Ascent Industries Bundle

Can Ascent Industries Forge Ahead?

Ascent Industries Co. (ACNT) is making bold moves to reshape its future in the industrial manufacturing sector. Specializing in metal fabrication and precision machining, the company serves diverse industries with custom solutions. A recent strategic pivot, including a significant asset sale, signals a shift towards a more focused and potentially lucrative business model.

This Ascent Industries SWOT Analysis offers a comprehensive look at the company's strategic realignment, including the implications of its recent divestiture and the focus on its core specialty chemicals business. Understanding Ascent Industries' growth strategy is critical for investors and stakeholders. Exploring the future prospects of Ascent Industries, including its expansion plans and market positioning, is essential for anyone seeking to understand the trajectory of this evolving company and its potential investment opportunities.

How Is Ascent Industries Expanding Its Reach?

Ascent Industries is heavily focused on expansion, with its Specialty Chemicals segment at the forefront of its Growth Strategy. This segment is projected to be the primary driver of future growth, with ambitious revenue targets set for the coming years. The company's strategic initiatives are designed to capitalize on emerging market trends and opportunities, positioning it for sustained success.

The company's expansion plans are multifaceted, encompassing both organic and inorganic growth strategies. These initiatives are aimed at strengthening its market position, broadening its product offerings, and enhancing its overall financial performance. Ascent Industries is actively exploring various avenues to achieve its growth objectives, including strategic acquisitions and product diversification.

A key component of Ascent Industries' growth strategy involves a shift towards higher-margin products. The company is concentrating on niche products, such as corrosion-resistant coatings and advanced polymers. This strategic pivot is designed to improve profitability and create a more resilient business model. The focus on sustainable solutions also aligns with current market trends.

Ascent Industries aims for significant growth in its Specialty Chemicals segment. The revenue target for this segment is between $80 million and $120 million by 2030. This ambitious goal highlights the company's commitment to expanding its presence in the specialty chemicals market.

The company is leveraging a robust pipeline of organic growth opportunities. A multi-year contract secured in April 2025 is expected to boost annual EBITDA by over $750,000. This contract represents a 10% year-over-year increase for the Specialty Chemicals segment.

Ascent Industries is strategically shifting its product mix. The focus is on higher-margin opportunities, including niche products. The company targets products with margins of 20% or higher, such as corrosion-resistant coatings and advanced polymers.

The company is exploring inorganic growth through mergers and acquisitions. These acquisitions aim to accelerate growth and expand manufacturing capabilities. The recent acquisition of Parkside in June 2024 is an example of this strategy.

Ascent Industries is implementing a multi-pronged approach to drive growth. The company is focusing on both organic and inorganic strategies. The expansion initiatives are designed to capitalize on market trends and improve financial performance.

- Focus on Specialty Chemicals segment with revenue targets of $80-$120 million by 2030.

- Securing multi-year contracts to boost EBITDA, such as the April 2025 contract.

- Shifting product mix towards higher-margin opportunities, with a focus on niche products.

- Exploring mergers and acquisitions to accelerate growth and expand capabilities.

