Bollore Bundle

How did a paper mill become a global giant?

Embark on a journey through time to uncover the remarkable Bollore SWOT Analysis, a French conglomerate that began in 1822. From humble beginnings as a paper mill, the Bollore Company has transformed into a multinational powerhouse. Discover the strategic shifts and pivotal moments that shaped its extraordinary evolution.

The Bollore history is a compelling narrative of adaptability and vision, a testament to the enduring power of strategic diversification. Understanding the Bollore Group's past is crucial to grasping its present-day influence, especially its significant African investments. This article will explore the Bollore Company's foundational years, expansion, and the influence of Vincent Bollore on its trajectory, offering insights into its remarkable journey from a regional paper producer to a global leader.

What is the Bollore Founding Story?

The Bolloré Company's story begins in 1822, a testament to enduring entrepreneurial spirit. The foundation was laid by Nicolas Le Marié, who established the Papeteries d'Odet paper mill in Ergué-Gabéric, Brittany, France. This marked the genesis of a company that would evolve into a global French conglomerate.

Le Marié's vision centered on the burgeoning paper industry, initially producing thin papers. These specialized papers, including those for religious texts and later, cigarette papers, provided an early competitive advantage. The company's initial success was built on leveraging local resources and skilled labor.

The business's early years were characterized by self-funding, with profits reinvested to fuel growth. The economic climate of post-Napoleonic France, undergoing the industrial revolution, provided a favorable environment for manufacturing ventures. The Bolloré name became associated with the company through Jean-René Bolloré's marriage into the Le Marié family in the mid-19th century, shaping its future.

The Bolloré Company's early success was rooted in specialized paper production. The company's focus on ultra-thin papers gave it a competitive edge.

- The company's early business model focused on high-quality, specialized paper production.

- Jean-René Bolloré's marriage into the Le Marié family was a pivotal moment.

- The industrial revolution in France provided a fertile ground for manufacturing.

- The company's early growth was largely self-funded through profit reinvestment.

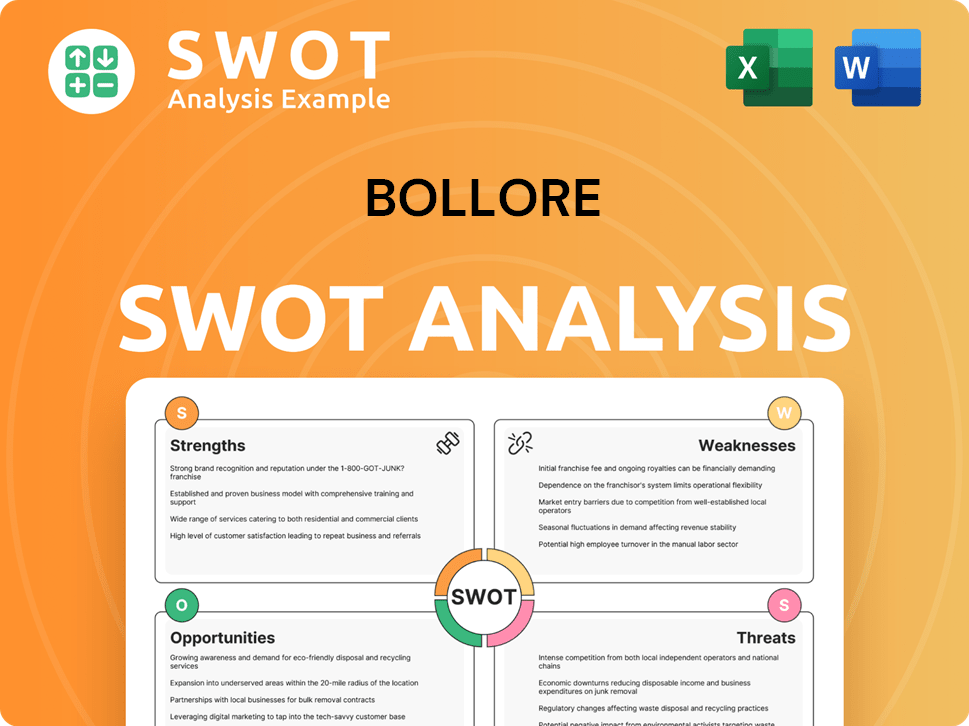

Bollore SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of Bollore?

