Bentley Bundle

Who Really Owns Bentley Systems?

Unraveling the ownership of Bentley Systems is key to understanding its trajectory in the infrastructure software market. After decades as a private entity, Bentley Systems went public on September 23, 2020, trading on the Nasdaq under the ticker 'BSY'. This move marked a significant shift in the company's financial landscape.

This analysis will explore the evolution of Bentley SWOT Analysis, from its founding to its current ownership structure, including the influence of its board and recent market performance. Understanding the Bentley ownership and its parent company details is crucial for investors and stakeholders alike. We'll delve into the history, examining who owns Bentley now and how this has shaped its strategic direction and financial outcomes, including its impressive financial performance in 2024.

Who Founded Bentley?

The story of Bentley's ownership begins in 1984 with its founding by the Bentley brothers. The company's early years were marked by self-funding and a strong emphasis on product development, setting the stage for its future in the luxury car market. This focus on innovation and quality has been a constant throughout its history.

Bentley's initial ownership structure was straightforward, with the founding brothers holding equal shares. This structure allowed for a unified vision and a hands-on approach to building the brand. The early involvement of the Bentley family in key roles helped shape the company's direction.

The founders, Keith A. Bentley and Barry J. Bentley, established the company. Raymond B. Bentley and Greg Bentley also played crucial roles early on. Greg Bentley later became the CEO, guiding the company's strategic decisions. The company's initial success was built on this strong foundation of family involvement and a clear vision for the future. Understanding the Brief History of Bentley helps to understand the ownership.

Keith A. Bentley and Barry J. Bentley founded the company in 1984.

Keith and Barry Bentley each initially held a 50% ownership stake.

Raymond B. Bentley was one of the original developers, and Greg Bentley later became CEO.

The company was self-funded for the first decade, focusing on product development.

Barry Bentley served as the chairperson of the board from 1984 to 1996.

Scott Bentley, another brother, was also involved early on.

The early ownership structure of Bentley, with the founding brothers at the helm, laid the groundwork for its future success. This hands-on approach and focus on product development were crucial in establishing the brand. Understanding the early ownership helps to understand the current Bentley's parent company.

- The company was founded by the Bentley brothers, with Keith and Barry holding equal shares.

- Raymond and Greg Bentley also played key roles in the company's early development.

- The initial self-funding approach allowed the company to focus on product development.

- Barry Bentley served as the chairperson, guiding the company's strategic direction.

