BRF Bundle

How Did a Brazilian Food Pioneer Become a Global Giant?

Embark on a journey through the compelling BRF SWOT Analysis and discover the remarkable transformation of a Brazilian food company into an international powerhouse. From its humble beginnings, the BRF Company has navigated the complexities of the global market, leaving an indelible mark on the food industry. Uncover the strategic decisions and pivotal moments that have shaped the BRF history and its evolution.

The story of Sadia Company is a testament to the power of strategic vision and adaptability. Understanding the Sadia history and how it became BRF foods is crucial for anyone interested in the dynamics of the Brazilian food industry and its global impact. This brief overview of BRF Company will delve into its key events, global expansion, and the evolution of its products.

What is the BRF Founding Story?

The story of the BRF Company begins with a strategic merger that reshaped the Brazilian food industry. Officially established on January 10, 2009, it was formed by the union of two of Brazil's leading food companies: Sadia S.A. and Perdigão S.A. This merger combined decades of experience and market presence, creating a powerhouse in the food sector.

The roots of BRF trace back to the mid-20th century. Sadia, founded in 1944 in Concórdia, Santa Catarina, and Perdigão, established in 1934 in Videira, Santa Catarina, were both pioneers in the Brazilian meat processing industry. The founders, Attilio Fontana for Sadia and Saul Brandalise and Gino Perdigão for Perdigão, saw the potential in providing high-quality, accessible food products to a growing population.

This strategic move was driven by the need to achieve greater scale, streamline operations, and improve competitiveness in both domestic and international markets. The combined entity aimed to build a strong company capable of navigating global competition and capitalizing on synergies in production, distribution, and brand recognition. The initial business model focused on the comprehensive production and commercialization of poultry and pork products, with a strong emphasis on vertical integration from feed production to processed foods.

The merger of Sadia and Perdigão created BRF, a major player in the Brazilian food industry.

- January 10, 2009: Official founding date of BRF through the merger of Sadia and Perdigão.

- Sadia's Founding: Founded in 1944 by Attilio Fontana.

- Perdigão's Founding: Established in 1934 by Saul Brandalise and Gino Perdigão.

- Strategic Goal: To gain scale, optimize operations, and enhance competitiveness.

The merger was also influenced by the global economic context of the late 2000s, where larger, integrated companies were better positioned to manage market fluctuations and expand into new territories. BRF's formation marked a significant shift in the Growth Strategy of BRF, setting the stage for its evolution into a global food company.

