AGBA Bundle

How Does AGBA Navigate the Complex Financial Services Arena?

The financial services sector is a battlefield of innovation and competition, and AGBA Group Holding Limited has established itself as a notable contender. Understanding the AGBA SWOT Analysis is crucial for grasping its position. This analysis will explore the competitive landscape, offering insights into AGBA's strategies and challenges.

This report provides a detailed AGBA market analysis, examining its position within the AGBA industry and the strategies it employs to compete. We will identify AGBA competitors and analyze their strengths and weaknesses, providing a comprehensive view of AGBA Group Holding's competitive advantages and how it compares to its rivals. Furthermore, we will examine AGBA Group Holding financial performance compared to competitors and its future outlook.

Where Does AGBA’ Stand in the Current Market?

The Growth Strategy of AGBA involves a strong market position within the financial services sector, particularly in the Asia-Pacific region. The company has established itself as a significant player in wealth management and fintech. AGBA's wealth management arm serves a substantial client base across Hong Kong and mainland China, consistently growing its assets under management (AUM).

AGBA's core operations are centered around financial advisory, asset management, and fintech solutions such as payment gateways and digital lending platforms. Geographically, its primary focus is Hong Kong, with an expanding presence in mainland China and strategic moves into other Southeast Asian markets. AGBA has strategically shifted its focus, embracing digital transformation to capture a larger share of the digital financial services market.

The company's financial health supports its ongoing expansion and diversification efforts. AGBA's strategic focus on integrating healthcare services with financial planning distinguishes its market approach, catering to a niche but expanding demographic seeking holistic financial and wellness solutions.

AGBA Group Holding Limited has a notable presence in the wealth management and fintech sectors. While specific market share data is not always available, the company's consistent growth in assets under management (AUM) indicates a solid market position. AGBA continues to expand its digital wealth management platforms, attracting tech-savvy investors.

AGBA offers a range of financial services, including financial advisory, asset management, and fintech solutions. These fintech solutions include payment gateways and digital lending platforms. The company focuses on integrating healthcare services with financial planning, providing holistic solutions.

AGBA's core operations are concentrated in Hong Kong, with a growing presence in mainland China. The company is also expanding into other Southeast Asian markets. This strategic geographic focus supports its growth and diversification efforts.

AGBA's financial health is robust, supporting its ongoing expansion and diversification. The company is focused on digital transformation and strategic investments in its fintech segment. Recent financial reports and analyst assessments indicate a strong performance.

AGBA's competitive advantages include its strong market position, diversified financial services, and focus on digital transformation. The company's strategic focus on integrating healthcare services with financial planning also distinguishes its market approach.

- Strong presence in wealth management and fintech.

- Diversified financial services offerings.

- Strategic focus on digital transformation and fintech.

- Integration of healthcare services with financial planning.

