Bentley Bundle

Can Bentley Systems Maintain Its Momentum?

Bentley Systems, a titan in infrastructure engineering software, has navigated a remarkable journey since its 1984 inception. Its strategic pivot towards digital twin technology and cloud-based solutions has reshaped infrastructure design and operation, reflecting a commitment to innovation. With a market capitalization of around $17 billion as of late 2024, the company's evolution from a startup to a global leader is a testament to its Bentley SWOT Analysis and strategic foresight.

This deep dive into Bentley's growth strategy and future prospects will explore how the company plans to sustain its competitive edge. We'll examine the key drivers behind Bentley's success, including its expansion plans, technological advancements, and financial performance. Understanding Bentley's approach is crucial for anyone interested in the intersection of technology and infrastructure, offering valuable insights into the company's long term business plan and its ability to capitalize on global market presence.

How Is Bentley Expanding Its Reach?

The company is actively pursuing a multi-faceted approach to expansion, focusing on both organic growth and strategic acquisitions. This strategy aims to broaden its market reach and enhance its product portfolio. A key element of this expansion involves deepening its presence in emerging markets, particularly in Asia and Latin America, where infrastructure development is experiencing rapid growth.

Bentley Systems is also expanding its offerings within existing markets by introducing new services that leverage its core software platforms. These include advanced analytics for asset performance and predictive maintenance solutions. The continuous development of its iTwin platform is a notable example of product expansion. This platform facilitates digital twin creation and collaboration across the infrastructure lifecycle, enabling new revenue streams through subscription models and value-added services.

Furthermore, the company continues to evaluate and execute strategic mergers and acquisitions. These initiatives are driven by the need to access new customer segments, diversify revenue streams, and stay ahead of industry shifts towards digitalization and sustainability. The company aims to achieve significant milestones in 2025, including a projected increase in annual recurring revenue (ARR) from its cloud-based offerings, reflecting the success of its digital transformation and expansion efforts.

Bentley Systems is focusing on expanding its presence in emerging markets, especially in Asia and Latin America. These regions are experiencing significant infrastructure development, providing opportunities for growth. This expansion is part of the overall Revenue Streams & Business Model of Bentley.

The company is broadening its offerings within existing markets. This includes introducing new services that utilize its core software platforms, such as advanced analytics. The iTwin platform is continuously developed to facilitate digital twin creation and collaboration.

Bentley Systems continues to evaluate and execute strategic mergers and acquisitions. This strategy aims to integrate new technologies and expand its market reach. These moves help the company diversify its revenue streams.

The company aims to increase its annual recurring revenue (ARR) from cloud-based offerings by 2025. This reflects the success of its digital transformation and expansion efforts. This growth is crucial for achieving long-term financial goals.

Bentley Systems' expansion strategy includes geographic expansion, product diversification, and strategic acquisitions. The company is focusing on emerging markets and enhancing its existing offerings. These initiatives are designed to drive growth and maintain a competitive edge in the market.

- Deepening penetration in emerging markets, particularly in Asia and Latin America.

- Expanding offerings within existing markets by introducing new services.

- Continuous development of the iTwin platform for digital twin solutions.

- Evaluating and executing strategic mergers and acquisitions to integrate new technologies.

