Ascent Industries Bundle

How Did Ascent Industries Rise to Prominence?

Embark on a journey through time to uncover the Ascent Industries SWOT Analysis and the fascinating Ascent Industries history. From its inception in 1958 as Blackman Uhler Industries Inc., a chemical manufacturing business, to its current status as a diversified industrial powerhouse, the Ascent Industries company has undergone a remarkable transformation. Discover the key milestones and strategic shifts that have shaped its corporate evolution.

This Ascent Industries company profile delves into the Ascent Industries history, exploring its early years and significant events. The Ascent Industries business timeline reveals the company's strategic acquisitions and leadership changes, highlighting its evolving market position. By understanding the past and present of Ascent Industries, we gain valuable insights into its future potential and industry involvement.

What is the Ascent Industries Founding Story?

The story of Ascent Industries Co., a company with a rich corporate evolution, began in 1958. Its roots trace back to 1945 with the establishment of Blackman Uhler Industries Inc., a chemical manufacturing business. This foundation set the stage for Ascent Industries' future, shaping its core competencies and strategic direction.

The company's journey includes a significant rebranding. Formerly known as Synalloy Corporation, it adopted the Ascent Industries Co. name on August 10, 2022. This change marked a strategic shift and a comprehensive rebuild under new management, signifying a new chapter in the company's history. The transformation aimed to reflect the significant changes implemented, making the company of the past 'barely recognizable'.

The company's headquarters are in Oak Brook, Illinois. Ascent Industries' early financial details, including initial funding for Blackman Uhler Industries Inc., are not publicly documented. However, the company's evolution is marked by its public listing. The company's IPO dates back to March 16, 1980. The company's history includes overcoming challenges in the competitive chemical manufacturing sector, which allowed for its diversification into industrial tubular products.

The company's history is marked by key milestones, including its founding and rebranding.

- 1945: Blackman Uhler Industries Inc. is founded, focusing on chemical manufacturing.

- 1958: Ascent Industries Co. is incorporated, building upon the legacy of Blackman Uhler Industries Inc.

- March 16, 1980: The company goes public.

- August 10, 2022: Synalloy Corporation rebrands to Ascent Industries Co.

Understanding the Competitors Landscape of Ascent Industries offers additional insights into the company's position within the industry.

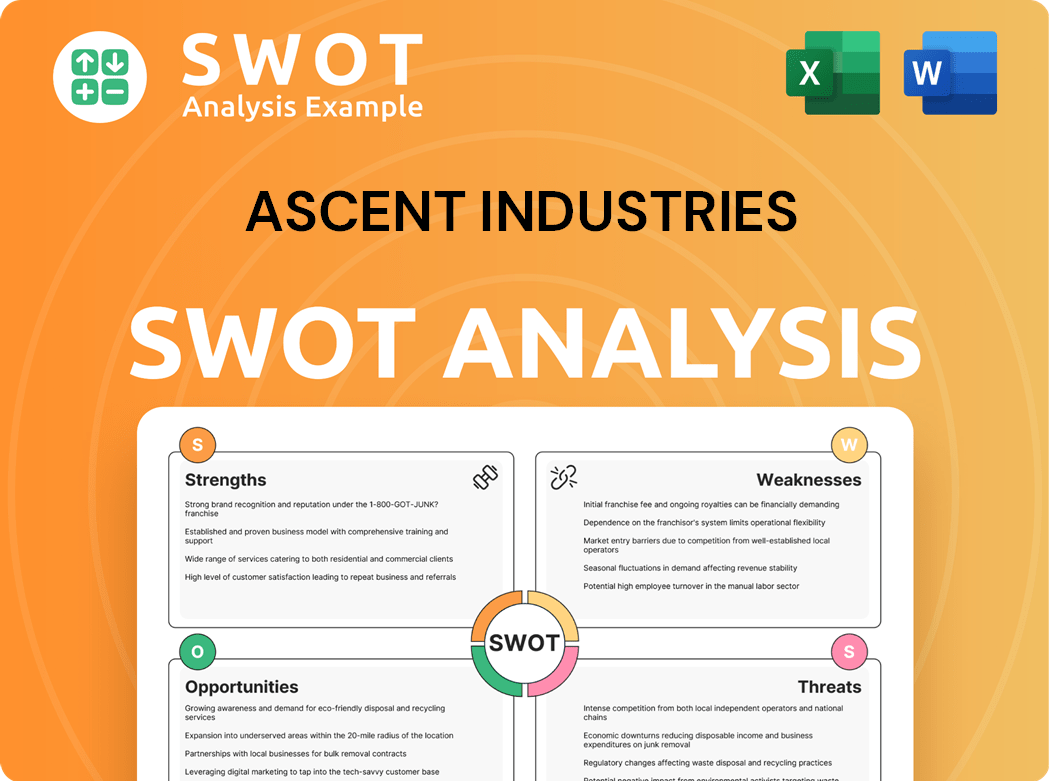

Ascent Industries SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Ascent Industries?

