Axon Enterprise Bundle

How Did Axon Enterprise Revolutionize Public Safety?

From its inception, Axon Enterprise, formerly known as Taser International, has been at the forefront of transforming law enforcement. Initially focused on revolutionizing self-defense with the Axon Enterprise SWOT Analysis, the company's journey is a compelling narrative of innovation. This brief history of Axon Enterprise explores its evolution from a single product to a comprehensive technology provider.

Founded in 1993 in Scottsdale, Arizona, Axon's initial goal was to make the "bullet obsolete" with the Taser weapon. Today, Axon Enterprise's impact on policing extends far beyond its conducted electrical weapons, encompassing body cameras, cloud-based evidence management, and more. Understanding Axon's history provides critical context for its current market position and future prospects in the rapidly evolving field of law enforcement technology.

What is the Axon Enterprise Founding Story?

The story of Axon Enterprise, formerly known as Taser International, began in 1993. It was founded by brothers Rick Smith and Tom Smith, who were driven by a personal tragedy that fueled their desire to create safer communities.

The company's initial focus was on developing less-lethal weapons for law enforcement. This commitment led to the creation of the TASER device, a product that would become synonymous with the company's early success and evolution. The company's journey reflects a blend of innovation, strategic adaptation, and a dedication to improving public safety.

Rick Smith's motivation stemmed from a personal tragedy, which spurred his commitment to developing technology to make the world safer. The company was initially named Air Taser, Inc., reflecting its first product.

- The original concept for the TASER device originated with NASA researcher Jack Cover in 1969.

- Early prototypes used gunpowder to propel two wired darts that delivered an electric shock.

- The company faced challenges, including failed product launches and near-bankruptcy.

- A unique marketing strategy involved paying police officers to train others on their products.

The initial concept for the TASER device was developed by NASA researcher Jack Cover in 1969, aiming to create a non-lethal electric weapon. Cover later collaborated with Rick and Tom Smith to bring the TASER into the mainstream. The early business model revolved around selling the TASER conducted electrical weapon. Early prototypes used gunpowder to propel wired darts that delivered an electric shock, a design that continues to influence the product today. The early years were marked by challenges, including failed product launches and a near-bankruptcy experience. However, the company found success through a unique marketing strategy: paying police officers to train others on their products, effectively turning customers into salesmen.

A significant milestone was the company's Initial Public Offering (IPO) in May 2001, when it went public as TASER International, raising approximately $11.7 million. The company's cultural context was influenced by the growing need for effective, less-lethal tools for law enforcement, a sentiment echoed by President Lyndon Johnson's earlier call for non-lethal means of incapacitating subjects. The company's focus on law enforcement technology and its commitment to public safety have shaped its trajectory. The evolution of Axon Enterprise's target market has been a key factor in its growth.

The company's history reflects a commitment to innovation and a strategic approach to addressing the needs of law enforcement. The evolution from Air Taser, Inc. to TASER International and finally to Axon Enterprise demonstrates the company's adaptability and its broader vision for public safety. The company's history is intertwined with the development and adoption of conducted electrical weapons and its expansion into body cameras and other technologies. This transformation underscores Axon's commitment to providing comprehensive solutions for law enforcement agencies.

