Axon Enterprise Bundle

How Does Axon Enterprise Dominate the Public Safety Tech Arena?

From its inception as AIR TASER in 1993, Axon Enterprise has revolutionized law enforcement technology, evolving from a purveyor of less-lethal weapons to a comprehensive public safety ecosystem. This evolution highlights a strategic shift, driven by the need for safer alternatives and enhanced accountability within law enforcement. Today, Axon is a key partner to law enforcement agencies worldwide, but what does its competitive landscape look like?

This Axon Enterprise SWOT Analysis will help you understand the company's position within the market. Understanding the Competitive Landscape is crucial for investors and stakeholders alike, as it directly impacts Axon Enterprise’s Market Analysis and future growth. The company's success is not just about its products; it's also about its ability to navigate a complex and evolving competitive environment. We will delve into Axon Enterprise competitors 2024 and the industry trends.

Where Does Axon Enterprise’ Stand in the Current Market?

Axon Enterprise holds a strong market position within the law enforcement technology sector. Its core operations revolve around providing advanced safety and security solutions, primarily focusing on conducted electrical weapons (CEWs), body-worn cameras (BWCs), and cloud-based evidence management software. The company's value proposition centers on enhancing public safety, improving transparency, and streamlining law enforcement workflows through innovative technology.

The company's products and services are designed to offer comprehensive solutions for law enforcement agencies, addressing critical needs such as less-lethal force options, digital evidence collection, and secure data storage. Axon's commitment to innovation and its focus on customer needs have solidified its position as a market leader. This approach has enabled Axon to build a strong brand reputation and establish long-term relationships with its customers.

Axon's strategic shift towards subscription-based services, particularly its cloud-based software suite, has been pivotal in solidifying its market dominance. This transition provides recurring revenue streams and fosters deeper integration with its customers, creating a more sustainable and predictable business model. This approach allows Axon to maintain a strong competitive advantage in the evolving law enforcement technology market.

Axon's TASER devices are a global standard for less-lethal force, widely adopted across U.S. law enforcement agencies. The company maintains a significant lead in the body-worn camera market, with its Axon Body cameras and Evidence.com platform. These products are critical components of many agencies' digital evidence workflows, solidifying Axon's market leadership.

Axon has a strong presence across North America, Europe, and Australia, serving a broad customer base. This includes federal, state, and local law enforcement agencies, as well as corrections and military entities. The company's global reach underscores its ability to meet diverse public safety needs worldwide, contributing to its competitive advantage.

For the fiscal year 2024, Axon reported total revenue of $1.94 billion, a 31% increase year-over-year, demonstrating strong market demand. The company's net income for 2024 was $185 million, reflecting healthy profitability. These figures highlight Axon's robust financial health and its ability to sustain growth in the competitive landscape.

Axon has strategically shifted its positioning, moving beyond hardware sales to emphasize subscription-based software and services. This digital transformation, with its focus on recurring revenue, has been pivotal in solidifying its market dominance. This approach ensures deeper integration with customers and enhances long-term growth prospects.

Axon's competitive advantages include its strong brand reputation, technological leadership, and comprehensive product offerings. The company's focus on innovation and customer needs has enabled it to maintain a leading position in the market. The company's commitment to research and development ensures it can stay ahead of the curve.

- Market leadership in CEWs and BWCs.

- Strong financial performance with consistent revenue growth.

- A strategic shift towards subscription-based services for recurring revenue.

- Extensive geographic presence and a diverse customer base.

