BP Bundle

How Does British Petroleum Stack Up Against Its Rivals?

BP, a titan in the global energy arena, faces a dynamic and fiercely contested BP SWOT Analysis. From its origins as the Anglo-Persian Oil Company, BP has evolved into an integrated energy powerhouse. Understanding the BP competitive landscape is crucial for anyone seeking to navigate the complexities of the oil and gas industry.

This exploration of BP's competitors will dissect its market position, core strengths, and the strategic moves shaping its future. We'll analyze BP's market analysis, revealing how it contends with industry giants and adapts to the evolving demands of the energy sector competition. By examining BP's global presence and competitive positioning, we aim to provide actionable insights for investors and strategists alike.

Where Does BP’ Stand in the Current Market?

BP, a prominent player in the oil and gas industry, holds a significant market position. Its operations span the entire value chain, from exploration and production to refining and distribution. This integrated approach allows BP to maintain a strong presence in the energy sector competition.

In 2024, BP's upstream production saw an increase, with approximately 2.36 million barrels per day, and plant reliability exceeding 95%. The company's strategic focus includes increasing investments in renewable energy sources, such as biofuels and wind power, alongside its traditional oil and gas activities, demonstrating its commitment to a diversified energy portfolio.

The BP competitive landscape is shaped by its global operations and diverse portfolio. The company's financial performance in 2024 showed revenues declined by 8.6% to US$194.63 billion from US$213.03 billion in 2023, with statutory pretax profit at US$6.78 billion, a 71% decrease. For the first quarter of 2025, BP reported an underlying replacement cost profit of US$1.4 billion. This financial performance indicates the challenges and opportunities BP faces within the oil and gas industry.

BP's revenue declined by 8.6% to US$194.63 billion. Statutory pretax profit was US$6.78 billion, a 71% decrease. These figures reflect the fluctuations and pressures within the energy sector competition and the broader market dynamics.

Upstream production increased by 2% to approximately 2.36 million barrels per day in 2024. BP anticipates lower reported and underlying upstream production in 2025 due to divestments. This strategic shift impacts the company's market positioning.

BP is increasing investments in renewable energy sources, including biofuels and wind power. This diversification strategy aims to strengthen its position in a changing BP competitive landscape. This is part of its long-term sustainability initiatives.

In 2024, BP's Obermatt Combined Rank was 14, indicating performance below 86% of alternatives. The Value Rank of 55 suggests better pricing than 55% of comparable stocks. Capital growth expectations ranked at 59, outperforming only 18% of competitors.

BP's competitive advantages include its integrated operations, global presence, and investments in renewable energy. These factors contribute to its ability to compete effectively within the BP competitive landscape. BP's strategic partnerships and alliances also play a crucial role in its market positioning.

- Integrated Operations: Spanning the entire oil and gas value chain.

- Global Presence: Operations worldwide, providing diverse revenue streams.

- Renewable Energy Investments: Diversifying its portfolio for future growth.

- Cost Reduction: Successfully reduced cash costs by US$750 million in 2024.

For a deeper understanding of how BP approaches its market strategy, consider reading about the Marketing Strategy of BP. This provides additional insights into its competitive positioning.