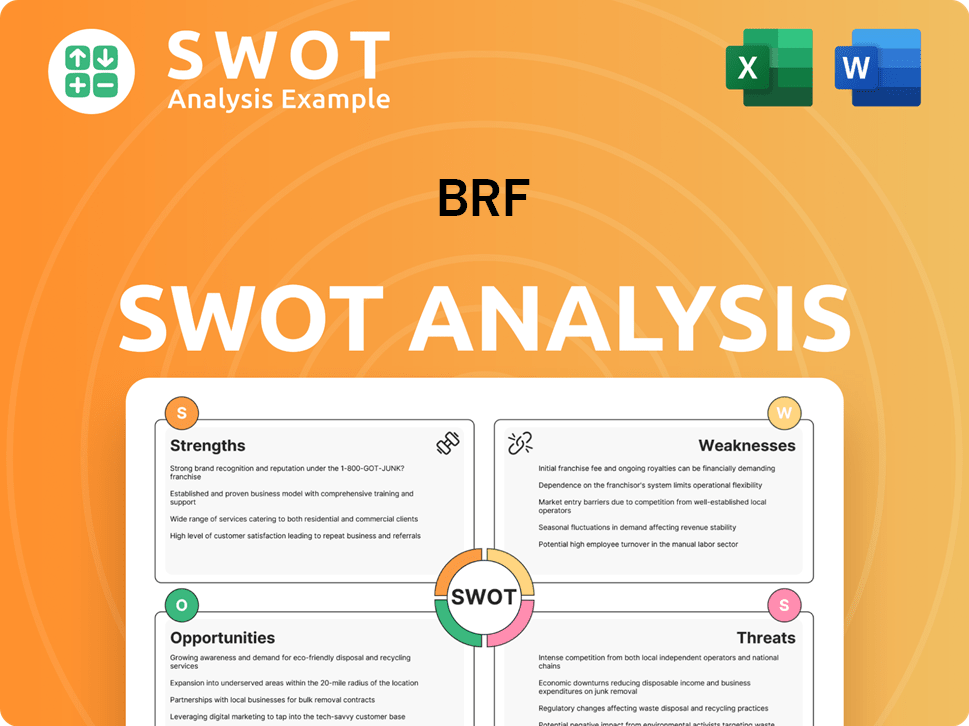

BRF SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

What Drove the Early Growth of BRF?

Following its establishment in 2009, the BRF Company entered a phase of significant consolidation and expansion. This involved integrating the operations of Sadia and Perdigão, which encompassed numerous facilities and product lines. Early growth was focused on optimizing this integration, streamlining supply chains, and leveraging the combined brand equity to strengthen its domestic market leadership.

The initial years of BRF were marked by the complex task of merging Sadia and Perdigão. This included integrating production facilities, distribution networks, and a diverse range of products. The company focused on streamlining its supply chains to improve efficiency and reduce costs, which was crucial for establishing a strong foundation for future growth.

By leveraging the combined brand equity of Sadia and Perdigão, BRF aimed to strengthen its position in the Brazilian market. This involved optimizing its product offerings and distribution channels to cater to the needs of a large and diverse consumer base. The focus was on becoming the leading Brazilian food company.

BRF's expansion quickly moved beyond Brazil, targeting international markets with high demand for protein. The company strategically entered new markets, particularly in the Middle East, Asia, and Latin America. This involved both organic growth and strategic acquisitions to increase its global footprint.

Significant investments were made in facilities, especially in the Middle East, a key market for halal poultry. BRF also diversified its product portfolio to include more processed and value-added food products. These strategic moves were supported by capital raises and investments in modernizing industrial parks.