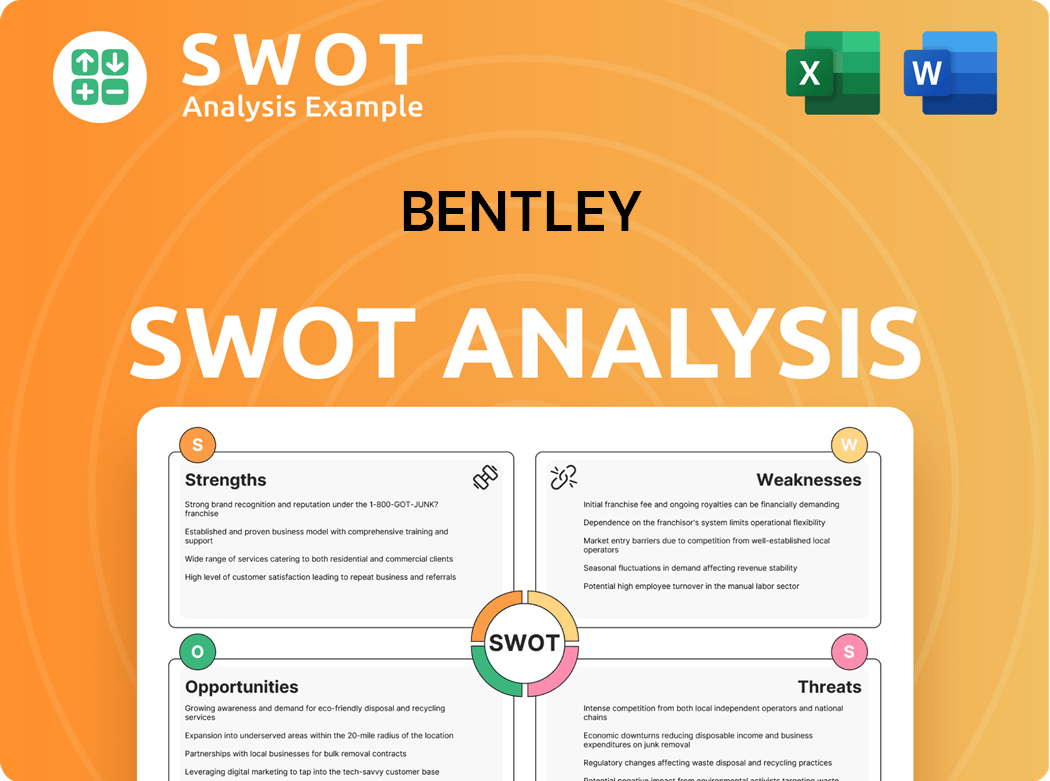

Bentley SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Bentley’s Ownership Changed Over Time?

The evolution of Bentley ownership is marked by significant milestones, particularly its transition from a privately held entity to a publicly traded company. Bentley Systems remained private for 36 years before its initial public offering (IPO) on September 23, 2020. This strategic move, which saw the sale of 10.75 million Class B common stock shares, was a pivotal moment in shaping its current ownership structure. The IPO, listed on the Nasdaq Global Select Market under the symbol 'BSY,' initially valued the company at approximately $5.75 billion. As of June 13, 2025, the market capitalization has grown to $15.56 billion, representing a substantial increase of 170.81% since the IPO.

The company's ownership structure is further defined by a dual-class share system. This system is a key aspect of Bentley ownership. Class B shares, traded publicly, have one vote per share, while Class A shares provide 29 votes per share. This structure allows the founding family to retain significant control over the company's direction. Following the IPO, the Bentley family, through the Bentley Control Group, controlled about 67.4% of the voting power of the outstanding capital stock.

| Ownership Category | Ownership Percentage (as of December 2024) | Key Stakeholders |

|---|---|---|

| Individual Insiders | 46% | Bentley family members: Corinne Bentley (11%), Marie Bentley (9.1%), Keith Bentley (6.4%) |

| Institutional Investors | 25.75% (as of June 9, 2025) | Vanguard Group Inc., Kayne Anderson Rudnick Investment Management LLC, BlackRock, Inc. |

| General Public | 14% | Individual investors |

The current ownership landscape of Bentley Systems reflects a mix of insider control, institutional investment, and public ownership. Individual insiders, primarily the Bentley family, hold the largest stake, with 46% of the shares as of December 2024. Institutional investors collectively possess a substantial portion of the stock, with 789 institutional owners holding a total of 139,381,365 shares as of June 12, 2025. The general public holds a 14% stake. Understanding the Bentley parent company and its ownership structure is crucial for anyone interested in the luxury car market. For a deeper dive into the competitive environment, consider exploring the Competitors Landscape of Bentley.

Bentley Systems' ownership structure is a blend of family control, institutional investment, and public ownership.

- The Bentley family, through the Bentley Control Group, maintains significant voting power.

- Institutional investors hold a substantial portion of the company's stock.

- The public holds a 14% stake, offering insights into the company's market presence.