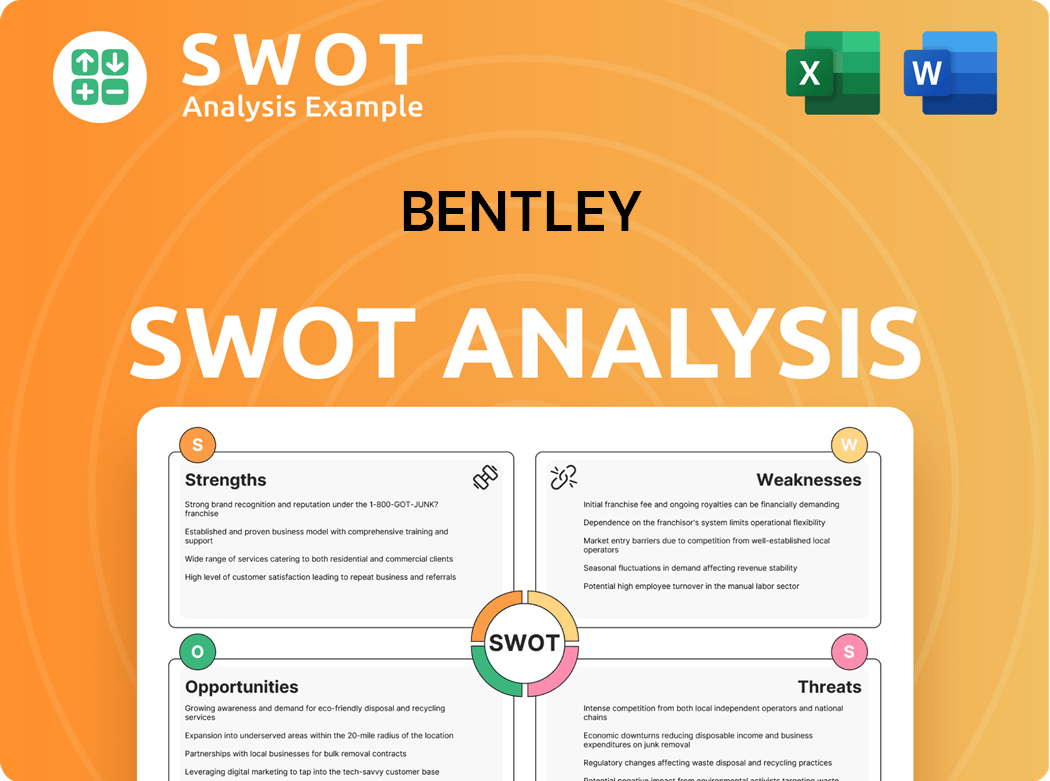

Bentley SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Bentley Invest in Innovation?

The innovation and technology strategy of Bentley Systems is central to its growth and future prospects. The company's dedication to research and development, coupled with its focus on digital transformation, positions it well within the infrastructure sector. This approach is critical for maintaining a competitive edge and addressing the evolving needs of its global clientele.

Bentley Systems consistently invests a significant portion of its revenue in R&D. This commitment supports the continuous enhancement of its existing products and the development of new solutions that drive growth. The company's strategic investments in emerging technologies are designed to deliver differentiated solutions, improving project delivery and asset performance.

By focusing on digital transformation, Bentley is leveraging technology to optimize the design, construction, and operation of infrastructure assets. This strategy is crucial for maintaining its leadership position and capitalizing on future market opportunities within the infrastructure sector. Bentley’s approach to innovation directly contributes to its long-term growth objectives.

Bentley Systems allocates approximately 17-18% of its revenue to research and development. This substantial investment underscores its commitment to in-house innovation and technological advancement.

Bentley is a pioneer in digital twin technology, creating virtual replicas of physical assets. These digital twins optimize design, construction, and operational processes.

The company integrates AI and machine learning algorithms into its digital twins. This allows for predictive analytics, enhancing infrastructure maintenance and anomaly detection.

Bentley incorporates IoT capabilities to gather real-time data from infrastructure assets. This enhances the accuracy and utility of its digital twins, providing up-to-the-minute insights.

Bentley promotes sustainability through its software, enabling more environmentally conscious design and construction practices. This supports the industry's move towards greener solutions.

Bentley holds key patents in areas such as reality modeling and intelligent infrastructure design. These innovations highlight its leadership in the field.

The company's focus on innovation and technology directly supports its growth objectives by delivering solutions that improve project delivery, enhance asset performance, and offer new value propositions to its global client base. Bentley’s commitment to innovation is a key driver in shaping the Marketing Strategy of Bentley and its future in the competitive landscape.

Bentley's technological advancements provide differentiated solutions, improving project delivery and asset performance. These innovations offer new value propositions to its global client base, driving growth and market share. The company's strategic investments in areas like digital twins and AI are expected to yield significant returns in operational efficiency and cost reduction.

- Enhanced Project Delivery: Streamlined processes and improved accuracy.

- Improved Asset Performance: Predictive maintenance and optimized operations.

- New Value Propositions: Innovative solutions for a global client base.

- Cost Reduction: Efficiency gains through digital transformation.

