Agilysys Bundle

How Did Agilysys Transform the Hospitality Tech Landscape?

Ever wondered how a company transitions from distributing electronics to dominating the hospitality software scene? The Agilysys SWOT Analysis reveals a fascinating story of strategic pivots and market adaptation. From its roots as Pioneer-Standard Electronics in 1963 to its current status, Agilysys's journey is a masterclass in corporate evolution. Discover the key milestones that shaped the Agilysys company we know today.

This brief history of Agilysys unveils a tale of resilience and foresight. The Agilysys timeline showcases how the company navigated market changes, making strategic acquisitions and refining its products to meet the evolving needs of the hospitality industry. Understanding Agilysys's early years and growth trajectory provides valuable insights into its current market position and future potential, offering a compelling case study for any investor or business strategist.

What is the Agilysys Founding Story?

The Agilysys history is a story of evolution and strategic adaptation. It began not as a new venture, but as a transformation of existing businesses. This journey highlights how a company can redefine itself to meet changing market demands.

The

Agilysys company

traces its roots back to the early to mid-20th century. This evolution culminated in the formation of Agilysys, Inc. in 2003, marking a significant shift in its business focus and identity. This strategic move was a pivotal moment in the company's history.The company's early history is marked by two key entities: Standard Radio, founded in 1932, and Pioneer, established in 1946. These companies merged in 1963 in Ohio, forming Pioneer-Standard Electronics, Inc. Initially, the focus was on distributing electronic components. Over time, the company expanded to include enterprise computer systems products and solutions.

Agilysys's founding wasn't a typical startup story. It was a strategic pivot by Pioneer-Standard Electronics, Inc.

- The company sold its Industrial Electronics Division in 2003.

- The company then restructured to concentrate on its enterprise computer solutions business.

- In September 2003, the company was renamed Agilysys, Inc., following shareholder approval.

- Arthur Rhein served as Chairman and CEO during this transition.

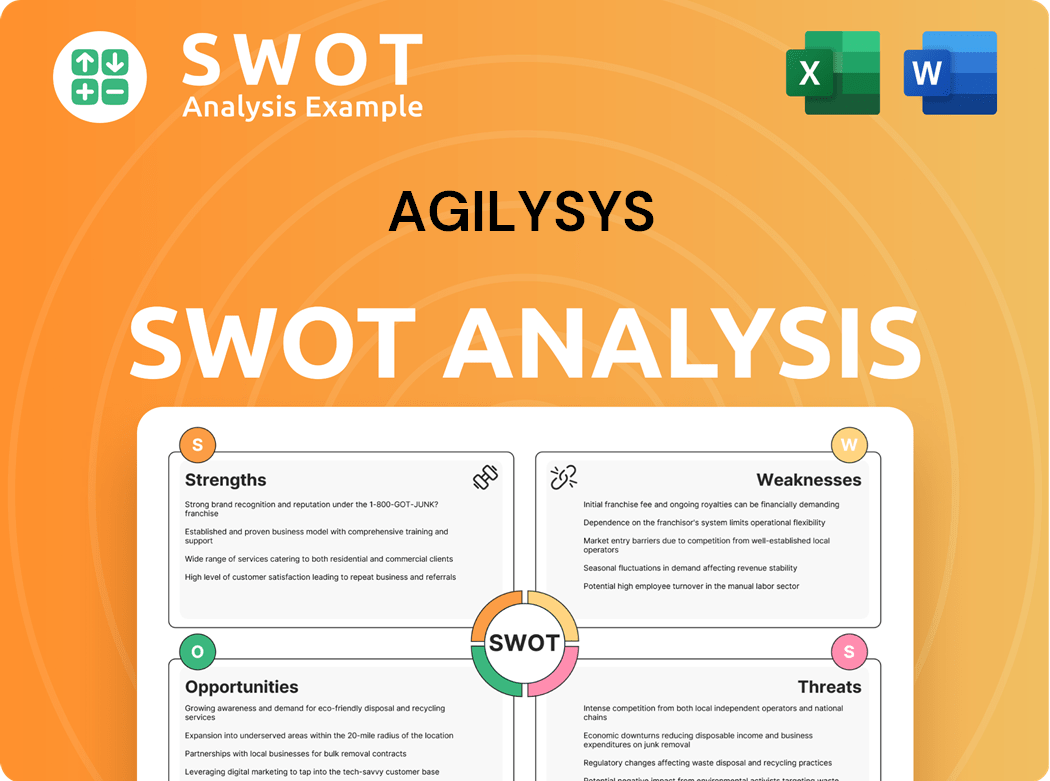

Agilysys SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Agilysys?

