Axon Enterprise Bundle

Who Really Controls Axon Enterprise?

Unveiling the ownership structure of Axon Enterprise, formerly known as Taser International, is key to understanding its strategic moves and future trajectory. From its inception in 1993 as Air Taser, Inc., the company has evolved significantly, expanding beyond its core Axon Enterprise SWOT Analysis product line. This exploration will help you understand the evolution of Axon ownership.

Knowing who owns Axon Enterprise is crucial for investors and stakeholders alike, as it directly impacts the company's direction and performance. The shift from Taser International to Axon reflects a broader vision, and understanding the influence of major shareholders, the Axon CEO, and the board of directors is essential. This analysis will examine Axon's ownership, from its founders to institutional investors, providing insights into the forces shaping this law enforcement technology leader, including its Axon stock and Axon products.

Who Founded Axon Enterprise?

The company, now known as Axon Enterprise, Inc., was established by brothers Rick and Tom Smith. Initially named Air Taser, Inc. in 1993, the company's foundation was built upon the vision of developing less-lethal force options for law enforcement. Rick Smith currently serves as the CEO, while Tom Smith, the co-founder, previously held the position of President.

Details regarding the exact equity distribution at the company's inception are not publicly available. However, it is evident that the Smith brothers were the key figures and initial owners, driving the company's mission. Their focus was on creating innovative technology for public safety, which shaped the early direction of the company.

As the company evolved, it secured early financial backing to support its growth and operations. While specific details about angel investors or contributions from friends and family during the initial phases are not widely documented, such support would have been essential for product development and market entry. Early agreements, such as vesting schedules or buy-sell clauses, likely existed to align the founders' interests and manage potential future ownership changes. Any initial ownership disputes or buyouts from this early period are not widely publicized, suggesting a relatively stable founding ownership structure.

The Smith brothers' vision centered on creating safer communities through technological innovation. This vision drove the development of the TASER device and subsequent products.

The Smiths were the primary owners, with early ownership likely concentrated among the founding team and initial investors. This structure reflected their commitment to the company's mission.

Early backing was crucial for product development and market entry. Support from angel investors and potentially friends and family played a vital role.

Agreements like vesting schedules and buy-sell clauses were likely in place to manage founder incentives and potential ownership changes. These were standard practices for startups.

The absence of widely publicized disputes or buyouts indicates a relatively stable ownership structure during the early years. This stability allowed the company to focus on its core mission.

The founding team's control over the company in its early years directly influenced product development, particularly the TASER device and subsequent innovations. This focus on technology for public safety remains a core aspect of the company.

The early ownership structure of Axon Enterprise, shaped by the founders' vision and early financial support, laid the groundwork for its growth. To learn more about the company's history, you can read this Brief History of Axon Enterprise. As of May 2024, the company's market capitalization is approximately $18 billion, reflecting its significant expansion and market presence. The current Axon CEO continues to lead the company, focusing on innovation and strategic growth in the public safety technology sector.

