AGBA Bundle

How Did AGBA Company Transform Over Time?

Embark on a journey through the AGBA SWOT Analysis and discover the remarkable evolution of AGBA Group, a financial services powerhouse. From its humble beginnings in 1993 to its current tech-driven status, AGBA's story is a testament to strategic adaptation and innovation. Explore the key milestones and pivotal decisions that have shaped AGBA's trajectory in the financial landscape.

The brief history of AGBA Group Holdings Limited reveals a commitment to serving over 400,000 customers. Understanding AGBA's history is crucial for investors and analysts seeking to grasp the company's potential. The company's journey reflects a significant transformation from a financial and insurance provider to a tech-centric holding company. This exploration will delve into AGBA's early business ventures, key acquisitions, and financial performance.

What is the AGBA Founding Story?

The story of AGBA Group Holding Limited, or AGBA Company, began in 1993. While the precise details of its inception, including the founders and their initial backgrounds, remain somewhat limited in public records before 2022, the company's roots trace back to its operations under the parent company, Convoy Holdings.

The vision that drove AGBA's formation was to address the need for integrated financial and healthcare services in Hong Kong, aiming to create a 'one-stop financial supermarket.' This ambition set the stage for AGBA's evolution into a significant player in the financial services sector. For a deeper understanding of their approach, consider exploring the Marketing Strategy of AGBA.

Initially, AGBA's business model focused on wealth management and healthcare services. This included financial advisory services, asset management, and related offerings tailored for both individual clients and businesses. A notable strategic shift occurred in 2019 when AGBA began separating its legacy broker-dealer operations into a platform and distribution business. This move signaled an early embrace of a more diversified and technologically advanced model.

AGBA's journey includes key events that shaped its current standing in the financial industry.

- 1993: AGBA Group Holding Limited was established.

- 2019: Implementation of a strategy to separate the broker-dealer business.

- November 2022: Became publicly listed on NASDAQ through a business combination with AGBA Acquisition Limited (AAL). The merger involved the issuance of 55,500,000 ordinary shares valued at $10 each.

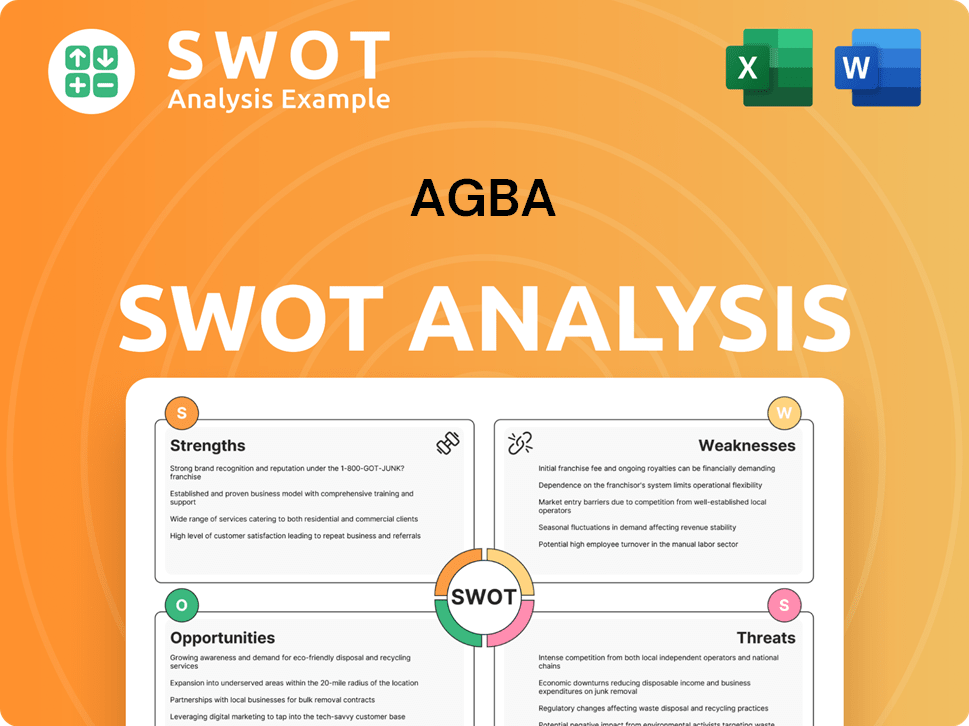

AGBA SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of AGBA?

