BP Bundle

How Does the BP Company Navigate the Energy Transition?

As a titan of the BP SWOT Analysis, British Petroleum (BP) is a global energy company at the forefront of the industry. BP operations span the globe, from extracting oil and gas to investing in renewable energy sources. In a world demanding sustainable solutions, understanding the BP business model is more critical than ever.

This exploration of the BP company will examine its core operations, including oil and gas exploration and its growing renewable energy portfolio. We'll analyze how BP generates revenue and the strategic shifts it's making to balance traditional energy demands with sustainability. Furthermore, we'll delve into BP's environmental initiatives, its impact on the environment, and its evolving role in the energy sector.

What Are the Key Operations Driving BP’s Success?

The core operations of the BP company revolve around integrated energy production and delivery. This encompasses activities from the extraction of crude oil and natural gas to the refining and marketing of petroleum products, as well as the development of lower-carbon energy solutions. BP's business model relies on a comprehensive approach, ensuring it can manage and adapt to the dynamic shifts within the energy market.

BP's value proposition is centered on providing reliable energy supplies and increasingly, sustainable alternatives. This is achieved through its extensive global operations, technological innovation, and strategic partnerships. The company serves a diverse customer base, including industrial clients, commercial enterprises, and individual consumers, offering a range of products and services designed to meet evolving energy demands.

BP's commitment to sustainability is evident in its investments in renewable energy and lower-carbon initiatives. The company aims to reduce its carbon emissions and contribute to a more sustainable energy future, making it a key player in the global transition towards cleaner energy sources. For more information, you can read about the Target Market of BP.

BP's operations are divided into upstream and downstream segments. Upstream focuses on exploration and production, while downstream includes refining, marketing, and distribution. The company's global reach and integrated model enable it to capitalize on synergies across these segments.

The value proposition of BP centers on providing reliable energy solutions and advancing lower-carbon alternatives. This includes a diverse portfolio of products, from traditional fuels to renewable energy sources like wind and solar. BP aims to meet the evolving energy needs of its customers while contributing to a sustainable future.

BP’s core products include crude oil, natural gas, and refined petroleum products such as gasoline and diesel. The company is also expanding its portfolio to include lower-carbon offerings, such as biofuels, wind power, and EV charging services. This diversification supports its transition to a more sustainable energy model.

BP serves a wide array of customer segments, including industrial clients, commercial enterprises, and retail consumers. Its global network of retail stations and commercial channels ensures that its products and services are accessible to a broad customer base. This diversified customer base supports BP's financial stability.

BP is actively investing in renewable energy projects and technologies to reduce its carbon footprint. The company's financial performance in 2024 reflects its strategic focus on energy transition and operational efficiency. BP's commitment to sustainability is driving its investments in green hydrogen and EV charging infrastructure.

- In 2024, BP announced plans to invest billions in low-carbon energy projects.

- BP's partnership with Jera for offshore wind development is a key strategic move.

- The company's focus on operational efficiency has led to cost savings.

- BP's revenue in 2024 was approximately $200 billion.

BP SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does BP Make Money?

The BP company generates revenue through diverse streams, with a primary focus on the sale of oil and gas, refined products, and a growing emphasis on low-carbon energy solutions. This integrated approach allows BP operations to capture value across the energy value chain, from exploration and production to refining, marketing, and the development of renewable energy projects. BP's business model is designed to adapt to the changing energy landscape while maintaining a strong financial foundation.

In Q1 2025, BP reported revenues of £47.9 billion ($47.9 billion), indicating the significant scale of its operations. The company continuously adjusts its strategy to navigate market dynamics and capitalize on emerging opportunities in the energy sector. This includes strategic investments in areas like biofuels and EV charging to diversify its revenue streams.

BP's revenue streams are multifaceted, encompassing various segments that contribute to its overall financial performance. These segments are crucial in understanding how British Petroleum operates within the oil and gas industry as a leading energy company.

BP's revenue streams are categorized into several key segments, each contributing to its overall financial performance. These segments reflect the company's integrated approach to the energy sector, from exploration and production to refining and marketing. Understanding these streams is essential for analyzing BP's financial performance analysis and its strategic direction.