Following its establishment, the Bolloré Company experienced consistent growth, mainly within the paper industry during the 19th and early 20th centuries. The Bollore history includes expanding paper production, investing in new machinery, and diversifying product lines beyond specialized papers. By the mid-20th century, the company began exploring avenues beyond its core paper manufacturing.

A significant strategic shift occurred in the 1980s under Vincent Bolloré, who initiated aggressive diversification and acquisitions. This era saw the company venture into transportation and logistics, acquiring various logistics firms and port operations. This marked a crucial step into global logistics, with the acquisition of Delmas-Vieljeux in 1991.

The Bollore Group also made strategic entries into the media and communication sectors. This period was marked by substantial capital raises and a willingness to enter new, high-growth markets. Its expansion into Africa, particularly in port concessions and logistics, became a cornerstone of its international strategy, leveraging the continent's growing trade.

By the early 2000s, Bolloré had established itself as a major player in logistics, with a strong presence in Africa. This expansion included significant investments in port infrastructure and logistics networks across several African countries. The company's focus on Africa was part of a broader strategy to capitalize on the continent's economic growth.

The market reception to these diversifications was generally positive, as the company demonstrated an ability to integrate new businesses effectively and generate synergies across its varied operations. This period of early growth and expansion laid the foundation for Bolloré's transformation into the diversified French conglomerate it is today, with a strong emphasis on international presence and strategic acquisitions. Read more about the company's core values in Mission, Vision & Core Values of Bollore.

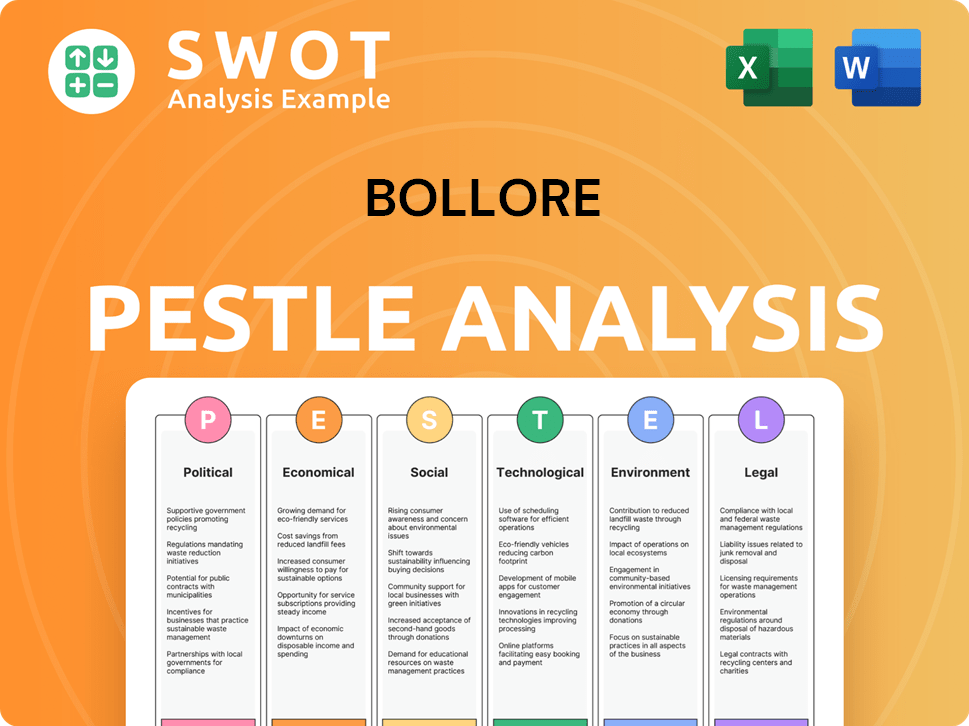

Bollore PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in Bollore history?

The Bollore Company, a prominent French conglomerate, has a rich

| Year | Milestone |

|---|---|

| Early Years | The |

| Late 20th Century | Aggressive diversification led to a strategic shift into transportation and logistics, including port operations and freight forwarding. |

| Late 20th Century | Significant strides were made in the media sector, highlighted by increasing stakes in Canal+ Group. |

| 21st Century | Innovation in electricity storage and solutions, including electric vehicles and battery technology, became a key focus. |

| 2024 | Continued influence in media, particularly through its role in Vivendi, parent company of Canal+, remains prominent. |

The

Early innovation in producing ultra-thin paper set the foundation for the company's initial success. This technological advancement differentiated the company in the paper industry.

