Bollore Bundle

Can Bolloré Company Sustain Its Growth Trajectory?

Bolloré SE, a global investment powerhouse, has a rich history of strategic adaptation since its inception in 1822. From paper manufacturing to a diversified conglomerate, the Bollore SWOT Analysis reveals the company's dynamic evolution across transportation, media, and energy sectors. Understanding Bolloré's growth strategy is crucial for anyone interested in the future of global business.

The Bolloré Group's journey exemplifies the power of strategic planning and business development. Its expansion into African port operations and the growth of Canal+ Group are prime growth strategy examples. This article delves into Bolloré's future prospects, exploring its expansion plans, sustainable growth initiatives, and how it aims to navigate the competitive landscape and capitalize on future investment opportunities.

How Is Bollore Expanding Its Reach?

The Bolloré Company's growth strategy is significantly shaped by its expansion initiatives, particularly within its core sectors of transportation and logistics and media. These initiatives are designed to enhance its market presence, diversify revenue streams, and fortify its competitive position. The company focuses on strategic investments and partnerships to capitalize on emerging market opportunities and adapt to evolving industry dynamics.

In the transportation and logistics sector, the Bolloré Group has historically concentrated on strengthening its footprint in Africa. This involves optimizing port operations and expanding logistics networks to leverage increasing trade volumes and infrastructure development. The media sector, spearheaded by Canal+ Group, is actively pursuing international expansion to broaden its subscriber base and revenue sources.

The company also explores new product categories and services, such as enhanced digital offerings and specialized logistics solutions, to meet evolving customer demands and stay ahead of industry changes. These initiatives are designed not only to access new customer segments but also to reinforce Bolloré's competitive position and ensure long-term revenue diversification. For a deeper understanding of the company's core values, consider reading Mission, Vision & Core Values of Bollore.

Bolloré continues to invest in its logistics network across Africa, aiming to capitalize on the continent's growing trade volumes and infrastructure development. This includes port concessions and logistics services, with ongoing efforts to optimize operations. The company's multimodal transport solutions and warehousing capabilities are also being enhanced, particularly in key emerging markets.

Canal+ Group is actively expanding internationally to diversify its subscriber base and revenue streams. This includes targeting new geographical markets for content distribution and exploring strategic partnerships in broadcasting and content production. The company is increasing its stake in various media entities to become a global leader in content.

Bolloré actively seeks strategic partnerships and acquisitions to bolster its market position and expand its service offerings. These initiatives are crucial for accessing new customer segments and reinforcing the company's competitive edge. Recent acquisitions and partnerships have focused on enhancing logistics capabilities and expanding media content portfolios.

The company continuously explores new product categories and services to meet evolving customer demands and stay ahead of industry changes. This includes enhanced digital offerings and specialized logistics solutions. Innovation is a key driver for Bolloré's long-term revenue diversification and market competitiveness.

Bolloré's expansion strategies are centered around geographic diversification, strategic acquisitions, and product innovation. These strategies are designed to drive Bolloré's future investment opportunities and ensure sustainable growth.

- Geographic Expansion: Focusing on emerging markets, particularly in Africa and Asia, to capitalize on growth opportunities.

- Strategic Acquisitions: Acquiring companies to enhance capabilities and expand market share in key business segments.

- Product Innovation: Developing new services and digital offerings to meet evolving customer needs and maintain a competitive edge.

- Partnerships: Forming strategic alliances to leverage expertise and resources, fostering collaborative growth.