- Oil Production & Operations: This segment involves the exploration and production of crude oil. Its profitability is directly influenced by global oil prices and the volumes produced.

- Gas & Low Carbon Energy: This segment includes natural gas production, LNG, and investments in low-carbon energy sources like wind, solar, and hydrogen. BP is also focusing on areas like biogas, biofuels, and EV charging to expand its low-carbon portfolio.

- Customers & Products: This segment covers refining and marketing activities, including the sale of gasoline, diesel, lubricants, and aviation fuel through its retail and commercial channels. In Q1 2025, this segment reported a profit of £677 million, a decrease from the previous year.

BP employs various monetization strategies to generate revenue and adapt to market changes. These strategies include traditional product sales and the development of new models for its lower-carbon ventures. For instance, BP is expanding its EV charging network, with new hubs opening in Germany and the US in early 2025. Furthermore, the company utilizes joint ventures and partnerships, such as the one with Jera for offshore wind projects, to share capital expenditure and leverage expertise. For more insights, read about the Marketing Strategy of BP.

BP PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped BP’s Business Model?

The BP company has undergone significant strategic shifts recently, particularly in response to changing market dynamics and financial performance. A key move in February 2025 was the announcement of a 'fundamental reset' of its strategy, signaling a shift in investment priorities. This involved increasing investment in oil and gas while scaling back on renewable energy investments.

This recalibration followed a challenging period, including a drop in profits in 2024, with net income reaching $8.9 billion. Despite these shifts, BP remains committed to reducing its operational emissions. The company aims to cut its operational Scope 1 and 2 emissions by 45-50% by 2030 against its 2019 baseline, demonstrating a continued focus on environmental sustainability alongside its core business operations.

The BP business model continues to evolve, adapting to both market pressures and long-term sustainability goals. This includes a focus on operational efficiency and cost reductions, alongside strategic investments in both traditional and emerging energy sectors. These moves reflect a broader strategy to balance profitability with environmental responsibility.

BP plans to grow its oil and gas production to 2.3-2.5 million barrels of oil equivalent per day by 2030. Three major projects are set to start, and six exploration discoveries were made in Q1 2025. This expansion is a significant part of BP's strategy to meet global energy demands.

BP is selectively investing in low-carbon areas like biogas, biofuels, and EV charging. It is also focusing on hydrogen and carbon capture and storage (CCS) projects. Construction of the Lingen Green Hydrogen Project in Germany is scheduled to commence in 2025.

The company is targeting $20 billion in divestments by 2027. BP aims for $4-5 billion in structural cost reductions by the end of 2027. In 2024, BP achieved $0.8 billion in structural cost reductions.

BP has faced volatile market conditions, weaker refining margins, and lower liquid price realizations. These factors contributed to a 45% drop in adjusted EPS in Q1 2025 compared to Q1 2024.

BP's competitive advantages include its global reach, diversified portfolio, and strong brand recognition. The company's extensive operational network and ability to adapt to new trends are also key. For more details on how BP is growing, check out the Growth Strategy of BP.

- Upstream plant reliability was at 95.4% in Q1 2025.

- Refining availability stood at 96.2% in Q1 2025.

- BP continues to invest in certain low-carbon areas.

- The company focuses on operational efficiency.

BP Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is BP Positioning Itself for Continued Success?

The BP company holds a strong position in the oil and gas industry as a leading integrated energy company. Its global presence spans across Europe, North America, South America, Africa, and the Asia Pacific. This extensive reach, coupled with a well-recognized brand, contributes to customer loyalty and operational stability.

However, the BP business model faces several significant risks and challenges. These include market volatility, regulatory changes, technological disruptions, and evolving consumer preferences. The company's ability to navigate these factors will be crucial to its future success.

Fluctuations in oil and gas prices and refining margins can significantly impact BP's profitability. For instance, the company's Q1 2025 results were influenced by these factors. Understanding and managing these market dynamics is crucial for BP's financial performance.

