Bentley Bundle

What's the Story Behind Bentley's Success?

Founded in 1984, Bentley Systems embarked on a mission to revolutionize infrastructure design, a journey that has cemented its place as a global leader. From its humble beginnings, the company has consistently innovated, providing software solutions that have reshaped how infrastructure projects are conceived and executed. Today, Bentley Systems stands as a testament to the power of vision and technological advancement.

While Bentley Systems focuses on infrastructure software, it's worth noting the legacy of another Bentley: Bentley SWOT Analysis can be used to understand the company's strategic position. This article delves into the remarkable Bentley history, exploring how a company born from a vision to improve design became a global force. We will explore the Bentley company's evolution, its key milestones, and its impact on the world.

What is the Bentley Founding Story?

The story of the Bentley company begins in 1984, not with luxury cars, but with software. Five brothers – Keith A. Bentley, Barry J. Bentley, Raymond B. Bentley, Greg Bentley, and Scott Bentley – came together to establish what would become a major player in infrastructure engineering software.

Keith and Barry Bentley are credited as the original founders. Their initial focus was on commercializing software Keith had developed. This early venture, far from the world of British luxury cars, was centered on enhancing Computer-Aided Design (CAD) technology as personal computers gained popularity.

The company's journey started in California before moving to Philadelphia and then settling in Exton, Pennsylvania. This move set the stage for the development and launch of their first commercial product, PseudoStation, in 1985.

The initial problem identified was the opportunity to enhance CAD technology as personal computers became widely available in the 1980s.

- In 1985, PseudoStation was introduced, priced at $7,943.

- This software allowed users of Intergraph's VAX systems to use lower-cost graphics terminals.

- It enabled the viewing and modification of designs on Intergraph IGDS installations.

- A DOS-based version of MicroStation, a flagship product, followed in 1986.

The Bentley family has maintained a majority stake in the company, demonstrating a long-term commitment to its management and direction. This family involvement has been a consistent factor throughout its history. To learn more about the brand, you can read about the Target Market of Bentley.

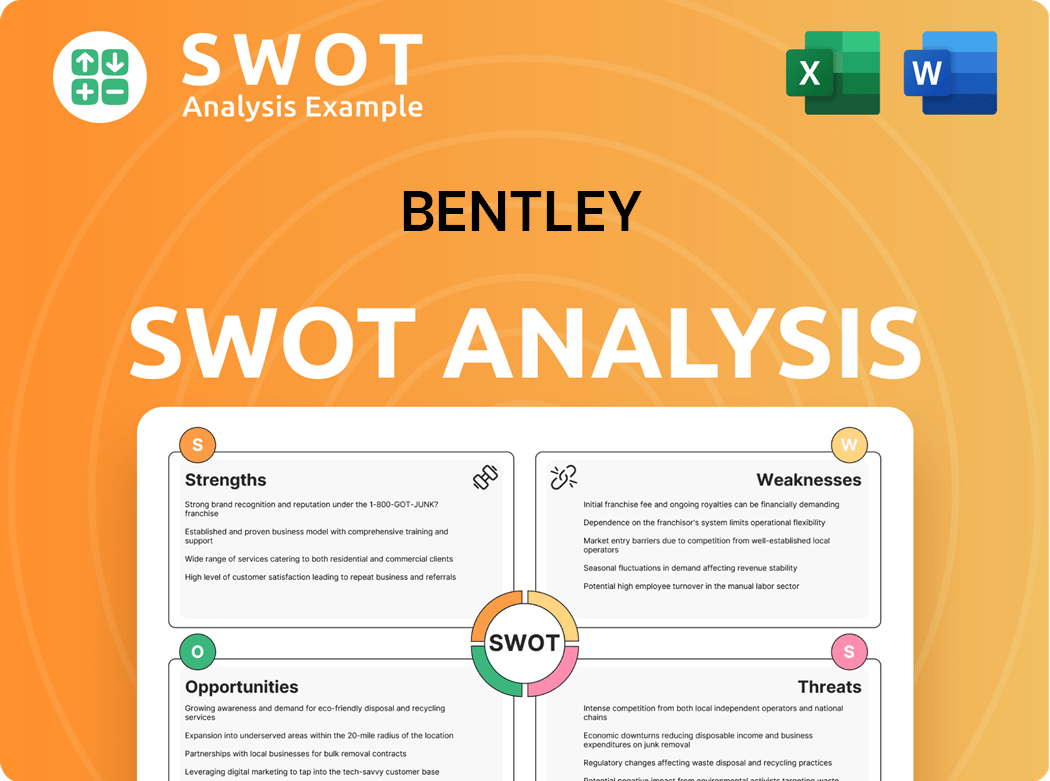

Bentley SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Bentley?

