BP Bundle

Can BP Navigate the Energy Transition and Thrive?

BP, a titan of the energy sector, is undergoing a significant strategic shift as of February 2025, reshaping its approach to both traditional oil and gas and the burgeoning renewable energy market. This pivotal moment demands a deep dive into BP's revised growth strategy and its potential to deliver shareholder value in a rapidly evolving global landscape. This BP SWOT Analysis provides a comprehensive overview of the company's strengths, weaknesses, opportunities, and threats.

This BP company analysis explores the core of British Petroleum's updated strategy, focusing on its renewed commitment to its core oil and gas operations while strategically recalibrating its investments in the energy sector outlook. Understanding BP's future prospects requires a thorough examination of its financial performance review, market share analysis, and its response to climate change. We'll delve into BP's sustainable growth initiatives, its carbon emissions reduction targets, and its long-term growth forecast, providing actionable insights for investors and industry observers alike, considering the dynamic oil and gas industry.

How Is BP Expanding Its Reach?

The Mission, Vision & Core Values of BP are driving significant expansion initiatives, particularly in the oil and gas sector, while also making strategic moves in the energy transition space. This dual approach is designed to balance current market demands with future sustainability goals. The company's strategy involves a blend of increasing production in established areas and selectively investing in low-carbon energy solutions.

BP's focus on optimizing its core business while cautiously entering the energy transition market is evident in its financial allocations. The company is increasing investments in oil and gas to boost production and is simultaneously scaling back its spending on renewables. This approach reflects a pragmatic view of the energy sector's evolution, acknowledging the ongoing importance of fossil fuels while preparing for a low-carbon future.

These strategic adjustments are crucial for BP to navigate the complex landscape of the energy sector and maintain its competitive edge. The company's plans for growth are designed to provide returns to shareholders while also contributing to the global effort to reduce carbon emissions.

BP plans to increase its annual investment in oil and gas to approximately $10 billion, a 20% increase from previous plans. The goal is to boost daily oil and gas production to between 2.3 million and 2.5 million barrels per day by 2030. This expansion includes strategic projects in the U.S. Gulf of Mexico, the Middle East, and the initiation of new major oil and gas projects.

Annual funding for renewables is being cut to between $1.5 billion and $2 billion annually, a reduction of over $5 billion from previous forecasts. This revised strategy focuses on specific areas like biogas, biofuels, and EV charging infrastructure. The company is taking a more selective and capital-light approach in this sector, aiming for strategic growth.

BP is making progress in carbon capture and storage (CCS) and hydrogen projects. In December 2024, BP reached financial close for two major CCS projects in Teesside, UK. Furthermore, BP and the Midwest Alliance for Clean Hydrogen (MachH2 coalition) signed an agreement with the US Department of Energy for a $1 billion federal award to help fund a regional low-carbon hydrogen hub in the Midwest.

BP completed its acquisition of Lightsource bp in October 2024, expanding its onshore renewable energy presence to 19 global markets. In December 2024, BP and JERA Co. agreed to combine their offshore wind businesses into an equally-owned joint venture, JERA Nex bp, expected to be completed by Q3 2025, with 13 GW of potential net generating capacity.

BP's BP growth strategy focuses on a dual approach: increasing oil and gas production while selectively investing in low-carbon energy. The company is strategically allocating resources to achieve a balance between current revenue generation and future sustainability goals. These initiatives are designed to ensure BP future prospects remain strong in a changing energy landscape.

- Increased oil and gas investment to approximately $10 billion annually.

- Focus on strategic locations like the U.S. Gulf of Mexico and the Middle East.

- Selective investments in biogas, biofuels, and EV charging infrastructure.

- Advancements in carbon capture and storage (CCS) and hydrogen projects.

BP SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does BP Invest in Innovation?

The innovation and technology strategy of British Petroleum (BP) is a crucial element of its BP growth strategy, focusing on both traditional oil and gas operations and its transition towards lower-carbon energy sources. This approach integrates digital transformation, automation, and advanced technologies like AI and IoT to enhance efficiency, optimize production, and reduce environmental impact. These initiatives are central to BP's future prospects.

BP's commitment to technological advancement is evident in its significant investments in digital solutions and AI-driven applications across various segments of its business. These investments are designed to improve operational performance, reduce costs, and support its sustainability goals. The company's strategic focus on innovation positions it to adapt to the evolving energy sector outlook.