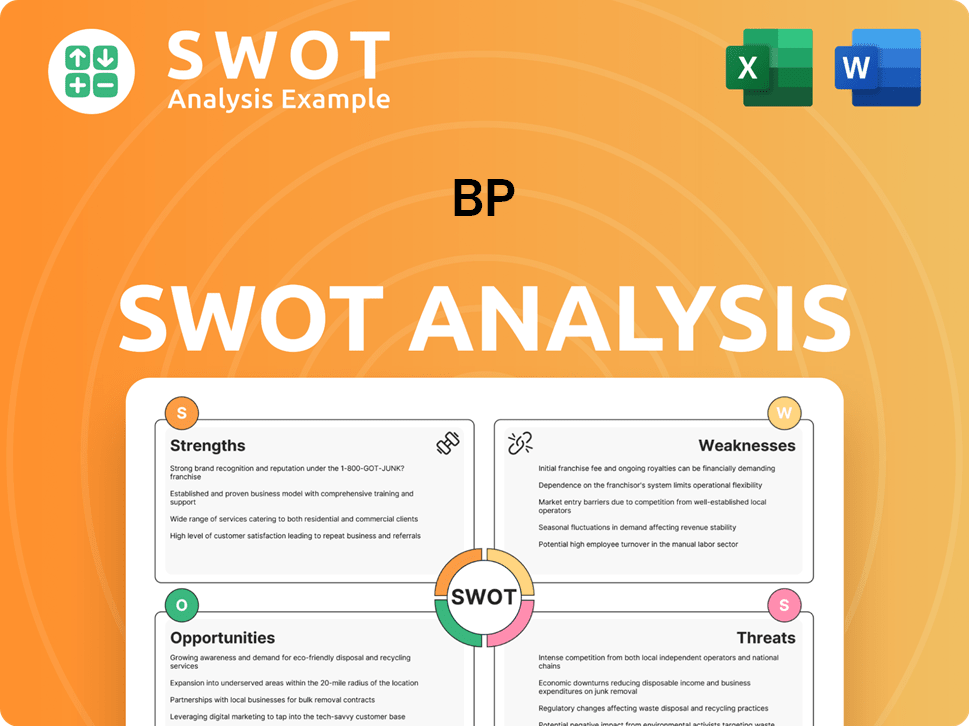

BP SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

Who Are the Main Competitors Challenging BP?

The BP competitive landscape is shaped by intense rivalry within the global energy sector. BP competitors include both established oil and gas giants and emerging players in renewable energy. This dynamic environment requires continuous strategic adaptation to maintain market share and profitability.

BP's market analysis reveals a complex interplay of factors influencing its competitive position. These include fluctuating oil prices, geopolitical risks, technological advancements, and the growing emphasis on sustainable energy solutions. Understanding these elements is crucial for assessing BP's long-term prospects.

The oil and gas industry is highly competitive, with companies constantly vying for market share and resources. The energy sector competition is fierce, with companies needing to innovate and adapt to survive. For a deeper look into the company's origins, consider reading a Brief History of BP.

BP's main rivals in the oil industry include major integrated oil companies. These competitors have significant resources and global reach. They compete across all segments of the energy value chain.

Shell operates across the entire oil and gas spectrum. Shell has a strong global presence, including a vast network of filling stations. Shell is also investing in renewable energy sources.

As the world's largest oil producer, Saudi Aramco is a significant competitor. Aramco has substantial reserves and production capacity. The company's influence extends globally.

ExxonMobil is another major player in the industry. ExxonMobil has a diverse portfolio and global operations. The company competes with BP in numerous markets.

Chevron is a significant competitor with a global presence. Chevron competes with BP in various segments of the energy sector. The company has a strong refining and marketing footprint.

TotalEnergies is a major integrated oil and gas company. TotalEnergies competes with BP in exploration, production, and refining. They have a significant global presence.

The competitive landscape is further shaped by the potential for industry consolidation. BP's strategic partnerships and alliances are crucial for navigating this environment. Potential mergers and acquisitions could significantly alter market share and competitive dynamics.

- Market chatter suggests potential buyouts of BP.

- Shell is reportedly considering the benefits of BP's natural gas and LNG operations.

- Chevron and ExxonMobil might reassess BP based on the Hess acquisition outcome.

- Abu Dhabi's Adnoc is also considered a potential bidder.

