Axon Enterprise Bundle

How Does Axon Enterprise Thrive in the Public Safety Sector?

Axon Enterprise, formerly known as Taser International, isn't just about tasers anymore; it's a powerhouse reshaping law enforcement. From body cameras to cloud-based evidence management, Axon Company offers a comprehensive suite of solutions. With record revenues and global adoption, understanding Axon's inner workings is key to grasping the future of Axon Enterprise SWOT Analysis and the evolution of police technology.

This deep dive into Axon's operations will explore how this Law Enforcement giant has built a business model centered around innovation, strategic acquisitions, and a commitment to improving public safety. We'll examine its products and services, from Axon body cameras for police to its cloud-based evidence management, and analyze how Axon technology helps law enforcement. By understanding Axon's revenue streams and strategic positioning, you'll gain valuable insights into its growth trajectory and impact on police accountability, addressing questions like "How does Axon Enterprise make money?"

What Are the Key Operations Driving Axon Enterprise’s Success?

Axon Enterprise, formerly known as Taser International, crafts value by providing an integrated ecosystem of hardware and software solutions. These solutions are designed to bolster public safety and streamline law enforcement operations. The company's core offerings include TASER conducted energy weapons, body-worn cameras, in-car cameras, and a cloud-based software suite called Axon Cloud.

Axon's operational model focuses on research and development for product innovation, advanced manufacturing for hardware, and continuous software development for its cloud platforms. The company uses direct sales channels and provides extensive customer service and training. This ensures effective deployment and utilization of its technologies, primarily serving law enforcement agencies, but also extending to corrections, military, and private security sectors globally.

The integrated approach of Axon, where hardware and software work seamlessly together, creates a strong ecosystem for its customers. This integration offers benefits such as improved officer safety, enhanced transparency, and streamlined evidence workflows. The ability to provide a comprehensive solution, from incident to resolution and evidence management, sets Axon apart from competitors.

Axon's primary products include TASER devices, body-worn cameras (Axon Body series), and in-car cameras (Axon Fleet). These hardware solutions are designed to capture and record critical interactions, enhancing accountability and providing evidence.

Axon Cloud offers a suite of software services, including Axon Evidence.com for digital evidence management, Axon Records for report writing, and Axon Dispatch for computer-aided dispatch. These services streamline workflows and improve operational efficiency.

Axon's value proposition centers on enhancing public safety through technology. Its integrated hardware and software solutions improve officer safety, increase transparency, and streamline evidence management. This leads to more efficient and accountable public safety operations.

The primary target market for Axon includes law enforcement agencies, corrections facilities, military branches, and private security firms. Axon's products and services are designed to meet the specific needs of these sectors globally.

Axon's operations are supported by robust R&D, advanced manufacturing, and continuous software development. The company's supply chain is essential for delivering physical products, and its cloud infrastructure ensures secure software service delivery. Axon's direct sales and customer service are key to its success.

- Axon's revenue for 2023 was approximately $1.5 billion, reflecting strong demand for its products and services.

- The company's cloud software segment has seen significant growth, with recurring revenue streams.

- Axon has expanded its international presence, with increasing sales in global markets.

- The company continues to invest in innovation, with new product launches and features. For more detailed information, you can explore the Growth Strategy of Axon Enterprise.