The early growth and expansion of Ascent Industries, formerly known as Synalloy Corporation, involved strategic investments and acquisitions. The company's history includes a focus on enhancing production processes and expanding its reach within the tubular and specialty chemicals sectors. A significant step was the 2021 acquisition of DanChem, which boosted manufacturing capabilities.

A pivotal moment in Ascent Industries' history occurred in the summer of 2020, with new management taking control after a proxy fight. This led to a comprehensive rebuild of the company, shifting the focus from cost-cutting to rebuilding and realigning the organization. These strategic changes quickly yielded results, with the company achieving its first GAAP profitable quarter since Q4 2018 in Q1 2021.

Under the new direction, Ascent Industries prioritized operational efficiencies, customer experience, and strategic sourcing. This included aligning various departments to deliver a more holistic customer experience. The company also saw improvements in on-time delivery rates and employee safety. The Owners & Shareholders of Ascent Industries have been key to driving these changes.

In Q1 2025, Ascent's Specialty Chemicals segment secured annualized net new business of $7.5 million with EBITDA margins exceeding 20%, demonstrating successful customer acquisition strategies. Despite a slight decline in net sales from continuing operations to $24.7 million in Q1 2025 from $28.0 million in Q1 2024, gross profit increased by 108.7% to $4.8 million, with the gross profit margin expanding from 8.2% to 19.4%. As of December 31, 2024, the company ended the year debt-free with $16.1 million in cash and nearly $15 million in free cash flow, showing a strong financial position.

Ascent Industries' history is marked by strategic acquisitions, such as DanChem in 2021, which expanded its manufacturing capabilities. The company's focus on rebuilding and realigning its operations, along with improvements in operational efficiencies and customer experience, has been critical. These strategic moves have positioned the company for continued growth and success in the specialty chemicals and tubular industries.

