Agilysys Bundle

Who Really Owns Agilysys?

Understanding a company's ownership is crucial for investors and strategists alike. It dictates the direction of the business and influences its performance in the market. This deep dive into Agilysys SWOT Analysis will explore the intricate details of Agilysys ownership, providing valuable insights for informed decision-making.

From its origins as a spin-off, the Agilysys company has undergone significant changes, shaping its current structure. This analysis will uncover who owns Agilysys, detailing the major shareholders, and exploring how these shifts have impacted the company's strategic direction and financial success. By examining the Agilysys ownership structure, we can better understand the forces driving the company's future, including its stock performance and the influence of its investors.

Who Founded Agilysys?

The story of Agilysys ownership begins not with a startup, but as a spin-off. The company emerged from Pioneer-Standard Electronics, Inc. in 2003, marking a pivotal shift in its business focus.

This transition saw Agilysys move from broad electronics distribution to specialized enterprise computer solutions. This strategic pivot, guided by leaders like Arthur Rhein, shaped the company's early direction and future acquisitions.

The initial Agilysys company structure was a result of corporate restructuring. It did not involve traditional venture capital or angel investments. The company's foundation was built upon the assets and framework inherited from its predecessor.

Agilysys was created through a spin-off from Pioneer-Standard Electronics, Inc. in 2003.

Arthur Rhein served as Chairman and CEO during this period of transition.

The company's focus shifted towards enterprise computer solutions, particularly for retail and hospitality markets.

Acquisitions like Kyrus Corporation in 2003, helped solidify its position in retail solutions.

Unlike startups, Agilysys did not have a traditional founding team with allocated equity.

The company's formation was a corporate restructuring, not a new venture.

The early Agilysys ownership structure details are rooted in its corporate spin-off. The company's history reflects a strategic evolution. For more insights into the company's strategic moves, you can explore the Marketing Strategy of Agilysys.

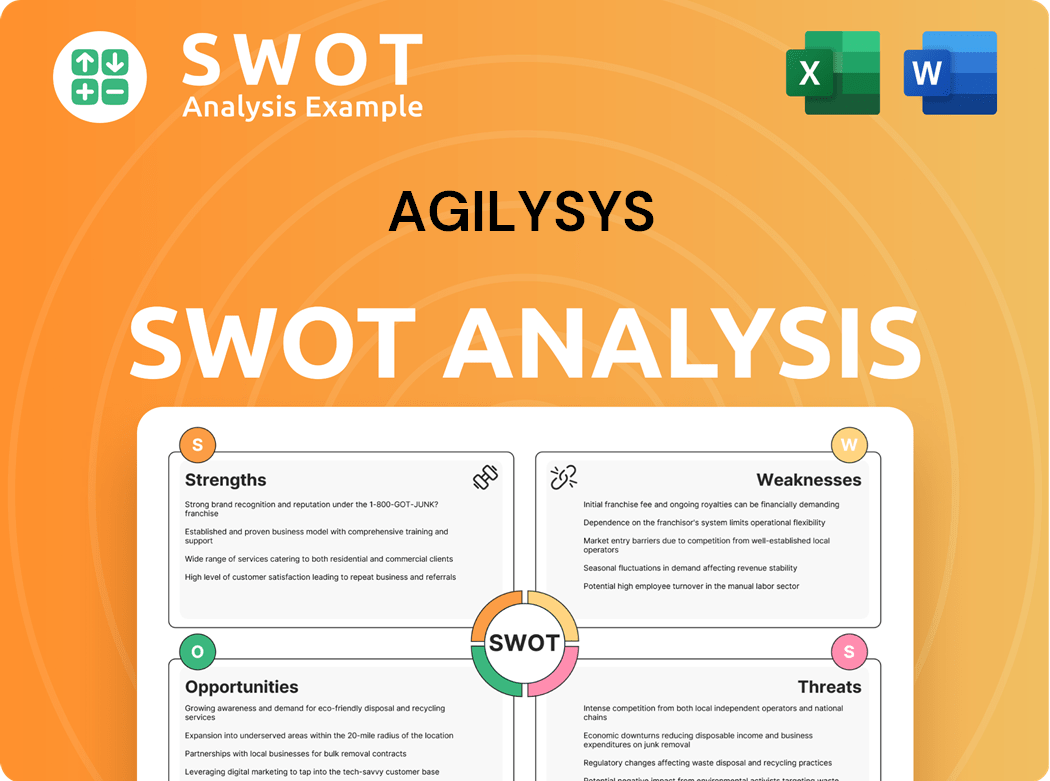

Agilysys SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Agilysys’s Ownership Changed Over Time?

