Axon Enterprise Bundle

Can Axon Enterprise Continue Its Dominance in Public Safety Technology?

From its humble beginnings as Air Taser, Inc., Axon Enterprise has revolutionized law enforcement, evolving from a single-product company to a global leader in Axon Enterprise SWOT Analysis. With a mission to protect life, Axon has consistently innovated, expanding its offerings to include body-worn cameras and cloud-based software. This transformation has propelled the company to impressive financial milestones, including surpassing $2 billion in revenue in 2024.

Axon's remarkable journey, marked by consistent revenue growth and a robust pipeline, underscores its strategic prowess and commitment to innovation in the public safety technology sector. The company's future prospects look bright, driven by its expansion plans, investments in cutting-edge technology, and a sound financial strategy. This analysis will delve into Axon Enterprise's growth strategy, market share analysis, and future prospects, providing insights into its continued success and impact on law enforcement.

How Is Axon Enterprise Expanding Its Reach?

Axon Enterprise is actively pursuing a multi-faceted growth strategy, focusing on both geographical and product category diversification, alongside strategic mergers and acquisitions. The company aims to expand its reach beyond its traditional law enforcement customer base, exploring opportunities in sectors like retail and healthcare. This strategic approach is designed to solidify its position in the public safety technology market and drive long-term value.

The company's expansion initiatives are supported by a robust product pipeline and strategic acquisitions. These efforts are geared towards enhancing its product portfolio and expanding its customer base. The company is also launching new products, such as Axon Body Workforce, a lightweight body-worn camera for frontline workers.

International growth is a significant driver for Axon Enterprise, with international bookings showing impressive gains in 2024. These initiatives are designed to drive social value and strengthen global engagement, showcasing the company's commitment to innovation and market expansion. For more context, you can read a Brief History of Axon Enterprise.

Axon Enterprise is focusing on expanding its international presence. International bookings saw a strong increase in 2024. This expansion is supported by adapting its domestic partnership framework for international markets. The company is aiming to strengthen its global engagement.

The company is expanding its product offerings beyond its core law enforcement solutions. Recent introductions like Axon Lightpost and Axon Outpost demonstrate its commitment to new segments. This includes areas like automatic license plate recognition (ALPR). Axon is also launching new products like Axon Body Workforce.

Axon Enterprise is exploring new market segments beyond law enforcement. This includes opportunities in retail and healthcare. The company is aiming to diversify its customer base. This strategic move is designed to drive revenue growth.

Mergers and acquisitions are a key part of Axon's expansion strategy. In 2024, Axon acquired Fusus to strengthen its Real-Time Operations (RTO) platform. The company also acquired Dedrone in May 2024 and made a strategic investment in Auror in November 2024.

Axon Enterprise's expansion strategy includes significant international growth and strategic acquisitions. The company is focused on diversifying its product offerings and entering new market segments. These initiatives support the company's long-term growth prospects.

- International bookings increased, with a 40% rise in Q3 2024 and nearly 50% in Q4 2024.

- Acquisition of Fusus strengthened the Real-Time Operations (RTO) platform.

- The company invested in Auror, a retail crime reporting software provider, in November 2024.

- Axon acquired Dedrone in May 2024, expanding its Axon Air portfolio.

