BRF Bundle

Who Really Owns BRF S.A.?

Ever wondered who pulls the strings at BRF, a global powerhouse in the food industry? Understanding the BRF SWOT Analysis is just the beginning. The ownership structure of BRF, formerly known as BRF Foods, is a complex interplay of institutional investors and individual shareholders, all influencing its strategic direction. Unraveling the BRF Company Ownership reveals crucial insights into its market influence and future prospects.

The story of BRF SA, a prominent Brazilian Food Company, begins with a pivotal merger. From its roots in the merger of Sadia Company and Perdigão, BRF has evolved into a global entity. Knowing the major BRF Shareholders and their influence is key to understanding the company's trajectory and operational decisions. This analysis will explore the evolution of BRF's ownership, shedding light on its strategic imperatives and accountability to its diverse shareholder base.

Who Founded BRF?

The formation of BRF S.A. in 2009 was a pivotal moment, born from the merger of two major Brazilian food companies: Sadia S.A. and Perdigão S.A. Understanding the ownership structure of BRF involves tracing back to the pre-merger ownership of these two entities, which were already significant players in the Brazilian food industry.

Sadia, founded in 1944 by Attilio Fontana, began as a small slaughterhouse and evolved into a major food producer. Perdigão, established in 1934 by Saul Brandalise and ngelo Fontana, also grew into a prominent food processing company. The merger brought together the legacies and ownership structures of these two companies under the BRF umbrella.

The founding ownership of BRF is therefore a composite of the pre-merger ownership of Sadia and Perdigão. The Fontana family, with roots in both Sadia and Perdigão, held considerable influence and ownership stakes in their respective companies leading up to the merger. Prior to the merger, both Sadia and Perdigão were publicly traded, with ownership diversified among various shareholders.

Sadia was founded in 1944 by Attilio Fontana.

Perdigão was established in 1934 by Saul Brandalise and ngelo Fontana.

The merger that formed BRF S.A. occurred in 2009.

Both Sadia and Perdigão were publicly traded before the merger, meaning their ownership was diversified among various shareholders.

The Fontana family held significant influence and ownership stakes in both Sadia and Perdigão.

The merger agreement outlined the share exchange ratio, defining how shareholders of Perdigão and Sadia would receive shares in the newly formed BRF.

The ownership of BRF, a major Brazilian food company, stems from the merger of Sadia and Perdigão. Before the merger, both companies were publicly traded, with ownership spread among various shareholders, including the founding families. The merger agreement detailed the share exchange, creating the new BRF entity. Understanding the history of the BRF company provides insights into its current shareholder structure.

- BRF S.A. was formed in 2009 through the merger of Sadia and Perdigão.

- Sadia and Perdigão were both publicly traded companies before the merger.

- The Fontana family, with roots in both Sadia and Perdigão, held significant ownership stakes.

- The merger agreement detailed the share exchange ratio for the new BRF.

