Bollore Bundle

How is the Bolloré Group Reshaping Its Competitive Arena?

Bolloré SE, a venerable French conglomerate, has undergone a dramatic transformation, making it crucial to understand its current position. From its origins in paper manufacturing to its expansive reach in transportation, media, and energy, Bolloré's journey is a masterclass in strategic adaptation. With significant divestitures and strategic shifts in 2024, the company's competitive landscape is more dynamic than ever.

This article provides a comprehensive Bollore SWOT Analysis to help you understand Bollore's business strategy. We will dissect the Bollore competitive landscape, identifying key industry rivals and examining Bollore's market share in logistics and other sectors. Our analysis will also explore Bollore's competitive advantages, delving into its financial performance compared to rivals, and offering insights into its future outlook and competitive threats. This in-depth Bollore market analysis will help you understand the company's position.

Where Does Bollore’ Stand in the Current Market?

The Bolloré Group's market position in 2024-2025 reflects a strategic shift following significant divestments, particularly the sale of Bolloré Logistics. This restructuring has reshaped its core operations, focusing on communications, energy, and industrial sectors. The company's competitive landscape has evolved as it navigates new strategic directions and market dynamics.

Following the sale of Bolloré Logistics to CMA CGM in February 2024 for €4.8 billion, the company has largely exited the international freight forwarding and logistics sector. This move has significantly altered its competitive positioning. However, Bolloré Energy remains a key player in oil distribution and logistics, particularly in France, Switzerland, and Germany, contributing to the group's overall market presence.

The company's strategy in oil logistics includes diversification into petroleum product storage and investment in alternative fuels like biodiesel. This diversification is a key part of the Bolloré business strategy, aiming to maintain a strong market position. The company's financial health, with a positive net cash position of over €5 billion as of December 31, 2024, provides a solid foundation for future investments and strategic maneuvers.

Bolloré Energy's revenue in Q1 2024 was €655 million, decreasing by 11% due to lower volumes and prices of oil products. However, in Q1 2025, revenue stabilized at €675 million, driven by increased sales volumes. It focuses on oil distribution and logistics in France, Switzerland, and Germany.

Bolloré holds significant stakes in key entities within the communications sector. As of December 31, 2024, the group owns 30.4% of Canal+, Louis Hachette Group, and Havas, and retains a 29.3% stake in Vivendi. Canal+ has a substantial subscriber base of over 26 million across more than 50 countries in 2024.

Bolloré SE reported a net income of €1,840 million in 2024, a significant increase from €566 million in 2023. This includes a net capital gain of €3.6 billion from the sale of Bolloré Logistics and a capital loss of €1.9 billion from the deconsolidation of Vivendi spin-off companies.

The industrial sector, including Blue (electric vehicles and batteries), Films, and Systems, saw a decline in earnings in 2024 compared to 2023. In Q1 2024, Industry revenue was €75 million, up 1%, and in Q1 2025, it reached €78 million, up 1.5%, driven by 6-meter bus sales and growth in Packaging and Dielectric Films.

The Bolloré competitive landscape has changed significantly due to strategic divestments and shifts in focus. The company's financial strength, with over €5 billion in net cash as of December 31, 2024, positions it well for future investments. To understand the company's origins, consider reading a Brief History of Bollore.

- The sale of Bolloré Logistics has reshaped the company's core operations.

- Bolloré Energy remains a key player in oil distribution and logistics.

- The communications sector, with stakes in Canal+ and Vivendi, is a significant part of the business.

- The industrial sector is focused on electric vehicles, films, and systems.

