Bentley Bundle

Who are Bentley's Customers in the Digital Age?

Understanding the Bentley SWOT Analysis is key to grasping its customer base. In the ever-evolving world of infrastructure, knowing who your customers are and what they need is crucial for success. This is especially true for a company like Bentley Systems, which has transformed its approach to serve the digital demands of infrastructure professionals.

Bentley Systems' evolution from CAD software to comprehensive digital solutions reflects a strategic adaptation to its target market. This exploration delves into the intricate details of Bentley's customer demographics and target market, examining their needs, preferences, and the company's strategic responses. By analyzing Bentley's customer profile, we gain valuable insights into the company's success in the dynamic infrastructure market, revealing how it caters to a diverse and sophisticated clientele.

Who Are Bentley’s Main Customers?

Understanding the primary customer segments is crucial for any company's strategic planning. For the company, this involves focusing on the specific groups that utilize its software solutions. These segments are defined by their needs for sophisticated tools to manage complex infrastructure projects, from initial design to ongoing operation.

The core focus is on business-to-business (B2B) relationships within the infrastructure sector. This approach allows the company to concentrate its resources on serving the unique requirements of these organizations. This targeted strategy is essential for maintaining a competitive edge and driving sustainable growth.

In 2024, the company continued to see strong adoption of its solutions across these segments, driven by global infrastructure spending. This demonstrates the ongoing relevance and value of its offerings in the market.

The primary customer groups include engineering, procurement, and construction (EPC) firms, owner-operators of infrastructure assets, government agencies, and architectural practices. These entities rely on the company's software to manage projects effectively. The solutions provided are essential for professionals in these fields.

The demographics within these segments typically comprise highly educated professionals. These include civil engineers, structural engineers, architects, project managers, and geospatial specialists. Their income levels are generally high, reflecting their specialized skills and the high-value projects they undertake. The target is enterprise-level decision-makers.

The owner-operator segment often shows the largest share of revenue and the fastest growth. This is due to the increasing use of digital twins for asset performance and predictive maintenance. This shift towards operational efficiency and sustainability within the infrastructure industry is a key trend.

The focus on enterprise-level solutions means that decision-makers within these organizations, rather than individual users, represent the primary target. This approach ensures that the company's products align with the strategic priorities of its clients. The market is driven by infrastructure spending.

The company's success is closely tied to the infrastructure sector's growth and the increasing adoption of digital solutions. The focus on enterprise-level customers and the owner-operator segment highlights the strategic direction. The emphasis on digital twins and predictive maintenance reflects the industry's move towards greater efficiency and sustainability, as seen in 2024 and projected for 2025.

The company's primary customer segments are B2B clients in the infrastructure sector, including EPC firms, owner-operators, government agencies, and architectural practices. These customers require advanced software solutions for complex projects.

- The core demographics are highly educated professionals with high incomes.

- The owner-operator segment is a significant driver of revenue and growth due to digital twin adoption.

- The company's focus on enterprise-level solutions aligns with industry trends toward efficiency and sustainability.

- The company's target market is defined by its software solutions.

