AGBA Bundle

Can AGBA Group Holding Limited Continue Its Ascent in the Financial World?

AGBA Group Holding Limited has embarked on a bold journey to reshape the financial services sector, starting with a vision to provide comprehensive financial advisory services. Founded in 1993 by Wing-Fai Ng, AGBA has strategically expanded its offerings, moving beyond wealth management to encompass healthcare and fintech solutions. This expansion marks a significant evolution, reflecting AGBA's commitment to adapting to market needs and leveraging technological advancements.

This AGBA SWOT Analysis will explore the AGBA growth strategy, detailing its ambitious plans for future growth through strategic expansion and continuous innovation. We'll dissect AGBA's market position and financial performance, providing insights into its investment potential. The analysis will also cover AGBA company analysis, examining its business model and strategy, and assessing its long-term growth potential in a dynamic global market, focusing on revenue growth drivers and profitability outlook.

How Is AGBA Expanding Its Reach?

The company is actively pursuing several expansion initiatives to broaden its market reach and diversify its revenue streams. These strategies are designed to capitalize on emerging opportunities and maintain a competitive edge in the financial services industry. A key aspect of the company's growth strategy involves entering new geographical markets and expanding its product offerings.

Geographical expansion is a significant part of the company's strategy, with a focus on the Asia-Pacific region to leverage the increasing demand for financial services in emerging economies. This includes exploring opportunities in Southeast Asia, aiming to establish a stronger presence by the end of 2025. Simultaneously, the company is focused on launching new products and services within its existing segments, particularly in wealth management, to cater to a broader range of clients.

The company's expansion plans also include mergers and acquisitions (M&A) to integrate complementary businesses and technologies. This approach is expected to enhance its fintech capabilities and expand its B2B service offerings. These efforts are aimed at accessing new customer segments and diversifying revenue streams beyond traditional financial advisory services.

The company is targeting the Asia-Pacific region for expansion, aiming to capitalize on growing economies and demand for financial services. Southeast Asia is a key area of focus, with plans to strengthen its presence by the end of 2025. This expansion is part of the company's broader strategy to increase its market share and diversify its revenue sources.

The company is developing tailored investment products for high-net-worth individuals and institutional clients within its wealth management segment. Several new offerings are expected to roll out in late 2024, enhancing its product portfolio. These new products are designed to meet the evolving needs of its client base and drive revenue growth.

The company is actively pursuing M&A to integrate complementary businesses and technologies, enhancing its fintech capabilities. An example is the acquisition of assets from a B2B fintech firm in early 2024. This strategy aims to expand its B2B service offerings and increase its client base.

The company is forming partnerships with technology providers to enhance its digital platforms, improving customer experience and operational efficiency. These collaborations support the company's goal of maintaining a competitive edge in the rapidly evolving financial services industry. The focus is on leveraging technology to drive innovation and improve service delivery.

The company's strategic initiatives are designed to drive growth and enhance its market position. These include geographical expansion, product diversification, and strategic acquisitions. These efforts are expected to increase the company's client base and revenue streams, contributing to its long-term growth potential. For more details on the company's ownership structure, you can refer to Owners & Shareholders of AGBA.

- Geographical Expansion: Targeting Asia-Pacific, particularly Southeast Asia, to capture growth opportunities.

- Product Diversification: Launching new wealth management products tailored for high-net-worth individuals.

- Strategic Acquisitions: Integrating complementary businesses to enhance fintech capabilities and expand B2B services.

- Partnerships: Collaborating with technology providers to improve digital platforms and customer experience.

