Bentley Bundle

How Does Bentley Systems Shape the Future of Infrastructure?

Bentley Systems stands as a global powerhouse, revolutionizing infrastructure engineering software and impacting projects worldwide. In 2024, the company's influence remained undeniable, powering critical projects across various sectors. Understanding the Bentley SWOT Analysis and its operational framework is essential for anyone seeking to navigate the complexities of the infrastructure software market.

This exploration into Bentley company will uncover the core of its operations, examining its value proposition and revenue streams. We'll dissect its strategic initiatives and competitive landscape, providing insights into how this pivotal player continues to innovate and thrive. This analysis is crucial for investors, industry professionals, and anyone interested in the digital transformation of infrastructure.

What Are the Key Operations Driving Bentley’s Success?

The Bentley company operates by providing software solutions that support the entire lifecycle of infrastructure assets. This includes design, project collaboration, and asset performance management. Their core products cater to various sectors, including transportation, water, and buildings.

The Bentley business model relies on continuous research and development, software engineering, cloud infrastructure management, and a global sales and support network. They focus on deep domain expertise in infrastructure, open standards, and interoperability to integrate solutions seamlessly.

Their distribution networks are global, utilizing direct sales, channel partners, and a strong online presence. This approach enables them to offer improved project efficiency, reduced costs, enhanced asset performance, and better risk management for their customers.

Bentley offers a suite of software solutions. Key products include MicroStation for design and modeling, ProjectWise for project collaboration, and AssetWise for asset performance management. These tools are essential for managing infrastructure projects efficiently.

Their customer base includes government agencies, engineering firms, contractors, and owner-operators. These entities operate in sectors such as transportation, water, utilities, and buildings. The software caters to a broad range of infrastructure needs.

The company's operations involve continuous research and development, software engineering, and cloud infrastructure management. A global sales and support network is also crucial. This ensures the products are continuously enhanced and delivered effectively.

Bentley provides improved project efficiency and reduced costs. They also offer enhanced asset performance and better risk management. This leads to superior project outcomes and operational intelligence for their clients.

Bentley's approach to infrastructure software provides significant advantages. Their solutions integrate seamlessly with other platforms, offering a holistic workflow for infrastructure projects. This integration is a key differentiator.

- Improved project efficiency

- Reduced costs

- Enhanced asset performance

- Better risk management

For further insights into how a luxury car manufacturer like Bentley approaches its marketing, you can explore the Marketing Strategy of Bentley. This provides additional context on the brand's overall business approach within the automotive industry.