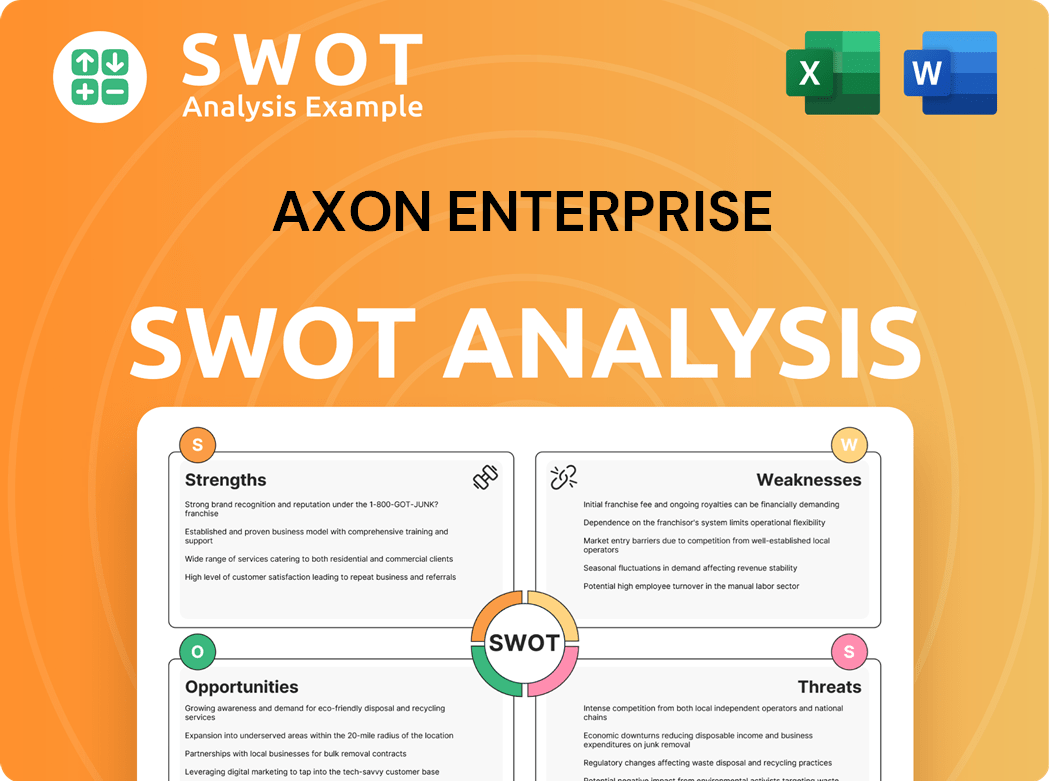

Axon Enterprise SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Axon Enterprise?

The competitive landscape for Axon Enterprise is multifaceted, encompassing both its established position in conducted electrical weapons (CEWs) and its growing presence in body-worn cameras (BWCs) and digital evidence management (DEM) software. A thorough market analysis reveals that while Axon holds a strong position, it faces challenges from various competitors. Understanding these competitors and their strategies is crucial for evaluating Axon's market position and future prospects.

The market for public safety technology is dynamic, with constant innovation and consolidation. Axon's financial performance and market share are directly influenced by its ability to compete effectively. Analyzing the competitive landscape helps to understand the pressures and opportunities that shape Axon's strategic decisions and financial outcomes. A detailed look at the key players provides insights into the industry dynamics and potential future trends.

Axon Enterprise's primary competition varies across its product lines. In the CEW market, Axon's TASER brand has a significant advantage due to its patent portfolio and brand recognition. However, other companies offer alternative less-lethal weapons. The BWC and DEM markets are more competitive, with several key players vying for market share. These competitors challenge Axon through various strategies, including integrated solutions, advanced features, and competitive pricing.

Axon's TASER brand dominates the CEW market. Smaller competitors exist, but they lack Axon's market penetration and brand recognition. The primary challenge in this segment is maintaining its market position and defending its intellectual property.

The BWC and DEM markets are more competitive. Key players include Motorola Solutions, Utility, Inc., Panasonic, and Reveal Media. These companies offer various solutions, often bundling them with other public safety technologies.

Motorola Solutions is a major competitor, leveraging its existing relationships with public safety agencies. They offer integrated BWC and DEM solutions. Their strength lies in their extensive sales channels and comprehensive public safety technology portfolio.

Utility, Inc. focuses on advanced features and data analytics for BWCs and DEM. They aim to differentiate through technological innovation and specialized solutions. They compete by offering a focus on integration and data analytics.

Panasonic and Reveal Media offer body camera solutions. They often target specific segments or regions. These companies provide additional competitive pressure in the BWC market.

Competitors use various strategies, including integrated solutions, advanced features, and competitive pricing. Mergers and acquisitions, like Motorola Solutions' acquisitions, further consolidate market power. New entrants often compete on price or niche solutions.

The competitive landscape is shaped by factors such as technological advancements, market consolidation, and changing customer needs. Understanding these dynamics is crucial for assessing Axon's future outlook. Key aspects of the competitive landscape include:

- Market Share Analysis: Axon holds a significant share in CEWs, but faces competition in BWCs and DEM.

- Product Comparison: Competitors offer different features and pricing models, impacting customer choices.

- Industry Trends: The industry is influenced by technological advancements, such as AI-powered analytics and cloud-based solutions.

- Mergers and Acquisitions: Motorola Solutions' acquisitions have expanded its offerings and market presence.

- Market Challenges: Axon faces challenges such as pricing pressures, technological innovation, and evolving customer demands.

Axon Enterprise PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Axon Enterprise a Competitive Edge Over Its Rivals?

Examining the Revenue Streams & Business Model of Axon Enterprise reveals a company deeply entrenched in the public safety sector. The competitive landscape for Axon Enterprise is shaped by its innovative approach to law enforcement technology, with a focus on integrated solutions. A thorough market analysis indicates that Axon's strategic moves and technological advancements have significantly influenced its position, especially in the body camera and less-lethal weapons markets.

Axon Enterprise's competitive edge is bolstered by its strong brand recognition and a comprehensive ecosystem that includes hardware, software, and cloud services. This integrated approach creates high switching costs for customers, providing a sustainable advantage. The company's ability to continuously innovate and adapt to the evolving needs of law enforcement agencies further solidifies its position in the competitive landscape.