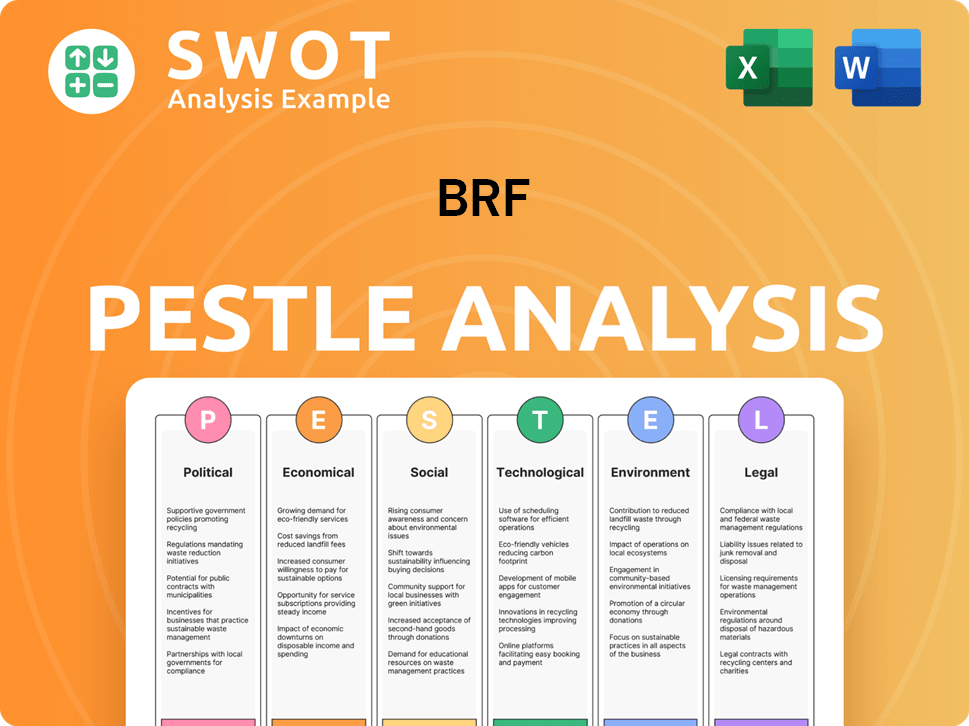

BRF PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What are the key Milestones in BRF history?

The BRF Company, a prominent Brazilian food company, has a rich history marked by significant milestones and achievements. This journey includes strategic acquisitions, global expansion, and a commitment to innovation in the food industry. The company's evolution reflects its adaptability and resilience in a dynamic market.

| Year | Milestone |

|---|---|

| 1953 | Sadia Company was founded by the Weiss family in Concórdia, Santa Catarina, Brazil, initially focusing on pork processing. |

| 1990s | Sadia expanded its product range and distribution network, becoming a major player in the Brazilian food market. |

| 2009 | Sadia merged with Perdigão to form BRF S.A., creating one of the largest food companies in the world. |

| 2010s | BRF expanded globally, increasing its presence in key markets, including the Middle East, Asia, and Europe. |

| 2020-2024 | BRF focused on operational efficiency, sustainability, and strengthening its brand portfolio while navigating global challenges. |

Innovation has been a cornerstone of the BRF Company's strategy, driving its growth and market position. The company has consistently invested in research and development to create new products and improve existing ones, catering to evolving consumer preferences and dietary needs.

BRF has implemented extensive vertical integration, controlling various stages of its production, from animal feed to processing and distribution. This approach enhances quality control and operational efficiency.

The company has diversified its product offerings to include a wide range of processed foods, ready-to-eat meals, and value-added products. This strategy allows BRF to cater to diverse consumer tastes and dietary requirements.

BRF has strategically expanded its presence in the halal food market, which is a significant and growing segment globally. This expansion has driven significant revenue and market share gains.

BRF has invested in sustainability initiatives, including reducing its environmental footprint and improving animal welfare practices. These efforts align with growing consumer demand for ethical and sustainable products.

The company has adopted advanced technologies in its production processes to enhance efficiency and product quality. This includes automation and data analytics to optimize operations.

BRF has built a robust global distribution network to ensure its products reach consumers worldwide. This network supports its international expansion and market penetration efforts.

The BRF Company has faced several challenges throughout its history, impacting its operations and financial performance. These challenges have required strategic adjustments and a focus on resilience to maintain its market position. The company's ability to adapt has been crucial.

Fluctuations in the prices of grains, particularly corn and soybeans used in animal feed, have significantly affected BRF's production costs. This volatility requires careful management of input costs.

Economic recessions in key markets, such as Brazil, have impacted consumer spending and demand for BRF's products. The company has responded by adjusting its pricing and product strategies.

BRF has faced challenges related to food safety and quality, requiring the implementation of enhanced compliance measures. These measures are crucial for maintaining consumer trust and regulatory compliance.

The company has dealt with reputational damage due to investigations and controversies, necessitating internal restructuring and leadership changes. Restoring trust is a key priority.

The COVID-19 pandemic caused significant disruptions to BRF's supply chains and distribution networks. The company adapted by implementing new operational and distribution strategies.

Geopolitical events and trade policies have impacted BRF's international operations and market access. The company has needed to navigate these challenges through strategic adjustments.

