Ascent Industries Bundle

How Does Ascent Industries Work?

Ascent Industries, a 75-year-old diversified industrial manufacturing company, has recently pivoted towards its specialty chemicals segment, now representing over 60% of its revenue. This strategic shift, coupled with a notable improvement in gross margin to 19.3% in Q1 2025, signals a compelling story of adaptation and resilience. Understanding Ascent Industries SWOT Analysis is key to grasping its current position.

This exploration will delve into the Ascent Industries business model, examining its Ascent Industries services and Ascent Industries operations. We'll analyze how Ascent Industries creates value, generates revenue, and aims to thrive in a dynamic industrial landscape. From Ascent Industries financial performance to its Ascent Industries industry position, this analysis provides actionable insights for investors and industry observers alike, answering the question: What does Ascent Industries do?

What Are the Key Operations Driving Ascent Industries’s Success?

The core operations of the Ascent Industries company revolve around creating and delivering value through specialty chemicals and industrial tubular products. Their strategic focus is primarily on specialty chemicals. They provide custom solutions and manufactured components, catering to diverse customer segments across industries like paints and coatings, personal care, oil and gas, and pulp and paper.

Their operational processes include metal fabrication, precision machining, and assembly services. They utilize advanced capabilities such as Swiss-style machining, 3D printing, precision CNC turning and milling, and fiber laser and waterjet cutting. This allows them to produce high-accuracy parts and components. A significant competitive advantage is their emphasis on domestic raw material sourcing, especially important in the current economic climate.

The company's approach involves fostering an entrepreneurial culture, implementing continuous process improvements for cost reduction and margin enhancement, and investing in research and development to expand its specialty chemical offerings. This innovation includes developing tailored formulations in close collaboration with customers.

The company's operational processes include metal fabrication, precision machining, and assembly services. They use advanced technologies like Swiss-style machining, 3D printing, and CNC turning and milling. These capabilities enable the production of high-accuracy parts and components.

The value proposition centers on solving complex technical problems for customers, fostering long-term relationships. They offer custom toll and contract manufacturing, providing flexible and scalable solutions. This approach streamlines production and accelerates product development.

Customers benefit from the company's ability to solve complex technical problems, leading to 'sticky' sales and long-term relationships. They also offer custom toll and contract manufacturing capabilities. This provides flexible and scalable solutions for production streamlining and accelerated product development.

A key competitive advantage is the emphasis on domestic raw material sourcing, which is crucial in the face of potential tariffs. The company's entrepreneurial culture and continuous process improvements also contribute to its success. They invest in R&D to expand their specialty chemical offerings.

The company's strengths lie in its ability to provide custom solutions and manufactured components. They focus on specialty chemicals and industrial tubular products, serving diverse industries. Their operational processes include metal fabrication and precision machining.

- Emphasis on domestic raw material sourcing.

- Entrepreneurial culture and continuous process improvements.

- Investment in research and development for specialty chemicals.

- Custom toll and contract manufacturing capabilities.

The company's core capabilities translate into customer benefits through their ability to solve complex technical problems. This leads to 'sticky' sales and long-term relationships. For example, in 2024, the oil and gas segment, with a new technical sales representative, rapidly developed and tested new formulations for a customer, resulting in $5-6 million of new business. The company also offers custom toll and contract manufacturing capabilities, providing flexible and scalable solutions for production streamlining and accelerated product development. To learn more about the company's strategic approach, consider reading about the Growth Strategy of Ascent Industries.