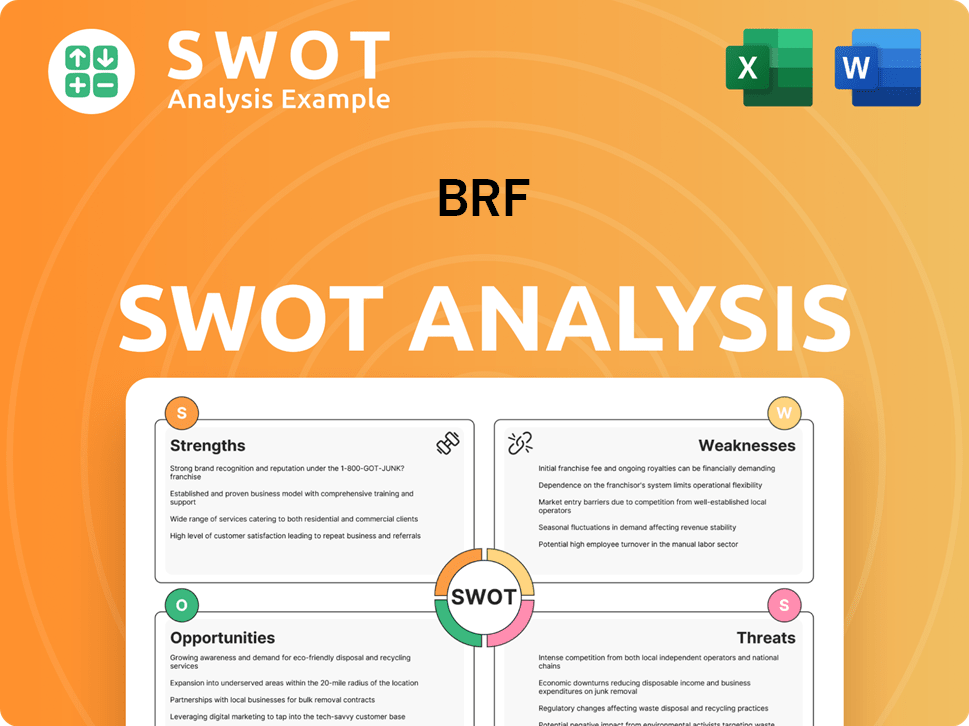

BRF SWOT Analysis

- Complete SWOT Breakdown

- Fully Customizable

- Editable in Excel & Word

- Professional Formatting

- Investor-Ready Format

How Has BRF’s Ownership Changed Over Time?

The ownership evolution of BRF S.A., a prominent Brazilian food company, since its inception in 2009, has been marked by significant shifts in major shareholding and strategic investments. Initially, BRF's shares were listed on the B3 in Brazil and had American Depositary Receipts (ADRs) on the New York Stock Exchange (NYSE), reflecting its global ambitions. This initial structure established it as a leading player in the food industry. Key events have reshaped its ownership over the years, with institutional investors playing an increasingly important role. These changes have had a direct impact on BRF's strategy and governance.

Institutional investors, both domestic and international, have become prominent BRF shareholders. Pension funds, mutual funds, and index funds hold substantial portions of BRF's shares, reflecting its status as a major player in the consumer staples sector. For example, as of early 2024, major shareholders included large investment management firms and Brazilian pension funds. Marfrig Global Foods S.A., another Brazilian food giant, emerged as a significant shareholder in BRF in recent years, demonstrating a strategic move towards consolidation within the industry. As of the first quarter of 2024, Marfrig held a substantial stake in BRF, becoming one of its largest individual shareholders. These changes in ownership often lead to greater scrutiny of financial performance and corporate governance, influencing decisions regarding capital allocation and future growth strategies.

| Shareholder | Stake (as of Q1 2024) | Notes |

|---|---|---|

| Marfrig Global Foods S.A. | Significant | One of the largest individual shareholders |

| Institutional Investors | Various | Includes pension funds, mutual funds, and investment management firms |

| Free Float | Variable | Subject to market fluctuations |

The increased presence of large institutional investors and strategic shareholders, such as Marfrig, often leads to greater scrutiny of financial performance, operational efficiency, and corporate governance practices. This can influence decisions regarding capital allocation, divestitures, and future growth strategies, pushing the company towards greater transparency and accountability. For further insights into the company's strategic direction, you can explore the Marketing Strategy of BRF.

BRF SA's ownership structure has evolved significantly since 2009, with institutional investors and strategic partnerships playing key roles. Marfrig Global Foods S.A. is a major shareholder, reflecting industry consolidation trends.

- Institutional investors hold significant shares.

- Marfrig is a key strategic shareholder.

- Ownership changes impact strategy and governance.

- BRF's transparency and accountability are increasing.

