AGBA Bundle

Decoding AGBA: How Does This Financial Powerhouse Operate?

AGBA Group Holding Limited (NASDAQ: AGBA) is reshaping the financial services landscape, particularly in the Asia-Pacific region. This company merges wealth management, healthcare, and fintech solutions, creating a holistic approach for clients. Discover how AGBA's innovative model and strategic expansion are making waves in the industry.

To truly understand the potential of AGBA SWOT Analysis, it's essential to dissect its operational framework. This article will explore the

What Are the Key Operations Driving AGBA’s Success?

The core operations of the AGBA Group revolve around wealth management, healthcare, and fintech, forming the foundation of its AGBA business model. This multi-faceted approach allows AGBA company to offer a wide array of services designed to meet the diverse needs of its clients. The integration of these sectors aims to provide comprehensive financial and lifestyle solutions, setting it apart from competitors.

In wealth management, AGBA financial services include financial advisory, asset management, investment planning, portfolio management, and insurance solutions. The healthcare segment integrates financial services with health-related offerings. Fintech operations enhance service accessibility and efficiency through digital platforms and online tools. This strategic integration of services is a key component of the AGBA Group's value proposition.

The operational processes of AGBA are supported by a combination of human expertise and technological infrastructure. Its supply chain involves partnerships with various financial product providers, insurance companies, and technology vendors. Distribution networks include direct sales channels and collaborations with independent financial advisors. For more insights into the company's structure, you can explore Owners & Shareholders of AGBA.

AGBA provides financial advisory, investment planning, and portfolio management services. These services are tailored to meet the financial goals of a diverse clientele, including high-net-worth individuals and SMEs.

The company integrates financial services with health-related offerings. This may include health insurance products or platforms that connect clients with healthcare providers, addressing holistic client needs.

AGBA leverages technology to enhance accessibility and efficiency across its services. This includes digital platforms for wealth management and online advisory tools, enhancing the customer experience.

AGBA utilizes both direct sales and collaborations with independent financial advisors. Partnerships with financial product providers and technology vendors support its operational capabilities.

AGBA differentiates itself through the integration of wealth management, healthcare, and fintech. This integrated approach provides a seamless experience for customers, offering a wide range of services through a single platform.

- Comprehensive service offerings that meet diverse financial needs.

- Use of technology to improve service accessibility and efficiency.

- Strategic partnerships to enhance service delivery and customer reach.

- Focus on providing holistic financial and lifestyle solutions.

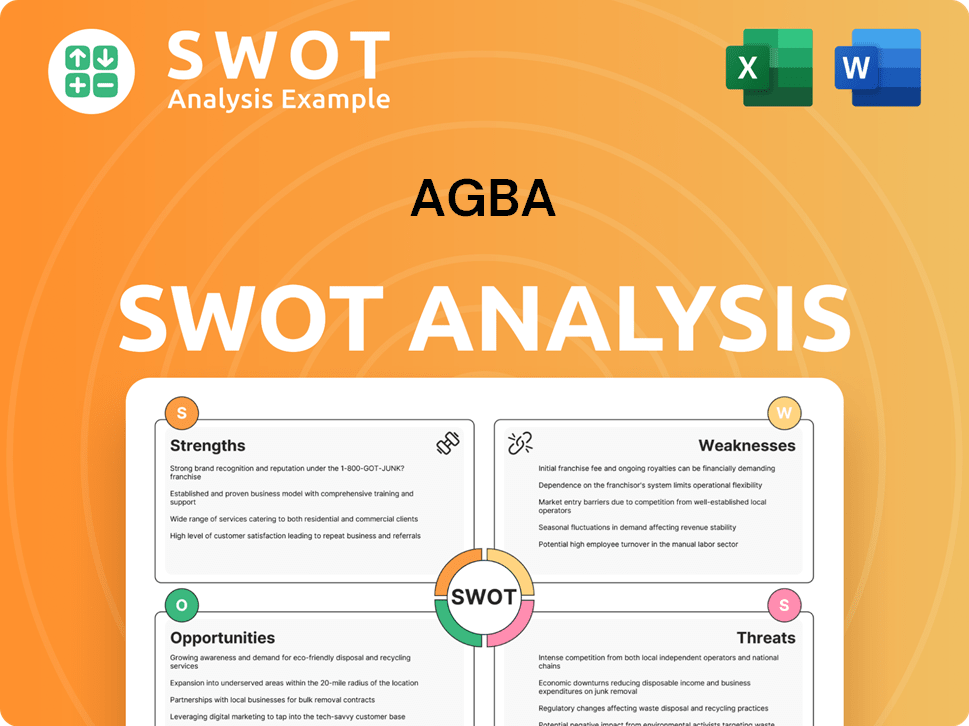

AGBA SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does AGBA Make Money?