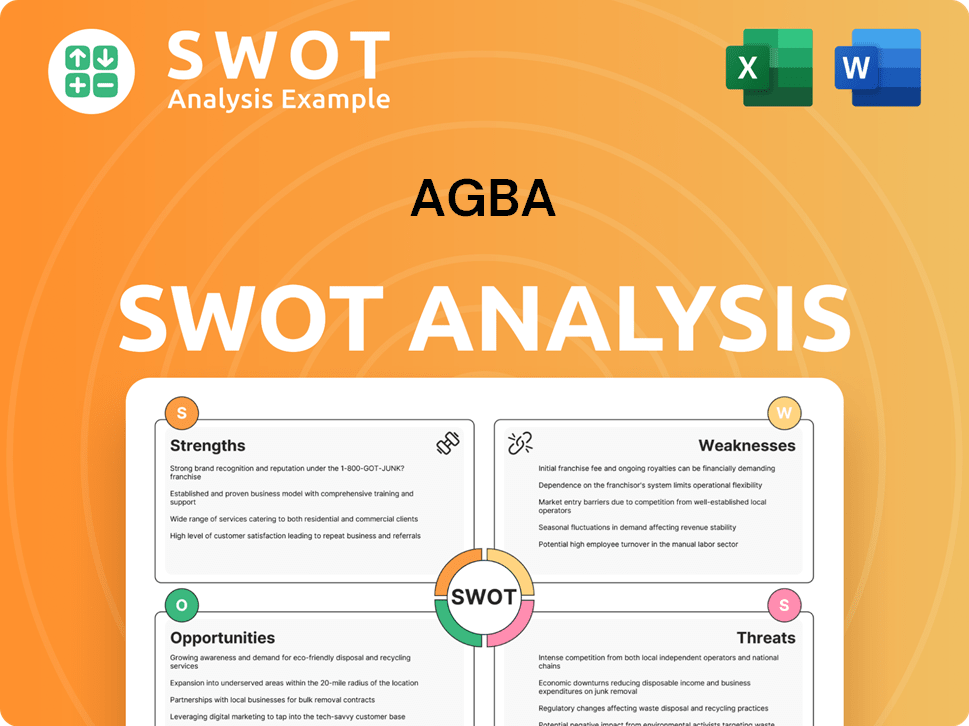

AGBA SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging AGBA?

The AGBA Group Holding faces a complex and dynamic competitive landscape. Its business segments compete with a diverse range of players, from established financial institutions to innovative fintech startups. Understanding these competitors is crucial for AGBA's strategic planning and maintaining a competitive edge in the financial services industry.

The competitive dynamics are shaped by factors like market share, technological innovation, regulatory changes, and mergers and acquisitions. AGBA's ability to adapt to these changes and differentiate its offerings will be critical for its long-term success. A thorough AGBA market analysis is essential to understanding the competitive pressures and opportunities.

In wealth management, AGBA directly competes with major banks and independent financial advisory firms. These competitors often have extensive branch networks and established client relationships, posing a challenge for AGBA in attracting and retaining customers. The AGBA industry is also seeing increased competition from fintech companies.

Large banks like HSBC and Standard Chartered offer comprehensive wealth management services, including investment advice, insurance, and retirement planning. These institutions have a significant market presence, particularly in Hong Kong, where they hold substantial market share in retail banking and wealth management. For example, HSBC's assets under management (AUM) in Asia were over $300 billion as of late 2024.

Independent financial advisors, such as St. James's Place and other regional wealth management firms, provide personalized financial planning and investment advice. They often focus on building long-term client relationships and offer a wider range of investment products. These firms compete by offering specialized services and tailored solutions to high-net-worth individuals.

Companies like Ant Group (Alipay) and Tencent (WeChat Pay) dominate the digital payments landscape in Asia, leveraging their vast user bases and integrated ecosystems. They offer payment solutions, lending services, and investment products, increasingly encroaching on traditional financial services. These firms have massive user bases, with Alipay and WeChat Pay each processing trillions of dollars in transactions annually.

Emerging fintechs specializing in AI-driven investment advice and personalized financial planning pose a threat through their innovative technological solutions and lower cost structures. These companies leverage technology to offer automated investment services and financial planning tools. The robo-advisor market has seen significant growth, with assets under management in the billions.

Insurance companies are expanding into wealth management and offering financial solutions related to medical services. This expansion increases competition for AGBA in the financial planning and investment space. These companies leverage their existing customer base and distribution networks to offer a range of financial products.

Healthcare providers are offering financial solutions related to medical services. This creates indirect competition for AGBA, especially in areas where financial planning is integrated with healthcare needs. These providers aim to offer comprehensive services, including financial planning for healthcare expenses.

The AGBA competitive landscape is also influenced by mergers and acquisitions, which can create larger, more formidable competitors. New entrants, particularly those leveraging blockchain and AI, are continuously disrupting traditional models, pushing AGBA to constantly innovate its offerings and maintain its competitive edge. Regulatory changes also play a significant role, impacting the strategies of all players in the AGBA financial services sector. For instance, stricter regulations around data privacy and cybersecurity require significant investments from all financial institutions.

Several factors determine the competitive positioning of AGBA and its rivals. These include market share, technological innovation, customer service, and pricing strategies. Understanding these factors is crucial for AGBA to maintain its competitive advantage.

