Bollore Bundle

Who Really Owns Bolloré?

Navigating the complexities of corporate ownership is crucial for any investor or strategist. Recent shifts, like the sale of Bolloré Logistics in early 2024 and the Vivendi spin-off in late 2024, highlight the dynamic nature of company control. Understanding the Bollore SWOT Analysis is just the beginning; knowing who truly owns Bolloré SE is key to unlocking its future potential.

This exploration into Bollore Company ownership will uncover the intricate web of stakeholders that shape this French multinational conglomerate. From its humble beginnings as a paper manufacturer to its current status as a diversified industrial group, the Bollore Group owner and its influence have been pivotal. We'll examine the role of Vincent Bollore and other key players in shaping the Bollore business and its strategic direction, providing insights for informed decision-making. Uncover the details of Bollore SA and its subsidiaries.

Who Founded Bollore?

The story of the Bolloré Company Ownership begins in 1822 with the founding of Papeteries d'Odet by Nicolas Le Marié. This marked the start of what would become a significant industrial entity. The company initially focused on paper manufacturing, setting the stage for its future developments.

Control of the company shifted to the Bolloré family in 1863 when Jean-René Bolloré, through marriage, took over. The family's influence has been a consistent feature. The company's early years were largely defined by its role as a paper mill, with a notable focus on producing tobacco paper.

The Bolloré family's enduring control is a key aspect of the Bolloré Group owner story. Vincent Bolloré's 1981 takeover of the struggling family business was a pivotal moment. He later took the company public in 1985, a move that altered its financial structure but maintained the family's influence. While detailed equity breakdowns from the founding period are not readily available, it is clear that the family maintained a controlling stake, which has been a defining characteristic of the company's ownership structure throughout its history. The family's concentrated stake has consistently granted them significant influence over strategic decisions.

The Bolloré Company Ownership structure has been significantly shaped by the Bolloré family's long-term control. Vincent Bolloré's role has been crucial in shaping the company's trajectory, particularly after taking control in 1981. Understanding the evolution of the Bolloré business requires examining the family's sustained influence and strategic decisions.

- The Bolloré family has had a controlling stake since the 19th century.

- Vincent Bolloré took control in 1981 and took the company public in 1985.

- The family's concentrated ownership has given them significant influence over strategic decisions.

- The company's history includes a focus on tobacco paper production.

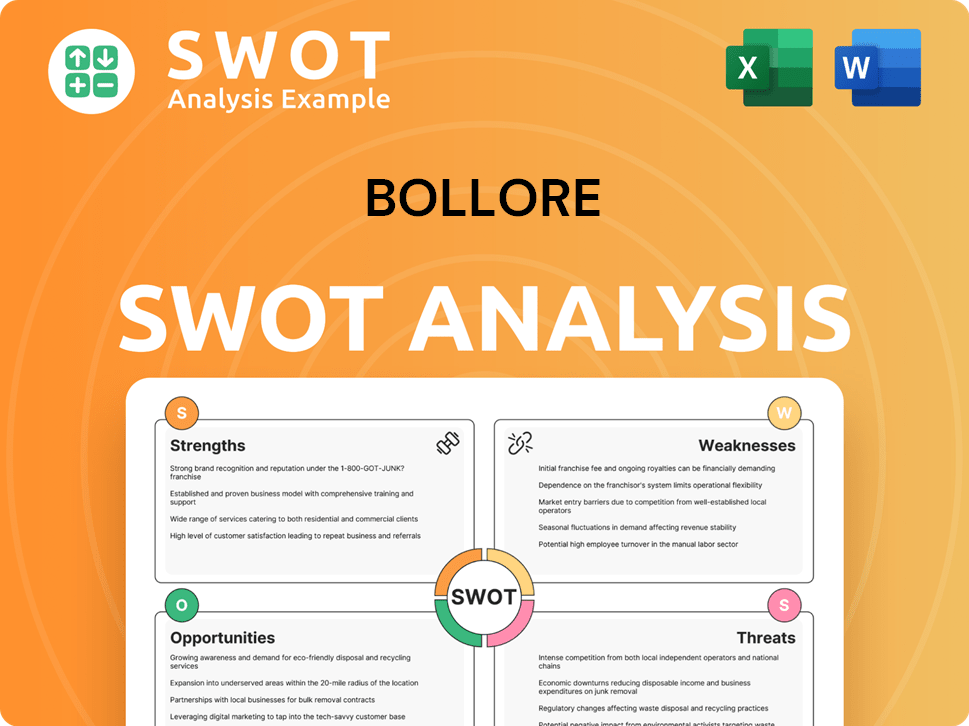

Bollore SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has Bollore’s Ownership Changed Over Time?