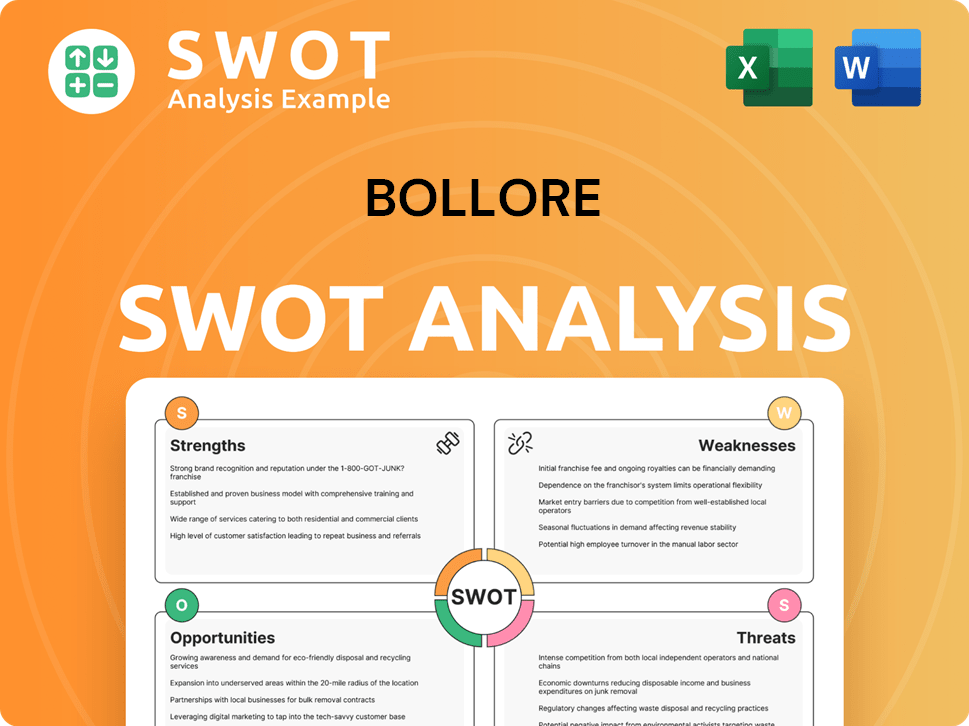

Bollore SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging Bollore?

The Bolloré Group, post the significant divestiture of its logistics arm in February 2024, now navigates a diverse competitive landscape across its remaining key sectors. This shift necessitates a fresh Bolloré market analysis to understand its current positioning and future prospects. The company faces competition from established players in various industries, including oil logistics, communications and media, and industrial sectors, particularly in electric vehicles and energy storage.

Understanding Bolloré's business strategy is crucial to assess its competitive standing. The company's focus areas include oil logistics, communications and media, and industrial sectors like electric vehicles and energy storage. This diversification requires a detailed examination of its Bolloré industry rivals and their strategies to maintain and enhance its market position. The strategic direction of Bolloré SE is now notably influenced by its reduced scope post-divestiture, impacting its competitive dynamics.

The Bolloré company overview reveals a conglomerate with a portfolio spanning multiple sectors, each with its own set of competitors and market dynamics. The company's ability to adapt to industry changes and leverage its strengths will be critical for future success. This analysis focuses on identifying Bolloré's main competitors and evaluating its strategic responses to remain competitive in each sector.

In oil logistics, Bolloré Energy competes with established players in France, Switzerland, and Germany. This market is experiencing a structural decline in oil distribution. The company is diversifying into petroleum product storage and alternative fuels to adapt.

Bolloré's significant holdings in Canal+, Havas, Louis Hachette Group, and Vivendi place it against global media conglomerates and advertising giants. Canal+ competes with major audiovisual groups and streaming services. Havas faces other leading advertising and marketing communication networks.

In the industrial sector, particularly with Blue Solutions, Bolloré competes in the green energy and e-mobility space. Blue Solutions aims to establish a solid-state battery gigafactory by 2030. This segment faces competition from other battery manufacturers and electric vehicle innovators globally.

Technological advancements, evolving consumer preferences, and industry consolidation influence the competitive dynamics across Bolloré's remaining segments. The company must adapt to these changes to maintain its market position. The divestiture of Bolloré Logistics has significantly reshaped the competitive landscape.

Blue Solutions' planned investment of €2.2 billion by 2026 in a new R&D center and a gigafactory highlights Bolloré's commitment to the battery technology market. This investment underscores its ambition to be a significant player in the energy storage sector. These investments will shape Bolloré's future competitive positioning.

While specific market share data is less detailed following the logistics divestment, Bolloré's competitive advantages are tied to its diversified portfolio and strategic investments. The company's ability to innovate and adapt to market changes will be crucial for its success. The company's focus on sustainable initiatives also plays a role.

Several factors influence Bolloré's competitive standing, including technological advancements, consumer preferences, and industry consolidation. The company's ability to navigate these challenges will determine its success. For a more detailed understanding of the company's financial performance, you can refer to a comprehensive analysis of Bolloré's financial data.

