BRF Bundle

How Does BRF Company Thrive in the Global Food Market?

BRF S.A., a powerhouse in the global food industry, presents a compelling case study for investors and strategists alike. Its operations span continents, impacting food supply chains worldwide with its extensive portfolio of BRF SWOT Analysis products. Understanding how BRF operates is vital for anyone seeking to navigate the complexities of international markets and the dynamics of the food sector.

This exploration into the BRF company will uncover the intricacies of its business model, from agricultural production to global distribution. Discover how BRF foods generates revenue and maintains its competitive edge in a challenging sector. We'll analyze its strategic expansions and market positioning to provide a comprehensive view of BRF business and its impact on the global food landscape, including insights into BRF Brazil and its global presence.

What Are the Key Operations Driving BRF’s Success?

The core operations of the company, also known as the BRF company, center on the integrated production and sale of animal protein and processed foods. This approach allows the BRF business to provide significant value through its extensive product range and global reach. The company's offerings include fresh and frozen poultry and pork, along with a variety of processed food products like sausages, ham, and ready meals. These products cater to a wide range of customers, from individual consumers to large institutional clients and food service providers across various markets.

The operational processes are highly integrated and sophisticated. BRF foods manages a robust supply chain, beginning with feed production and animal farming, and extending through slaughtering, processing, and packaging. The company uses advanced manufacturing technologies and stringent quality control measures to ensure product safety and consistency. Logistics and distribution are critical components, with the company operating an extensive network of distribution centers and sales channels to efficiently deliver products to both domestic and international markets. This includes direct sales to retailers, distributors, and food service companies.

The effectiveness of the company's operations is enhanced by its vertical integration, giving it greater control over the entire production process, from farm to fork. This integration, combined with its vast scale, enables economies of scale and cost efficiencies that are difficult for smaller competitors to replicate. These core capabilities translate into customer benefits through consistent product quality, wide availability, and competitive pricing, fostering strong brand loyalty and market differentiation. To understand more about the company's reach, you can read about the Target Market of BRF.

The company's supply chain is highly integrated, starting from feed production and animal farming to slaughtering, processing, and packaging. This vertical integration allows for greater control over the entire process, ensuring product quality and efficiency. The company operates production facilities in multiple countries, including Brazil, which is a key location for its operations.

The company offers a diverse range of products, including fresh and frozen poultry and pork, as well as processed foods like sausages and ready meals. These products are distributed through various channels, including direct sales to retailers, distributors, and food service companies. The company's global presence is supported by an extensive distribution network.

The company has a significant market share in the global food industry, with a strong presence in both domestic and international markets. In recent years, the company has focused on improving its financial performance through cost optimization and strategic investments. The company's financial results reflect its efforts to enhance profitability and efficiency.

The company is committed to sustainability initiatives, focusing on environmental and social responsibility. It invests in innovative technologies and processes to improve efficiency and reduce its environmental impact. These efforts are integral to the company's long-term strategy and brand image.

The company's operations are characterized by vertical integration, a broad product portfolio, and a global distribution network. These elements enable the company to maintain a competitive edge and meet the diverse needs of its customers. The company's focus on quality, efficiency, and sustainability underpins its operational success.

- Vertical integration from feed production to distribution.

- Extensive product range including poultry, pork, and processed foods.

- Global distribution network with a strong presence in key markets.

- Commitment to sustainability and innovation in its operations.

