AGBA Bundle

Who Really Owns AGBA?

Ever wondered who pulls the strings at AGBA Group Holding? Understanding the ownership structure is key to unlocking the company's potential and predicting its future moves. The recent merger with Triller Corp. has dramatically reshaped AGBA's landscape, making it more critical than ever to dissect its ownership.

This analysis delves deep into AGBA SWOT Analysis, exploring the evolution of AGBA ownership, from its roots as Convoy Global Holdings Limited in Hong Kong to its present form as Triller Group Inc. We'll examine the key players, including AGBA investors, founder stakes, and the impact of the Triller merger on AGBA stock and the company's strategic direction. Discover the answers to questions like "Who is the CEO of AGBA" and "Who owns AGBA company?"

Who Founded AGBA?

The story of AGBA Group Holding Limited, or AGBA company, began in 1993 as Convoy Global Holdings Limited, a broker-dealer in Hong Kong. While the founders' specific details aren't readily available, the company underwent a significant transformation starting in 2017. This restructuring was crucial for addressing past issues and setting the stage for future growth.

A new management team implemented a multi-year turnaround plan. This plan culminated in its listing on NASDAQ in November 2022. This public listing was a major step in separating the business from its historical issues and creating a platform for future expansion. This listing is important for AGBA investors.

The ownership structure of AGBA Group Holding has evolved significantly. The company's history includes a special purpose acquisition company (SPAC) transaction. This transaction changed the ownership landscape, with key figures and entities holding substantial stakes in the company.

Founded in 1993 as Convoy Global Holdings Limited.

Significant changes began in 2017 to address past issues.

Listed on NASDAQ in November 2022.

Merger with AGBA Acquisition Limited (AAL) in November 2022.

TAG Holdings held a significant stake as of April 2024.

Group CEO Wing-Fai Ng and other management held shares.

As of April 2024, the major shareholder of AGBA Group Holding, in terms of AGBA ownership, was TAG Holdings, which held 74.6% of the shares. Group CEO Wing-Fai Ng owned 1.2%, and other management and board members held an additional 1.4%. This structure reflects the company's evolution and the roles of key individuals in its current state. For more details, you can read an article about AGBA here: 0. This information is crucial for those interested in AGBA stock and understanding the company's shareholder structure.

Understanding AGBA Group Holding shareholders is important for investors.

- Founded in 1993 as Convoy Global Holdings Limited.

- Restructured starting in 2017.

- Listed on NASDAQ in November 2022.

- TAG Holdings held 74.6% of shares as of April 2024.

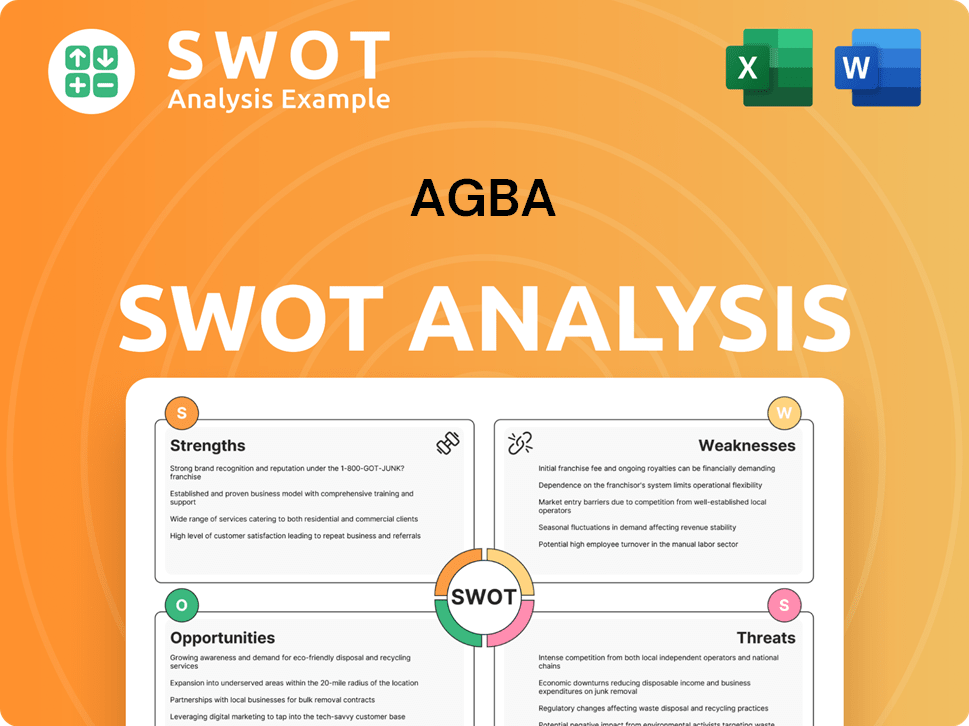

AGBA SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has AGBA’s Ownership Changed Over Time?

