BP Bundle

Who Really Owns BP?

Delving into the heart of a global energy titan, understanding BP ownership unveils the forces driving its strategies and shaping its future. The legacy of the Deepwater Horizon disaster serves as a stark reminder of how crucial shareholder oversight and corporate responsibility are. From its inception as the Anglo-Persian Oil Company in 1908, BP's journey is a compelling story of evolution and influence.

BP, a publicly traded company, operates with a complex ownership structure, primarily influenced by institutional investors and individual shareholders. Exploring the dynamics of BP SWOT Analysis, BP shareholders, and the board of directors is essential to understanding its operational decisions, financial performance, and its role in the energy transition. Knowing who owns BP, including major shareholders and the BP parent company, helps to understand who controls BP's decisions. As of early 2024, BP's market capitalization remains substantial, reflecting its significant presence in the global energy market.

Who Founded BP?

The origins of the company now known as BP, began with the discovery of oil in Persia (modern-day Iran) in 1908. This led to the formation of the Anglo-Persian Oil Company (APOC). The initial vision and drive came from William Knox D’Arcy, an Australian millionaire who secured the rights to explore for oil.

D'Arcy's personal finances were quickly overwhelmed by the capital needed for exploration and development. This necessitated the involvement of the Burmah Oil Company, which became the primary financial backer by acquiring a majority stake in APOC in 1909. While D'Arcy was crucial in the early exploration phases, Burmah Oil became the dominant shareholder in the formal corporate structure.

The British government's interest in APOC was significant from early on. Recognizing the strategic importance of oil for its navy, the government invested £2 million and acquired a controlling interest of 50.003% in 1914. This move was driven by national security concerns, ensuring a reliable oil supply during a period of increasing naval reliance on fuel oil.

William Knox D’Arcy, an Australian millionaire, is the key figure in the company's founding. He secured the initial oil concession in Persia.

The Burmah Oil Company provided significant early financial backing. It acquired a majority stake in 1909, becoming the principal early investor.

The British government acquired a controlling interest in 1914. This was driven by strategic interests and national security concerns.

Early ownership was a mix of corporate and governmental interests. Burmah Oil and the British government held significant stakes.

Oil was seen as strategically vital for the British navy. This influenced the government's decision to invest in APOC.

The early ownership structure shaped the company's trajectory. National interests and commercial objectives were intertwined.

Understanding the early ownership of BP (formerly APOC) provides essential context for its later development. The initial ownership structure, with a significant government stake, highlights the strategic importance of oil during that period. For more information on the company's consumer base, consider reading about the Target Market of BP.

- William Knox D’Arcy initiated the venture, but the Burmah Oil Company provided crucial financial backing.

- The British government's investment in 1914 underscored the strategic importance of oil for national security.

- The early ownership structure, involving both corporate and governmental interests, profoundly shaped the company's initial direction.

- The government's stake was a landmark event, influencing the company's decisions for many decades.

