Ascent Industries Bundle

How is Ascent Industries Revolutionizing Its Sales and Marketing Approach?

Ascent Industries Company is undergoing a pivotal transformation, shifting from diversified manufacturing to a specialty chemicals powerhouse. This strategic pivot, highlighted by a major contract secured in April 2025, is poised to significantly boost EBITDA and redefine its market presence. But how is Ascent Industries adapting its Ascent Industries SWOT Analysis, sales and marketing strategies to capitalize on this exciting new chapter?

This exploration will uncover Ascent Industries' evolving sales strategy, examining how it's navigating the complexities of the industrial landscape. We'll also analyze the company's marketing strategy, including its brand positioning and customer acquisition strategies. Understanding Ascent Industries' approach to business development and its sales and marketing efforts is crucial for investors and industry watchers alike, especially considering the company's recent positive financial performance and focus on specialty chemicals.

How Does Ascent Industries Reach Its Customers?

The sales strategy of Ascent Industries centers on direct sales, particularly within its industrial client base. This approach is essential for delivering custom solutions and manufactured components, which are key offerings. Their focus on long-term, high-value agreements, especially in the Specialty Chemicals segment, highlights a B2B sales model rather than broad retail or e-commerce channels.

Ascent Industries' marketing strategy is closely aligned with its sales approach. The company emphasizes building strong, direct relationships with customers. This strategy is crucial for the specialized industrial manufacturing sector, where tailored solutions and deep customer relationships are vital. The company's participation in industry conferences further supports its sales and marketing efforts.

The company's strategic shift towards becoming a specialty chemicals company has significantly influenced its sales channels. The streamlining of operations and the divestiture of non-core assets, such as the sale of Bristol Metals, LLC for $45 million in April 2025, have allowed Ascent Industries to concentrate on its core business. This strategic move has freed up resources to focus on the Specialty Chemicals business, which now accounts for over 60% of revenue.

Ascent Industries primarily uses direct sales to reach its industrial clients. This approach is ideal for offering custom solutions and building strong customer relationships. This strategy is particularly effective in the specialty chemicals sector.

The company's business model is centered around securing long-term, high-value agreements. This highlights a strong emphasis on direct B2B sales relationships. This approach is crucial for the specialized industrial manufacturing sector.

The company is transforming into a pure-play specialty chemicals company. This involves streamlining operations and divesting non-core assets. This strategic shift allows for a more concentrated, high-margin product mix.

Ascent Industries participates in investor conferences to communicate its strategic direction. This helps in building relationships with potential investors and partners. These activities indirectly support future sales and market presence.

Ascent Industries' sales strategy is heavily reliant on direct interaction with clients, ensuring tailored solutions. The marketing strategy supports this by focusing on building strong relationships and communicating the company's strategic direction. The company is focusing on the Specialty Chemicals business, which now accounts for over 60% of revenue.

- Direct Sales: Focusing on direct sales to industrial clients for custom solutions.

- Long-Term Agreements: Securing high-value, long-term contracts.

- Strategic Shift: Streamlining operations and divesting non-core assets.

- Industry Engagement: Participating in conferences to communicate strategy.

