Bentley Bundle

How Does Bentley Navigate the Ever-Shifting Competitive Terrain?

Bentley Systems isn't just building software; it's shaping the future of infrastructure, a sector ripe with innovation and fierce competition. With impressive revenue growth, including a substantial boost in subscription services, Bentley is clearly making its mark. But how does this tech giant stack up against its rivals, and what strategies are they employing to stay ahead?

To truly understand Bentley's position, we must delve into its competitive landscape. This analysis will dissect Bentley's market strategies, identify its key competitors, and explore the factors that drive its success in the dynamic infrastructure engineering software market. Discover how Bentley SWOT Analysis can help you to understand the company's competitive advantages and disadvantages. We'll also examine the impact of emerging technologies and partnerships on Bentley's future.

Where Does Bentley’ Stand in the Current Market?

Bentley Systems is a significant player in the infrastructure engineering software sector. It provides software solutions for professionals in areas like transportation, water, buildings, and campuses. The company's products cover the entire infrastructure lifecycle, from design to maintenance, using digital twin technology.

The company serves approximately 41,000 customers across 189 countries, showcasing a strong global presence. No single customer accounts for more than 2% of annual revenue, reducing dependency risks. A substantial 58% of its revenue comes from outside the United States, highlighting its international footprint. Bentley's market analysis reveals a focus on sustainable growth and technological advancement.

Bentley Systems' market position is further solidified by its financial performance and strategic initiatives. The company's recurring revenue dollar-based net retention rate was 110% as of December 31, 2024, and remained at 110% in Q1 2025, indicating strong customer loyalty and increased spending by existing clients. Challenges persist in the Chinese market, despite a robust global demand environment.

Bentley Systems focuses on providing software solutions for infrastructure engineering. Its core operations involve developing and selling software for the entire infrastructure lifecycle. This includes planning, design, construction, and operations, with a strong emphasis on digital twin technology.

The value proposition lies in offering comprehensive software solutions that improve efficiency and productivity in infrastructure projects. Bentley's software helps clients reduce costs, enhance project outcomes, and manage assets more effectively. This is particularly relevant in the context of the Bentley competitive landscape.

Bentley has a strong global presence, serving customers in nearly every country. The company's diversified customer base, with no single customer accounting for more than 2% of revenue, reduces risk. The company's international revenue is significant, with approximately 58% coming from outside the United States.

Bentley's strategic initiatives include Enterprise 365 (E365) for large enterprise accounts and Virtuosity for small and medium businesses (SMB). These initiatives are designed to capture a larger share of the total addressable market. E365 has grown from 25% of total ARR in 2020 to 45% in 2024.

Bentley Systems demonstrates strong financial health and growth. Total revenues reached $1.353 billion in 2024, a 10.1% increase over 2023. The gross profit margin was 81% in 2024, with projections to expand to 84% by 2029. The company's strong financial performance is a key factor in its competitive advantage.

- Total revenues of $1.353 billion in 2024.

- Gross profit margin of 81% in 2024, projected to expand to 84% by 2029.

- Recurring revenue dollar-based net retention rate of 110% as of December 31, 2024, and remained at 110% in Q1 2025.

- Enterprise 365 (E365) has grown from 25% of total ARR in 2020 to 45% in 2024.