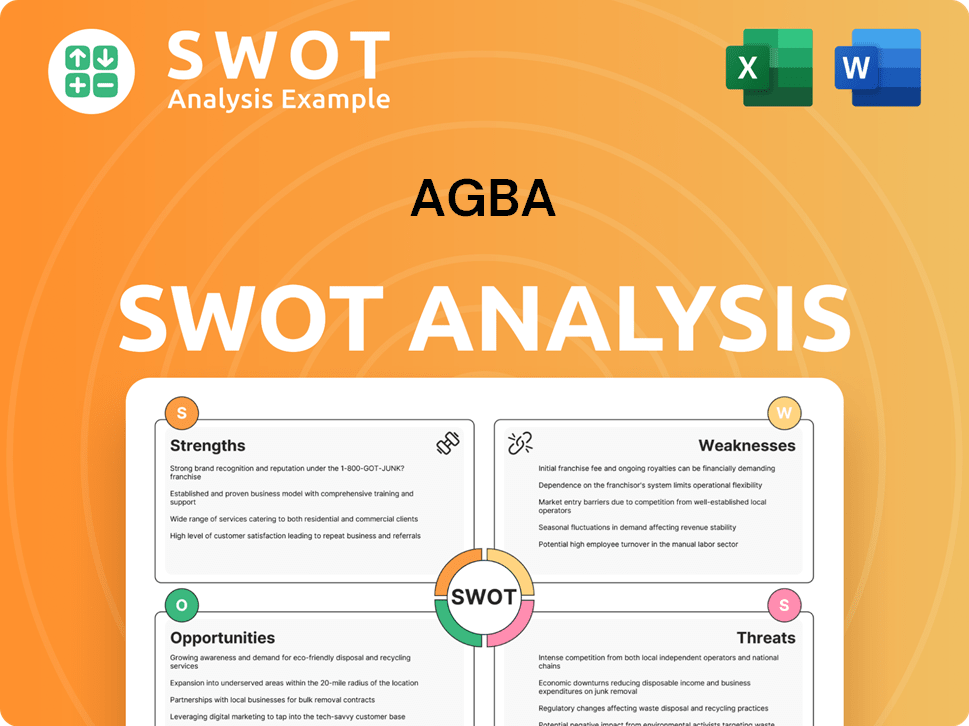

AGBA SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does AGBA Invest in Innovation?

The growth strategy of AGBA Group Holding Limited heavily emphasizes innovation and technology to drive its future prospects. This approach is central to enhancing its market position and achieving sustainable growth within the financial services sector. The company's commitment to digital transformation and the integration of advanced technologies are key components of its strategic initiatives.

AGBA's focus on technology extends to improving customer engagement and operational efficiency. By leveraging digital solutions and exploring cutting-edge technologies like blockchain, AGBA aims to offer more personalized services and secure transactions. This proactive stance is designed to attract a broader client base and maintain a competitive edge in the market.

AGBA's investment potential is boosted by its strategic investments in research and development (R&D). The company is focused on in-house development of proprietary platforms and strategic collaborations with external innovators. This focus on innovation is designed to improve AGBA's financial performance and foster long-term growth.

AGBA is integrating AI-powered analytics into its wealth management platforms. This initiative is designed to provide more personalized financial advice and automated portfolio management services.

The company is exploring the use of blockchain for secure transactions within its fintech segment. Pilot programs are anticipated to launch in 2024.

AGBA is exploring green financial products and socially responsible investment platforms. These initiatives are aimed at meeting the growing demand for ESG-compliant solutions.

AGBA is focused on digital transformation to streamline operations and enhance customer engagement. This includes the development of advanced digital solutions.

Significant investments in research and development (R&D) are a core part of AGBA's innovation strategy. These investments support the development of proprietary platforms and strategic collaborations.

New technologies and digital solutions are designed to improve operational efficiencies. These advancements directly contribute to AGBA's growth objectives.

The company's strategic initiatives are designed to enhance its market position and drive revenue growth. The integration of AI-powered analytics, with full implementation expected by late 2025, is a key step in providing personalized financial advice. Furthermore, the exploration of blockchain technology for secure transactions and the development of ESG-compliant solutions demonstrate AGBA's commitment to innovation and sustainable growth. For a deeper understanding of the company's background, consider reading a Brief History of AGBA.

AGBA's innovation strategy is multifaceted, focusing on digital transformation and the integration of advanced technologies to improve its financial performance. These efforts are designed to attract a wider client base and improve operational efficiencies.

- AI Integration: Implementing AI-powered analytics for personalized financial advice and automated portfolio management.

- Blockchain Exploration: Investigating blockchain technology for secure and transparent transactions within the fintech segment.

- ESG Initiatives: Developing green financial products and socially responsible investment platforms to meet the demand for ESG-compliant solutions.

- Digital Transformation: Streamlining operations and enhancing customer engagement through advanced digital solutions.

- R&D Investments: Investing in research and development to develop proprietary platforms and strategic collaborations.

