BRF Bundle

Can BRF S.A. Continue Its Global Food Dominance?

BRF S.A., born from the merger of Brazilian food giants Perdigão and Sadia, has rapidly ascended to become a leading global food enterprise. Its strategic moves, particularly its international expansion, have reshaped the competitive landscape. Understanding the BRF SWOT Analysis is crucial to grasping the company's trajectory.

This deep dive into BRF company analysis will dissect its BRF growth strategy, exploring how it plans to navigate the complexities of the global food market. We'll examine its BRF business model, market share, and financial performance, while also investigating its future prospects and strategic plan for the next five years. From its competitive advantages in the poultry market to its sustainability initiatives, we'll uncover the factors shaping BRF's path forward, including its response to economic downturns and its plans for emerging markets.

How Is BRF Expanding Its Reach?

The company's expansion initiatives are primarily focused on strengthening its presence in key international markets and diversifying its product portfolio. This strategic approach aims to capitalize on growing global demand for protein and adapt to evolving consumer preferences. The BRF growth strategy includes entering new geographical markets, particularly in regions with high growth potential, and expanding its product offerings to cater to a broader consumer base.

A significant aspect of the company's expansion involves increasing its presence in the Middle East and Asia. These regions are experiencing rising demand for protein, making them crucial for the company's BRF future prospects. The company is also investing in halal food production to meet the specific dietary requirements of these markets. This includes investments in new processing plants and partnerships with local distributors.

In terms of product categories, the company is expanding beyond its traditional poultry and pork segments. It is investing in developing and launching new processed food products, ready meals, and plant-based alternatives. These initiatives aim to access new customer segments and diversify revenue streams, reducing reliance on core commodity products. The strategic plan for 2023-2025 emphasizes operational excellence, market expansion, and portfolio diversification, with clear milestones set for increasing market share in key regions and achieving specific revenue targets from new product launches.

The company is targeting the Middle East and Asia for expansion, focusing on increasing its market share. This strategy aligns with the growing demand for protein in these regions. The company is investing in halal food production to cater to specific dietary requirements.

The company is expanding its product offerings beyond poultry and pork. This includes new processed food products, ready meals, and plant-based alternatives. This diversification aims to meet evolving consumer preferences and health trends.

The company engages in strategic partnerships and potential acquisitions. These collaborations enhance distribution networks and access new technologies. This approach supports overall BRF business model and market position.

The company focuses on operational efficiency and supply chain optimization. This ensures sustainable and profitable growth. This strategic focus supports the company's expansion efforts.

The company's strategic plan for 2023-2025 focuses on operational excellence, market expansion, and portfolio diversification. This plan includes clear milestones for increasing BRF market share in key regions and achieving specific revenue targets from new product launches. The strategic plan also includes exploring opportunities for mergers and acquisitions to strengthen its market position and expand its product offerings. The company's focus on sustainability is also a key part of its future plans.

- Increasing market share in key regions.

- Achieving specific revenue targets from new product launches.

- Exploring mergers and acquisitions.

- Focusing on sustainability initiatives.

