AGBA Bundle

How Has AGBA Company Redefined Its Customer Base?

In the ever-evolving financial landscape, understanding AGBA SWOT Analysis and its customer base is critical. AGBA Group Holding Limited, a company with a rich history, has undergone a significant transformation, especially after its NASDAQ listing in late 2022. This shift, highlighted by the recent merger with Triller Corp., necessitates a deep dive into its customer demographics and target market.

This exploration of AGBA Company's evolving customer profile is essential for investors, analysts, and anyone seeking to understand the company's strategic direction. The merger with Triller and the move towards a tech-focused model dramatically reshape the company's target market and customer acquisition strategies. Analyzing customer demographics for AGBA provides valuable insights into its potential for growth and its ability to navigate the complexities of the global market, including understanding AGBA's customer behavior analysis.

Who Are AGBA’s Main Customers?

Understanding the customer demographics and target market is crucial for assessing the business strategy of AGBA Company. The company's approach to customer segmentation has evolved, particularly with recent strategic moves. This analysis delves into the primary customer segments, highlighting the key demographics and market focus of AGBA.

AGBA's customer base can be broadly divided into two main categories: consumers (B2C) and businesses (B2B). This dual approach allows it to serve a wide range of clients, with a significant presence in the Hong Kong and Greater Bay Area markets. The company's strategic direction and recent acquisitions further refine its target market, opening up new opportunities for growth.

The company's focus on wealth management and healthcare products suggests a target demographic with disposable income and a need for financial planning and health provisions. The company's 'PERFORM' team caters to high-net-worth individuals within the Greater Bay Area, indicating a focus on affluent segments. For a deeper dive into AGBA's strategic direction, consider reading about Growth Strategy of AGBA.

AGBA's B2C segment primarily targets consumers in Hong Kong and the Greater Bay Area (GBA). The focus is on providing a 'one-stop financial supermarket' with wealth and health products. While specific breakdowns are not extensively detailed, the target audience likely includes individuals with disposable income seeking financial planning and health provisions.

The B2B customer base includes banks, financial institutions, brokers, and independent financial advisors (IFAs). AGBA has a large network of IFAs, with over 1,200 as of December 31, 2023, and approximately 1,500 in March 2023, which serves as a crucial distribution channel. This network helps reach both retail and corporate clients.

The merger with Triller Corp. in October 2024 significantly altered AGBA's target market. This acquisition introduced a global user base of 450 million, expanding the reach beyond the Hong Kong and GBA markets. This move targets a younger, digitally native audience, integrating financial services with social video platforms.

AGBA employs various customer segmentation strategies to cater to different needs. The company focuses on wealth management and healthcare, indicating a segmentation based on financial goals and health needs. The PERFORM team and the IFA network are tailored approaches to serve specific customer segments effectively.

AGBA's target market is multifaceted, encompassing both B2C and B2B segments. The company's strategic moves, particularly the Triller acquisition, have broadened its reach and customer demographics. Understanding these segments is crucial for evaluating AGBA's growth potential and market position.

- Focus on wealth management and healthcare products targets individuals with financial needs.

- The IFA network is a key channel for reaching both retail and corporate clients.

- The Triller acquisition expands AGBA's reach to a global and younger audience.

- AGBA's customer segmentation strategies are evolving to adapt to market changes.