The ownership structure of the Bolloré Company, now a diversified conglomerate, has evolved significantly since its inception. The Bolloré family maintains majority control through a complex holding structure. Compagnie de l'Odet SE holds approximately 69.72% of Bolloré SE's shares, as of the latest available data. This intricate structure ensures the family's continued significant sway over corporate decisions. The family's influence is further cemented by the ownership of Bolloré Participations SE, with Vincent Bolloré holding the usufruct and his children equally holding the bare ownership of almost all shares.

Key events have shaped the company's ownership landscape, including its listing on the Euronext exchange in Paris in 1985. Major shifts in shareholding also involve institutional investors. For example, Yacktman Asset Management LP held 7.126% of shares, and Orfim SAS held 5.481% as of recent data. The Norwegian Government Pension Fund Global (GPFG) held 1.15% of Bolloré's shares, valued at USD 84.5 million, at the close of 2023. For more details, you can read the Brief History of Bollore.

| Shareholder | Percentage of Shares | Notes |

|---|---|---|

| Compagnie de l'Odet SE | 69.72% | Majority shareholder |

| Yacktman Asset Management LP | 7.126% | Institutional Investor |

| Orfim SAS | 5.481% | Institutional Investor |

Recent strategic moves have further reshaped Bolloré's portfolio, impacting its assets. In February 2024, the company sold 100% of Bolloré Logistics to CMA CGM for €4.8 billion, resulting in a consolidated net capital gain of €3.6 billion after tax. This boosted the company's net cash to €5,306 million at December 31, 2024, compared to a net debt of -€1,465 million at the end of 2023. In December 2024, Vivendi, in which Bolloré Group holds a 29.9% stake, completed a partial demerger, leading to direct holdings in Canal+, Louis Hachette Group, and Havas.

The Bolloré family, through Compagnie de l'Odet SE, maintains majority control of the Bolloré Group.

- Compagnie de l'Odet SE holds approximately 69.72% of shares.

- Vincent Bolloré and his children control Bolloré Participations SE.

- Institutional investors also hold significant stakes.

- Recent strategic moves include the sale of Bolloré Logistics and the Vivendi demerger.

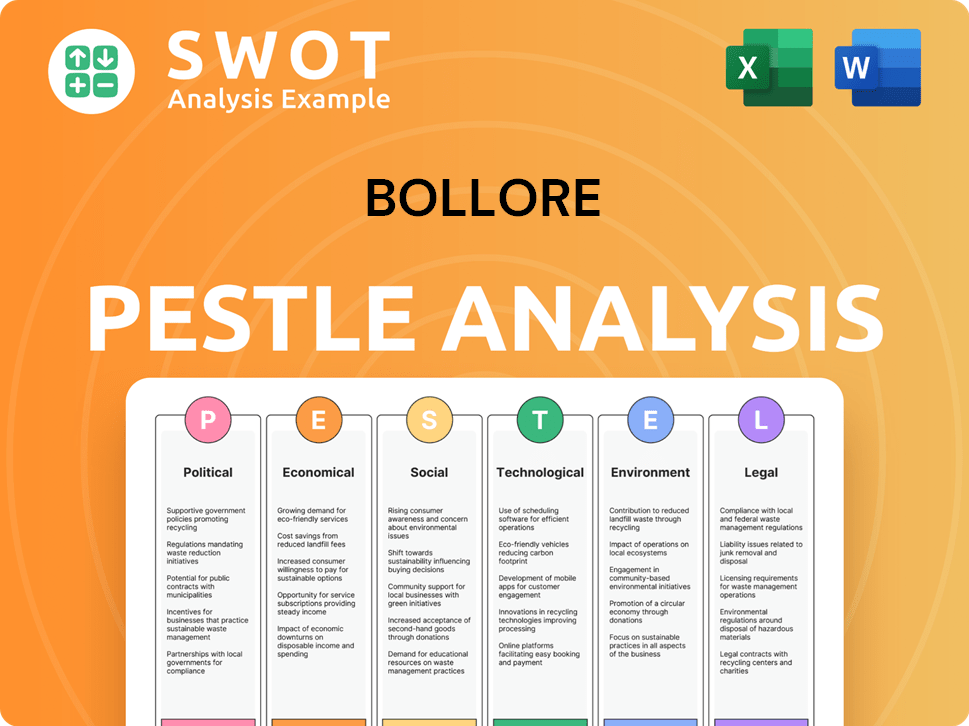

Bollore PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on Bollore’s Board?