- Market Share: The percentage of the total market that a company controls. HSBC and other major banks have a significant market share in wealth management.

- Technological Innovation: The use of technology to improve services and reduce costs. Fintech startups often have an advantage in this area.

- Customer Service: The quality of service provided to clients. This is a key differentiator for wealth management firms.

- Pricing Strategies: The methods used to determine the cost of services. Fintech companies often offer lower fees.

- Regulatory Compliance: Adhering to all relevant laws and regulations. This is essential for all financial institutions.

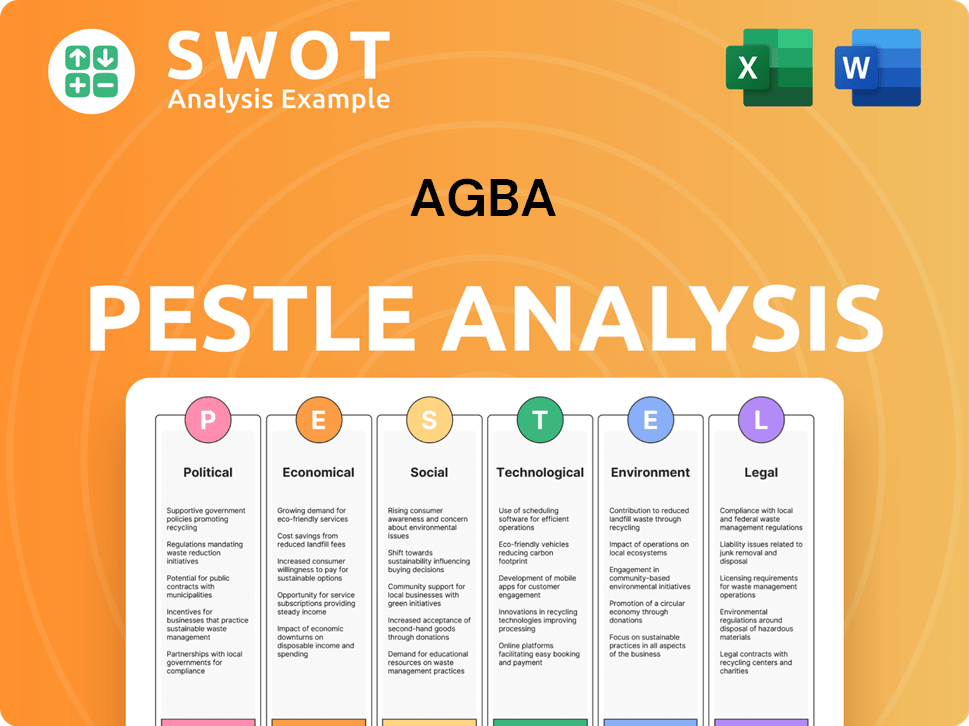

AGBA PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives AGBA a Competitive Edge Over Its Rivals?

Understanding the AGBA competitive landscape requires a deep dive into its strengths and how it differentiates itself in the financial services sector. The company's strategy revolves around integrated services and technological innovation, setting it apart from traditional financial institutions. This approach is crucial for maintaining a competitive edge in a rapidly evolving market. For a comprehensive overview of AGBA's target audience, consider exploring the Target Market of AGBA.

AGBA Group Holding Limited leverages several competitive advantages to thrive. These advantages include a unique ecosystem, proprietary technology, and deep regional expertise. These elements are essential for understanding AGBA's strategic position and its ability to compete effectively. The company's ability to integrate wealth management, healthcare, and fintech services provides a holistic approach to client needs, fostering loyalty and creating cross-selling opportunities.

The company's focus on technology and regional expertise is a significant differentiator. AGBA's investments in fintech platforms and its understanding of the Asian market, particularly Hong Kong and mainland China, enable it to offer tailored services and navigate complex regulatory environments. These strategic moves are crucial for its sustained growth and market leadership.