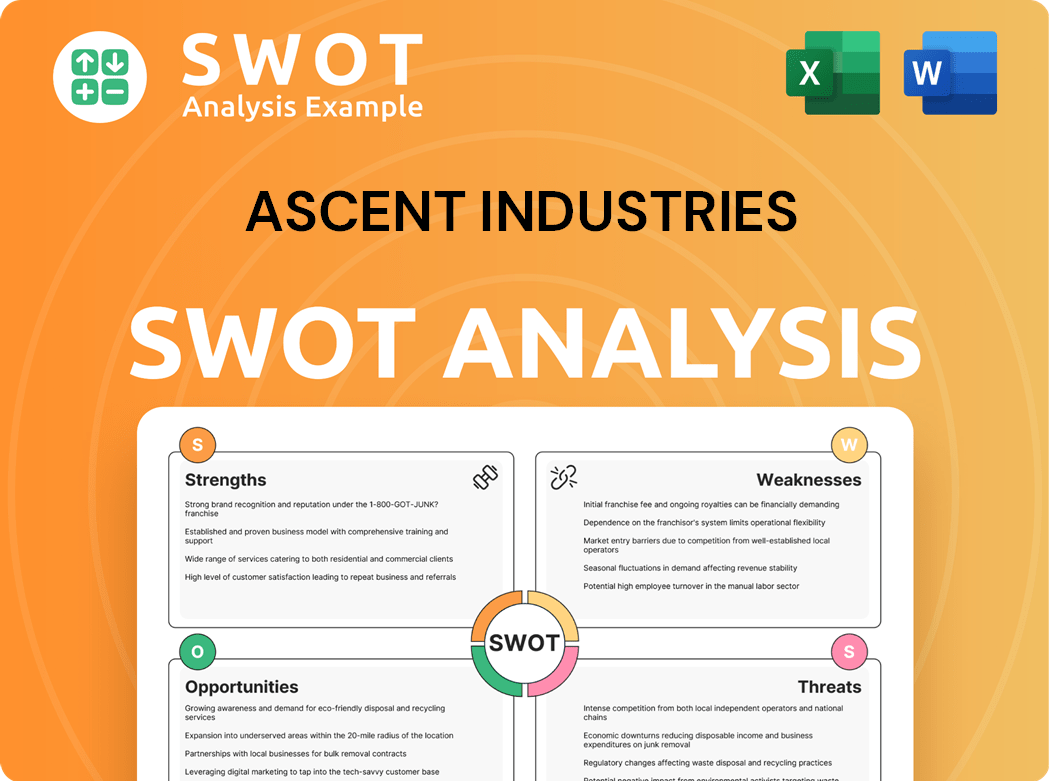

Ascent Industries SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Marketing Tactics Does Ascent Industries Use?

The company, Ascent Industries, employs a strategic mix of marketing tactics to build awareness, generate leads, and drive sales within the industrial sector. Their approach increasingly focuses on digital strategies and thought leadership, aligning with 2025 industrial marketing trends. This includes a strong emphasis on content marketing, SEO, and targeted digital advertising to reach its target audience effectively.

Ascent Industries' marketing strategy is designed to position itself as an industry expert. This is crucial for B2B buyers who need guidance through complex decisions. The company likely uses technical blog posts, detailed case studies, and informative white papers to showcase its expertise in metal fabrication, precision machining, and specialty chemicals, enhancing its Sales and marketing efforts.

The company's focus on data-driven marketing and customer segmentation is evident in its strategic shift towards higher-margin opportunities, particularly within its Specialty Chemicals segment. This approach indicates a deep understanding of customer needs and a tailored approach to address them, which is a key aspect of its Company strategy. The company's investor outreach efforts, including presentations at investor conferences, also serve as a form of strategic communication.

Ascent Industries likely utilizes content marketing to establish itself as an industry leader. This involves creating valuable and informative content. SEO is a critical component to convert website visitors into leads.

The company participates in industry conferences like AFPM 2025 and SOCMA 2025. These events provide opportunities for direct engagement and partnership exploration.

Ascent Industries focuses on data-driven marketing and customer segmentation. This approach supports its shift towards higher-margin opportunities. The company understands customer needs.

The industrial marketing landscape in 2025 sees increased adoption of AI-powered chatbots. Conversational marketing streamlines the buyer's journey. These trends could be integrated into their future marketing mix.

Investor outreach efforts, including presentations at investor conferences, are a form of strategic communication. This reinforces the company's repositioned industrial player narrative.

The company's strategic communications highlight its growth platform. This is part of the overall Sales strategy. These efforts aim to reinforce its market position.