The early growth and expansion of the company, following its 2003 rebranding, marked a significant shift towards the enterprise computer solutions market, with a strong emphasis on the retail and hospitality sectors. This period was characterized by strategic acquisitions and divestitures aimed at solidifying its position in these specialized markets. These moves helped shape the company into a key technology provider for the hospitality industry.

In September 2003, the company acquired Kyrus Corporation for $29.6 million. This strategic acquisition was a pivotal move, establishing the company as a leading provider of IBM retail solutions and services. The acquisition significantly broadened the company's customer base and expanded its product and service offerings, contributing to its early growth trajectory.

February 2004 saw the acquisition of most of the assets of Inter-American Data, Inc. (IAD) for $38.0 million. This acquisition was crucial in positioning the company as a leading developer and provider of technology solutions for property and inventory management, particularly within the casino and destination resort segments. This move significantly enhanced the company's market position.

By fiscal year 2007, the company had exited the enterprise computer distribution business to concentrate on software and services for specialized markets. This shift was a strategic decision to focus on high-growth areas such as hospitality and retail. This strategic pivot helped the company to become more focused on its core competencies.

Further strategic moves included the divestiture of the Technology Solutions Group in 2011 and the Retail Solutions Group in 2013. These actions sharpened the company's exclusive focus on the hospitality market. The company's early acquisitions and divestitures shaped its identity as a hospitality technology provider, as seen in the Competitors Landscape of Agilysys.

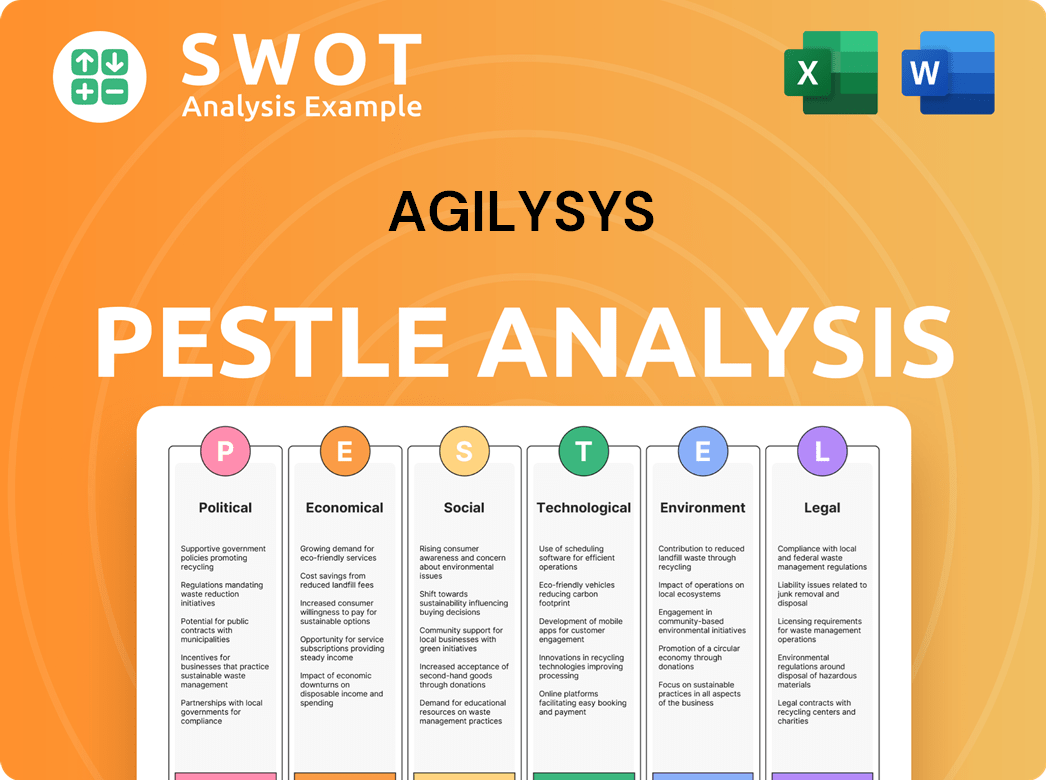

Agilysys PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Agilysys history?