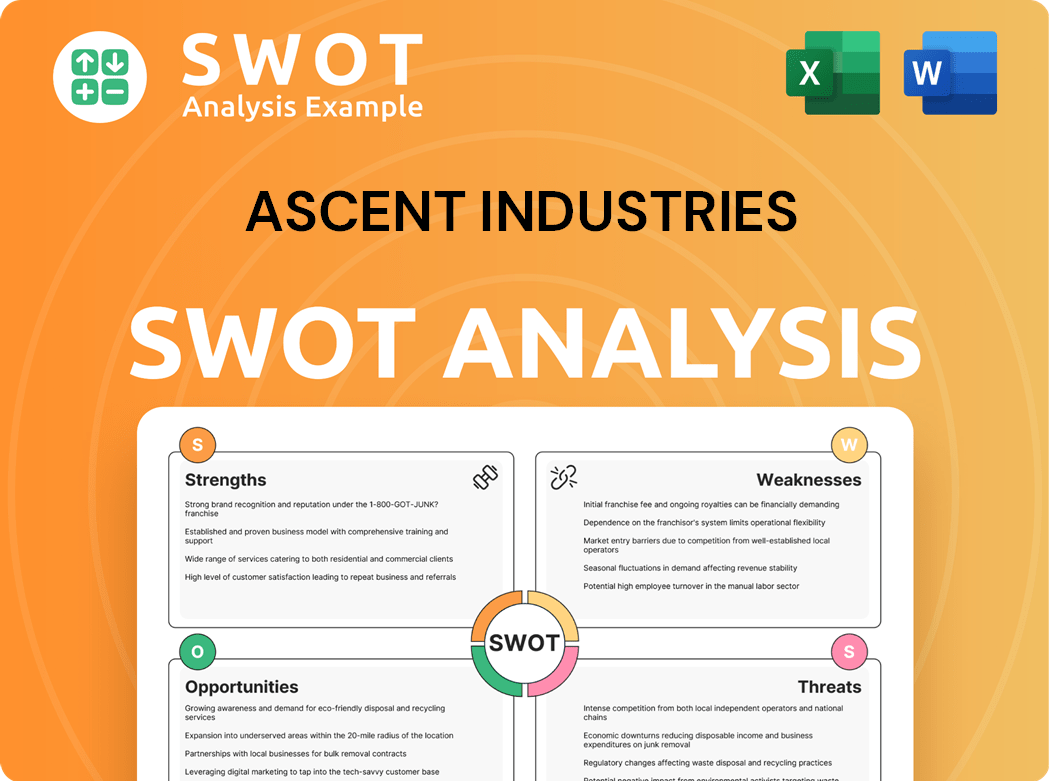

Ascent Industries SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Ascent Industries Invest in Innovation?

The focus on innovation and technology at Ascent Industries is central to its Mission, Vision & Core Values of Ascent Industries, particularly within its Specialty Chemicals segment. This strategic approach aims to meet evolving customer demands and improve profitability. Ascent Industries is actively investing in research and development (R&D) to expand its specialty chemicals offerings.

A key element of Ascent Industries' strategy is the creation of tailored formulations through close collaboration with customers. This customer-centric approach allows the company to address specific needs and market trends. The company is also developing bio-based chemistries, such as defoamers that are now up to 81% vegetable-based and renewable-sourced.

Digital transformation and automation are also key components of Ascent Industries' strategy. The company is reinvesting in these areas within its manufacturing facilities to enhance quality, reliability, and cost efficiency. This includes exploring the use of cutting-edge technologies like Artificial Intelligence (AI), primarily for business development.

Ascent Industries is increasing its investment in research and development to create new products. This includes a focus on specialty chemicals and tailored formulations.

The company is developing bio-based chemistries, such as defoamers. These defoamers are now up to 81% vegetable-based and renewable-sourced, offering sustainable solutions.

Ascent Industries is reinvesting in digital transformation and automation within its manufacturing facilities. This aims to improve quality, reliability, and cost efficiency.

The company is exploring the use of Artificial Intelligence (AI) for business development. Potential applications include product development and application science.

Ascent Industries launched its new corporate headquarters in Schaumburg, Illinois, in August 2024. This move signals a focus on collaboration and long-term growth.

These advancements in product innovation and operational technology contribute directly to the company's growth objectives. They enable Ascent Industries to meet evolving customer demands and improve overall profitability.

Ascent Industries' Growth Strategy is focused on innovation and technology to drive sustained expansion. This includes strategic investments and leveraging cutting-edge technologies to enhance its competitive advantages. These initiatives aim to meet market trends and improve overall profitability.

- R&D Focus: Expanding specialty chemicals offerings and creating tailored formulations.

- Sustainability: Developing bio-based chemistries, such as defoamers.

- Digital Transformation: Reinvesting in automation to improve efficiency.

- AI Integration: Exploring AI for business development and product innovation.

- Collaboration: Working closely with customers to meet their specific needs.