The strategic move into transportation and logistics, including port operations and freight forwarding, marked a significant diversification. This expansion broadened the company's scope and global presence.

Increasing stakes in Canal+ Group and involvement in Vivendi demonstrated a strategic focus on media. This has expanded the company's influence in European broadcasting and content creation.

The development of electric vehicles like the Bluecar and the Autolib' car-sharing service showcased innovation in sustainable technologies. These initiatives highlighted the company's commitment to eco-friendly solutions.

The company's shift towards solid-state battery technology represents a cutting-edge innovation. This technology has the potential to significantly improve energy storage capabilities.

Strategic investments in Africa, particularly in logistics and infrastructure, have significantly expanded the company's global footprint. These investments have driven growth in key markets.

The

Intense competition in the global logistics market has required the company to focus on specialized services. This has necessitated continuous innovation to maintain a competitive edge.

Economic downturns have impacted the financial performance of various

Changes in regulations have posed challenges to the company's operations across different sectors. Adaptation to new regulatory environments has been crucial for sustained success.

The Autolib' car-sharing service faced challenges related to operational complexities and financial viability. These issues highlighted the difficulties of scaling up such services.

Market volatility in various sectors, including media and transportation, has created uncertainty. The company has had to adjust its strategies to mitigate risks.

The company has faced controversies related to its business practices and

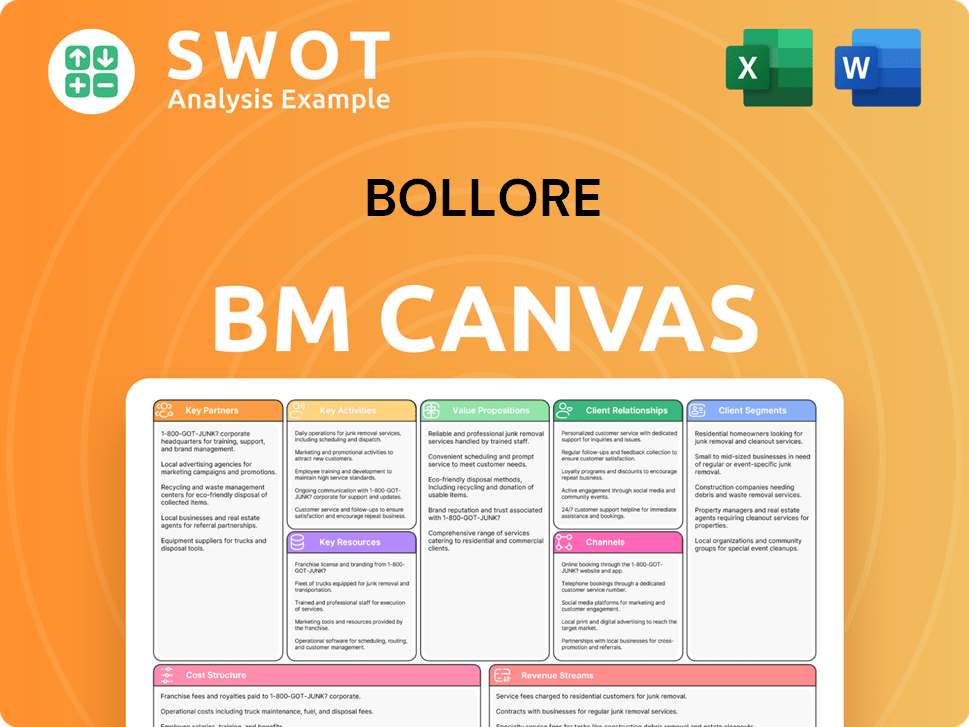

Bollore Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for Bollore?

The Bollore Company's journey, a French conglomerate, began in 1822 with the founding of a paper mill. The Bolloré family's influence began in 1863 with Jean-René Bolloré's marriage into the Le Marié family, marking the start of the family's long association with the company. Under Vincent Bolloré's leadership in the 1980s, the company underwent aggressive diversification, including the acquisition of Delmas-Vieljeux in 1991, expanding logistics and shipping capabilities. The 2000s saw significant African investments in port concessions and logistics. Innovative ventures like the Bluecar electric vehicle and Autolib' car-sharing service launched in 2011. A major strategic shift occurred in 2023 with the sale of Bolloré Logistics to MSC Group for an enterprise value of 5.7 billion euros.