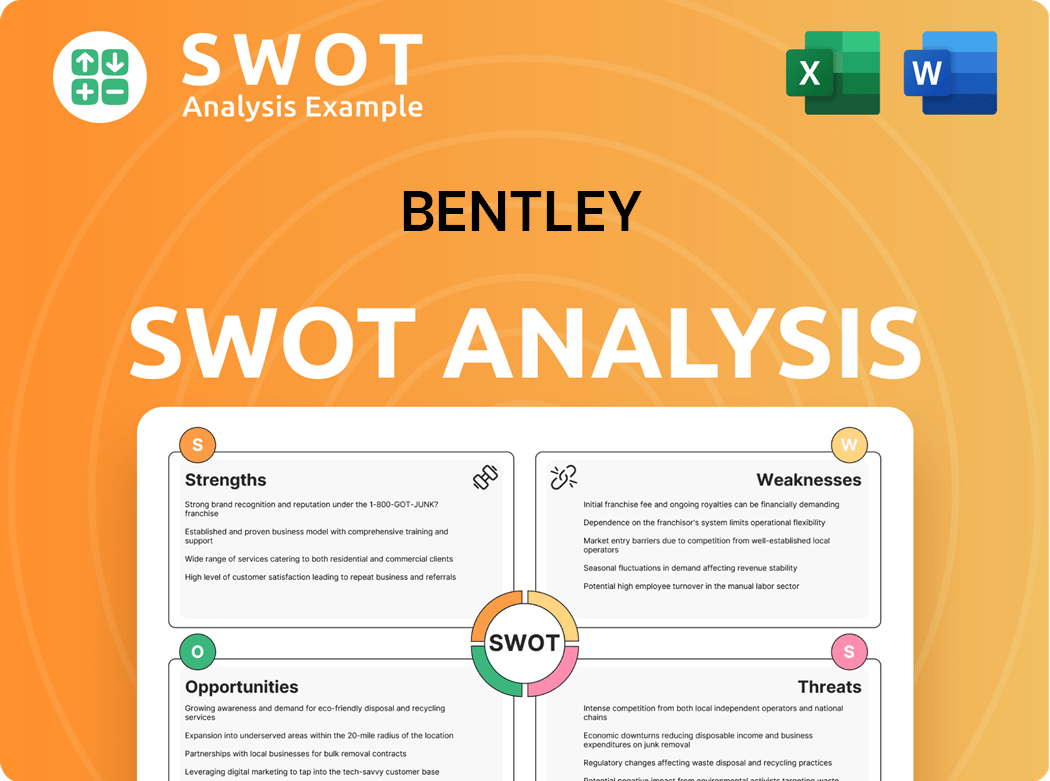

Bentley SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Bentley?

The competitive landscape for Bentley Systems is shaped by both direct and indirect rivals. The company faces significant competition, especially from larger entities with broader product portfolios and more extensive resources. Understanding this competitive environment is crucial for assessing Bentley's market position and strategic direction. This analysis will focus on key competitors and the dynamics influencing the industry.

Bentley Systems operates within the broader system infrastructure software market, which was valued at approximately $161.55 billion in 2024. This market is projected to reach $425.64 billion by 2034, indicating substantial growth and increased competition. This expansion attracts various players, each vying for market share through innovation, strategic partnerships, and technological advancements.

One of Bentley Systems' most significant direct competitors is Autodesk. Autodesk is a larger company with a wider range of software offerings and greater financial strength. While Autodesk provides a broad spectrum of CAD software, Bentley Systems has focused on specialized areas within infrastructure engineering, such as roadway design and wind analysis. This specialization allows Bentley to compete effectively in specific niches.

Autodesk is a primary direct competitor, offering a wide array of CAD software. Bentley Systems competes by specializing in infrastructure engineering sectors.

The broader market includes companies focused on cloud-based technologies, virtualization, and automation. These companies indirectly compete by offering alternative solutions.

Competition involves challenges related to pricing, innovation, and technology. Strategic partnerships and mergers also impact the landscape.

AI and machine learning integration are key areas of focus for many players. Emerging technologies and strategic alliances are reshaping the market.

The system infrastructure software market is experiencing significant growth. The market's expansion creates opportunities for both established companies and new entrants.

Cisco's acquisition of Splunk in 2024 demonstrates the importance of integrating data analytics. Such moves enhance cybersecurity and observability.

The Bentley competitive landscape is influenced by several factors. These include technological innovation, pricing strategies, and the ability to form strategic partnerships. Understanding these elements is crucial for assessing Bentley's market position and its ability to compete effectively.

- Innovation: Continuous development and integration of new technologies, such as AI and machine learning.

- Pricing: Competitive pricing models that align with market demands and customer needs.

- Partnerships: Strategic alliances that enhance product offerings and market reach.

- Market Share: Assessing Bentley market analysis and its position relative to competitors.

- Product Specialization: Focusing on specific niches within infrastructure engineering.