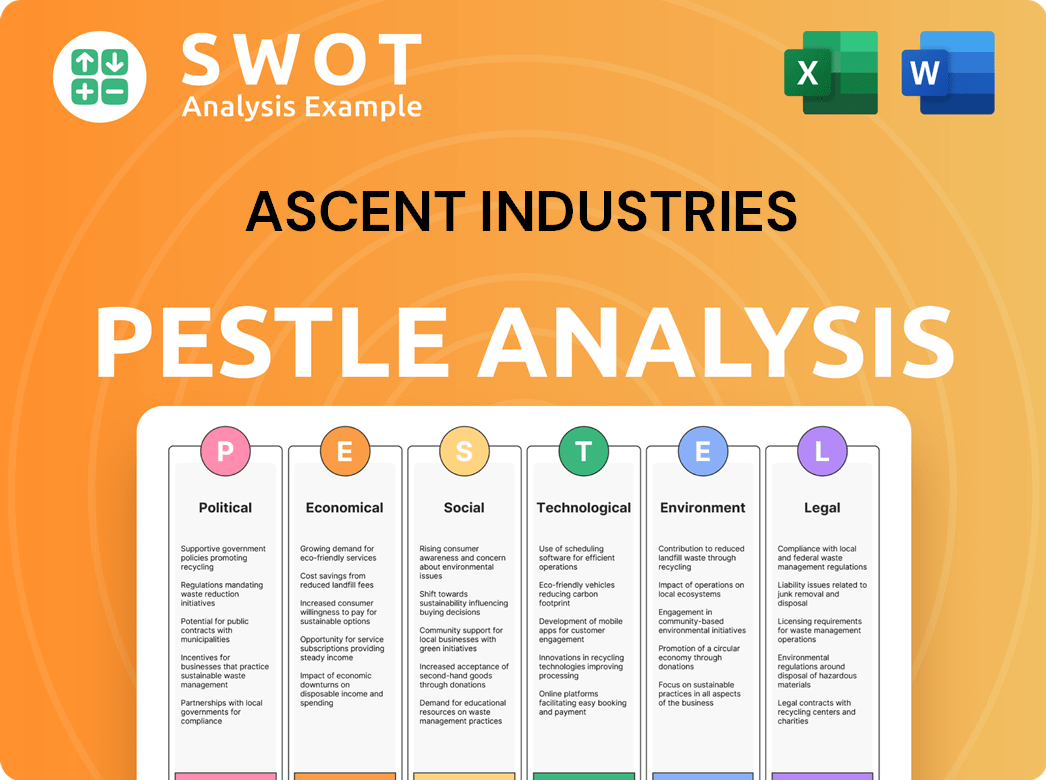

Ascent Industries PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Ascent Industries history?

The Ascent Industries history is marked by significant changes and strategic shifts. The company's evolution reflects its adaptability and commitment to overcoming challenges and pursuing growth.

| Year | Milestone |

|---|---|

| 2020 | New management, including CEO Chris Hutter (later succeeded by Bryan Kitchen), takes over after a proxy fight, initiating a major company rebuild. |

| August 2022 | The company officially changes its name from Synalloy Corporation to Ascent Industries Co., representing a comprehensive transformation. |

| Q1 2025 | Adjusted EBITDA improves by $3.5 million, moving from a loss of $2.7 million in Q1 2024 to a positive $0.8 million. |

A key innovation has been the shift towards problem-solving and delivering reliable solutions. This involves creating formulations and ensuring speed, reliability, and compliance, moving beyond simply selling products.

The company has moved beyond just selling products to creating formulations and ensuring speed, reliability, and compliance.

Ascent Industries has strategically shifted its product mix towards higher-margin opportunities.

The company has implemented operational rigor to improve efficiency.

Ascent Industries has faced several challenges, including inherited inefficiencies and market pressures. The company has also dealt with customer concentration risks, with the top 15 customers in the Specialty Chemicals segment accounting for approximately 53% of revenues in 2024.

Market downturns and competitive pressures have impacted sales and profitability.

Customer concentration poses a risk, with a significant portion of revenues coming from a small number of customers.

Net sales from continuing operations declined by 11.8% to $24.7 million in Q1 2025 compared to $28.0 million in Q1 2024.