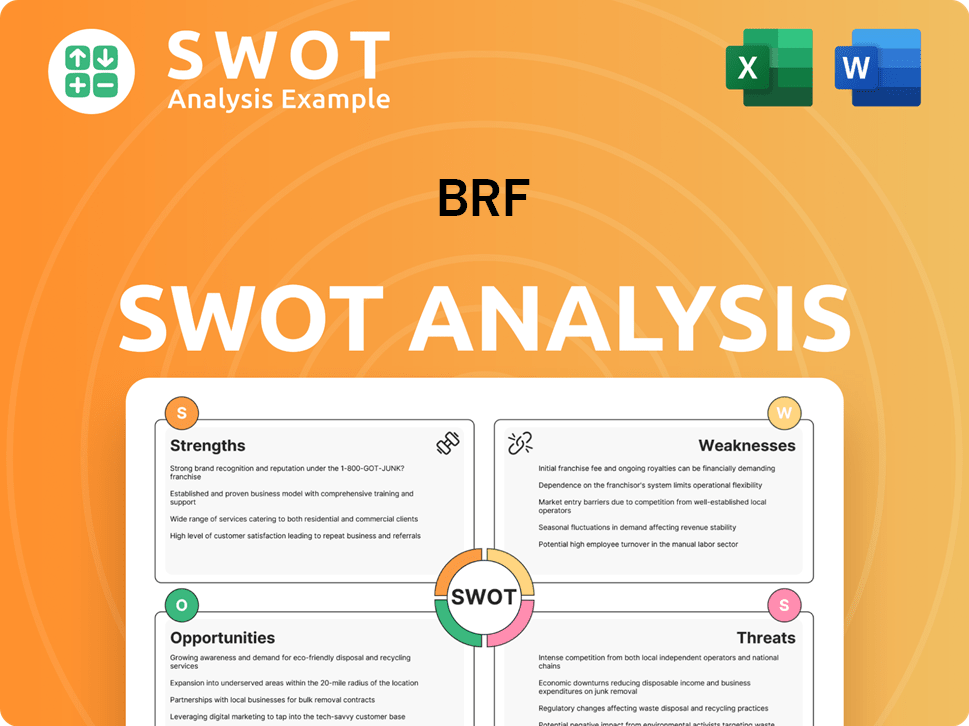

BRF SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does BRF Invest in Innovation?

The company strategically employs innovation and technology to fuel sustained growth, focusing on enhancing efficiency, product development, and sustainability. This approach is central to its overall BRF growth strategy. Investments in research and development (R&D) are significant, driving the creation of new products and improvements to existing ones, aligning with evolving consumer preferences for healthier and more convenient food choices.

A key element of the company's strategy involves digital transformation and automation across its operations. This includes the implementation of advanced analytics, artificial intelligence (AI), and the Internet of Things (IoT) in production facilities to optimize processes, enhance quality control, and reduce operational costs. These advancements are crucial for maintaining a competitive edge in the dynamic food industry.

Sustainability initiatives are deeply integrated into the company's innovation strategy. The company explores new technologies to reduce its environmental footprint, including water and energy efficiency, waste reduction, and sustainable sourcing practices. This commitment not only addresses growing consumer and investor demand for ethical production but also contributes to long-term operational resilience.

The company allocates substantial resources to research and development to foster innovation. This investment is crucial for staying ahead of market trends and consumer demands.

Digital transformation is a core focus, with the implementation of advanced technologies like AI and IoT. This drives efficiency and improves operational performance.

Sustainability is a key component of the company's innovation strategy. Efforts to reduce environmental impact are ongoing and integral to long-term success.

Automation in processing plants is used to enhance productivity and consistency. This leads to improved efficiency and product quality.

The company utilizes technology to ensure the origin and quality of its products. This builds consumer trust and ensures regulatory compliance.

Data analytics are used to help in demand forecasting and supply chain management. This ensures a more efficient and responsive supply chain.

The company's continuous investment in these areas demonstrates its commitment to maintaining a competitive edge through technological advancement and innovation. While specific recent patents or industry awards are not publicly detailed for 2024-2025, the ongoing focus on these areas underscores the importance of innovation for the company's BRF future prospects. These strategies are critical for addressing the key challenges for BRF's growth and maintaining its competitive advantage in the poultry market and processed food sector.

The company's approach to innovation and technology is multifaceted, encompassing various strategies to enhance its operations and product offerings. These strategies are designed to drive efficiency, improve product quality, and ensure sustainability. The company's ability to adapt to changing consumer trends and its financial performance are directly influenced by these initiatives.

- Research and Development: The company invests heavily in R&D to create new products and improve existing ones.

- Digital Transformation: Implementing advanced analytics, AI, and IoT across operations.

- Sustainability Initiatives: Focusing on water and energy efficiency, waste reduction, and sustainable sourcing.

- Automation: Utilizing automation in processing plants to improve productivity and consistency.

- Traceability: Employing technology to ensure the origin and quality of products.

