Agilysys Bundle

How Does Agilysys Thrive in the Hospitality Tech Arena?

Agilysys, a key player in hospitality software, recently celebrated record-breaking revenue, proving its strong market position. Its comprehensive suite of Agilysys SWOT Analysis reveals a deep understanding of the industry's needs. With a focus on enhancing guest experiences and streamlining operations, Agilysys is transforming how businesses in the hospitality sector operate.

This article dives deep into the operational framework of the Agilysys company, exploring its Agilysys products and services, and how they contribute to its financial successes. We'll examine the company's strategic moves, including its shift to a recurring revenue model and strategic acquisitions, to understand How Agilysys works to maintain its competitive edge. The insights provided are crucial for anyone looking to understand the dynamics of the hospitality technology market, including Agilysys solutions and their impact on businesses.

What Are the Key Operations Driving Agilysys’s Success?

The Agilysys company creates value by offering a broad array of hardware, software, and services tailored for the hospitality sector. Its core operations revolve around providing property management, point-of-sale (POS), inventory, and analytics solutions. These Agilysys solutions cater to a wide range of clients, including hotels, resorts, casinos, and more.

How Agilysys works involves developing and delivering modular and integrated software solutions, primarily through its Agilysys Hospitality Experience Cloud. This includes both cloud-native SaaS and on-premise solutions. The company focuses on customer-centric approaches, continuous product innovation, and global market expansion. For example, the Agilysys Guest App provides a mobile platform for guests to book, order, and explore property offerings.

Agilysys products also include self-service and mobile ordering capabilities, such as Agilysys IG Kiosk and Agilysys IG OnDemand. The company’s supply chain relies on a concentrated number of suppliers for hardware and software, and it forms strategic partnerships to offer integrated solutions. This comprehensive approach, combined with deep industry expertise, enables streamlined operations, improved guest experiences, and increased revenue for its clients.

Agilysys provides property management, point-of-sale (POS), inventory and procurement, analytics, and document management applications.

These solutions are designed to streamline operations and enhance guest experiences.

The company serves a diverse range of clients, including hotels, resorts, casinos, cruise lines, and corporate dining providers.

Other segments include higher education, food service management companies, hospitals, and theme parks.

Agilysys emphasizes technology development, delivering modular and integrated software solutions via its Agilysys Hospitality Experience Cloud.

This includes cloud-native SaaS and on-premise solutions, customer-centric approaches, and continuous product innovation.

Agilysys offers comprehensive solutions, industry expertise, and innovative technology.

This translates into streamlined operations, improved efficiency, enhanced guest experiences, and increased revenue for clients.

Agilysys distinguishes itself through comprehensive solutions, deep industry expertise, and a commitment to innovative technology. This approach allows the company to meet the evolving needs of the hospitality industry effectively.

- Comprehensive Solutions: Offering a full suite of integrated software and hardware.

- Industry Expertise: Decades of experience in the hospitality sector.

- Innovative Technology: Continuous development of cutting-edge solutions.

- Strategic Partnerships: Collaborations with other technology providers.