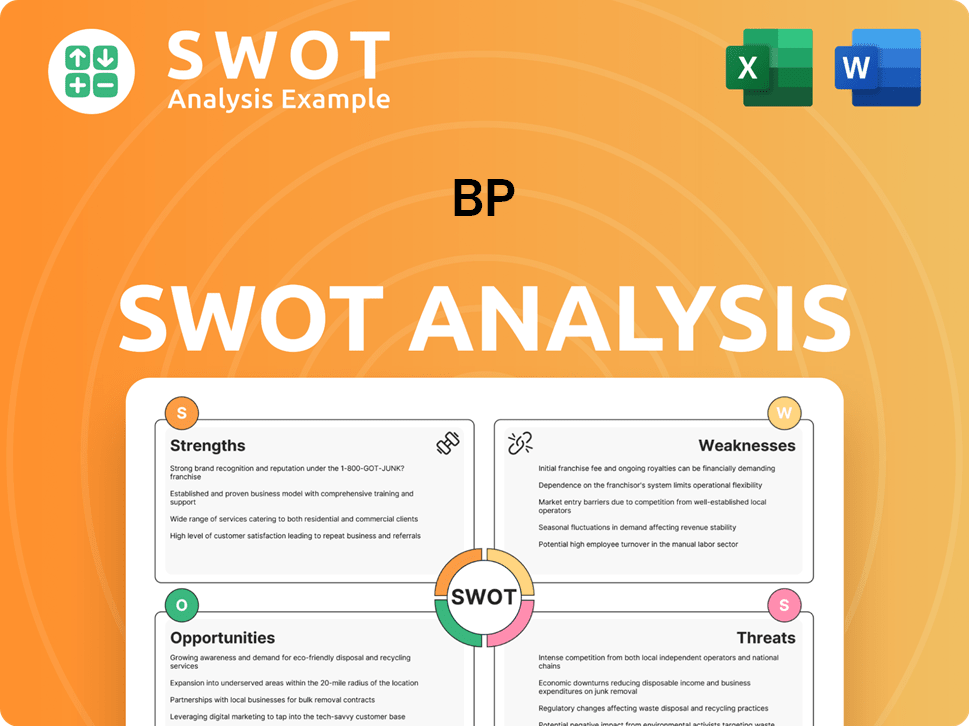

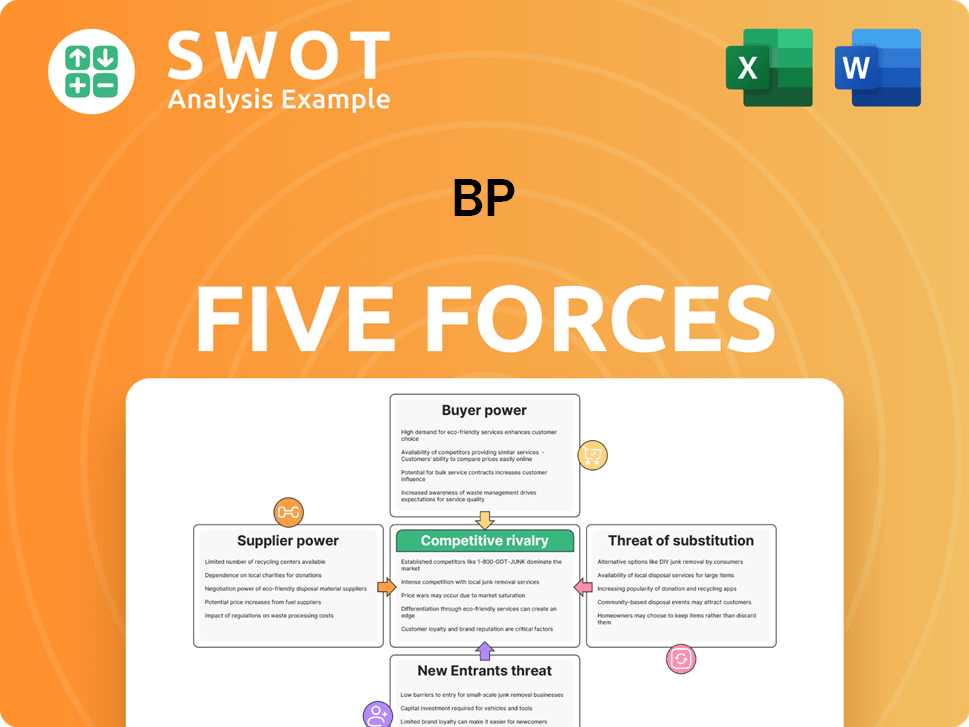

BP SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has BP’s Ownership Changed Over Time?

The evolution of BP's ownership reflects a significant shift from government control to a publicly traded model. Initially, the British government held a majority stake in the company. However, a pivotal change occurred with the privatization program initiated in the late 1970s and completed in 1987. This transition, spearheaded by Prime Minister Margaret Thatcher, saw the gradual divestment of the government's shares, transforming BP into a fully public entity.

The initial public offering (IPO) in 1979 marked a crucial turning point, as a portion of the government's shares was offered to the public. This move signaled a new era for BP, transitioning from state control to a more dispersed ownership structure. The company's shares became widely traded on stock exchanges, primarily the London Stock Exchange and the New York Stock Exchange, opening up investment opportunities to a broader range of investors. This transition fundamentally altered the dynamics of BP's ownership, paving the way for the current structure dominated by institutional investors.

| Event | Date | Impact on Ownership |

|---|---|---|

| Government Divestment | Late 1970s - 1987 | Transition from state control to public ownership. |

| Initial Public Offering (IPO) | 1979 | Offered a portion of government shares to the public. |

| Ongoing Market Activity | Ongoing | Fluctuations in ownership percentages due to trading. |

Currently, BP's ownership is primarily held by institutional investors. As of early 2025, major BP shareholders include large asset management firms and mutual funds. Key players often include Vanguard Group, BlackRock, and Norges Bank Investment Management (NBIM). These institutional investors typically hold significant portions of BP's outstanding shares. For example, as of the end of 2024, Vanguard Group and BlackRock collectively held over 10% of BP's shares. Individual insider ownership, including shares held by the board of directors and BP executives, represents a small percentage of the total outstanding shares. The shift to institutional dominance has also increased the focus on environmental, social, and governance (ESG) factors, influencing BP's strategic direction towards energy transition and sustainability. To learn more about the company's strategic direction, you can read about the Growth Strategy of BP.