Between 2022 and 2024, AI and advanced analytics contributed to an approximate 4% increase in BP-operated production and protected around 10% more from shutdowns through monitoring and analysis, highlighting the tangible benefits of its digital transformation efforts. For a deeper understanding, consider exploring the Competitors Landscape of BP.

BP leverages AI to optimize oil and gas production. The 'Wells Assistant' provides instant access to data, saving an estimated 5,000 hours of work for BP teams. Another tool, 'Optimization Genie,' has led to production increases of about 2,000 barrels per day at the Atlantis hub.

BP uses machine learning to predict and prevent equipment issues. The 'AAD' tool helps reduce production challenges and supports plant reliability. This proactive approach minimizes downtime and enhances operational efficiency.

AI-driven analytics predict output from solar and wind operations. This ensures optimal energy flow, making renewables more reliable. BP is using technology to make renewable energy more efficient.

BP uses AI to reduce methane leaks, a significant greenhouse gas. This has saved BP around $1.6 billion in the past five years. Reducing methane emissions is key to BP's environmental goals.

BP implemented new digital systems like IRIS and LENS in 2024. These systems improve safety performance and standardize processes. They also support agile working practices.

BP collaborates with partners like Infosys on AI projects. These projects modernize its digital application landscape. These partnerships accelerate its digital transformation journey.

BP's technology strategy focuses on integrating AI and digital solutions across its operations. This approach aims to improve efficiency, enhance safety, and support its transition to lower-carbon energy sources. These initiatives are critical for the oil and gas industry.

- AI-driven production optimization in oil and gas.

- Use of machine learning for equipment maintenance and reliability.

- Application of AI in renewable energy output prediction.

- AI-based methane leak detection and reduction.

- Implementation of new digital systems for safety and process standardization.

- Partnerships to modernize the digital application landscape.

BP PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is BP’s Growth Forecast?

The financial outlook for British Petroleum (BP) is centered around a strategic reset, emphasizing growth in free cash flow, returns, and shareholder value. This approach is crucial for understanding the BP growth strategy and its BP future prospects within the dynamic energy sector outlook.

In the first quarter of 2025, BP reported an underlying replacement cost (RC) profit of $1.4 billion. While this reflects a slight increase from the previous quarter's $1.2 billion, the reported profit of $0.7 billion for Q1 2025 is a significant drop from the $2.72 billion reported in the same period last year. This decline is primarily due to weaker refining margins, softer oil and gas trading performance, and market volatility, which impacts the overall BP company analysis.

BP aims to increase its annual investment in oil and gas to approximately $10 billion per year. Simultaneously, the company is significantly reducing its 'transition investment' to between $1.5 billion and $2 billion annually. This shift in investment strategy is a key component of BP's long-term financial planning and its response to climate change.

BP plans to reduce capital expenditure to a range of $13 billion to $15 billion per year up to 2027. This represents a $1 billion to $3 billion decrease compared to 2024 levels. The expected capex for 2025 is around $15 billion.

The company is committed to maintaining a strong balance sheet and an 'A' grade credit rating. BP aims to achieve a net debt target of $14-18 billion by the end of 2027. Net debt at the end of Q1 2025 was $27.0 billion.

BP is targeting structural cost reductions of $4 billion to $5 billion by the end of 2027, based on a 2023 baseline. The company had already achieved $0.8 billion in cost reductions by the end of 2024.

BP intends to return 30% to 40% of its operating cash flow to shareholders over time through share buybacks and a resilient dividend. The dividend is expected to increase by at least 4% per year. For Q1 2025, a dividend per ordinary share of 8 cents was announced, and a $0.75 billion share buyback was initiated.

These financial strategies highlight the company's commitment to sustainable growth and value creation. For a deeper dive into BP's operational strategies and market position, consider reading this article about BP's market share analysis.

BP Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow BP’s Growth?

The growth strategy of British Petroleum (BP) faces several risks and obstacles, especially with its recent focus back on hydrocarbons. The energy sector's competitive landscape, encompassing both traditional oil and gas companies and emerging renewable energy firms, presents a significant challenge for the company. Regulatory changes and the global push for decarbonization further complicate BP's strategic direction and financial investments.

Supply chain vulnerabilities and geopolitical events significantly impact energy markets. Technological advancements and internal pressures, such as those from activist investors, also pose risks. These factors require careful management to ensure the company's continued success in the dynamic energy sector.