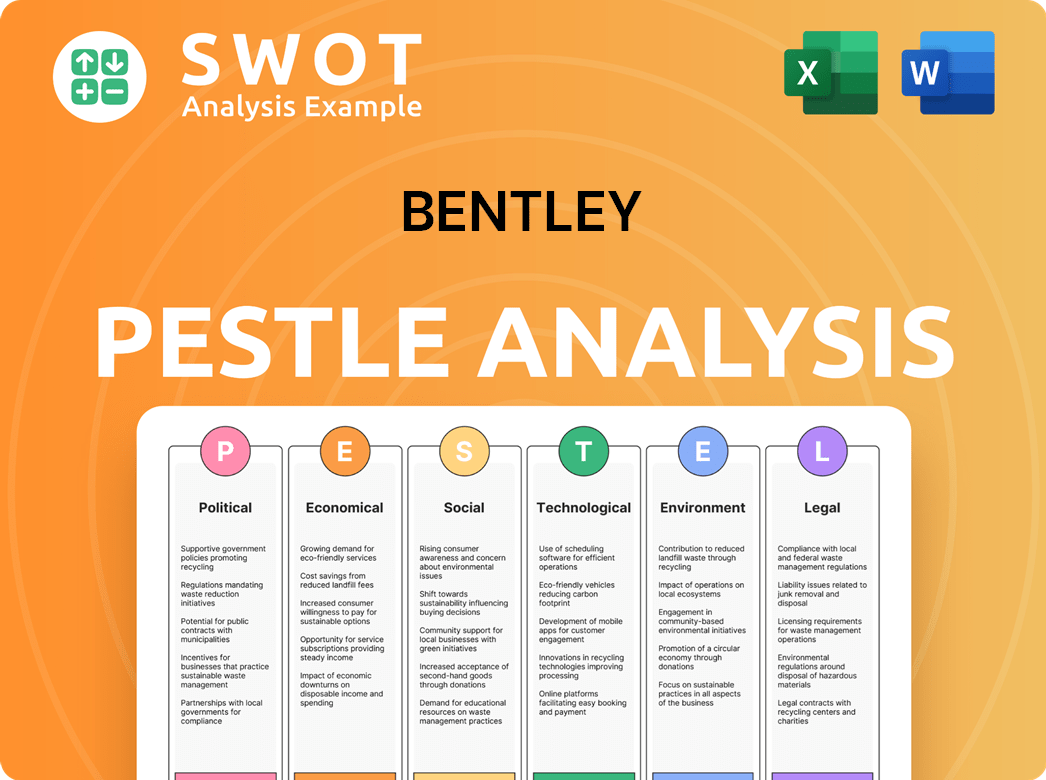

Bentley PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Bentley’s Board?

The current board of directors significantly influences the governance of the company, especially considering its dual-class share structure. Key figures include four Bentley brothers, with Greg Bentley serving as Executive Chairman. Keith Bentley, a co-founder and former CTO, also holds a position on the board following his retirement. Raymond Bentley, another founder, has been a director since 2015. Specific details regarding all current board members and their direct representation of major shareholders beyond the Bentley family are not readily available.

The board's composition reflects the company's historical roots and the influence of its founding family. This structure is crucial in understanding the distribution of power and decision-making processes within the organization. The presence of the Bentley family members on the board underscores their continued involvement and strategic direction of the company.

| Board Member | Title | Notes |

|---|---|---|

| Greg Bentley | Executive Chairman | One of the Bentley brothers. |

| Keith Bentley | Director | Co-founder and former CTO. |

| Raymond Bentley | Director | Founder, served as a director since 2015. |

The voting structure of the company is designed to ensure the Bentley family maintains substantial control. Class A shares possess significantly more voting power than Class B shares. This setup allows the Bentley family to retain a considerable influence over corporate decisions. The Bentley Control Group holds or can control approximately 67.4% of the voting power following the IPO. This concentration of control limits the influence of Class B common stock holders.

The ownership of the company is primarily influenced by the Bentley family through a dual-class share structure. This structure gives the family significant control over the company's strategic direction. Learn more about the Marketing Strategy of Bentley.

- The Bentley family maintains a strong influence.

- Class A shares have more voting power.

- The Bentley Control Group has significant voting power.

- Class B shareholders have limited influence.