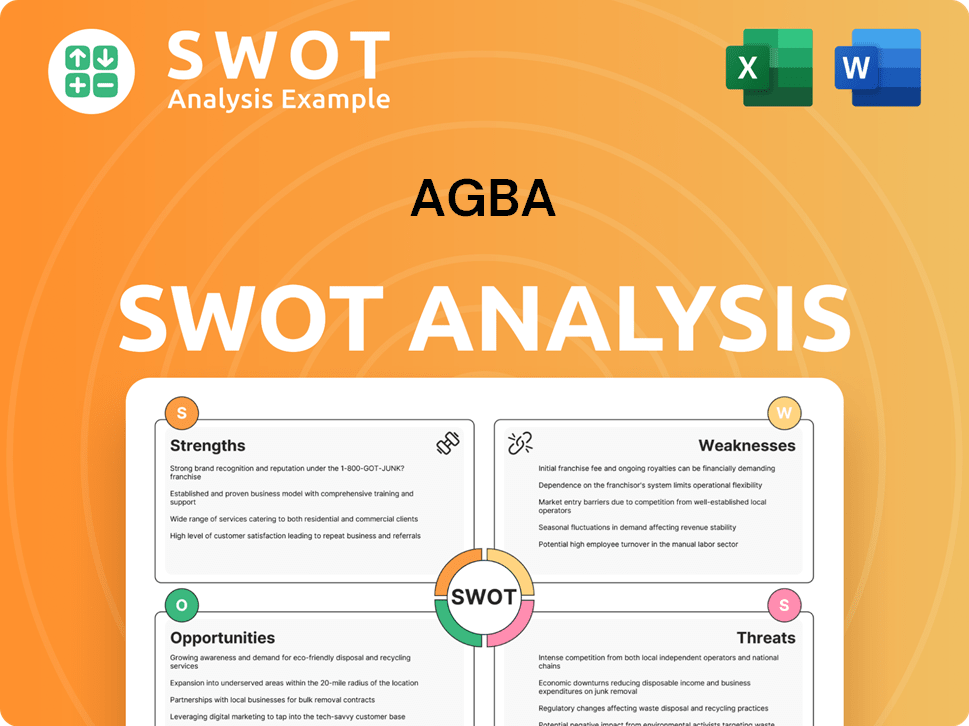

AGBA SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do AGBA’s Customers Want?

The primary needs of AGBA Company customers, whether individuals or corporations, revolve around financial security and healthcare solutions. Individual clients seek a variety of financial products, including life insurance, pensions, and mortgages, along with healthcare services. This 'one-stop financial supermarket' approach simplifies wealth and health management, addressing the practical need for integrated solutions.

Psychological drivers also play a significant role, with customers aspiring for long-term financial stability and peace of mind regarding their health. This is particularly relevant in regions like China, where concerns about state pensions and welfare systems are prevalent. The company's focus is on providing tailored solutions to meet these diverse needs, leveraging its extensive network of independent financial advisors.

Purchasing behaviors often involve a preference for personalized, independent financial advice. This trend is noticeable globally, especially in Hong Kong, where the growth of the broker channel in the life insurance industry highlights this preference. AGBA addresses this by utilizing its network of independent financial advisors, allowing for tailored advice and product offerings. The company also focuses on identifying common pain points, such as the underserved mass affluent market, which is expected to become the largest segment by financial wealth.

Customers need comprehensive financial security and effective healthcare provisions. Individual clients seek diverse financial products like life insurance and pensions.

Customers often seek personalized financial advice. The growth of the broker channel in the life insurance industry highlights this preference.

AGBA focuses on the underserved mass affluent market. This segment is expected to become the largest by financial wealth.

Technology and market trends significantly influence product development. AGBA continuously enhances client and advisor tools through tech deployment.

In Q1 2023, AGBA's Platform Business onboarded 10 new insurance partners. Over 170 new insurance and investment products were released.

The planned acquisition of Triller Corp. aims to revolutionize digital financial services. This includes developing an easy-to-use app for financial and healthcare services.

AGBA employs several strategies to meet customer needs and preferences, including leveraging technology and market insights.

- Personalized Advice: Utilizing a network of independent financial advisors to offer tailored advice.

- Product Innovation: Continuously enhancing client and advisor tools through technology.

- Market Focus: Targeting the underserved mass affluent market.

- Strategic Acquisitions: Planning acquisitions like Triller Corp. to expand digital financial service offerings.

- Product Expansion: Expanding its product offerings, with over 2,000 financial products available.