BP's strategic adjustments, including a shift towards increasing oil and gas spending, have drawn criticism, particularly regarding its climate commitments. Despite these changes, BP remains committed to achieving net-zero emissions for its operations by 2050 or sooner, with interim targets for emission reductions.

The energy sector is highly competitive, with traditional oil and gas companies and renewable energy firms vying for market share. The Owners & Shareholders of BP should be aware of the competitive pressures, which can impact profitability and growth. This competition necessitates strategic agility and investment in technologies to maintain a competitive edge.

Governments worldwide are implementing policies aimed at decarbonization, which could affect BP's fossil fuel investments. These regulatory changes can lead to increased compliance costs, potential asset impairments, and shifts in demand. Companies must adapt to these evolving regulations.

Geopolitical events, such as the war in Ukraine, can significantly impact energy markets and transition speeds. These events can disrupt supply chains, increase price volatility, and affect investment decisions. BP must navigate these uncertainties.

Technological advancements, while offering opportunities, also pose risks if BP fails to adapt. Competition from new technologies, such as renewable energy sources and electric vehicles, can erode market share. Adapting to these technological changes is crucial.

BP faces pressure from activist investors to enhance shareholder returns, which can influence strategic adjustments. This pressure can lead to decisions that prioritize short-term gains over long-term sustainability goals. Balancing shareholder interests with long-term strategic objectives is critical.

While BP's operational Scope 1 and 2 emissions in 2024 were 38% lower than in 2019, they did increase from 2023 levels. The company has also retired its 2030 Scope 3 decarbonization target. Meeting its emissions reduction targets, such as the commitment to reduce emissions by 20% by the end of 2025 and 45-50% by the end of 2030 against its 2019 baseline, is essential.

Supply chain disruptions can significantly impact operations and project timelines in the complex energy industry. These disruptions can lead to increased costs, delays, and reduced profitability. Robust supply chain management and diversification are essential to mitigate these risks.

BP has faced internal pressures, including from activist investors, that influence strategic decisions. These pressures can lead to shifts in investment priorities, potentially impacting long-term sustainability goals. Addressing internal challenges requires a balanced approach.

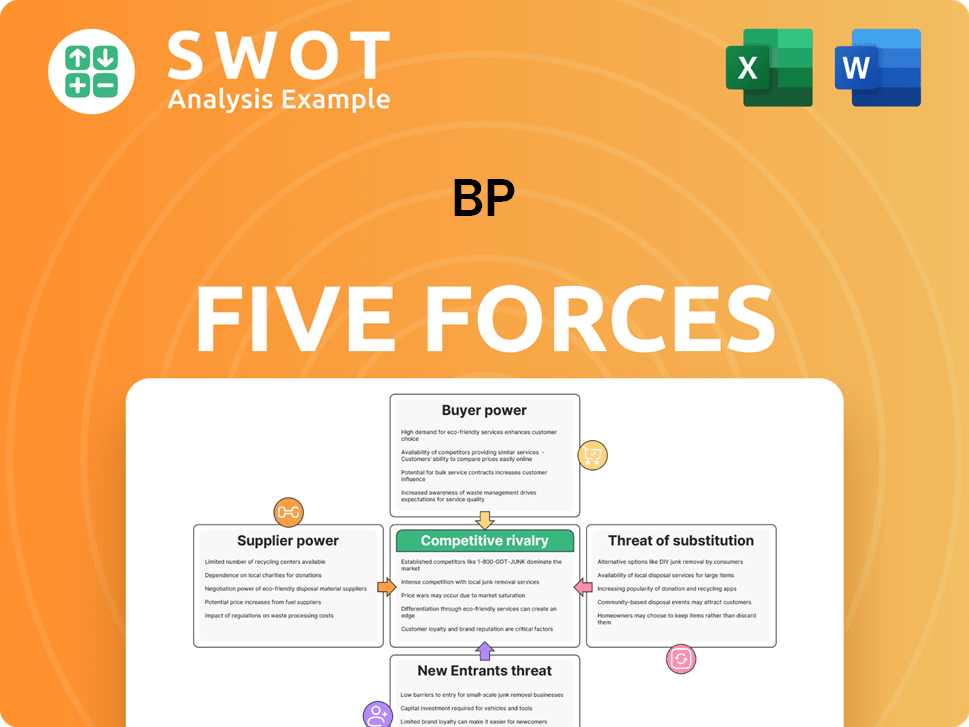

BP Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.