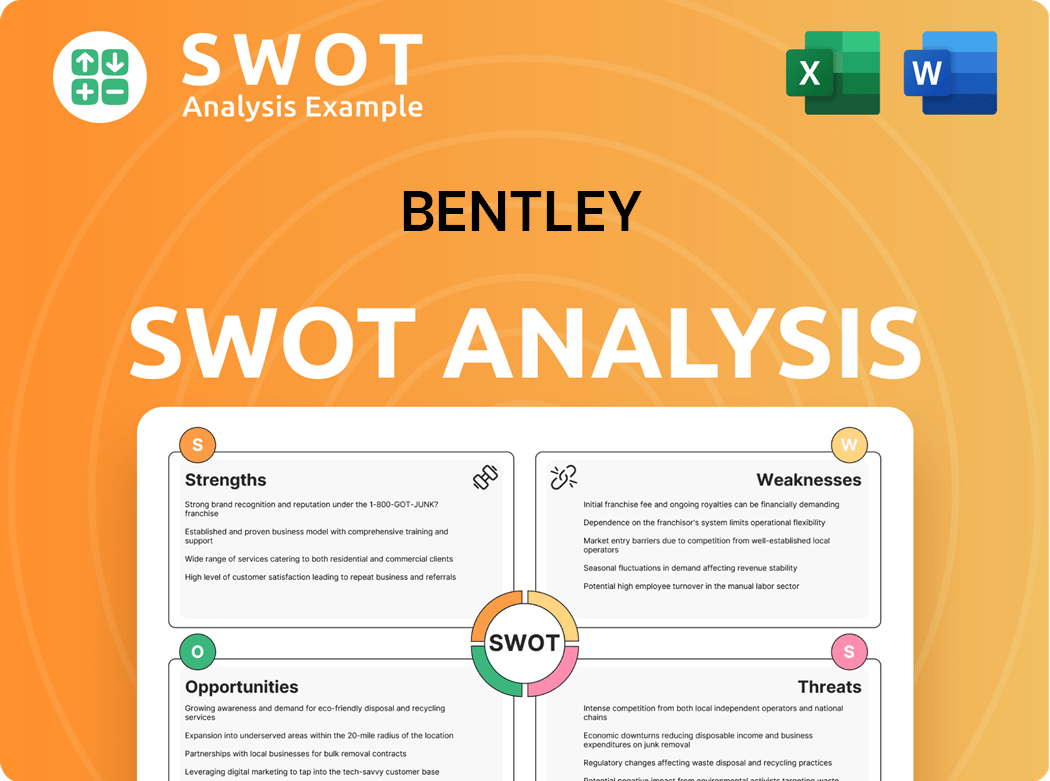

Bentley SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Do Bentley’s Customers Want?

Understanding the needs and preferences of customers is crucial for any successful business. For the company, it's about knowing what drives their clientele to choose their offerings. This involves delving into the motivations, decision-making processes, and the specific factors that influence their purchasing behavior.

The company's customers are primarily driven by the desire for superior project delivery, enhanced asset performance, and increased efficiency and sustainability in their infrastructure projects. Their purchasing decisions are often characterized by extended sales cycles and thorough evaluations, with a strong emphasis on the return on investment (ROI) that the company's solutions can provide.

The company's focus on customer needs and preferences is evident in its product development and marketing strategies. By understanding these key drivers, the company can tailor its offerings to meet the evolving demands of its target market, ensuring continued success and customer satisfaction. This approach is essential for maintaining a strong position in the competitive infrastructure solutions market.

Customers of the company often go through long sales cycles. They conduct comprehensive evaluations before making a purchase. The emphasis is always on the return on investment (ROI).

Key factors influencing decisions include software interoperability, scalability, and security. Ease of integration with existing workflows and the vendor's reputation and support services are also important.

Customers are often motivated by risk mitigation and compliance with industry standards. The aspiration to leverage cutting-edge technology for a competitive edge is also a key factor.

The need for accurate design tools, efficient data management, and collaborative platforms drives customer choices. These factors help address practical challenges in infrastructure projects.

The company helps solve data silos, project delays, and cost overruns. They do this through their comprehensive suite of applications.

Customer feedback and market trends, such as cloud computing and AI, influence product development. Innovations like the iTwin Platform are a direct result of these influences.

The company's approach to understanding its customers is multifaceted, focusing on both the practical and psychological aspects that influence their decisions. For instance, in 2024, the demand for integrated digital twin solutions was a significant driver for adoption, reflecting the need for a holistic view of infrastructure assets. By addressing these needs and preferences, the company positions itself as a valuable partner for its customers. To delve deeper into the company's strategic approach, consider exploring the Growth Strategy of Bentley.

The company tailors its offerings to meet specific needs. This includes specialized solutions for different infrastructure sectors.

- Interoperability: Ensuring seamless integration with existing systems.

- Scalability: Providing solutions that can grow with the customer's needs.

- Security: Offering robust security features to protect data and assets.

- Ease of Integration: Simplifying the process of incorporating the company's solutions.

- Vendor Reputation: Building trust through reliable support and service.

