Agilysys Bundle

Can Agilysys Continue Its Impressive Growth Trajectory?

Agilysys, a key player in the hospitality technology sector, has been making strategic moves to solidify its market position. The acquisition of Book4Time in August 2024 was a game-changer, significantly expanding its reach and product offerings, particularly in the spa management software market. With a long history of providing innovative solutions, Agilysys is now focused on cloud-based solutions and digital transformation to meet the evolving needs of the hospitality industry.

This Agilysys SWOT Analysis will delve into the company's expansion plans, technological advancements, and financial outlook. We'll explore the Agilysys growth strategy, examining its recent successes, including record revenue in fiscal year 2025, and analyze the potential risks and opportunities that lie ahead. Understanding Agilysys's future prospects requires a deep dive into its market position and competitive landscape within the hospitality technology sector.

How Is Agilysys Expanding Its Reach?

The ongoing Agilysys growth strategy involves a multifaceted approach to expand its market presence and product offerings. This includes both organic growth initiatives and strategic acquisitions designed to broaden its customer base and enhance its technological capabilities. The company's focus on innovation and customer satisfaction is central to its expansion plans, ensuring that it remains competitive in the dynamic hospitality technology sector.

Agilysys future prospects are closely tied to its ability to execute these expansion initiatives effectively. The company is investing in its cloud solutions and modernizing its product suite to meet evolving customer demands. This strategic direction is expected to drive revenue growth and improve profitability, solidifying its position in the market. A key element of this strategy is to leverage its existing customer relationships to cross-sell new products and services.

The company's commitment to international expansion and strategic partnerships further supports its growth objectives. By entering new markets and forming alliances, Agilysys aims to increase its global footprint and tap into new revenue streams. The company's focus on technological advancements and customer-centric solutions is expected to contribute to its long-term success and enhance its overall Agilysys company analysis.

Agilysys is actively expanding its presence in international markets to diversify its revenue streams and reach new customers. This includes targeting regions with high growth potential in the hospitality and retail sectors. The company is investing in building brand recognition and establishing a stronger local presence to support its expansion efforts.

The company is broadening its product offerings to cater to a wider range of customer needs within the hospitality industry. The acquisition of Book4Time in August 2024 is a prime example of this, expanding into the spa and wellness sector. This strategy allows Agilysys to offer a more comprehensive suite of solutions, increasing its market share.

Agilysys is focusing on acquiring new customers through targeted sales and marketing efforts. This includes expanding its sales team to improve territory coverage and reach a broader audience. The company is also leveraging digital marketing and other channels to generate leads and increase brand awareness.

The company is prioritizing the transition to its new cloud-native, modernized product suite. This technological upgrade is designed to enhance the user experience and support future growth. These advancements are crucial for maintaining a competitive edge in the hospitality technology market.

The acquisition of Book4Time in August 2024 is a significant step in Agilysys' expansion strategy. This acquisition not only adds new customers but also provides cross-selling opportunities. Agilysys can introduce its existing property management software (PMS) and point of sale systems (POS) solutions to Book4Time's customer base, driving further growth.

- Book4Time acquisition expands Agilysys' reach into the spa and wellness sector across over 100 countries.

- The acquisition enhances Agilysys' product portfolio, offering a more comprehensive suite of solutions.

- Cross-selling opportunities allow Agilysys to leverage its existing customer relationships.

- Strategic acquisitions are a key component of Agilysys' overall growth strategy.

Agilysys SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Agilysys Invest in Innovation?

Innovation and technology are at the core of the Marketing Strategy of Agilysys, driving its growth strategy. The company is making significant investments in research and development (R&D), particularly in areas like artificial intelligence (AI) and cloud-native solutions. These efforts are designed to enhance customer experiences and improve operational efficiency within the hospitality industry.

Agilysys's focus on technological advancements is evident in its commitment to revamping core products, including point of sale (POS) systems and property management software (PMS). By rewriting these solutions as cloud-native software, the company aims to provide a competitive edge and support its shift towards subscription-based revenue models. This strategic approach is essential for adapting to evolving market demands and maintaining a strong position in the hospitality technology sector.

The company's guestsense.ai, which integrates AI into various solutions, is a key example of its innovative approach. This technology is designed to improve revenue management, enhance staff productivity, and personalize guest experiences. This focus on AI aligns with the broader industry trend of using AI for predictive analytics and dynamic pricing, further demonstrating Agilysys' commitment to technological leadership.

Agilysys' guestsense.ai leverages AI to improve revenue management and personalize guest experiences. This technology helps hotels and resorts optimize pricing and enhance customer service.