The ownership of Agilysys, a publicly traded company, has evolved significantly since its spin-off in 2003. The company, trading under the ticker symbol AGYS on the Nasdaq Global Select Market, has a shareholder base that is primarily composed of institutional investors, company insiders, and retail investors. This structure has been shaped by key events, including the initial public offering (IPO) and subsequent funding rounds, influencing the distribution of shares and the influence of different investor groups. As of June 2025, the company's ownership structure reflects a dynamic interplay between institutional and insider holdings.

The primary shift in Agilysys's ownership structure occurred with its IPO, which established it as an independent public company. The most recent funding round was an undisclosed Post IPO round on January 10, 2024, which included investors such as Marlin Equity Partners, MAK Capital, and Paloma. These events have contributed to the current distribution of shares, where institutional investors hold a significant portion of the company's stock. The evolution of ownership continues to be influenced by market dynamics and strategic decisions.

| Ownership Category | Share Percentage (May 2025) | Share Percentage (June 2025) |

|---|---|---|

| Institutional Investors | Approximately 84.7% | Data Not Available |

| Insider Ownership | Approximately 17.82% | Approximately 4.83% |

| Retail and Other | Remaining Shares | Remaining Shares |

The significant presence of institutional investors, with 612 institutional owners holding 38,483,063 shares as of May 2025, highlights their crucial role in shaping the company's strategic direction and governance. Key institutional investors include BlackRock, Inc., and Vanguard Group Inc. The decrease in insider ownership, as seen in the shift from approximately 17.82% to approximately 4.83% by June 2025, reflects changes in leadership's holdings. Understanding the dynamics of Agilysys ownership is crucial for anyone interested in the company, as detailed in this analysis of the Competitors Landscape of Agilysys.

Agilysys is a publicly traded company with a diverse ownership structure.

- Institutional investors hold a significant majority of the shares.

- Insider ownership, while smaller, aligns leadership interests with shareholder value.

- Recent filings show changes in insider holdings.

- The company's ownership structure is influenced by market dynamics and strategic decisions.

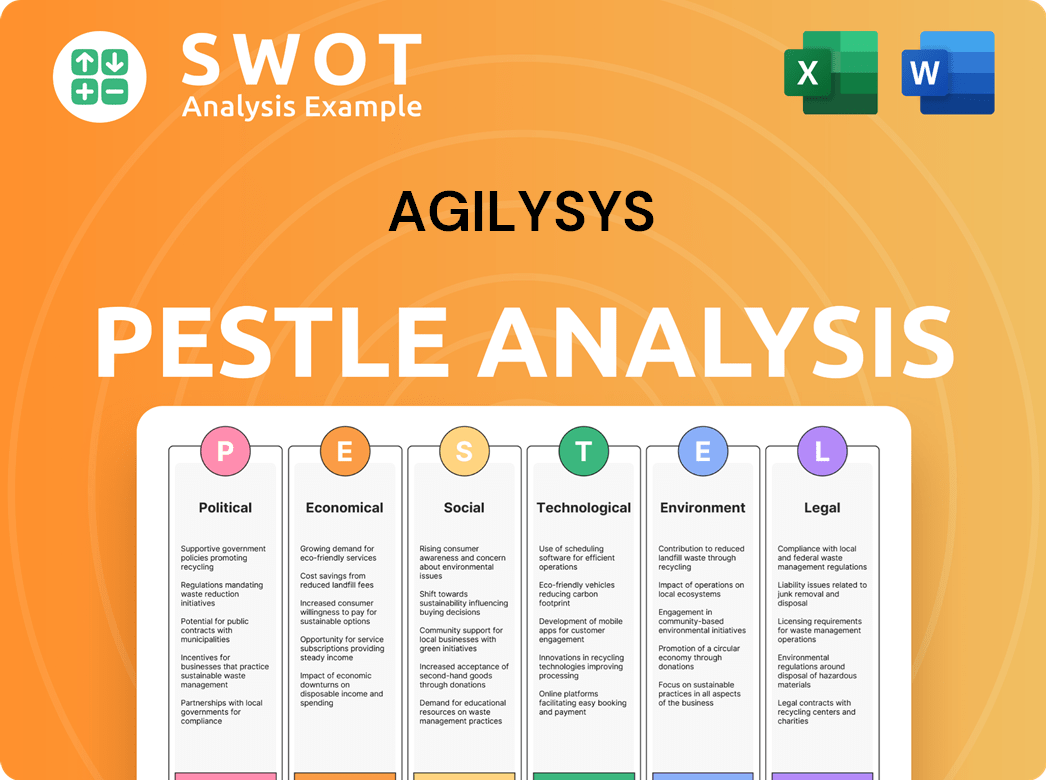

Agilysys PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Agilysys’s Board?