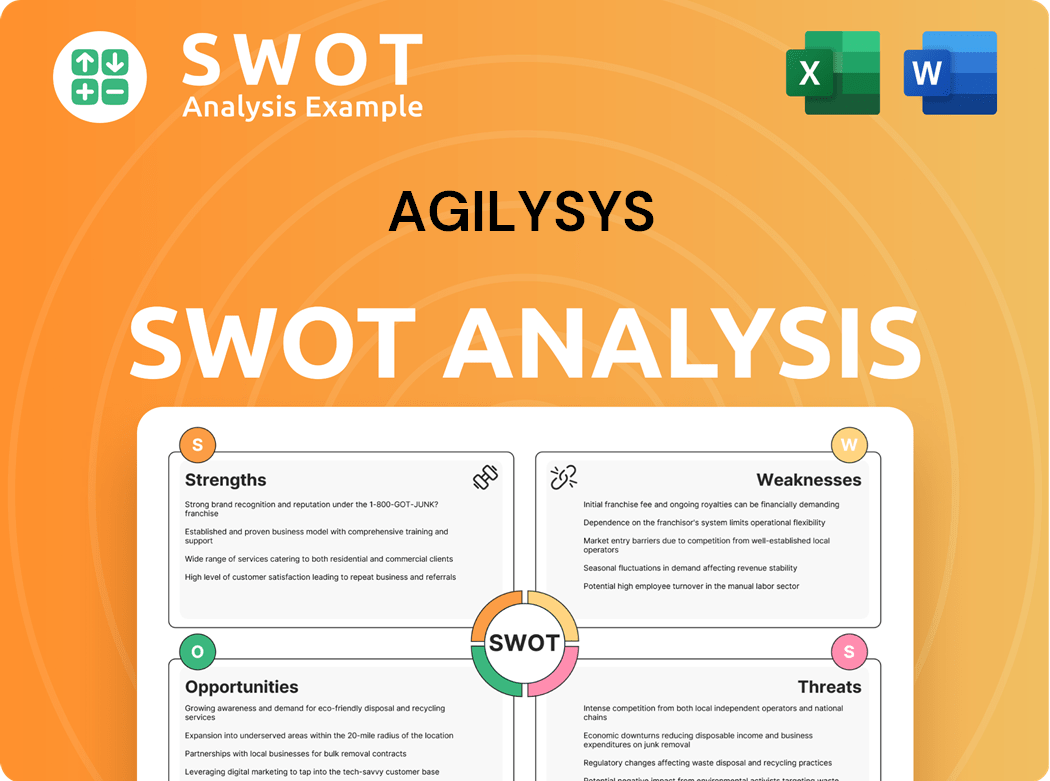

Agilysys SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Agilysys Make Money?

The Agilysys company generates revenue through a diversified approach, primarily focusing on products, subscription and maintenance, and professional services. This strategy has allowed Agilysys to successfully transition towards a recurring revenue model, with subscription and maintenance becoming a significant portion of its income.

For fiscal year 2025, the total net revenue reached $275.6 million, reflecting a 16.1% increase compared to fiscal year 2024. This growth underscores the effectiveness of its revenue strategies and the increasing demand for its solutions.

A key aspect of How Agilysys works involves its monetization strategies, which include bundled services and tiered pricing. The company’s focus on 'Hospitality Solution Studios' combines core operational systems with 'Experience Enhancers' tailored to specific hospitality settings. This approach enhances customer value and drives revenue growth.

The revenue streams of Agilysys are categorized into three main areas: Products, Subscription and Maintenance, and Professional Services. The company's financial performance demonstrates a strategic shift towards recurring revenue models, which provide stability and predictability. The acquisition of Book4Time in August 2024 further strengthens its position in the SaaS market.

- Recurring revenue, which includes subscription and maintenance, reached a record $170.1 million in fiscal year 2025, accounting for 61.7% of total net revenue. This is up from 58.1% in fiscal year 2024.

- Subscription revenue specifically increased by 39.5% year-over-year in fiscal year 2025, representing 61.9% of total recurring revenue. This indicates a strong preference for subscription-based software licenses.

- Professional services revenue increased by 27.7% in fiscal year 2025 due to higher sales and service activity.

- Product revenue decreased by 15.8% in fiscal year 2025, reflecting the increasing adoption of subscription models and reduced hardware needs.

The acquisition of Book4Time for $145.8 million in August 2024 is a strategic move to enhance its SaaS offerings and expand its solutions per customer globally, contributing to subscription revenue growth. The company is also focused on providing comprehensive Agilysys target market solutions for the hospitality industry, including point of sale systems, property management systems, and cloud solutions.

Looking ahead, Agilysys anticipates full-year fiscal 2026 revenue to be in the range of $308 million to $312 million, driven by a 25% year-over-year subscription revenue growth. This forecast highlights the company's confidence in its business model and its ability to capitalize on the growing demand for its services. The company's focus on recurring revenue and strategic acquisitions positions it for continued growth in the competitive market.