AGBA combines wealth management, healthcare, and fintech, offering comprehensive solutions. This integration attracts clients seeking holistic financial and wellness services. This approach creates a sticky client base and fosters cross-selling opportunities.

AGBA's fintech platforms include advanced algorithms, efficient payment gateways, and data analytics. These technologies enhance operational efficiency, improve customer experience, and enable personalized service delivery. The company's investment in technology is a key competitive advantage.

AGBA has a deep understanding of the Asian market, especially Hong Kong and mainland China. This expertise allows the company to tailor its products and services effectively. This regional focus helps AGBA navigate complex regulatory environments.

AGBA has built a strong brand and customer loyalty over decades of service. This contributes to a stable revenue base. This long-standing presence in the market provides a competitive advantage.

AGBA's competitive advantages are rooted in its diversified service model, integrated technology, and regional expertise. These factors enable AGBA to offer unique value propositions and maintain a strong market position. The company's focus on innovation and strategic partnerships is vital for sustaining its competitive edge.

- Diversified Service Model: Combines wealth management, healthcare, and fintech.

- Proprietary Technology: Advanced fintech platforms for efficiency and personalization.

- Regional Expertise: Deep understanding of the Asian market, especially Hong Kong and China.

- Brand Equity: Established brand and customer loyalty built over time.

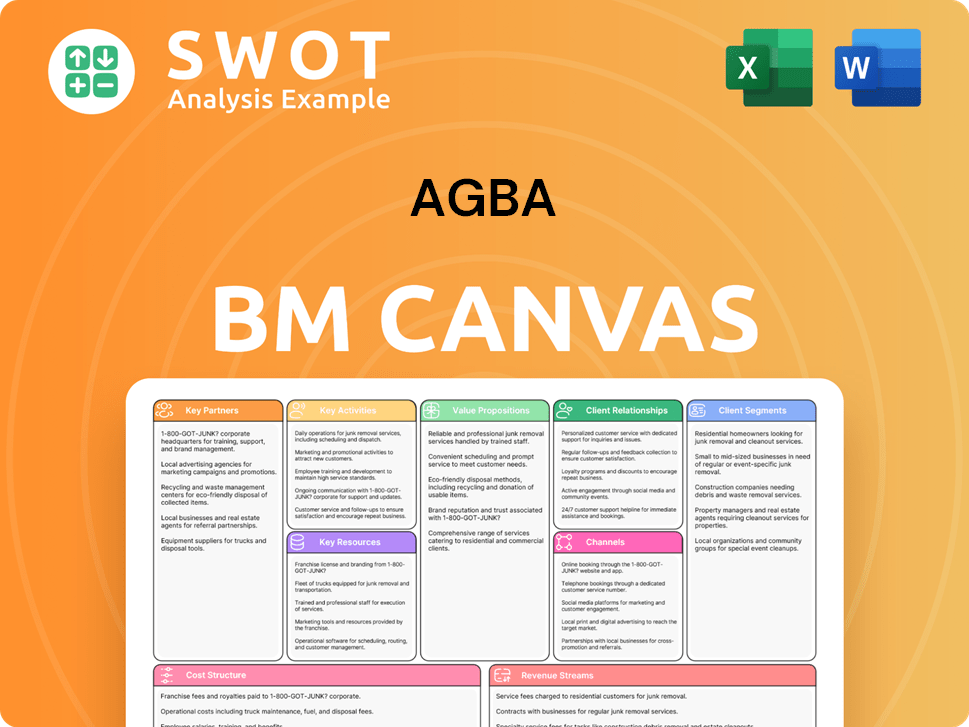

AGBA Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping AGBA’s Competitive Landscape?

The financial services sector is undergoing a significant transformation, driven by technological advancements and evolving consumer preferences. This creates both challenges and opportunities for companies like AGBA Group Holding Limited. The AGBA competitive landscape is shaped by these industry shifts, requiring continuous adaptation and strategic foresight.