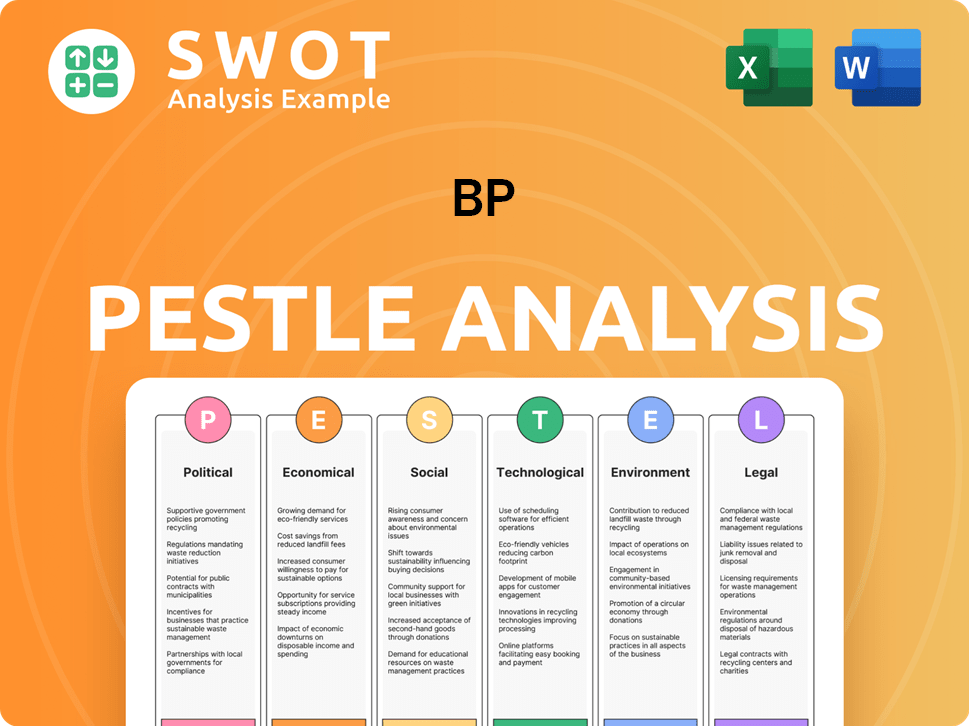

BP PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Gives BP a Competitive Edge Over Its Rivals?

Understanding the Revenue Streams & Business Model of BP, and its competitive advantages is crucial for assessing its position in the oil and gas industry. BP's strengths lie in its integrated operations, global reach, and strategic investments. These factors contribute significantly to its ability to compete effectively in a dynamic market environment. The company's financial performance and strategic decisions are key indicators of its competitive standing.

BP's competitive edge is also shaped by its commitment to both traditional and low-carbon energy sources. This dual approach allows BP to navigate the energy transition while maintaining a strong presence in established markets. Recent strategic moves, such as new Final Investment Decisions and securing access to new markets, showcase BP's adaptability and commitment to enhancing its competitive standing. The company's focus on operational efficiency, including cost reduction initiatives, further strengthens its position.

The company's ability to reshape its portfolio and achieve structural cost reductions is a testament to its operational efficiency. For instance, BP achieved a US$0.8 billion reduction in 2024, demonstrating its commitment to strengthening its balance sheet. Strategic moves, like securing access to new markets such as Iraq and India, highlight its adaptive strategies to maintain and enhance its competitive standing within the oil and gas industry.

BP benefits from its integrated structure, spanning exploration, production, refining, and distribution. This integration provides operational efficiencies and resilience against commodity price volatility. The company's global presence and established infrastructure, including operations in key regions, contribute to economies of scale and robust distribution networks.

BP strategically invests in both traditional and low-carbon energy sources. This includes selective investments in biogas, biofuels, and EV charging, where strong demand growth is observed. BP is also adopting innovative capital-light partnerships in renewables, such as its offshore wind joint venture with JERA, aiming for a significant net generating capacity.

BP focuses on operational efficiency, including cost reduction initiatives. The company's ability to reshape its portfolio and achieve structural cost reductions, such as the US$0.8 billion reduction in 2024, demonstrates its commitment to strengthening its balance sheet. This focus enhances its ability to compete effectively in the energy sector.