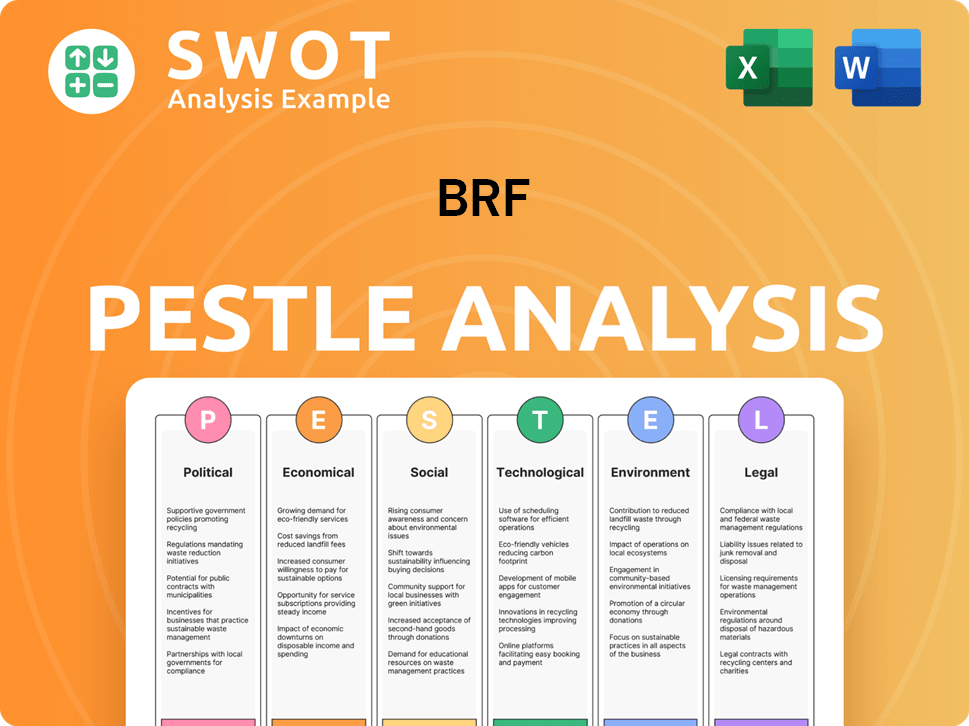

BRF PESTLE Analysis

- Covers All 6 PESTLE Categories

- No Research Needed – Save Hours of Work

- Built by Experts, Trusted by Consultants

- Instant Download, Ready to Use

- 100% Editable, Fully Customizable

Who Sits on BRF’s Board?

The board of directors at BRF S.A., a key player in the Brazilian Food Company landscape, currently includes a mix of representatives from major shareholders, independent members, and company executives. As of early 2024, the board's composition typically features individuals with extensive experience in the food industry, finance, and corporate governance. The board often includes members representing significant institutional investors and strategic corporate shareholders. Independent directors are also appointed to ensure a balanced perspective and uphold corporate governance best practices within BRF Foods.

The board's structure is designed to oversee the company's strategic direction and operational decisions. The board's composition and activities are crucial for maintaining investor confidence and ensuring the long-term sustainability of BRF SA. The board's decisions have a direct impact on the company's performance and its ability to navigate the complexities of the global food market. This includes decisions related to capital allocation, executive compensation, and strategic partnerships. The company's commitment to strong corporate governance is reflected in its board's composition and practices.

| Board Member | Role | Affiliation |

|---|---|---|

| Pedro Parente | Chairman of the Board | Independent |

| Lorival Nogueira Luz Jr. | CEO | BRF S.A. |

| Marcos Molina dos Santos | Board Member | Marfrig Global Foods S.A. |

BRF operates under a one-share-one-vote structure for its common shares listed on the B3, which is a standard arrangement aimed at ensuring proportional voting rights based on shareholding. There are no publicly reported dual-class shares, special voting rights, or golden shares that would grant disproportionate control to any single entity or individual. This structure generally promotes a more equitable distribution of voting power among BRF Shareholders.

BRF's voting structure ensures that each share held has equal voting rights, promoting fairness among shareholders. This structure is typical for publicly traded companies and helps to maintain investor confidence. The voting system allows shareholders to influence the company's direction and decisions.

- One-share-one-vote structure.

- No dual-class shares.

- Equal voting rights for all common shareholders.

- Shareholders can influence company decisions.