The AGBA Group generates revenue through a multifaceted approach across its wealth management, healthcare, and fintech sectors. This diversified strategy allows the company to tap into various income streams, enhancing its financial stability and market presence. The AGBA business model focuses on providing a range of services designed to meet diverse financial and healthcare needs.

Within wealth management, AGBA financial services likely derive revenue from management fees, commissions on product sales, and performance-based fees related to asset management. The healthcare segment potentially generates income through health insurance product sales, service fees from healthcare platforms, and partnerships with medical providers. The fintech segment contributes through transaction fees, technology licensing, and subscription models.

The company's monetization strategies include bundling services, offering financial and healthcare solutions as packages to increase customer lifetime value. This integrated approach aims to capture a larger share of client spending, fostering cross-selling opportunities across its segments. Understanding how AGBA makes money is key to evaluating its overall financial health and investment potential.

The AGBA Group's revenue model is built on several key pillars. These include wealth management, healthcare, and fintech, each contributing distinct revenue streams. The company's approach emphasizes cross-selling and integrated services to maximize customer value. For more information, you can check out this article about the AGBA company for a deeper dive into its operations.

- Wealth Management: Fees from financial advisory services, asset management, and product sales.

- Healthcare: Revenue from health insurance products, healthcare platform services, and partnerships.

- Fintech: Income from transaction fees, technology licensing, and subscription services.

- Bundled Services: Packages combining financial and healthcare solutions to boost customer value and cross-selling.

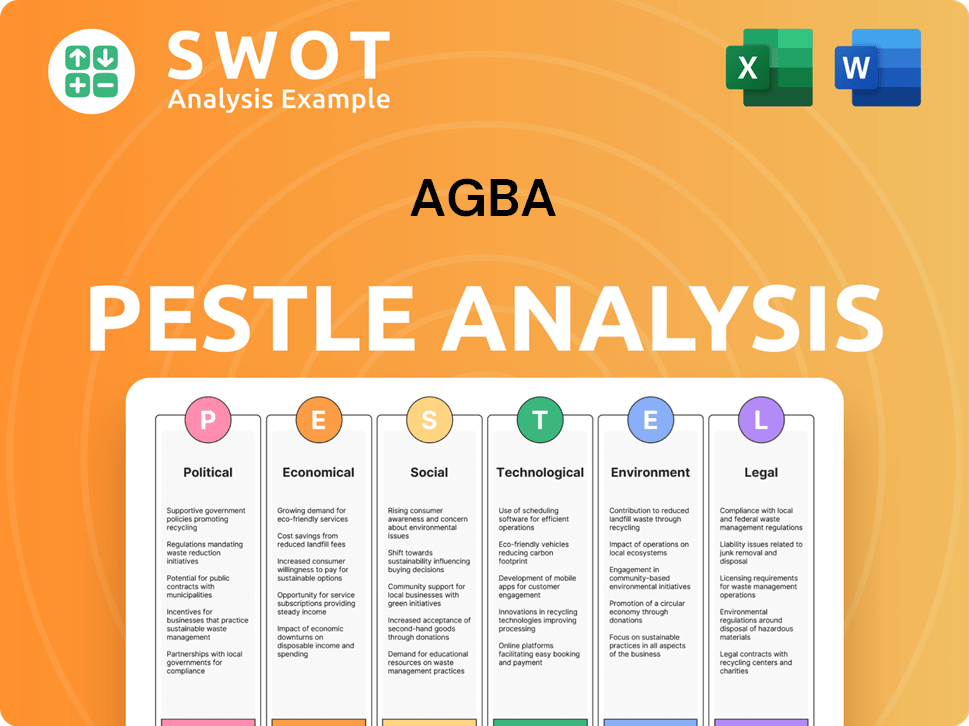

AGBA PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped AGBA’s Business Model?

Understanding the trajectory of the AGBA company involves examining its key milestones, strategic moves, and competitive advantages. While specific recent data is needed to provide a comprehensive view, we can analyze the typical patterns of companies in the financial services sector to infer likely developments. These companies often mark significant progress through product launches, market entries, and strategic partnerships.

