Ascent Industries Bundle

Who Really Controls Ascent Industries?

Unraveling the Ascent Industries SWOT Analysis reveals a complex web of stakeholders. Understanding Ascent Industries ownership is crucial for investors and strategists alike. This deep dive explores the evolution of Ascent Industries, from its roots to its current structure, offering critical insights into its future.

The ownership structure of Ascent Industries Co. is a key factor in understanding its strategic direction and market performance. Tracing the Ascent Industries SWOT Analysis reveals the influence of its major shareholders, from individual investors to institutional players. Examining the Ascent Industries history and the current owner of Ascent Industries provides a comprehensive view of the company's governance and potential for growth, considering factors like Ascent Industries executives and the board of directors.

Who Founded Ascent Industries?

The story of Ascent Industries Co. begins in 1945 with the founding of Blackman Uhler Industries Inc., a chemical manufacturing business. This initial venture laid the groundwork for what would become the company we know today. The company was later incorporated in 1958, marking a significant step in its evolution.

While the original founders of Blackman Uhler Industries Inc. set the stage, specific details about the initial equity split or shareholding percentages are not readily available in recent public filings. The company's executive office is currently located at 1400 16th Street, Suite 270, Oak Brook, Illinois 60523.

Unfortunately, information about early backers, angel investors, or family members who acquired stakes during the early phases of Blackman Uhler Industries Inc., or its incorporation as Synalloy Corporation, is not detailed in recent public records. Similarly, early agreements like vesting schedules or founder exit strategies from the company's early stages are not publicly disclosed in recent financial reports. The focus of available information is primarily on the company's current structure and more recent ownership changes.

Ascent Industries' history starts with Blackman Uhler Industries Inc. in 1945. The company was incorporated in 1958, setting the stage for its future.

Specific details about the original founders' equity or shareholding are not available in recent public filings. The company's initial focus was on chemical manufacturing.

Information on early backers or angel investors from the initial phase of Blackman Uhler Industries Inc. is not detailed in recent public records.

The company's executive office is located at 1400 16th Street, Suite 270, Oak Brook, Illinois 60523.

Early agreements, like vesting schedules, are not publicly disclosed in recent financial reports. The focus is on the current structure.

The available information primarily focuses on the company's current structure and more recent ownership changes.

Understanding the Revenue Streams & Business Model of Ascent Industries provides additional context to the company's evolution. While specific details about the early ownership structure of Ascent Industries are limited in public records, it's clear that the company's roots are in chemical manufacturing. The current ownership structure and major shareholders are more readily available in the company's recent financial reports. The headquarters location in Oak Brook, Illinois, serves as the central hub for the company's operations. Further details about the Ascent Industries ownership structure can be found in their investor relations materials.

The early history of Ascent Industries is marked by the founding of Blackman Uhler Industries Inc. in 1945, which later became incorporated in 1958.

- Specific details about the original founders' equity are not available in recent public filings.

- Information on early investors is not detailed in recent public records.

- The company's executive office is located in Oak Brook, Illinois.

- Available information focuses on the current structure and recent ownership changes.