Axon Enterprise's competitive advantages are multifaceted, stemming from proprietary technology, strong brand equity, a comprehensive ecosystem, and deep customer relationships. At the core of its strength is its intellectual property, particularly surrounding its TASER conducted electrical weapons, which have a long history of innovation and effectiveness, giving Axon a near-monopoly in this critical less-lethal force category. This proprietary technology is protected by numerous patents, making direct imitation difficult.

Axon's TASER technology and related patents are a cornerstone of its competitive advantage. The company holds numerous patents that protect its intellectual property, making it difficult for competitors to replicate its products. This strong IP portfolio allows Axon to maintain a significant market share in the less-lethal weapons market.

The Axon Cloud platform, including Evidence.com, creates a highly integrated ecosystem for law enforcement agencies. This integrated system manages data from TASERs, body-worn cameras, and in-car cameras. The high switching costs associated with migrating vast amounts of critical evidence to a different platform provide a significant competitive advantage.

The 'TASER' brand is widely recognized and trusted by law enforcement professionals globally, signifying reliability and effectiveness. Axon's strong relationships with law enforcement agencies, built over decades, provide a significant barrier to entry for competitors. The company actively engages with its customer base to understand their evolving needs, leading to continuous product development and enhancements.

Axon's focus on a 'Sensors to Software' strategy, integrating hardware with cloud-based solutions, allows for a more holistic and efficient approach to public safety technology. This approach provides a more comprehensive solution compared to competitors offering fragmented solutions. This integrated approach enhances operational efficiency for law enforcement agencies.

Axon Enterprise's competitive advantages are largely sustainable due to continuous innovation, strong customer loyalty, and the inherent stickiness of an integrated technology ecosystem. Axon continues to invest heavily in research and development, with R&D expenses reaching approximately $122.7 million in 2023. This investment supports the development of new products and enhancements to existing offerings.

- Intellectual Property: Extensive patent portfolio protecting core technologies.

- Integrated Ecosystem: Axon Cloud platform creates high switching costs.

- Brand Recognition: 'TASER' brand is synonymous with reliability.

- Customer Relationships: Long-standing relationships with law enforcement agencies.

Axon Enterprise Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Axon Enterprise’s Competitive Landscape?

The competitive landscape for Axon Enterprise is significantly shaped by the dynamic nature of the public safety technology sector. The company, a leader in this space, faces both opportunities and challenges driven by technological advancements, regulatory changes, and evolving market demands. Understanding the industry trends, potential future challenges, and emerging opportunities is crucial for assessing Axon's strategic positioning and future prospects.

The company’s success hinges on its ability to navigate these complexities while maintaining its competitive edge. A thorough market analysis is essential to understanding the current state and anticipating future developments within the law enforcement technology industry. This includes evaluating Axon Enterprise's market share analysis, identifying its key partnerships, and assessing the impact of recent acquisitions.

Several key trends are currently influencing the law enforcement technology industry. These include the growing adoption of AI and machine learning, increased demand for body-worn cameras, and a focus on data-driven policing. Regulatory changes related to data privacy and the use of force also play a significant role. The industry is moving towards more integrated and comprehensive solutions.

Axon Enterprise faces challenges such as increased competition from both established technology companies and agile startups. Evolving regulatory environments, particularly around data privacy and AI ethics, pose ongoing compliance hurdles. Public scrutiny of surveillance technologies and the use of force requires careful product development and transparent communication. Maintaining innovation and adapting to market changes are crucial.

Axon has significant opportunities to leverage industry trends. The company is investing in AI-powered features for its Axon Cloud platform. Expanding into areas like virtual reality training and drone integration aligns with market demands. Emerging markets, particularly internationally, offer substantial growth potential. Strategic partnerships and acquisitions can also bolster its market position.

To remain competitive, Axon is focusing on deepening its ecosystem integration and expanding its subscription-based services. Continued innovation in AI and other advanced technologies is essential. The company's strategies include strengthening its position as a holistic public safety partner. These efforts aim to secure long-term growth and market leadership.

Axon Enterprise's market position is influenced by its product offerings, including Tasers, body-worn cameras, and cloud-based evidence management systems. Key competitors include Motorola Solutions and smaller, specialized firms. The company's financial performance is a key indicator of its success, with revenue growth and profitability being closely watched by investors. For a deeper understanding of the company's financial health and strategic direction, consider exploring the insights provided by Owners & Shareholders of Axon Enterprise.

- Market Share Analysis: Axon holds a significant market share in body-worn cameras and Taser devices.

- Financial Performance: In 2023, Axon reported revenues of approximately $1.48 billion, a 27% increase year-over-year.

- Competitive Advantage: Axon's competitive advantage lies in its integrated product ecosystem and strong brand reputation.

- Future Outlook: The company anticipates continued growth, driven by increasing demand for its products and services.

Axon Enterprise Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Axon Enterprise Company?

- What is Growth Strategy and Future Prospects of Axon Enterprise Company?

- How Does Axon Enterprise Company Work?

- What is Sales and Marketing Strategy of Axon Enterprise Company?

- What is Brief History of Axon Enterprise Company?

- Who Owns Axon Enterprise Company?

- What is Customer Demographics and Target Market of Axon Enterprise Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.