BP Bundle

How did a 1908 oil discovery shape the global energy landscape?

Journey back in time to 1908, when the discovery of oil in Persia ignited the creation of what would become a global energy titan: British Petroleum (BP). From its humble beginnings as the Anglo-Persian Oil Company, BP's BP SWOT Analysis reveals a fascinating evolution. This company's story is one of strategic adaptation, technological innovation, and navigating the ever-changing demands of the energy sector.

This exploration of BP's history will delve into the early days of British Petroleum, tracing its path from its founding and origins to its current status. We'll examine key milestones, major acquisitions, and its significant role in the oil industry, providing a comprehensive company timeline. Understanding BP's journey offers valuable insights into the dynamics of the energy sector and the strategies that have defined this influential company.

What is the BP Founding Story?

The story of the British Petroleum, now known as BP, began with a bold vision and a risky venture. It all started with the pursuit of oil in Persia, a region rich in resources but challenging to access. This early chapter set the stage for a company that would become a major player in the global energy sector.

The roots of the BP company trace back to the early 20th century. The company's early days were marked by significant exploration efforts and the establishment of its initial operational framework. This foundational period was crucial in shaping the company's future in the oil industry.

The early history of the BP company is an important part of the larger narrative of the oil industry. The company's evolution reflects the broader trends and challenges faced by energy companies over the past century.

The genesis of BP, then known as the Anglo-Persian Oil Company (APOC), dates back to May 26, 1901. William Knox D'Arcy, a British millionaire, secured a concession from the Shah of Persia. This concession allowed him to explore for oil in Persia, marking the beginning of a long and complex journey.

- Exploration efforts were challenging and costly, spanning several years.

- Oil was finally discovered in Masjid-i-Sulaiman, Persia, on May 26, 1908.

- The Anglo-Persian Oil Company (APOC) was officially incorporated on April 14, 1909, in London, United Kingdom.

- Key figures in the establishment included William Knox D'Arcy, Lord Strathcona, and Lord Inchcape.

The initial business model focused on the exploration, production, and export of crude oil from Persia. Raw crude oil was the primary product, destined for refining and consumption in the growing industrial economies. The company faced significant challenges, including difficult terrain, logistical hurdles, and the need for substantial financial investment.

The company's early funding came from D'Arcy's personal wealth and investments from the Burmah Oil Company. The British government became a major shareholder in 1914, recognizing the strategic importance of a secure oil supply. The name 'Anglo-Persian Oil Company' reflected its British origins and its operational base in Persia.

In 2024, BP's total revenue was approximately $222.6 billion. The company's history is marked by significant milestones, including major acquisitions and expansions. BP's role in the oil industry has evolved over time, reflecting changes in the energy sector and global markets.

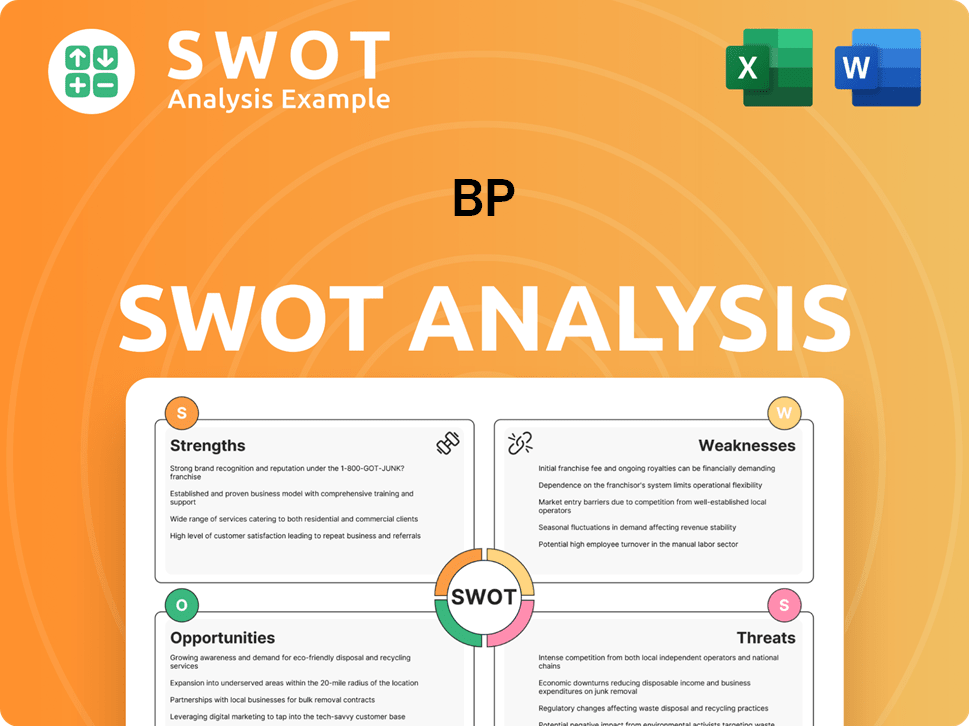

BP SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of BP?