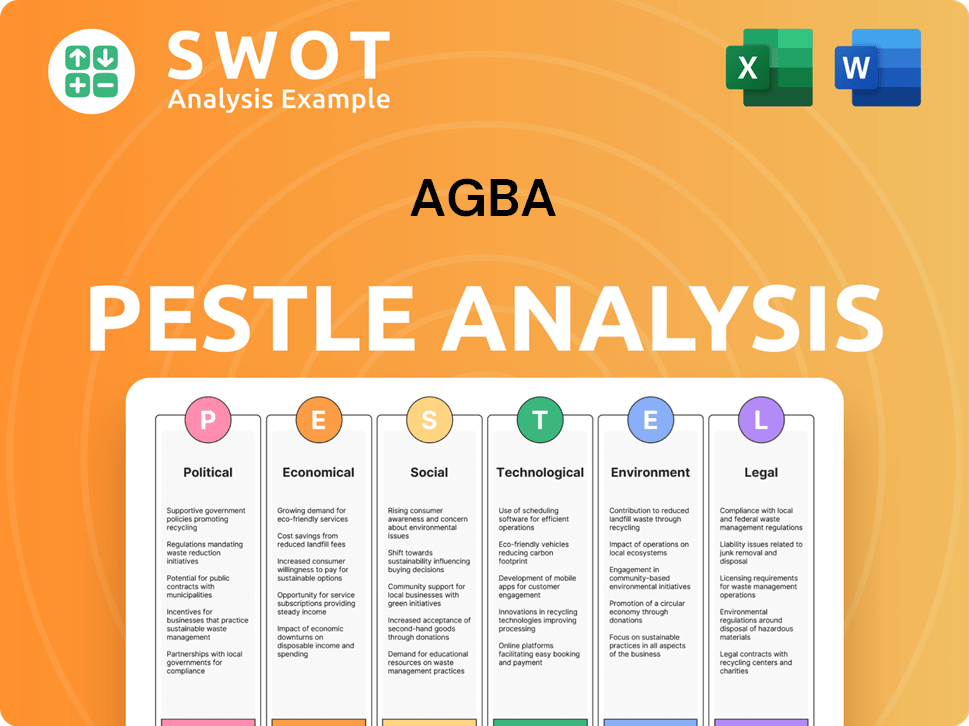

AGBA PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does AGBA operate?

The geographical market presence of the [Company Name] has historically centered on Hong Kong and the Guangdong-Hong Kong-Macao Greater Bay Area (GBA). This strategic focus is supported by a customer base exceeding 400,000 individuals and corporate clients, reflecting its position as a leading 'one-stop financial supermarket'. The integration of Hong Kong into the GBA is expected to broaden the customer base, particularly attracting demand from Mainland Chinese customers for life insurance, asset management, and healthcare products.

The company's distribution network, the largest in Hong Kong, is a key asset in this region. This extensive network of independent financial advisors plays a crucial role in reaching and serving the target market. The focus on the GBA reflects a strategic understanding of the market's potential and the demand for quality financial products and services.

Recent developments indicate a strategic expansion beyond the GBA, with a focus on Southeast Asia and the U.S. In April 2023, the company announced an agreement to acquire Sony Life Financial Advisers Pte Ltd in Singapore, a move to tap into Singapore's wealthy customer base. This expansion is part of a broader strategy to diversify its geographical footprint and capitalize on new growth opportunities.

The primary market for the [Company Name] is Hong Kong and the Guangdong-Hong Kong-Macao Greater Bay Area (GBA). This region is home to over 400,000 customers, making it a crucial area for the company. The GBA's integration is expected to increase the customer base, particularly with demand from Mainland Chinese customers.

The company has expanded into Southeast Asia, with an agreement to acquire Sony Life Financial Advisers Pte Ltd in Singapore. This move is designed to capitalize on Singapore's reputation as a global center for innovation and finance. This expansion strategy is part of a broader effort to diversify its geographical footprint.

The merger with Triller Corp. in October 2024, which involved a valuation of approximately US$4 billion, led to the relocation of the company's headquarters to Los Angeles, U.S. This move is intended to leverage Triller's global user base of 450 million and expand into new markets. This strategic shift indicates a clear strategy for global expansion beyond its traditional Asian strongholds.

The company focuses on using technology and partnerships to access markets, especially in the Chinese insurance and savings market. The Triller merger provides access to an AI-driven social video platform and a tech-driven wealth management ecosystem. This approach highlights the company's commitment to innovation and strategic alliances.

The company's geographical strategy involves a multi-pronged approach to market expansion. The primary focus includes leveraging the strong base in Hong Kong and the GBA, expanding into Southeast Asia, and entering the U.S. market through strategic mergers.

- The GBA continues to be a core market, with a focus on attracting Mainland Chinese customers.

- Southeast Asia expansion, particularly Singapore, aims to tap into wealthy customer databases.

- The U.S. market entry through the Triller merger provides access to a global user base and a tech-driven wealth management ecosystem.

- The company is using technology and partnerships to access the Chinese insurance and savings market.

For more insights into the company's marketing strategies, consider reading this article: Marketing Strategy of AGBA.