For a diversified financial services entity like AGBA Group, a pivotal milestone could be the successful integration of a new fintech platform that enhances customer experience or operational efficiency. Another could be a major acquisition that expands its client base or service capabilities. These moves are crucial for growth and maintaining relevance in a dynamic market. The Competitors Landscape of AGBA provides additional context on the competitive pressures influencing these strategic decisions.

Challenges such companies face include navigating complex regulatory environments, adapting to rapid technological advancements, and responding to evolving market demands. The AGBA business model, often centered on an integrated approach, offering wealth management, healthcare, and fintech services, allows for holistic solutions. This integrated approach can foster customer loyalty and create a more stable client base compared to specialized competitors.

Key milestones for AGBA financial services could include the launch of new wealth management products or the expansion into new geographic markets. Strategic partnerships with fintech companies to enhance service offerings or improve operational efficiency are also pivotal. Furthermore, securing significant regulatory approvals in key markets can be a crucial step.

Strategic moves might involve acquisitions to broaden its service portfolio, such as acquiring an AGBA insurance provider to integrate insurance products into their wealth management offerings. Investing in technology to improve the customer experience and operational efficiency is common. Entering new markets, particularly in high-growth regions, would also be a key strategic focus.

AGBA Group Holdings likely gains a competitive edge from its integrated service offerings, providing wealth management, healthcare, and fintech solutions under one umbrella. Strong brand recognition within its target markets and economies of scale through diversified operations also contribute. Continuous adaptation to new trends and technology shifts in the financial and healthcare sectors is crucial for sustaining its business model.

Key market trends impacting AGBA stock include the growing demand for integrated financial services, the increasing adoption of fintech solutions, and the rising importance of personalized financial advice. The company must also navigate regulatory changes and address cybersecurity risks. The ability to adapt to these trends will determine its long-term success.

Sustaining a competitive advantage requires AGBA Group Holdings to continuously innovate and adapt. This includes investing in technology, expanding service offerings, and enhancing customer experience. Building strong relationships with clients and partners is also essential. Furthermore, maintaining a robust risk management framework is crucial for long-term stability.

- Focus on technological advancements to improve service delivery.

- Expand service offerings to meet evolving customer needs.

- Strengthen relationships with clients and partners.

- Maintain a strong risk management framework.

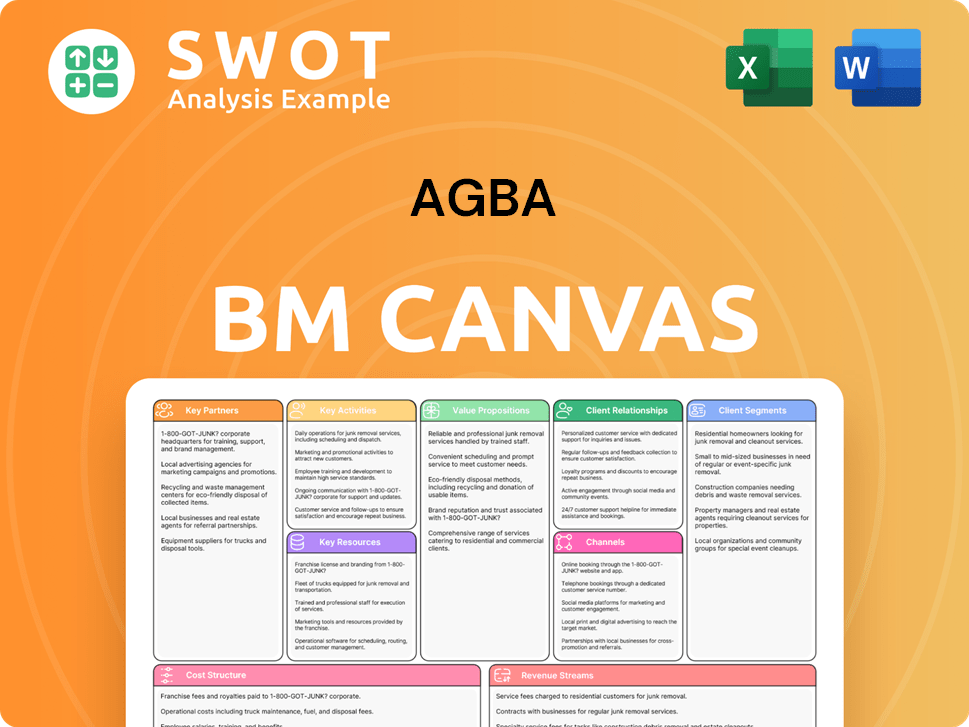

AGBA Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is AGBA Positioning Itself for Continued Success?