The early growth of the Bentley company was characterized by strategic product development and significant expansion. Following the introduction of MicroStation in 1986, the company focused on building its platform. The late 1990s saw rapid growth, driven by networked PCs and servers, leading to global expansion and the establishment of its own distribution channels. Revenue increased substantially during this period.

A key development was the acquisition of Opti Inter-Consult, which provided the foundation for ProjectWise, Bentley's infrastructure project delivery software, launched in 1999. ProjectWise is currently used by 46 U.S. State Departments of Transportation. From 2000 to 2004, Bentley made several strategic acquisitions, including Rebis and Haestad Methods, which solidified its leadership in various design sectors.

In 2005, Bentley further strengthened its position in structural engineering software by acquiring STAAD and RAM International. The company also opened a development center in Lithuania. By 2009, revenues surpassed $500 million, demonstrating substantial growth and market penetration. These moves helped shape the Bentley history.

The 2010s saw the introduction of AssetWise software for optimizing infrastructure asset performance, which was adopted by Europe's Crossrail project. Acquisitions like SACS for offshore structural analysis and the establishment of its first U.K. headquarters in London further marked this period of growth. Revenues in Asia, particularly Greater China, also accelerated, doubling during this time. If you want to learn more about the Bentley company, you can read about its brief history.

Revenue climbed from $95 million in 1995 to over $182 million in 1999, showcasing significant financial progress. The expansion into new markets and the development of innovative software solutions were key drivers of this financial success. This period solidified Bentley's position in the automotive industry.

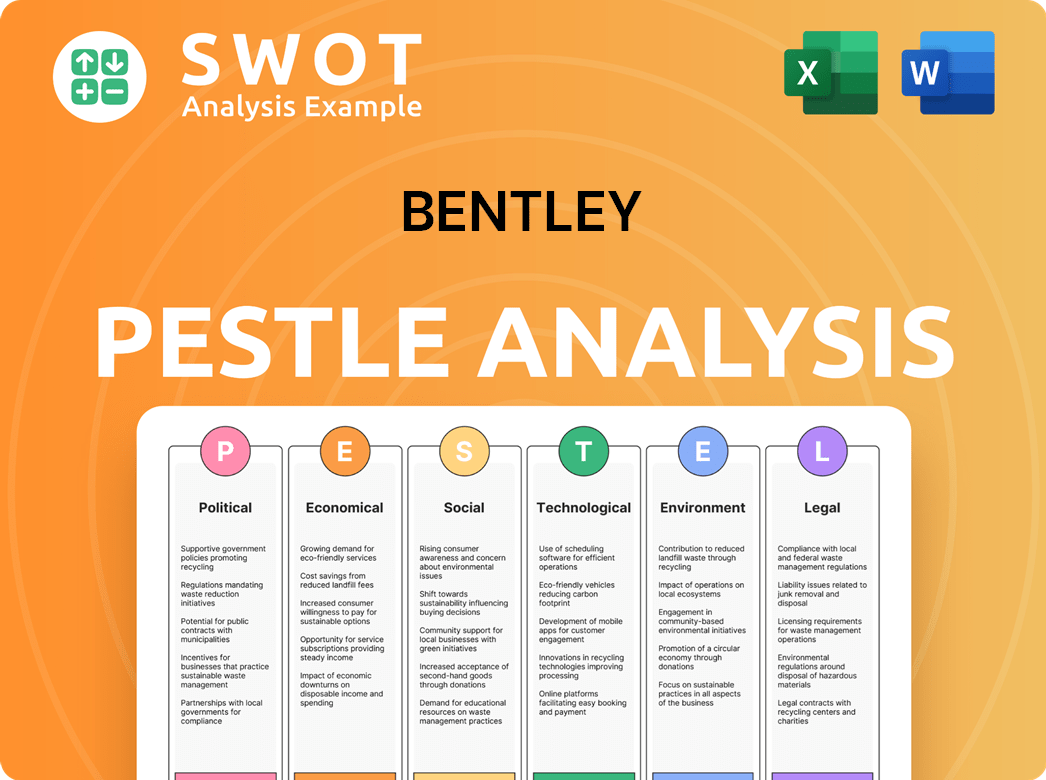

Bentley PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Bentley history?