The ownership structure of AGBA Group Holding Limited, also known as the AGBA company, has seen significant changes, especially with its public listing and the merger with Triller Corp. Initially, the company went public on NASDAQ in November 2022. Before the merger, AGBA ownership was largely concentrated, with TAG Holdings holding 74.6% of the shares as of April 2024. The CEO held 1.2%, and other management and board members owned 1.4%, leaving a free float of 22.8%.

A major shift occurred on October 15, 2024, when AGBA merged with Triller Corp. This led to AGBA changing its name to Triller Group Inc. and trading under the tickers 'ILLR' and 'ILLRW' on the Nasdaq Capital Market from October 16, 2024. Post-merger, former Triller stockholders now own 70% of the combined company, while former AGBA shareholders hold the remaining 30%. The combined entity was valued at approximately $4 billion, with Triller shareholders' stake at $3.2 billion and AGBA shareholders' stake at $800 million. This merger significantly altered the landscape of AGBA investors.

| Event | Date | Impact on Ownership |

|---|---|---|

| Public Listing | November 2022 | Increased public float, initial concentrated ownership. |

| Merger with Triller Corp. | October 15, 2024 | Shifted ownership to 70% Triller, 30% former AGBA shareholders. |

| Share Distribution | October 15, 2024 | Approximately 299.9 million shares of common stock and 37.7 million shares of preferred stock issued to Triller's current stockholders. |

Key stakeholders in Triller Group Inc. include former Triller stockholders and the remaining AGBA shareholders. Pre-merger, institutional ownership of AGBA Group Holding Limited was limited. The merger involved issuing approximately 299.9 million shares of common stock and 37.7 million shares of preferred stock to Triller's current stockholders, with additional shares reserved and held in escrow. To understand the company's strategic approach, consider the Marketing Strategy of AGBA.

The merger between AGBA and Triller significantly reshaped the ownership structure, with Triller shareholders now holding a majority stake.

- Post-merger ownership split: 70% Triller, 30% AGBA shareholders.

- Combined entity valued at approximately $4 billion.

- Limited institutional ownership reported before the merger.

- The transformation is a key factor for anyone asking who owns AGBA.

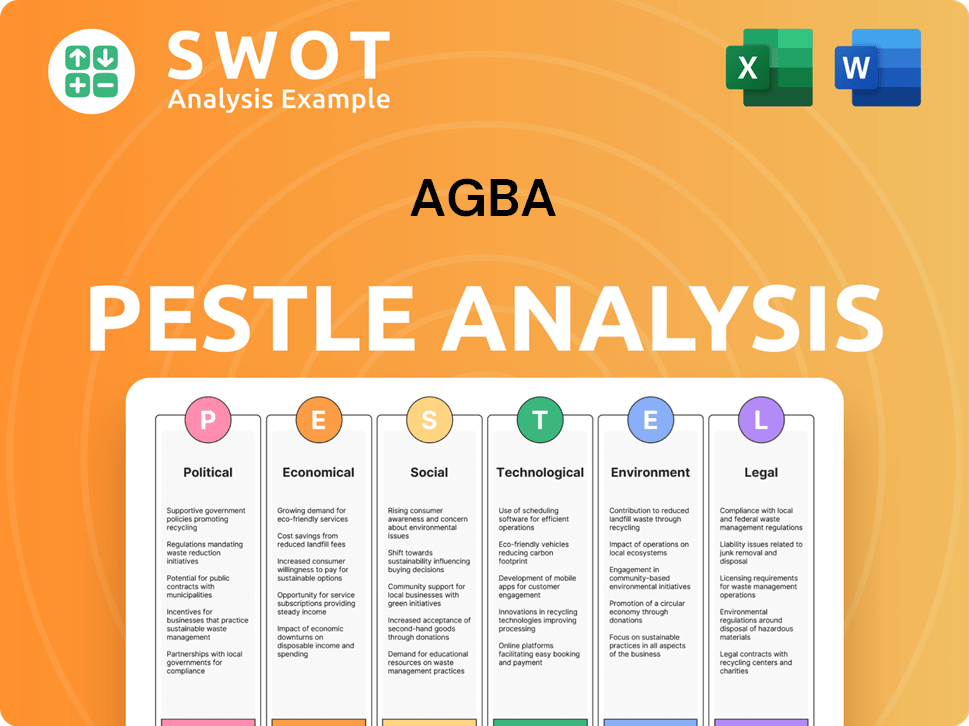

AGBA PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on AGBA’s Board?