The current board of directors of the Bollore Company plays a crucial role in the company's governance. The Bolloré family maintains significant control. While specific details of all board members and their representation of major shareholders are not fully available in public data, the family's concentrated ownership clearly influences the board. Vincent Bolloré, a key family member, previously served as Chairman and CEO until retiring from the family business in 2022. His son, Cyrille Bolloré, took over as CEO in 2019, highlighting familial representation at the highest levels.

The board's actions, such as approving financial statements and managing share repurchases, demonstrate the controlling shareholders' ability to shape the company's capital structure and strategic direction. This control is further reinforced through a complex, indirect holding structure, with Compagnie de l'Odet SE holding a majority of shares in Bolloré SE.

| Key Figures | Details | As of |

|---|---|---|

| Total Shares | 2,852,174,816 | August 31, 2024 |

| Total Voting Rights | 4,956,947,838 | August 31, 2024 |

| Exercisable Voting Rights | 4,940,965,726 | August 31, 2024 |

The voting structure of Bolloré SE is designed to give the Bolloré family significant influence over strategic decisions. As of August 31, 2024, the company had a substantial difference between the number of shares and voting rights. This suggests mechanisms, possibly dual-class shares, that give the controlling family disproportionate voting power. In March 2025, the board approved the 2024 financial statements and decided to cancel 21.4 million shares as part of a share repurchase program. These actions underscore the family's control over the company's direction.

The Bolloré family maintains significant control over the company.

- Vincent Bolloré previously held key leadership positions.

- Cyrille Bolloré currently serves as CEO.

- Compagnie de l'Odet SE holds a majority of shares.

- The family's concentrated stake gives them substantial voting power.

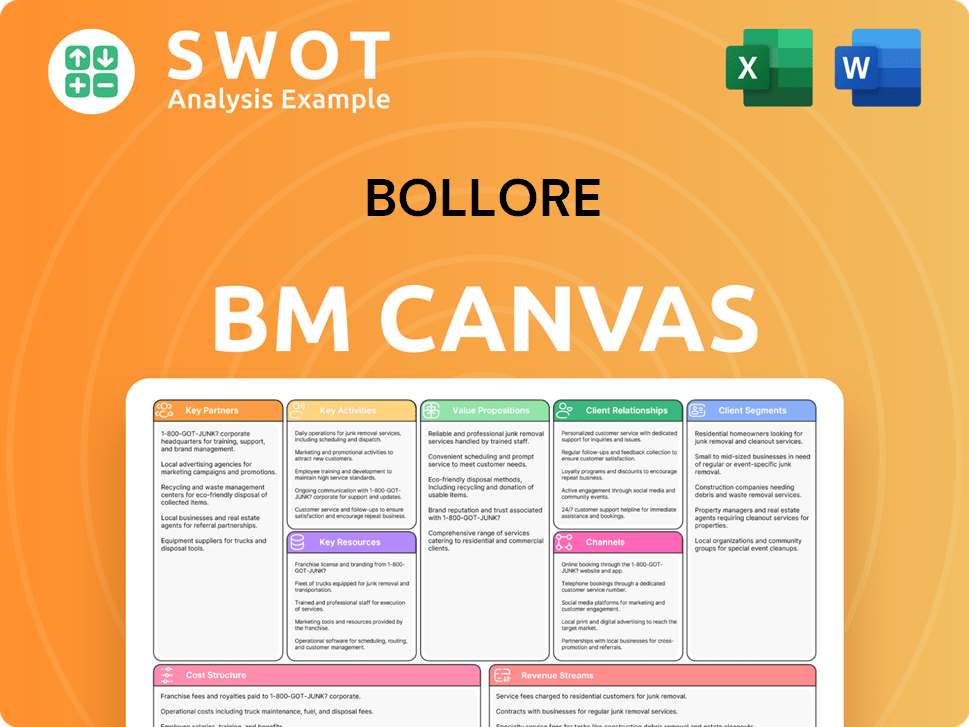

Bollore Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped Bollore’s Ownership Landscape?

Over the past few years, the ownership structure of the Bolloré Company has seen considerable transformation. A significant event was the sale of Bolloré Logistics to CMA CGM in February 2024 for €4.8 billion. This transaction resulted in a net capital gain of €3.6 billion after tax and bolstered Bolloré's net cash position to €5.306 billion by the end of December 2024. This financial boost gives the group flexibility for future investments, potentially in media, communication, or other sectors. The recent developments significantly impact the question of 'Who owns Bolloré?'