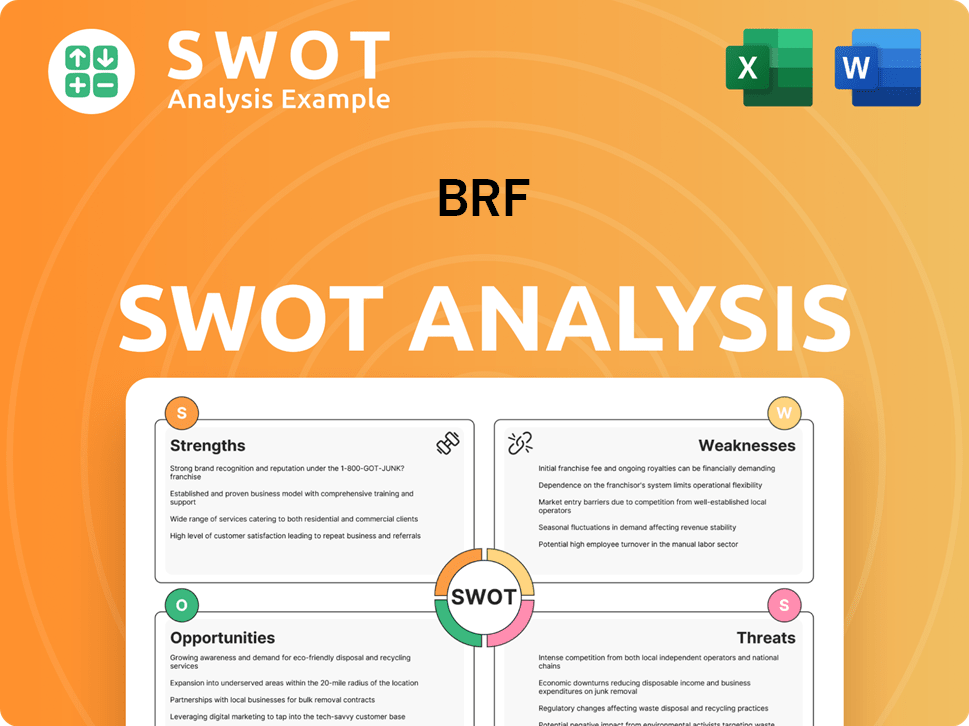

BRF SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Does BRF Make Money?

The BRF company generates revenue primarily through the sale of its diverse food products. Its monetization strategies span various segments, with the bulk of revenue stemming from product sales, including fresh and frozen poultry, pork, and processed foods like hams and sausages. Understanding how BRF operates involves analyzing its revenue streams and how it leverages different channels to maximize profitability.

In 2023, BRF reported net revenue of R$55.7 billion. The company's international operations are a significant contributor, accounting for 52.4% of the total net revenue, which amounted to R$29.2 billion in 2023. This global presence highlights the company's strategic focus on international markets.

Within its product sales, poultry and pork products provide substantial contributions, available in both in-natura and processed forms. The prepared foods segment, featuring ready-to-eat and convenience items, also plays a crucial role in revenue generation. BRF foods employs tiered pricing strategies based on product type, volume, and customer segment (retail, foodservice, industrial). Furthermore, it utilizes cross-selling opportunities, offering a broad product mix to its existing customer base.

The primary revenue stream for BRF business is the sale of its food products. This includes a wide array of items, from fresh and frozen meats to processed foods.

Pricing is tiered based on product type, volume, and customer segment. This allows for optimized revenue generation across different markets and customer needs.

Expanding into new international markets is a key strategy. This helps diversify revenue streams and reduce reliance on any single region.

Offering a broad product mix to existing customers maximizes value per transaction. This approach enhances customer loyalty and increases sales.

Focusing on higher-value-added processed products boosts profitability. This strategy aligns with consumer preferences for convenience and quality.

Strategic entry into new international markets is essential for growth. This diversification reduces risk and expands the company's global footprint.

The BRF company employs several strategies to generate revenue and maintain its market position. These strategies are crucial for long-term financial health and sustainability.

- Product Diversification: Expanding the product portfolio to include a wider range of processed and value-added items.

- Geographic Expansion: Entering new international markets to diversify revenue streams and reduce reliance on any single region.

- Strategic Pricing: Implementing tiered pricing strategies based on product type, volume, and customer segment.

- Cross-Selling: Offering a broad product mix to existing customers to maximize value per transaction.

- Focus on High-Value Products: Prioritizing the development and sale of higher-value-added products to increase profitability.