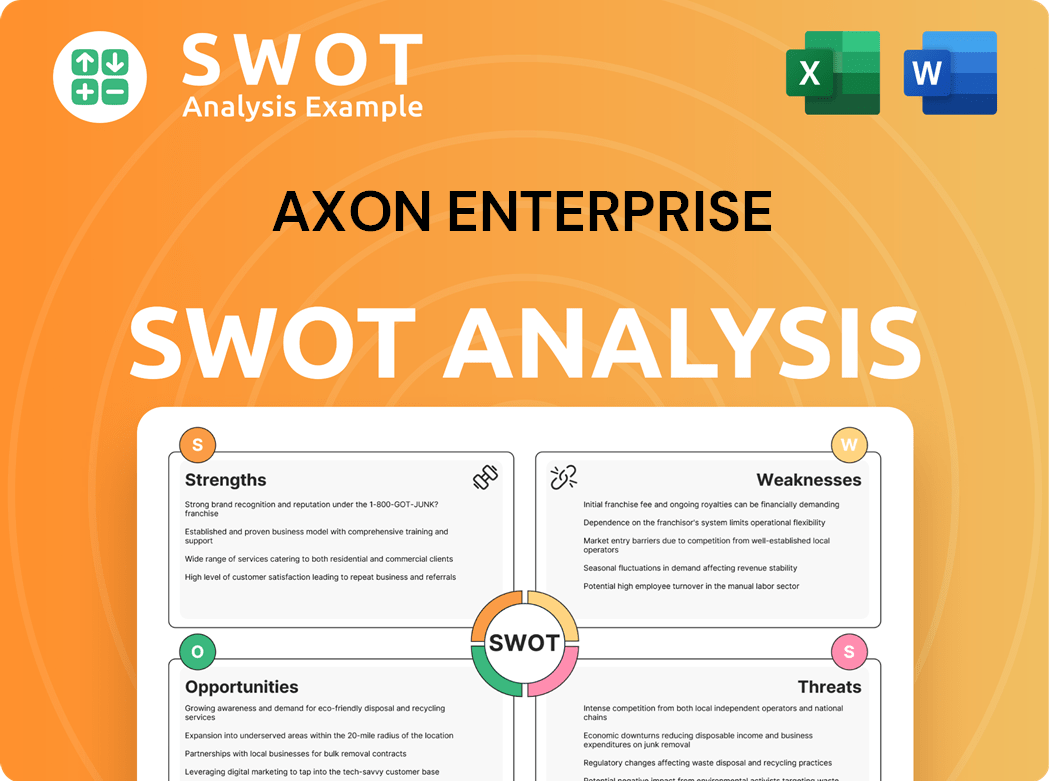

Axon Enterprise SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Axon Enterprise’s Ownership Changed Over Time?

The evolution of Axon Enterprise's ownership began with its initial public offering (IPO) on May 17, 2001, under the ticker 'TASR' on NASDAQ. This event marked a pivotal shift, transitioning from private ownership to a structure that included public shareholders. The IPO's initial market capitalization was significantly smaller compared to its valuation in early 2025, which has grown to tens of billions of dollars. This growth reflects the company's market dominance and expansion over the years, particularly in the law enforcement technology sector.

Since the IPO, the ownership structure of Axon Enterprise has seen considerable changes. A significant portion of the company is now held by institutional investors. As of late 2024 and early 2025, major institutional shareholders include prominent asset management firms such as The Vanguard Group, BlackRock, and State Street Global Advisors. These firms collectively hold a substantial percentage of outstanding shares through various investment vehicles. For instance, Vanguard and BlackRock each hold over 8% of Axon's shares, indicating strong institutional confidence in the company's long-term prospects. Individual insiders, including Axon CEO Rick Smith, also maintain notable stakes, aligning their interests with the broader shareholder base. The shift in ownership has directly influenced company strategy and governance, with institutional investors often driving decisions related to capital allocation and market expansion. To learn more about Axon's strategic direction, read about the Growth Strategy of Axon Enterprise.

| Key Event | Date | Impact on Ownership |

|---|---|---|

| Initial Public Offering (IPO) | May 17, 2001 | Transitioned from private to public ownership, introducing public shareholders. |

| Institutional Investment Increase | Ongoing (Late 2024-Early 2025) | Increased holdings by institutional investors like Vanguard and BlackRock, influencing strategic decisions. |

| Executive Compensation and Stock Options | Ongoing | Dilution of insider ownership over time due to stock-based compensation and offerings. |

Axon Enterprise's ownership structure has evolved significantly since its IPO, with a shift towards institutional investors. The influence of major shareholders like Vanguard and BlackRock is substantial. The company's strategic decisions are often influenced by these key stakeholders.

- Institutional investors hold a significant portion of Axon stock.

- Individual insiders, including the Axon CEO, maintain notable stakes.

- Ownership changes impact company strategy and governance.

- The market capitalization has grown to tens of billions of dollars by early 2025.

Axon Enterprise PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Axon Enterprise’s Board?

The current Board of Directors at Axon Enterprise plays a vital role in guiding the company's strategy and ensuring accountability to shareholders. As of early 2025, the board includes a mix of independent directors and those with ties to the company's origins. For example, CEO Rick Smith, a co-founder, holds a prominent position, reflecting the founder's influence. Other members bring expertise in technology, finance, and public safety. These independent directors ensure diverse perspectives and strong oversight. Understanding the Target Market of Axon Enterprise is also crucial for the board's strategic decisions.