The Bentley Motors story is marked by significant milestones that have shaped its legacy in the automotive industry. From its early days to its current status as a symbol of luxury, the company has achieved numerous benchmarks.

| Year | Milestone |

|---|---|

| 1919 | W.O. Bentley founded the company, marking the beginning of a new era in British luxury cars. |

| 1920s | Bentley established its reputation through racing, including multiple wins at the 24 Hours of Le Mans. |

| 1931 | The company was acquired by Rolls-Royce, which led to a period of shared engineering and design. |

| 1998 | The company was acquired by Volkswagen, leading to significant investments and modernization. |

| 2003 | The Continental GT was launched, becoming a major success and redefining the brand's appeal. |

| 2024 | The company continues to innovate, with a focus on electrification and sustainable luxury. |

Bentley Motors has consistently pushed the boundaries of automotive technology. The company has been at the forefront of innovation, from pioneering engine designs to integrating advanced technologies.

Bentley has been known for its powerful and refined engines, including the iconic V8 and W12 configurations. These engines have provided exceptional performance and a distinctive driving experience.

Bentley's involvement in racing, particularly at the 24 Hours of Le Mans, has driven innovation in engine technology and vehicle design. This heritage has been a cornerstone of the brand's identity.

The company has consistently introduced luxurious features, including high-quality materials, advanced infotainment systems, and bespoke customization options. These features have set the standard for luxury vehicles.

Bentley has integrated advanced technologies, such as driver-assistance systems, connectivity features, and electric powertrains. These innovations enhance both performance and sustainability.

The company is investing heavily in electrification, with plans to introduce hybrid and fully electric models. This shift reflects a commitment to sustainable luxury.

Bentley offers extensive customization options through its Mulliner division, allowing customers to create unique vehicles. This level of personalization is a key aspect of the brand's appeal.

Despite its successes, Bentley has faced challenges throughout its history. The company has had to navigate economic downturns, changing consumer preferences, and the evolving automotive landscape.

The luxury car market is sensitive to economic fluctuations, and Bentley has had to adapt to periods of reduced demand. Strategic adjustments have been necessary to maintain profitability.

Bentley faces intense competition from other luxury brands, requiring continuous innovation and differentiation. Maintaining a strong brand identity is crucial in this environment.

Changes in consumer preferences and the rise of electric vehicles pose challenges and opportunities. The company must adapt its product offerings to remain relevant.

Stringent emissions standards and safety regulations require significant investment in technology and design. Compliance is essential for market access.

Disruptions in the global supply chain can impact production and delivery schedules. Effective supply chain management is essential for operational efficiency.

The rapid pace of technological change requires continuous investment in research and development. Staying ahead of the curve is vital for long-term success.

For more insights into Bentley's ownership and financial performance, explore the resources available at Owners & Shareholders of Bentley.