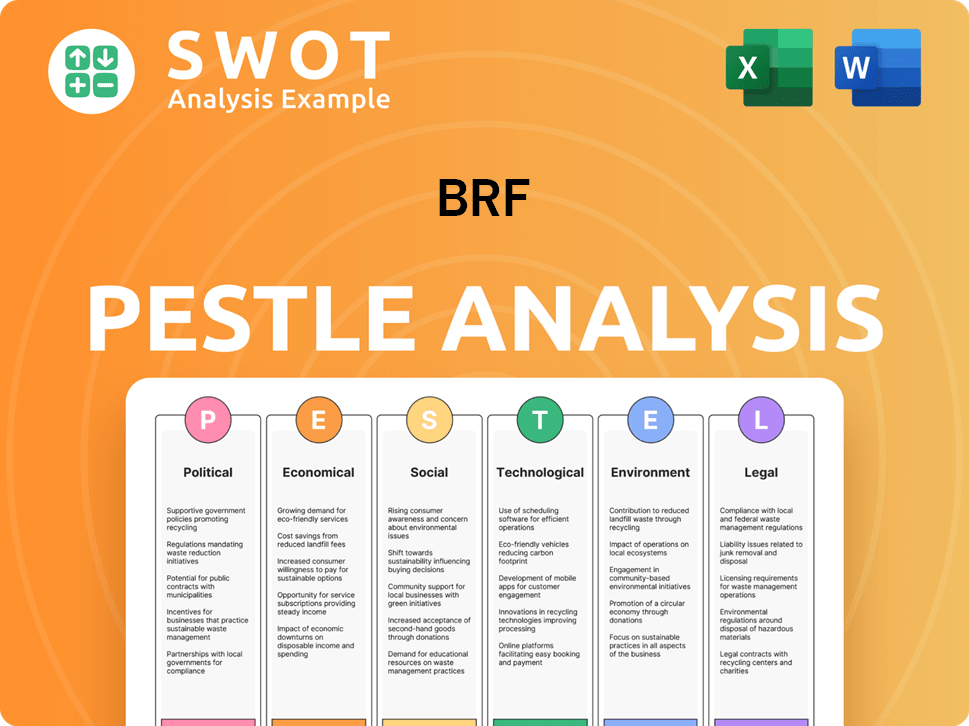

BRF PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

What Is BRF’s Growth Forecast?

The financial outlook for BRF is largely shaped by its strategic investments and focus on operational efficiency. The company's BRF growth strategy is centered around expanding its market presence, diversifying its product offerings, and optimizing costs. These initiatives are designed to enhance profitability and strengthen its financial position, which is crucial for long-term sustainability and success. This approach is critical as the company navigates the complexities of the global food market.

In the fourth quarter of 2023, BRF reported a net revenue of R$ 14.4 billion, reflecting a modest 0.5% increase year-over-year. For the entire year of 2023, the net revenue reached R$ 56.2 billion. This performance, combined with strategic financial management, sets the stage for continued growth. The company's ability to generate robust cash flow and reduce debt levels further supports its financial goals.

BRF's adjusted EBITDA for Q4 2023 was R$ 1.7 billion, with a margin of 11.9%. For the full year 2023, the adjusted EBITDA was R$ 6.0 billion, with a margin of 10.6%. These figures highlight the company's improving operational efficiency and profitability. These improvements are essential for achieving the company's financial objectives and ensuring its ability to invest in future growth opportunities.

BRF's financial performance in 2023 demonstrates a positive trajectory, with net revenue reaching R$ 56.2 billion. Adjusted EBITDA for the year was R$ 6.0 billion, with a margin of 10.6%. These results reflect the company's ability to navigate market challenges and improve operational efficiency. This performance is crucial for supporting future investments and expansion plans.

A significant improvement in BRF's financial health is evident in its reduced net debt to adjusted EBITDA ratio, which improved to 2.29x by the end of 2023. This is a substantial decrease from 3.51x in the previous quarter. This deleveraging strategy strengthens the company's financial flexibility and supports its growth initiatives. The company's commitment to financial discipline is key to its long-term success.

BRF's robust cash generation, reaching R$ 4.7 billion in 2023, provides a solid foundation for future investments and expansion. This strong cash position enables the company to pursue strategic growth opportunities and enhance its market position. The ability to generate substantial cash flow is a critical factor in supporting the company's ambitious growth plans.

BRF is focused on market expansion and product diversification to drive sustained growth. These strategies are designed to increase revenue streams and enhance its competitive position. By expanding into new markets and offering a wider range of products, BRF aims to capture greater market share and improve its overall financial performance. These initiatives are key to the company's long-term success.