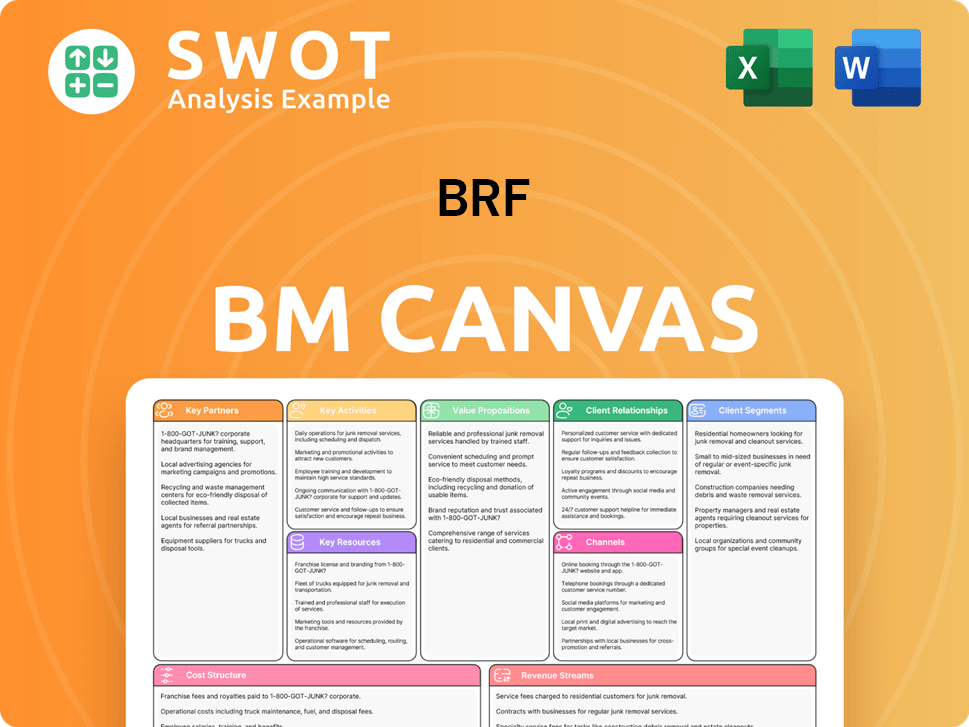

BRF Business Model Canvas

- Complete 9-Block Business Model Canvas

- Effortlessly Communicate Your Business Strategy

- Investor-Ready BMC Format

- 100% Editable and Customizable

- Clear and Structured Layout

What Recent Changes Have Shaped BRF’s Ownership Landscape?

Over the past few years, the ownership structure of BRF SA has seen significant shifts, reflecting broader trends within the Brazilian and global food industries. A key development has been the increasing stake held by Marfrig Global Foods S.A. Marfrig's strategic acquisitions, starting in 2021 and solidifying by early 2024, have positioned them as a major shareholder. This indicates a strategic move towards consolidation within the Brazilian protein sector, potentially leading to operational synergies or a more integrated value chain. This is a crucial aspect to consider when examining BRF Company Ownership.

Other relevant developments include potential share buybacks or secondary offerings, which BRF Foods might undertake based on market conditions and its capital allocation strategies. Such financial activities are typical for large publicly traded companies to manage their capital structure and shareholder returns. Leadership changes, particularly at the CEO or Chairman level, often coincide with shifts in strategic direction and can be influenced by major shareholders seeking to optimize performance. These changes can impact the company's direction and, consequently, the interests of BRF Shareholders.

| Ownership Trend | Details | Impact |

|---|---|---|

| Increased Institutional Ownership | Large asset managers and pension funds hold substantial portions of publicly traded companies. | Increased focus on ESG factors and long-term sustainability. |

| Rise of Activist Investors | Shareholders are increasingly vocal about corporate governance and financial performance. | Potential for changes in strategic decisions and management. |

| Consolidation Discussions | Ongoing discussions in the market about consolidation within the global food industry. | Could lead to privatization or further public offerings. |

Industry-wide trends impacting BRF SA include the continued rise of institutional ownership, leading to a greater focus on ESG factors and sustainability. The rise of activist investors also plays a role, with shareholders increasingly vocal about corporate governance and financial performance. For more insights into BRF's market positioning, you can explore the Target Market of BRF. These trends contribute to the evolving landscape of the Brazilian Food Company.

Institutional investors, such as asset managers and pension funds, hold a significant portion of BRF's shares. This trend emphasizes the importance of ESG factors and long-term sustainability for the company.

Activist investors are becoming more vocal about corporate governance and financial performance. They can influence strategic decisions and management practices within BRF.

Ongoing discussions about consolidation in the global food industry could lead to privatization or further public offerings for BRF. This impacts the company's future.