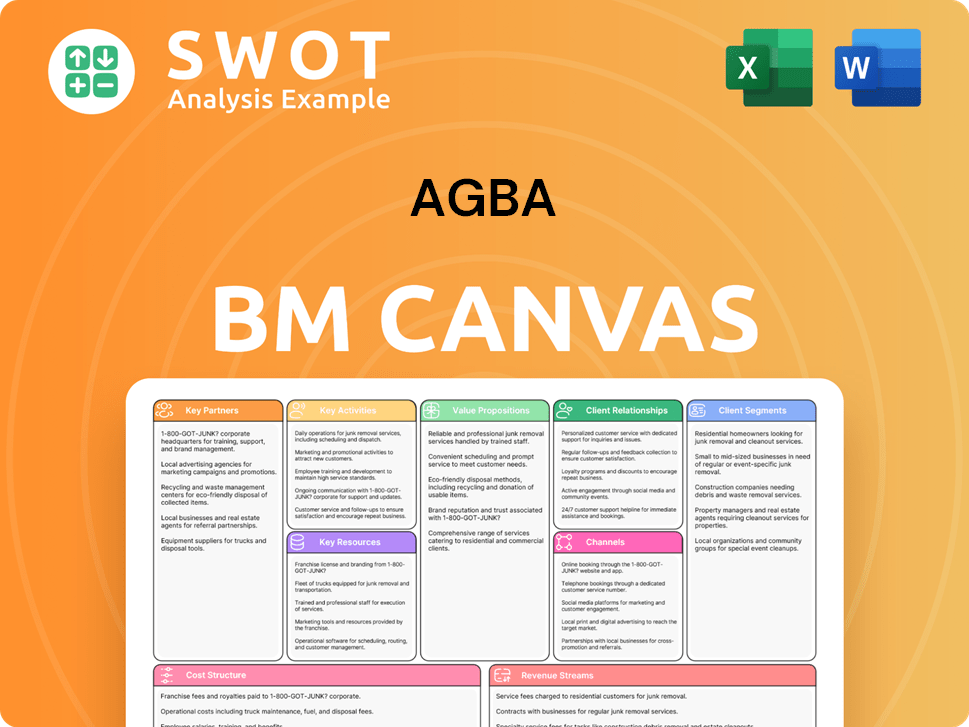

AGBA Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does AGBA Win & Keep Customers?

The strategies of AGBA Group Holding Limited for acquiring and retaining customers are multifaceted, blending traditional methods with technological advancements. A key element of AGBA's approach involves leveraging its extensive network of independent financial advisors (IFAs), which is the largest in Hong Kong. This network supports direct engagement and personalized advisory services, covering wealth management, insurance, and healthcare. AGBA also expands its distribution channels through internal growth and partnerships with external entities, including major local banks, to reach new customer segments.

To enhance customer acquisition, AGBA integrates both online and offline marketing strategies. The 'OnePlatform' serves as a comprehensive omnichannel financial business solution platform, catering to financial advisors, brokers, and institutions. A planned integration with Triller Corp. is expected to boost digital marketing capabilities, utilizing Triller's advanced AI, video, and digital marketing tools to target a global audience. This merger aims to revolutionize customer acquisition by tailoring digital financial services to evolving consumer preferences worldwide.

For customer retention, AGBA focuses on providing a comprehensive suite of products and services, essentially acting as a 'financial supermarket'. The company emphasizes continuous tech deployment and enhancements to its client and advisor tools to improve customer journeys and service delivery. The focus on integrating health and wealth services, and addressing common pain points, contributes to customer loyalty. The company's commitment to delivering market-leading customer care and infrastructure, supported by data analytics, particularly in its Healthcare Business, also plays a role in retention.

AGBA's primary customer acquisition strategy leverages its extensive network of independent financial advisors (IFAs). As of December 31, 2023, there were over 1,200 IFAs, with approximately 1,500 in March 2023. This network facilitates direct engagement and personalized advisory services across wealth management, insurance, and healthcare, allowing AGBA to offer tailored financial solutions.

The planned integration with Triller Corp. is a key initiative to enhance AGBA's digital marketing. This partnership is expected to leverage Triller's AI, video, and digital marketing tools to reach a global audience. This strategic move aims to tailor digital financial services, thereby improving customer acquisition and engagement.

AGBA offers a wide range of financial products and services, acting as a 'financial supermarket'. As of Q1 2023, over 2,000 financial products were available through its Platform Business. This comprehensive offering aims to meet diverse customer needs, encouraging customer loyalty and retention.