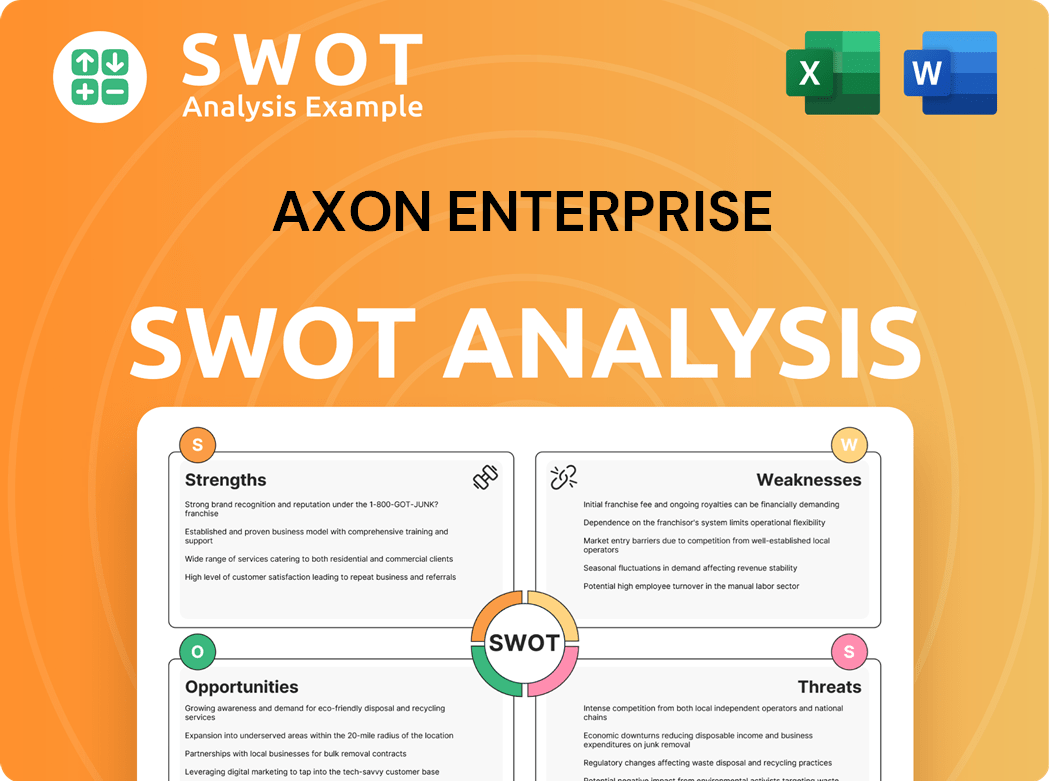

Axon Enterprise SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Axon Enterprise Make Money?

The business model of Axon Enterprise revolves around a dual approach: selling products and offering recurring subscription services. This strategy has significantly boosted its revenue, particularly in the software and services segment. This shift is designed to create a stable, predictable income stream, crucial for long-term financial health.

Axon's main revenue streams include sales of TASER devices, body-worn cameras, in-car cameras, and subscriptions to its Axon Cloud platform. The company has successfully integrated hardware and software, creating a comprehensive ecosystem for law enforcement agencies. This integrated approach enhances customer value and drives recurring revenue.

In 2023, Axon's software and sensors segment saw a remarkable 39% year-over-year growth, reaching $1.11 billion. This growth significantly outpaced the TASER segment, which grew by 16% to $542 million. This highlights the increasing importance of its recurring software revenue and its successful pivot towards a SaaS model.

Initial sales of TASER devices, body cameras, and in-car cameras generate revenue. These sales are often followed by ongoing sales of accessories and consumables, like TASER cartridges. This creates a continuous revenue cycle from the hardware.

Axon offers tiered subscription plans for its Axon Cloud services, providing varying levels of storage, features, and support. This model allows agencies to select plans that match their needs, encouraging adoption across different-sized departments. This is a key aspect of how Axon's business evolved.

Axon employs cross-selling strategies, bundling hardware (cameras) with software subscriptions (Axon Evidence.com) to provide a more comprehensive solution. This approach increases customer value and encourages long-term contracts. It enhances the overall revenue profile.

The company generates revenue from professional services, such as training and implementation support. These services enhance the overall value proposition, fostering customer loyalty and additional revenue streams. This further strengthens its financial performance.

The consistent growth in its software and sensor segment underscores a successful pivot towards a high-margin, recurring revenue model. This shift makes its financial performance more stable and predictable. This is a key factor in Axon's long-term financial strategy.

Axon's monetization strategies are centered around its integrated ecosystem. For hardware, initial sales generate revenue, often followed by ongoing sales of consumables. The cloud-based software, however, represents the most significant and growing monetization strategy.

Axon's financial success is driven by a combination of hardware sales, subscription services, and professional services. The company's focus on recurring revenue and integrated solutions solidifies its position in the police technology market.

- Sales of TASER devices and accessories.

- Sales of body-worn cameras and in-car cameras.

- Subscriptions to the Axon Cloud platform.

- Professional services, including training and implementation.

Axon Enterprise PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Axon Enterprise’s Business Model?

The journey of Axon Enterprise has been marked by strategic shifts and key milestones that have shaped its current standing in the law enforcement technology sector. Initially known for its TASER devices, the company strategically expanded into body-worn cameras and cloud-based digital evidence management software. This evolution allowed the company to transition into a comprehensive technology provider for law enforcement agencies.