The early growth and expansion of the AGBA Company involved a strategic shift in its business model and significant investments in technology. This period saw the company evolving from its legacy broker-dealer operations to a tech-driven platform, aiming to serve various distribution channels. The expansion included the launch of digital platforms, strategic acquisitions, and key partnerships to broaden its market reach and product offerings. For a deeper dive into the AGBA Group's strategic development, consider reading about the Growth Strategy of AGBA.

In 2019, AGBA Group began separating its operations into distinct platform and distribution businesses. This strategic move involved investing over US$200 million to upgrade and expand its capabilities. The goal was to create a high-margin platform business that could support multiple distribution channels, while also strengthening its existing financial advisory services, which are the largest in Hong Kong.

In November 2020, AGBA financial launched AGBA Money (formerly Tandem Money), a digital platform focused on health and wealth. The platform attracted over 40,000 members. Although repositioned in Q2 2023, the app aimed to serve as a one-stop platform for retail investors, offering a range of financial products and services.

Q1 2023 saw AGBA insurance reporting a significant revenue increase of 500% compared to Q1 2022, reaching US$11.1 million. The company also expanded its offerings by onboarding 10 new insurance partners and releasing over 170 new insurance and investment products. This expansion broadened its product portfolio to over 2,000 financial products.

AGBA's expansion strategy included key acquisitions and partnerships. In April 2023, an agreement was announced to acquire Sony Life Financial Advisers Pte Ltd in Singapore, marking its international expansion into Southeast Asia. In Q4 2023, the Distribution Business generated US$48.9 million in commissions, doubling the figure from the same period in 2022.

On October 15, 2024, AGBA history completed a $4 billion merger with Triller Corp., an AI-powered social media and live-streaming platform. This merger resulted in the company changing its name to Triller Group Inc. This strategic move is expected to accelerate innovation and expand the combined company's global market presence.

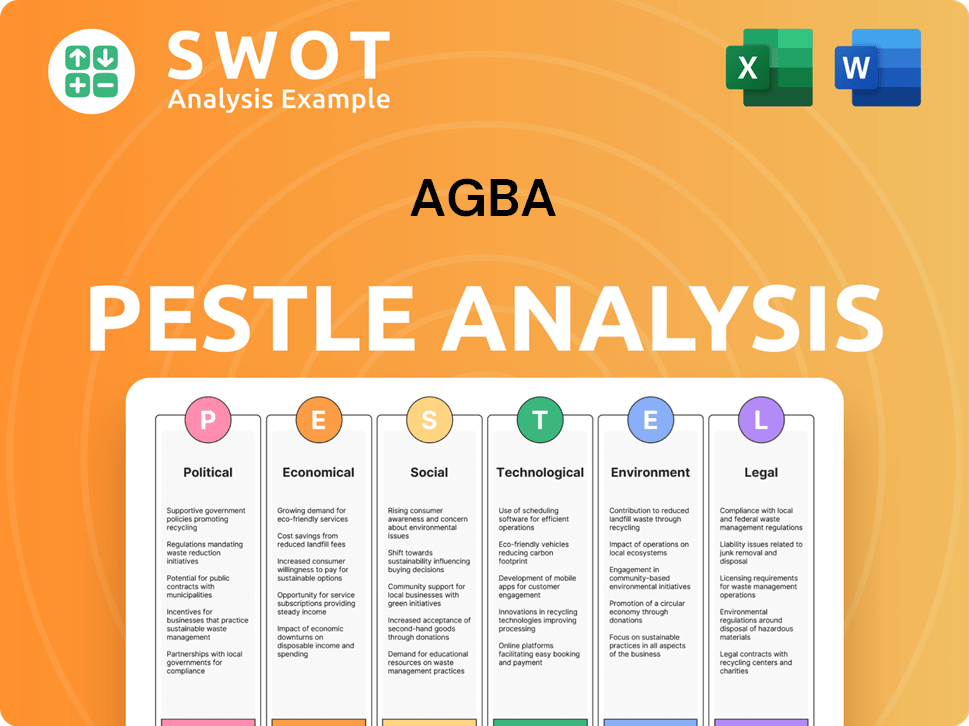

AGBA PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in AGBA history?

