Ascent Industries Bundle

Who Buys from Ascent Industries?

Navigating the complexities of Ascent Industries SWOT Analysis requires a deep understanding of its customer base. With a strategic shift towards specialty chemicals, Ascent Industries has redefined its target market. This article explores the crucial aspects of customer demographics and how they shape Ascent Industries' future.

Understanding the customer profile is essential for effective business strategy and market analysis. This includes identifying the Ascent Industries customer age range, income levels, and geographic location. By examining Ascent Industries customer buying behavior, needs, and wants, we can gain insights into how the company identifies its target market and maintains its market share.

Who Are Ascent Industries’s Main Customers?

Understanding the Competitors Landscape of Ascent Industries requires a deep dive into its primary customer segments. Ascent Industries, operating primarily in the B2B space, has a clearly defined target market. This focus allows for strategic alignment and targeted marketing efforts. The company's ability to adapt to market changes is a key factor in its success.

The core of Ascent Industries' business revolves around two main segments: Specialty Chemicals and Tubular Products. These segments cater to a diverse range of industries, reflecting a broad customer base. The company's strategic decisions and financial performance are closely tied to these key customer groups. A detailed market analysis is crucial for understanding the company's position.

The Specialty Chemicals segment has shown significant growth, even in challenging market conditions. The Tubular Products segment, while undergoing strategic adjustments, has historically served a wide array of industries. Ascent Industries' focus on high-margin opportunities within Specialty Chemicals is evident in its recent performance. This strategic shift is crucial for understanding the company's future direction and its business strategy.

The Specialty Chemicals segment serves a broad spectrum of industries. These include pulp and paper, coatings, adhesives, sealants, and elastomers (CASE), textile, automotive, household, industrial and institutional (HII), agricultural, water and waste-water treatment, construction, and oil and gas. This diversification helps mitigate risks and provides multiple revenue streams. The customer profile here is varied.

Historically, the Tubular Products segment served markets such as appliance, architectural, automotive, commercial transportation, brewery, chemical, petrochemical, pulp and paper, mining, power generation (including nuclear), water and waste-water treatment, liquid natural gas (LNG), food processing, pharmaceutical, and oil and gas. The sale of Bristol Metals, LLC for $45 million in April 2025 indicates a strategic shift. This segment's customer base was diverse.

Ascent Industries is prioritizing higher-margin opportunities within the Specialty Chemicals segment. This segment's gross profit increased by $2.1 million, rising from $1.6 million in Q1 2024 to $3.7 million in Q1 2025, a 131% improvement. Gross margin expanded from 7.6% to 21% in Q1 2025. This focus is paying off with significant growth. The company is actively working with customers to onshore essential ingredient supply chains.

In April 2025, Ascent Industries secured a multi-year specialty chemicals contract. This contract is expected to generate over $750,000 in additional annual EBITDA. This represents a 10% year-over-year increase for the segment. This contract further solidifies the company's focus on the high-growth Specialty Chemicals area. These developments highlight the company's strategic direction.

Ascent Industries' target market is primarily composed of businesses in the Specialty Chemicals and Tubular Products sectors. The company's strategic shift towards Specialty Chemicals indicates a focus on higher-margin opportunities and supply chain resilience. This shift is supported by recent contract wins and improved financial performance.

- The Specialty Chemicals segment serves diverse industries.

- The Tubular Products segment has historically served a wide range of markets.

- Ascent Industries is prioritizing high-margin opportunities in Specialty Chemicals.

- The company is focused on supply chain resilience and domestic sourcing.