A significant move was the launch of Axon Evidence.com, which established a recurring revenue model. In 2023, the company acquired Dedrone's government-facing counter-drone business, broadening its public safety technology offerings. These moves highlight Axon's commitment to innovation and addressing emerging threats within the industry. The company continues to adapt to new trends, such as the increasing demand for real-time intelligence and AI-powered solutions in public safety, through ongoing innovation and strategic partnerships.

Operational challenges have included managing rapid growth and ensuring seamless integration of new technologies and acquisitions, all while navigating the complexities of government procurement cycles. The company has responded by investing heavily in R&D and scaling its cloud infrastructure. The company's ability to navigate these challenges has been crucial to its continued success.

The company's history is marked by several important milestones. The initial success of TASER devices provided a strong foundation. The introduction of body-worn cameras and cloud-based evidence management systems, such as Axon Evidence.com, transformed the business model. The acquisition of Dedrone in 2023 further expanded its offerings.

Strategic moves have been central to Axon's evolution. The shift from a hardware-focused company to a provider of integrated hardware and software solutions was critical. Investing in R&D and cloud infrastructure has been ongoing. Strategic partnerships have also played a role in expanding its capabilities and market reach.

The company maintains a strong competitive position. Its brand recognition within law enforcement, built over decades, provides a significant advantage. Technology leadership, particularly its integrated hardware-software ecosystem, sets it apart. Economies of scale in manufacturing and cloud services enhance cost efficiency.

In 2024, the company reported strong financial results, driven by recurring revenue from its software and services. The company's revenue for 2024 is projected to be between $1.75 billion and $1.80 billion. The company's gross profit margin is expected to be around 60%. These figures demonstrate the company's strong financial health and growth potential.

Axon's competitive advantages are built on several key factors. Strong brand recognition and technology leadership are crucial. The integrated hardware-software ecosystem provides a comprehensive solution. Economies of scale and the network effect further enhance its position. You can find more about its competitors in the Competitors Landscape of Axon Enterprise.

- Brand Recognition: Decades of experience in the law enforcement market.

- Technology Leadership: Integrated hardware-software solutions.

- Network Effect: Large installed base of agencies using its products.

- Recurring Revenue: Subscription-based services for evidence management.

Axon Enterprise Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Axon Enterprise Positioning Itself for Continued Success?

Axon Enterprise holds a strong position in the law enforcement technology market, particularly in body-worn cameras and digital evidence management. Its comprehensive ecosystem gives it a significant competitive edge. The company's products are used by a large number of law enforcement agencies globally, and it has a high customer retention rate due to its integrated solutions.

Despite its strong market position, Axon faces several risks. These include regulatory changes, new competitors, technological disruptions, and economic downturns. The company is focused on expanding its product portfolio and integrating AI to enhance efficiency for law enforcement.

Axon dominates the law enforcement technology sector, especially in body-worn cameras and digital evidence management systems. Its integrated approach provides a competitive advantage over point solution providers. The company's extensive customer base and high retention rates reflect the value of its comprehensive offerings.

Axon faces risks from regulatory changes, competition from AI-focused companies, and technological advancements. Economic factors and shifts in government spending can also impact its revenue. These factors could affect product development and market acceptance.

Axon plans to expand its product offerings, especially in real-time operations, VR training, and drone technology. The company aims to integrate AI further into its solutions. Its commitment to innovation and its vision for a safer future position it for continued growth.

Axon generates revenue through its TASER segment, sales of body cameras, and its Axon Cloud software. The company's business model relies on recurring revenue from software subscriptions and services. It also focuses on expanding its connected public safety ecosystem.

In Q1 2024, Axon reported revenues of $377 million, a 34% increase year-over-year. Software and related revenue grew by 49% to $145 million. The company's net income was $22.7 million, with an adjusted EBITDA of $71.2 million. Axon is focused on expanding its cloud-based services and global market presence.

- Revenue growth driven by strong demand for body cameras and cloud services.

- Significant expansion in international markets.

- Continued investment in AI and product development.

- Focus on long-term growth through recurring revenue streams.

Axon Enterprise Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Axon Enterprise Company?

- What is Competitive Landscape of Axon Enterprise Company?

- What is Growth Strategy and Future Prospects of Axon Enterprise Company?

- What is Sales and Marketing Strategy of Axon Enterprise Company?

- What is Brief History of Axon Enterprise Company?

- Who Owns Axon Enterprise Company?

- What is Customer Demographics and Target Market of Axon Enterprise Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.