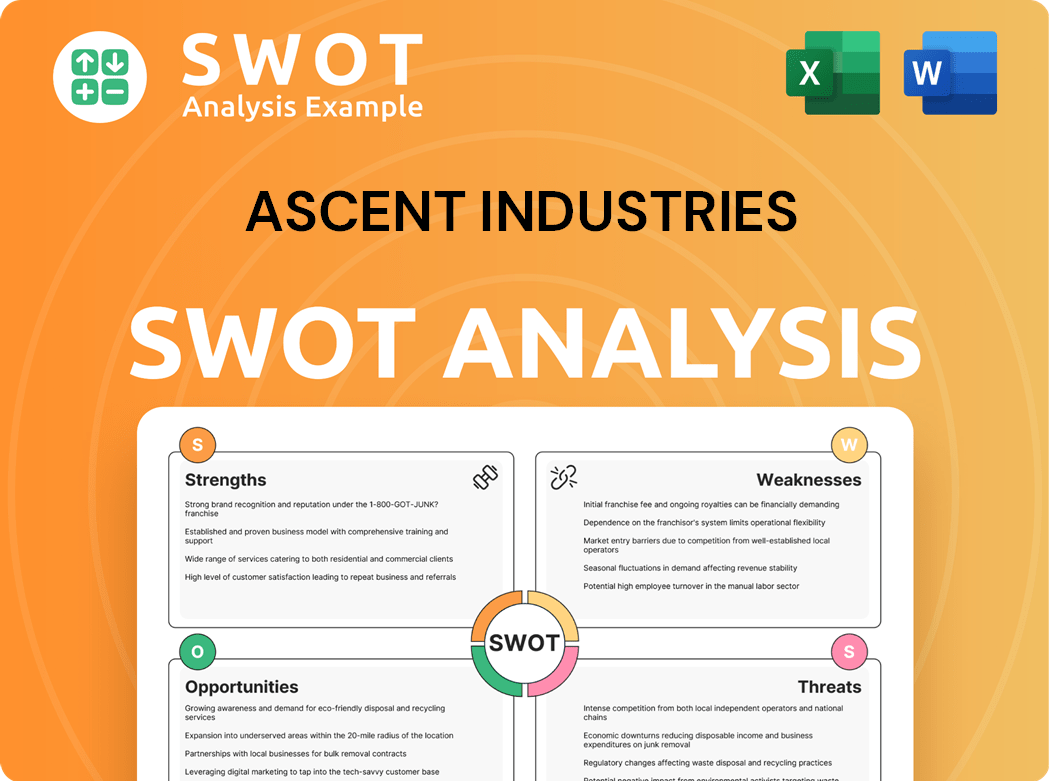

Ascent Industries SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Ascent Industries Make Money?

The core of how Ascent Industries works revolves around its revenue generation and monetization strategies. The company primarily operates through two key segments: Specialty Chemicals and Tubular Products. A significant shift towards specialty chemicals has been a strategic focus, influencing sales and profitability.

In Q1 2025, Ascent Industries reported net sales of $24.7 million from continuing operations. This reflects a strategic realignment aimed at enhancing profitability. The company's approach focuses on optimizing product mix and managing costs to improve overall financial performance.

Ascent Industries's monetization strategies are designed to boost profitability even with fluctuations in sales volume. This is evident in the significant increase in gross profit to $4.8 million in Q1 2025, up 108.7% from Q1 2024, with the gross profit margin expanding to 19.4% from 8.2%.

Ascent Industries generates revenue through two main segments: Specialty Chemicals and Tubular Products. The company is strategically shifting towards higher-margin opportunities within the specialty chemicals segment. This strategic shift is part of a broader plan to improve financial performance.

- In Q1 2025, the Specialty Chemicals segment contributed $17.8 million to net sales, a 12.3% decrease from Q1 2024.

- The Tubular Products segment recorded net sales of $6.9 million in Q1 2025, down from $7.7 million in Q1 2024.

- For the full year 2024, Ascent Industries reported net sales of $177.9 million, a decrease of 7.9% from $193.2 million in 2023.

- The trailing twelve-month revenue for Ascent Industries as of March 31, 2025, was $158 million.

- Ascent Industries secured a multi-year contract in the specialty chemicals segment expected to generate over $750,000 in additional annual EBITDA, representing a 10% year-over-year increase for that segment.