Key trends include the rise of fintech, regulatory changes, and the shift towards digital-first experiences. AGBA's market analysis must consider these factors to maintain a competitive edge. Understanding the AGBA industry dynamics is crucial for anticipating future challenges and capitalizing on emerging opportunities. For a deeper dive into AGBA's operations, consider exploring the Revenue Streams & Business Model of AGBA.

Technological advancements, such as AI and blockchain, are reshaping financial services. Digital platforms and personalized financial planning are becoming increasingly prevalent. Regulatory changes and data privacy concerns also influence the market.

Intensified competition from global tech giants poses a threat to AGBA's competitive landscape. Cyberattacks and economic downturns could impact investment appetite and assets under management. Adapting to evolving regulatory environments is also a key challenge.

Emerging markets, particularly in Southeast Asia, offer significant growth potential. Product innovations, such as ESG investments, can drive expansion. Strategic partnerships can strengthen market position and expand service offerings.

AGBA Group Holding focuses on its integrated ecosystem and digital transformation. It aims for targeted expansion into high-growth segments. This approach is designed to ensure resilience amidst industry shifts.

AGBA's competitors include both traditional financial institutions and fintech disruptors. AGBA Group Holding must continually innovate to maintain a competitive edge. Understanding AGBA's financial services market position is crucial for strategic planning.

- Assess the impact of global economic trends on investment appetite.

- Explore strategic partnerships to enhance service offerings and market reach.

- Invest in cybersecurity measures to protect against potential threats.

- Focus on digital transformation to meet evolving consumer preferences.

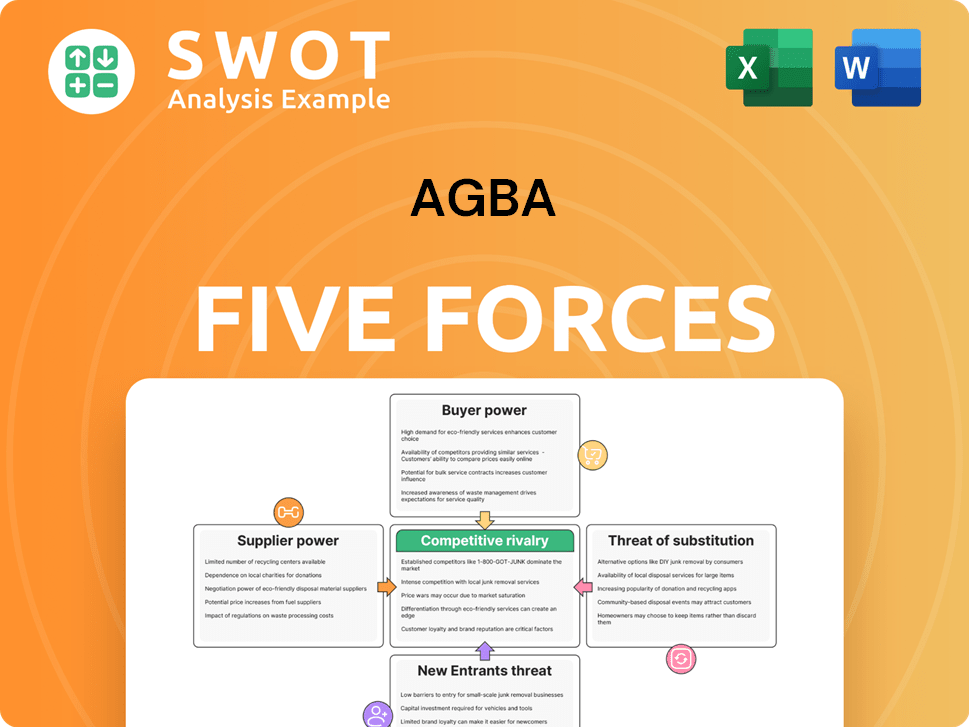

AGBA Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of AGBA Company?

- What is Growth Strategy and Future Prospects of AGBA Company?

- How Does AGBA Company Work?

- What is Sales and Marketing Strategy of AGBA Company?

- What is Brief History of AGBA Company?

- Who Owns AGBA Company?

- What is Customer Demographics and Target Market of AGBA Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.