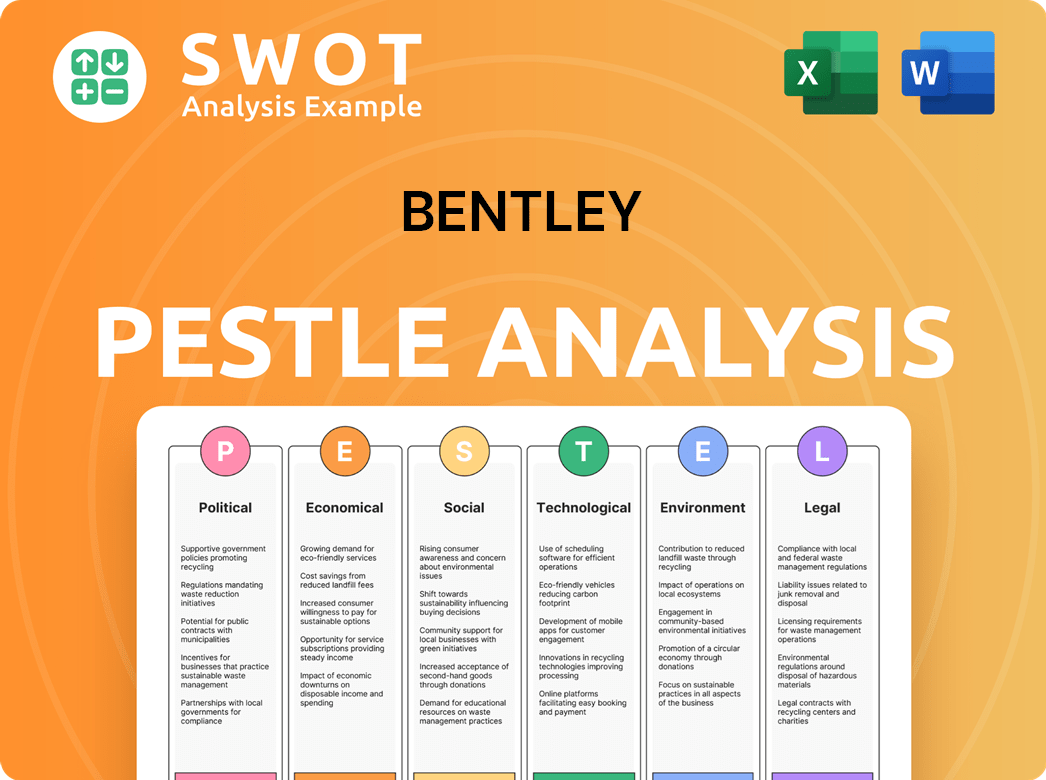

Bentley PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Bentley a Competitive Edge Over Its Rivals?

The competitive landscape of Bentley Systems is shaped by its specialized software solutions and deep customer relationships, particularly within the public works and utilities sectors. The company's competitive advantages stem from high switching costs, a strong subscription model, and strategic acquisitions that enhance its digital twin platform. Understanding these strengths is crucial for a thorough Bentley market analysis.

Bentley maintains a narrow economic moat due to the complexity of its design, modeling, and simulation software. This complexity creates high switching costs for users, who face a steep learning curve and significant risks if the software is used improperly. The company's focus on digital twin technology and its interconnected ecosystem of cloud products further strengthens its position in the market. A key element of the Marketing Strategy of Bentley involves leveraging these advantages.

In 2024 and Q1 2025, Bentley's recurring revenue dollar-based net retention rate reached 110%, demonstrating strong customer loyalty and the effectiveness of its subscription model. This financial performance highlights the company's ability to retain and grow its customer base, which is a significant competitive advantage. Strategic acquisitions, like Cesium in 2024, have also bolstered its digital twin platform by adding geospatial 3D tools, enhancing its competitive edge.

Bentley's strong dollar-based net retention rate of 110% in 2024 and Q1 2025 indicates robust customer loyalty. This high retention rate is a key indicator of the company's ability to maintain and grow its revenue base. The subscription model contributes significantly to this stability.

The acquisition of Cesium in 2024 is a strategic move that strengthens Bentley's digital twin platform. This acquisition adds geospatial 3D tools, enhancing the company's capabilities in the digital twin space. These acquisitions are a key part of Bentley's market strategy.

Bentley's competitive advantages are multifaceted, including high switching costs, a strong subscription model, and strategic acquisitions. These factors contribute to the company's ability to maintain a strong position in the market. The mission-critical nature of its software and deeply embedded customer relationships further solidify its competitive edge.

- High Switching Costs: The complexity of Bentley's software creates barriers to entry for competitors.

- Subscription Model: Provides recurring revenue and enhances customer loyalty.

- Digital Twin Technology: Focus on digital twins and cloud products offers comprehensive solutions.

- Strategic Acquisitions: Enhance platform capabilities and market reach.