BRF's strategy to improve profitability margins and reduce leverage is a core element of its financial planning. The company's net debt to adjusted EBITDA ratio improved to 2.29x by the end of 2023, down from 3.51x in the previous quarter. This improvement indicates a stronger financial position, which is vital for supporting future growth initiatives. The company's commitment to financial discipline is evident in its deleveraging strategy.

The BRF future prospects are supported by its strategic investments, focus on operational efficiency, and financial discipline. The company's performance in 2023, including revenue growth and improved profitability, sets a positive tone for the future. The company's ability to generate strong cash flow and reduce debt levels further strengthens its position for growth. For more insights, explore the Mission, Vision & Core Values of BRF.

- Market Expansion: Expanding into new markets to increase revenue streams.

- Product Diversification: Offering a broader range of products to capture more market share.

- Cost Optimization: Implementing measures to improve operational efficiency and reduce costs.

- Financial Discipline: Deleveraging and improving financial ratios to strengthen financial health.

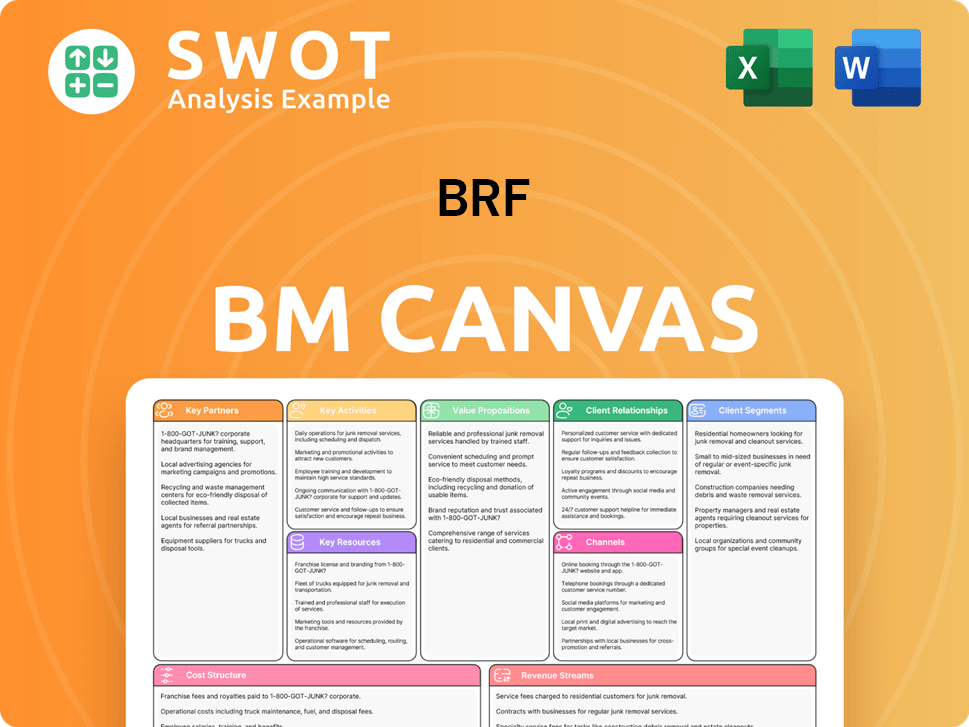

BRF Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Risks Could Slow BRF’s Growth?

The success of the Marketing Strategy of BRF hinges on navigating several significant risks and obstacles. These challenges span market dynamics, operational complexities, and external factors that can significantly influence the company's growth trajectory. Understanding these potential pitfalls is crucial for investors and stakeholders assessing the company's long-term viability and strategic positioning.

Market competition remains a primary concern, with intense rivalry from both global food giants and regional players. This competition can erode profit margins and limit the expansion of market share. Furthermore, regulatory changes, particularly regarding food safety, environmental standards, and international trade, pose continuous risks. These regulatory hurdles can increase operational costs and disrupt supply chains, especially given the company's extensive international operations.