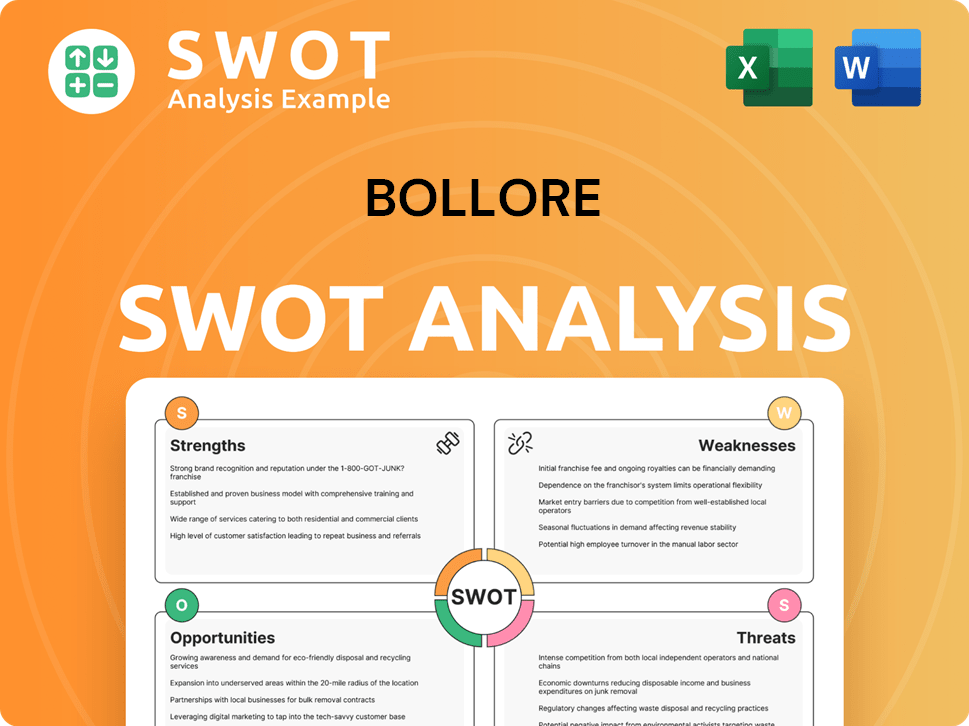

Bollore SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Bollore Invest in Innovation?

The Bolloré Company (Bolloré Group) employs a robust innovation and technology strategy to achieve its Growth Strategy. This approach is integral to its Bolloré Future, focusing on sustainable solutions and digital transformation across its diverse business segments. The company consistently invests in research and development to maintain a competitive edge and capitalize on emerging market opportunities.

Bolloré's commitment to innovation is evident in its focus on electricity storage and digital solutions. The company's strategic investments in technology are designed to improve operational efficiency, enhance service delivery, and create new revenue streams. This forward-thinking approach is essential for navigating the evolving business landscape and ensuring long-term success.

The company’s strategic initiatives are designed to capitalize on market trends and technological advancements. By integrating innovation into its core operations, Bolloré aims to strengthen its market position and drive sustainable growth. This proactive stance is crucial for adapting to changing customer needs and maintaining a competitive advantage.

Bolloré's Blue Solutions subsidiary is at the forefront of developing solid-state battery technology. This technology is designed to enhance energy storage capabilities for electric vehicles and stationary applications. The company's focus is on sustainable energy solutions.

Bolloré integrates automation and advanced analytics into its logistics and port operations. This integration improves efficiency, optimizes supply chains, and enhances service delivery. Digital transformation is a key element of the company's strategic planning.

Bolloré explores cutting-edge technologies such as AI and IoT to create smart logistics solutions. These solutions include predictive maintenance capabilities within its transportation networks. The company aims to optimize logistics.

Canal+ Group continuously invests in technological advancements to improve content delivery. The focus is on personalizing user experiences and combating piracy, leveraging digital platforms and data analytics. This investment is crucial for the media sector.

The company's sustained investment in these areas underscores its dedication to innovation. This commitment is a key driver for future growth and maintaining technological leadership in its respective markets. R&D is critical for future success.

Bolloré Group often engages in strategic partnerships to enhance its technological capabilities. These collaborations can provide access to new technologies and markets. Strategic partnerships are important for Business Development.

Bolloré's technology strategy includes several key initiatives aimed at driving Bollore Future growth. These initiatives are designed to enhance operational efficiency, improve customer experience, and create new revenue streams. The company is focused on sustainable growth initiatives.