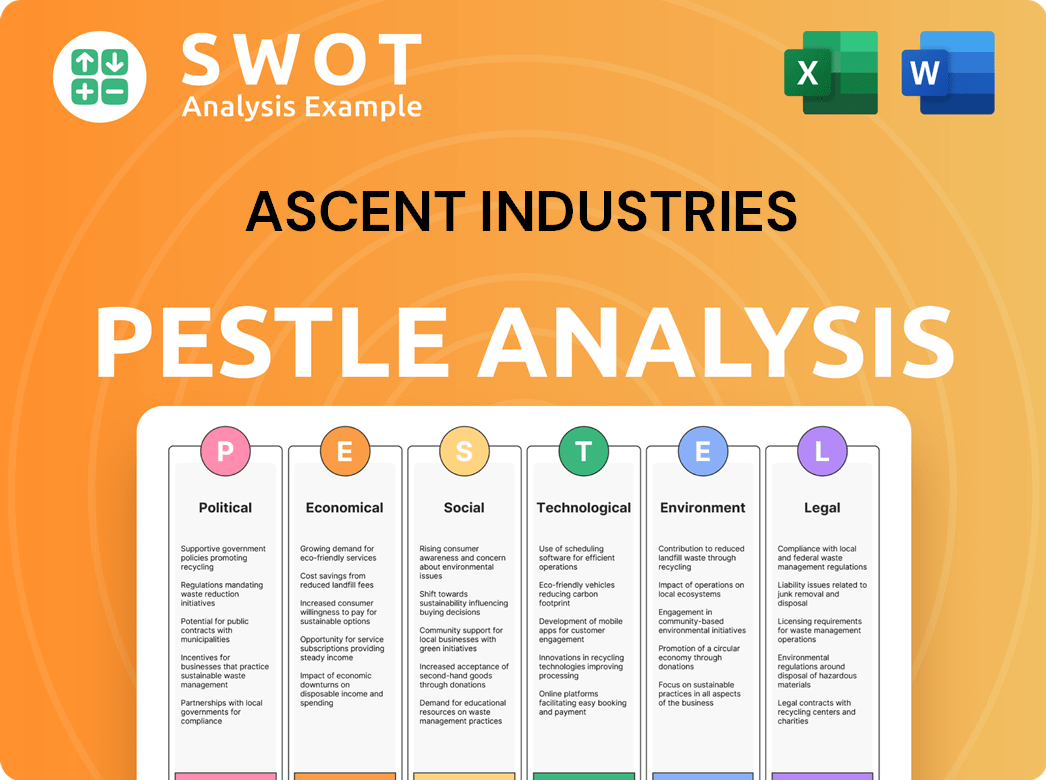

Ascent Industries PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Ascent Industries’s Growth Forecast?

The financial outlook for Ascent Industries is centered on a strategic shift toward higher-margin opportunities and disciplined cost management. The company's approach aims to improve profitability and drive sustainable Growth Strategy. This strategic direction is crucial for realizing its Future Prospects in a competitive market.

In Q1 2025, the company experienced a decrease in net sales from continuing operations, yet it achieved a significant improvement in gross profit. This improvement underscores the effectiveness of its cost management and product optimization strategies. The focus on higher-margin opportunities is a key element of its Business Development initiatives.

The company's financial performance in Q1 2025 shows a positive trajectory. Despite lower overall sales volumes, Ascent Industries managed to improve its gross profit and reduce its net loss. This financial discipline sets a solid foundation for future expansion and growth. For more information on how the company is approaching its market, consider reading about Marketing Strategy of Ascent Industries.

Net sales from continuing operations were $24.7 million, down from $28.0 million in Q1 2024. Gross profit rose to $4.8 million (19.4% of net sales) in Q1 2025, compared to $2.3 million (8.2% of net sales) in Q1 2024. The net loss improved to $1.0 million, or $0.10 diluted loss per share, from a $5.5 million loss, or $0.37 diluted loss per share, in Q1 2024.