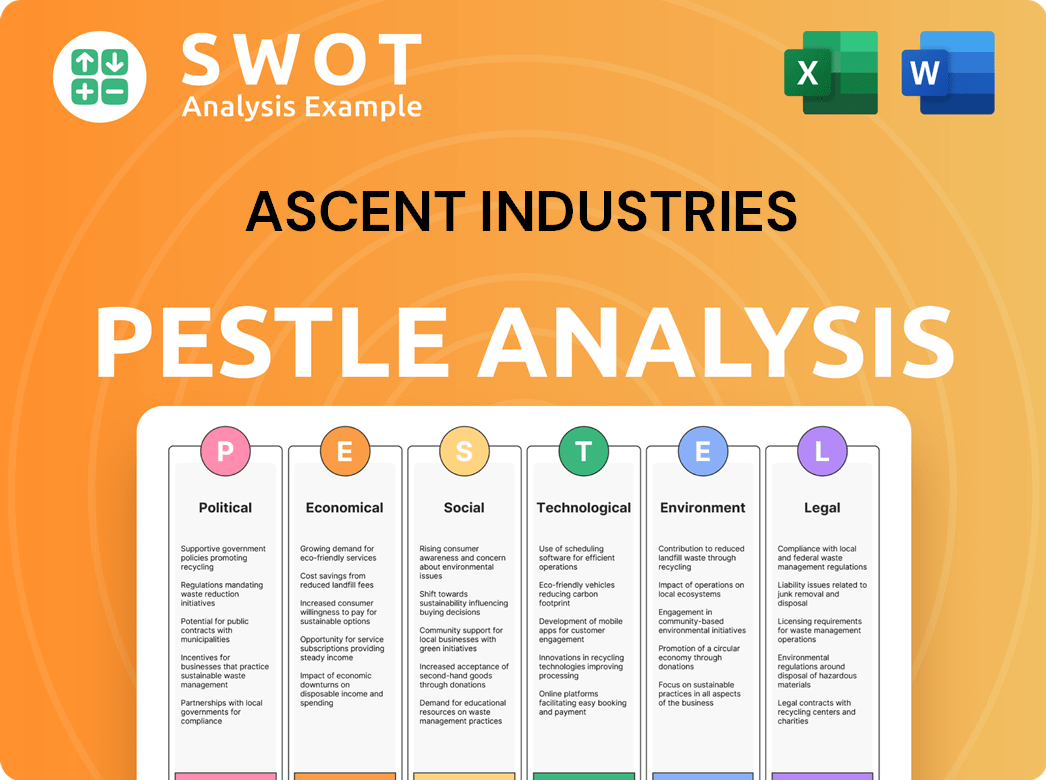

Ascent Industries PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Ascent Industries’s Business Model?

The journey of Ascent Industries has been marked by strategic shifts and significant milestones. The company has focused on streamlining operations and concentrating on its core specialty chemicals business. Recent moves, such as the divestiture of its tubular products division in late 2023 and the sale of Bristol Metals, LLC in April 2025, highlight this strategic realignment.

Ascent Industries has also demonstrated its commitment to growth and collaboration. The launch of a new corporate headquarters in Schaumburg, Illinois, in August 2024, is a clear indication of its focus on long-term expansion. Furthermore, the securing of a multi-year specialty chemicals contract, projected to add over $750,000 in annual EBITDA, underlines the company's growth trajectory within its core business segment.

Despite facing operational challenges, including market volatility, Ascent Industries has implemented effective strategies to improve financial performance. These include aggressive cost management, product line optimization, and operational efficiencies. The company's proactive measures have led to a notable improvement in gross profit and adjusted EBITDA, as seen in Q1 2025, where adjusted EBITDA improved to $0.8 million from a loss of $2.7 million in Q1 2024.

Divestiture of tubular products division in late 2023 for $55 million. Sale of substantially all assets of Bristol Metals, LLC for $45 million in April 2025. Launch of a new corporate headquarters in Schaumburg, Illinois, in August 2024.

Focus on the specialty chemicals business, which now accounts for over 60% of revenue. Securing a multi-year specialty chemicals contract projected to add over $750,000 in annual EBITDA. Implementation of cost management and operational efficiencies to improve financial performance.

Emphasis on domestic raw material supply to mitigate risks. Focus on innovation and an entrepreneurial culture. Customer-centric approach with tailored formulations and continuous process improvements.

Adjusted EBITDA improved to $0.8 million in Q1 2025 from a loss of $2.7 million in Q1 2024. The specialty chemicals segment is projected to increase by 10% year-over-year due to the new contract.

Ascent Industries distinguishes itself through several key competitive advantages. The company's emphasis on domestic raw material supply reduces risks associated with tariffs and supply chain disruptions. The company's ability to onshore essential ingredient supply chains also provides a significant advantage.

- Focus on domestic raw materials to mitigate risks.

- Investment in innovation and R&D for tailored customer formulations.

- Customer-centric approach with a focus on higher-margin products.

- Exploring AI for business and product development.