The company is modernizing its core products, such as POS and PMS, by rewriting them as cloud-native software. This shift provides scalability, flexibility, and cost-effectiveness.

Agilysys is investing heavily in research and development, particularly in AI and cloud technologies. These investments are crucial for driving innovation and maintaining a competitive edge.

The modernization of its product offerings supports Agilysys' transition towards subscription-based revenue models. This shift provides a more predictable and recurring revenue stream.

Agilysys leverages data analytics to enhance customer experiences and improve operational efficiency. This focus on data-driven insights is critical for making informed decisions.

The company's technological advancements are aimed at enhancing customer experiences. This includes personalized interactions and improved service delivery.

Agilysys's technology strategy includes significant investments in AI and cloud-native solutions. These advancements are designed to drive the company's future prospects and enhance its position in the hospitality technology market.

- AI-Powered Solutions: Integrating AI to improve revenue management, staff productivity, and guest experiences.

- Cloud-Native Platforms: Modernizing core products like POS and PMS to offer scalability and flexibility.

- Data Analytics: Leveraging data analytics to enhance customer experiences and operational efficiency.

- Subscription Model: Shifting towards subscription-based revenue to provide a more predictable revenue stream.

Agilysys PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Agilysys’s Growth Forecast?

The financial outlook for Agilysys reflects a positive trajectory, with a strong emphasis on subscription services driving revenue growth. The company's performance indicates a strategic shift towards recurring revenue streams, which is a key factor in its long-term sustainability and market competitiveness. This focus is evident in the increasing contribution of subscription and maintenance revenue to the overall financial results.

For the fiscal year 2025, Agilysys reported record total net revenue, showcasing a significant increase from the previous year. This growth is further supported by the company's projections for fiscal year 2026, indicating continued expansion and market penetration. These financial trends are crucial for understanding the Agilysys growth strategy and its ability to capitalize on opportunities within the hospitality technology sector.

Despite investments in growth initiatives, the company's profitability has been impacted. However, the adjusted EBITDA is expected to be 20% of revenue for fiscal year 2026. Agilysys maintains a strong cash position, which provides a financial cushion for future investments and strategic moves. Let's delve into the detailed financial aspects to understand the Agilysys financial performance review.

In fiscal 2025, Agilysys achieved record total net revenue of $275.6 million, marking a 16.1% increase from fiscal 2024. This growth demonstrates the company's ability to expand its market presence and meet the increasing demand for its solutions. The company's revenue growth drivers include strategic partnerships and technological advancements.

Subscription and maintenance revenue is a key driver of Agilysys' financial performance. In fiscal 2025, this segment grew by 23.2%, accounting for 61.7% of total net revenue. This growth highlights the success of the company's cloud solutions and its ability to retain customers through recurring revenue streams.

For fiscal year 2026, Agilysys anticipates revenue in the range of $308 million to $312 million. Subscription revenue is projected to grow by 25%, indicating continued momentum in this critical area. These projections are crucial for understanding the Agilysys future prospects and investment opportunities.

Adjusted EBITDA is expected to be 20% of revenue for fiscal year 2026. As of March 31, 2025, Agilysys held $73 million in cash and cash equivalents. While the liquidity position has shown some weakening, the company's free cash flow has increased significantly.

The financial performance of Agilysys showcases a company focused on sustainable growth and strategic investments. The shift towards subscription-based revenue models and the expansion of its cloud solutions are key factors in its success. Understanding these metrics is essential for anyone looking into Agilysys company analysis.

- Record total net revenue of $275.6 million in fiscal 2025.

- Subscription and maintenance revenue growth of 23.2% in fiscal 2025.

- Projected revenue of $308 million to $312 million for fiscal 2026.

- Adjusted EBITDA expected to be 20% of revenue in fiscal 2026.

Agilysys Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Agilysys’s Growth?

The path to growth for the company is not without its challenges. The company's Agilysys growth strategy faces several potential hurdles. Navigating these risks is crucial for realizing its Agilysys future prospects.

One significant challenge is the competitive landscape within the hospitality technology market. The company must continuously innovate and invest in research and development to maintain its edge. Economic fluctuations and industry-specific issues also pose potential risks.

Furthermore, the company's reliance on the hospitality sector exposes it to economic downturns. Cybersecurity threats and data privacy regulations present ongoing challenges. Addressing these obstacles is essential for sustainable growth, as highlighted in the Owners & Shareholders of Agilysys analysis.

The hospitality technology market is highly competitive, with both large and small providers vying for market share. This requires constant innovation and competitive pricing strategies. Understanding how the company competes is key to understanding Agilysys market share 2024.