Following the merger with Triller Corp., AGBA Group Holding Limited, now known as Triller Group Inc., has a board of directors elected by its shareholders. Robert E. Diamond, Jr., from Atlas Merchant Capital, serves as Chairman, a role he assumed in September 2023. Wing-Fai Ng, previously Group President of AGBA Group Holding Limited, remains involved in the management of the combined entity. Further details on the board's composition and specific representation were expected to be announced on October 22, 2024.

The merger agreement also included Bobby Sarnevesht, representing Triller stockholders, as a director of the Delaware Parent (Triller Group Inc.) through December 31, 2025. Information about the board, including major shareholders and independent seats, is still being formalized. For those interested in the Growth Strategy of AGBA, this information is crucial for understanding the company's direction.

| Board Member | Title | Affiliation |

|---|---|---|

| Robert E. Diamond, Jr. | Chairman | Atlas Merchant Capital |

| Wing-Fai Ng | Involved in Management | AGBA Group Holding Limited (Former) |

| Bobby Sarnevesht | Director | Triller Stockholders |

The merger significantly altered the voting structure. Triller Stakeholders now hold 70% of the combined economic interests, while current AGBA shareholders hold 30%. The holder of the Delaware Parent Series B Preferred Stock controls approximately 65% of the total voting power. In September 2024, AGBA shareholders approved issuing over 20% of the outstanding shares to Triller Stockholders, potentially leading to a 'change of control' under Nasdaq rules. This restructuring impacts AGBA ownership and how AGBA investors can influence the company.

The board of directors has been reshaped post-merger, with significant changes in voting power.

- Robert E. Diamond, Jr. is the Chairman.

- Triller Stakeholders have majority economic interest.

- The Series B Preferred Stock holder holds the majority of voting power.

- Bobby Sarnevesht is a director representing Triller stockholders.

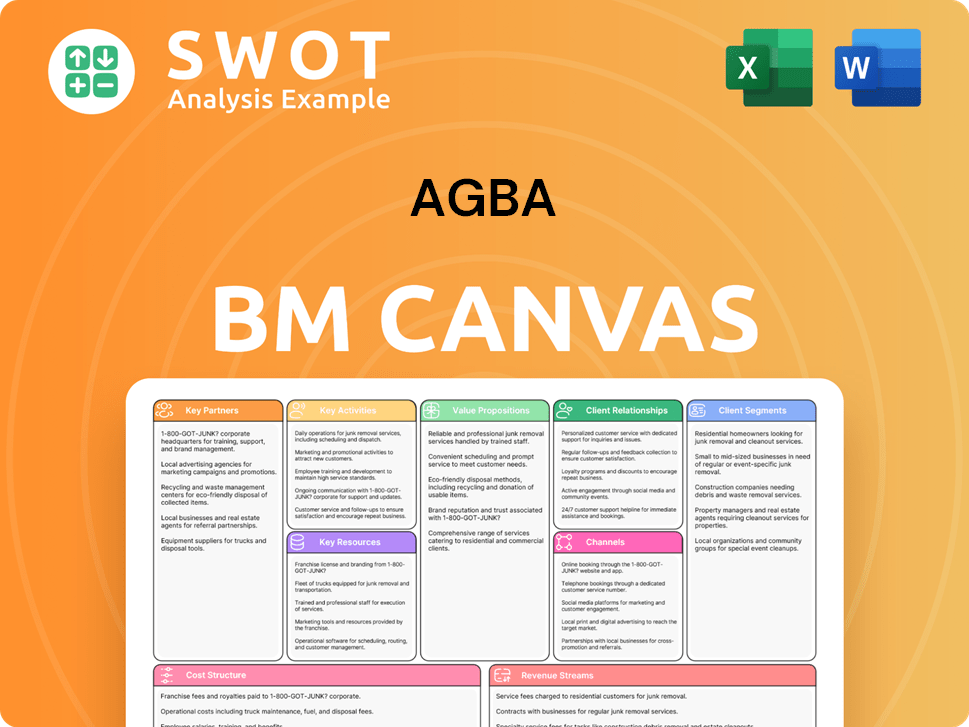

AGBA Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped AGBA’s Ownership Landscape?