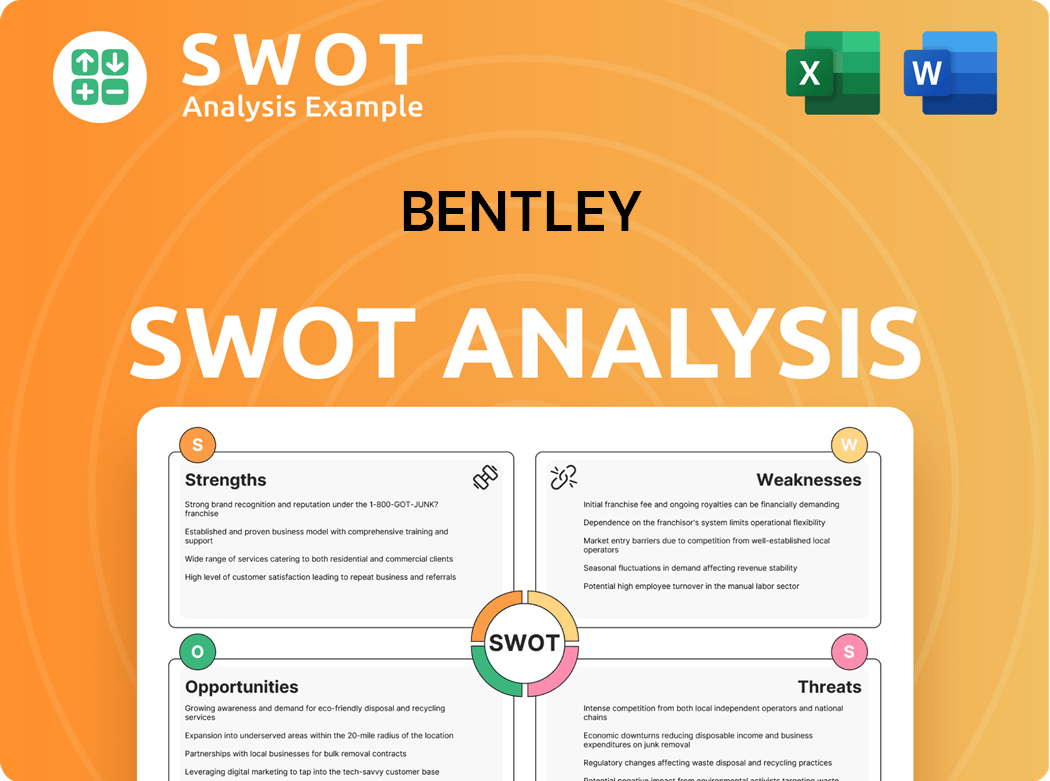

Bentley SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Bentley Make Money?

The Bentley company primarily relies on software subscriptions for its revenue, a strategy that ensures a steady income stream. This approach provides a stable and predictable financial foundation for the company, with recurring revenues forming a significant part of its total earnings. This business model is a key element of Bentley operations.

The monetization strategies employed by the Bentley business model include tiered pricing for software licenses, enterprise agreements, and professional services. These methods allow the company to cater to a wide range of customer needs and project scales. Additionally, the company is exploring innovative models such as consumption-based pricing for cloud services.

Recurring revenues consistently make up a large portion of Bentley's total revenue. For example, in recent financial reports, recurring revenues have accounted for over 80% of the total revenue. This high percentage underscores the stability and predictability of Bentley's business model, making it a key factor in the company's financial performance.

Bentley's revenue streams are primarily driven by software subscriptions, with a focus on recurring revenue. The company uses various monetization strategies to maximize revenue and cater to diverse customer needs. These strategies include tiered pricing, enterprise agreements, and professional services.

- Software Subscriptions: The core revenue generator, with a high percentage of recurring revenue.

- Tiered Pricing: Offers different software license levels to meet various customer requirements.

- Enterprise Agreements: Provides large organizations with flexible access to the software suite.

- Professional Services: Includes consulting, implementation, and training services to support software adoption.

- Consumption-Based Models: Exploring pay-as-you-go models for cloud services to align costs with usage.