The AGBA Group has experienced a dynamic journey, marked by significant milestones and strategic shifts in the financial and healthcare sectors. The AGBA Company's history reflects its evolution from a financial services provider to a technology-driven entity, with a focus on innovation and strategic partnerships. The company's journey has been shaped by acquisitions, technological advancements, and responses to market challenges, all contributing to its current positioning in the industry. Learn more about the Owners & Shareholders of AGBA.

| Year | Milestone |

|---|---|

| April 2023 | Acquired Sony Life Financial Advisers in Singapore, expanding its presence in the Asian market. |

| October 2024 | Merged with Triller Corp., forming Triller Group Inc., a significant move to integrate financial services with a social media platform. |

| 2020-2022 | AGBA’s revenues were in line with the COVID years, showing resilience in the face of economic challenges. |

AGBA Group has aggressively adopted and integrated artificial intelligence (AI) and machine learning technologies across its operations, demonstrating a commitment to technological advancement. This tech-led ecosystem provides a broad range of financial and healthcare products, enhancing customer service and operational efficiency.

Rolled out a dedicated in-house AI curriculum for its employees and financial advisors, equipping them with the latest AI tools.

Developed a comprehensive tech-led ecosystem to provide a wide array of financial and healthcare products.

Formed partnerships to expand its service offerings and market reach, including the acquisition of Sony Life Financial Advisers.

Merged with Triller Corp. to create Triller Group Inc., integrating financial services with an AI-powered social media platform.

Leverages AI to drive innovation in wealth management and other financial services.

Focused on innovation in AI-driven social video platforms to enhance user engagement and service delivery.

Despite its achievements, AGBA financial has faced challenges, particularly within the macroeconomic environment, impacting its financial performance. The company's revenue in 2023 was US$54 million, and it was loss-making, though it aimed to break even by Q4 2024 on a standalone basis.

Acknowledged the risks associated with market downturns and their potential impact on operating environment and transaction-based fees.

Adjusted the 2023 budget and forecast downward in August 2023 due to the economic environment, expecting US$104 million in revenue.

Recognized the inherent risks of competitive threats within the financial services industry.

Focused on cost control initiatives to navigate market fluctuations and improve financial performance.

Refined its business model to adapt to changing market conditions and enhance operational efficiency.

Pursued strategic partnerships to strengthen its market position and expand its service offerings.

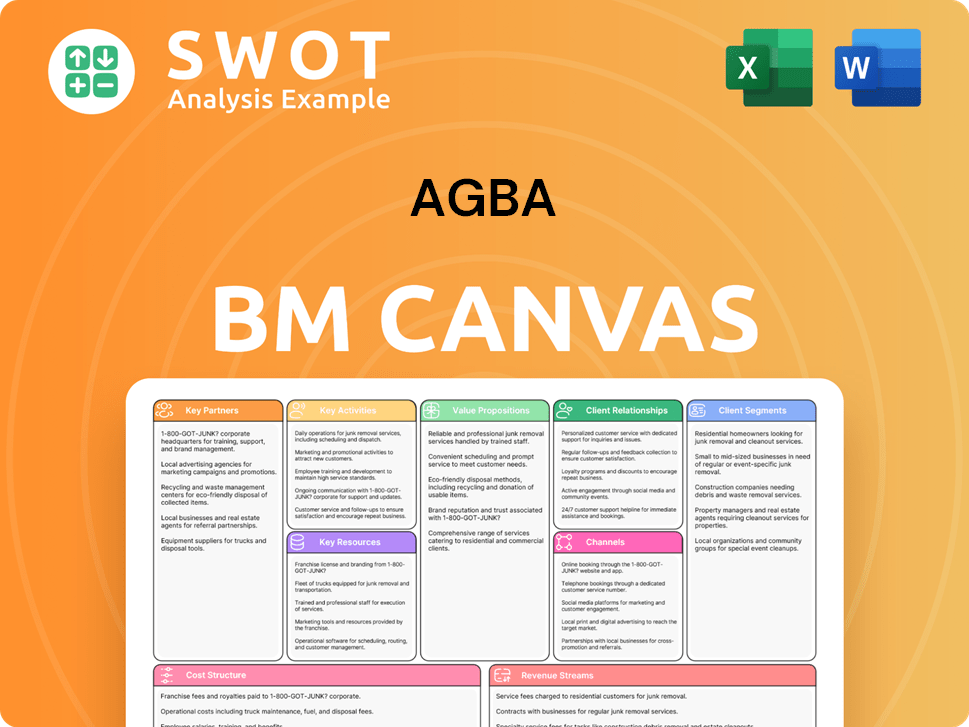

AGBA Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for AGBA?