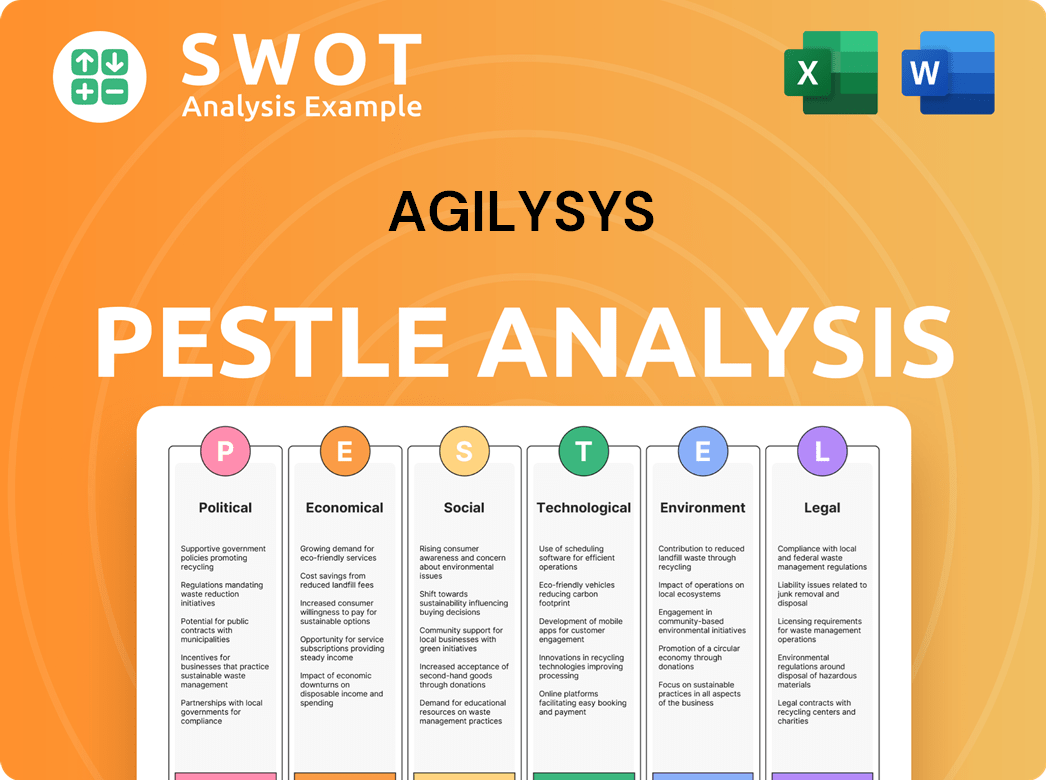

Agilysys PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Agilysys’s Business Model?

The journey of the Agilysys company has been marked by strategic acquisitions, innovative product launches, and significant partnerships. These moves have solidified its position in the hospitality technology market. The company's focus on enhancing its software offerings and expanding its customer base reflects its commitment to growth and adaptation in a dynamic industry.

A key strategic move for Agilysys was the acquisition of Book4Time in August 2024 for approximately $150 million. This acquisition significantly boosted its Software-as-a-Service (SaaS) offerings in spa management software. The company has also continuously innovated its product portfolio, launching solutions like Agilysys IG Kiosk and Agilysys IG OnDemand, enhancing self-service and mobile ordering capabilities.

In May 2025, Agilysys entered into a Software-as-a-Service agreement with Boyd Gaming Corporation for its InfoGenesis POS ecosystem, showcasing a significant sales opportunity. Despite operational challenges, the company has shown resilience, with accelerating sales demand for its modernized cloud-native software ecosystem. These actions highlight the company's ongoing efforts to meet the evolving needs of the hospitality sector.

The acquisition of Book4Time in August 2024 for around $150 million expanded its SaaS offerings. The 2021 purchase of ResortSuite further broadened its reach. Agreements like the one with Boyd Gaming Corporation in May 2025 for its InfoGenesis POS ecosystem demonstrate significant sales opportunities.

Agilysys has focused on acquisitions to enhance its software offerings, particularly in spa management. Continuous innovation in its product portfolio, such as launching self-service and mobile ordering solutions, is another key strategic move. These moves are aimed at expanding its customer base and meeting market demands.

Agilysys solutions include POS, PMS, and inventory and procurement systems, streamlining operations. Its commitment to research and development ensures its products remain at the forefront of technological advancements. Strong customer relationships contribute to high satisfaction levels.

The company faced challenges such as the end stages of product modernization and slow point-of-sale bookings in the first half of fiscal year 2025. Despite these challenges, Agilysys demonstrated resilience. Accelerating sales demand for its cloud-native software ecosystem shows its ability to adapt.

Agilysys distinguishes itself through comprehensive solutions, deep industry knowledge, and innovative technology. Its wide range of Agilysys products allows it to streamline operations and enhance guest experiences, catering to various hospitality businesses. The company's focus on personalized guest experiences, mobile technology, and cloud-based solutions keeps it ahead of industry trends.

- Comprehensive Solutions: Offers a wide array of integrated systems, including POS, PMS, and inventory management.

- Industry Expertise: Possesses in-depth knowledge of the hospitality sector's specific needs and challenges.