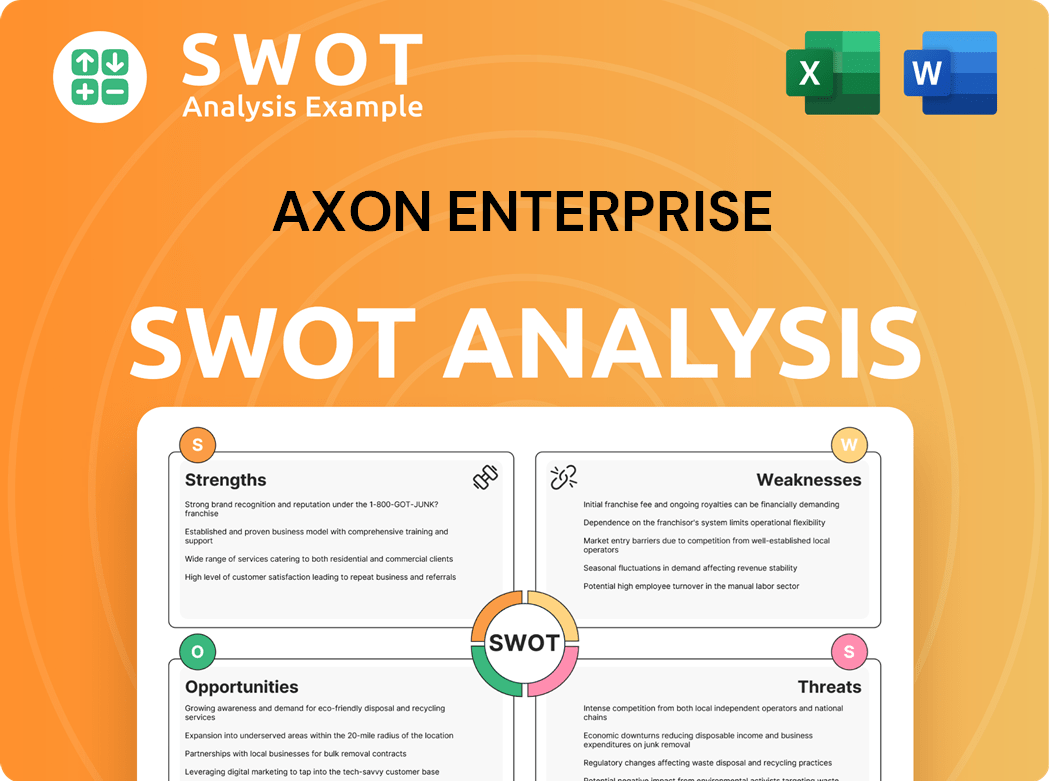

Axon Enterprise SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Axon Enterprise Invest in Innovation?

The innovation and technology strategy of Axon Enterprise is central to its long-term growth. The company strategically invests in research and development (R&D) to maintain its competitive edge in the public safety technology market. This commitment is reflected in its capital expenditure plans for 2025, which include significant investments in R&D alongside capacity expansion and new product development.

In 2024, Axon Enterprise increased its capital expenditures by 32% to support new product development, expand its Axon Evidence cloud infrastructure, and scale up production of TASER 10 and Axon Body 4. Management anticipates high investment activity in 2025, with R&D investments projected to remain at 3.5–5% of revenue over the long term. This focus on innovation is crucial for maintaining its position in the law enforcement sector.

Axon Enterprise's approach to innovation is deeply rooted in the integration of artificial intelligence (AI) into its product ecosystem. The 'AI Era Plan' bundle is a significant driver of growth, with analysts projecting a potential $1.8 billion in annual recurring revenue from this initiative. This strategic move underscores the company's commitment to leveraging cutting-edge technology to enhance its offerings.

Axon Enterprise is at the forefront of AI-driven public safety solutions. Its generative AI tool, Draft One, automates initial drafts of police reports from body and dashboard camera footage.

Draft One has proven highly effective, contributing to over 100,000 incident reports. It has saved officers an estimated 2.2 million minutes of valuable time, significantly improving operational efficiency.

Evidence.com, Axon Enterprise's cloud-based digital evidence management software, is a major growth driver. This platform streamlines the management of digital evidence, enhancing security and accessibility.

Axon Enterprise has made strategic acquisitions to strengthen its technology offerings. The acquisition of Fusus in February 2024 enhances the Real-Time Operations (RTO) platform.

The company is expanding its Axon Air portfolio, including the acquisition of Dedrone in May 2024. This acquisition adds AI-based smart airspace security solutions.

Axon Enterprise's product-led flywheel approach uses data and connected devices to drive innovation. This approach enhances customer experience and attracts new users.

Axon Enterprise is developing new systems to measure how community feedback influences product decisions. This creates a robust framework for accountability and continuous improvement.

- Axon Enterprise's commitment to R&D is a key element of its growth strategy.

- The integration of AI is transforming public safety technology.

- Strategic acquisitions are expanding the company's capabilities.

- The product-led flywheel approach enhances customer experience.

Axon Enterprise PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Axon Enterprise’s Growth Forecast?

The financial outlook for Axon Enterprise is notably positive, fueled by strong performance in 2024 and ambitious growth targets for 2025. The company's strategic focus on public safety technology and its subscription-based business model are key drivers of this financial success. This positions Axon Enterprise for continued expansion and leadership in the law enforcement and public safety sectors.

Axon Enterprise's financial health is reflected in its impressive revenue growth. The company's ability to consistently exceed growth expectations underscores its effective growth strategy and strong market position. The company is also focused on product innovation, which is a key component of its long-term growth strategy.

Axon Enterprise's commitment to innovation and strategic acquisitions further strengthens its market position. The company's investor relations efforts and transparent communication about its financial performance build confidence among stakeholders. To understand the target audience of Axon Enterprise, you can read this article: Target Market of Axon Enterprise.

Axon Enterprise reported annual revenue of $2.1 billion for 2024, a 33% year-over-year increase. This marks the third consecutive year of over 30% annual growth, demonstrating strong momentum. The company's performance highlights its effective growth strategy and market leadership.

Axon's annual recurring revenue reached $1.1 billion as of Q1 2025. This growth underscores the success of its subscription-based business model, which provides predictable revenue streams. The increase in ARR is a strong indicator of future financial performance.

Total future contracted bookings stood at $10.1 billion in 2024. This substantial figure indicates significant revenue visibility and supports long-term growth. The company's ability to secure large contracts is a key factor in its financial outlook.