The AGBA Company has a history marked by strategic shifts and significant milestones. Established in Hong Kong in 1993, the company initially focused on traditional financial services. Over time, AGBA Group expanded its operations and adapted to market changes, leading to its public listing and international expansion. The company's journey reflects its evolution from a broker-dealer to a multifaceted financial services provider, now operating as Triller Group Inc.

| Year | Key Event |

|---|---|

| 1993 | AGBA Group Holding Limited is established in Hong Kong, marking the company's inception. |

| 2019 | AGBA begins a strategic shift by separating its broker-dealer business into platform and distribution segments. |

| November 2020 | AGBA Money (formerly Tandem Money), a digital health and wealth platform, is launched, expanding its digital footprint. |

| November 14, 2022 | AGBA Acquisition Limited (SPAC) merges with TAG Holdings Limited, forming AGBA Group Holding Limited, which begins trading on NASDAQ. |

| April 2023 | AGBA announces an agreement to acquire Sony Life Financial Advisers Pte Ltd in Singapore, commencing international expansion. |

| Q1 2023 | AGBA reports a 500% increase in revenue to US$11.1 million compared to Q1 2022, showcasing strong growth. |

| August 2023 | AGBA revises its 2023 revenue forecast to US$104 million, projecting 40% top-line revenue growth over the next 3-5 years. |

| October 15, 2024 | AGBA completes its $4 billion merger with Triller Corp., changes its name to Triller Group Inc., and begins trading under the ticker 'ILLR'. |

Triller Group Inc. is concentrating on its AI-driven social video platform. This involves generating content from influencers and artists. The company aims to leverage its technology to enhance user engagement and expand its market reach.

The company is establishing a technology-driven wealth management and financial services ecosystem. This includes developing a wider range of financial products and solutions. The goal is to cater to both individual and corporate clients.

Triller Group Inc. anticipates accelerated revenue growth for 2024. The company aims to achieve break-even in Q4 2024 on a standalone basis for the legacy AGBA business. This focus highlights the company's commitment to financial sustainability.

The merger with Triller is expected to create substantial synergies by using Triller's 450 million user base and AI capabilities. The company's headquarters will relocate to Los Angeles. These strategic moves will help the company become a global leader in tech and fintech.

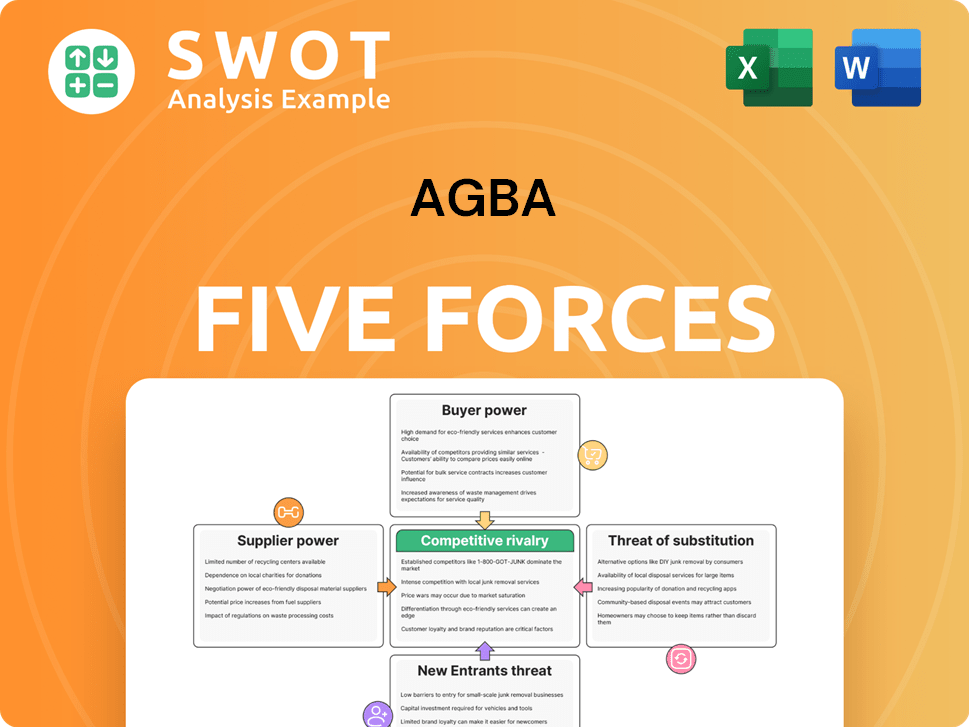

AGBA Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of AGBA Company?

- What is Growth Strategy and Future Prospects of AGBA Company?

- How Does AGBA Company Work?

- What is Sales and Marketing Strategy of AGBA Company?

- What is Brief History of AGBA Company?

- Who Owns AGBA Company?

- What is Customer Demographics and Target Market of AGBA Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.