Adjusted EBITDA from continuing operations significantly increased to $0.8 million in Q1 2025. This is a substantial improvement from a $2.7 million loss in the prior year period. The adjusted EBITDA margin was 3.4%, up from a negative 9.6% in Q1 2024.

As of Q1 2025, Ascent ended the quarter with $14.3 million in cash and no debt prior to the sale of Bristol Metals. This financial position offers considerable strategic flexibility for future investments and growth initiatives.

Ascent is targeting significant growth in its Specialty Chemicals segment, aiming for $80 million to $120 million by 2030. The company anticipates a growth ramp in the second half of 2025 and plans to shift its product mix towards higher-margin opportunities. This focus aligns with Market Trends.

Ascent Industries' financial performance in Q1 2025 reflects a strategic shift towards profitability and growth. The company's focus on cost management and higher-margin opportunities is evident in its improved gross profit and adjusted EBITDA. The sale of Bristol Metals has provided the company with substantial strategic flexibility.

- Improved gross profit margins.

- Reduced net loss from continuing operations.

- Significant increase in adjusted EBITDA.

- Strong cash position for future investments.

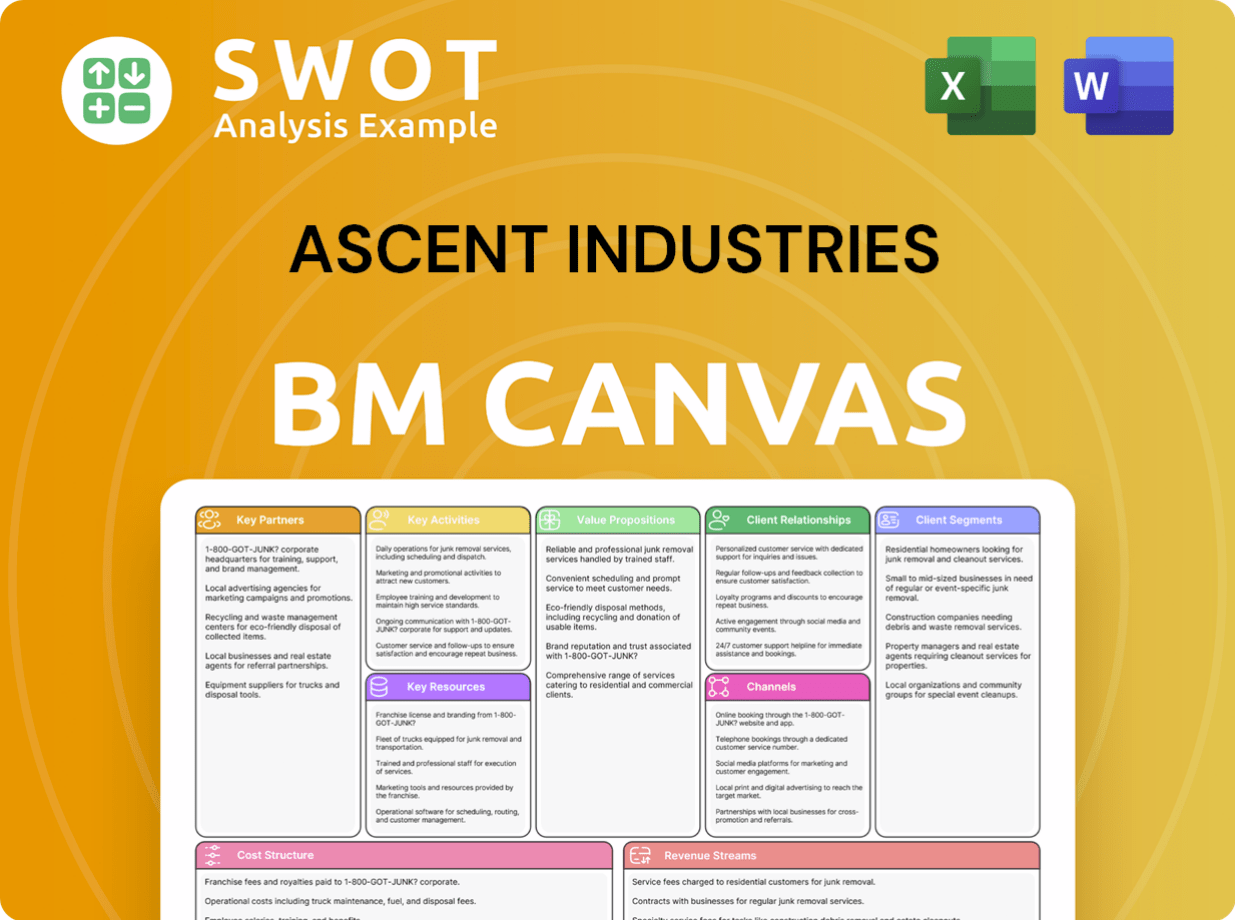

Ascent Industries Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Ascent Industries’s Growth?

The path to growth for Ascent Industries, like any company, isn't without its potential pitfalls. Several factors could impede Ascent Industries' Growth Strategy and affect its Future Prospects. Understanding these risks is crucial for investors and stakeholders looking at the company's long-term potential. A thorough Company Analysis reveals these challenges, which management must address strategically.

Market competition presents a significant hurdle, particularly in the Specialty Chemicals market. The intensity of competition and the possibility of excess manufacturing capacity in the stainless steel industry can lead to price reductions, affecting profitability. Also, Ascent Industries' reliance on a limited number of major customers in its Specialty Chemicals segment, where the top 15 customers accounted for approximately 53% of revenues in 2024, presents a risk. Any adverse changes in these relationships could substantially impact operations.

Regulatory changes, especially in environmental regulations related to chemicals manufacturing, could increase compliance costs. Supply chain vulnerabilities, including potential impacts from the tariff environment and reliance on domestic raw materials, could affect costs and availability. While Ascent Industries has focused on strategic sourcing to build resilience in its supply chain, these risks persist. Technological disruption and the effective launch of new or enhanced products also present challenges, as market acceptance and unforeseen delays can impact success. For a deeper dive into the target audience, you can read more about the Target Market of Ascent Industries.