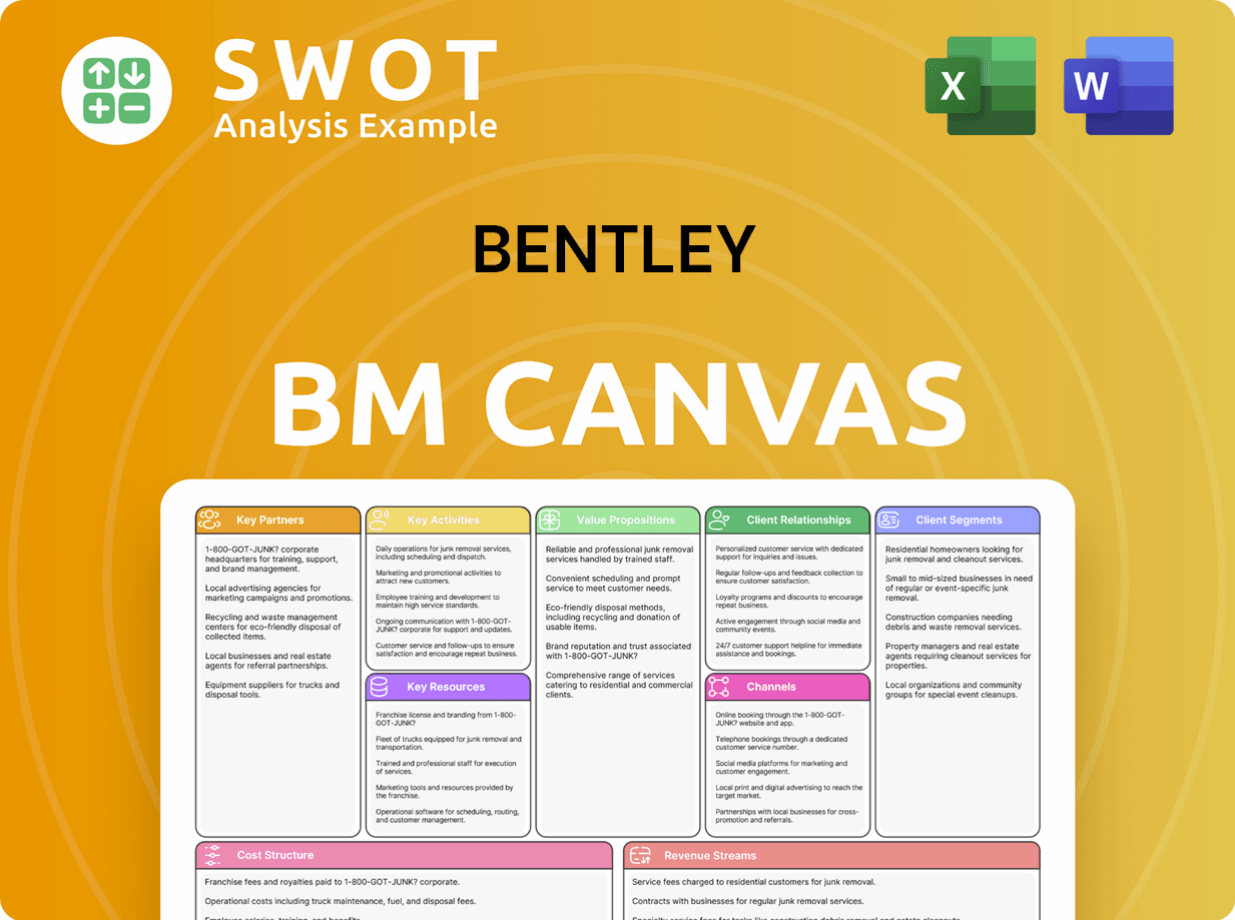

Bentley Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Bentley’s Competitive Landscape?

The infrastructure engineering software industry is currently experiencing significant shifts, driven by technological advancements, evolving consumer demands, and global economic factors. This dynamic environment presents both challenges and opportunities for companies like Bentley Systems. A deep dive into the Bentley competitive landscape reveals strategic positioning, potential risks, and future growth prospects, all of which are crucial for understanding the company's trajectory.

The company faces challenges such as market difficulties in China, competitive pricing pressures, and currency fluctuations, with approximately 35% of its revenue not priced in USD. Despite these hurdles, the company is strategically positioned to capitalize on emerging trends and maintain its competitive edge in the market. For more insights, consider reading about the Growth Strategy of Bentley.

A key trend in the infrastructure engineering software sector is the increasing adoption of AI and machine learning. The AI in infrastructure market is projected to reach $15.6 billion by 2026, growing at a 35.1% CAGR. Bentley Systems is actively integrating AI, as seen with the launch of OpenSight Plus and its partnership with Google to leverage Vertex AI.