- Innovative Technology: Continuously invests in research and development to provide cutting-edge solutions.

- Strong Customer Support: Maintains strong customer relationships, leading to high satisfaction and loyalty.

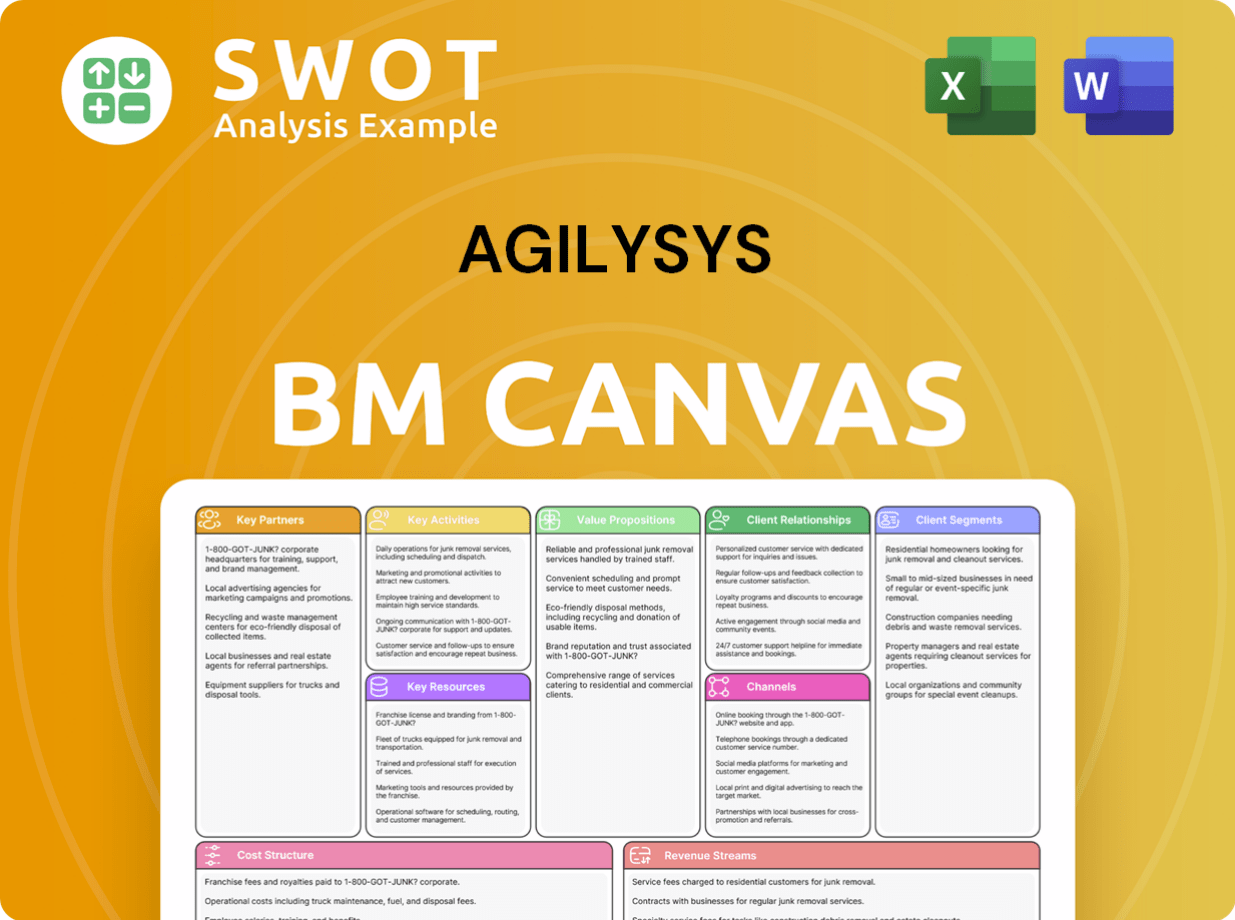

Agilysys Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Agilysys Positioning Itself for Continued Success?

The Agilysys company holds a strong position in the hospitality technology sector, providing comprehensive, integrated Agilysys solutions for casinos, resorts, and hotels. While specific market share figures for 2024-2025 aren't readily available, the company's growth and acquisitions indicate a solid competitive standing. They serve over 1,700 enterprise-level hospitality and retail businesses as of 2024. Their focus on customer satisfaction helps build a loyal customer base.