Major shareholders, like Marfrig, can significantly influence strategic decisions. This influence can shape the company's future direction and operational strategies.

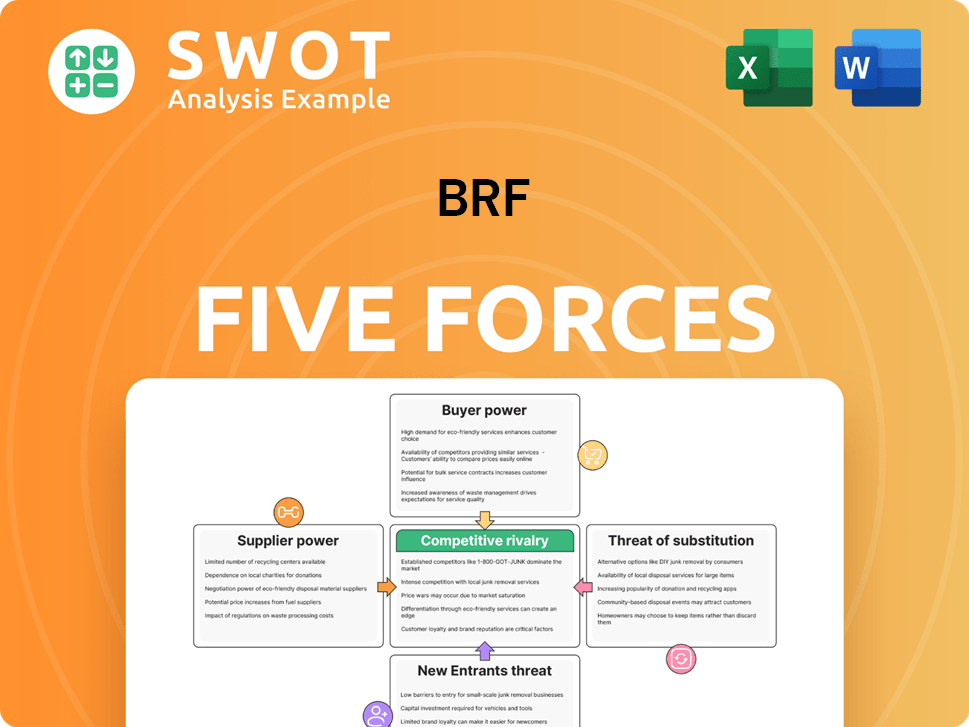

BRF Porter's Five Forces Analysis

- Covers All 5 Competitive Forces in Detail

- Structured for Consultants, Students, and Founders

- 100% Editable in Microsoft Word & Excel

- Instant Digital Download – Use Immediately

- Compatible with Mac & PC – Fully Unlocked

Related Blogs

- What are Mission Vision & Core Values of BRF Company?

- What is Competitive Landscape of BRF Company?

- What is Growth Strategy and Future Prospects of BRF Company?

- How Does BRF Company Work?

- What is Sales and Marketing Strategy of BRF Company?

- What is Brief History of BRF Company?

- What is Customer Demographics and Target Market of BRF Company?

Disclaimer

All information, articles, and product details provided on this website are for general informational and educational purposes only. We do not claim any ownership over, nor do we intend to infringe upon, any trademarks, copyrights, logos, brand names, or other intellectual property mentioned or depicted on this site. Such intellectual property remains the property of its respective owners, and any references here are made solely for identification or informational purposes, without implying any affiliation, endorsement, or partnership.

We make no representations or warranties, express or implied, regarding the accuracy, completeness, or suitability of any content or products presented. Nothing on this website should be construed as legal, tax, investment, financial, medical, or other professional advice. In addition, no part of this site—including articles or product references—constitutes a solicitation, recommendation, endorsement, advertisement, or offer to buy or sell any securities, franchises, or other financial instruments, particularly in jurisdictions where such activity would be unlawful.

All content is of a general nature and may not address the specific circumstances of any individual or entity. It is not a substitute for professional advice or services. Any actions you take based on the information provided here are strictly at your own risk. You accept full responsibility for any decisions or outcomes arising from your use of this website and agree to release us from any liability in connection with your use of, or reliance upon, the content or products found herein.