- Technological Innovation: Adapting to new technologies in the energy and media sectors.

- Market Trends: Responding to changing consumer preferences and industry consolidation.

- Strategic Investments: Leveraging investments in R&D and new facilities to gain a competitive edge.

- Diversification: Managing a diverse portfolio across multiple sectors to mitigate risks.

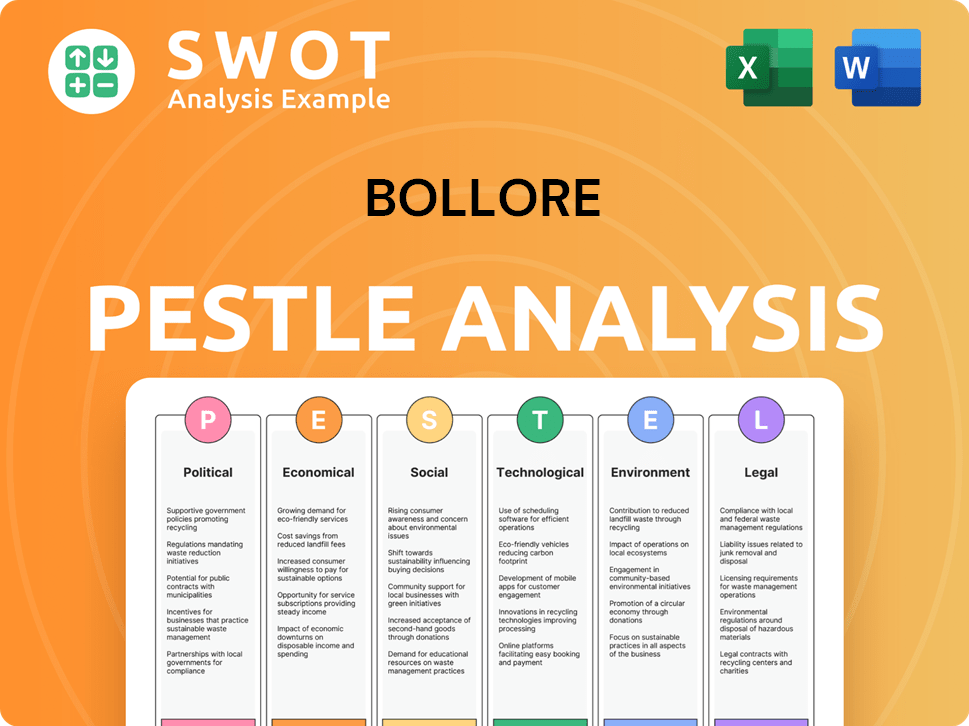

Bollore PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives Bollore a Competitive Edge Over Its Rivals?

Understanding the competitive landscape of Bolloré requires a deep dive into its strategic strengths and market positioning. The company, now operating with a streamlined focus following the sale of Bolloré Logistics in early 2024, has demonstrated resilience and adaptability across various sectors. This shift has allowed for a clearer focus on core competencies and strategic investments, enhancing its competitive edge in a dynamic market.

Bolloré's business strategy is underpinned by a diversified portfolio, spanning communications, industrial solutions, and energy. This diversification helps mitigate risks and capitalize on growth opportunities in different sectors. The company's financial performance, especially its robust cash position, provides a solid foundation for future expansion and strategic initiatives, making it a key player in the industries it operates within.

A comprehensive Bolloré market analysis reveals key competitive advantages. These advantages are rooted in its financial strength, brand equity, and commitment to innovation. Bolloré's ability to adapt to market changes and invest in long-term growth initiatives, such as sustainable technologies, further solidifies its position against industry rivals.

Following the sale of Bolloré Logistics, the Group achieved a positive net cash position of over €5 billion. At December 31, 2024, this figure reached €5,306 million. With €8 billion in cash and confirmed credit lines at the end of December 2024, Bolloré has significant flexibility for strategic investments and navigating economic uncertainties.

Bolloré's substantial stakes in established entities like Canal+, Havas, and Universal Music Group (UMG) provide considerable brand equity and market reach. Canal+ boasts over 26 million subscribers across more than 50 countries in 2024. The increase in UMG's earnings also contributed to the 23% growth in the Communications sector's earnings in 2024.