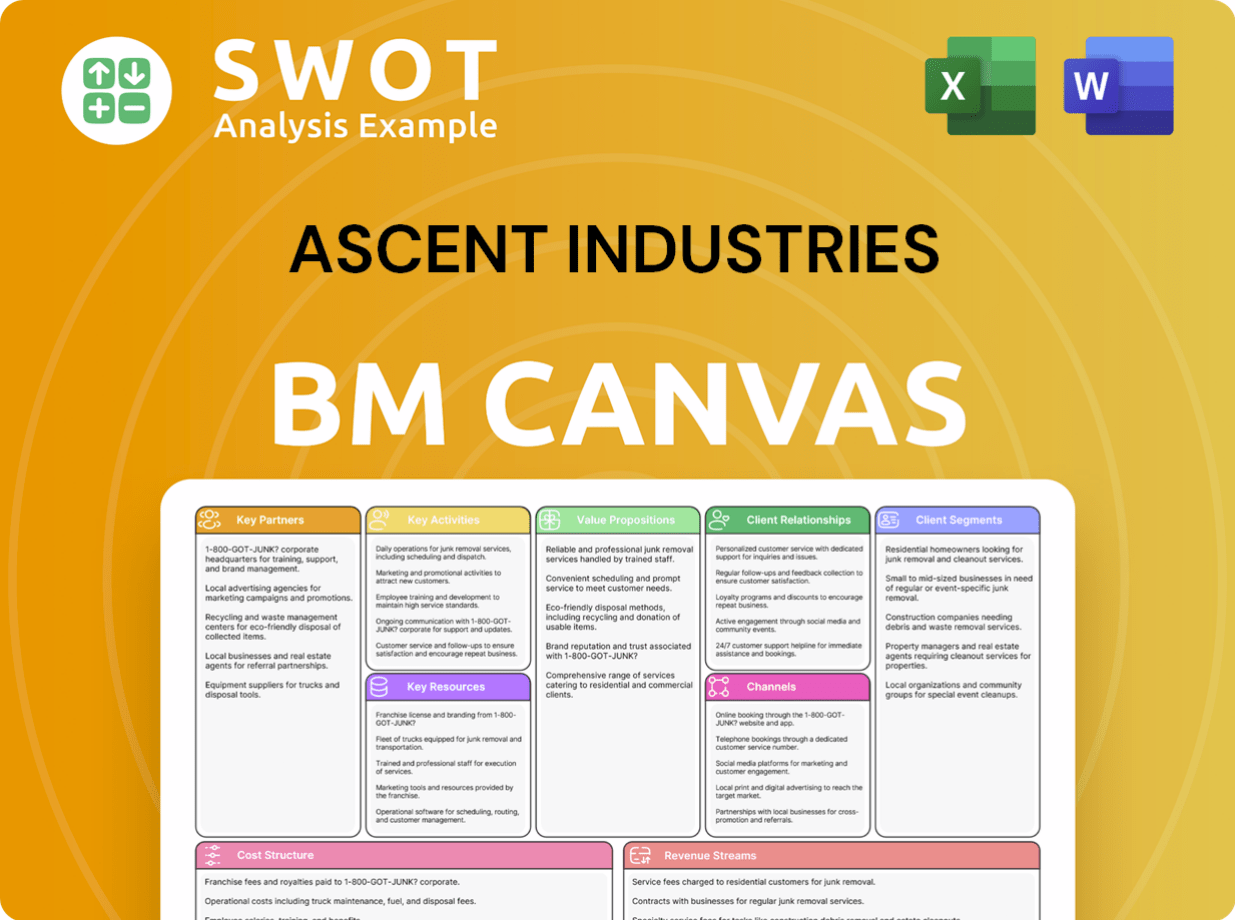

Ascent Industries Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Ascent Industries?

The journey of Ascent Industries, formerly Synalloy Corporation, is marked by significant transformations and strategic shifts. From its origins in 1945 as Blackman Uhler Industries Inc., a chemical manufacturing business, to its current focus on growth, the company has evolved through various stages of development, acquisitions, and rebranding.

| Year | Key Event |

|---|---|

| 1945 | Blackman Uhler Industries Inc., a chemical manufacturing business, was founded. |

| 1958 | Ascent Industries Co. was incorporated as the successor to Blackman Uhler Industries Inc. |

| 1967 | The company operated as Synalloy Corporation. |

| March 16, 1980 | The company's IPO date was marked. |

| Summer 2020 | New management gained control of the board via a proxy fight, initiating a major turnaround. |

| Q1 2021 | The company achieved its first GAAP profitable quarter since Q4 2018, showing the initial success of new management's initiatives. |

| October 2021 | DanChem was acquired, expanding the company's specialty chemicals contract manufacturing capabilities. |

| August 10, 2022 | Synalloy Corporation officially rebranded to Ascent Industries Co. |

| December 22, 2023 | Substantially all assets of Specialty Pipe & Tube (SPT) were sold, categorizing financial results into discontinued operations. |

| Q4 2024 | Strong earnings growth was reported, finishing debt-free with $16.1 million in cash, and generating nearly $15 million in free cash flow. |

| April 4, 2025 | The transaction to sell substantially all assets of Bristol Metals, LLC (BRISMET) was closed, categorizing its financial results into discontinued operations. |

| Q1 2025 | Gross profit doubled to $4.8 million, and gross margin expanded by 1,120 basis points to 19.4%, despite an 11.8% decrease in net sales to $24.7 million compared to Q1 2024. |

Ascent Industries is transitioning from stabilization to growth. The focus is on the Specialty Chemicals segment, aiming for $80 million to $120 million by 2030. Management anticipates a growth ramp in the second half of 2025.

The company reported strong Q4 2024 earnings and a debt-free position with $16.1 million in cash. Q1 2025 saw gross profit doubling to $4.8 million, with a gross margin of 19.4%. Free cash flow generation remains a key focus.

Expansion of the stock repurchase program is planned. Ascent Industries is working to onshore essential ingredient supply chains. The company's total addressable market for existing products is over $9 billion.

Continued soft market conditions and an uncertain tariff environment remain potential challenges. The company anticipates top-line growth primarily in the second half of 2025. Minimal capital expenditure needs are estimated at $1-3 million annually.

Ascent Industries Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Ascent Industries Company?

- What is Growth Strategy and Future Prospects of Ascent Industries Company?

- How Does Ascent Industries Company Work?

- What is Sales and Marketing Strategy of Ascent Industries Company?

- What is Brief History of Ascent Industries Company?

- Who Owns Ascent Industries Company?

- What is Customer Demographics and Target Market of Ascent Industries Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.