The Agilysys company has achieved significant milestones, especially after focusing on the hospitality sector. This focus has driven the company's evolution and market position. A brief history of Agilysys reveals a commitment to innovation and strategic adaptation within the technology landscape.

| Year | Milestone |

|---|---|

| Ongoing | Focus on cloud-native SaaS and on-premise solutions for the hospitality industry. |

| Recent Years | Transition to a subscription revenue model, significantly impacting financial performance. |

| Fiscal Year 2025 | Subscription revenue increased by 39.5% year-over-year. |

| Fiscal Year 2025 | Revenue reached $275.6 million, a 16.1% increase from fiscal 2024. |

Agilysys has consistently innovated in hospitality technology. They've developed comprehensive software solutions for property management, point-of-sale, and inventory management. These Agilysys products aim to streamline operations and enhance guest experiences.

Agilysys provides integrated software solutions, including property management systems (PMS), point-of-sale (POS) systems, and inventory and procurement tools. These solutions are designed to work together, offering a streamlined approach to managing various aspects of hospitality operations.

The company has been developing cloud-native SaaS solutions. This shift allows for greater flexibility, scalability, and accessibility for clients in the hospitality industry.

Agilysys has been driving hospitality software innovations for over 40 years. Their solutions like Agilysys Stay (cloud-native PMS) and Agilysys InfoGenesis (POS) are examples of their product development efforts aimed at streamlining operations and enhancing the guest experience.

The company's innovations prioritize enhancing the guest experience. By improving operational efficiency through technology, Agilysys helps its clients deliver better service and satisfaction.

Agilysys has formed strategic partnerships and client wins. These collaborations help expand its market reach and provide tailored solutions to meet the specific needs of various hospitality businesses.

Agilysys has focused on transitioning to a subscription revenue model. This strategic shift has significantly impacted the company's financial performance, with subscription revenue representing a substantial portion of total net revenue.

Despite its successes, Agilysys has faced challenges, including market shifts and competitive pressures. The company has navigated strategic transformations through Agilysys acquisitions and divestitures. For more information on the company, you can read about Owners & Shareholders of Agilysys.

Agilysys has faced challenges related to shifts in the market landscape. These shifts require the company to adapt its strategies and offerings to remain competitive and meet evolving customer needs.

Like many technology companies, Agilysys faces competitive pressures. These pressures necessitate continuous product modernization and innovation to maintain a strong market position and attract new clients.

Challenges in one-time product revenue in certain verticals have been noted. The company must address these challenges through strategic initiatives focused on customer-first approaches, product innovation, and operational efficiency.

Net profit margin fluctuations indicate variability in profitability. The company must manage costs and optimize its business model to maintain a healthy financial outlook.

The need for continuous product modernization and cloud transition is also a challenge. This requires ongoing investment and adaptation to maintain a competitive edge.

Agilysys has addressed challenges through strategic initiatives focused on customer-first approaches, product innovation, and operational efficiency. These initiatives are designed to improve the company's market position and financial performance.