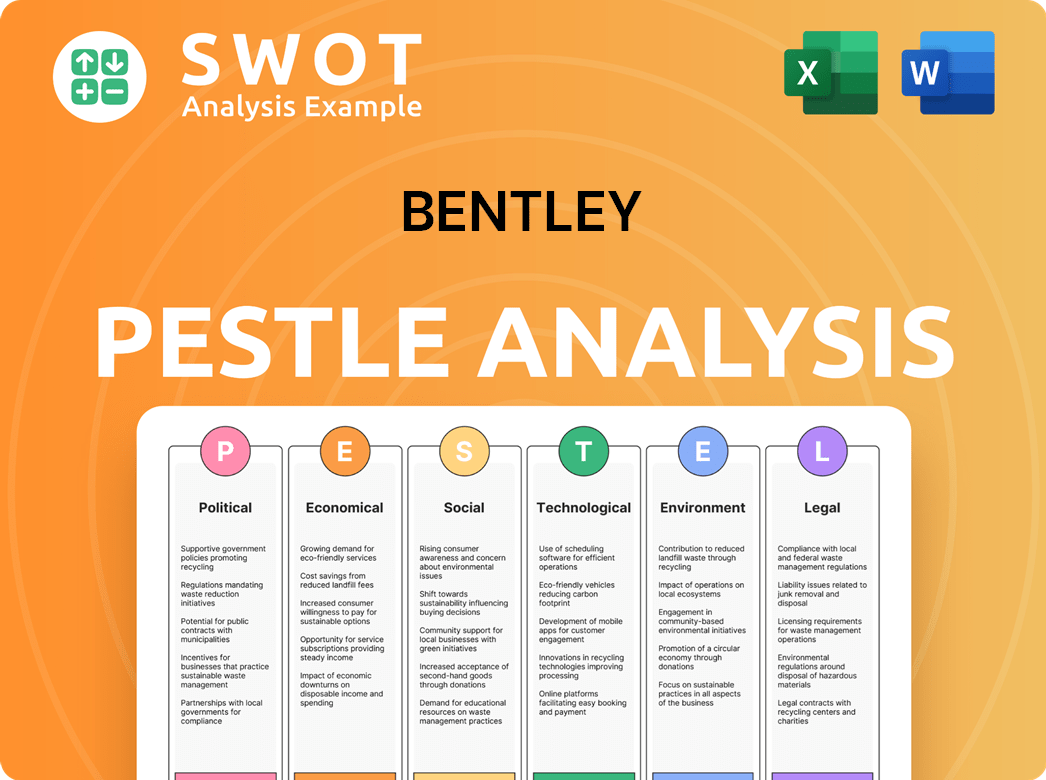

Bentley PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Bentley’s Business Model?

The evolution of the Bentley company reflects a journey marked by significant milestones, strategic shifts, and a sustained focus on maintaining its competitive edge within the luxury automotive sector. The brand's operational strategies, from design to manufacturing, have been crucial in shaping its identity and market position. Understanding these elements provides insights into how Bentley operations drive its success.

Key strategic moves have been instrumental in shaping the company's trajectory. Bentley's commitment to innovation, particularly in design and engineering, has allowed it to stay ahead of market trends. These initiatives, coupled with a strong brand image, have enabled the company to cultivate a loyal customer base and maintain its premium pricing strategy. The Bentley business model has been carefully crafted to support its position as a leading luxury car manufacturer.

Bentley's approach to the automotive industry is characterized by a blend of heritage and forward-thinking strategies. The company has successfully navigated the challenges of the global market, adapting its offerings to meet evolving consumer preferences. The company's ability to balance tradition with innovation has been a key factor in its sustained success. For more details, you can explore the Growth Strategy of Bentley.

Bentley has a long history, with notable milestones including its founding in 1919. The introduction of iconic models like the Continental and Mulsanne has been pivotal. The company's acquisition by Volkswagen Group in 1998 marked a significant turning point, providing access to resources and technology.

Bentley's strategic moves include a focus on electrification, with plans to offer only electric vehicles by 2030. The expansion of its model range to include SUVs, such as the Bentayga, has broadened its appeal. Investments in personalization and bespoke services cater to high-net-worth individuals.

Bentley's competitive edge stems from its brand reputation and craftsmanship. The company's commitment to luxury, performance, and exclusivity sets it apart. Its strong dealer network and customer service further enhance its market position. Bentley's ability to innovate while preserving its heritage is key.

In recent years, Bentley has shown strong financial performance. In 2023, deliveries reached a record high, with over 13,500 cars delivered. Revenue has also seen significant growth, reflecting the demand for its vehicles. The company's profitability is supported by its high-end pricing strategy and focus on personalization.

Bentley's operations are characterized by precision manufacturing and a commitment to quality. The company's factory in Crewe, England, is central to its production process. Bentley emphasizes sustainability in its manufacturing, aiming for carbon neutrality.

- The manufacturing process involves a blend of handcraftsmanship and advanced technology.

- Bentley's supply chain is carefully managed to ensure the quality of materials and components.

- Customer service is a key focus, with personalized experiences and after-sales support.

- The company invests in employee training to maintain high standards of craftsmanship.