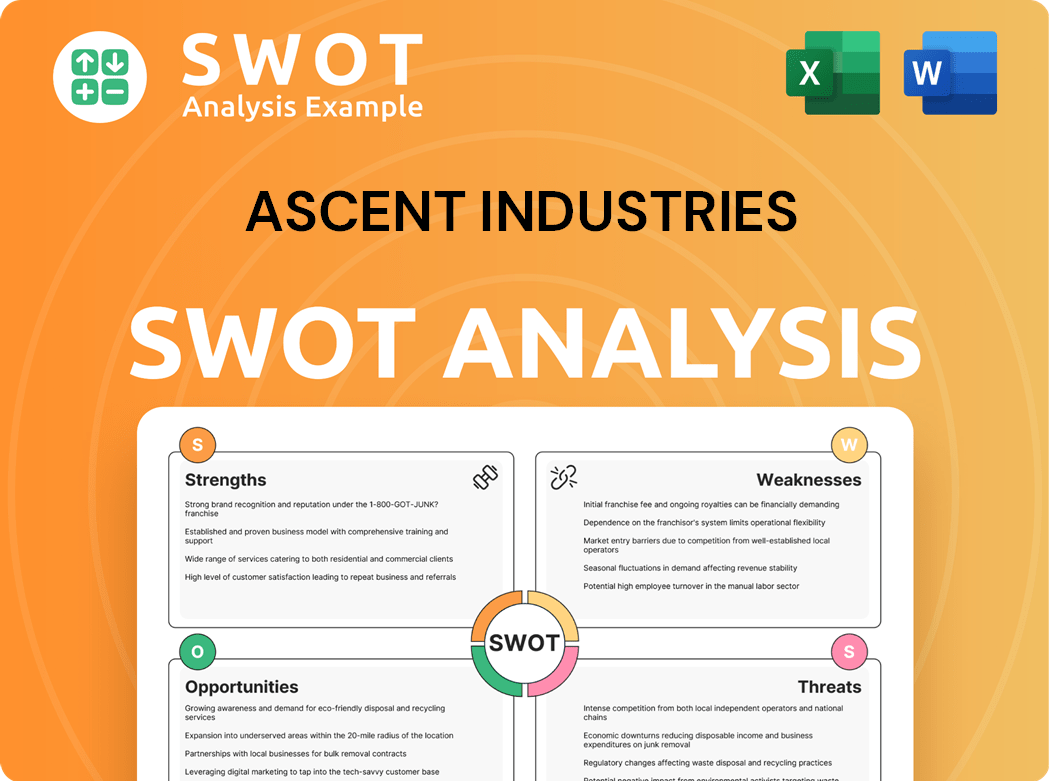

Ascent Industries SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Ascent Industries’s Ownership Changed Over Time?

The company, now known as Ascent Industries, has a history that dates back to its initial public offering on March 16, 1980. Formerly operating as Synalloy Corporation, the company rebranded in August 2022. This evolution in identity reflects shifts in strategy and potentially, the company's ownership structure over time.

Recent strategic moves, such as the sale of Bristol Metals, LLC ('BRISMET') for $45 million in April 2025, and the earlier sale of Specialty Pipe & Tube ('SPT') in December 2023 for approximately $55 million, are key events. These actions impact the company's financial profile, which can influence investor confidence and potentially alter the ownership dynamics.

| Ownership Category | Percentage of Shares (May 2025) | Notes |

|---|---|---|

| Individual Investors | Approximately 36% | Largest ownership group. |

| Institutional Investors | Approximately 31.87% | Significant influence. |

| Hedge Funds | Approximately 9.9% | Impact on trading and strategy. |

| Private Equity Firms | Approximately 7.8% | Influence on board and direction. |

As of May 2025, individual investors hold the largest stake at approximately 36%. Institutional investors follow closely, controlling around 31.87% of the shares. Hedge funds and private equity firms also have notable positions, influencing the company's strategic direction. These ownership dynamics are crucial for understanding the company's strategic direction and future prospects. For more details, you can check out this article about Ascent Industries company profile.

Ownership of Ascent Industries is diverse, with individual and institutional investors holding significant shares.

- Individual investors hold the largest portion of shares.

- Institutional investors and hedge funds also have substantial holdings.

- Strategic sales, like BRISMET and SPT, can influence investor confidence.

- Mink Brook Asset Management LLC is a major institutional shareholder.

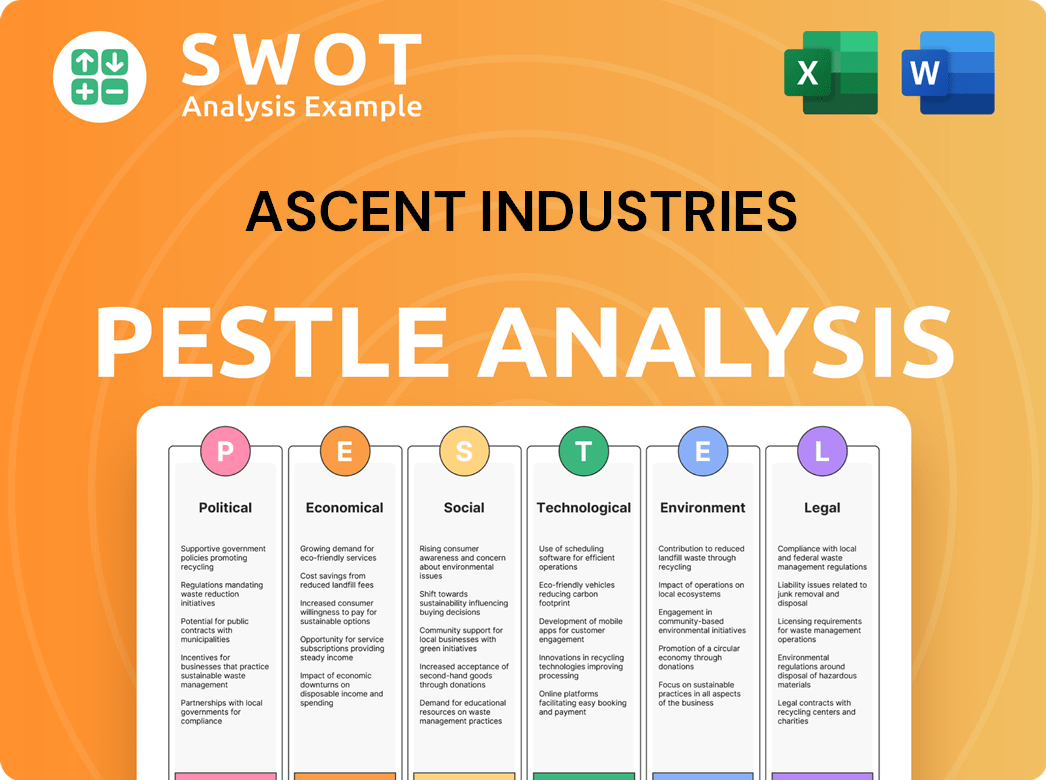

Ascent Industries PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Ascent Industries’s Board?