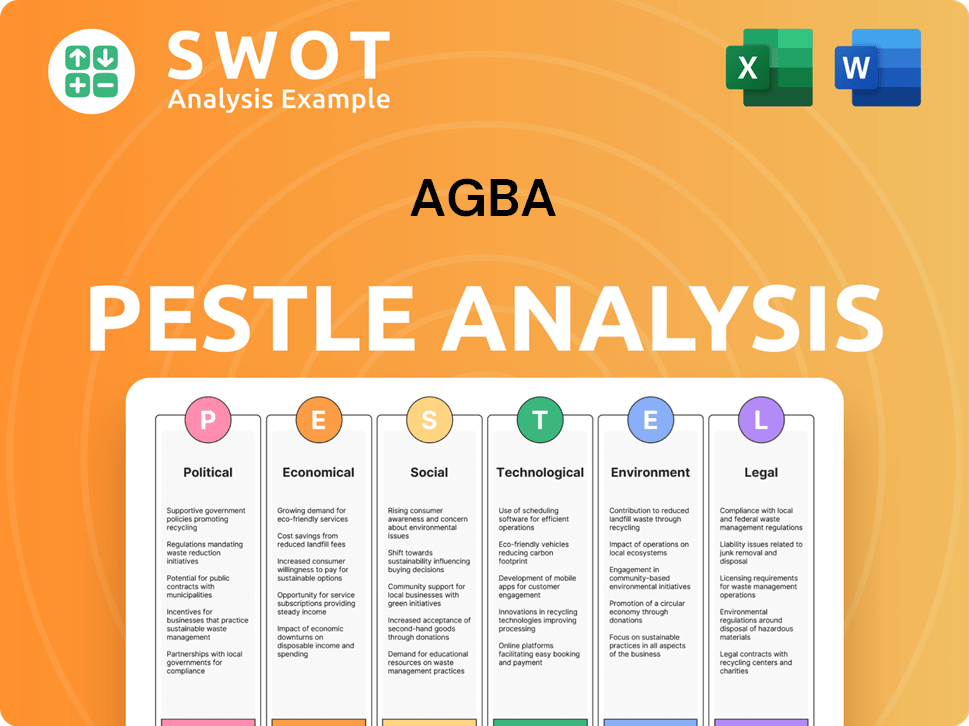

AGBA PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is AGBA’s Growth Forecast?

The financial outlook for AGBA Group Holding Limited is promising, underpinned by its strategic initiatives and diversified business model. The company anticipates robust financial performance, driven by expansion across wealth management, healthcare, and fintech sectors. Recent acquisitions, such as those from Convoy Global Holdings Limited, are expected to significantly boost revenue streams, particularly in the fintech segment. This positions AGBA favorably for sustained growth and enhanced market share.

AGBA's growth strategy is focused on increasing profit margins through operational efficiencies, leveraging digital transformation and automation. The company's historical performance indicates consistent growth, and current strategies are designed to accelerate this trajectory. Strategic investments in technology and mergers and acquisitions (M&A) activities suggest a proactive approach to capital allocation, supporting its growth objectives. This financial approach aims to achieve long-term financial stability and increased shareholder value.

The company's commitment to sustainable growth is evident in its strategic investments and diversified business model. As AGBA continues to evolve, its financial performance will be a key indicator of its success. Examining the Mission, Vision & Core Values of AGBA provides further insight into the company's long-term goals and strategic direction, which are crucial for understanding its financial trajectory.

AGBA's financial performance is expected to be robust, driven by its diversified business model and strategic acquisitions. The company's focus on wealth management, healthcare, and fintech provides multiple revenue streams. The integration of assets from Convoy Global Holdings Limited is anticipated to enhance revenue and market share.

AGBA's market position is strengthened by its diversified business model and strategic acquisitions. The company operates across wealth management, healthcare, and fintech, providing a broad market presence. The acquisition of assets from Convoy Global Holdings Limited is expected to significantly enhance its market share, especially in the fintech sector.

Key drivers for AGBA's revenue growth include strategic acquisitions, particularly in the fintech sector. Expansion across wealth management and healthcare also contributes to revenue diversification. Operational efficiencies gained through digital transformation and automation are designed to boost profit margins.

The profitability outlook for AGBA is positive, supported by operational efficiencies and strategic revenue growth. Digital transformation and automation initiatives are designed to improve profit margins. The company's diversified business model across wealth management, healthcare, and fintech provides a solid foundation for sustained profitability.

AGBA's growth strategy focuses on strategic acquisitions, particularly in fintech, and expansion across wealth management and healthcare. The company aims to increase profit margins through operational efficiencies gained from digital transformation and automation. This multi-faceted approach supports long-term financial stability.

The future prospects for AGBA in the insurance market are promising, driven by its diversified business model and strategic acquisitions. Expansion into fintech and healthcare enhances its market presence. The company's focus on operational efficiencies and digital transformation supports sustainable growth.

A financial performance review for 2024 would likely highlight the impact of recent acquisitions and the integration of new assets. Revenue growth across wealth management, healthcare, and fintech sectors will be key indicators. Operational efficiencies and digital transformation initiatives are expected to improve profit margins.