Intense competition in the Specialty Chemicals market could reduce selling prices and affect profitability. The competitive landscape requires constant monitoring and adaptation. Strategies to maintain or increase market share are essential for sustained Business Development.

A significant portion of revenue comes from a limited number of customers. In 2024, the top 15 customers accounted for roughly 53% of revenues. This concentration increases the risk from changes in these relationships.

Changes in environmental regulations could increase compliance costs. The chemicals manufacturing industry faces ongoing scrutiny. Adapting to new regulations is a continuous challenge.

Supply chain disruptions and reliance on domestic raw materials can affect costs and availability. Strategic sourcing is crucial to mitigate these risks. The tariff environment also poses risks.

The ability to launch new or enhanced products effectively is crucial. Market acceptance and unforeseen delays can impact success. Continuous innovation is essential for Growth Strategy.

Continued soft market conditions could impact sales and profitability. Management focuses on stabilization initiatives, including cost management and operational efficiencies. The sale of Bristol Metals, LLC, for $45 million in April 2025, aimed to streamline operations and boost liquidity.

Ascent Industries has implemented aggressive cost management strategies. Product line optimization and operational efficiencies are key. These initiatives aim to improve profitability.

The sale of Bristol Metals, LLC, for $45 million in April 2025, reduced debt and boosted liquidity. This provides flexibility to mitigate risks. It also allows for pursuing new Growth Strategy opportunities.

Management prepares for risks through disciplined execution and continuous process improvements. A strategic pivot to higher-margin products is underway. This helps to offset potential challenges.

The company must adapt to changing Market Trends. Understanding and responding to these trends is essential. This includes adapting to customer needs and technological advancements.

Ascent Industries Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Ascent Industries Company?

- What is Competitive Landscape of Ascent Industries Company?

- How Does Ascent Industries Company Work?

- What is Sales and Marketing Strategy of Ascent Industries Company?

- What is Brief History of Ascent Industries Company?

- Who Owns Ascent Industries Company?

- What is Customer Demographics and Target Market of Ascent Industries Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.