As of December 31, 2024, the Board of Directors of Ascent Industries included five members. These members were Henry L. Guy, Christopher G. Hutter, Benjamin Rosenzweig, John P. Schauerman, and Aldo J. Mazzaferro. Henry L. Guy, Aldo J. Mazzaferro, and John P. Schauerman were deemed independent directors, according to Nasdaq rules. Benjamin Rosenzweig serves as the Executive Chairman, and Christopher G. Hutter is a Board Member and a Co-Founder and Manager of UPG Enterprises LLC. Henry L. Guy is the Chief Investment Officer for Pittco Management LLC. John P. Schauerman brings expertise in operational, financial, and strategic planning. Aldo J. Mazzaferro has extensive experience in the steel and metals industries.

The composition of the board reflects a mix of financial, operational, and industry-specific expertise. This diverse background is crucial for guiding Ascent Industries' strategic direction and ensuring effective governance. Understanding the Competitors Landscape of Ascent Industries is also vital for the board's decision-making process.

| Board Member | Title | Affiliation |

|---|---|---|

| Henry L. Guy | Chief Investment Officer | Pittco Management LLC |

| Christopher G. Hutter | Board Member | UPG Enterprises LLC |

| Benjamin Rosenzweig | Executive Chairman | Privet Fund Management LLC |

| John P. Schauerman | Board Member | N/A |

| Aldo J. Mazzaferro | Board Member | N/A |

The voting structure for Ascent Industries common stock is straightforward, with each share carrying one vote. Shareholders can vote in person at the Annual Meeting or by proxy. Beneficial owners must follow their nominee's instructions. Participants in the 401(k) Plan can direct the trustee on how to vote their shares. If no instructions are provided by the June 5, 2025, deadline, the company instructs the trustee to vote 'FOR' all director nominees and other proposals. As of March 18, 2025, key executives and board members held significant shares. CEO J. Bryan Kitchen owned 0.6% of the company's shares. Christopher G. Hutter had direct and indirect ownership. Benjamin Rosenzweig and John P. Schauerman each held 1.04% of the shares. Henry L. Guy held 0.76%, and Aldo J. Mazzaferro, Jr. held 0.15%.

Understanding the ownership structure of Ascent Industries is key to assessing its governance and potential for growth. The board's composition, coupled with the voting structure, provides insights into how decisions are made.

- The board includes independent directors, ensuring a degree of objectivity.

- Shareholders have clear voting options, including proxy voting.

- Key executives and board members hold significant shares, aligning their interests with those of the company.

- The 401(k) Plan's voting mechanism ensures employee participation in governance.

