Bollore Bundle

Unveiling the Inner Workings of Bolloré: A Strategic Deep Dive

Bolloré SE, a French conglomerate, is a significant player across several global sectors, often operating behind the scenes. Its influence spans transportation, logistics, communication, and electricity storage, showcasing a diverse and resilient business model. This multifaceted approach makes understanding Bolloré's operations critical for anyone seeking to navigate the complexities of global commerce.

This exploration into the Bollore SWOT Analysis will uncover the intricacies of the Bollore Company, examining its core operations and revenue streams. We'll delve into the Bollore business model, offering insights into how this diversified group generates value and maintains its competitive edge. From its transportation services to its media empire, we'll dissect the strategies that have shaped the Bollore Group's impressive global presence and financial performance.

What Are the Key Operations Driving Bollore’s Success?

The Bolloré Company operates across various sectors, creating value through its diverse business model. The company's core operations span transportation and logistics, communication and media, and electricity storage solutions. This diversification allows the company to serve a broad range of markets and industries, providing integrated services and innovative solutions.

The Bolloré Group focuses on providing comprehensive solutions, with a strong emphasis on sustainability and technological innovation. Its operations are characterized by significant capital investments, continuous technological advancements, and strategic partnerships. The company's global reach and integrated service offerings provide a competitive edge, enhancing customer benefits and driving growth across its segments.

The value proposition of Bolloré's business model lies in its ability to offer integrated solutions, leveraging its extensive network and technological expertise. The company's commitment to sustainability, particularly in its electricity storage and solutions segment, positions it well for future growth. The company's strategic focus on key markets, such as Africa, further enhances its value proposition by providing essential services and infrastructure.

This segment provides comprehensive services, including port concessions, freight forwarding, and supply chain management. The company has a significant presence in Africa, with port terminals forming a critical backbone for international trade. This segment serves diverse industries, emphasizing reliability and efficiency in global supply chains.

Led by Canal+ Group, this segment focuses on pay television, content creation, and distribution. Canal+ delivers a variety of entertainment, sports, and news content, leveraging its technological infrastructure. The value proposition includes premium content and widespread accessibility.

This segment focuses on developing and deploying electric vehicles and energy storage systems. The value proposition centers on sustainable and efficient energy solutions. The company addresses the growing demand for clean transportation and reliable power grids.

Operations involve significant capital expenditure in infrastructure, continuous technological development, and intricate logistical coordination. The company's global reach, established partnerships, and integrated service offerings provide a unique competitive advantage. This translates into comprehensive solutions and enhanced customer benefits.

The Bolloré Company's operations are characterized by a diversified approach, allowing it to mitigate risks and capitalize on various market opportunities. The company's strategic investments in infrastructure and technology underscore its commitment to long-term growth and sustainability. Its financial performance is influenced by its ability to adapt to changing market dynamics and maintain operational efficiency. For more information, you can read about the Owners & Shareholders of Bollore.

- Transportation and Logistics: Includes port concessions, freight forwarding, and supply chain management, with a strong presence in Africa.

- Communication and Media: Primarily driven by Canal+ Group, focusing on pay television and content distribution.

- Electricity Storage and Solutions: Involves electric vehicles and energy storage systems, promoting sustainable energy solutions.

- Financial Performance: The company's financial results are influenced by its ability to adapt to market changes and maintain operational efficiency.