Rapid technological changes necessitate continuous investment in research and development. Staying ahead of the curve is critical to avoid technological obsolescence. The company's ability to adapt to Agilysys technological advancements will be crucial.

The company's dependence on the hospitality industry makes it vulnerable to economic instability. Economic downturns can reduce customer spending and affect the Agilysys financial performance review. This impacts the company's overall Agilysys stock forecast.

Challenges can arise in developing and integrating new products, potentially delaying market entry. Successfully launching new offerings is vital for growth and maintaining a competitive edge. The Agilysys product roadmap plays a key role here.

The company faces risks related to cybersecurity threats and data privacy regulations. Protecting customer data and ensuring compliance are crucial. These factors impact the company's reputation and its ability to attract and retain customers.

The transition to new cloud-native point of sale systems can present short-term challenges. Successfully navigating these transitions is essential for long-term success. The company's focus on Agilysys cloud solutions is key.

The hospitality technology sector is highly competitive. Competitors include established players and emerging software companies. The company must differentiate itself through innovation and service quality to maintain and grow its Agilysys customer base.

The company's performance is closely tied to the health of the hospitality industry. Economic downturns can lead to decreased spending by hotels and restaurants. This directly impacts the company's Agilysys revenue growth drivers and overall financial results.

The rapid pace of technological change requires continuous investment in R&D. Failure to innovate can lead to outdated products. This impacts the company's ability to attract new clients and maintain its position in the market. Staying ahead of Agilysys industry trends is crucial.

Developing and integrating new products can be complex and time-consuming. Delays or failures can negatively impact the company's growth trajectory. Effective project management and testing are crucial for successful product launches. This affects the Agilysys expansion plans.

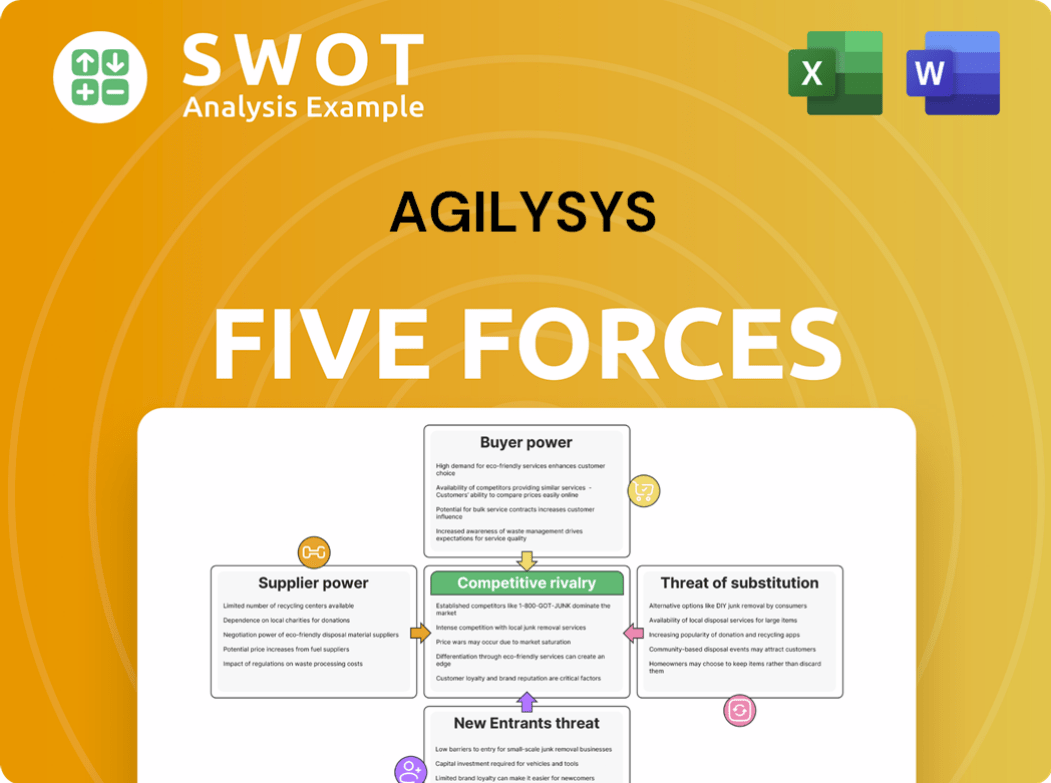

Agilysys Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Agilysys Company?

- What is Competitive Landscape of Agilysys Company?

- How Does Agilysys Company Work?

- What is Sales and Marketing Strategy of Agilysys Company?

- What is Brief History of Agilysys Company?

- Who Owns Agilysys Company?

- What is Customer Demographics and Target Market of Agilysys Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.