Blue Solutions is focused on solid-state battery technology, with plans for a gigafactory by 2030 and an R&D center by 2026, backed by a €2.2 billion investment. Bolloré Energy's diversification into petroleum product storage and alternative fuels like biodiesel showcases its adaptability and response to market shifts. These initiatives position the company as a leader in sustainable innovation.

Bolloré's long-term investment policy is supported by the majority control of the Bolloré family. This ensures a consistent approach to strategic planning and investment. The company's commitment to innovation, particularly in sustainable technologies, demonstrates a forward-thinking approach to market challenges.

Bolloré's competitive advantages stem from its financial strength, diversified business model, and commitment to innovation. Its strong financial position allows for strategic investments and resilience in economic downturns. The company's presence in communications, industrial solutions, and energy provides a balanced portfolio that can capitalize on various market opportunities.

- Financial Strength: Over €5 billion net cash position and €8 billion in cash and confirmed credit lines at the end of December 2024.

- Diversified Portfolio: Operations in communications, industrial solutions, and energy.

- Innovation: Investment in solid-state battery technology and alternative fuels.

- Brand Equity: Strong presence through Canal+, Havas, and UMG.

- Strategic Vision: Supported by long-term investment policies and family control.

For more insights into the company's growth strategies, consider the article on Growth Strategy of Bollore.

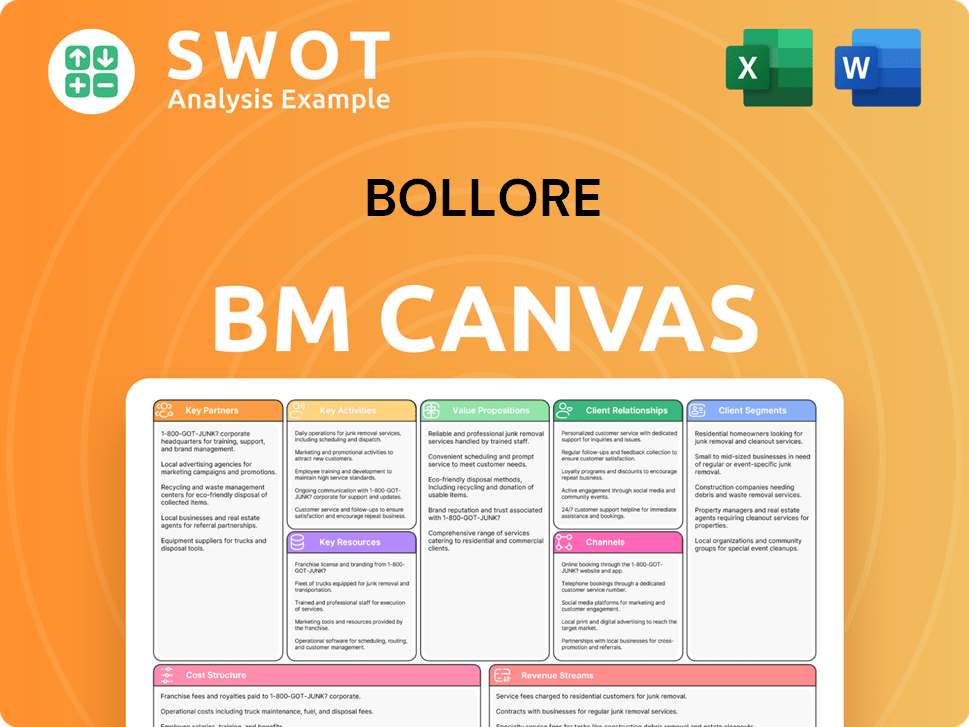

Bollore Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping Bollore’s Competitive Landscape?

The Bolloré competitive landscape is undergoing significant shifts driven by digital transformation, decarbonization efforts, and strategic realignment. The company faces challenges in adapting to evolving consumer preferences in media, transitioning to sustainable energy sources, and scaling its battery technology. However, these shifts also present opportunities for growth through digital expansion, alternative fuel development, and advancements in electric vehicle technology. For a deeper understanding, explore the Target Market of Bollore.