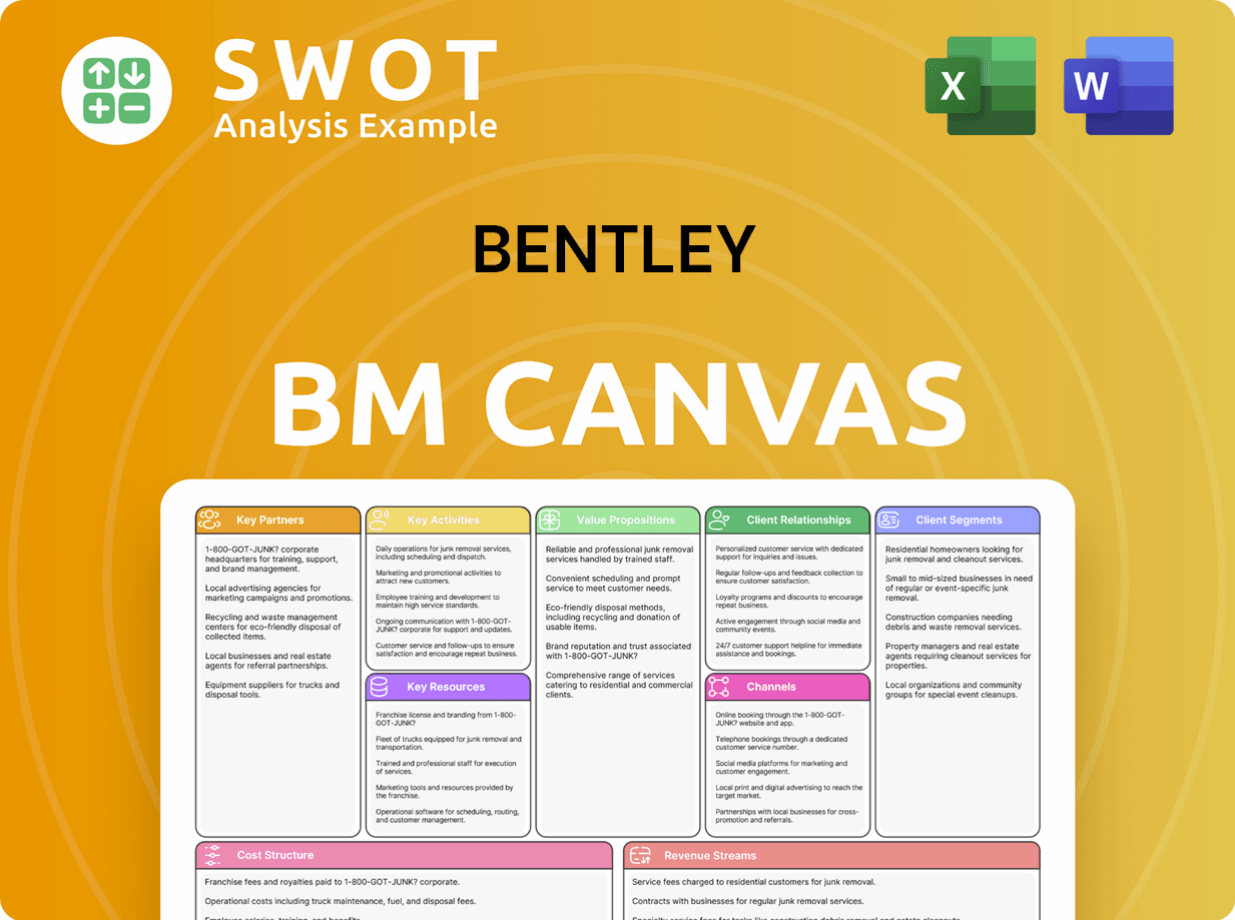

Bentley Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Bentley’s Ownership Landscape?

In the past few years, the Bentley ownership structure has seen some shifts. The company has actively managed its capital, as seen with the share repurchase program. This program, authorized for $200 million, is set to conclude on June 30, 2026. Furthermore, Bentley has increased its quarterly dividend, demonstrating its commitment to shareholder returns. The dividend rose from $0.05 per share in 2023 to $0.06 per share in 2024, and is projected to be $0.07 per share for the second quarter of 2025.

Industry trends indicate a dynamic landscape in Bentley Motors ownership. There's been a notable increase in institutional ownership, with 789 institutional owners holding a substantial 139,381,365 shares as of June 12, 2025. However, some institutional investors have reduced their stakes. For example, Artisan Partners Limited Partnership decreased its holdings by 3,749,190 shares in Q4 2024, and AllianceBernstein L.P. reduced its position by 2,697,330 shares in Q1 2025. Conversely, other institutions have increased their investments. BESSEMER GROUP INC added 1,883,185 shares in Q1 2025, and SWEDBANK AB added 1,873,029 shares in Q4 2024. Additionally, there has been insider selling activity, with Greg Bentley and Keith A. Bentley selling shares in the last six months.