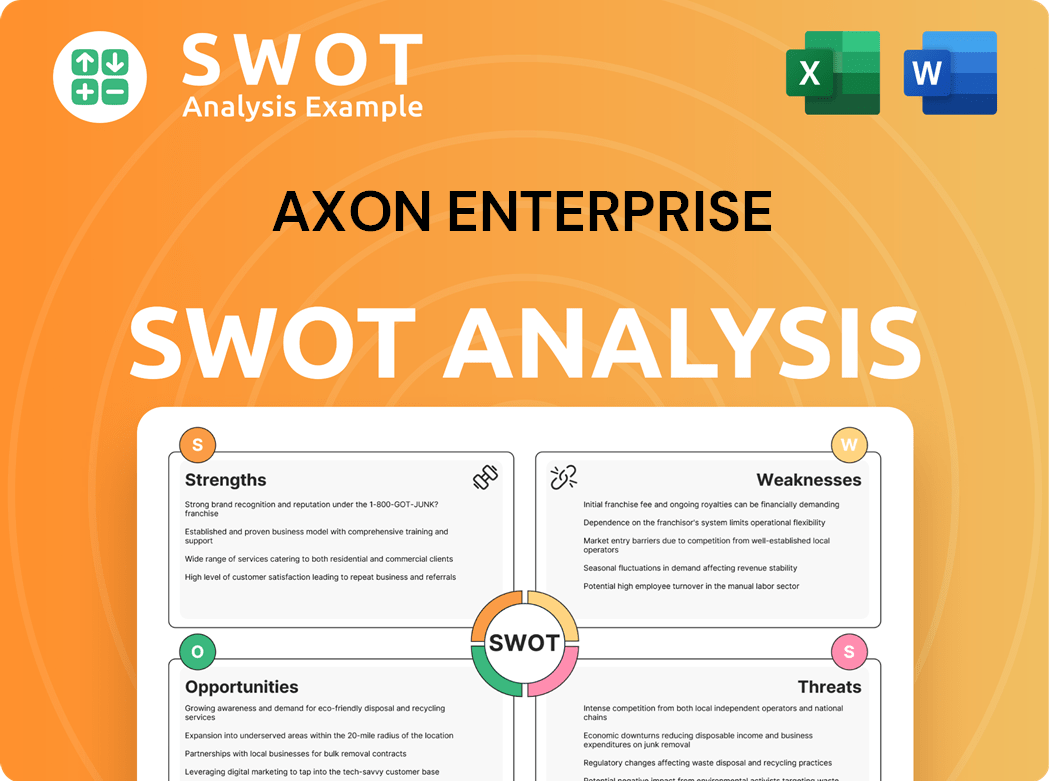

Axon Enterprise SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Axon Enterprise?

The early growth and expansion of Axon Enterprise, formerly known as Taser International, centered on establishing its core product, the TASER device. The company's initial public offering (IPO) in May 2001 provided essential capital for growth and market penetration. This period laid the groundwork for Axon's future as a leader in law enforcement technology. A pivotal shift occurred with the introduction of body cameras and digital evidence management systems.

Initially, Axon, then operating as Taser International, focused on its TASER device. The IPO in May 2001 was a critical step, providing financial resources for research, development, and expanding market presence. This early phase was crucial for establishing the company's foundation in the law enforcement technology sector. The Owners & Shareholders of Axon Enterprise benefited from this early growth.

A significant shift occurred in 2008 with the launch of Evidence.com and the introduction of body cameras. This marked a diversification beyond conducted energy devices into digital evidence management. The Axon Pro body camera and its associated online storage system gained rapid traction. This integration highlighted the value of combined hardware and software solutions.

Axon continued to expand by introducing new product iterations and features. In 2017, the company rebranded from Taser International to Axon Enterprise, Inc. This change signified a strategic shift towards a connected technology ecosystem. This ecosystem encompassed software, sensors (cameras), and weapons.

Axon's growth has been robust, with full-year 2024 revenue reaching $2.1 billion, marking its third consecutive year of over 30% top-line growth. Its annual recurring revenue grew by 37% to $1.0 billion in 2024. In Q1 2025, Axon's revenue hit $604 million, a 31% year-over-year increase, with annual recurring revenue at $1.1 billion. The company has expanded globally, with over 500 employees outside the U.S. and efforts to understand localized needs.

Axon Enterprise PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Axon Enterprise history?

The Axon Enterprise, formerly known as Taser International, has a rich history marked by significant milestones in law enforcement technology. From its origins in less-lethal weapons to its expansion into body cameras and cloud-based evidence management, the company has consistently evolved to meet the changing needs of public safety. This evolution has been driven by innovation and strategic decisions, shaping its trajectory and impact on policing practices.

| Year | Milestone |

|---|---|

| 2008 | Strategic expansion into body-worn cameras and Evidence.com (now Axon Cloud) began, transforming the company into a technology solutions provider. |

| 2019 | Launched Redaction Assistant, its first AI product using computer vision to redact faces and license plates from footage. |

| 2023 | Introduced new products like Axon Body Workforce, Draft One, and its Drone as a First Responder (DFR) solution. |

| 2023 | Acquired Sky-Hero to expand its drone portfolio. |

| 2024 | Acquired Fusus, integrating diverse data sources into a unified cloud-based platform. |

| 2025 | Introduced Axon Assistant, an AI voice companion for Axon Body 4. |

| 2025 | Announced integration with Ring to enhance community collaboration. |

Axon Enterprise has been at the forefront of innovation in law enforcement technology, constantly introducing new products and services. One notable innovation is the TASER 10, which has shown a high adoption rate compared to its predecessors. In April 2025, the company introduced Axon Assistant, an AI voice companion for its Axon Body 4, enhancing its technology offerings.

The TASER 10 was a significant advancement in less-lethal weapons technology, offering improved performance and adoption rates. This innovation underscored Axon's commitment to providing effective and safe tools for law enforcement.

The development of Axon Cloud marked a shift from hardware to a comprehensive technology solution. This move allowed for recurring revenue streams and enhanced digital evidence management capabilities.

The introduction of AI-driven solutions, such as Redaction Assistant and Axon Assistant, streamlined processes and improved efficiency. These tools demonstrated Axon's focus on leveraging technology to enhance public safety.

The DFR solution, developed in partnership with Skydio, represented an innovative approach to emergency response. This technology aimed to provide rapid situational awareness and improve response times.