- Battery Technology: Development of solid-state batteries for electric vehicles and stationary applications.

- Digital Logistics: Implementation of AI and IoT for smart logistics and predictive maintenance.

- Media Innovation: Continuous investment in digital platforms and data analytics for content delivery.

- Operational Efficiency: Integration of automation and advanced analytics in logistics and port operations.

For more insights into how the company approaches its marketing efforts, consider reading about the Marketing Strategy of Bollore. This can provide a broader understanding of the company's strategic approach.

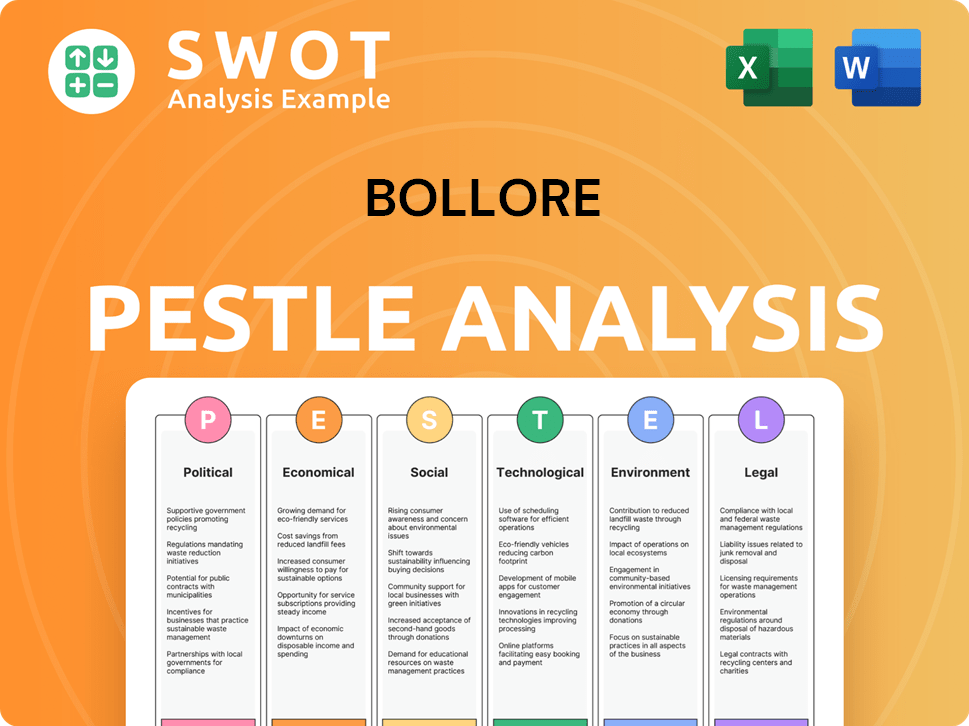

Bollore PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is Bollore’s Growth Forecast?

The financial outlook for the Bolloré Company reflects a strategic focus on enhancing profitability and supporting future growth. The Bolloré Group has demonstrated resilience and strategic financial maneuvering in recent reports. This includes a significant increase in net income attributable to the Group, driven by contributions from key holdings. The company's strategic financial planning is geared towards optimizing the performance of its existing assets and selectively pursuing acquisitions.

For the first nine months of 2023, the Bolloré Group's revenue reached €9,643 million. The company is focused on key growth areas, such as international expansion and the development of its battery technology. The proposed simplified public tender offer for shares further indicates a strategic consolidation of ownership, potentially aimed at streamlining decision-making and facilitating long-term investments.

This financial narrative underpins Bolloré's strategic plans, providing the necessary capital and stability to pursue its ambitious growth trajectory. For more insights into the company's strategic positioning, consider reading about the Target Market of Bollore.

Bolloré's net income attributable to the Group in 2023 was reported at €606 million, a significant increase from €339 million in 2022. This increase was primarily driven by the contribution of the share in Canal+ Group and Universal Music Group.