| Year | Key Event |

|---|---|

| 1822 | Nicolas Le Marié founded Papeteries d'Odet paper mill. |

| 1863 | Jean-René Bolloré married into the Le Marié family, starting the Bolloré family's involvement. |

| 1980s | Vincent Bolloré took leadership, initiating aggressive diversification. |

| 1991 | Acquisition of Delmas-Vieljeux, boosting logistics and shipping. |

| 2000s | Significant expansion of port concessions and logistics in Africa. |

| 2011 | Launch of the Bluecar electric vehicle and Autolib' car-sharing service. |

| 2019 | Sale of Bolloré Logistics' stake in the logistics joint venture with CMA CGM. |

| 2022 | Bolloré Group celebrated its 200th anniversary. |

| 2023 | Bolloré finalized the sale of Bolloré Logistics to MSC Group for 5.7 billion euros. |

| 2024 | Bolloré continues to consolidate its influence in media through Vivendi and Canal+ Group. |

Bolloré's future is centered on media and content, particularly through Canal+ Group. This strategic focus aims to strengthen its position in the global media landscape. The company is committed to expanding Canal+ Group's international reach and content offerings.

The sale of Bolloré Logistics in 2023 provided significant capital for future investments. This move allows the company to focus on its core businesses. Potential investments include media, telecommunications, and further development of battery technology.

Bolloré is expected to continue exploring opportunities in sustainable technologies. This includes leveraging its expertise in electric batteries and energy storage solutions. The company aims to capitalize on the growing demand for sustainable solutions.

Analyst predictions suggest that Bolloré will pursue strategic acquisitions and partnerships. These moves are aimed at strengthening its position in its chosen sectors. The company is particularly focused on the competitive media landscape.

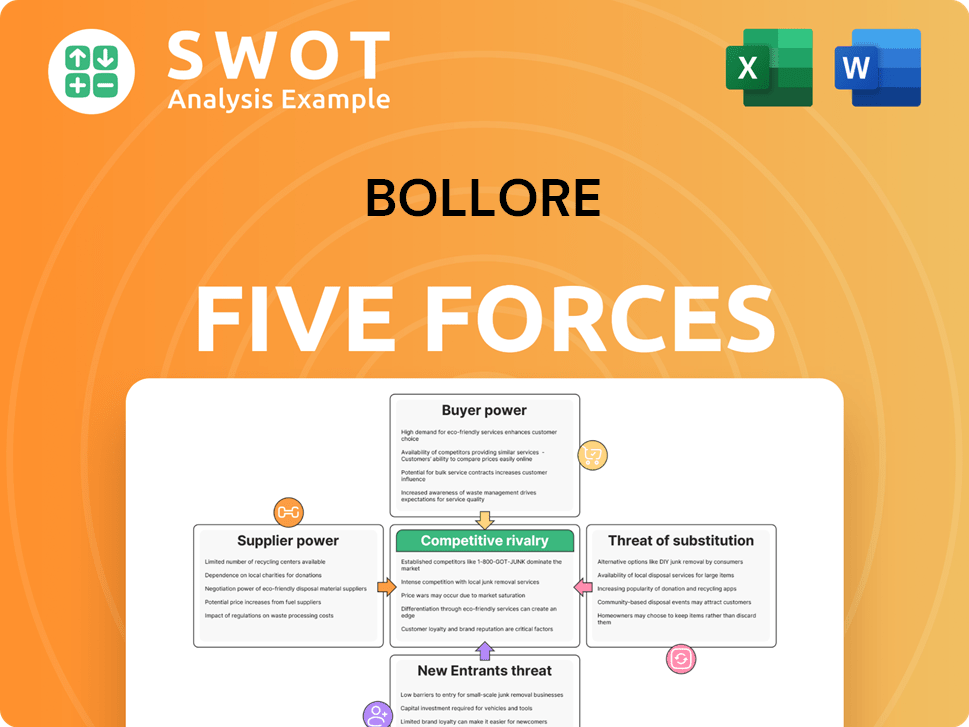

Bollore Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of Bollore Company?

- What is Growth Strategy and Future Prospects of Bollore Company?

- How Does Bollore Company Work?

- What is Sales and Marketing Strategy of Bollore Company?

- What is Brief History of Bollore Company?

- Who Owns Bollore Company?

- What is Customer Demographics and Target Market of Bollore Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.