Axon Enterprise Bundle

Who Buys Axon's Tech?

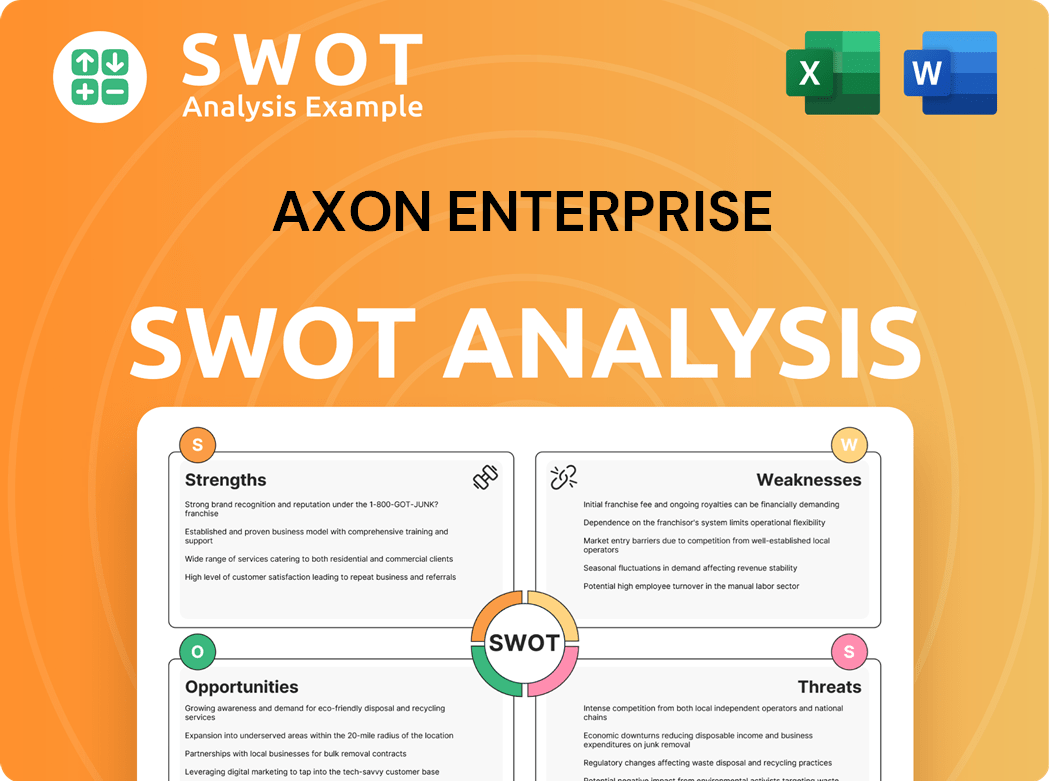

For Axon Enterprise, understanding its customer demographics and target market is not just a business strategy; it's fundamental to its mission of enhancing public safety. Founded in 1993, Axon has transformed from a CEW provider to a comprehensive public safety technology leader. This evolution, marked by innovations like the Axon Enterprise SWOT Analysis, has broadened its reach and reshaped its approach to market analysis.

This shift has allowed Axon to achieve impressive growth, with significant revenue increases in recent years. This detailed analysis will explore Axon's customer profile, including its target audience, market segmentation strategies, and customer acquisition strategies. We'll examine the demographic data and geographic focus of Axon's clientele, providing insights into who Axon's main customers are and how the company meets their evolving needs and wants.

Who Are Axon Enterprise’s Main Customers?

Understanding the customer demographics and target market of Axon Enterprise is crucial for grasping its business model and growth trajectory. Axon primarily operates in the Business-to-Government (B2G) and Business-to-Business (B2B) sectors. Its core focus lies within the public safety domain.

The primary target audience for Axon includes various public safety agencies. These include law enforcement at international, federal, state, and local levels, along with fire departments, corrections facilities, and emergency medical services. This focus has allowed Axon to establish a strong market presence.

Axon is expanding its customer base beyond its core law enforcement segment. This includes the justice sector, enterprises, and consumers. This diversification reflects an emerging opportunity to connect public and enterprise safety networks.

The main customer segment for Axon Enterprise is public safety agencies globally. This includes law enforcement, fire departments, and emergency medical services. The U.S. state and local government law enforcement segment remains a key area for revenue.