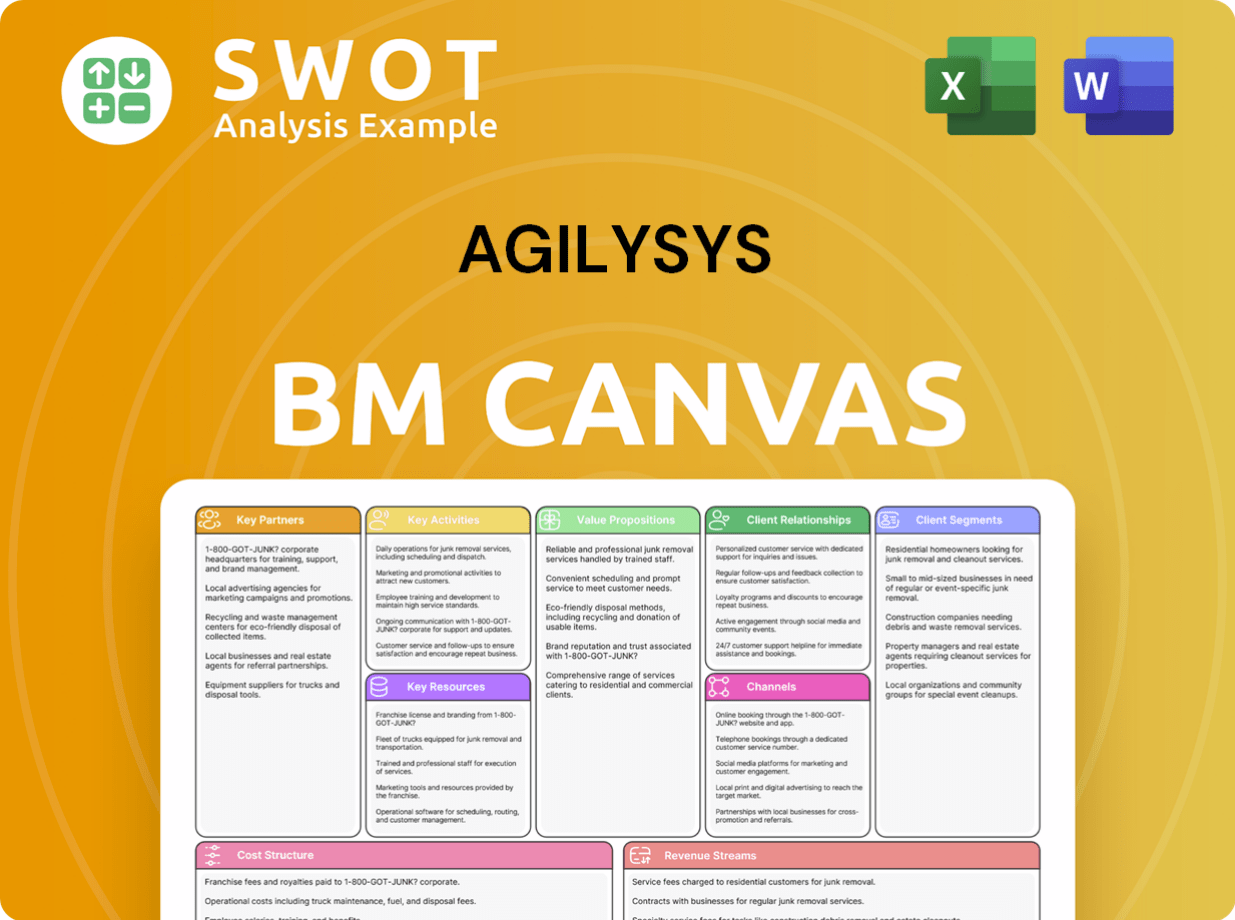

Agilysys Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Agilysys?

The Agilysys history is marked by strategic shifts and acquisitions. From its beginnings in electronics to its current focus on hospitality solutions, the company has consistently adapted to market demands, driving innovation and growth.

| Year | Key Event |

|---|---|

| 1963 | Formation of Pioneer-Standard Electronics, Inc. in Ohio. |

| 1970 | Pioneer-Standard goes public. |

| 2003 | The company changes its name to Agilysys, Inc. and divests its electronics distribution business. |

| 2003 | Acquires Kyrus Corporation, expanding into retail solutions. |

| 2004 | Acquires Inter-American Data, Inc. (IAD), strengthening hospitality offerings. |

| 2007 | Exits the enterprise computer distribution business. |

| 2011 | Divests Technology Solutions Group. |

| 2013 | Divests Retail Solutions Group, focusing exclusively on hospitality. |

| 2021 | Acquires ResortSuite for $25 million, enhancing SaaS solutions for resorts. |

| Fiscal Year 2024 | Reports record revenue of $237.4 million, with subscription revenue at approximately 60%. |

| 2024 | Acquires Book4Time for $150 million, expanding spa management software offerings. |

| Fiscal Year 2025 | Reports record revenue of $275.6 million, a 16.1% increase from fiscal 2024. Subscription revenue increased 39.5% year-over-year in fiscal 2025. |

| May 2025 | Reports fiscal 2025 fourth quarter record revenue of $74.3 million. |