Another major change involved the partial spin-off of Vivendi in December 2024. Bolloré SE, which held a stake in Vivendi, now directly holds shares in Canal+, Louis Hachette Group, and Havas, while retaining a stake in the new Vivendi. This move was part of a strategic realignment of its media assets. The listing of Canal+ on the London Stock Exchange, Louis Hachette Group on Euronext Growth, and Havas NV on Euronext Amsterdam also reflects a strategic realignment. These changes provide insights into the Bolloré Group owner and its strategic direction. Find more information about Competitors Landscape of Bollore.

| Key Developments | Details | Financial Impact |

|---|---|---|

| Sale of Bolloré Logistics | Sold to CMA CGM | Net capital gain of €3.6 billion; net cash position of €5.306 billion (December 31, 2024) |

| Spin-off of Vivendi | Partial distribution of Vivendi shares | Strengthened control over Canal+, Louis Hachette Group, and Havas |

| Share Buyback Programs | Acquisition of Bolloré shares | Increased ownership stake for existing shareholders |

In terms of ownership trends, Bolloré SE has been actively involved in share buyback programs. In 2024, Bolloré acquired 12 million shares for €69 million. As of March 10, 2025, Bolloré SE held 21.4 million shares (0.75% of capital) for €123 million, which the Board of Directors decided to cancel. Compagnie de l'Odet also acquired 22.5 million Bolloré SE shares (0.79% of share capital) for €129.3 million in 2024. These actions are a key part of understanding the Bolloré Company ownership structure.

Bolloré increased its stake in UMG NV by acquiring an additional 9.2 million shares for €197 million in July 2024. This demonstrates a continued focus on strategic investments and portfolio management.

The company increased its stake in Rubis to 5.96% as of February 28, 2025, with a market value of €163 million, signaling a strategic investment in the energy sector.

Bolloré acquired 12 million shares for €69 million in 2024. As of March 10, 2025, Bolloré SE held 21.4 million shares (0.75% of capital) for €123 million, which the Board of Directors decided to cancel.

The company anticipates more representative results in 2025, following the significant restructuring in 2024, reflecting the impact of these ownership changes.

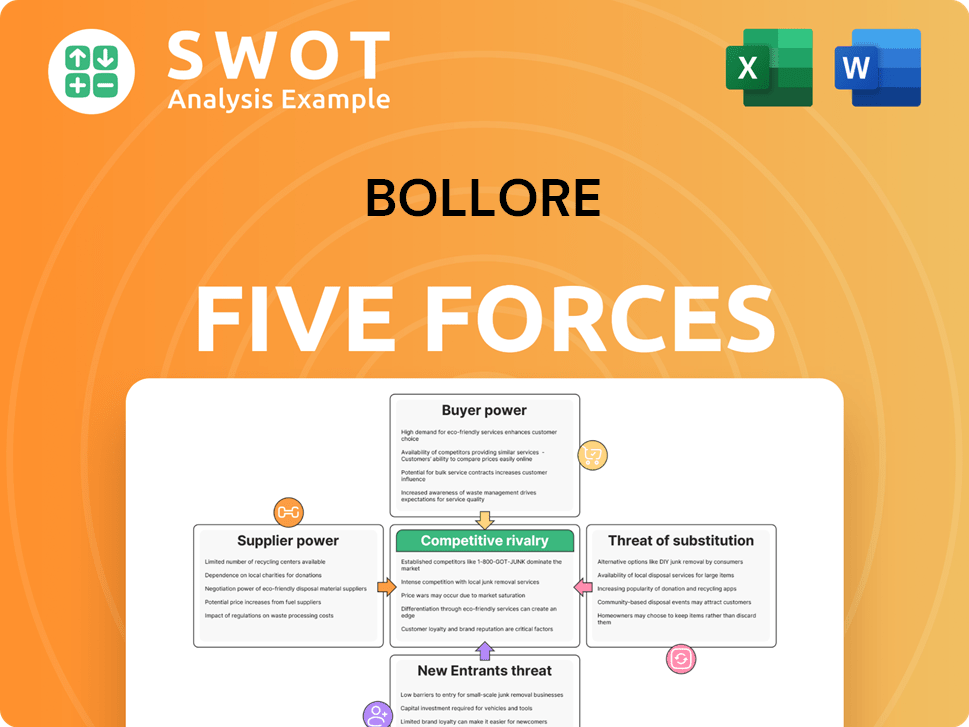

Bollore Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of Bollore Company?

- What is Competitive Landscape of Bollore Company?

- What is Growth Strategy and Future Prospects of Bollore Company?

- How Does Bollore Company Work?

- What is Sales and Marketing Strategy of Bollore Company?

- What is Brief History of Bollore Company?

- What is Customer Demographics and Target Market of Bollore Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.