The early growth of the Anglo-Persian Oil Company (APOC), later known as British Petroleum (BP), was fueled by the rising global demand for oil. This growth was especially pronounced with the rise of motorized transport and strategic needs of navies. The company focused on developing its Persian oil fields and building the necessary infrastructure for production and export, marking a significant period in the BP history.

A pivotal moment for the BP company was the construction of the Abadan Refinery, which became operational in 1912. This refinery processed crude oil into various petroleum products, allowing APOC to move beyond simply exporting crude. This expansion into refining was a crucial step in the company's early development, showcasing its growing capabilities within the energy sector.

In 1914, the British government acquired a majority stake in APOC, providing significant capital and strategic backing. This solidified the company's position within the oil industry. The company expanded its shipping fleet and established marketing and distribution networks across Europe and Asia, demonstrating its global ambitions and operational growth.

The British Tanker Company (later BP Tanker Company) was formed in 1917 to manage the company's growing fleet. APOC also expanded geographically, acquiring interests in other oil concessions and establishing subsidiaries. The company's name changed to the Anglo-Iranian Oil Company (AIOC) in 1935, reflecting the renaming of Persia to Iran.

By the mid-20th century, AIOC had become a major international oil company, marked by increasing production volumes and a widening global presence. This growth was driven by a consistent strategy of securing new oil sources and expanding its refining and marketing capabilities. Understanding the Target Market of BP helps to grasp its historical expansion.

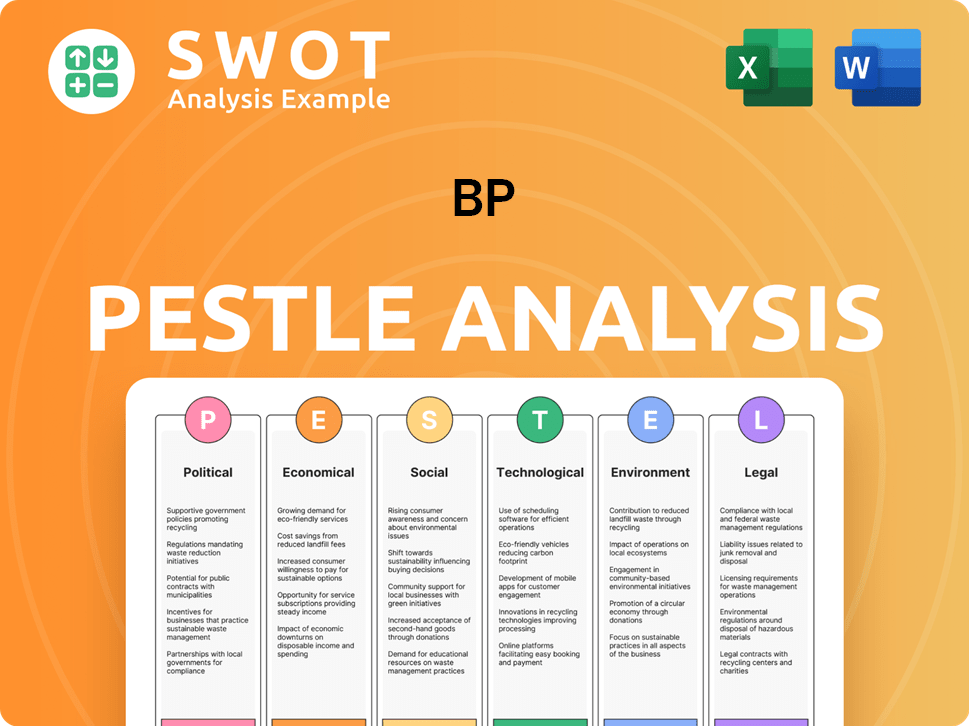

BP PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in BP history?

The BP company, formerly known as British Petroleum, has a rich history marked by significant milestones that have shaped its trajectory in the oil industry. From its early days to its present-day focus on energy transition, the BP history reflects a company constantly adapting to global events and market dynamics.

| Year | Milestone |

|---|---|

| 1908 | Founded as the Anglo-Persian Oil Company, marking the beginning of BP's founding and origins in the oil industry. |

| 1951 | Nationalization of assets in Iran forced a strategic shift, leading to a diversification of its global portfolio. |

| 1954 | Renamed British Petroleum (BP), reflecting a new era of expansion and global presence. |

| 1960s | Significant oil discoveries, including in Alaska's North Slope, boosted production capacity. |

| 2010 | The Deepwater Horizon oil spill resulted in substantial environmental, financial, and reputational damage, prompting major operational changes. |

| 2020 | Announced an accelerated transition to a low-carbon energy company, setting ambitious net-zero targets. |

Innovation has been a cornerstone of British Petroleum's operations, driving its exploration and production capabilities. The company has consistently invested in new technologies to improve efficiency and discover new resources.