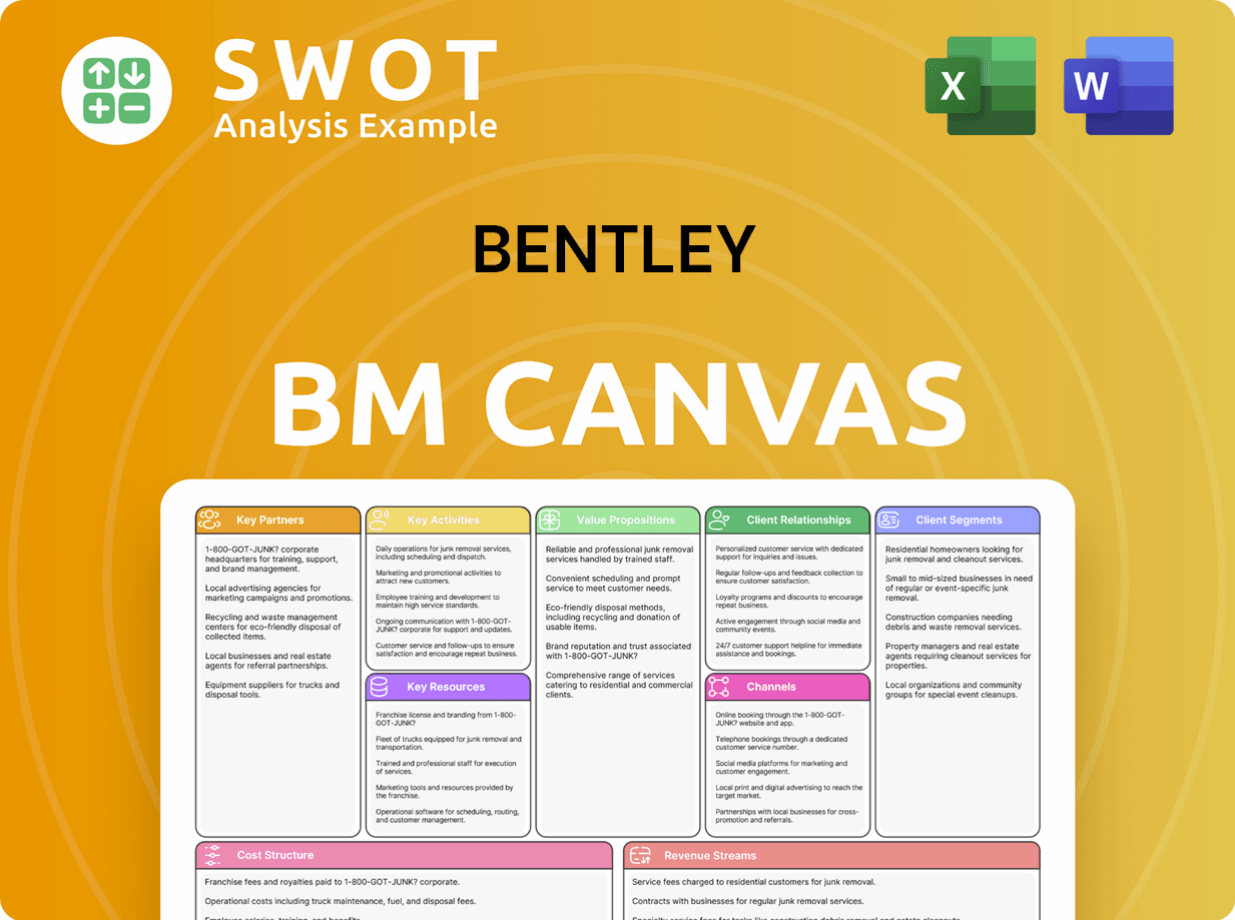

Bentley Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Bentley Positioning Itself for Continued Success?

The Bentley company holds a strong position in the infrastructure engineering software market, competing with major players like Autodesk and Trimble. It distinguishes itself through its specialized focus on infrastructure and its commitment to digital twin technology, which has garnered a loyal customer base. Its market share in specific segments, particularly in areas like civil engineering and plant design, remains significant.

Key risks that could impact Bentley operations or revenue include intense competition, the rapid pace of technological change requiring continuous R&D investment, potential cybersecurity threats to its cloud-based platforms, and economic downturns that could reduce infrastructure spending. Regulatory changes related to data privacy and intellectual property could also pose challenges. Looking ahead, Bentley business model is focused on strategic initiatives such as expanding its cloud offerings, further integrating AI and machine learning into its products, and leveraging its digital twin expertise to drive greater adoption across various infrastructure sectors. Leadership statements consistently emphasize the company's commitment to advancing infrastructure intelligence and sustainability.

The company competes with major players like Autodesk and Trimble in the infrastructure engineering software market. Its focus on infrastructure and digital twin technology helps it stand out, maintaining a strong market share in areas like civil engineering and plant design. The company's solutions are used globally, supporting projects across various sectors.

The company faces risks from intense competition and rapid technological change, requiring continuous investment in research and development. Cybersecurity threats to cloud-based platforms and economic downturns impacting infrastructure spending are also significant concerns. Regulatory changes related to data privacy and intellectual property could pose additional challenges for the Bentley company.