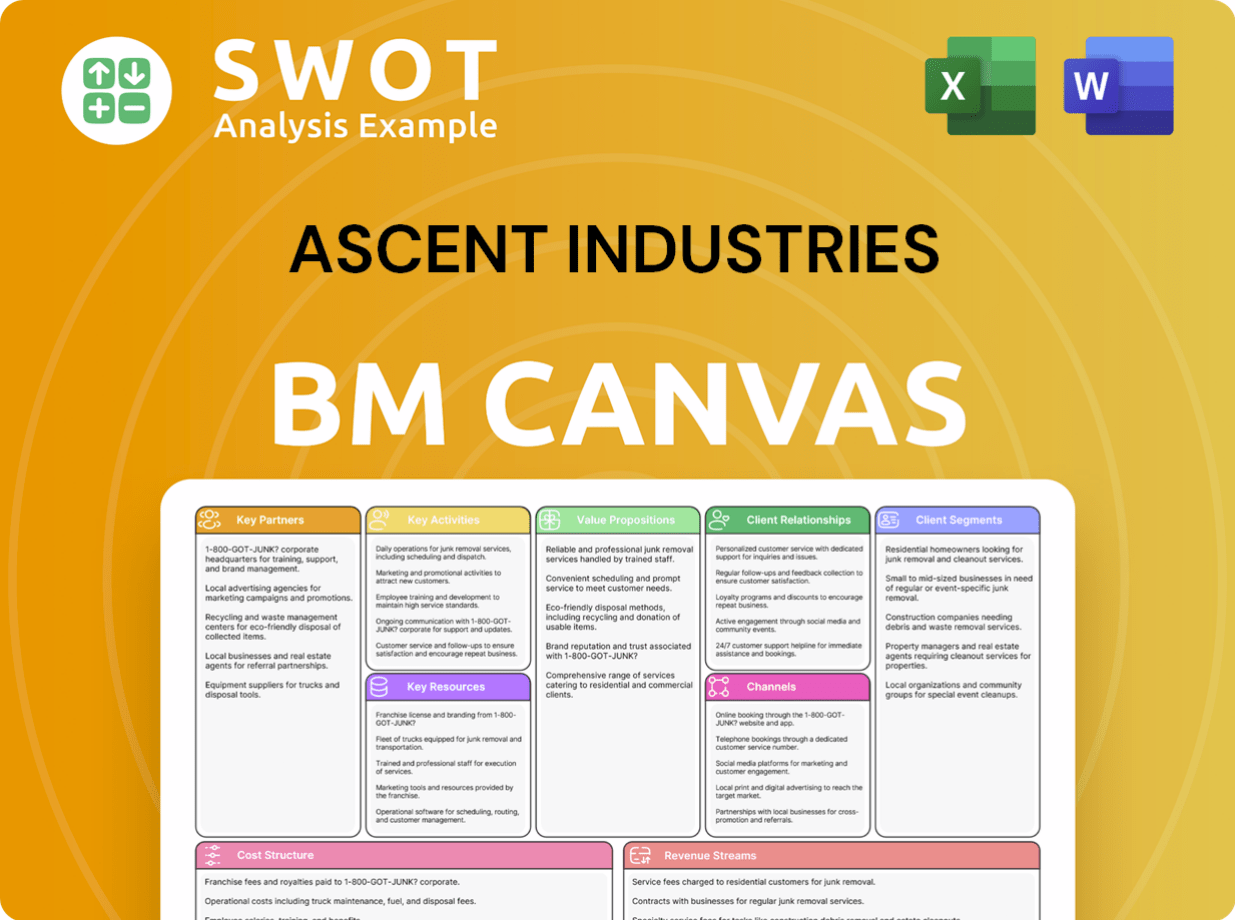

Ascent Industries Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Ascent Industries’s Ownership Landscape?

Over the past few years, Ascent Industries has undergone significant strategic changes that have affected its ownership profile. A key move was the sale of substantially all assets of Bristol Metals, LLC (BRISMET) for $45 million in cash on April 4, 2025. This transaction, along with the earlier sale of Specialty Pipe & Tube (SPT) assets in December 2023 for approximately $55 million, highlights the company's efforts to streamline operations and concentrate on its core assets, particularly specialty chemicals and industrial tubular products. These actions demonstrate a strategic shift in the Growth Strategy of Ascent Industries.

In May 2025, institutional investors held steady at 31.87% of Ascent Industries' shares, while insider holdings slightly increased from 8.04% to 8.08%. Mutual funds' holdings also remained unchanged at 18.83%. As of March 2025, individual investors held the largest stake at 36%, followed by institutions at 29% and hedge funds at 9.9%. Private equity firms held 7.8% of the company. The company has also engaged in share buybacks, repurchasing 101,263 shares in 2024.

| Ownership Category | March 2025 | May 2025 |

|---|---|---|

| Individual Investors | 36% | - |

| Institutional Investors | 29% | 31.87% |

| Hedge Funds | 9.9% | - |

| Private Equity | 7.8% | - |

| Insider Holdings | - | 8.08% |

| Mutual Funds | - | 18.83% |

For Q1 2025, Ascent Industries reported net sales of $24.7 million, a decrease from $28.0 million in Q1 2024. Despite this, gross profit significantly increased by 108.7% to $4.8 million, with a gross profit margin of 19.4%. Adjusted EBITDA improved to $0.8 million in Q1 2025 from a loss of $2.7 million in Q1 2024. The 2025 Annual Meeting of Stockholders, initially set for June 11, 2025, was adjourned and will reconvene on June 25, 2025, indicating ongoing governance processes.

Individual investors held the largest stake as of March 2025, demonstrating the company's broad shareholder base.

The sales of BRISMET and SPT assets reflect a strategic focus on core business areas.

Improved gross profit and adjusted EBITDA in Q1 2025 signal positive financial trends.

The adjourned Annual Meeting of Stockholders suggests ongoing shareholder engagement and governance.

Ascent Industries Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Ascent Industries Company?

- What is Competitive Landscape of Ascent Industries Company?

- What is Growth Strategy and Future Prospects of Ascent Industries Company?

- How Does Ascent Industries Company Work?

- What is Sales and Marketing Strategy of Ascent Industries Company?

- What is Brief History of Ascent Industries Company?

- What is Customer Demographics and Target Market of Ascent Industries Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.