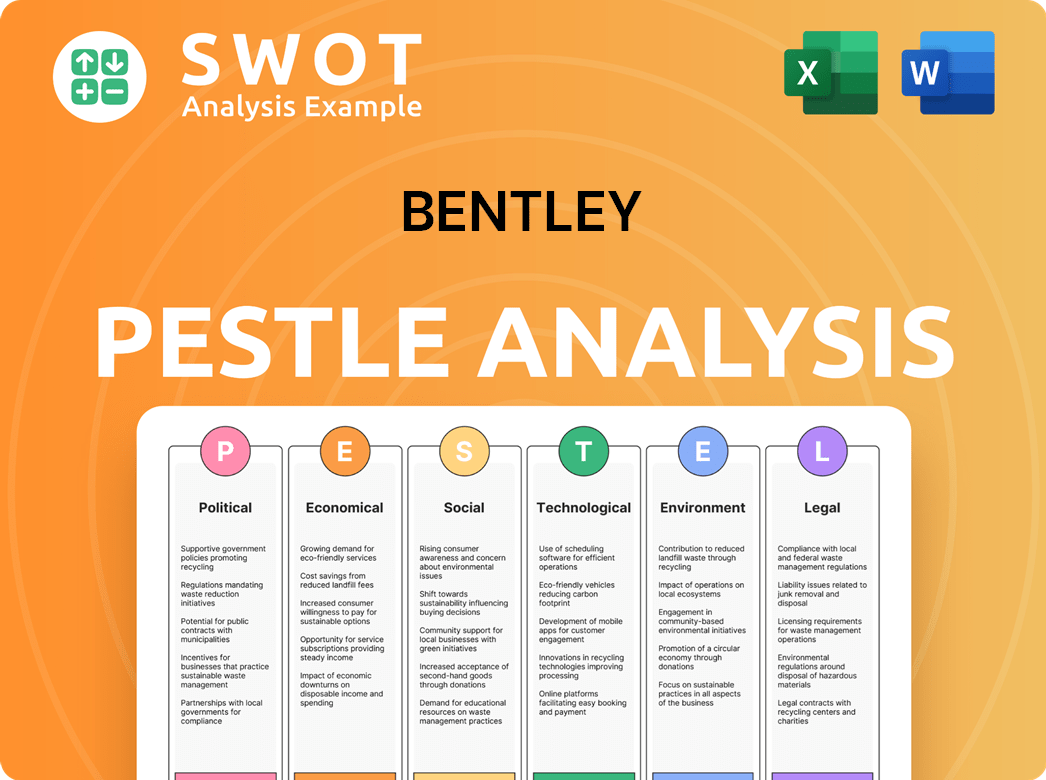

Bentley PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Where does Bentley operate?

The geographical market presence of the company is extensive, encompassing major regions such as North America, Europe, and the Asia-Pacific, with growing influence in the Middle East and Africa. This global footprint allows the company to cater to diverse customer needs and capitalize on infrastructure development worldwide. The company's strategy involves a blend of established market dominance and expansion into high-growth areas, reflecting a dynamic approach to global market dynamics.

In 2024, the company continued to see significant revenue contributions from North America and Europe. However, the Asia-Pacific region showed accelerated growth, driven by substantial infrastructure investments and increasing demand for advanced engineering solutions. This expansion is supported by localized strategies, including region-specific support, sales teams, and partnerships, to meet diverse customer needs.

The company's approach to its global market is characterized by its ability to adapt to local market conditions. This includes tailoring its offerings to meet the specific demands of emerging and developed markets. For example, in 2024, emerging markets may prioritize cost-effectiveness, whereas developed markets often seek advanced features and cloud integration. This localized approach ensures relevance and competitiveness across different regions.

The North American market, including the United States and Canada, remains a key region for the company. The company benefits from robust infrastructure spending and high digital adoption rates in this area. The market's preference for advanced features and digital twin capabilities aligns well with the company's offerings.

Europe, particularly the United Kingdom and Germany, represents another significant market for the company. The region's focus on sustainable infrastructure and advanced engineering solutions supports the company's market position. The company adapts its offerings to meet local regulatory environments and infrastructure priorities.

The Asia-Pacific region, including countries like India and those in Southeast Asia, shows accelerated growth due to substantial infrastructure investments. The company is expanding its presence in this area, driven by large-scale infrastructure projects. This expansion is supported by strategic market entry strategies.

The Middle East and Africa are emerging markets for the company, with increasing infrastructure development. The company is expanding its presence in these regions to capitalize on growth opportunities. The company adapts its marketing messages to resonate with local regulatory environments and infrastructure priorities.

The company's market entry strategies involve a combination of direct sales, partnerships, and localized support. This approach ensures that the company can effectively address the specific needs of each region. The company also adapts its marketing messages to resonate with local regulatory environments and infrastructure priorities.