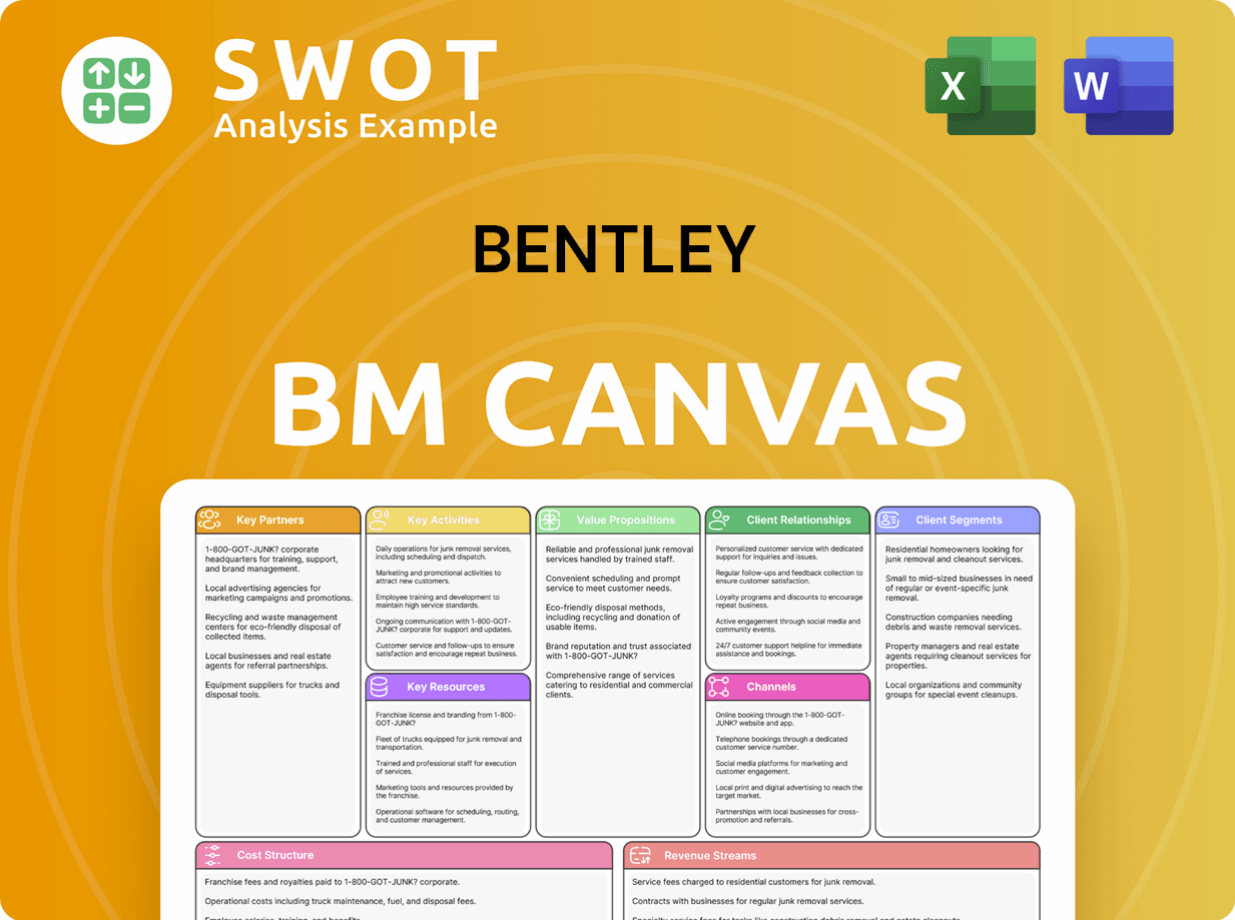

Bentley Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Bentley?

The story of the Bentley Motors is marked by innovation and strategic shifts. The company's journey, from its inception to its current position, showcases its evolution within the automotive industry.

| Year | Key Event |

|---|---|

| 1984 | Bentley Systems is established by the Bentley brothers. |

| 1985 | PseudoStation, the company's first commercial product, is introduced. |

| 1986 | A DOS-based version of MicroStation is launched. |

| 1997-2004 | A series of acquisitions, including IdeaGraphix (1997) and Rebis (2003), expand the company's software portfolio. |

| 1999 | ProjectWise is officially launched. |

| 2005 | Acquisitions of STAAD and RAM International establish leadership in structural engineering software. |

| 2010 | AssetWise software is introduced to optimize infrastructure asset performance. |

| 2016 | Siemens acquires a minority stake in Bentley Systems. |

| 2020 | Bentley Systems goes public with an Initial Public Offering (IPO) on Nasdaq. |

| October 2024 | Bentley Systems begins using Google 2D and 3D geospatial content in some of its software, following the acquisition of Cesium. |

| 2024 | Nicholas Cumins succeeds Greg Bentley as CEO. |

| Q4 2024 | Total revenues reach $1,353.1 million, with subscription revenues at $1,223.4 million. |

| Q1 2025 | Total revenues reach $370.5 million, with Annualized Recurring Revenues (ARR) of $1,319.3 million. |

| April 2025 | Bentley Systems partners with Google to enhance infrastructure asset analytics. |

Bentley Systems anticipates continued growth, projecting total revenues between $1,461 million and $1,490 million, or $1,481 million to $1,510 million in constant currency. Subscription revenues are expected to increase by 10.5% to 12.5% in constant currency. The company aims for an adjusted operating income margin of approximately 28.5%.