The Group's revenue for the first nine months of 2023 reached €9,643 million. This showed a slight decrease of 0.8% at current exchange rates but an increase of 2.7% at constant exchange rates compared to the same period in 2022.

The company aims to continue its investment in key growth areas, such as the expansion of Canal+ Group internationally and the development of its battery technology. This indicates a focus on business development and long-term strategic planning.

The proposed simplified public tender offer for the shares by Financière de l’Odet, which concluded in December 2023, indicates a strategic consolidation of ownership. This could streamline decision-making and facilitate long-term investments.

The Bollore Company's growth strategy focuses on several key areas to ensure sustainable growth initiatives. This includes expanding existing successful ventures and investing in new technologies.

- Expansion of Canal+ Group internationally.

- Development of battery technology.

- Strategic acquisitions aligned with long-term objectives.

- Optimizing the performance of existing assets.

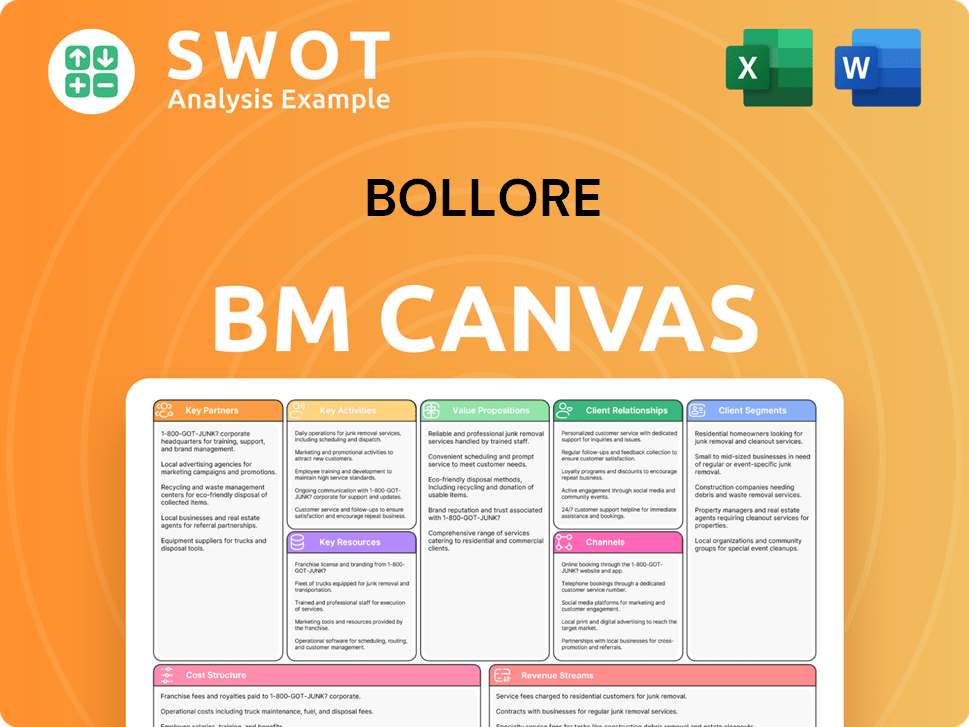

Bollore Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow Bollore’s Growth?

The Bolloré Company faces several potential risks and obstacles that could affect its growth ambitions. These challenges span across its diverse business segments, requiring the company to maintain a proactive and adaptable approach to navigate the evolving market dynamics. Understanding these risks is crucial for assessing the Bolloré future and its strategic planning.

Market competition, regulatory changes, and supply chain vulnerabilities are among the key challenges. The company must also contend with technological disruptions and internal resource constraints. Effective risk management and strategic adaptation are critical for the Bolloré Group to sustain its growth trajectory.

The Bolloré Company's expansion plans and overall growth strategy must consider these potential hurdles. The company's ability to mitigate these risks will significantly influence its financial performance and long-term goals. For more insights into the company's business model, consider reading the article Revenue Streams & Business Model of Bollore.