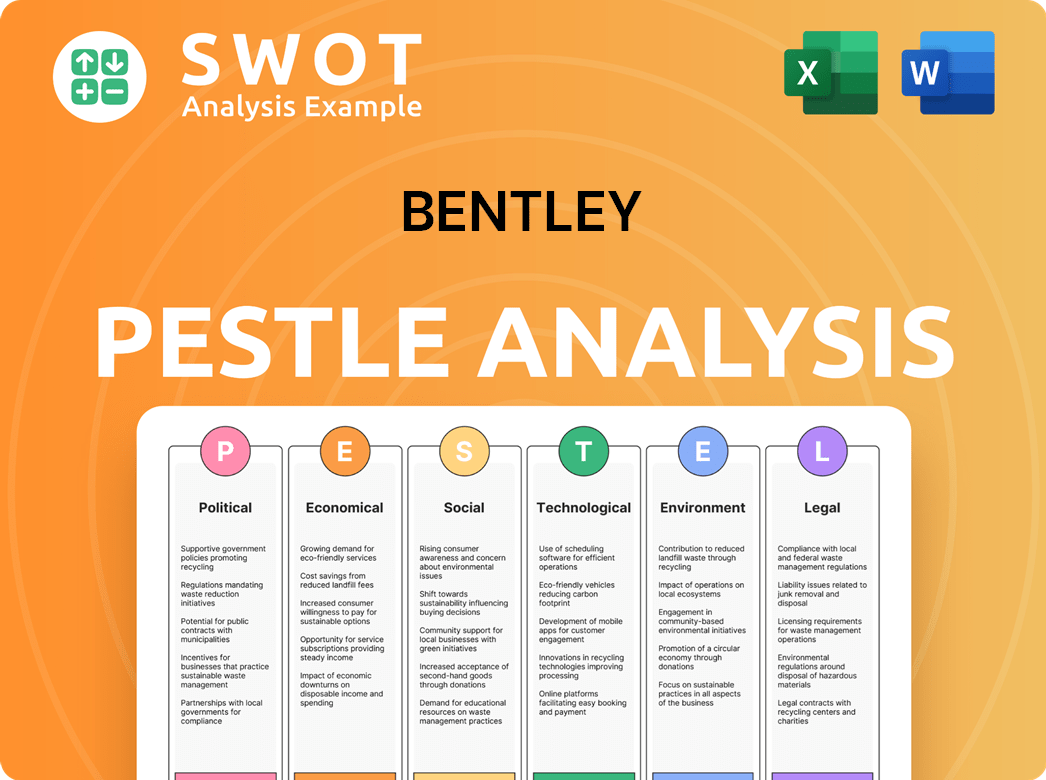

Bentley PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Bentley’s Growth Forecast?

The financial outlook for the company is robust, driven by its strategic focus on infrastructure digital solutions. Analysts project a revenue increase of approximately 10-12% for fiscal year 2024, potentially reaching around $1.3 billion. This positive trajectory is expected to continue into 2025, supported by the expansion of subscription-based revenues, which provide a stable and predictable income stream.

Profit margins are anticipated to remain healthy, with operating margins projected to be in the range of 25-28% for 2024. This reflects efficient operations and the scalability of its software business model. The company's financial strategy emphasizes leveraging its strong cash flow to fund organic growth and strategic mergers and acquisitions (M&A) activities.

Investment levels are expected to remain significant, particularly in research and development (R&D) and strategic acquisitions, to drive future innovation and market expansion. The company's long-term financial goals include achieving sustained double-digit revenue growth and increasing its market share in key infrastructure sectors. For a more detailed look at the company's financial performance, you can explore the insights provided by Owners & Shareholders of Bentley.

The company anticipates revenue growth of approximately 10-12% for fiscal year 2024. This growth is driven by the expansion of subscription-based revenues. The company's focus on subscription-based models provides greater predictability in revenue streams.

Operating margins are expected to be in the range of 25-28% for 2024. This demonstrates efficient operations and the scalability of the software business model. The company's profitability is a key indicator of its financial health.

The company plans to maintain robust investment levels, particularly in R&D and strategic acquisitions. These investments are crucial for future innovation and market expansion. This strategy supports the company's long-term growth prospects.

The company aims to achieve sustained double-digit revenue growth and expand its market share. These goals are supported by its technological leadership and strategic market positioning. The company's focus on profitable growth is a key aspect of its strategy.