Bentley is expanding its Enterprise 365 (E365) subscription model for large enterprise accounts. They are also increasing their presence in the small and medium business (SMB) market through Virtuosity. The company is actively investing in AI-driven solutions and exploring new product offerings like Bentley Asset Analytics.

Strategic partnerships, such as the one with Google for geospatial content integration, are expected to open new market opportunities. Bentley's focus on 'open data ecosystems' aims to address challenges like the shortage of engineers and the increasing demand for AI in data analysis within the infrastructure industry.

The company anticipates free cash flow between $415 million and $455 million for 2025. This financial outlook reflects Bentley's commitment to infrastructure advancements and its vision of combining technology with human expertise. The focus remains on future-proofing infrastructure.

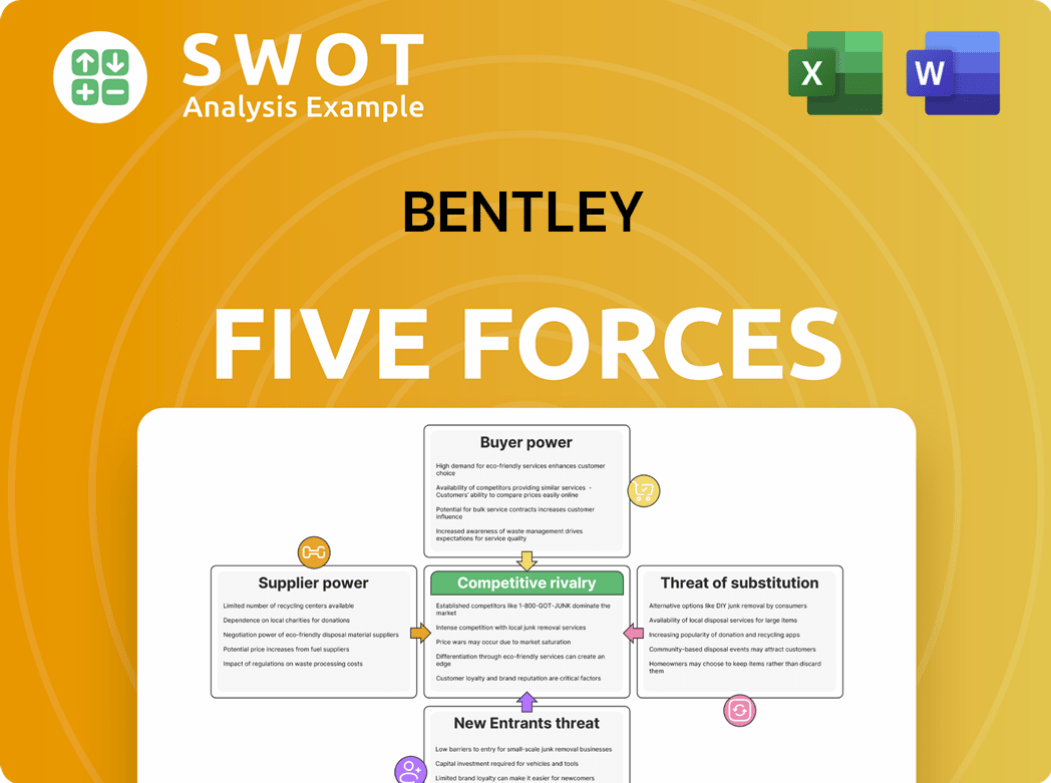

Bentley Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Bentley Company?

- What is Growth Strategy and Future Prospects of Bentley Company?

- How Does Bentley Company Work?

- What is Sales and Marketing Strategy of Bentley Company?

- What is Brief History of Bentley Company?

- Who Owns Bentley Company?

- What is Customer Demographics and Target Market of Bentley Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.