The composition of the board and its governance practices are regularly reviewed by institutional investors and proxy advisory firms. The company's commitment to ethical product development and its societal impact are also key areas of focus for shareholders and the board. The board's decisions, influenced by management and shareholder input, directly shape the company's product roadmap and market strategies.

| Board Member | Title | Relevant Experience |

|---|---|---|

| Rick Smith | CEO and Director | Co-founder, extensive experience in technology and public safety |

| Luke T. Williams | Lead Independent Director | Experience in finance and corporate governance |

| Mark W. Kroll | Independent Director | Experience in technology and business strategy |

| Lisa M. Bencivenga | Independent Director | Experience in finance and legal |

Axon operates under a one-share-one-vote structure. This means that each share of common stock generally entitles its holder to one vote. This structure empowers all shareholders proportionally to their ownership stake. There are no publicly reported dual-class shares or special voting rights that would grant outsized control to specific individuals beyond their direct equity ownership. Large institutional holders, by virtue of their substantial shareholdings, naturally wield significant voting power. The company's commitment to ethical product development and its impact on society are areas of increasing focus for both shareholders and the board.

Axon's governance structure ensures that each share generally equals one vote, promoting fairness among investors. This structure is regularly scrutinized by institutional investors and proxy advisory firms.

- One-share-one-vote structure.

- Focus on ethical product development.

- Regular review by institutional investors.

- Board decisions shape product roadmap.

Axon Enterprise Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Axon Enterprise’s Ownership Landscape?

Over the past three to five years (2022-2025), the ownership structure of Axon Enterprise has seen gradual shifts, largely influenced by its market performance and strategic acquisitions. The company, formerly known as Taser International, hasn't engaged in significant share buybacks or major secondary offerings. Instead, growth has been primarily through organic means and strategic acquisitions. For instance, acquisitions of complementary tech companies have expanded its product ecosystem, with these transactions often involving a mix of cash and stock, leading to minor shifts in ownership as former owners of acquired entities become Axon shareholders. The company's focus remains on expanding its market reach and technological offerings, which attracts and retains a diverse shareholder base.

Leadership stability has been a consistent feature, with co-founder Rick Smith continuing as CEO. While there have been adjustments to the executive team, no major founder departures have significantly impacted the core ownership or control. The primary trend in Axon ownership, reflecting broader market dynamics, is an increasing concentration of institutional ownership. Large asset managers continue to accumulate shares, reflecting confidence in Axon's long-term growth trajectory in the public safety technology sector. Industry trends, such as the increasing adoption of body-worn cameras and digital evidence management systems by law enforcement agencies globally, have bolstered Axon's market position, making it an attractive investment for large funds. The company's consistent innovation and strong financial results are key drivers in maintaining and evolving its ownership composition.

| Metric | Data (2024-2025) | Source |

|---|---|---|

| Institutional Ownership | Approximately 80% | Public Filings (e.g., 13F filings) |

| Market Capitalization | Over $10 billion | Financial News Outlets |

| Revenue Growth (YoY) | Approximately 20% | Company Earnings Reports |

The shift towards greater institutional ownership signifies a maturing market perception of Axon stock. This trend is further supported by the company's consistent financial performance. As of early 2024, Axon's revenue growth has been robust, with earnings reports indicating a YoY increase of roughly 20%. The market capitalization has surpassed $10 billion, reflecting investor confidence. For more insights into the company's strategic approach, consider exploring the Marketing Strategy of Axon Enterprise.

Institutional investors hold a significant portion of Axon's shares, indicating confidence in the company's long-term prospects. This trend has been consistent over the past few years.

Rick Smith, the co-founder, continues to lead as CEO, ensuring strategic continuity. This stability is crucial for investor confidence and long-term vision.

Acquisitions have slightly shifted the ownership structure. Former owners of acquired companies become shareholders, contributing to a diverse ownership base.

Axon's strong market performance and consistent revenue growth have been key factors in attracting and retaining a diverse shareholder base, driving the company's success.

Axon Enterprise Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Axon Enterprise Company?

- What is Competitive Landscape of Axon Enterprise Company?

- What is Growth Strategy and Future Prospects of Axon Enterprise Company?

- How Does Axon Enterprise Company Work?

- What is Sales and Marketing Strategy of Axon Enterprise Company?

- What is Brief History of Axon Enterprise Company?

- What is Customer Demographics and Target Market of Axon Enterprise Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.