Evolving environmental regulations and climate policies pose ongoing challenges for BP. These changes, especially concerning carbon emissions and renewable energy mandates, require strategic adaptation. The company must navigate these policies to ensure compliance and maintain competitiveness.

Rapid technological advancements in renewable energy and other low-carbon solutions necessitate continuous investment and adaptation. The pace of change requires BP to stay at the forefront of innovation. Strategic investments are essential for long-term viability.

A growing global emphasis on sustainability and a shift toward lower-carbon energy sources could impact demand for traditional fossil fuels. Adapting to these changing consumer preferences is vital. BP's ability to meet these demands will shape its future.

BP's future outlook is guided by its 'reset' strategy, which prioritizes growing shareholder value. This strategy focuses on high-return businesses, including increased investment in oil and gas production. The company is also selectively investing in low-carbon areas like biogas, biofuels, and hydrogen, aiming for strong returns in these sectors.

- BP aims to achieve $4-5 billion in structural cost reductions by the end of 2027.

- The company targets $20 billion in divestments by the end of 2027 to strengthen its balance sheet.

- BP plans to repurchase $0.75-1.0 billion in shares in Q2 2025.

- The company anticipates that oil will continue to play a significant role for the next 10-15 years, requiring continued investment in upstream operations.

BP's long-term vision involves a complex balancing act, maintaining its core hydrocarbon business while strategically advancing its position in the energy transition. This approach aims to sustain profitability and meet future energy demands. For more on the company's history, consider reading about the Brief History of BP.

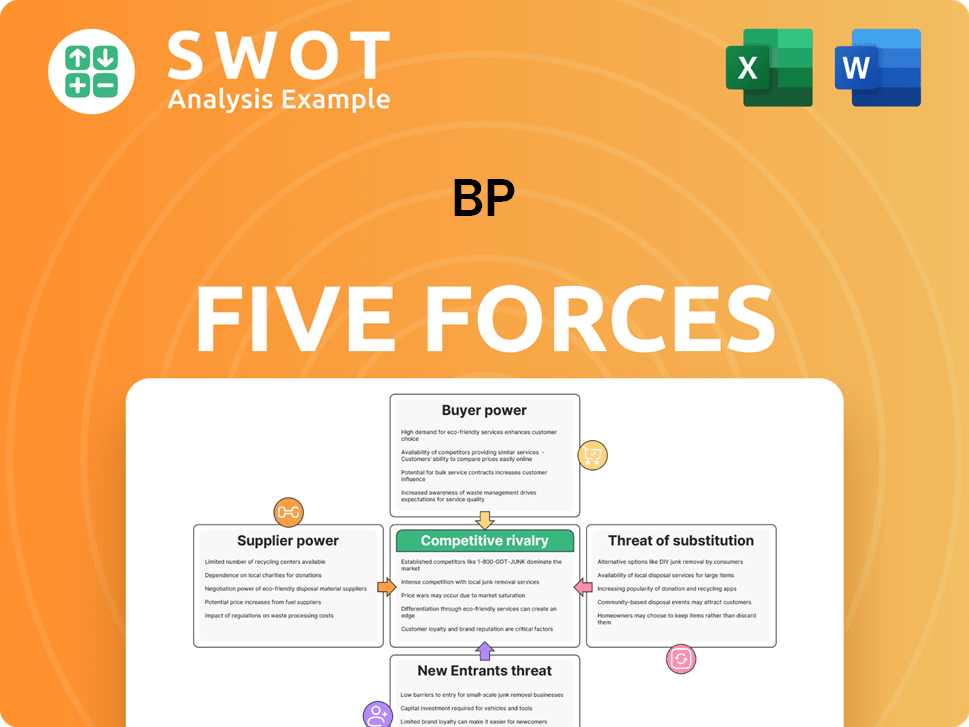

BP Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of BP Company?

- What is Competitive Landscape of BP Company?

- What is Growth Strategy and Future Prospects of BP Company?

- What is Sales and Marketing Strategy of BP Company?

- What is Brief History of BP Company?

- Who Owns BP Company?

- What is Customer Demographics and Target Market of BP Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.