Continuous tech deployment and enhancements to client and advisor tools are crucial for improving customer journeys and service delivery. AGBA focuses on integrating health and wealth services to address customer pain points. These enhancements aim to improve customer satisfaction and retention.

AGBA's customer acquisition and retention strategies are dynamic, adapting to market changes and technological advancements. The company's shift towards a tech-centric holding company, including investments in fintech startups and the merger with Triller, reflects this evolution. These changes aim to drive growth and enhance financial flexibility, ultimately impacting customer lifetime value through expanded offerings and a wider reach. To understand more about the company's background and evolution, you can read Brief History of AGBA.

The 'PERFORM' team, a dedicated high-net-worth individual (HNWI) sales team, provides customized financial planning services. This targeted approach ensures that high-end customers receive tailored financial solutions, enhancing customer satisfaction and loyalty. This approach is critical for AGBA's customer demographics.

The 'OnePlatform' serves as an omnichannel financial business solution platform. This platform supports financial advisors, brokers, and institutions, offering a wide range of financial products and services. This ensures a seamless experience for both advisors and clients, improving customer retention.

AGBA expands its distribution footprint through partnerships with external channels, including large local banks. These partnerships help tap into new revenue pools and reach new customer segments. This expansion is a key part of the AGBA's market analysis.

AGBA's commitment to market-leading customer care and infrastructure is supported by data analytics. This approach is especially important in its Healthcare Business. Data analytics helps in understanding customer behavior analysis and improving service delivery.

AGBA's investments in fintech startups and the merger with Triller are aimed at driving growth and enhancing financial flexibility. These initiatives support the expansion of offerings and a wider reach. This is a key part of AGBA's customer segmentation strategies.

The integration of health and wealth services is a core strategy for customer retention. Addressing common pain points and providing comprehensive solutions contributes to customer loyalty. This approach ensures that AGBA meets the needs of its target market.

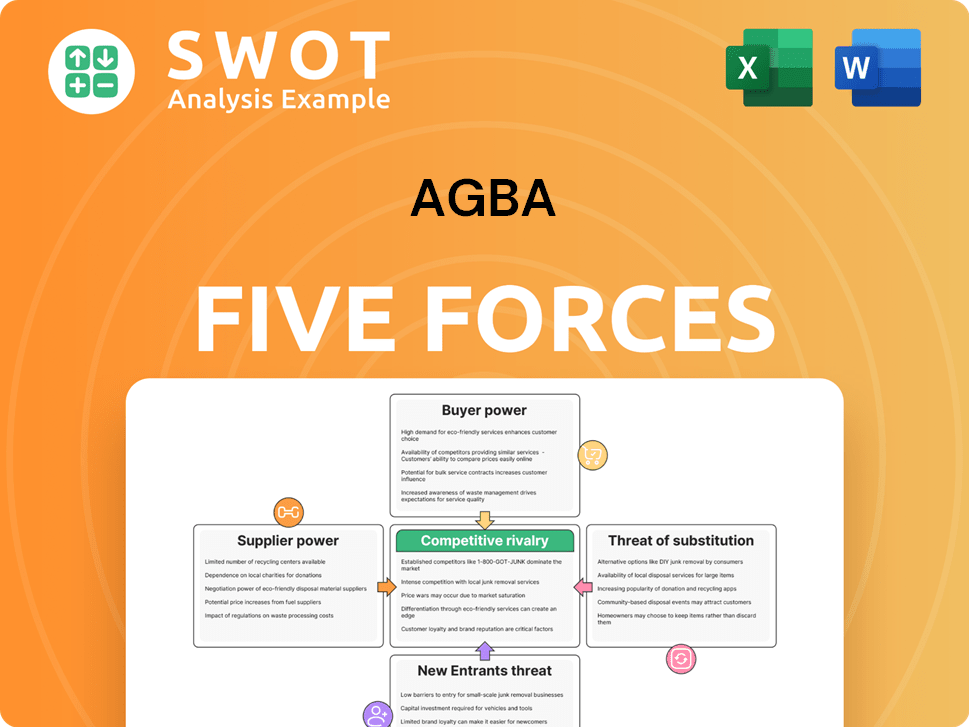

AGBA Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of AGBA Company?

- What is Competitive Landscape of AGBA Company?

- What is Growth Strategy and Future Prospects of AGBA Company?

- How Does AGBA Company Work?

- What is Sales and Marketing Strategy of AGBA Company?

- What is Brief History of AGBA Company?

- Who Owns AGBA Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.