexity of vehicles and the rise of electric vehicles (EVs) are significant drivers. Consumer demand for convenient online shopping and faster delivery is also reshaping the market. Regulatory changes, particularly environmental standards, also play a role.

Advance Auto Parts encounters several challenges. Slowing consumer spending on vehicle maintenance, inflation, and supply chain bottlenecks impact operations. Intense competition from larger peers puts pressure on margins. The company must also optimize its store network and distribution system to stay competitive.

Despite the challenges, there are growth opportunities for Advance Auto Parts. The increasing average age of vehicles in the US creates a larger market for replacement parts. E-commerce expansion through strategies like Click & Collect can broaden the customer base. Investing in technology and strategic partnerships are also key.

Advance Auto Parts is actively pursuing strategies to drive growth. These include opening new stores and market hubs. The company is also focused on improving operational execution. These efforts aim to enhance customer experience and streamline operations.

To succeed in the Competitive Landscape, Advance Auto Parts must focus on several key areas. These include enhancing its digital presence, improving supply chain efficiency, and forming strategic partnerships. These initiatives are aimed at improving customer experience and streamlining operations.

- Expand e-commerce capabilities and omnichannel strategies.

- Invest in data-driven personalization to improve customer experience.

- Streamline the supply chain using real-time analytics and partnerships.

- Form strategic alliances with automotive forums and mechanic networks.

The auto parts industry is dynamic, with significant changes expected in the coming years. Companies like Advance Auto Parts must adapt to these trends to maintain their market position. For more insights, you can explore the Revenue Streams & Business Model of Advance Auto Parts.

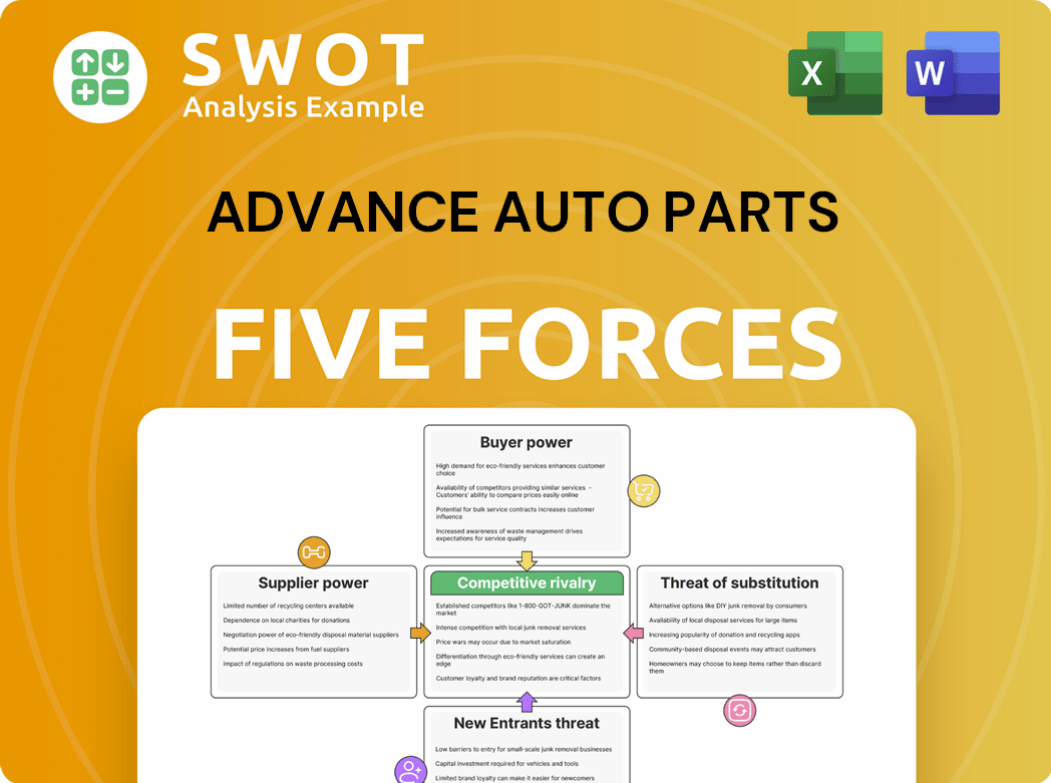

Advance Auto Parts Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Advance Auto Parts Company?

- What is Growth Strategy and Future Prospects of Advance Auto Parts Company?

- How Does Advance Auto Parts Company Work?

- What is Sales and Marketing Strategy of Advance Auto Parts Company?

- What is Brief History of Advance Auto Parts Company?

- Who Owns Advance Auto Parts Company?

- What is Customer Demographics and Target Market of Advance Auto Parts Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.