For more in-depth information on the company's ownership structure and stakeholders, you can refer to the article about Owners & Shareholders of BRF.

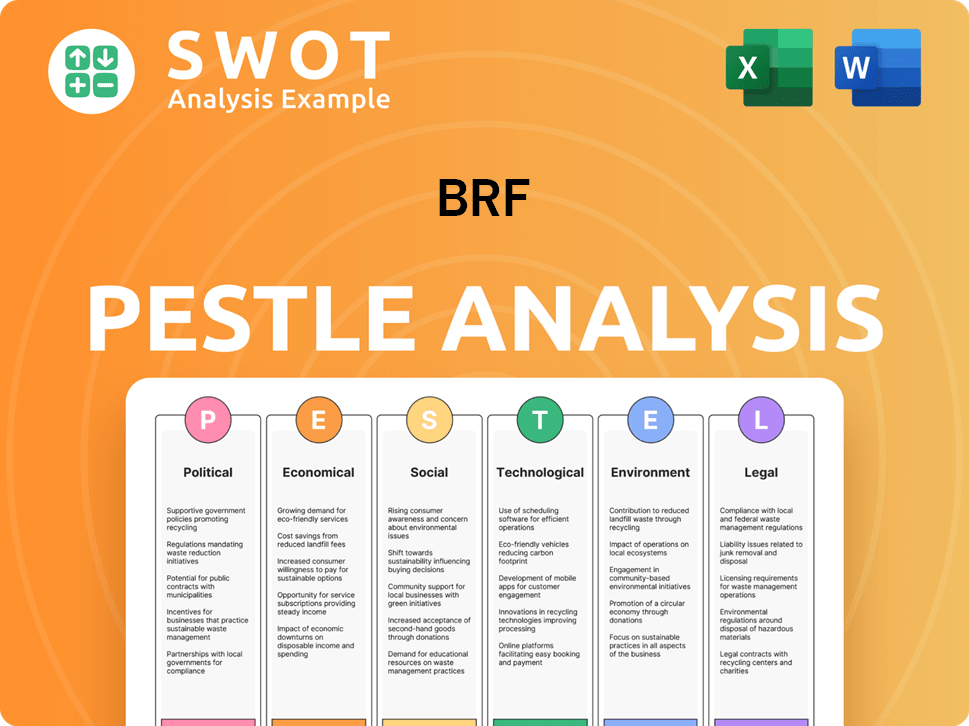

BRF PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Which Strategic Decisions Have Shaped BRF’s Business Model?

The operational and financial journey of the BRF company has been shaped by key milestones and strategic shifts. A significant move was the 'Vision 2030' plan, launched in 2020. This initiative aimed to double the company's market value while expanding into new markets and product categories, with a strong emphasis on sustainable practices. This strategic direction has influenced recent investments and operational adjustments within the company.

BRF has focused on optimizing its production capacity and improving operational efficiency. This is evident in its investments in new facilities and upgrades to existing ones, particularly in its European operations. These adjustments are designed to enhance competitiveness. The company has also addressed operational challenges such as fluctuating feed costs and avian influenza outbreaks, which have impacted its supply chain and profitability.

BRF's competitive advantages are multifaceted. These include its extensive brand portfolio, featuring well-known names like Sadia and Perdigão, which foster strong consumer loyalty. The company benefits from significant economies of scale due to its large-scale integrated operations, enabling cost-effective production. Its robust global distribution network ensures broad market penetration. BRF continues to adapt to new trends by investing in innovation, focusing on plant-based alternatives, and enhancing its digital capabilities to improve supply chain visibility and customer engagement, thereby sustaining its business model against evolving competitive threats and consumer preferences. For more insights into its global approach, consider reading about the Marketing Strategy of BRF.

In 2020, BRF initiated its 'Vision 2030' plan. This plan aimed to double market value and expand into new markets and product categories. The company has focused on optimizing production capacity and improving operational efficiency.