For fiscal year 2025, Axon has raised its revenue guidance to a range of $2.60 billion to $2.70 billion, representing approximately 27% annual growth at the midpoint. This reflects management's confidence in Axon's continued momentum. This positive outlook is supported by strong market demand.

Axon expects adjusted EBITDA to be between $650 million and $675 million in 2025, maintaining an approximate 25% margin. This demonstrates the company's focus on profitability and efficient operations. The company's adjusted EBITDA margin for the full year 2024 was 25%.

The Software & Services segment achieved adjusted gross margins of 75.9% in Q1 2025, while Connected Devices maintained healthy margins of 59.9%. Overall, the company achieved a total adjusted gross margin of 65.9% in Q1 2025. These margins highlight the profitability of Axon's business model.

Axon's subscription-based revenue model provides high visibility into future performance, with 95% of its revenue tied to subscription plans. Approximately 75% of subscription revenue comes from software over a typical 5-year term. This model ensures a steady revenue stream.

The company plans to invest between $160 million and $180 million in capital expenditures in 2025. These investments will support R&D, capacity expansion, and new product development. This investment is crucial for sustaining innovation.

Analysts project Axon to achieve a long-term revenue compound annual growth rate (CAGR) of over 20% and an adjusted EBITDA margin of around 25% beyond fiscal year 2024. These projections reflect strong confidence in Axon's future performance. This forecast supports the company's long-term growth strategy.

Axon's focus on product innovation and strategic acquisitions is expected to drive future growth. The company's commitment to sustainability initiatives also contributes to its long-term outlook. These strategic moves are designed to strengthen Axon's competitive landscape.

Axon Enterprise Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Axon Enterprise’s Growth?

Despite its promising Growth Strategy and Future Prospects, Axon Enterprise faces several potential risks and obstacles that could hinder its expansion. These challenges span market competition, regulatory hurdles, and operational vulnerabilities. Understanding these risks is crucial for investors and stakeholders evaluating Axon Enterprise's long-term potential.

The company's dependence on the public sector, specifically law enforcement agencies, introduces a degree of strategic risk. Any shifts in purchasing patterns or budget cuts within these agencies could significantly impact Axon Enterprise's financial performance. Furthermore, rapid technological advancements and the emergence of new competitors continually reshape the Law Enforcement technology landscape, creating ongoing challenges.

Axon Enterprise must navigate a complex web of challenges to sustain its growth. These include competitive pressures, regulatory changes, and operational risks. The company's ability to effectively manage these obstacles will be critical to achieving its Future Prospects.

Axon Enterprise operates in a competitive market. Competitors like Motorola Solutions are actively expanding their offerings. Motorola Solutions' $4.4 billion acquisition of Silvus Technologies in May 2025 could pose challenges for Axon's expansion.

Regulatory changes and legal challenges can impact Axon Enterprise. Antitrust investigations and potential litigation could force the company to alter its business strategy. Innovative solutions like Drone as First Responder (DFR) also face regulatory hurdles.

Supply chain vulnerabilities and the potential unavailability of materials can affect financial results. Rapid technological changes and new competing products can impact Axon's competitive position. The development and use of AI also introduce security and ethical considerations.

Axon Enterprise's reliance on law enforcement agencies is a strategic risk. Any reduction in purchases by these agencies could adversely affect the company's business and financial condition. Diversification into other markets is a key strategy.

Expanding internationally introduces risks such as regulatory hurdles and competition in foreign markets. Axon Enterprise's global expansion plans must carefully consider these factors to ensure sustainable growth. Navigating international markets requires careful planning.

The development, deployment, and use of AI in its products and services pose risks. These include potential security breaches involving third-party providers. Axon Enterprise is investing in responsible innovation to address these challenges.

Axon Enterprise employs several strategies to mitigate risks. Diversification into new markets, such as retail and healthcare, aims to reduce reliance on law enforcement. The company's focus on subscription-based models provides revenue predictability.

Investing heavily in research and development is crucial for maintaining a technological advantage. Axon Enterprise emphasizes responsible innovation and integrates ethical tech training. This focus helps navigate potential policy challenges with AI.

The company's subscription-based model, featuring long-term contracts (up to 10 years), helps with customer retention. This approach provides a degree of revenue predictability, which helps mitigate business downturns. This strategy supports stable financial performance.

Expanding into markets beyond law enforcement, such as retail and healthcare, is a key strategy. This diversification reduces the company's reliance on a single customer base. Diversification improves the overall financial stability of Axon Enterprise.

For a deeper understanding of the competitive landscape, consider exploring the Competitors Landscape of Axon Enterprise.

Axon Enterprise Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Axon Enterprise Company?

- What is Competitive Landscape of Axon Enterprise Company?

- How Does Axon Enterprise Company Work?

- What is Sales and Marketing Strategy of Axon Enterprise Company?

- What is Brief History of Axon Enterprise Company?

- Who Owns Axon Enterprise Company?

- What is Customer Demographics and Target Market of Axon Enterprise Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.