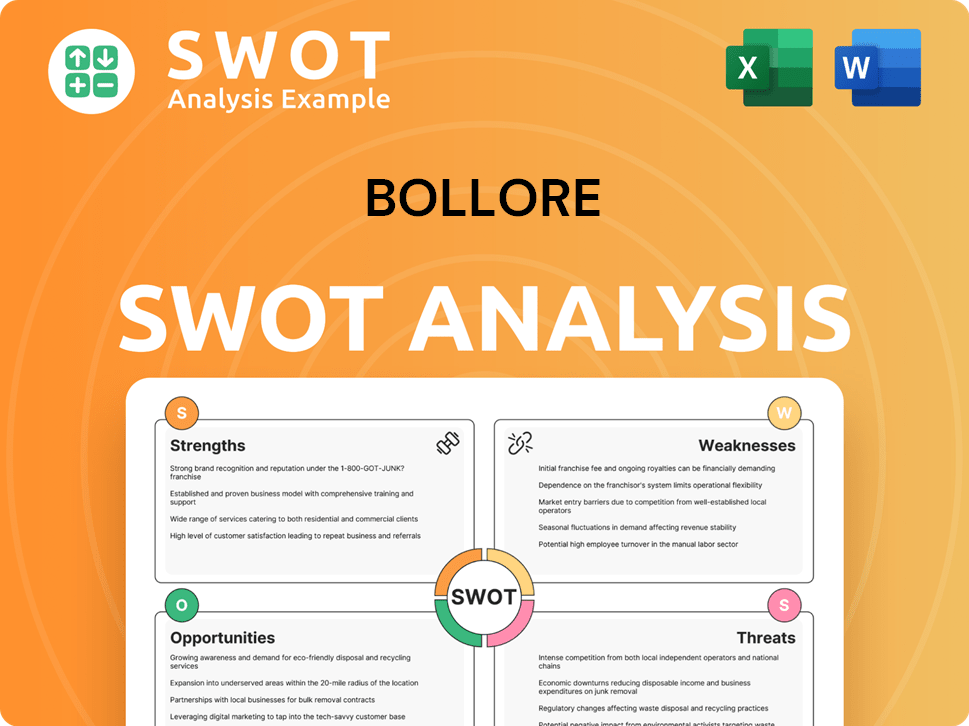

Bollore SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does Bollore Make Money?

The Bolloré Company generates revenue through diverse streams, reflecting its multifaceted business model. Its operations span several sectors, including transportation and logistics, communication and media, and electricity storage solutions. Understanding how the Bolloré Group monetizes its various ventures provides insight into its financial strategy and overall market position.

The company's revenue streams are primarily driven by its transportation and logistics segment, which includes port concessions, freight forwarding, and warehousing. The communication and media segment, largely through Canal+ Group, also contributes significantly through subscriptions, advertising, and content distribution. Additionally, the electricity storage and solutions segment generates revenue from electric vehicles and energy storage systems.

The Bolloré business model is designed to capitalize on diverse market opportunities, ensuring a robust and adaptable financial structure. The company’s approach to monetization involves a mix of service fees, subscriptions, sales, and strategic partnerships, allowing it to maintain a strong market presence and pursue growth across its key sectors.

The transportation and logistics segment is a major revenue driver. It derives income from port concession fees, freight forwarding, warehousing, and supply chain management solutions.

The communication and media segment, primarily through Canal+ Group, generates revenue from subscription fees, advertising sales, and content distribution rights.

This segment monetizes its offerings through the sale of electric vehicles, energy storage systems, and related services. It focuses on long-term growth and technological innovation.

Bundled services, particularly in logistics, are offered to provide integrated solutions. Tiered pricing for media subscriptions is also a key strategy.

The company explores new revenue opportunities, such as expanding its digital media presence and forging strategic partnerships in emerging markets for its energy solutions.

In 2023, the Bolloré Group reported a revenue of €13,678 million. The Communication segment, including Canal+ Group, generated €6,211 million.

The Bolloré operations are structured to maximize revenue through diversified streams. The company's ability to adapt and innovate is crucial for its continued success. For more insights into the competitive environment, consider exploring the Competitors Landscape of Bollore.

The company utilizes several key strategies to generate revenue and maintain a competitive edge.

- Port Concession Fees: Revenue from managing and operating ports.

- Subscription Model: Recurring revenue from Canal+ pay-television services.

- Advertising Sales: Generating income through advertising on various platforms.

- Freight Forwarding: Providing logistics and transportation services.

- Sale of Electric Vehicles: Revenue from the sale of electric vehicles (e.g., Bluecar).