Ascent Industries employs a multifaceted approach to marketing, focusing on digital strategies and industry engagement. This includes content marketing, SEO, and participation in industry events. The company's approach is aligned with broader manufacturing marketing trends that emphasize digital presence.

- Content Marketing: Utilizes technical blog posts, case studies, and white papers to demonstrate expertise.

- SEO: Optimizes online content to convert website visitors into leads.

- Industry Events: Participates in conferences like AFPM and SOCMA for direct engagement.

- Data-Driven Marketing: Focuses on customer segmentation and higher-margin opportunities.

For example, in 2024, B2B companies that invested in content marketing saw conversion rates increase by an average of 2.9%, according to the Content Marketing Institute. Also, according to a recent study by Statista, the global digital advertising spend in the manufacturing sector is projected to reach over $35 billion by 2026. To gain a better understanding of the competitive landscape and how Ascent Industries positions itself, you can review the Competitors Landscape of Ascent Industries.

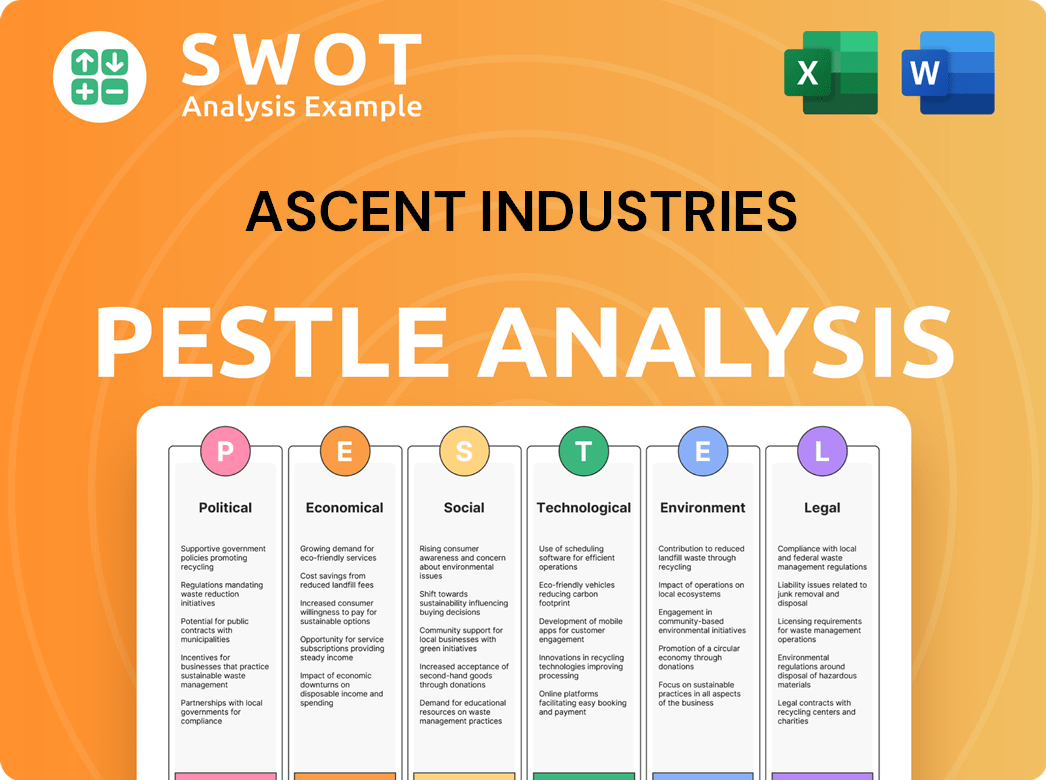

Ascent Industries PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

How Is Ascent Industries Positioned in the Market?

Ascent Industries positions itself as a diversified industrial manufacturing firm, with a strategic shift towards specialty chemicals. This rebranding highlights higher-margin opportunities and a more predictable business model. This focus is a key element of their overall Growth Strategy of Ascent Industries.