The AGBA company operates within a competitive financial services landscape. It competes with traditional financial institutions, independent wealth management firms, and fintech companies. Its diversified approach, including wealth management, healthcare, and fintech, aims to serve a broad client base, particularly within the Asia-Pacific region. Understanding the AGBA business model is key to assessing its industry position.

Several risks could impact the AGBA Group's operations. These include evolving regulations in the financial and healthcare sectors, the emergence of new competitors, and broader economic downturns. The company must continuously innovate and adapt to maintain its competitive edge and manage regulatory complexities.

AGBA Group's industry position is shaped by its diverse service offerings. These include wealth management, healthcare, and fintech solutions. This diversification allows it to target a broad range of clients. The company's strategic focus is on integrated solutions to enhance customer loyalty and expand its global reach.

Key risks for AGBA financial services include evolving regulations, new competitors, and economic downturns. Changes in regulatory frameworks can lead to increased compliance costs. The emergence of disruptive technologies could challenge the company's market position. Economic fluctuations can impact demand for its services.

The future outlook for AGBA Group involves further integration of its service offerings. It will likely leverage technology to improve efficiency and customer experience. Expansion into new markets or niche segments is also possible. The company's success will depend on its ability to adapt to market changes.

AGBA Group Holdings financial performance is crucial for its future. Sustaining and expanding revenue will depend on market adaptability. The company's ability to manage regulatory complexities is also a key factor. Capitalizing on technological advancements and changing consumer demands is essential. To understand more about the company, you can read a Brief History of AGBA.

AGBA Group Holdings business strategy likely focuses on several key areas. These include integrating service offerings, leveraging technology, and exploring new markets. The company aims to strengthen its wealth management advisory services. Leadership will likely emphasize innovation in fintech solutions.

- Continued innovation in fintech solutions.

- Strengthening wealth management advisory services.

- Exploring synergies within its healthcare segment.

- Adapting to market dynamics and regulatory changes.

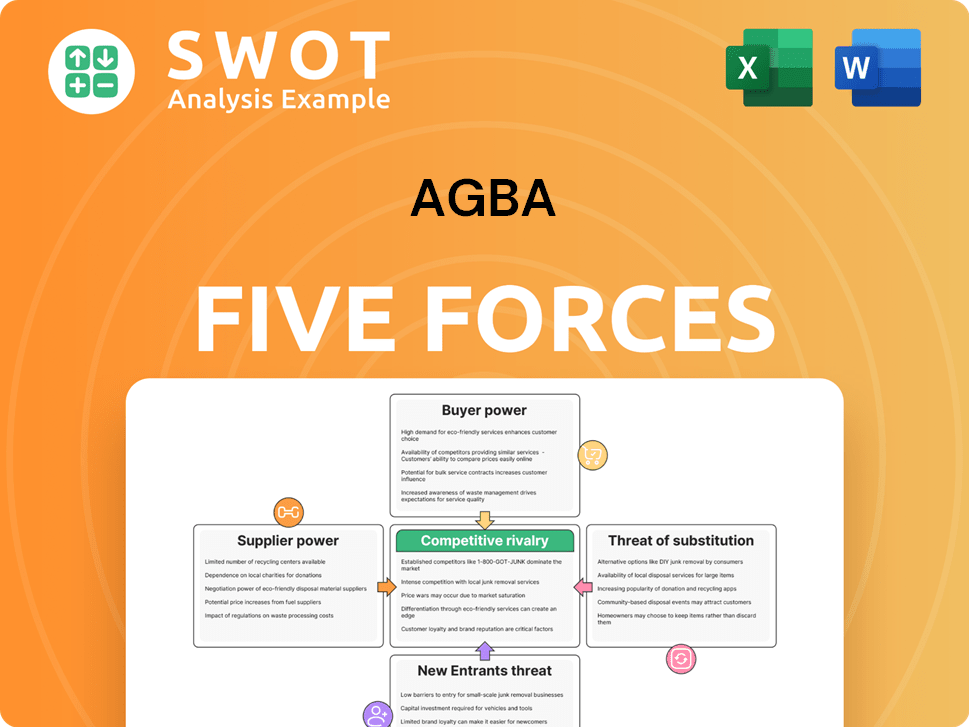

AGBA Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of AGBA Company?

- What is Competitive Landscape of AGBA Company?

- What is Growth Strategy and Future Prospects of AGBA Company?

- What is Sales and Marketing Strategy of AGBA Company?

- What is Brief History of AGBA Company?

- Who Owns AGBA Company?

- What is Customer Demographics and Target Market of AGBA Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.