Challenges include market difficulties in China and competitive pricing. Foreign exchange fluctuations also pose a risk, as a significant portion of revenue is not USD-priced. Global economic uncertainties and their impact on infrastructure investments could also pose a challenge. These factors can influence Bentley market analysis and future performance.

The global digital twin software market presents a significant opportunity, valued at $17.73 billion in 2024, with a projected CAGR of 40.1% through 2032. Bentley Systems is developing digital twin solutions. Expanding cloud-based offerings, transitioning to a subscription model, and diversifying revenue streams are also key opportunities.

Bentley Systems is focused on continued investment in AI and digital twin technologies, expanding its Enterprise 365 and Virtuosity programs. The company is also aiming to maintain strong financial health, with projected total revenues of $1.461 billion to $1.490 billion in 2025.

The demand for better and more resilient infrastructure, alongside a shortage of engineers, supports Bentley's growth. The company's focus on digital twins and AI integration provides a competitive edge. Bentley's strategies highlight its ability to adapt to changing market dynamics and maintain its position.

- AI and Digital Twin Technology: Investment in these technologies is crucial for innovation.

- Subscription Model: Transitioning clients to a subscription model ensures recurring revenue.

- Diversification: Targeting new industries expands market reach and revenue streams.

- Financial Health: Maintaining strong financial performance supports long-term growth and resilience.

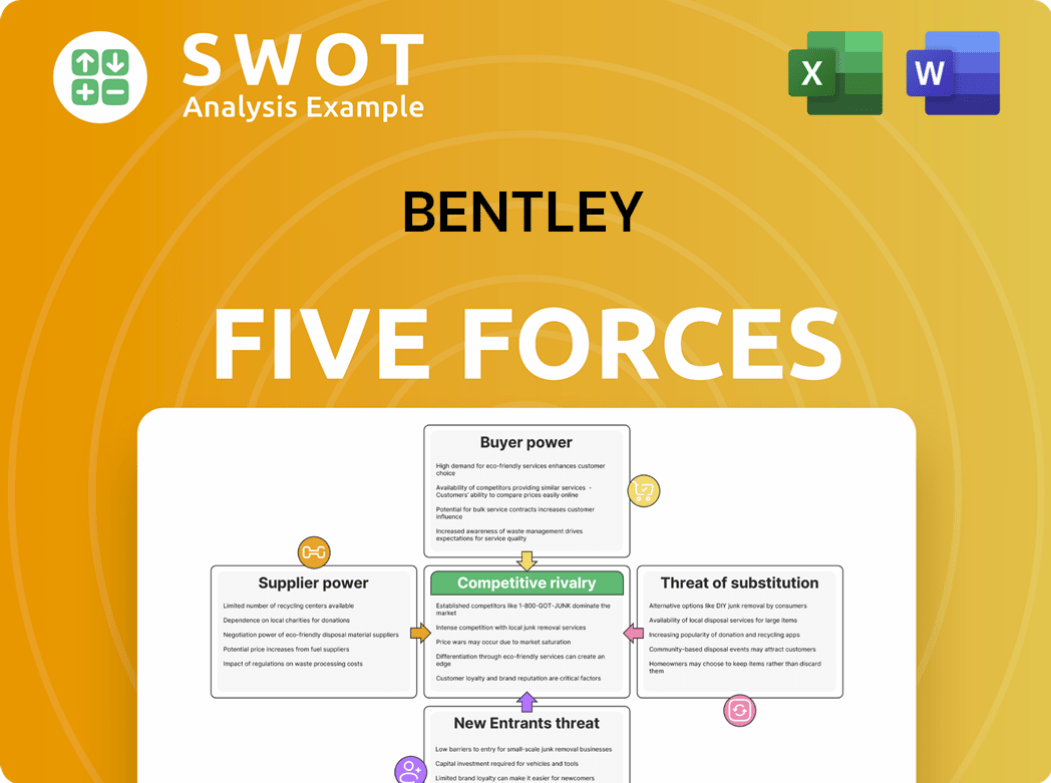

Bentley Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Bentley Company?

- What is Growth Strategy and Future Prospects of Bentley Company?

- How Does Bentley Company Work?

- What is Sales and Marketing Strategy of Bentley Company?

- What is Brief History of Bentley Company?

- Who Owns Bentley Company?

- What is Customer Demographics and Target Market of Bentley Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.