BP's global reach and strategic moves, including securing access to new markets like Iraq and India, further highlight its adaptive strategies to maintain and enhance its competitive standing. Its established infrastructure and distribution networks contribute to its economies of scale. The company's ability to navigate diverse markets is a key advantage.

BP's competitive advantages are multifaceted, stemming from its integrated energy operations, strategic investments, and operational efficiency. These strengths are critical for navigating the complexities of the oil and gas industry and the energy transition. The company's ability to adapt and innovate is crucial for maintaining its market position.

- Integrated Operations: Provides operational efficiencies and resilience.

- Strategic Investments: Focus on both traditional and low-carbon energy.

- Operational Efficiency: Drives cost reductions and strengthens the balance sheet.

- Global Presence: Enhances market access and distribution capabilities.

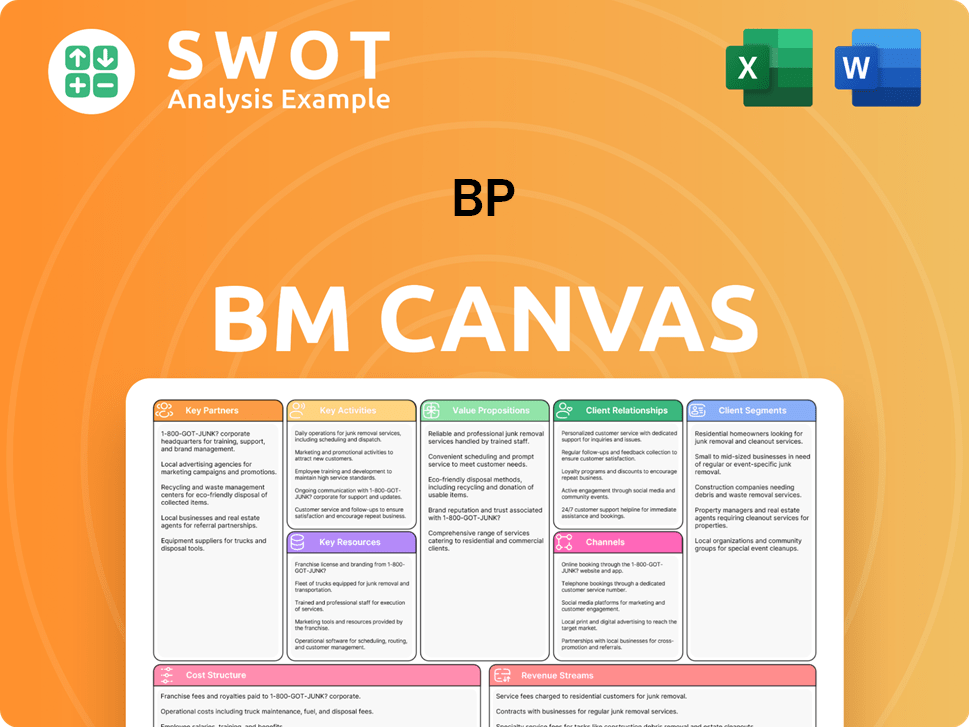

BP Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Industry Trends Are Reshaping BP’s Competitive Landscape?

The energy industry is undergoing a significant transformation, presenting both challenges and opportunities for companies like BP. This shift is driven by technological advancements, evolving regulatory landscapes, and changing consumer preferences, which are reshaping the competitive landscape for BP. Understanding the dynamics of the BP competitive landscape is crucial for making informed investment decisions and developing effective business strategies.

BP faces a complex environment influenced by geopolitical tensions, economic uncertainties, and the need to balance investments in traditional fossil fuels with the growing demand for low-carbon energy solutions. The BP market analysis reveals that the company must strategically navigate these challenges to maintain and enhance its competitive position within the oil and gas industry.

Technological advancements are rapidly changing the energy sector. AI is enhancing operational efficiencies, and battery storage technologies are seeing rapid cost reductions. Green hydrogen technology is also advancing, with production costs expected to decrease. These trends are crucial to understand when analyzing BP competitors.