- Region-specific support teams

- Localized sales and marketing efforts

- Strategic partnerships

- Adaptation to local regulatory environments

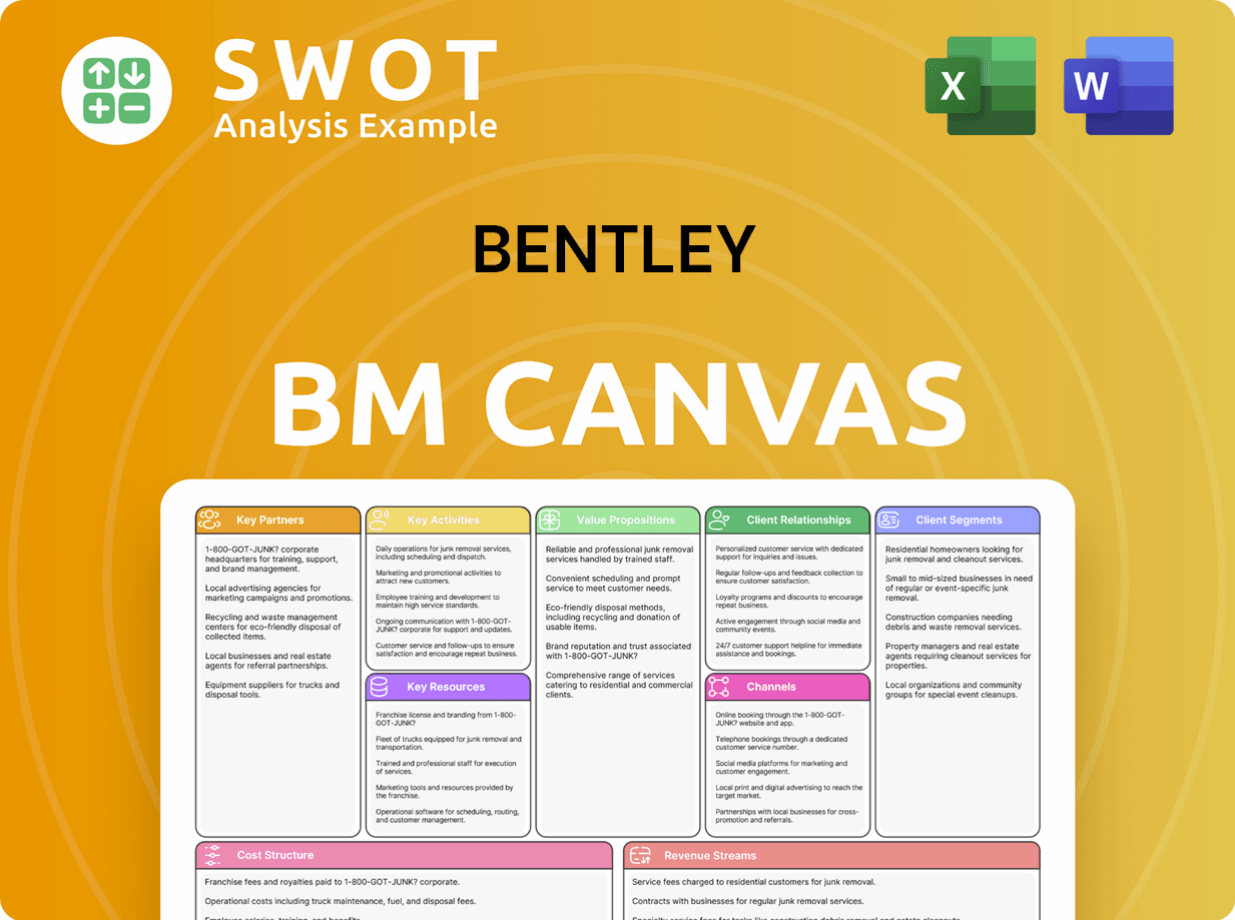

Bentley Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Does Bentley Win & Keep Customers?

The company, like many luxury brands, employs a multifaceted approach to acquire and retain customers. This strategy encompasses various marketing channels, direct sales efforts, and the cultivation of strategic partnerships. Their customer-centric approach is designed to build long-term relationships and ensure customer satisfaction, which is crucial in the high-end vehicle market.

Digital marketing, including content marketing and targeted online advertising, plays a significant role in reaching potential buyers. Traditional methods such as participation in exclusive events and auto shows remain crucial for networking and showcasing their vehicles. The company also leverages social media and influencer marketing to engage with its target audience. Their focus on personalized experiences, after-sales service, and continuous software updates enhances customer loyalty.

Sales teams often adopt a consultative approach, working closely with prospective clients to understand their needs and demonstrate how the vehicles meet their expectations. Loyalty programs, though not explicitly branded, are embedded in their long-term customer relationships through continuous software updates, dedicated support services, and user communities. Data analytics is crucial for targeting campaigns, segmenting the audience, and delivering relevant messaging. Successful acquisition campaigns highlight the unique features and benefits that resonate with luxury car buyers.

The company uses digital channels such as social media, targeted online advertising, and content marketing to reach potential customers. This includes showcasing new models, highlighting features, and engaging with the target audience. They also focus on search engine optimization (SEO) to improve online visibility and attract potential buyers. These efforts are crucial for reaching the desired Bentley brand audience.