AGBA's business model is diversified across wealth management, healthcare, and fintech, supporting multiple revenue streams. The company's strategy includes strategic acquisitions and a focus on operational efficiencies. Digital transformation and automation are central to its long-term growth plan.

The competitive landscape for AGBA includes players in wealth management, healthcare, and fintech. The company's diversified business model and strategic acquisitions provide a competitive edge. Its focus on operational efficiencies and digital transformation supports its market position.

AGBA's expansion plans include strategic acquisitions and organic growth across wealth management, healthcare, and fintech. The company aims to increase its market share through these initiatives. Operational efficiencies and digital transformation are key components of its expansion strategy.

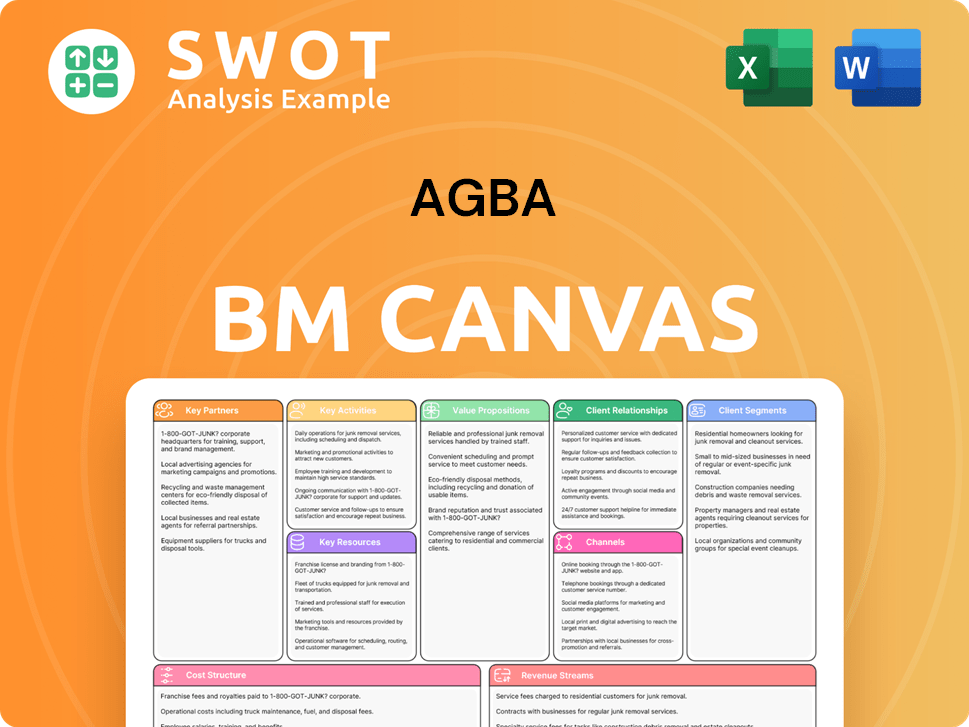

AGBA Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow AGBA’s Growth?

The path of AGBA Group Holding Limited, like any growth-oriented company, is fraught with potential risks and obstacles. Understanding these challenges is crucial for a comprehensive AGBA company analysis and assessing its investment potential. Several factors could impede AGBA's progress, affecting its AGBA growth strategy and future prospects.

Intense competition within the financial services industry is a primary concern. Numerous established firms and nimble fintech startups are constantly vying for market share, creating a challenging landscape. Furthermore, the highly regulated nature of both the financial and healthcare sectors introduces continuous regulatory risks, demanding adaptive strategies and increased operational costs. This dynamic environment necessitates careful navigation to ensure sustained AGBA financial performance.

Beyond these, AGBA faces potential disruptions from supply chain vulnerabilities, particularly concerning its partnerships with technology providers. Technological advancements, such as AI and blockchain, pose a constant threat of rendering existing solutions obsolete if AGBA fails to adapt swiftly. Internal resource constraints, including attracting and retaining top talent, also present challenges. Understanding these factors is key to evaluating AGBA's strategic positioning and long-term growth potential.

The financial services sector is highly competitive, with both established players and emerging fintech companies. This intense competition could pressure AGBA's market position and impact its ability to gain or maintain market share. The competitive landscape requires constant innovation and strategic agility to stay ahead.

Regulatory changes in the financial and healthcare sectors pose a significant risk. Evolving compliance requirements, data privacy regulations, and international financial laws can necessitate significant operational adjustments and increased costs. These changes could affect AGBA's business model and strategy.

Rapid advancements in technologies such as AI and blockchain could render existing solutions obsolete. Failure to adapt quickly to these technological shifts could undermine AGBA's competitive advantage. This requires continuous investment in R&D and a proactive approach to innovation.