Agilysys is committed to continuous product innovation. This includes enhancements to their existing

The company aims to expand both geographically and vertically within the hospitality sector. This includes targeting new markets and broadening their service offerings to cater to a wider range of hospitality businesses. They are focused on the growth trajectory of the company.

A key strategic focus is on increasing recurring subscription revenue. This shift towards a subscription-based model is expected to provide a more stable and predictable revenue stream. Subscription revenue increased 39.5% year-over-year in fiscal 2025.

Agilysys aims to grow annual revenue to between $308 million and $312 million in fiscal 2026. This reflects their confidence in their strategic initiatives and the growth potential within the hospitality technology market. The company is focused on its market position.

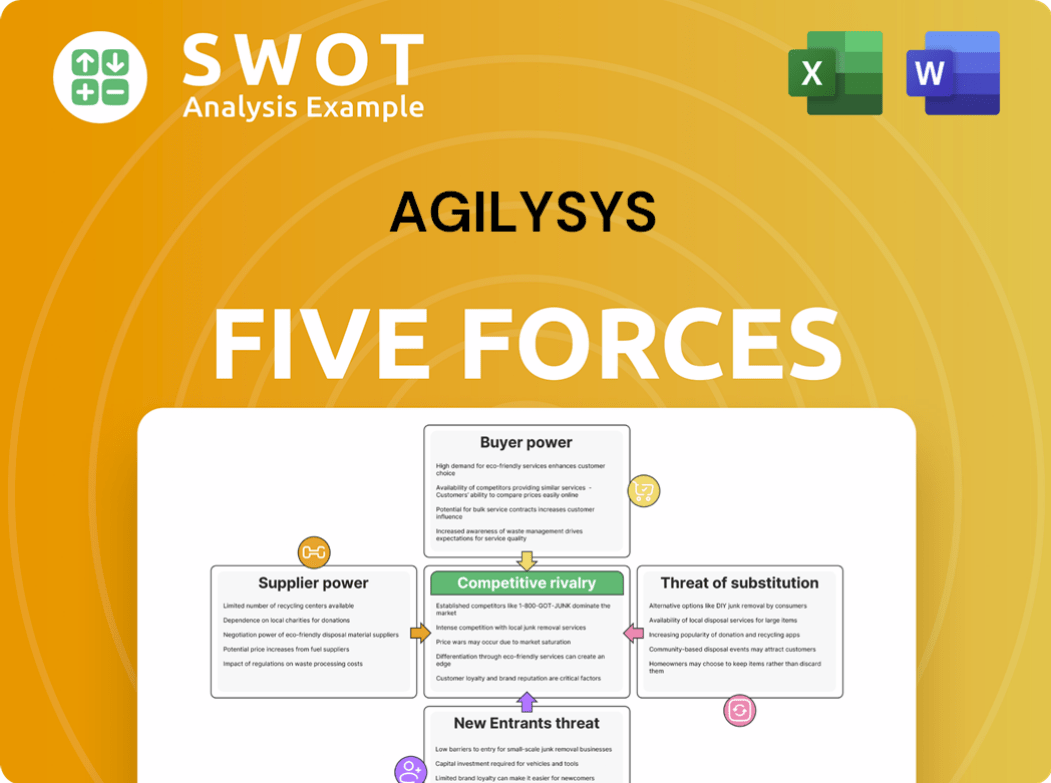

Agilysys Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Agilysys Company?

- What is Growth Strategy and Future Prospects of Agilysys Company?

- How Does Agilysys Company Work?

- What is Sales and Marketing Strategy of Agilysys Company?

- What is Brief History of Agilysys Company?

- Who Owns Agilysys Company?

- What is Customer Demographics and Target Market of Agilysys Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.