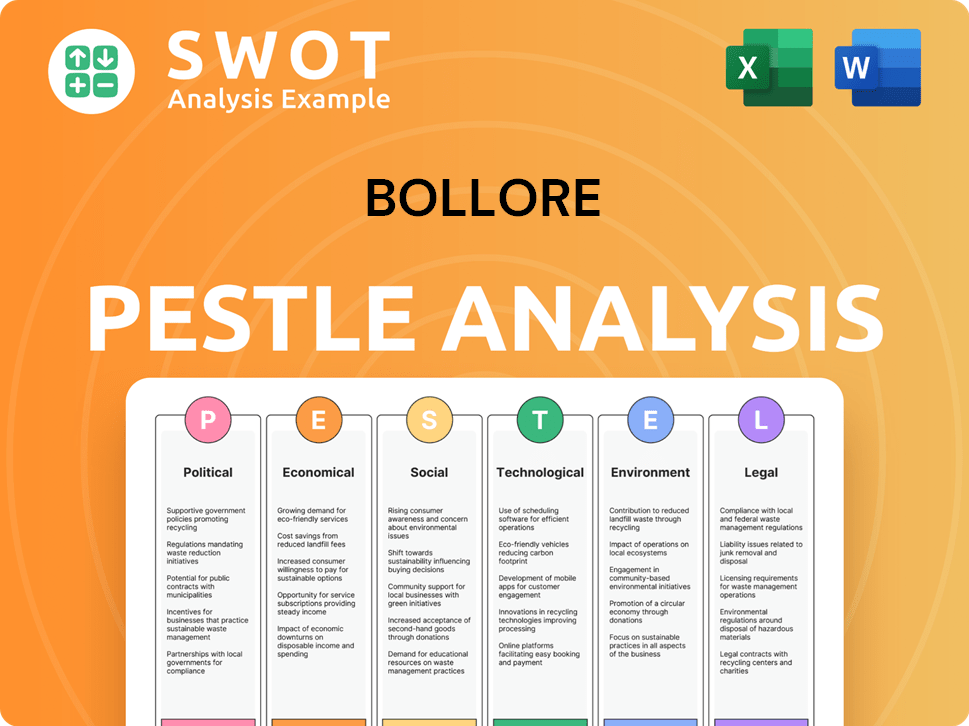

Bollore PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped Bollore’s Business Model?

The Brief History of Bollore reveals a trajectory defined by strategic milestones and significant operational shifts. The company's expansion into diverse sectors, including logistics, media, and energy, showcases its adaptability and vision. These strategic moves have been pivotal in shaping its competitive landscape and financial performance.

A key strategic focus has been the expansion of port concessions and logistics networks, particularly in Africa. This has established the company as a leading player on the continent. Concurrently, acquisitions in the media sector, notably the Canal+ Group and Lagardère, have positioned the company as a dominant force in the European media landscape. These moves have been transformative for the business.

The company has navigated operational challenges, including geopolitical instability and intense competition in the media sector. The response has included diversifying its geographical footprint, optimizing the supply chain, and investing heavily in content and digital platforms. The company's competitive advantages are multifaceted, including a strong brand reputation and significant economies of scale.

Key milestones include the expansion of port concessions and logistics networks, particularly in Africa. The acquisition of major stakes in media companies, such as Canal+ Group and Lagardère, has been a transformative strategic move. These actions have reshaped the company's operational and financial standing.

Strategic moves include the continuous expansion of port concessions and logistics networks, especially in Africa. Investing heavily in content and digital platforms for Canal+ has also been a key strategy. The company has diversified its geographical footprint to mitigate risks.

The company benefits from a strong brand reputation built over two centuries. Significant economies of scale in logistics and media distribution provide an advantage. A vertically integrated approach, particularly in media, strengthens its competitive position.

The company faces operational challenges, including geopolitical instability affecting logistics operations. Intense competition in the media sector is another significant hurdle. The company responds by diversifying its geographical footprint and optimizing the supply chain.

The company's success is built on several strategic pillars and competitive advantages. These include a strong presence in logistics and media, coupled with a focus on long-term investments. The company's ability to adapt to market changes and its focus on sustainability further enhance its position.

- Logistics and Transportation: The company's logistics arm, Bolloré Logistics, has a significant presence in Africa, handling a substantial volume of cargo. In 2024, the logistics sector saw a revenue increase, reflecting the company's robust performance.