The most significant recent development for AGBA Group Holding Limited is the merger with Triller Corp., finalized on October 15, 2024. This strategic move resulted in a name change to Triller Group Inc. and new stock tickers 'ILLR' and 'ILLRW' on the Nasdaq Capital Market, effective October 16, 2024. Post-merger, former Triller stockholders now hold a 70% stake in the combined company, while former AGBA shareholders own the remaining 30%. This represents a considerable shift in ownership, with Triller's shareholders gaining majority control due to the higher pre-merger valuation of Triller.

Before the merger, in April 2024, AGBA had a low free float, approximately 23% of its 74.4 million outstanding shares. In July 2024, AGBA entered into an agreement with Yorkville, aimed at securing financing and improving share liquidity. The merger, valued at roughly $4 billion, aligns with the trend of consolidation in the digital economy, integrating financial services, healthcare, and fintech with AI-driven social media and content. This merger and the subsequent changes in AGBA's structure have significantly reshaped the company's ownership profile, affecting both existing and new investors.

| Metric | Pre-Merger (AGBA) | Post-Merger (Triller Group Inc.) |

|---|---|---|

| Ticker Symbol | AGBA | ILLR |

| Free Float (approx.) | 23% (April 2024) | Data still solidifying |

| Ownership Structure | AGBA shareholders | Triller shareholders (70%), AGBA shareholders (30%) |

The transformation of AGBA into Triller Group Inc. highlights a shift towards a more diversified business model and a potentially broader investor base. The company's decision to domesticate to Delaware from the British Virgin Islands, coinciding with the merger, could attract more institutional investment, similar to other U.S.-based corporations. The management anticipates significant growth across its combined business pillars in 2024 and 2025. The company's positive performance, recognized by Forbes as one of the top-performing stocks on Nasdaq in 2024 (through June 15), indicates strong investor confidence leading up to the merger's completion. For more information on the company's strategic direction, consider reading about the Growth Strategy of AGBA.

Merger with Triller Corp. on October 15, 2024.

Former Triller shareholders now hold 70% of the combined company.

Domesticated to Delaware from the British Virgin Islands.

Anticipated exponential growth in 2024 and 2025.

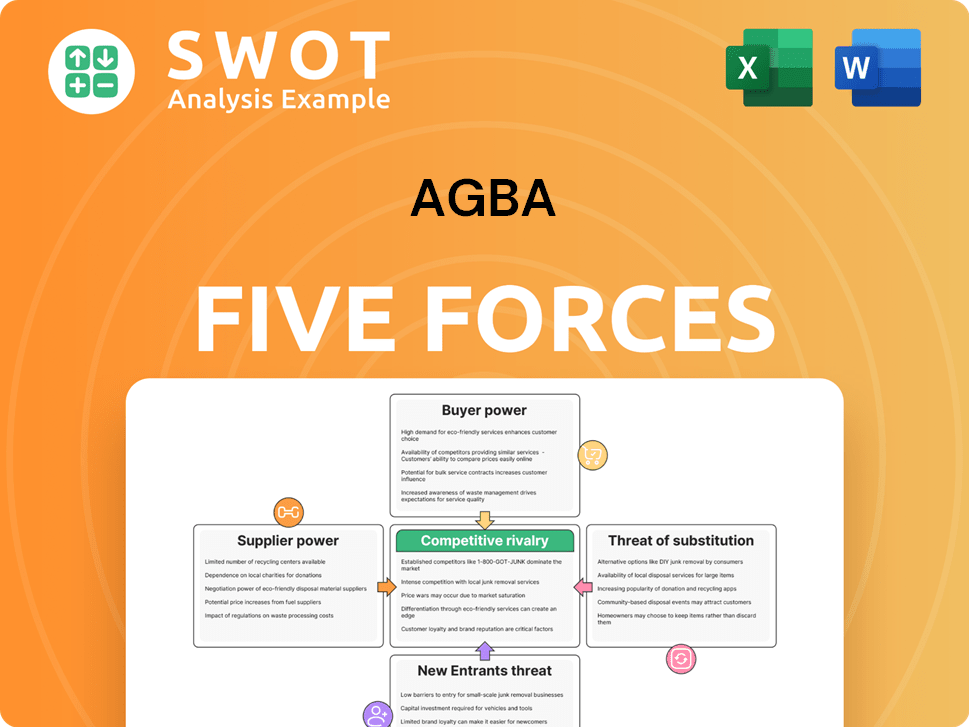

AGBA Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of AGBA Company?

- What is Competitive Landscape of AGBA Company?

- What is Growth Strategy and Future Prospects of AGBA Company?

- How Does AGBA Company Work?

- What is Sales and Marketing Strategy of AGBA Company?

- What is Brief History of AGBA Company?

- What is Customer Demographics and Target Market of AGBA Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.