The current board of directors significantly influences the governance and strategic direction of the company. On December 5, 2024, the board expanded from seven to eight members with the addition of Lisa Pope. Stockholders nominate board members for election at the annual meeting, ensuring shareholder input in the leadership selection process. Understanding the composition and responsibilities of the board is crucial for investors interested in Agilysys.

Shareholders vote on key issues at the annual meeting, including the election of directors, approval of equity incentive plans, and advisory votes on executive compensation. All nominated directors were successfully elected to serve until the 2025 annual meeting. Michael Kaufman serves as the Chairman of the Board. Ramesh Srinivasan is the President, Chief Executive Officer, and also a Board Director, playing a dual role in the company's leadership.

| Director | Title | Additional Information |

|---|---|---|

| Michael Kaufman | Chairman of the Board | Oversees board meetings and strategic direction. |

| Ramesh Srinivasan | President, CEO, and Director | Leads the company's operations and strategic initiatives. |

| Lisa Pope | Director | Appointed to the board on December 5, 2024. |

| Other Directors | Directors | Details of other board members can be found in recent proxy statements. |

The voting structure for Agilysys is generally one-share-one-vote for common shares, ensuring that each share of common stock has equal voting power on all matters presented at shareholder meetings. Directors are expected to acquire and maintain minimum ownership in the company's stock, specifically three times their annual retainer within two years of their appointment or election, and six times their annual retainer within four years. This policy aims to align the interests of the board with those of the shareholders.

The board of directors plays a crucial role in Agilysys's strategic oversight and governance. The voting structure is straightforward, with one-share-one-vote for common shares. Board members are expected to hold significant stock ownership, aligning their interests with shareholders.

- The board expanded to eight members in December 2024, with Lisa Pope joining.

- Shareholders vote on key issues, including director elections and executive compensation.

- Directors are required to meet minimum stock ownership guidelines.

- Michael Kaufman is the Chairman, and Ramesh Srinivasan is the President, CEO, and a Director.