The company's core message revolves around delivering sustainable, long-term value through operational discipline and innovation. This strategy is evident in their Q1 2025 results, where they achieved a substantial increase in gross margin to 19.3% from 8.3%, despite a decline in net sales to $24.7 million from $28.0 million in Q1 2024. This focus likely appeals to industrial clients.

The company's communication emphasizes 'stabilization progress' and a 'strengthened foundation,' conveying reliability and strategic foresight. The move to a new corporate headquarters in August 2024 signals a commitment to collaboration and long-term growth. In a competitive industrial landscape, Ascent Industries focuses on streamlining operations and core assets to maintain agility and innovation.

Ascent Industries is increasingly defined by its strategic pivot towards specialty chemicals. This shift is underscored by recent multi-year contracts in this segment, differentiating the company from competitors. The brand identity is evolving to reflect this focus on higher-margin opportunities.

The core message centers on delivering sustainable, long-term value through operational discipline and innovation. This is supported by their Q1 2025 results, showing improved gross margins. This focus appeals to industrial clients seeking reliable and cost-effective solutions.

The company's communication through investor conferences emphasizes 'stabilization progress' and a 'strengthened foundation.' This suggests a brand voice that conveys reliability, strategic foresight, and a commitment to disciplined execution. The tone is professional and focused on long-term value.

In a competitive industrial landscape, Ascent Industries responds to shifts by streamlining operations and focusing on core assets. This strategy aims to maintain agility and innovation. This approach is vital for effective Sales and marketing practices.