Bentley operations are focused on expanding cloud offerings and integrating AI and machine learning into its products. The company aims to leverage its digital twin expertise to drive greater adoption across infrastructure sectors. The company plans to sustain and expand its ability to make money by continuing to innovate its software solutions, expanding its global reach, and fostering strong partnerships within the infrastructure ecosystem, ultimately aiming to capitalize on the growing global demand for resilient and intelligent infrastructure.

The company is investing in AI and machine learning to improve its software offerings. It's also expanding its cloud-based services to meet growing demand. The company is focused on leveraging its digital twin technology to provide comprehensive solutions for infrastructure projects. For more details about Bentley's financial performance analysis, you can read more about Owners & Shareholders of Bentley.

As a publicly traded company, Bentley's financial performance is closely watched by investors. The company's revenue streams are primarily subscription-based, providing recurring revenue. Bentley's global market presence is significant, with operations and customers worldwide. The company's success is tied to its ability to innovate and adapt to changes in the infrastructure industry.

- The company's revenue model is primarily based on subscriptions.

- Bentley has a strong global presence, serving customers worldwide.

- The company continues to invest in R&D to stay competitive.

- Bentley's growth is tied to the expansion of the infrastructure market.

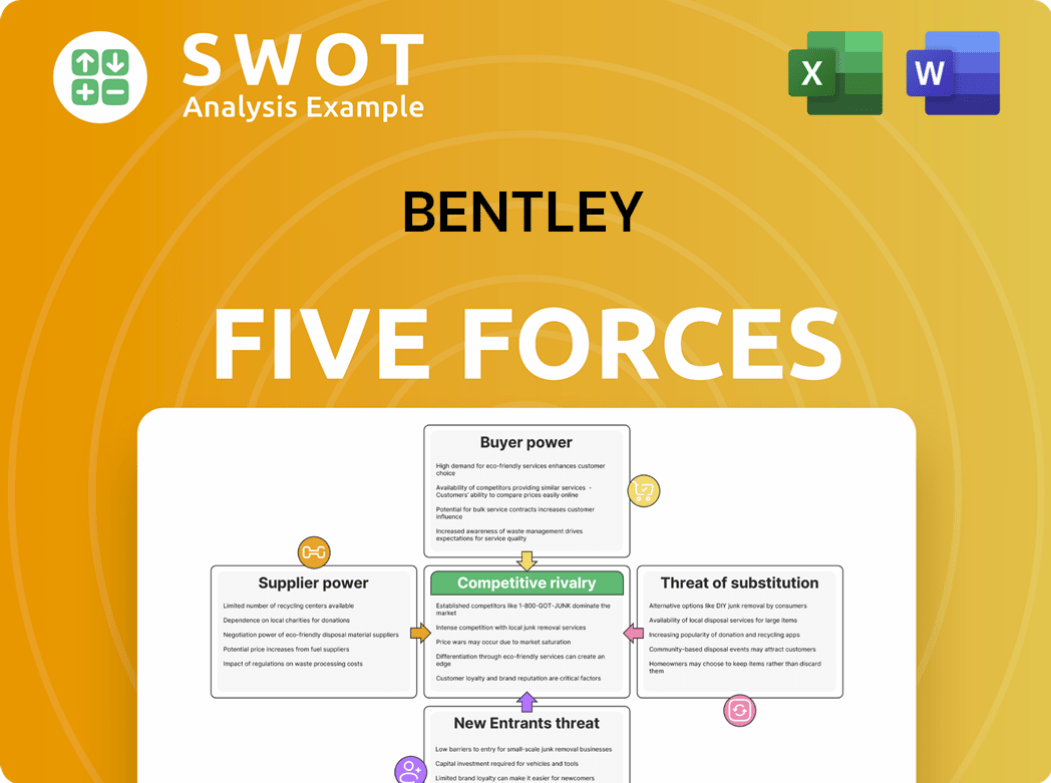

Bentley Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Bentley Company?

- What is Competitive Landscape of Bentley Company?

- What is Growth Strategy and Future Prospects of Bentley Company?

- What is Sales and Marketing Strategy of Bentley Company?

- What is Brief History of Bentley Company?

- Who Owns Bentley Company?

- What is Customer Demographics and Target Market of Bentley Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.