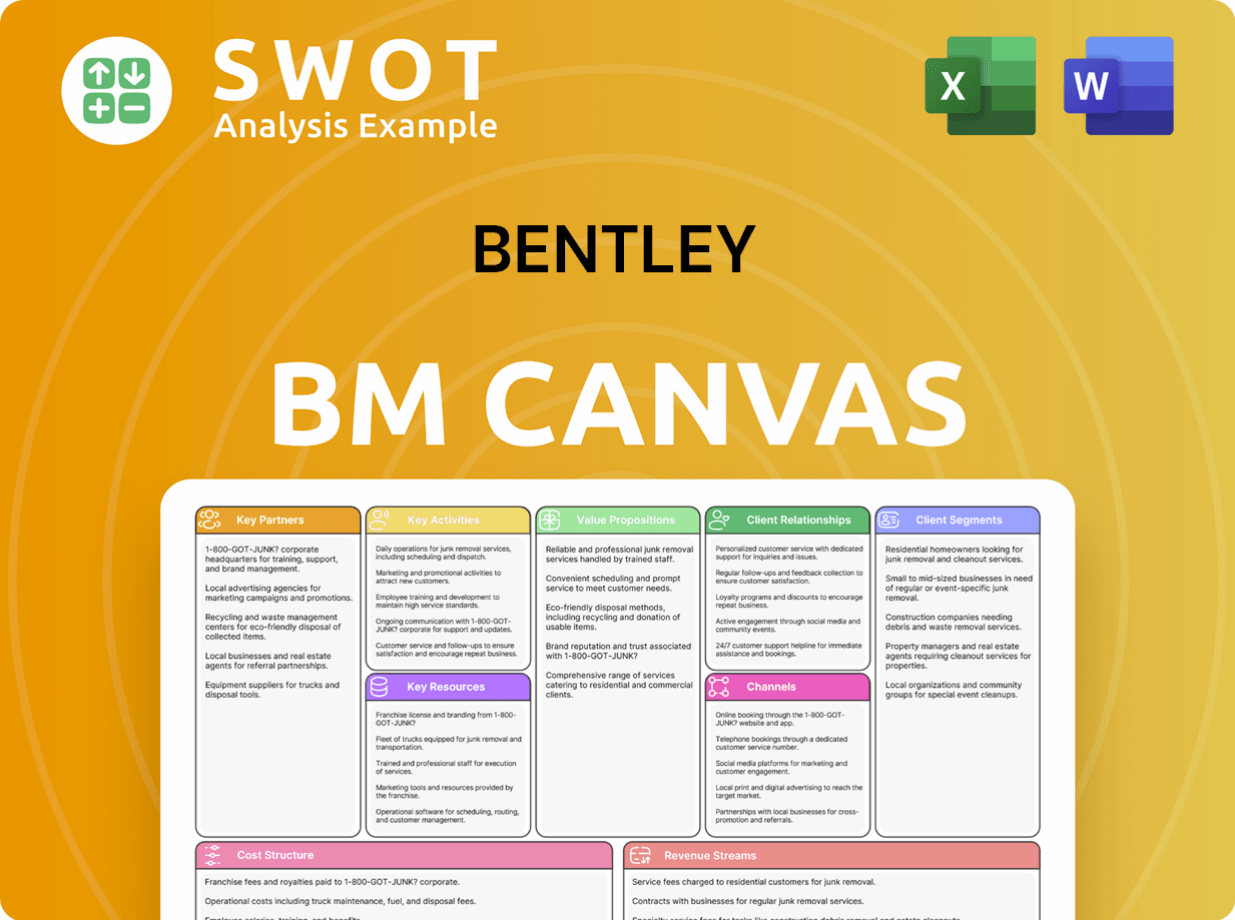

Bentley Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Bentley’s Growth?

The future of the company, while promising, is not without its challenges. Several potential risks and obstacles could affect its growth trajectory and market position. Understanding these challenges is crucial for investors and stakeholders assessing the long-term viability of the company.

One of the primary concerns is the competitive landscape within the luxury car market. The automotive industry trends are constantly evolving, with new entrants and shifting consumer preferences. The company must continuously innovate and adapt to maintain its market share and brand prestige. Additionally, the company faces internal and external challenges that could impact its operations and financial performance.

The company's ability to navigate these risks will significantly influence its future prospects and overall success. Proactive risk management and strategic planning are essential to mitigate potential setbacks and capitalize on growth opportunities. The company's long term business plan must address these challenges to ensure sustained success.

The luxury car market is highly competitive, with established brands and new entrants vying for market share. The company faces competition from other luxury automakers. Maintaining its market position requires continuous innovation and strong brand positioning.

Global economic conditions, including inflation and recessionary pressures, can affect consumer spending on luxury goods. Economic downturns can lead to decreased sales and reduced profitability. The company needs to be prepared to navigate fluctuating economic cycles.

Disruptions in the global supply chain, such as shortages of semiconductors or other components, can impact production. These disruptions can lead to delays in vehicle deliveries and reduced sales volumes. The company needs to have a diversified supply chain.

The rapid pace of technological change, particularly in electric vehicles (EVs) and autonomous driving, requires significant investment. The company must invest in these technologies to remain competitive. Failure to adapt to these advancements could affect its market position.

Changes in environmental regulations, safety standards, and trade policies can create compliance challenges. These regulatory shifts may necessitate modifications to product design and manufacturing processes. The company must stay compliant with evolving regulations.