Key risks for Agilysys include intense competition in the hospitality software market, which could lead to price reductions. Economic instability can also negatively affect the hospitality industry, impacting software spending. Cybersecurity threats and data privacy regulations are ongoing risks. Additionally, the company faces risks related to its reliance on a concentrated number of suppliers. Understanding these factors is important for anyone looking at Owners & Shareholders of Agilysys.

Agilysys is a key player in the hospitality technology market, known for its integrated solutions. They focus on complex environments like casinos and resorts. Their customer base is concentrated in high-demand market segments.

The company faces competition and economic risks. Cybersecurity and data privacy are also concerns. Reliance on suppliers presents another challenge.

Agilysys plans to invest in strategic growth, enhancing its products. They aim to expand their customer base and focus on international markets. The company projects full-year revenue between $308 million to $312 million for fiscal year 2026.

Subscription revenue is expected to grow by 25% year-over-year. Analysts have a consensus 'Buy' rating for Agilysys. The average twelve-month stock price forecast is $116.57.

Agilysys is focused on strategic growth initiatives to increase revenue and expand its market presence. They are investing in enhancing existing software products and developing new ones. The company is also targeting vertical and geographical expansion, particularly in international markets.

- Investing in product enhancements and new software development.

- Expanding customer base both vertically and geographically.

- Focusing on international market opportunities.

- Aiming for continued growth in subscription revenue.

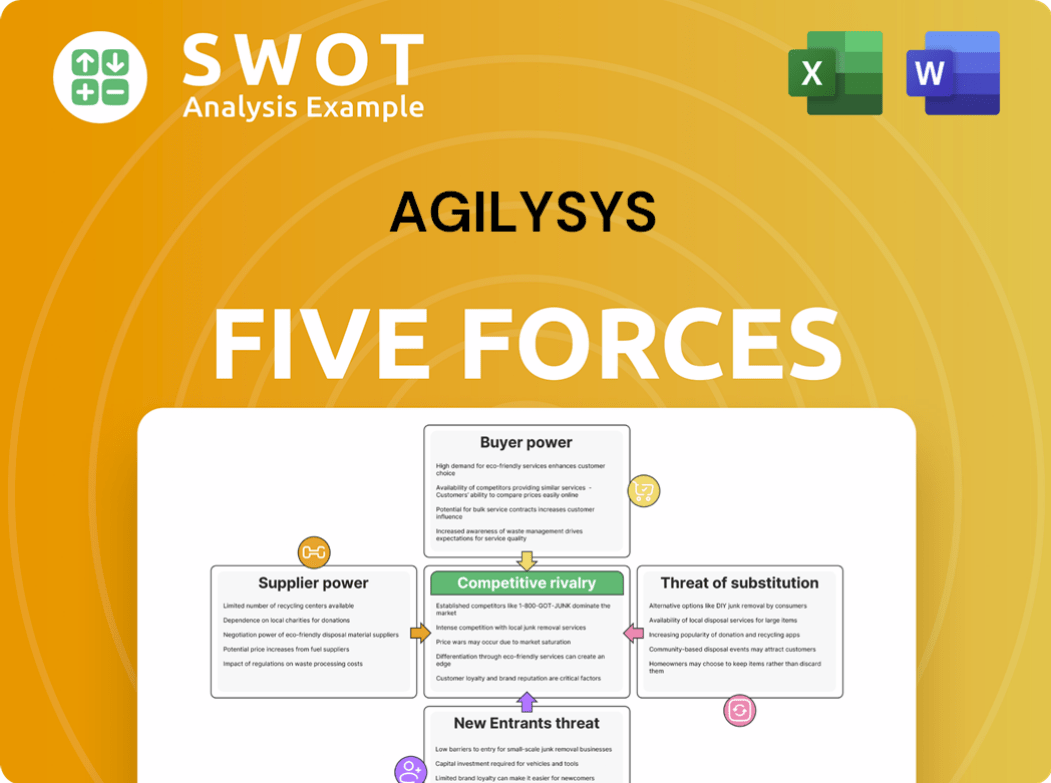

Agilysys Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Agilysys Company?

- What is Competitive Landscape of Agilysys Company?

- What is Growth Strategy and Future Prospects of Agilysys Company?

- What is Sales and Marketing Strategy of Agilysys Company?

- What is Brief History of Agilysys Company?

- Who Owns Agilysys Company?

- What is Customer Demographics and Target Market of Agilysys Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.