Regulatory changes are creating a dynamic environment. Federal energy policy in the U.S. is anticipated to shift, while the European Union is pushing for decarbonization. Governments globally are shaping energy transition policies, prioritizing jobs and manufacturing. These changes impact the British Petroleum’s strategic direction.

Consumer preferences are shifting towards sustainable consumption and clean energy solutions. A significant portion of the global population believes in the transition to renewables. This shift drives demand for digital-first experiences and personalized energy solutions, impacting BP's main rivals in the oil industry.

BP faces challenges including geopolitical tensions, economic uncertainties, and the need to balance investments in fossil fuels with low-carbon energy. Oil prices are projected to remain range-bound, and the refining sector faces profitability challenges. Expedited investment in infrastructure is also needed. Read more about Growth Strategy of BP.

BP has opportunities to grow its upstream business and focus its downstream operations while investing in the energy transition. This includes leveraging existing infrastructure to develop low-carbon solutions and capitalizing on M&A activity. Emerging markets also present growth opportunities, aligning with consumer preferences for clean energy.

- Develop and deploy low-carbon solutions like carbon capture and storage (CCUS) and hydrogen.

- Capitalize on increasing M&A activity in the energy sector.

- Align with consumer preferences for clean energy and digital solutions.

- Invest in advanced technologies to strengthen its competitive position.

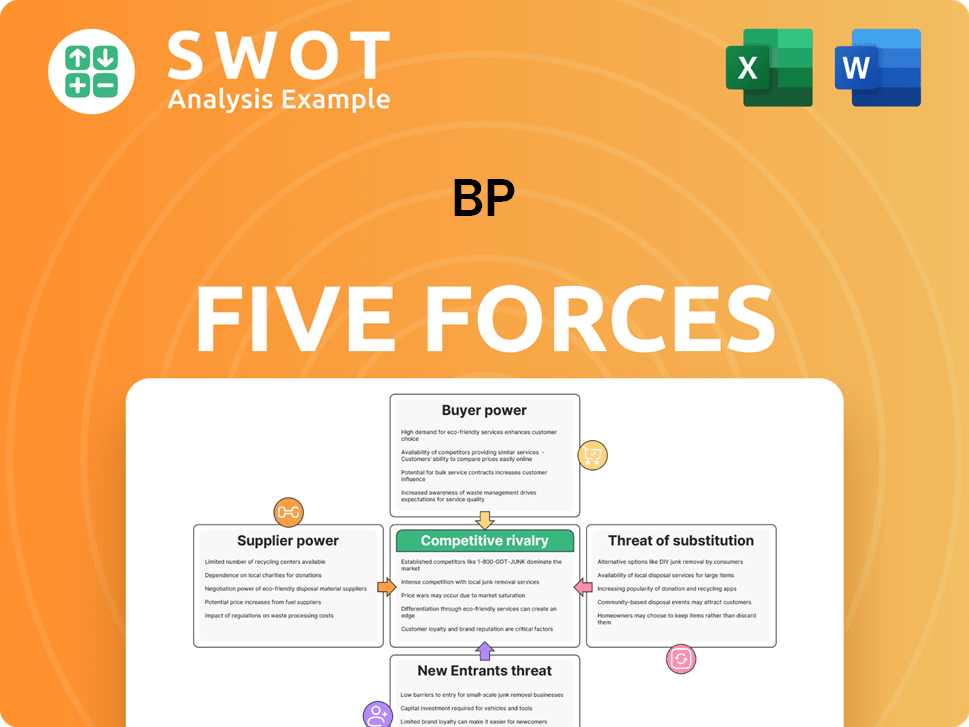

BP Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of BP Company?

- What is Growth Strategy and Future Prospects of BP Company?

- How Does BP Company Work?

- What is Sales and Marketing Strategy of BP Company?

- What is Brief History of BP Company?

- Who Owns BP Company?

- What is Customer Demographics and Target Market of BP Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.