BRF has invested in new facilities and upgraded existing ones, particularly in Europe. It has adapted to challenges like fluctuating feed costs and avian influenza. The company is investing in innovation, plant-based alternatives, and digital capabilities.

BRF has a strong brand portfolio, including Sadia and Perdigão, and benefits from economies of scale. It has a robust global distribution network. The company is focused on sustainability initiatives to maintain its business model.

In recent financial reports, BRF has shown resilience despite market challenges. The company's focus on operational efficiency and strategic investments has helped maintain its market position. The company continues to adapt to changing consumer preferences.

BRF's strategy includes optimizing production and improving efficiency. The company has invested in new facilities and upgrades. It is also addressing challenges like feed costs and disease outbreaks.

- Investment in new facilities and upgrades.

- Focus on plant-based alternatives and digital capabilities.

- Emphasis on supply chain visibility and customer engagement.

- Adaptation to changing consumer preferences.

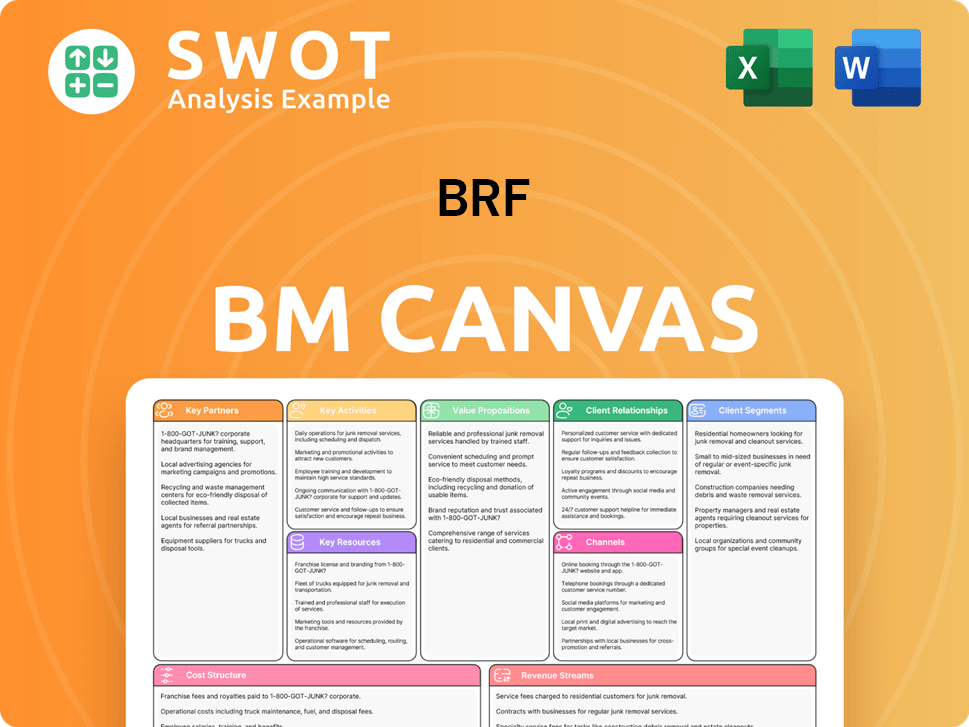

BRF Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

How Is BRF Positioning Itself for Continued Success?

The BRF company holds a prominent position in the global animal protein market, particularly in poultry and pork. It has a significant market share in key regions, including Brazil and the Middle East, and a strong brand recognition, with brands like Sadia and Perdigão. Its global reach extends to over 100 countries across five continents, making it a major player in the food industry.

However, BRF foods faces several risks, including volatility in commodity prices, regulatory changes, and outbreaks of animal diseases. The rising consumer preference for plant-based proteins also presents a long-term challenge. Despite these risks, the company focuses on sustaining and expanding its profitability through strategic initiatives, such as investing in innovation and optimizing operational efficiency.

The company is a leading global player in the animal protein sector, with a strong presence in poultry and pork. It has a significant market share in key regions, including Brazil and the Middle East. The company benefits from strong brand recognition, exemplified by brands like Sadia and Perdigão, enhancing customer loyalty.