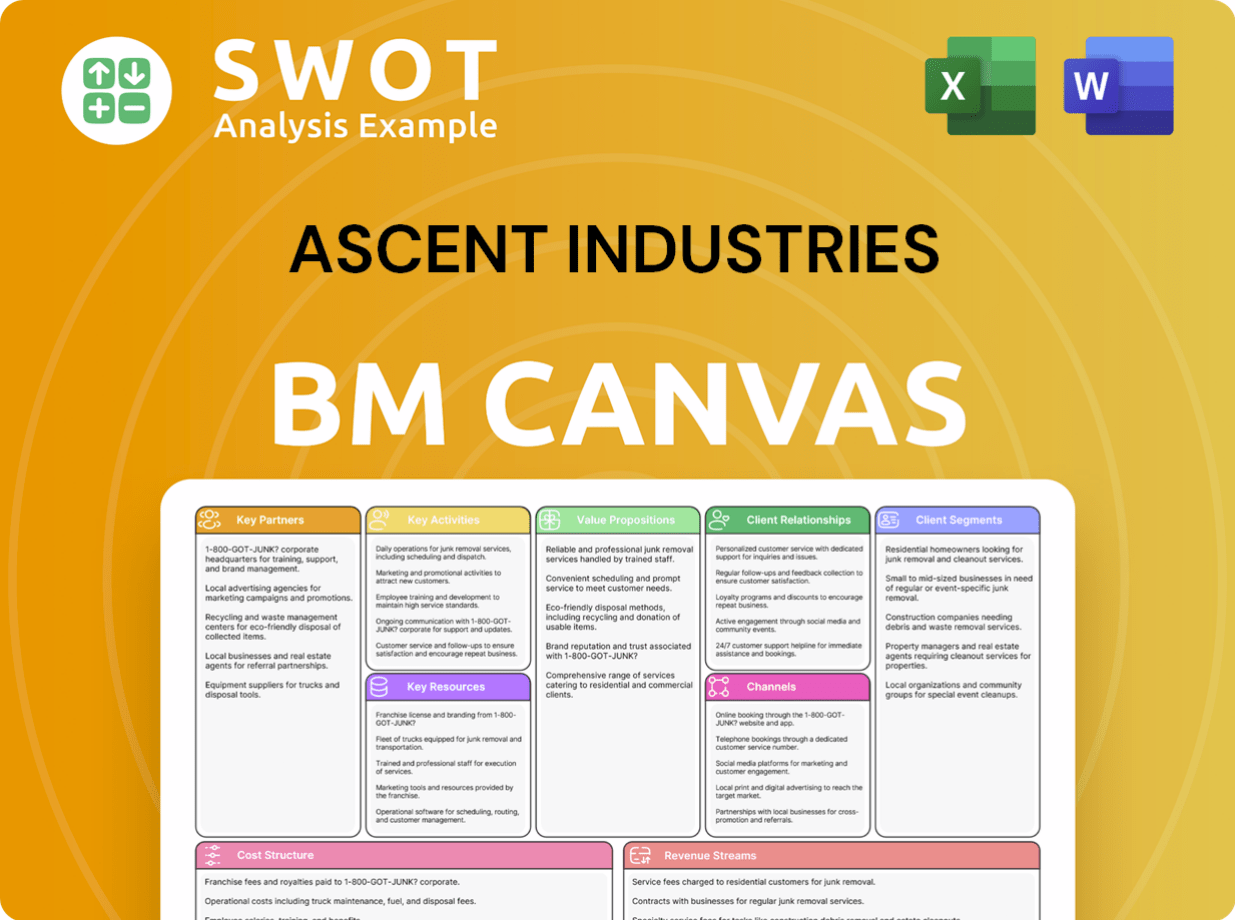

Ascent Industries Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Are Ascent Industries’s Most Notable Campaigns?

The key campaigns of Ascent Industries Company focus on strategic repositioning and operational efficiency, primarily targeting investors and B2B clients. These campaigns are crucial for communicating the company's value proposition and driving financial performance. The company has leveraged various channels, including press releases, investor conferences, and quarterly earnings reports, to disseminate its key messages.

One major focus has been the transition to a pure-play specialty chemicals company. This strategic shift is communicated through investor relations activities, highlighting a focus on higher-margin segments and streamlined operations. The company's initiatives also encompass internal improvements aimed at boosting profitability and operational effectiveness, even amidst market challenges. These efforts are demonstrated through financial results reported in quarterly reports and investor calls.

The success of these campaigns is evident in the company's financial performance. For example, the announcement of a multi-year specialty chemicals contract in April 2025, which is expected to generate over $750,000 in additional annual EBITDA, indicates a successful sales strategy implementation. Furthermore, the company's ability to improve gross margins and achieve positive adjusted EBITDA in Q1 2025, despite a decrease in net sales, demonstrates the effectiveness of its internal operational strategies.

The primary objective was to highlight Ascent's transformation into a specialty chemicals company through press releases and investor conferences. This initiative aimed to reinforce the new industrial player narrative and showcase its post-divestiture growth strategy, focusing on streamlined operations and high-margin segments. The goal was to attract investors and communicate the company's strategic direction.

Ongoing initiatives, including 'self-help' and 'product-mix optimization' strategies, aimed to improve profitability and operational efficiency. The company communicated the outcomes through quarterly earnings reports and conference calls. These internal campaigns aimed to drive financial improvements despite market challenges, focusing on cost reduction and margin enhancement.

The company's share repurchase program, such as the buyback of 101,263 shares in 2024, served as a campaign to boost shareholder value. This action signals management confidence and commitment to enhancing shareholder returns. The focus was on demonstrating the company's financial health and its commitment to shareholder interests.

Securing long-term contracts, such as the multi-year specialty chemicals contract announced in April 2025, is a key element of the sales strategy. The objective is to secure high-value agreements that strengthen the company's financial position. This involves focused business development efforts to create a stable revenue stream.

Ascent Industries Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Ascent Industries Company?

- What is Competitive Landscape of Ascent Industries Company?

- What is Growth Strategy and Future Prospects of Ascent Industries Company?

- How Does Ascent Industries Company Work?

- What is Brief History of Ascent Industries Company?

- Who Owns Ascent Industries Company?

- What is Customer Demographics and Target Market of Ascent Industries Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.