BP has been a pioneer in offshore drilling, developing advanced techniques to access oil and gas reserves in challenging environments. These innovations have allowed the company to explore and produce in deeper waters and more remote locations.

Advancements in seismic imaging have significantly improved the accuracy of subsurface mapping, enabling BP to identify and extract oil and gas from complex geological formations. This technology has been crucial for exploration success.

BP has made substantial investments in renewable energy sources, including wind, solar, and biofuels, to diversify its energy portfolio. In 2024, the company continued to advance its bioenergy strategy with new partnerships and projects.

BP has been actively involved in the development of biofuels, seeking to reduce its carbon footprint and offer sustainable energy solutions. This includes research and development in advanced biofuels.

BP is investing in carbon capture and storage (CCS) technologies to reduce emissions from its operations and support the decarbonization of the energy sector. This includes projects aimed at capturing and storing CO2 emissions.

BP is exploring opportunities in hydrogen production, aiming to become a key player in the emerging hydrogen economy. This involves investments in both blue and green hydrogen projects.

BP has faced numerous challenges throughout its history, including environmental disasters, economic downturns, and geopolitical instability. The company has had to adapt to changing market conditions and increasing pressure to transition to a low-carbon economy.

The 2010 Deepwater Horizon oil spill resulted in significant environmental damage, loss of life, and substantial financial and reputational costs, leading to major operational and safety overhauls. This event prompted a comprehensive review of safety protocols and operational practices.

BP has navigated the volatility of global oil prices, which can significantly impact its financial performance and investment decisions. The company's profitability is closely tied to fluctuations in the price of crude oil.

Geopolitical tensions in key regions where BP operates can disrupt production, impact supply chains, and affect the company's strategic planning. Political instability poses significant risks to its operations.

The increasing pressure to transition to a low-carbon economy requires BP to invest heavily in renewable energy and low-carbon solutions, which can be costly and complex. The company has set ambitious net-zero targets by 2050.

BP has undergone financial restructuring and asset sales to manage debt and reallocate capital towards its strategic priorities, including renewable energy and low-carbon initiatives. This has involved streamlining its portfolio.

Environmental incidents and controversies can pose significant reputational risks, affecting investor confidence and public perception. BP must manage its environmental impact and maintain transparency.

For more detailed information about the BP company, you can explore the Owners & Shareholders of BP.

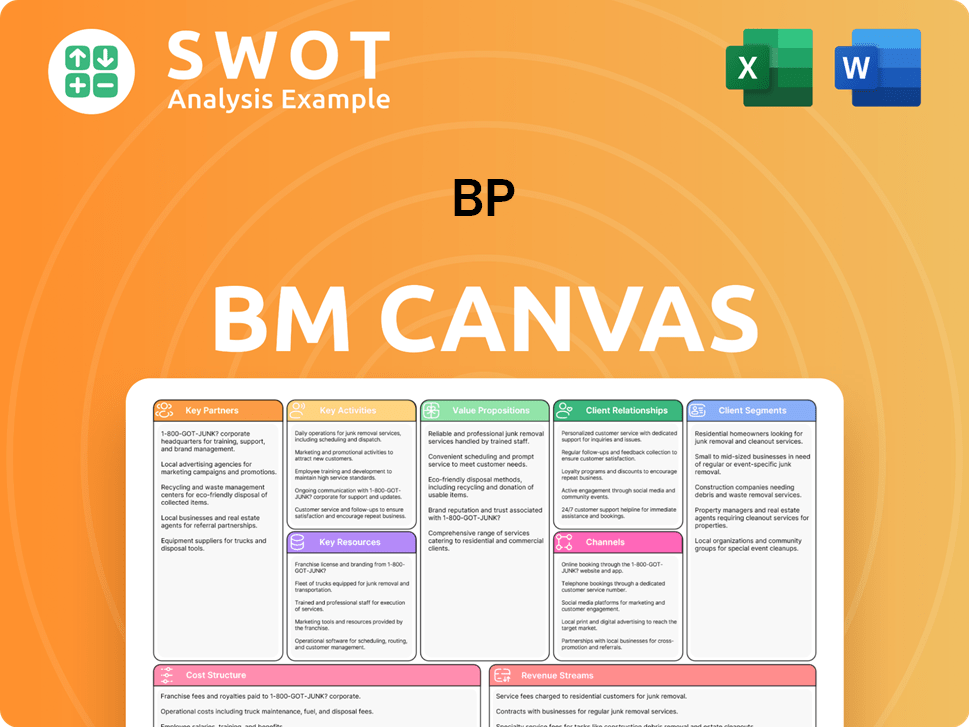

BP Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for BP?