Axon's revenue streams are segmented into Connected Devices and Software & Services. The Software & Services segment is a significant growth driver. In Q1 2025, Axon Cloud & Services revenue grew by 41% year-over-year. The TASER segment also saw substantial growth.

Axon's annual recurring revenue (ARR) reached $1.1 billion in Q1 2025, a 34% year-over-year increase. This growth is primarily from software and cloud services. Axon secured its largest deal in company history in 2024, expanding its reach beyond traditional public safety.

Axon is actively diversifying its customer profiles beyond its core law enforcement base. This includes the justice sector, enterprises, and consumers. This expansion reflects an emerging opportunity to connect public and enterprise safety networks. Brief History of Axon Enterprise provides further insight into the company's evolution.

The target audience for Axon Enterprise includes public safety professionals within agencies globally. The company's offerings are designed for professionals within these roles. Axon is focused on expanding its market share and revenue streams.

- Law Enforcement: Primary customer segment, including international, federal, state, and local agencies.

- Software & Services Growth: Significant growth in cloud services and subscription models.

- Market Diversification: Expanding into the justice sector, enterprises, and consumer markets.

- Financial Performance: Strong ARR growth driven by software and cloud services.

Axon Enterprise SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Axon Enterprise’s Customers Want?

Understanding the customer needs and preferences is crucial for any company, and for the [Company Name], this involves a deep dive into the requirements of law enforcement agencies and other public safety organizations. The core of their business revolves around providing technology solutions that enhance safety, improve efficiency, and ensure accountability. This focus directly addresses the critical needs of their customers, influencing purchasing decisions and shaping product development.

The primary drivers for [Company Name]'s customers are centered on public safety, the need for reliable evidence management, and the desire for integrated technology solutions. These needs translate into a demand for products that are not only effective but also secure, easy to integrate, and compliant with regulations. The company's ability to meet these needs is a key factor in its market success and customer satisfaction.

The company's customer base is primarily composed of law enforcement agencies and other public safety organizations. These entities are looking for solutions that improve officer safety, streamline operational workflows, and provide irrefutable digital evidence. The adoption of cloud-based solutions, like Axon Evidence.com, is a significant growth driver for the company, reflecting the evolving needs of its customer base.

Customers require reliable, integrated, and secure technology solutions. They need comprehensive digital evidence management systems to streamline data collection, storage, and analysis.

Key factors include product reliability, data security, ease of integration, and compliance with regulations. The company's offerings must meet stringent standards.

Customers seek increased transparency, officer safety, and community trust. The company's mission aligns with these aspirations.

The company addresses administrative burdens through AI-powered tools. Draft One, for example, saves officers significant time.

Feedback and market trends, especially the demand for cloud solutions and AI, influence product development. The company tailors offerings through premium subscription plans.

The company is actively expanding its 'Works With Axon' program to integrate with third-party devices, enhancing its ecosystem.

The [Company Name]'s customers, primarily law enforcement agencies, are driven by the need for enhanced public safety, accountability, and efficient evidence management. Their preferences lean towards reliable, integrated, and secure technology solutions. The company’s commitment to these needs is reflected in its product development and market strategies.

- Officer Safety: Solutions that protect officers in the field are a top priority.

- Evidence Management: Systems that streamline the collection, storage, and analysis of digital evidence are crucial.

- Integration: The ability of products to integrate with existing systems is a key consideration.

- Data Security: Protecting sensitive data is paramount for maintaining trust and compliance.

- AI-Powered Tools: Innovations like Draft One, which uses AI to draft reports, are highly valued for saving time and improving accuracy.

Axon Enterprise PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Axon Enterprise operate?

The geographical market presence of Axon Enterprise is predominantly focused on the United States, with a significant and growing international footprint. In the first quarter of 2025, the U.S. accounted for the vast majority, specifically 88%, of Axon's revenue. The remaining 12% came from international markets, highlighting the company's global expansion efforts.

Axon holds a strong market position in the U.S., particularly in segments like body cameras and TASER devices. It is estimated that in 2024, Axon had approximately 45% market share in these key areas. This dominance in the domestic market provides a solid base for further expansion.