- Media and Communications: The company's media holdings, including Canal+, have a significant impact on the European media landscape. The acquisition of Lagardère in 2024 further expanded its media empire, increasing its influence and market share.

- Financial Performance: In 2024, the company's revenue reached approximately €25 billion, with a significant portion coming from its logistics and media divisions. The company's investments in digital platforms and content have driven growth.

- Sustainability Initiatives: The company is investing in electric transport solutions and renewable energy. This strategic move aligns with the growing demand for sustainable logistics and media practices.

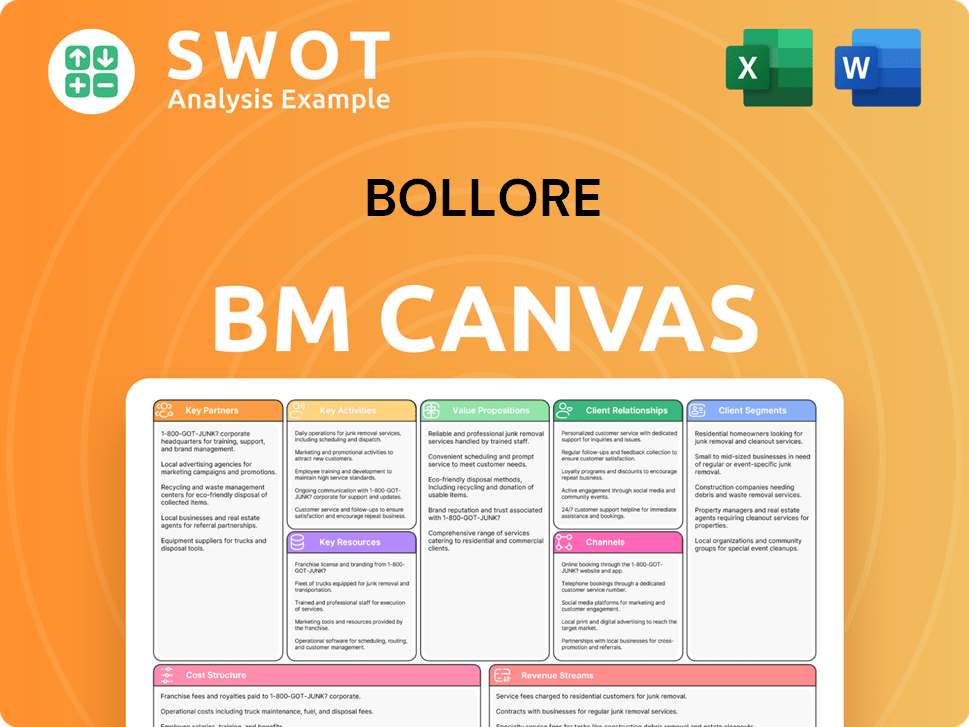

Bollore Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is Bollore Positioning Itself for Continued Success?

The Bolloré Company, now known as Bolloré SE, maintains a robust industry position across its core sectors. Its operations are diversified, with significant involvement in transportation, logistics, media, and energy solutions. This strategic diversification helps the company navigate various market conditions and capitalize on emerging opportunities. The company's global reach and strong market presence, particularly in Africa, are key strengths.

Bolloré's business model is centered around a diversified portfolio of investments and operations, with a focus on creating long-term value through strategic acquisitions, operational efficiency, and innovation. The sale of Bolloré Logistics to MSC Group for €5.7 billion in 2024, while a significant change, still leaves the company with interests in other related areas. The company's ability to adapt and innovate is crucial for its continued success in a rapidly changing global landscape.

Bolloré SE holds a strong market position, particularly in transportation, logistics, and media. Canal+ Group, a key media asset, is a leading pay-television operator in France and Africa. The company's extensive network and expertise, especially in Africa, contribute significantly to its market share and influence. Its strategic focus is on leveraging its existing strengths and expanding its global footprint.

Bolloré faces risks from regulatory changes, especially in transportation and media, which could impact profitability. Competition from new digital media and energy storage companies poses a threat. Technological disruptions and geopolitical instability also present ongoing challenges. The company must constantly adapt to these evolving conditions to maintain its competitive edge.