The BP company has a rich history marked by significant milestones in the oil industry. From its early days as the Anglo-Persian Oil Company to its current focus on sustainable energy, British Petroleum has evolved significantly. BP's history includes major oil discoveries, strategic acquisitions, and responses to environmental crises, shaping its trajectory in the energy sector.

| Year | Key Event |

|---|---|

| 1908 | Oil discovered in Persia, leading to the formation of APOC. |

| 1909 | Anglo-Persian Oil Company (APOC) officially incorporated. |

| 1912 | Abadan Refinery becomes operational. |

| 1914 | British government acquires a majority stake in APOC. |

| 1935 | APOC renamed Anglo-Iranian Oil Company (AIOC). |

| 1951 | Iranian oil industry nationalized, leading to AIOC's expulsion from Iran. |

| 1954 | AIOC renamed British Petroleum Company (BP). |

| 1965 | First oil discovery in the North Sea. |

| 1969 | Major oil discovery in Prudhoe Bay, Alaska. |

| 1987 | Acquired Britoil. |

| 1998 | Merged with Amoco, forming BP Amoco. |

| 2001 | Company rebranded as BP. |

| 2010 | Deepwater Horizon oil spill in the Gulf of Mexico. |

| 2020 | BP announces new ambition to be a net-zero company by 2050. |

| 2024 | BP continues to invest in renewable energy projects and low-carbon solutions, aiming for significant growth in these areas. |

BP is focused on transitioning from an international oil company to an integrated energy company. This strategy emphasizes sustainability and increasing investments in low-carbon energy sources. The company plans to significantly boost investments in renewables, hydrogen, and EV charging infrastructure. This shift aligns with broader trends in the energy sector.

BP aims to reduce emissions from its operations by 50% by 2030, using a 2019 baseline. This ambitious target reflects the company's commitment to reducing its environmental footprint. The company's actions are driven by the need to meet global energy demand. This commitment is a central part of their strategy.

BP faces the challenge of balancing global energy demand with the transition to lower-carbon alternatives. Geopolitical risks and market volatility are also key factors influencing its future. The company's ability to navigate these challenges will be crucial. The company's long-term success depends on its ability to innovate.

The company's future depends on successfully executing its low-carbon strategy. Innovation in both traditional and new energy sectors will be essential. BP's forward-looking approach is rooted in its founding vision. For a deeper dive into the company's evolution, consider reading more about the BP company's history.

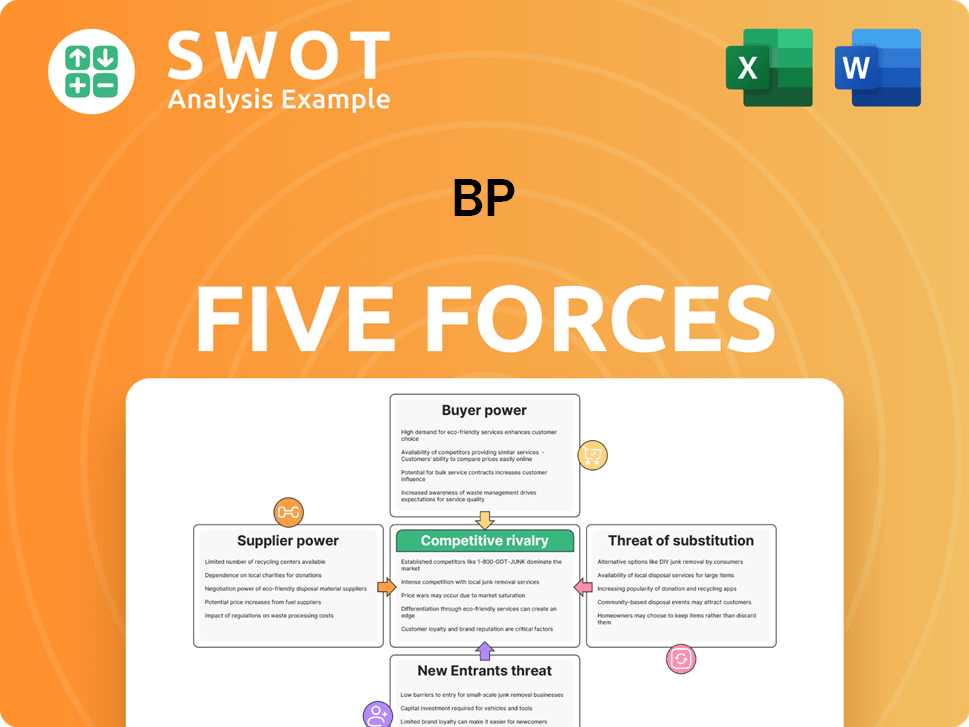

BP Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.