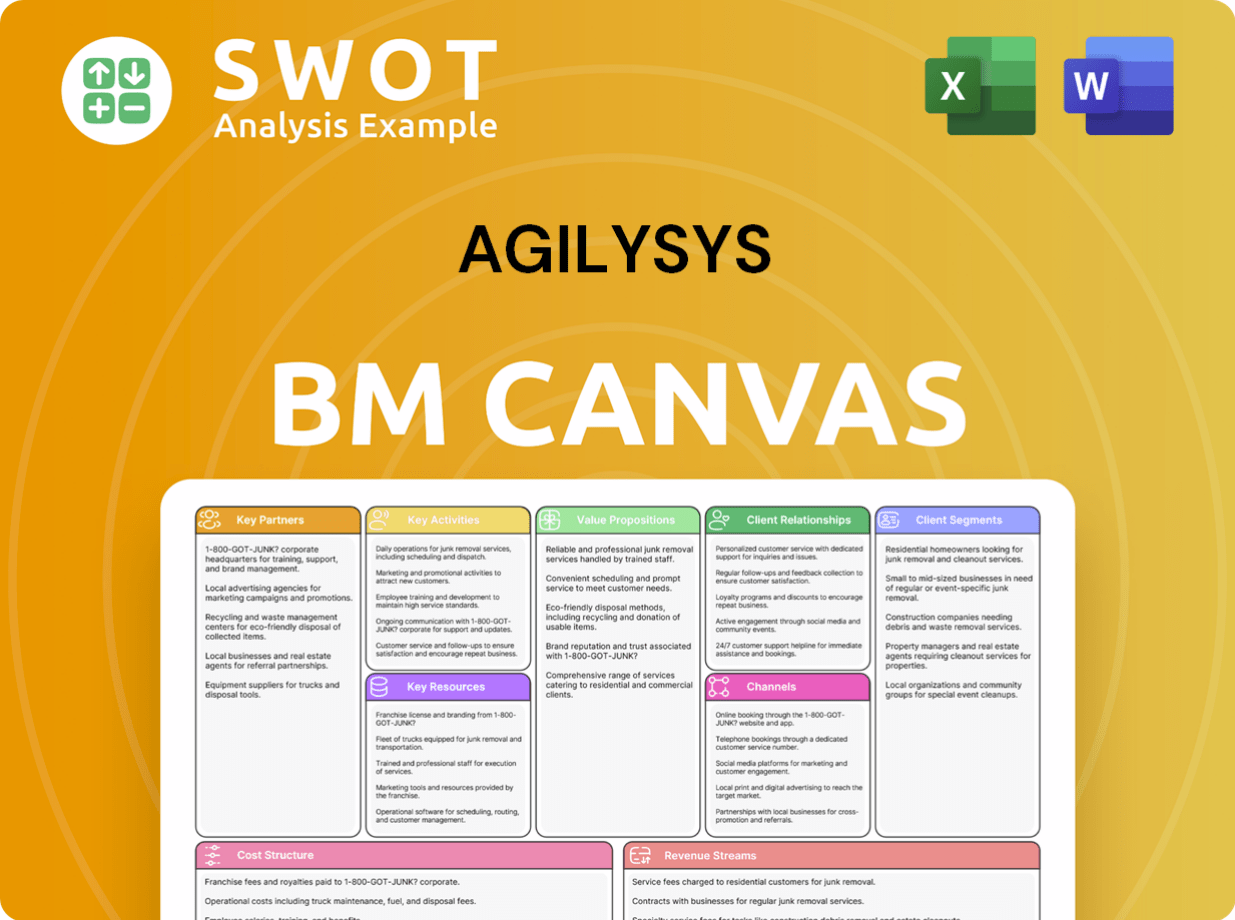

Agilysys Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Agilysys’s Ownership Landscape?

Over the past few years, the ownership landscape of the Agilysys company has seen considerable shifts. The company has reported record fiscal 2025 revenue of $275.6 million, a 16.1% increase from fiscal 2024, fueled by a 39.5% surge in subscription revenue. This indicates a strategic move towards a recurring revenue model. Institutional ownership remains a significant factor in Agilysys ownership, with 612 institutional owners holding over 38 million shares as of June 2025.

Key leadership changes have also taken place. Joe Youssef was appointed Senior Vice President, Sales, Americas and EMEA, and Chief Commercial Officer in August 2024. In February 2025, Dan Bell joined as Vice President, North America Sales East – Hotels, Resorts and Cruises. The board of directors was expanded from seven to eight members in December 2024, with the addition of Lisa Pope. These changes reflect the company's strategic growth initiatives and its focus on expanding its market presence and enhancing its software solutions.

| Metric | Details | Year |

|---|---|---|

| Revenue | $275.6 million | Fiscal 2025 |

| Subscription Revenue Growth | 39.5% | Fiscal 2025 |

| Institutional Owners | 612 | June 2025 |

| Shares Held by Institutions | Over 38 million | June 2025 |

| Insider Selling (CEO & Affiliates) | Over $199 million | 2024-2025 |

In terms of ownership trends, while Vanguard increased its stake by 26%, some major institutional investors like BlackRock and Franklin Resources have reduced their holdings. Insider selling has been noted, with CEO Ramesh Srinivasan and affiliated entities offloading over $199 million in shares during 2024-2025. Despite this, insiders still retain 19.3% of shares. For a deeper dive into the company's financial strategies, consider reading about Revenue Streams & Business Model of Agilysys.

Record fiscal 2025 revenue of $275.6 million reflects strong financial performance.

Significant growth in subscription revenue indicates a shift towards a recurring revenue model.

Leadership changes and board expansion show strategic adjustments.

Substantial institutional ownership remains a key factor.

Some institutional investors reduced holdings, while others increased.

Insider selling has occurred, but insiders still hold a significant share.

Agilysys Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Agilysys Company?

- What is Competitive Landscape of Agilysys Company?

- What is Growth Strategy and Future Prospects of Agilysys Company?

- How Does Agilysys Company Work?

- What is Sales and Marketing Strategy of Agilysys Company?

- What is Brief History of Agilysys Company?

- What is Customer Demographics and Target Market of Agilysys Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.