Attracting and retaining top talent, particularly in specialized fields like fintech and AI, is critical. Internal resource constraints can impede growth and limit AGBA's ability to execute its strategic plans. This includes managing human capital effectively to support AGBA's expansion plans and strategies.

Supply chain disruptions could indirectly affect AGBA through its partnerships and technology providers, potentially disrupting service delivery or platform development. This highlights the need for robust supply chain management and diversification strategies. This could impact AGBA's revenue growth drivers.

Emerging risks, such as increased cybersecurity threats and geopolitical instability, could shape AGBA's future trajectory. These risks require ongoing vigilance and adaptive strategies to ensure sustainable growth initiatives. This could impact AGBA's profitability outlook and market share and trends.

AGBA mitigates risks through diversification across its wealth management, healthcare, and fintech segments. It likely employs robust risk management frameworks and scenario planning to anticipate and respond to potential challenges. Strategic M&A activities and continuous investment in technology are also key strategies.

The financial services market is highly dynamic, with evolving consumer preferences and technological advancements. Understanding the competitive landscape is crucial for AGBA. For a deeper dive, consider exploring the Competitors Landscape of AGBA to understand the competitive dynamics.

Assessing AGBA's financial performance requires a detailed review of its revenue growth, profitability, and cash flow. Key metrics include revenue growth rates, profit margins, and return on equity. Analyzing these metrics provides insights into AGBA's ability to generate sustainable returns and manage its financial obligations. Investors should also consider the company's debt levels and credit ratings to assess its financial stability. The analysis should also include a forward-looking assessment of the company’s ability to achieve its financial targets.

Investment in AGBA involves risks, including market volatility, regulatory changes, and competition. However, potential opportunities exist in its growth strategy, market expansion, and strategic partnerships. A thorough analysis of these risks and opportunities is essential for making informed investment decisions. Investors should consider the company's strategic partnerships and acquisitions, which play a crucial role in its long-term growth potential.

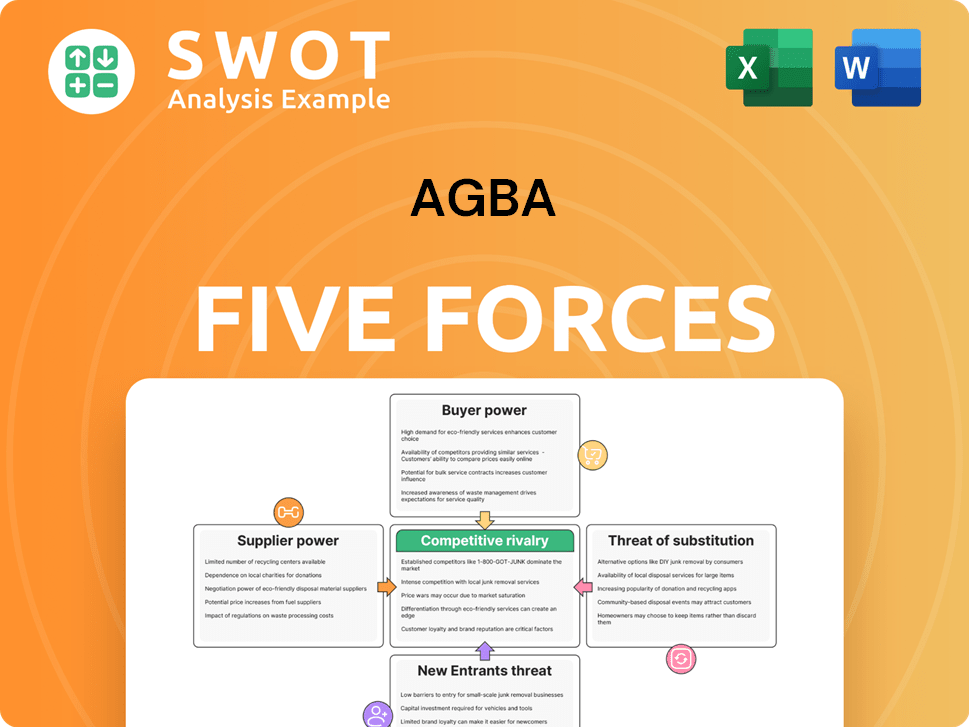

AGBA Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of AGBA Company?

- What is Competitive Landscape of AGBA Company?

- How Does AGBA Company Work?

- What is Sales and Marketing Strategy of AGBA Company?

- What is Brief History of AGBA Company?

- Who Owns AGBA Company?

- What is Customer Demographics and Target Market of AGBA Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.