Intense competition in logistics and media sectors poses a continuous challenge. In logistics, global players and regional specialists compete for market share. The media sector faces competition from streaming services and content providers.

Changes in regulations, particularly in port operations and media, can impact costs and market access. Compliance with international trade laws, environmental regulations, and broadcasting policies is essential. These changes require continuous adaptation.

Global geopolitical events and economic instability can disrupt logistics operations. Disruptions can lead to delays and increased expenses, affecting the efficiency and profitability of the Bolloré Group's logistics network. This requires proactive risk management.

Rapid advancements in battery technology can impact the competitiveness of the Blue Solutions subsidiary. The company must continually innovate and adapt to stay ahead. This requires significant investment in research and development.

Availability of skilled labor and capital for large-scale investments can impede growth. The company needs to invest in training and development. Securing adequate funding is crucial for Bolloré future investment opportunities.

Increasing cybersecurity threats and the accelerating pace of climate change pose emerging risks. These factors require proactive measures. They also necessitate ongoing strategic adaptation for the Bolloré Company.

The Bolloré Company mitigates risks through diversification across business segments. It employs robust risk management frameworks and continuous scenario planning. This allows for proactive adaptation to changing market conditions and helps in Business Development.

The Bolloré Group faces competition from major players in logistics, such as DHL and Maersk. In media, it competes with global streaming services and traditional media outlets. Understanding the Bollore Group competitive landscape is crucial for strategic decisions.

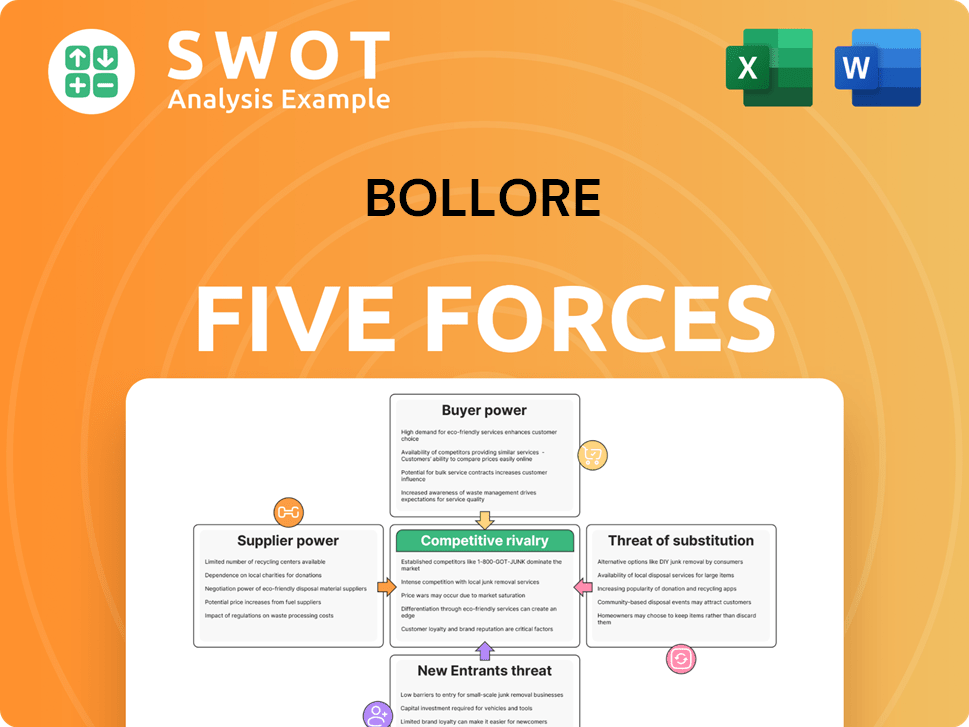

Bollore Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Bollore Company?

- What is Competitive Landscape of Bollore Company?

- How Does Bollore Company Work?

- What is Sales and Marketing Strategy of Bollore Company?

- What is Brief History of Bollore Company?

- Who Owns Bollore Company?

- What is Customer Demographics and Target Market of Bollore Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.