BP is a publicly traded company, meaning anyone can invest in it through stock exchanges.

- The British government once owned most of BP but sold its shares over time.

- Today, large investment firms like Vanguard and BlackRock own a significant portion of BP.

- Who owns BP influences the company's decisions, especially regarding environmental and social issues.

- Understanding BP ownership helps investors and stakeholders assess the company's direction and priorities.

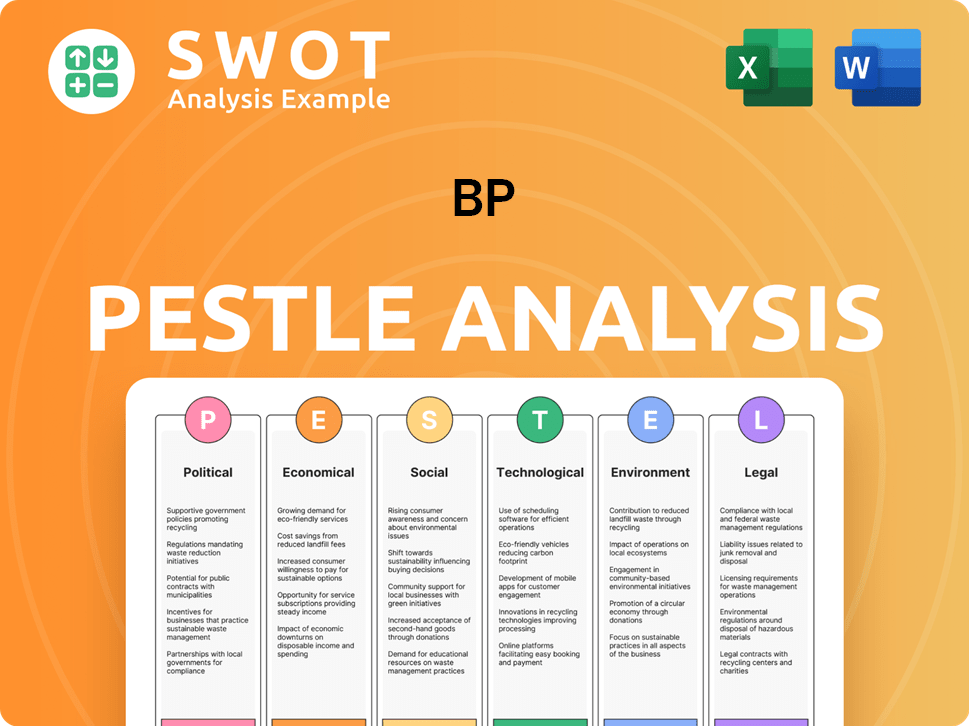

BP PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on BP’s Board?

The current board of directors at BP plays a vital role in the company's governance, representing the interests of BP shareholders and overseeing the company's strategic direction. As of early 2025, the board typically consists of a mix of executive directors, including the CEO and CFO, and a larger number of independent non-executive directors. While specific names change over time due to retirements and new appointments, the board generally includes individuals with extensive experience in the energy sector, finance, and international business. For instance, the Chair of the board is typically an independent non-executive director, a common governance practice to ensure oversight. Understanding who owns BP is crucial for grasping the company's operational dynamics.

The board's composition is crucial for navigating the evolving landscape of the energy sector. The board's decisions are frequently influenced by various factors, including shareholder expectations and environmental considerations. The board's structure and the influence of its members are key aspects of BP ownership.

| Board Role | Description | As of Early 2025 |

|---|---|---|

| Chair | Independent Non-Executive Director | Oversees the board's activities and ensures effective governance. |

| CEO | Chief Executive Officer | Leads the company's operations and strategic direction. |

| CFO | Chief Financial Officer | Manages the company's financial activities and reporting. |

The voting structure for BP shares generally follows a one-share-one-vote principle, ensuring that each ordinary share has equal voting rights. This structure allows institutional investors, who hold large blocks of shares, to wield significant voting power proportional to their ownership. There are no known dual-class share structures or special voting rights that grant outsized control to specific individuals or entities. This promotes a more equitable distribution of influence among BP shareholders. For more insights into BP's financial operations, consider reading about Revenue Streams & Business Model of BP.

The board of directors at BP is composed of executive and independent non-executive directors, ensuring diverse expertise and oversight.

- The voting structure is one-share-one-vote, which provides equal voting rights to all shareholders.

- BP has faced scrutiny from activist investors and environmental groups, influencing board decisions.

- Shareholder resolutions at AGMs often focus on climate strategy and transparency.

- Understanding the board's composition is essential for grasping BP's corporate governance.