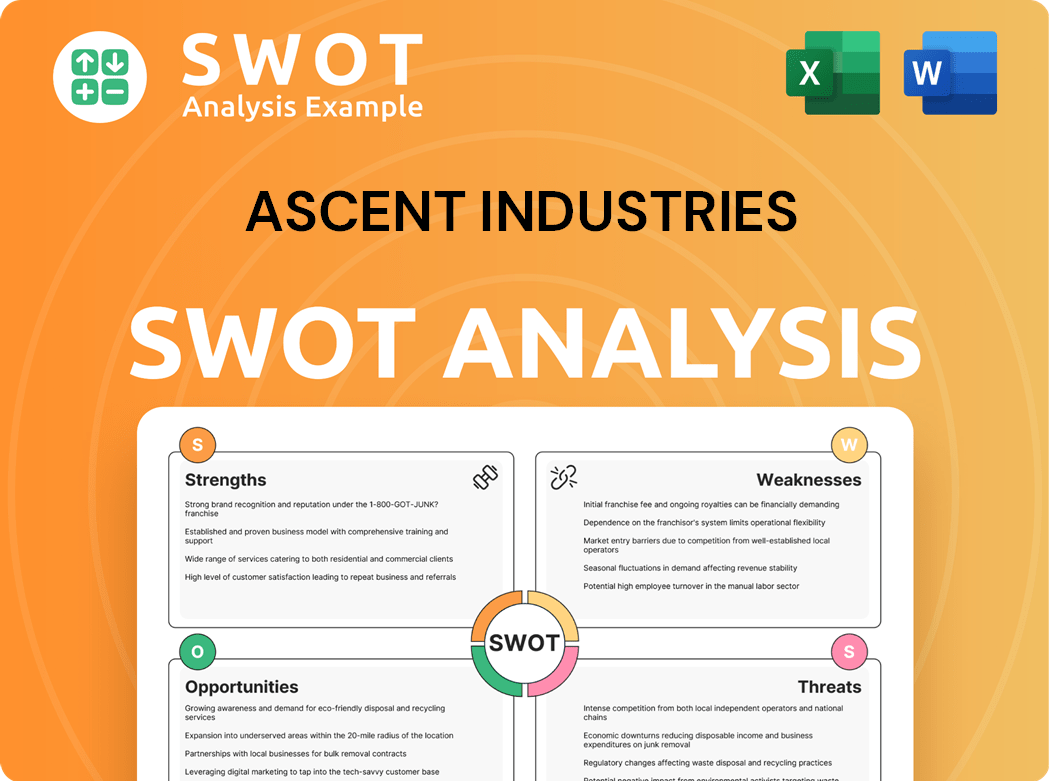

Ascent Industries SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Ascent Industries’s Customers Want?

Understanding the customer needs and preferences is crucial for Ascent Industries' success. Their business-to-business (B2B) customers are primarily driven by the need for custom solutions and manufactured components that meet precise specifications. These customers, forming a significant part of the company's target market, value product quality, reliability, and cost-effectiveness.

The purchasing decisions of Ascent Industries' customers are heavily influenced by technical requirements and the ability of the company to meet those needs. Ascent Industries focuses on providing solutions that enhance efficiency, performance, and durability across various industries. This customer-centric approach is vital for maintaining a strong market position.

The company's approach directly addresses its customers' practical needs, ensuring that its products and services align with the demands of its target market. This strategic focus allows Ascent Industries to secure new business and maintain robust profit margins.

Customers require custom solutions and components that meet strict specifications. They prioritize product quality, reliability, and cost-effectiveness. Ascent Industries addresses these needs by focusing on efficiency and performance.

The global precision engineering machines market is expected to grow from $20.09 billion in 2025 to approximately $29.16 billion by 2034. The precision machining market was valued at $107.06 billion in 2024 and is projected to reach $115.41 billion in 2025. These figures highlight the demand for highly precise components.

Customers face challenges such as supply chain disruptions and the need for specialized materials. Ascent Industries positions itself as a reliable partner, assisting with product development and commercial production. The company also designs and operates dedicated manufacturing plants.

Ascent Industries has shifted towards higher-margin opportunities, such as specialty chemicals. This segment saw a 131% improvement in gross profit in Q1 2025, from $1.6 million in Q1 2024 to $3.7 million in Q1 2025. This demonstrates responsiveness to market demands.

The trend of reshoring manufacturing is a significant driver, with customers seeking reliable domestic partners. Ascent Industries is well-positioned to fulfill this need. The company tailors its focus to opportunities where it has a competitive advantage.