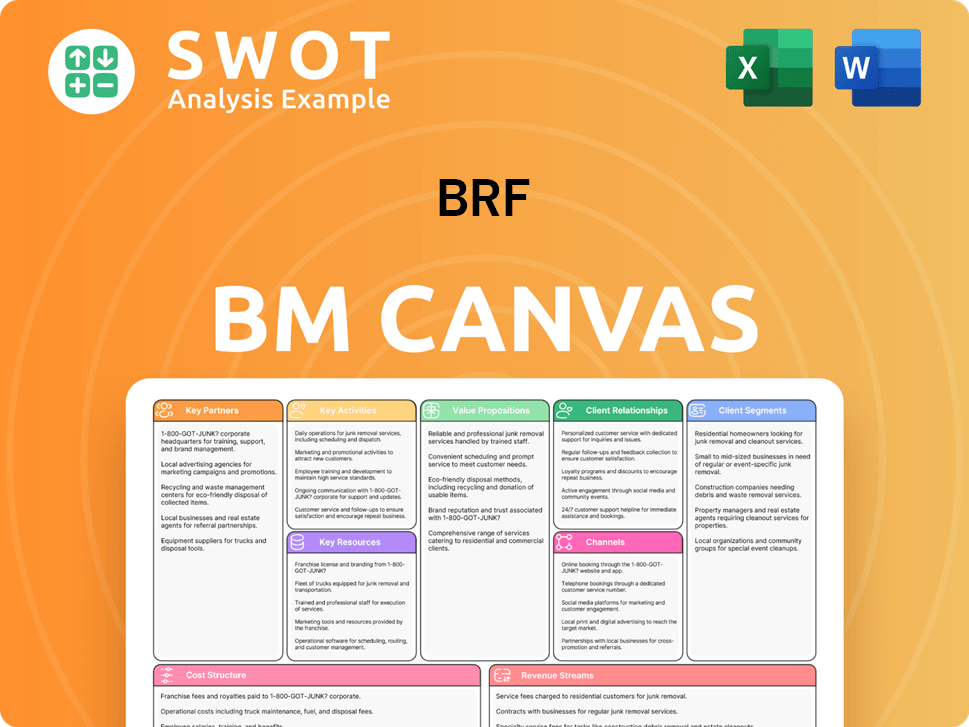

BRF Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What is the Timeline of Key Events for BRF?

The BRF Company, a prominent Brazilian food company, has a rich history marked by strategic expansions and adaptations. Founded in 1934 as Perdigão S.A., the company saw the establishment of Sadia S.A. in 1944. The significant merger occurred in 2009, forming BRF S.A. through the association of Sadia and Perdigão. In 2011, BRF began trading on the New York Stock Exchange (NYSE). Over the years, the company has strategically acquired assets, such as those in the Middle East in 2012, and divested others, like its dairy assets in 2013, to focus on its core protein business. BRF expanded into new markets in Asia and Africa in 2015. The company has also navigated challenges, including a restructuring plan in 2018 and supply chain disruptions during the COVID-19 pandemic in 2020. Sustainability initiatives and ESG goals have been a focus since 2022, and in 2024, strategic partnerships and investments in plant-based protein alternatives were announced.

| Year | Key Event |

|---|---|

| 1934 | Perdigão S.A. was founded, marking the beginning of one of Brazil's leading food companies. |

| 1944 | Sadia S.A. was established, which later became a crucial part of BRF's formation. |

| 2009 | BRF S.A. was created through the association of Sadia and Perdigão, consolidating its market presence. |

| 2011 | Shares of BRF began trading on the New York Stock Exchange (NYSE), indicating its global reach. |

| 2012 | BRF acquired key assets in the Middle East to strengthen its presence in the halal market. |

| 2013 | The company divested dairy assets to concentrate on its core protein business. |

| 2015 | BRF expanded into new markets in Asia and Africa, broadening its international footprint. |

| 2018 | A comprehensive restructuring plan was implemented to address operational and financial challenges. |

| 2020 | BRF navigated global supply chain disruptions due to the COVID-19 pandemic. |

| 2022 | The company continued its focus on sustainability initiatives and ESG goals. |

| 2024 | Strategic partnerships and investments in plant-based protein alternatives were announced. |

BRF is focused on consolidating its leadership in key international markets, particularly in Asia and the Middle East. This involves expanding distribution networks and tailoring products to local tastes. The company aims to increase its global market share by focusing on regions with high growth potential. This strategic expansion is crucial for BRF's long-term growth and profitability.