Key risks include volatility in commodity prices, particularly for feed inputs like corn and soy. Regulatory changes related to food safety and trade policies also pose risks. Outbreaks of animal diseases and the growing consumer preference for plant-based proteins present further challenges.

The future outlook for BRF business is focused on sustaining and expanding profitability through strategic initiatives. The company aims to strengthen its market position through continued investment in innovation and optimizing operational efficiency. Leadership is committed to sustainable practices and expanding in high-growth markets.

The company is investing in innovation, particularly in value-added and plant-based products. It is also focusing on optimizing operational efficiency through digital transformation. Furthermore, BRF Brazil is committed to enhancing its financial flexibility and reducing leverage.

The company's ability to manage commodity price volatility and adapt to changing consumer preferences will be crucial. Strategic investments in innovative products, like plant-based alternatives, are essential for long-term growth. Enhancing financial flexibility and expanding into high-growth markets are also key priorities for BRF products.

- Commodity Price Management: Strategies to mitigate the impact of fluctuating feed costs.

- Product Innovation: Development and expansion of plant-based protein offerings.

- Operational Efficiency: Continued efforts in digital transformation to streamline operations.

- Market Expansion: Growth in high-potential markets to increase revenue streams.

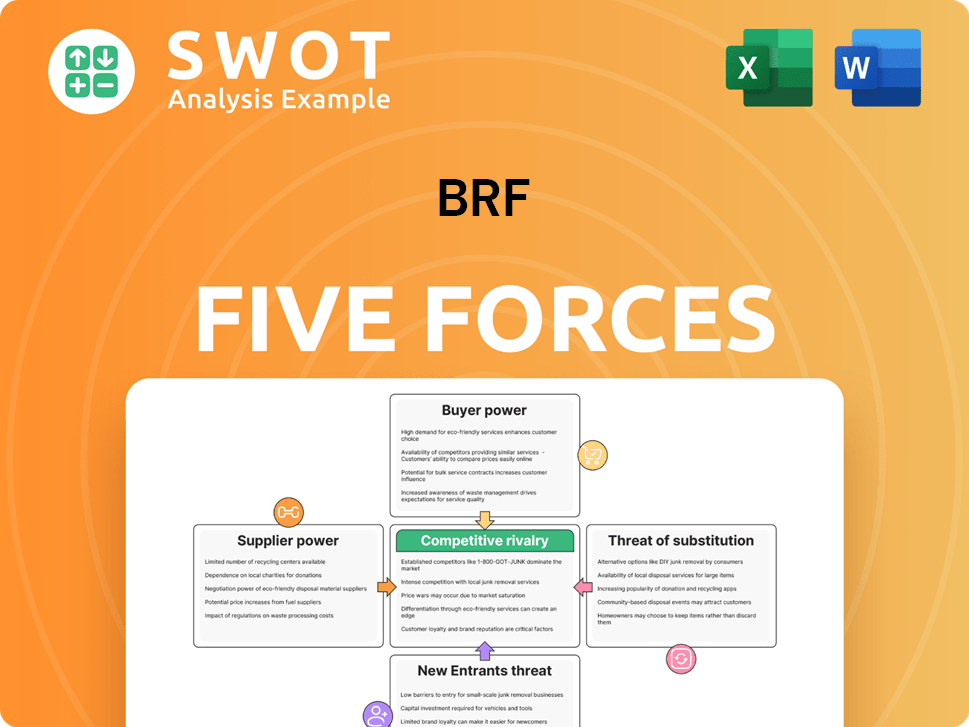

BRF Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of BRF Company?

- What is Competitive Landscape of BRF Company?

- What is Growth Strategy and Future Prospects of BRF Company?

- What is Sales and Marketing Strategy of BRF Company?

- What is Brief History of BRF Company?

- Who Owns BRF Company?

- What is Customer Demographics and Target Market of BRF Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.