Supply chain vulnerabilities, including fluctuations in commodity prices and logistical disruptions, are also substantial operational risks. These factors directly impact production costs and product availability. The company must continuously adapt its strategies to mitigate these risks and maintain its competitive edge in the global food market. For instance, in 2023, the company reported challenges related to fluctuating commodity prices, which impacted its operational costs, demonstrating the need for robust risk management.

Intense competition from global food companies and local players can erode profit margins. The competitive landscape demands continuous innovation and efficient operations to maintain market share. The BRF growth strategy must address these competitive pressures effectively.

Changes in food safety regulations, environmental standards, and international trade policies pose significant risks. These changes can increase operational costs and disrupt supply chains, especially for a company with extensive international operations. The BRF company analysis must consider these regulatory impacts.

Fluctuations in commodity prices, disease outbreaks, and logistical disruptions represent major operational risks. These factors directly affect production costs and product availability. The BRF business model depends on robust supply chain management.

Failure to adapt to new food production technologies and changing consumer preferences driven by technological advancements. Innovation in food technology is critical for the future. The BRF future prospects depend on embracing technological advancements.

Limitations in skilled labor or capital for large-scale investments can impede growth. Efficient resource allocation and strategic investments are crucial. The BRF market share can be affected by these constraints.

Economic downturns can reduce consumer spending and affect the demand for food products. The company must be prepared to adjust its strategies to navigate these challenges. BRF financial performance can be impacted by economic fluctuations.

The company employs diversification for sourcing raw materials to reduce supply chain risks. It implements stringent biosecurity measures in its farms and processing units to prevent disease outbreaks. Furthermore, it utilizes robust risk management frameworks and scenario planning to address potential challenges. For example, in 2024, the company continued to invest in supply chain resilience to buffer against commodity price volatility.

The company focuses on continuous innovation in food production technologies. It actively monitors and adapts to changing consumer preferences. This includes investing in research and development to meet evolving demands. In 2024, the company increased its focus on developing plant-based protein products to align with consumer trends.

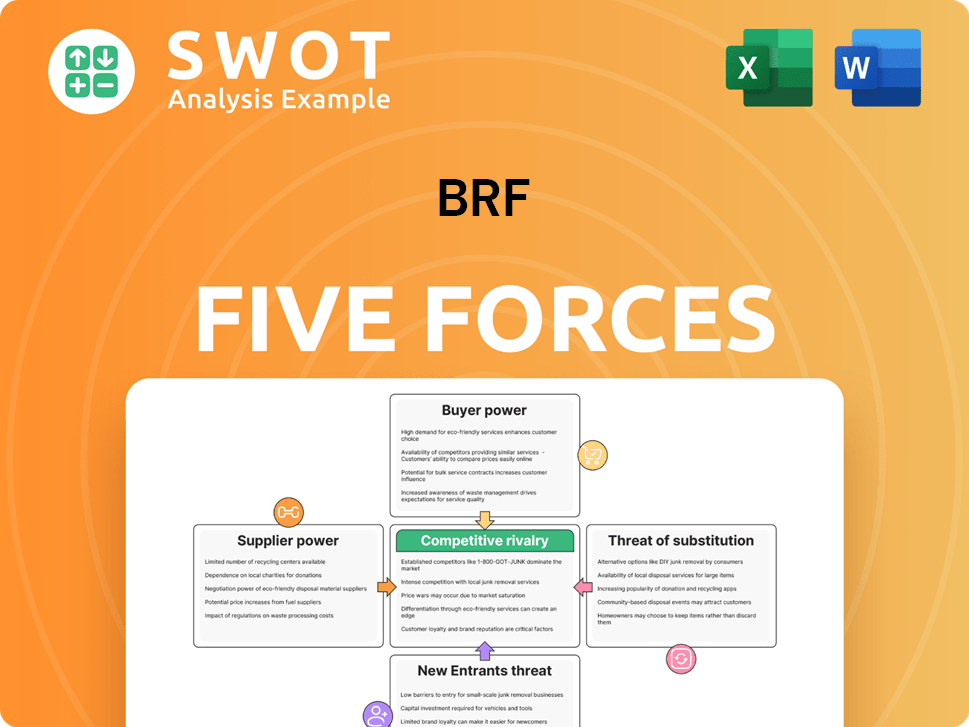

BRF Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.