Ascent Industries secured $7.5 million of net new business with EBITDA margins exceeding 20% in Q1 2025. This financial performance reflects the company's strategic alignment and customer focus.

Ascent Industries' target market, which includes customers in metal fabrication, precision machining, aerospace, electronics, and automotive industries, values several key factors:

- High-Precision Components: Customers require components that meet exact specifications for various applications.

- Reliability and Quality: Product reliability and high quality are essential for customer satisfaction.

- Cost-Effectiveness: Competitive pricing is a significant factor in purchasing decisions.

- Custom Solutions: The ability to provide tailored solutions to meet specific technical requirements.

- Supply Chain Stability: Customers seek partners that can mitigate supply chain disruptions.

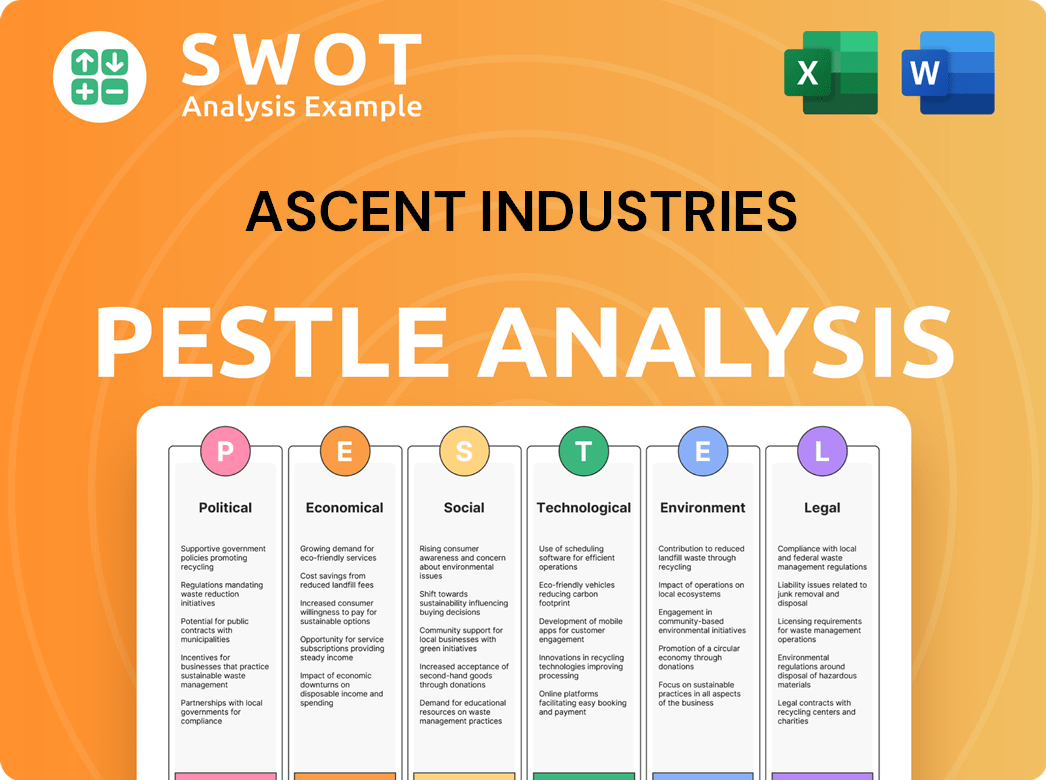

Ascent Industries PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Ascent Industries operate?

The geographical market presence of Ascent Industries is primarily focused within the United States. This strategic positioning aligns with the growing trends of onshoring and reshoring in the manufacturing sector. The company's operations are largely centered in the U.S., serving various domestic industries.

While specific details on market share by country or region are not publicly available, the company's recent moves, like establishing its headquarters in Schaumburg, Illinois, in August 2024, underscore its commitment to the U.S. market. This focus is further reinforced by its emphasis on domestic supply chains, especially in specialty chemicals.

Ascent Industries caters to a diverse industrial client base, addressing regional differences in customer preferences and buying power. The company's approach involves tailoring solutions to meet the specific needs of its business-to-business (B2B) clients, supporting their operations within the U.S.