Risks include intense competition, the need for substantial capital investments, and macroeconomic uncertainties. The future outlook for Bolloré hinges on its ability to execute its strategic initiatives, leverage its financial strength, and adapt to technological and market disruptions. The company's 'Converged' strategy and investments in technology are designed to enhance its competitive position and drive future growth.

The media and communications sector is experiencing digital transformation and evolving consumer behavior. The energy sector is focused on decarbonization and alternative fuels. The industrial segment is driven by the electric vehicle and energy storage revolution.

Challenges include adapting to digital consumer preferences, transitioning to sustainable energy, and intense competition in the battery market. Capital investment is required for scaling production, and macroeconomic and geopolitical uncertainties pose risks. Declining demand for conventional oil products presents a challenge.

Opportunities include expanding subscriber bases, leveraging new streaming agreements, and enhancing digital capabilities in media and advertising. There is potential for growth in alternative fuels like biodiesel and synthetic diesel. Blue Solutions has the opportunity to become a leader in advanced battery technology.

The company is spinning off entities for focused operations. It is investing in the storage of petroleum products and alternative fuels. A €2.2 billion investment is planned for a gigafactory and R&D center by 2030. The 'Converged' strategy aims to streamline operations.

Bolloré's strategic initiatives and strong financial position are key to navigating industry changes. The company's net cash position of over €5 billion as of December 31, 2024, provides a significant financial buffer. Strategic partnerships and product innovations are crucial for remaining resilient and capturing growth in emerging markets.

- Digital transformation and expansion of subscriber bases in media.

- Investment in alternative fuels and sustainable energy solutions.

- Focus on advanced battery technology through Blue Solutions.

- Leveraging a strong net cash position for investments and adaptation.

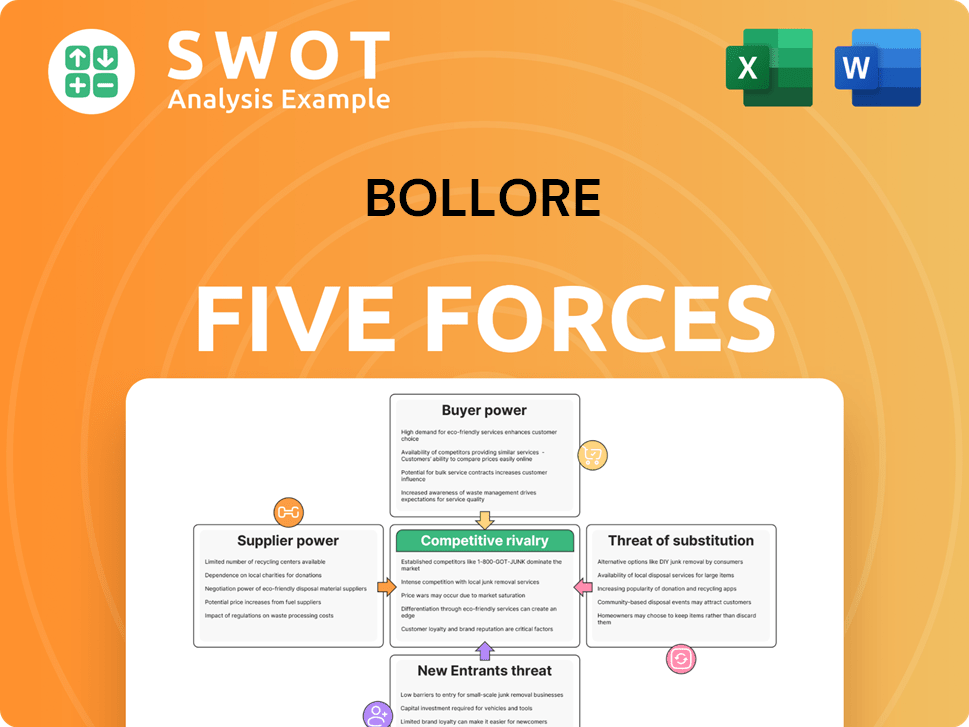

Bollore Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Bollore Company?

- What is Growth Strategy and Future Prospects of Bollore Company?

- How Does Bollore Company Work?

- What is Sales and Marketing Strategy of Bollore Company?

- What is Brief History of Bollore Company?

- Who Owns Bollore Company?

- What is Customer Demographics and Target Market of Bollore Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.