Who owns Bentley has also been influenced by strategic initiatives. Bentley Systems has been focused on expanding its E365 subscription model and investing in AI and digital twin technologies. A significant move was the acquisition of Cesium in September 2024, which strengthened its digital twin platform. Furthermore, in October 2024, Bentley Systems began using Google 2D and 3D geospatial content in some of its software. The company also secured a new Credit Facility in October 2024, providing a $1.3 billion revolving credit facility. To understand more about the company's financial performance, consider exploring the Revenue Streams & Business Model of Bentley.

Bentley Systems is executing a share repurchase program. The company repurchased $64.4 million in shares in 2024. The program is part of a $200 million plan authorized and extends through June 30, 2026.

Bentley has increased its quarterly dividend. The dividend was $0.05 per share in 2023. It increased to $0.06 per share in 2024. The dividend is projected to be $0.07 per share for Q2 2025.

Institutional ownership is a key aspect of Bentley's parent company. As of June 12, 2025, there were 789 institutional owners. These owners held a total of 139,381,365 shares.

Bentley is focused on expanding its E365 subscription model. The company is also investing in AI and digital twin technologies. The acquisition of Cesium in September 2024 is a key move.

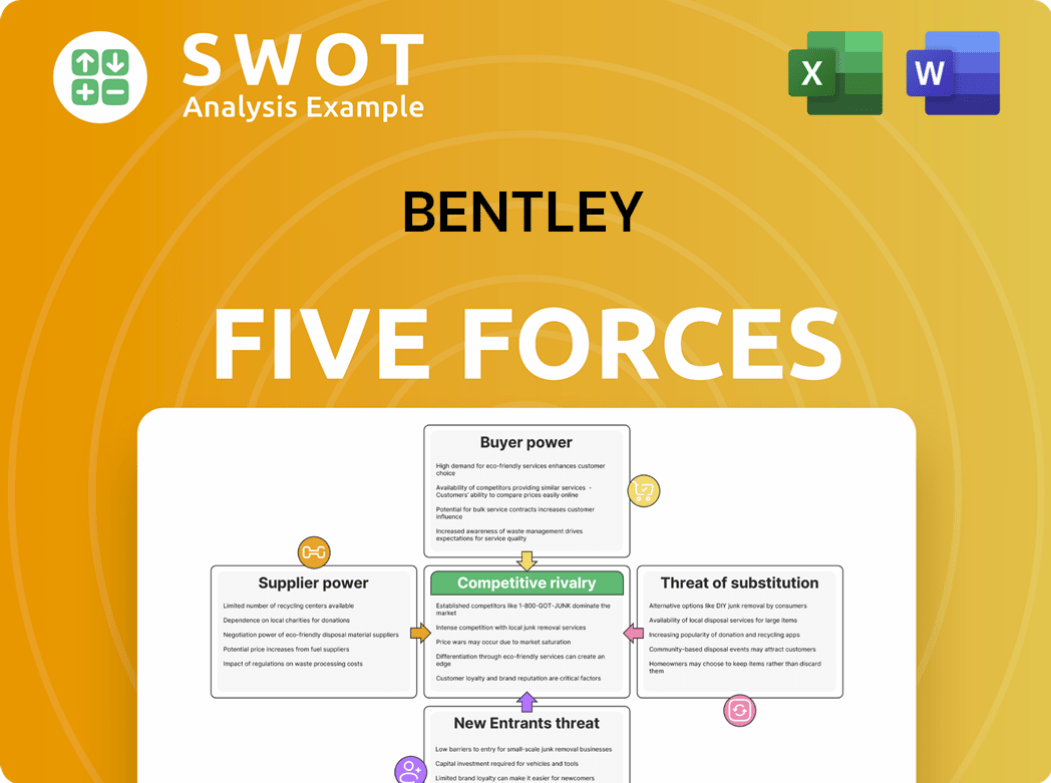

Bentley Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Bentley Company?

- What is Competitive Landscape of Bentley Company?

- What is Growth Strategy and Future Prospects of Bentley Company?

- How Does Bentley Company Work?

- What is Sales and Marketing Strategy of Bentley Company?

- What is Brief History of Bentley Company?

- What is Customer Demographics and Target Market of Bentley Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.