Participation in exclusive events, auto shows, and partnerships with high-end lifestyle brands are essential. These events provide opportunities to showcase new models and connect with affluent consumers. Direct mail campaigns and print advertising in luxury lifestyle publications are also utilized to target specific demographics. These efforts help maintain a strong presence in the high-end vehicle market.

Sales teams employ a consultative approach, focusing on understanding individual customer needs and preferences. CRM systems are used to manage customer data, personalize interactions, and track customer journeys. This allows for targeted communication and tailored offers. In 2024, CRM data analysis played a key role in improving customer satisfaction and retention.

While not explicitly branded as loyalty programs, continuous software updates, dedicated support services, and access to exclusive events foster customer loyalty. After-sales service, including comprehensive technical support and training programs, ensures customer satisfaction. These services are designed to maintain long-term relationships with the brand.

The company's customer acquisition and retention strategies emphasize building strong, lasting relationships with its clientele. These strategies are designed to resonate with the preferences of luxury car buyers and affluent consumers.

- Consultative Sales Approach: Sales teams engage in personalized interactions to understand individual customer needs.

- Digital Marketing: Targeted online advertising and content marketing are used to reach potential customers.

- Exclusive Events: Participation in high-end events and partnerships to showcase the brand.

- After-Sales Service: Comprehensive support and training to ensure customer satisfaction.

- Data Analytics: Leveraging customer data for targeted campaigns and personalized experiences.

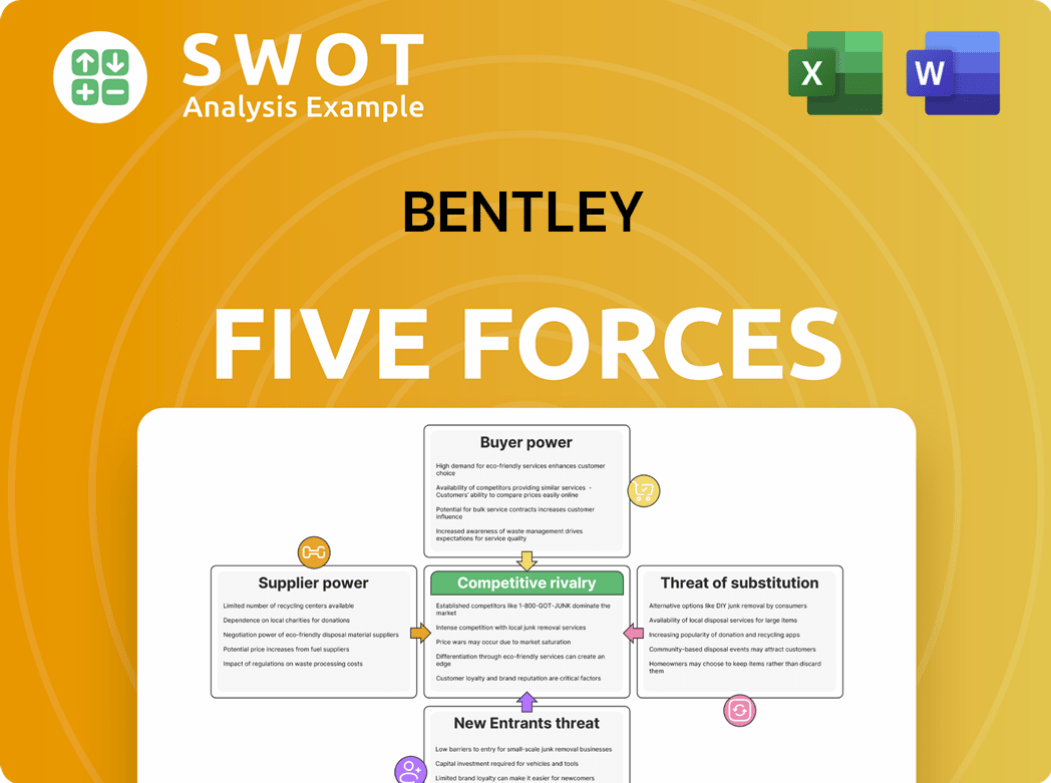

Bentley Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Bentley Company?

- What is Competitive Landscape of Bentley Company?

- What is Growth Strategy and Future Prospects of Bentley Company?

- How Does Bentley Company Work?

- What is Sales and Marketing Strategy of Bentley Company?

- What is Brief History of Bentley Company?

- Who Owns Bentley Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.