Innovation in processed foods and value-added products remains a priority for BRF. The company is placing a growing emphasis on health, wellness, and convenience to meet evolving consumer demands. BRF is investing in research and development to create new products and improve existing ones. The company's focus on innovation is expected to drive sales and market share.

BRF is actively exploring opportunities in alternative proteins, including plant-based options, to meet evolving consumer demands. The company is also committed to sustainability and ESG goals. Sustainable practices and alternative protein options are becoming increasingly important to consumers. This commitment is expected to attract environmentally conscious consumers.

Digital transformation is a key pillar, with investments in automation, data analytics, and e-commerce. These investments aim to enhance efficiency and customer engagement. BRF is focused on operational excellence to improve profitability and competitiveness. The company's digital transformation efforts are expected to streamline operations and improve customer experiences.

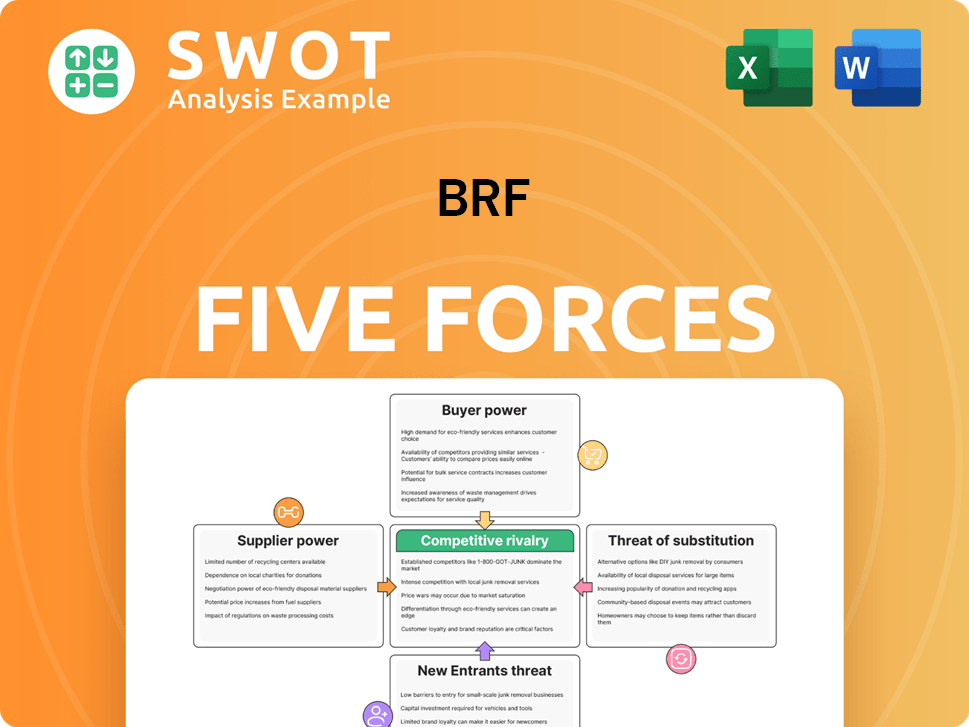

BRF Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What is Competitive Landscape of BRF Company?

- What is Growth Strategy and Future Prospects of BRF Company?

- How Does BRF Company Work?

- What is Sales and Marketing Strategy of BRF Company?

- What is Brief History of BRF Company?

- Who Owns BRF Company?

- What is Customer Demographics and Target Market of BRF Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.