Bolloré's future includes further consolidation of media assets, like the acquisition of Lagardère in 2024. Investments in electricity storage and solutions are also planned to capitalize on sustainable energy demand. The company aims for long-term value creation through strategic acquisitions, operational efficiency, and innovation. The company is focused on adapting to trends and making opportunistic investments.

Bolloré's strategy involves leveraging its market positions, adapting to emerging trends, and pursuing strategic investments. The company is focused on enhancing its media presence through acquisitions and expanding its reach in the energy sector. Operational efficiency and innovation are critical components of its long-term value creation strategy. The company aims to leverage its strengths to drive growth.

Bolloré's strategic initiatives focus on consolidating its media assets, particularly after the acquisition of Lagardère. The company is also investing in electricity storage solutions to capitalize on the growing demand for sustainable energy technologies. These initiatives are designed to drive long-term value creation and expand the company's revenue streams.

- Acquisition of Lagardère to enhance its publishing and travel retail presence.

- Continued investment in electricity storage and solutions to meet the growing demand for sustainable energy.

- Commitment to long-term value creation through strategic acquisitions, operational efficiency, and innovation.

- Focus on leveraging strong market positions, adapting to emerging trends, and pursuing opportunistic investments.

For a deeper dive into the company's marketing strategies, consider reading the Marketing Strategy of Bollore. The company's ability to navigate risks, adapt to changes, and implement strategic initiatives will be crucial for its future success. The company's financial performance and operational strategies are continuously evolving, which is essential in today's dynamic market environment.

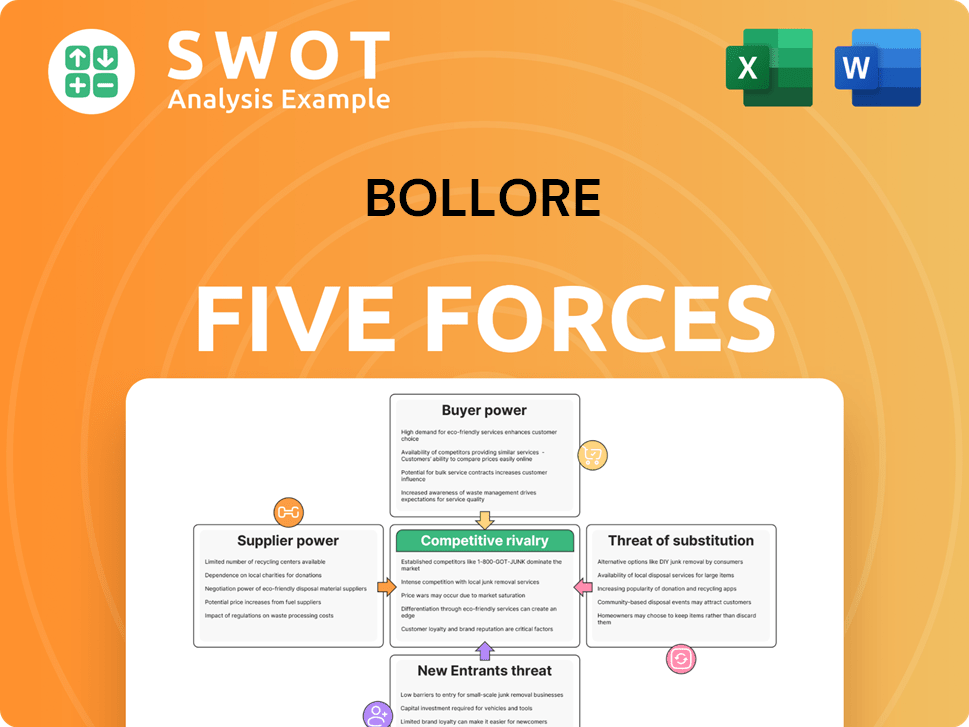

Bollore Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Bollore Company?

- What is Competitive Landscape of Bollore Company?

- What is Growth Strategy and Future Prospects of Bollore Company?

- What is Sales and Marketing Strategy of Bollore Company?

- What is Brief History of Bollore Company?

- Who Owns Bollore Company?

- What is Customer Demographics and Target Market of Bollore Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.