Ascent Industries concentrates its efforts on the U.S. market, capitalizing on the onshoring and reshoring trends. This strategy is supported by its headquarters location and focus on domestic supply chains.

The company serves industries with significant domestic operations, such as agriculture, construction, and transportation. These sectors are key to its Marketing Strategy of Ascent Industries.

The sale of Bristol Metals, LLC, in April 2025 for $45 million, reflects a strategic shift toward optimizing its geographic and product portfolio. This move helps Ascent Industries concentrate on core assets.

The U.S. construction industry is expected to grow, with manufacturing plant construction as a robust area. The transportation and logistics industry is also forecast to grow by 2.0% in 2025.

Ascent Industries' target market segmentation is primarily defined by industry, with a focus on sectors like agriculture, construction, and transportation. These industries have significant domestic operations.

The company addresses customer needs by focusing on specific industry requirements and tailoring solutions for its B2B clients. This includes helping customers onshore essential ingredient supply chains.

Market analysis indicates continued growth in sectors like construction and transportation within the U.S. The agricultural machinery market is projected to reach nearly $200 billion by 2029, with the U.S. being a significant market.

The geographic location of Ascent Industries' customers is predominantly within the United States. The company's strategic decisions and operational focus support this geographic concentration.

The customer profile of Ascent Industries includes businesses in agriculture, construction, and transportation. These businesses have a significant presence in the U.S. and are key to its business strategy.

Ascent Industries' business strategy involves meeting industry-specific needs and supporting domestic supply chains. This aligns with the company's focus on the U.S. market and its customer demographics.