International expansion is a primary growth driver for Axon, with a strategic focus on over 100 countries worldwide. The company is reevaluating its international opportunities, extending beyond its initial successes. International bookings saw significant growth in 2024, with a 40% increase from Q2 2024 and nearly 50% growth in Q4 2024, indicating strong global demand for its solutions. This expansion is supported by tailored product offerings for global markets.

Axon's strong presence in the U.S. market, especially in body cameras and TASER devices, provides a stable foundation. The company's market share in the U.S. is a key indicator of its success. The focus on the U.S. market has allowed Axon to refine its products and strategies.

Axon is actively expanding its international presence, with a focus on over 100 countries. International bookings experienced substantial growth, with notable increases in 2024. This expansion is supported by strategic product adjustments to meet global market needs. For more details, check out the Marketing Strategy of Axon Enterprise.

Axon Enterprise Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Axon Enterprise Win & Keep Customers?

The success of Axon Enterprise hinges on its effective strategies for acquiring and retaining customers. These strategies are multifaceted, incorporating direct sales, digital marketing, and strategic partnerships to reach and engage its target market. As of 2024, the company's approach has proven effective, driving significant revenue and fostering strong customer relationships.

Axon's customer acquisition efforts are significantly boosted by innovative product launches and a strong emphasis on ethical practices. The company's commitment to ethical AI, including bias mitigation in its AI-powered solutions, builds trust and addresses critical concerns within its customer base. These strategies help to build and maintain a loyal customer base.

Retention strategies are deeply embedded in Axon's business model, particularly its increasing reliance on recurring revenue from its cloud-based solutions. The company's focus on providing value-added services and flexible pricing models supports its customers. Continuous product innovation and deep customer collaboration are also key to its strong product-market fit and customer expansion.

Axon maintains a dedicated sales team of 572 direct sales representatives focused on law enforcement and public safety markets. This team is crucial for acquiring new customers and maintaining relationships. The average annual sales per representative reached $1.3 million.

Axon's online e-commerce platform generates substantial annual revenue. This platform serves as a key channel for reaching a broader customer base and facilitating transactions. The e-commerce platform generated $124.7 million in annual revenue.

Axon utilizes various marketing channels to engage with its target audience. These channels include digital marketing, trade shows, and industry events. They are essential for promoting products and building brand awareness.

Axon actively engages with its customers through events like Axon Week, its user conference, attracting over 2,000 key clients. The company also utilizes social media platforms such as X, Facebook, and LinkedIn for communication.

Innovative product launches are a significant driver of customer acquisition. Products like the TASER 10 and Axon Body 4 have seen rapid adoption rates. Continuous innovation is key to capturing new market segments.

- The TASER 10 and Axon Body 4 have contributed significantly to customer acquisition.

- These products offer advanced features and capabilities that attract new customers.

- Axon's commitment to innovation helps it stay ahead of the competition.

- The company's focus on product development is a core acquisition strategy.

Axon's increasing reliance on recurring revenue from cloud-based solutions like Axon Evidence.com is a key retention strategy. This model ensures a steady stream of income and strengthens customer loyalty. Annual recurring revenue reached $1.1 billion in Q1 2025.

- Recurring revenue provides financial stability and predictability.

- Cloud-based solutions enhance customer retention rates.

- The subscription-based model fosters long-term customer relationships.

- This model contributes to a net revenue retention of 123%.

The 'stickiness' of Axon's revenue stems from its mission-critical products and services. These products are integral to its customers' operations, making switching costly and time-consuming. This high level of integration boosts customer retention.

- Products and services are essential for daily operations.

- Switching costs are high due to the integration of Axon's solutions.

- This creates a strong incentive for customers to remain with Axon.

- The company's products are indispensable for its customer base.

Axon emphasizes continuous product innovation and deep customer collaboration. This approach ensures that products meet the specific needs of the target market. It also strengthens the product-market fit and fosters customer expansion.

- Collaboration with customers helps to refine products.

- This approach ensures products meet specific needs.

- It strengthens the product-market fit.

- Customer feedback is essential for product development.

Axon Enterprise Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Axon Enterprise Company?

- What is Competitive Landscape of Axon Enterprise Company?

- What is Growth Strategy and Future Prospects of Axon Enterprise Company?

- How Does Axon Enterprise Company Work?

- What is Sales and Marketing Strategy of Axon Enterprise Company?

- What is Brief History of Axon Enterprise Company?

- Who Owns Axon Enterprise Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.