The launch of the next-generation body-worn camera, Axon Body 4, introduced advanced features and capabilities. This product highlighted Axon's continuous efforts to improve its hardware offerings.

The announced integration with Ring in April 2025, enhanced community collaboration. This partnership aimed to improve information sharing and support public safety efforts.

Axon Enterprise has faced several challenges throughout its history, including competitive pressures and regulatory scrutiny. The company has also dealt with rising costs, with sales costs increasing by 39% year-over-year in 2024. For more details, you can explore Revenue Streams & Business Model of Axon Enterprise.

The emergence of competitors offering alternative less-lethal tools presented a challenge to Axon's market position. Companies like Wrap Technologies have increased competition in the industry.

Axon has faced regulatory scrutiny, including an antitrust action by the Federal Trade Commission (FTC). These actions can impact the company's operations and strategy.

In 2024, Axon experienced escalating costs of sales, which soared by 39% year-over-year, and increased selling, general, and administrative expenses. These higher costs affected the company's financial performance.

The dissolution of a partnership with Flock Safety regarding ALPR technology presented a setback. Axon expressed optimism about resuming the collaboration, highlighting the need for adaptability.

Concerns from some agencies about Axon's closed ecosystem and rising costs have been raised. Addressing these concerns is crucial for maintaining customer relationships and market share.

The evolving market and regulatory landscapes continue to pose challenges. Axon must adapt to these changes to remain competitive and maintain its mission of protecting life.

Axon Enterprise Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Axon Enterprise?

The evolution of Axon Enterprise, formerly known as Taser International, showcases significant milestones. From its inception as Air Taser, Inc. in 1993 by Rick and Tom Smith, the company has continually adapted and expanded its offerings in the law enforcement technology sector. The initial public offering in 2001 marked a pivotal moment, followed by strategic moves into body cameras and cloud-based evidence management. The rebranding to Axon Enterprise in 2017 reflected its broader vision, and recent acquisitions and partnerships, including those in 2023 and 2024, highlight its commitment to innovation and market leadership. Axon's journey is a testament to its adaptability and vision for safer communities through advanced technology.

| Year | Key Event |

|---|---|

| 1993 | Air Taser, Inc. is founded in Scottsdale, Arizona. |

| 2001 | The company goes public as TASER International, raising approximately $11.7 million in its IPO. |

| 2008 | Launches Evidence.com (now Axon Cloud) and enters the body camera market. |

| 2009 | Axon Evidence, a cloud-based evidence management system, is launched. |

| 2017 | Rebrands from TASER International to Axon Enterprise, Inc. |

| 2019 | Launches its first AI product, Redaction Assistant. |

| July 2023 | Acquires Sky-Hero, expanding its Axon Air drone portfolio. |

| 2023 | Axon celebrates its 30th anniversary. |

| January 2024 | Acquires Fusus, a leader in real-time crime center technology. |

| June 2024 | Enters into a partnership with Skydio to introduce a comprehensive line of drones for public safety. |

| 2024 | Reports full-year revenue of $2.1 billion, marking its third consecutive year of over 30% growth. |

| April 2025 | Introduces Axon Assistant, an AI voice companion for Axon Body 4, and announces plans to integrate with Ring. |

| May 2025 | Reports Q1 2025 revenue of $604 million, up 31% year-over-year, and raises full-year 2025 revenue guidance. |

Axon Enterprise projects full-year 2025 revenue to be between $2.60 billion and $2.70 billion. This represents approximately 27% annual growth at the midpoint, demonstrating strong financial performance and market expansion. The company's ability to sustain this growth is a key indicator of its success.

The total addressable market is estimated at $129 billion. There are significant opportunities in international governments ($32 billion), enterprise ($23 billion), and AI solutions ($17 billion). These diverse markets provide substantial avenues for Axon's continued growth and product adoption.

Axon is focused on AI-powered solutions, real-time crime center technology, drone operations, enterprise collaboration, and mobile-first policing. Ongoing strategic initiatives include expanding into new markets such as retail and healthcare, integrating AI into core products, and continuous innovation. These efforts are designed to reinforce its position in the law enforcement technology market.

Axon plans to spend between $160 million and $180 million in 2025 on research and development. Industry trends like the increasing demand for public safety and security solutions, coupled with the rising adoption of cloud-based solutions for digital evidence management, are expected to positively impact Axon's future. The company is well-positioned to capitalize on these trends.

Axon Enterprise Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Axon Enterprise Company?

- What is Growth Strategy and Future Prospects of Axon Enterprise Company?

- How Does Axon Enterprise Company Work?

- What is Sales and Marketing Strategy of Axon Enterprise Company?

- What is Brief History of Axon Enterprise Company?

- Who Owns Axon Enterprise Company?

- What is Customer Demographics and Target Market of Axon Enterprise Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.