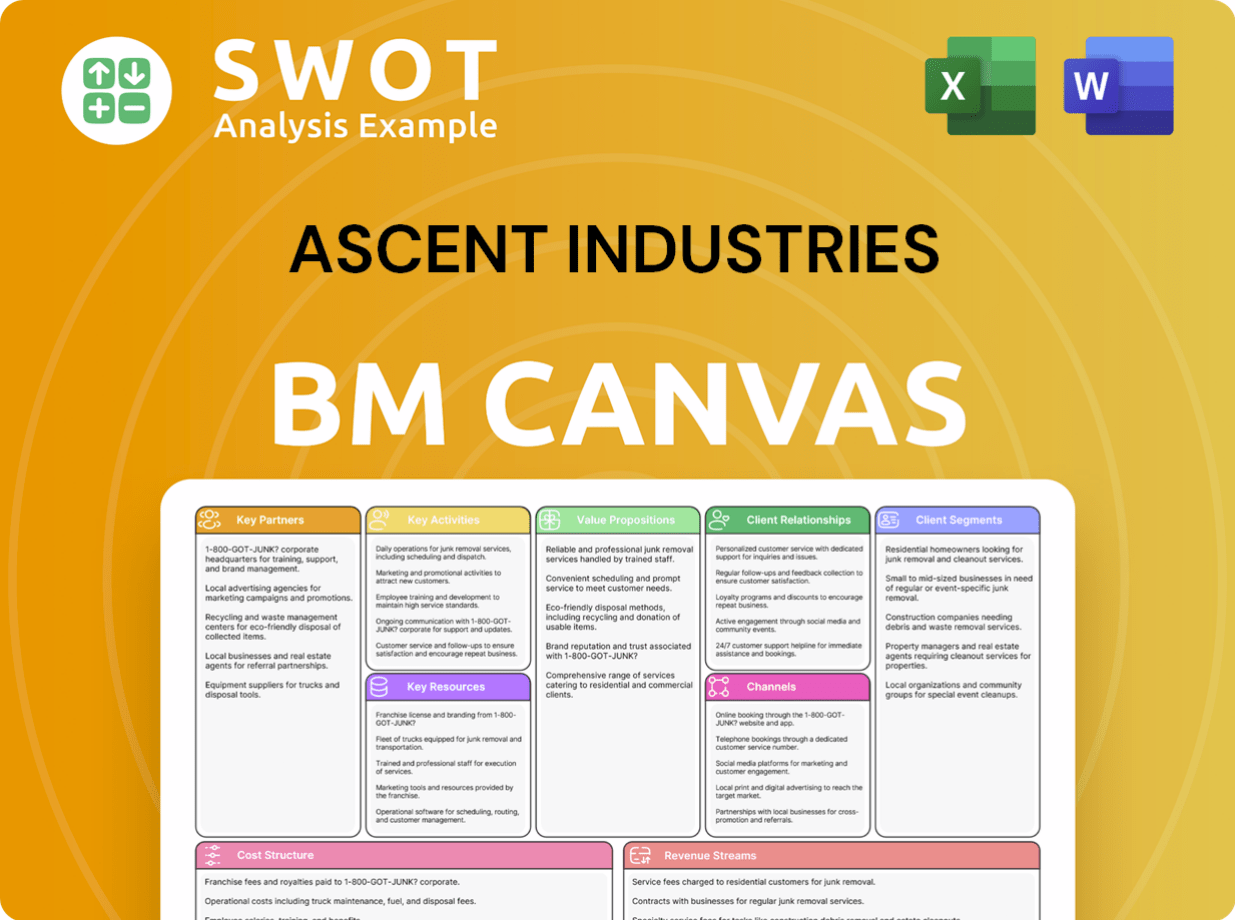

Ascent Industries Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Ascent Industries Win & Keep Customers?

Ascent Industries focuses on a multi-faceted approach to acquire and retain B2B customers. Their strategy emphasizes strategic partnerships, operational excellence, and providing value-added solutions. This approach is crucial for navigating the complexities of their customer demographics and securing their target market.

A key acquisition strategy involves leveraging their expertise in specialized manufacturing to secure long-term, high-value contracts. This includes deepening relationships with current clients and expanding their engagement. By focusing on 'onshoring essential ingredient supply chains,' they appeal to businesses seeking reliable domestic partners, aligning with customer needs for supply chain resilience.

For customer retention, Ascent Industries prioritizes delivering 'quality over quantity.' They focus on higher-margin opportunities and tighten their commercial focus. This product-mix optimization, coupled with aggressive cost management, contributed to a significant improvement in gross margin, demonstrating a commitment to delivering profitable value for long-term customer relationships.

Ascent Industries secures long-term contracts by leveraging its expertise in specialized manufacturing. A recent multi-year contract with an existing customer in the Specialty Chemicals segment is expected to generate over $750,000 in additional annual EBITDA. This represents a 10% year-over-year increase for that segment.

The company focuses on 'onshoring essential ingredient supply chains' to attract customers. This strategy appeals to businesses seeking reliable domestic partners, especially amidst geopolitical uncertainties. This approach directly addresses the needs of their target market for supply chain stability.

Ascent Industries provides a 'more holistic customer experience' by aligning technical sales, applications development, operations, and supply chain. They aim for stronger quoting agility and improvements in customer response time and solution delivery. These improvements are vital for retention in the B2B industrial sector.

The company focuses on delivering 'quality over quantity' by shifting its product mix to higher-margin opportunities. This strategy is coupled with aggressive cost management and operational rigor. This contributed to a significant improvement in gross margin to 19.3% in Q1 2025, up from 8.3% in Q1 2024.

Ascent Industries actively communicates its strategic direction and value proposition to a broader audience. Their consistent investor outreach, including participation in conferences like the Planet MicroCap Showcase and the Oppenheimer 20th Annual Industrial Growth Conference in April and May 2025, signals an active effort. This can indirectly aid in customer perception and retention, supporting their market analysis.

- Conferences help communicate their value proposition.

- They aim to build brand awareness and strengthen relationships.

- This strategy supports customer perception and retention.

- These activities help in defining their customer profile.

Ascent Industries Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Ascent Industries Company?

- What is Competitive Landscape of Ascent Industries Company?

- What is Growth Strategy and Future Prospects of Ascent Industries Company?

- How Does Ascent Industries Company Work?

- What is Sales and Marketing Strategy of Ascent Industries Company?

- What is Brief History of Ascent Industries Company?

- Who Owns Ascent Industries Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.