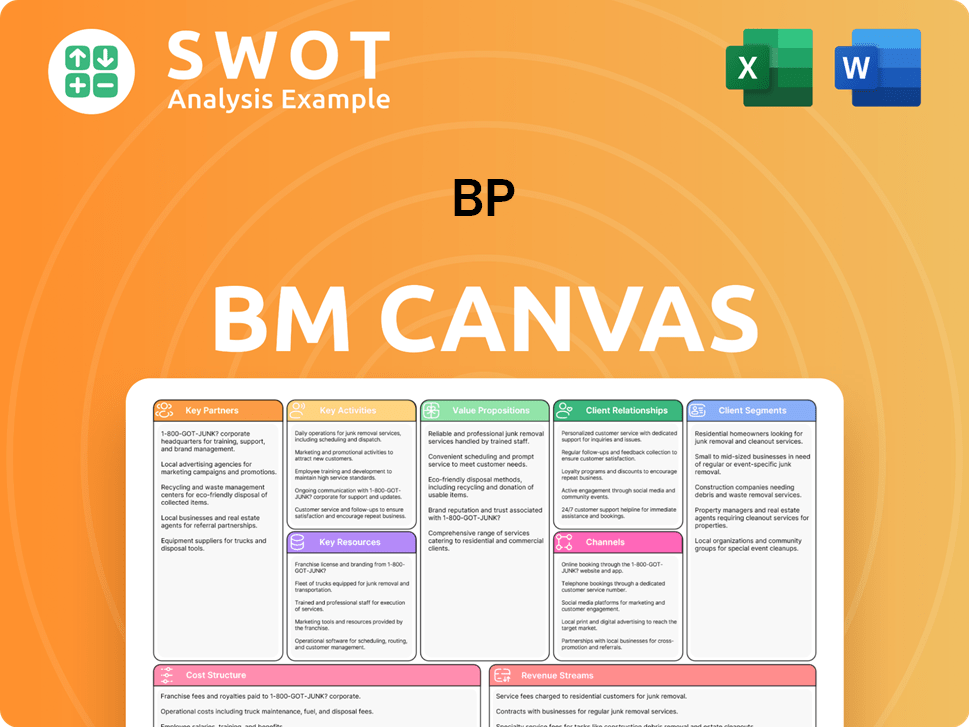

BP Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped BP’s Ownership Landscape?

In the past few years, the ownership profile of the company has been influenced by its strategic shift towards an 'integrated energy company' model. This includes a greater emphasis on lower-carbon investments, alongside its traditional oil and gas operations. This strategic pivot has attracted new investor interest. Share buyback programs have been a notable feature, with the company announcing significant buybacks in 2023 and 2024. For example, in Q1 2024, the company announced a further $1.75 billion share buyback, demonstrating a commitment to returning capital to shareholders.

The trend of increased institutional ownership continues to impact the company. Large passive funds, such as those managed by BlackRock and Vanguard, have seen their stakes grow as they track major indices where the company is a constituent. This often leads to a more stable, but also more scrutinizing, shareholder base, particularly regarding ESG performance. The ongoing energy transition is expected to remain a dominant factor in shaping the company's ownership structure in the coming years.

| Metric | Value | Year |

|---|---|---|

| Market Capitalization (Approx.) | $100-120 Billion | 2024 |

| Share Buyback (Q1 2024) | $1.75 Billion | 2024 |

| Institutional Ownership (Approx.) | 60-70% | 2024 |

The company's leadership is focused on executing its energy transition strategy, which inherently influences investor sentiment and ownership patterns. The potential for further portfolio optimization, including asset sales, could indirectly impact the shareholder base. You can learn more about the company's origins in Brief History of BP.

The company is primarily owned by institutional investors, with significant stakes held by large asset management firms like BlackRock and Vanguard. Individual shareholders also hold a portion of the shares. The company is a publicly traded company.

Major shareholders include institutional investors, with BlackRock and Vanguard among the largest. The exact percentages change frequently, but these firms typically hold substantial portions of the company's outstanding shares. The company's executives also own shares.

The company is a publicly traded company, operating under a corporate structure. This structure allows for a wide range of shareholders, including institutional and individual investors. The company's decisions are controlled by the board of directors.

Investors can purchase shares of the company stock through a brokerage account. The stock is traded on major stock exchanges. Investors should research the company and consult with a financial advisor before investing.

BP Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of BP Company?

- What is Competitive Landscape of BP Company?

- What is Growth Strategy and Future Prospects of BP Company?

- How Does BP Company Work?

- What is Sales and Marketing Strategy of BP Company?

- What is Brief History of BP Company?

- What is Customer Demographics and Target Market of BP Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.