Geopolitical instability, such as trade wars or political conflicts, can disrupt global operations and impact sales. These risks can affect the company's ability to operate in certain markets. The company needs to have a global market presence.

The luxury car market is characterized by high consumer expectations, with a focus on performance, design, and exclusivity. The company's brand evolution needs to align with these expectations. The company's market share analysis requires a deep understanding of these dynamics. The company's ability to maintain its brand image is crucial for sustained success.

The shift towards electric vehicles (EVs) is a significant trend in the automotive industry. The company's electric vehicle strategy is crucial for its future. The company's sustainability initiatives, including reducing carbon emissions and using sustainable materials, are essential for long-term viability. The company's environmental efforts are becoming increasingly important to consumers.

Expanding into new markets, particularly in regions with growing affluence, is a key strategy for the company. The company's expansion plans in China and other emerging markets are crucial for growth. The company's global market presence needs to be strategically managed. The company's dealer network expansion plays a vital role in market penetration.

The company's financial performance review is critical for investors and stakeholders. The company's sales growth forecast and profitability metrics are key indicators of success. The company's ability to secure investments and manage its financial resources is essential for its long-term growth. The company's financial health is a key factor in its ability to overcome challenges.

The company's ability to navigate these potential risks and obstacles is critical for its sustained success. By proactively addressing these challenges and adapting to the evolving market dynamics, the company can strengthen its position in the luxury car market. For a deeper understanding of the company's origins, you might find Brief History of Bentley informative.

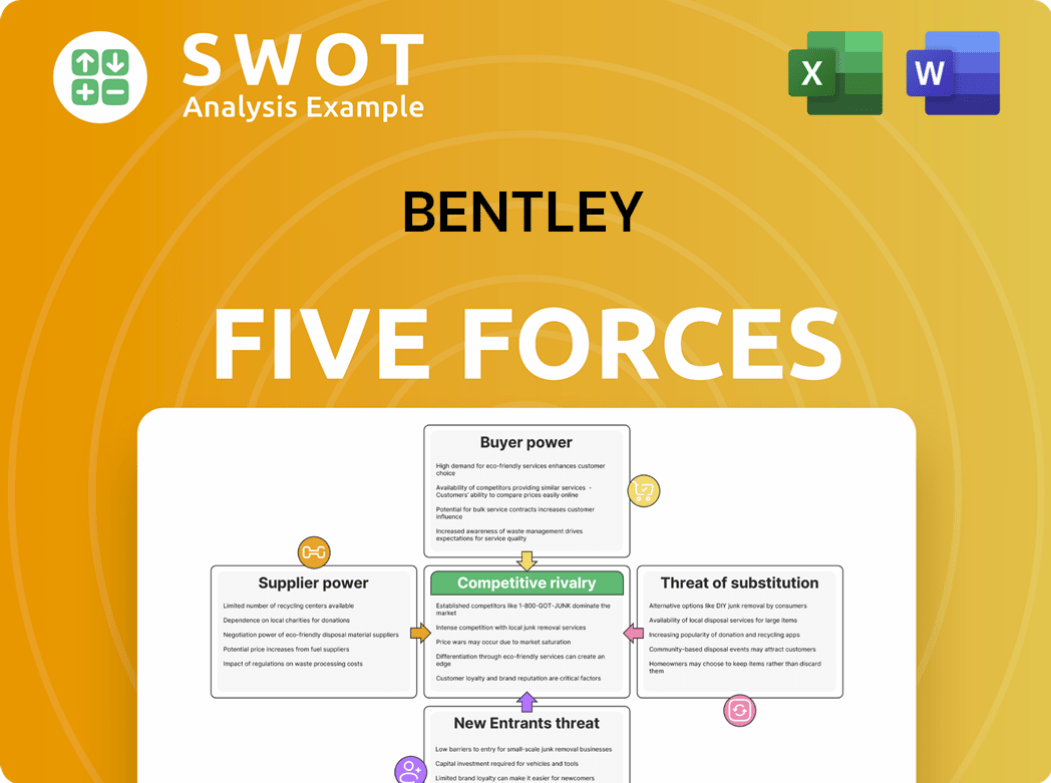

Bentley Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Bentley Company?

- What is Competitive Landscape of Bentley Company?

- How Does Bentley Company Work?

- What is Sales and Marketing Strategy of Bentley Company?

- What is Brief History of Bentley Company?

- Who Owns Bentley Company?

- What is Customer Demographics and Target Market of Bentley Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.