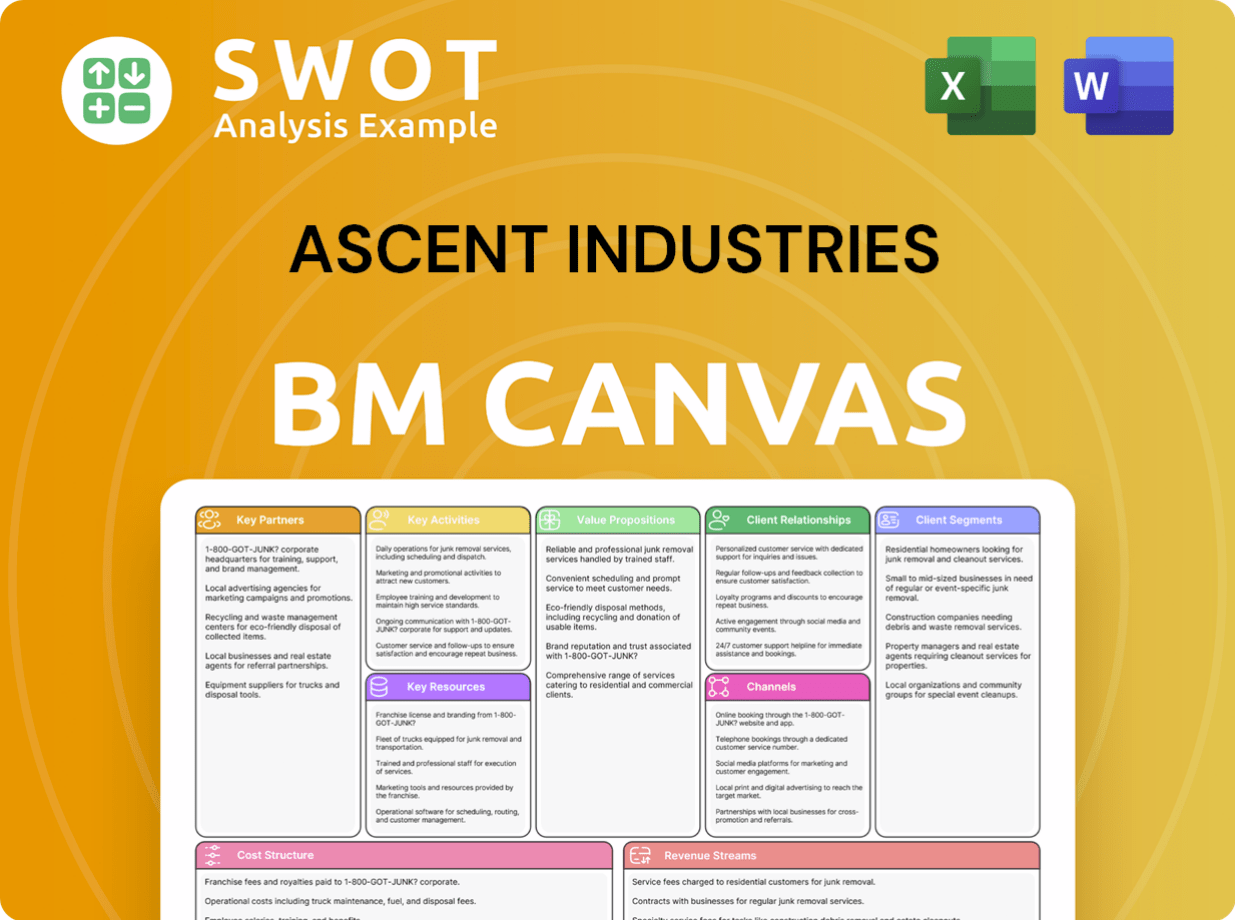

Ascent Industries Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Ascent Industries Positioning Itself for Continued Success?

The company, Ascent Industries, is currently repositioning itself within the industrial manufacturing sector, focusing on becoming a specialty chemical company. This strategic shift aims to strengthen its competitive position. Ascent operates in a competitive industry. A 'Moat Score' of 3 out of 10, as assessed by GuruFocus, suggests 'No Moat - Very weak/transient advantages'.

Key risks and headwinds include soft market conditions and competitive pressures in the specialty chemicals market. Over-reliance on the specialty chemicals segment also poses execution risks. Looking ahead, Ascent Industries is targeting significant growth in its Specialty Chemicals segment, aiming for $80 million to $120 million in revenue by 2030. The company is also open to inorganic growth opportunities, aiming to accelerate its growth path through potential acquisitions.

Ascent Industries is aiming to become a pure-play specialty chemical company, which is a strategic move to enhance its market position. The company is trying to provide unique, customized solutions. The Brief History of Ascent Industries shows its evolution.

The company faces risks such as soft market conditions and competitive pressures within the specialty chemicals market. Over-reliance on the specialty chemicals segment also creates execution risks. Commodity price fluctuations and environmental regulations could also impact margins and compliance costs.

Ascent Industries is aiming for substantial growth in its Specialty Chemicals segment, with a revenue target of $80 million to $120 million by 2030. The company plans to shift its product mix towards higher-margin opportunities. Strategic initiatives include fostering an entrepreneurial culture and investing in R&D.

The company highlights its ability to provide unique, customized solutions. It also emphasizes its commitment to domestic manufacturing. These factors differentiate Ascent from competitors in the specialty chemicals market.

Ascent Industries Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Ascent Industries Company?

- What is Competitive Landscape of Ascent Industries Company?

- What is Growth Strategy and Future Prospects of Ascent Industries Company?

- What is Sales and Marketing Strategy of Ascent Industries Company?

- What is Brief History of Ascent Industries Company?

- Who Owns Ascent Industries Company?

- What is Customer Demographics and Target Market of Ascent Industries Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.